Bloomberg, the Wall Street Journal, and Institutional Investor have published new reports in the last two days on the escalating controversy surrounding CalPERS CIO Ben Meng missing out on over $1 billion in gains1 by exiting a tail risk hedge right before the coronacrash.

Meng’s self-defense is backfiring. Not only is the press exposing more layers of his misrepresentations, but Meng’s dogged refusal to admit error is proof of that he is unfit for his job.

Meng keeps trying to pass of the Big Lie that his decision was sound even if it didn’t pan out well. Nassim Nicholas Taleb, who advises the bigger manager that CalPERS ditched, Universa, has already called out some of Meng’s self-justifications in a video we posted on Thursday.

The latest round of coverage reveals more falsehoods. One of the biggest was that Meng kept insisting that the tail hedges were a bad bet because they were too expensive.

It is certainly true that if you overpay for an asset or an exposure, it’s less likely to work out well. To depict the tail hedges as overpriced, Meng flatly said that tail hedges cost usually cost 3% to 5% of the exposure insured. Bloomberg reported that the Universa hedge cost only 1% to 1.5% of the covered amount when CalPERS had the trade on. So Meng exaggerated the cost by three to five times to try to make it look like a bad deal.3

Either Meng was knowingly fibbing about the economics of these hedges or as some anonymous CalPERS sources have charged, he is in over his head and didn’t even understand what these products really cost or how they worked. There is evidence for both theories.

The fact that Meng keeps insisting, as he did in a video for his department members and again to the Journal, that “Knowing what we know, we would make the exact same decision,” says either his ego is out of control or he’s incapable of understanding how his choice was poor on every front: risk/return, avoidance of liability, and proper procedure in dealing with the board.

Either one suggests Meng is not capable of executing his duties as Chief Investment Officer.

Normally, if a senior officer is performing poorly, he should be monitored more closely. CEO Marcie Frost, who has only a high school degree, no mathematical chops, no financial training, and no investment management experience, is unable to oversee him.2 The Chief Investment Officer used to report directly to the CalPERS board, but the board abandoned that arrangement years ago, in 2014.

Nevertheless, the California constitution makes the board the sole and exclusive fiduciary for CalPERS’ assets, so the board can and should be minding the investment store even if they can no longer fire the CIO.

However, the board has been abandoning its supervision of staff, particularly of investments, over the years. And despite this blow-up exposing the dangers of this asleep-at-the-wheel posture, the board plans to relinquish most of its remaining checks on the investment process at its board meetings next week. We hope those of you in California will object and we tell you at the end of this post how to do that.

Meng’s Nose Is Getting So Long He Needs a Hacksaw

To show that Meng’s determination to ditch the tail risk hedges, made in October and was implemented early this year, demonstrates bad judgment, we need to debunk some of his justifications. As an internal talk and his statements to the media show, Meng claimed CalPERS had superior “alternative hedges” and in keeping those hedges made more money. In fact:

Meng tried to present his “alternative hedges” by using “alternative” as an either/or when he should have kept both. According to press reports, CalPERS had $5 billion in equities hedged. If we take the high end of Universa’s range for the hedge cost, it was 1.5% a year or $75 million. Adding $75 million (or more germane, the roughly $19 million that three months of options costs and fees would have amounted to) to any other position in CalPERS’ portfolio wouldn’t have had a measurable impact. It’s an insult to the public’s intelligence to pretend otherwise. [Update: I forgot that Bloomberg reported the actual costs in its first story: “Public filings show Calpers paid Universa $22.5 million and LongTail Alpha $3.2 million that year.” Recall that $5 billion was the peak amount CalPERS protected; the $22.5 million shows that the amount and possible the percentage cost were considerably lower than our assumption].

Meng’s “alternative hedges” were not hedges but at best garden-variety portfolio diversification. According to portfolio theory, being invested in more asset classes does not increase returns but does reduce risk. But Meng is trying to play on the ignorance of many CalPERS beneficiaries with his word choice. A hedge is protection against specific outcomes.

As Taleb pointed out in an interview with Institutional Investor:

“If you have such a large portfolio, you must have hedges. So the more hedges you can find, the better it is, the more variety. Getting rid of hedges makes no sense…..

“Saying ‘it does not fit an institutional investor’ is flawed. CalPERS is a collection of retirees getting a paycheck. You have a responsibility to those beneficiaries. He’s not hedging Coca Cola or some large corporation. He’s hedging the portfolio for real people. You wouldn’t drive a car without insurance. Nothing can replace your car insurance. It directly covers your liability and clips your tail completely.” For CalPERS, “out of the money insurance is not replaceable by any other instrument,” he added.

Meng cherry picked positions to claim they “made” $11 billion, to minimize significance the tail risk give-up, but those positions cost CalPERS much more in the previous year. It’s perverse to see Meng cavil about at most $75 million of mainly options costs to Universa, yet pretend vastly larger opportunity costs on his lower-risk portfolio components don’t count.

If I were Matt Levine, I might reduce Meng’s defense to: CalPERS owned some safe bonds. So would any pension fund.

The other component that Meng highlights as doing less badly than stocks overall, as confirmed by the Wall Street Journal, was his factor-weighted portfolio, which included lower-vol equities. Taleb dismissed that in his video:

Mr. Meng said he made $11 billion on alternative strategies that sort of offset the losses during this collapse.

I don’t know if you realize that these strategies need to be weighted against what they made or lost before that. Effectively, we think, back of the envelope calculation is so-called mitigating strategy would have lost something like $30 billion the previous year. So you make $11 billion, you lose $30 billion before, not a great trade, and definitely not a great trade if you take that over long periods of time, where you lose in rallies and make back a little bit in the selloff. That’s not a mitigating strategy, that’s something that may work in the portfolio, definitely not comparable to tail hedging.

It is noteworthy that all three articles appeared after we published the Taleb video. Two of them, Institutional Investor’s and Bloomberg’s, quoted from it and were gracious enough to credit the site. None of the CalPERS’ statements in these pieces rebut Taleb; they merely repeat points Meng made in the speech that Taleb addressed, at best slightly reformulating them. So Taleb’s arguments have yet to be refuted, which strongly suggests CalPERS can’t.

Meng grotesquely overstated the cost of the Universa program. There’s no way to unsay what Meng said. Perhaps he thought he could get away with this baldfaced misrepresentation to his troops because Ron Lagnado, his quant maven, was no longer there to call him out.

It’s inconceivable that some staffers didn’t know better by having access to the records and/or hearing of the apparently heated opposition to Meng’s desire to end the hedges, which Bloomberg reported in its original April 9 account.

Meng must be overconfident about his internal information lockdown. All investment professionals were able to see total fund performance data by department and program during the eras of Meng’s predecessors, Ted Eliopoulos and Joe Dear. Meng cut access in June 2019.

From Meng at 11:39 in the second video in this post:

Now on to the cost of such explicit options-based tail risk hedging strategy. This type of strategy usually costs about 3 to 5% of the protected notional amount, about half of the expected return of the underlying assets being hedged.

You can see why Taleb felt compelled to respond. Meng is clearly addressing the brouhaha over terminating the Universa hedge and losing out on more than $1 billion. Yet rather than use Universa’s charges, Meng uses irrelevant and misleading ranges rather than the actual costs. And those actual costs would have shown that Meng’s claim that the program was too pricey was a fabrication.

Let’s look at it another way. Recall that CalPERS’ long-standing, far-too-often repeated justification for private equity is that it is the only strategy expected to exceed CalPERS now 7% return target.

Consider this section of the Wall Street Journal story, Calpers Unwound Hedges Just Before March’s Epic Stock Selloff:

Mark Spitznagel, Universa’s chief investment officer, said in his letter to investors that the firm’s strategy can help boost returns if investors stick with it through thick and thin. The strategy’s annualized compounded return since 2008 was about 11.5%, according to the letter.

So if an investor had gotten into Universa’s program in 2008 when markets were already heaving and held on through the recovery, not having the foggiest idea when the next big crash would take place, you would have made 11.5%.4 CalPERS started participating in 2017, so it would have paid far less in what amounted to premiums before getting the payout. It’s annualized compounded return would have been vastly higher.

That is why Wilshire reminded the board last August of the attractiveness of staying in despite the bad optics of ongoing costs. And Wilshire assumed that the exposure might earn only 1000% in a crisis, not the ~4000% reward for investors still with the fund in April.

Meng misrepresented the “research” supposedly backing his view. In his talk, Meng cited what he depicted as two papers. One by Robert Litterman, who has cred as a quant (among other things, he and Fisher Black devised an important refinement to the Black-Scholes formula), can’t be called a paper. As we discussed, it’s an opinion piece which does a remarkable job of getting the economics of investment bank equity market operations wrong. It also seems clueless about the liquidity demands on pension funds like CalPERS which are in a negative cash flow position, as in paying out more in benefits than they are taking in in contributions.

Due to time constraints, including inability to access our former industry-leading options-trading clients on a timely basis for a sanity check, we accepted Taleb’s dismissal of the other paper, which was a bona fide journal article, that Meng also touted, Antti Ilmanen’s Do Financial Markets Reward Buying or Selling Insurance and Lottery Tickets? Reader JP depicted the article as completely off point as far as tail risk hedging is concerned:

Second, it’s not clear that Ben read Ilmanen’s paper, who concluded that timing matters with tail risk strategies. More disturbingly, Ilmanen uses VIX futures as the tail risk hedge comparison. These instruments are dominated by ATM [at the market] option pricing, not by tail risk option pricing [which is out of the market]. This is probably what disgruntles Taleb. Apple meet orange.

Third, there is a larger problem: Ilmanen fails to realize that VIX futures are the market price of risk. Any public market index can be replicated with VIX futures and a Treasury bond, so they are not hedging, its simply market exposure.

There is no way to put lipstick on this pig. JP politely suggests Meng didn’t read the paper, which he presumably regards as less damning than reading it and not understanding that its analysis was fundamentally wrong, or actually appreciating that but citing the paper anyhow because for some not-defensible-in-terms-of-expected returns reason, he wanted out of the tail hedges.

Meng shifted grounds. In his video, Meng tried to present his “alternative hedges” as better for drawdown mitigation. That was never what the tail risk hedges were designed to do, as we explained in detail earlier.

Meng’s Inability To Make Good Decisions

Meng’s statement “Knowing what we know, we would make the exact same decision,” is so idiotic as to disqualify him from being in a position of authority. It contradicts his earlier and at least dimly defensible position that it was unfair to judge the results based on 20-20 hindsight.

He is literally saying he’s fine with making choices that have bad outcomes, and would willingly repeat them even if he had the perfect foresight so as to avoid them. Meng would choose to stay in Groundhog Day forever, rerunning the same tape loop.

But this Trumpian bluster is a lousy ruse to avoid admitting to a clearly flawed decision process. Consider:

Meng did not consult his expert, Wilshire. That alone is indefensible. Meng can’t pretend his course of action was sound when he froze out his top adviser, the one with better expertise than anyone in his shop save possibly Ron Lagnado and it’s not hard to infer that Lagnado was opposed.

Meng flip-flopped on the tail hedges. Meng came in as of January 2019. Under Meng, in June, CalPERS increased its commitment to the tail hedge program. There is no evidence of anything happening in the markets or with Universa or the other tail-risk manager, LongTail Alpha, between June and October, to warrant Meng doing a 180. Recall as Meng acknowledged, that the portfolio changes he touted as reducing “drawdown risk” had been decided before he came on board, and the board’s authorization of those changes contemplated the tail hedge program remaining in place.

Meng lied to the board. This is arguably his biggest sin. From the March board transcript:

BOARD MEMBER MARGARET BROWN: Ben, can you tell me how our left-tail investments are performing? Are they performing the way we thought they would in this economic downturn?

CHIEF INVESTMENT OFFICER MENG: Good morning, Ms. Brown. Yes, for any left-tail risk hedging strategy you’re referring to, they should perform well in this kind of a down market, as they were exactly designed to do. And from what we know are most of these strategies are performing as anticipated.

Keep in mind that the only exposures that CalPERS calls “left tail investments” were the tail-risk programs managed by Universa and LongTail Alpha, as well as an internal fund.

The Journal confirms that Brown isn’t alone in thinking the board was snookered:

Stacie Olivares, another board member, said she doesn’t recall being told that the [tail risk] strategies had been dropped.

The Cost of “Wrong Way Meng” and Leaving the Staff Running the Asylum

Since Meng is embodying two of CalPERS worst tendencies, casual lying and restricting access to information. It’s conceivable that their is more risk ordnance set to blow up on his watch.

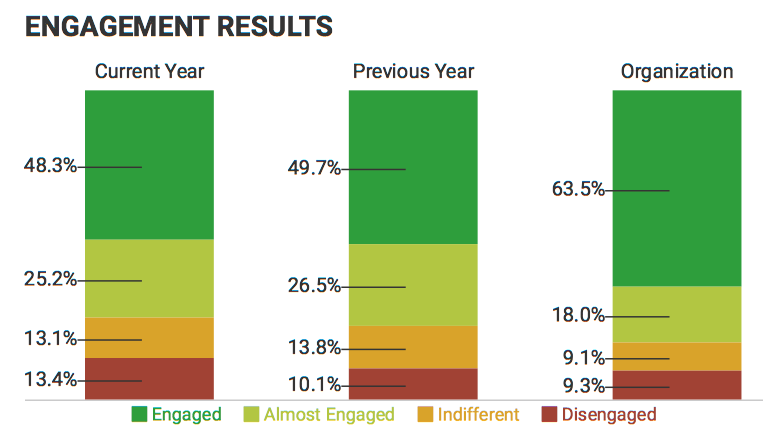

What we do know is that even under his short tenure, investment office morale has dropped markedly:

Employees who know Meng’s record from his earlier time at CalPERS question his competence:

I always laugh when Marcie touts Ben’s experience as an investor. First when he was in the Fixed Income Department he was the group quant, he wasn’t running any money. He had no portfolios under his control. He did a quantitative finance project with Professor Andrew Lo of MIT during the first part of his tenure in Fixed Income – nothing usable came out of it. He did try to build an analytic suite of tools to provide things such as attribution analysis but they were no better than what the Fixed Income Department was able to get from the BlackRock Aladdin system it uses so there really was no lasting legacy to his work in Fixed Income. If he did actually run Fixed income portfolios it had to have been during his tenure at BGI before it become part of Blackrock. As you know Curtis Ishii ran a very good department and produced significant alpha. If Ben was good at running money Curtis would have given him money to run but he didn’t.

Look at what Ben was involved in when he moved to become the Deputy Head of Asset Allocation or as we call it TLPM [Trust Level Portfolio Management]. Two disasters that he was a part of stand out. First was the fund’s decision to terminate its currency hedging program. The analytics work and Board presentations, in which Ben was front and center, were done in 2013 and the $15 billion FX hedge was terminated in June 2014 right before the dollar started to rally. We’ve kissed away $3 billion on that one. The second thing was the creation of what was called the MAC Partners (MAC standing for Multi Asset Class) program. Another brilliant TLPM idea that Ben was a big part of. Essentially it was CalPERS’ way of bringing hedge funds back into the plan through the back door after we had kicked them out the front door. Performance on that as well as well as pretty much everything else TLPM oversaw was terrible and it was terminated last year.

And from another insider:

It’s even worse than it looks. The better minds in the place are leaving even in the midst of the Coronavirus pandemic. In the last two weeks two of CalPERS best and brightest have quit to go back to the private sector. Ron Lagnado who essentially followed Meng’s career path as the fund’s Fixed Income quant and then became the deputy head of Asset Allocation and is a Caltech PhD has just left to work for an options specialty firm [the very same Universa]. Paul Mouchakka who ran Real Assets and did so much to turn the real estate portfolio around and divest bad assets is going back to his native Canada to be a senior partner at one of the biggest Canadian real estate firms. Meng’s message of one team one dream doesn’t have space for the smarter people in the crew, only for his sycophants.

Adding insult to injury in all this is that Meng signed off on a series of steps that led to CalPERS having a very narrow heavily equity and corporate credit risk centric portfolio going into this debacle. Cash liquidity was taken down to 1% from 4% under Ted Eliopoulos and after dispensing with the tail risk hedge and many other long standing diversifying elements in the portfolio the only thing that CalPERS was left with that didn’t get crushed was a 10% position in US treasuries. Why the “brain trust” felt implementing a “go for it” portfolio 10 years into a bull market boggles the mind.

The fact that Taleb was able to see and respond to Meng’s archived webcast is another proof that his staff is in revolt. The video was not listed on the CalPERS website. You would have to know it was there to find it on YouTube, particularly within what was about a day, unless an insider had sent the URL to Taleb.

Even outside fund managers can discern that either Meng is over his head or at best dialing in his presentations to the board. They’ve noted bloopers like using a normal distribution to describe market returns in a June 2019 presentation when markets are not normally distributed.

In other words, Meng was already demoralizing staff and driving the best people out. How much has his authority plunged as a result of his poor judgment and patent lies about why he ditched Universa and LongTail Alpha?

The board as the sole and exclusive fiduciaries cannot prudently leave $370 billion unsupervised, which is what they are effectively doing, as you can see if you pull up the videos for any recent Investment Committee meeting. Even basic questions are few and far between and the committee chairman can be relied upon to shut down any serious line of questioning before it gets very far.

The status quo was bad enough. Now CalPERS afflicted with the worst crisis since the Great Depression and a Chief Investment Officer who isn’t up to his job.

The board plans to make this dire situation even worse by giving away virtually all of what little authority they retain to staff. You can read the sorry details here.

If you are a CalPERS beneficiary or a California resident, give CalPERS a piece of your mind! State that you firmly oppose the reduction of board investment oversight as a rejection of its fiduciary duty. All you need to do is pen an e-mail that is up to about three minutes of reading time and send it in. Get a cup of coffee, sit down and do it pronto, since the first of the two key board meetings is Monday

From CalPERS:

Public Comment

Individuals present at the CalPERS auditorium may provide public comment on agenda items at the time each item is heard. Members of the public may also submit written public comments by email to board@calpers.ca.gov. Written public comments should note the meeting and agenda item the comments relate to and shall be read into the record at the time the corresponding agenda item is heard. All public comments shall be subject to CalPERS Pusblic Comment Regulation (Cal. Code Regs. tit. 2, § 552.1.)

https://www.calpers.ca.gov/docs/board-agendas/202004/board-notice.pdf

Be sure to check the board vote on April 20, because you have two shots at defeating these changes. Even if they are approved at the Investment Committee on April 20, they still need to be voted through by the full board on April 22. So you may need to submit a second round of critical comments and perhaps enlist even more friends and colleagues to join you.

Give them a piece of your mind! And please circulate this post widely and ask everyone you know to do the same!

_____

1 It’s probable that the initial give-up was much bigger than $1 billion. CalPERS would have challenged the Bloomberg figure otherwise.

On top of that, the initial Bloomberg report said CalPERS had missed out on over $1 billion. That was when the profit on the bigger position, run by Universa, was up only 3600%. It was up over 4100% in early April, meaning the lost profits were even greater.

To put this in context, the State of California has given CalPERS two $3 billion mini-bailouts in the form of pre-funding. So Meng wiped out a big chuck of the state’s gimmie.

2 That’s why his pay is higher than hers.

3 It may well be true that other tail hedges cost 3% to 5%. But that’s not the issue. It’s what CalPERS was paying for its hedges, not what other hedges might cost.

4 Note that the 11.5% figure is not the stand-alone return on the its hedges, but in combination with the returned on the hedged position, so it contemplates Meng’s concern about the impact on the hedged position. From Institutional Investor:

For example, Universa recommends a hypothetical portfolio of a 3.33 percent allocation to its tail-risk product, coupled with a 96.67 percent position to the Standard & Poor’s 500 stock index, a proxy the firm uses for the systematic risk being mitigated.

In the month of March 2020, the hypothetical portfolio showed a compound annual growth rate of 0.4 percent. In March, the S&P 500 stock index lost 26.2 percent at its lowest point, and closed the month down 12.4 percent. For the year to date, Universa’s hypothetical portfolio had a CAGR of 16.2 percent, versus the S&P 500’s 4.5 percent. The model has produced a CAGR of 11.5 percent since March 2008 inception.

A few observations.

1) A return of 4000% might indicate an even lower ex-post insurance cost. We don’t know cos we don’t know whether that is per year or per month etc.

2) They didnt specify what their alternative strategy was. If they sold equities to buy bonds, that is not quite the same thing as making $11bn, because the NPV of their liabilities would have risen even more. One might argue they should have done both, with hindsight.

3) Similarly, the argument that the tail risk hedge could not be scaled is not a reason to have no tail risk hedge. Rather it is a reason to max out your tail risk hedge and then seek further risk mitigation.

4) “Cash liquidity was taken down to 1% from 4% under Ted Eliopoulos and after dispensing with the tail risk hedge and many other long standing diversifying elements in the portfolio the only thing that CalPERS was left with that didn’t get crushed was a 10% position in US treasuries.

Taking down cash and dispensing with tail risk are both risk increasing transactions. One wonders what the UST position was or where on the curve it was located. Calpers will have very long dated liabilities. To match them it would need very long dated assets.

The 11.5% return mentioned later from 2008 to present is in combination with the assumed underlying. I just added a footnote to clarify a bit, and then I saw your comment, so this was a point worth unpacking a bit more.

The 4144% per the Wall Street Journal is for the first quarter for the hedge performance alone; Institutional Investor said: “For the year to date, Universa’s hypothetical portfolio had a CAGR of 16.2 percent.”

https://www.wsj.com/articles/hedge-fund-star-behind-4-000-coronavirus-return-peers-into-crystal-ball-11586343603

https://www.institutionalinvestor.com/article/b1l65mvpw5xpts/The-Inside-Story-of-CalPERS-Untimely-Tail-Hedge-Unwind

Agreed 100% about your comment re scalability and wish I had made that point in the posts. Eliopoulos had wanted to double the amount hedged, so CalPERS clearly had more head room, since I doubt CalPERS would have considered that if they would have incurred a size penalty (among other things, Wilshire would be expected to clear its throat).

I am pretty sure they sold equities to buy bonds. CalPERS cut its public equity allocation in late 2016, shortly before Trump won and thus got less of the benefit of the Trump rally than they would have otherwise. I have been told this was based on the assumption Hillary would win and Mr. Market would not like it very much. I would need to check if there was any increase to real estate or other “alts” as opposed to bonds, but my dim recollection is that virtually all of the increase in other asset classes was in fixed income.

The “long Treasuries” are 10 to 20 year maturities.

Meng has also discussed levering the entire portfolio. I would need to check board meeting records, but I believe he has gotten authorization and would assume he would have implemented that pretty pronto. Obviously that is intended to increase risk.

Levering the portfolio? Dear Lord! If they do it remind me to pull up a ringside seat. I guarantee it will end badly, and in enormous scale.

Hiring someone to supervise the investment office who lacks investment experience raises real questions about the Board’s understanding of fiduciary responsibilities. Where was the fiduciary counsel?

In Meng’s defense he has been asked to manage the assets. He has not been tasked with with focus on the relationship between assets and liabilities.

I’m not too sure of that. Chief Investment Officer ought to imply the person is well versed on both aspects. Understanding the unfunded liabilities is an important factor.

To your point maybe its a deputy role but still. I cant imagine giving investment advisory options to a bank or credit union without consideration of the funding strategy. Not fully equivalent example, perhaps, but worth the discussion.

This role is likely a well compensated position, so its not like he should just isolate his view of the assets/investments alone.

“Ought” and “is” are two different words.

Even if the CIO should be watching funded staff that is NOT the assignment at CalPERS.

In fact making progress on the funded status is not included in the incentive plans of either the CIO or CEO. It was suggested several times but staff opposed and it was rejected by the Board. Here are the incentive metrics for the CEO. The CIO incentive is secret.

https://www.calpers.ca.gov/docs/board-agendas/201906/pctm/item08a-01_a.pdf

https://www.calpers.ca.gov/docs/board-agendas/202002/pctm/item08a-01_a.pdf

No, no no, liabilities are what the Chief Actuary does.

CalPERS, by virtue of having >2200 plans, is considered to be one of the two most demanding actuarial jobs in the US. The Social Security Administration is #1.

I think you are letting Meng too easily, especially in the view of the board moving more responsibilities to the staff.

Someone at CP must carry the can for ALM. It can’t be the board, they do not have the expertise to do it in detail – at best, they can be offered plans/strategy, and approve (or not) it.

The Chief actuary provides the liabilities shape – the half that’s there. But IMO the CIO role at a defined-benefit organisation like CP should really be the ALM-in-chief, not the same role as say CIO at any pure investment organisation (or a defined-contribution fund). A separate CALM role would make not a huge amount of sense, as the CIO would have to take his/her orders from CALM in the first place. CA in a government organisation doesnt take “orders”, they role is purely to report and estimate the liabilities, they can’t affect them by saying “don’t take any more fit firefighters, we need more obese cops instead”.

It’s not in his job description, nor is it in the job description of any CIO at a public pension fund. See this from the job posting:

https://www.jobs.ca.gov/CalHrPublic/Jobs/JobPostingPrint.aspx?jcid=116845

His role is only to meet the return target and provide for adequate liability to meet for near-term payout needs (which was not an issue in the 1990s when CalPERS was in a positive cash flow position; if there was cash oopsie, all CalPERS had to do was wait a few days at most for new contributions coming in to cover the shortfall).

In other financial institutions, the liability side is way more dynamic than at a pension fund.

The actuary describes the liability profile. And the actuary importantly sets the requirements for the contributions by employers. With CalPERS only 2/3 funded, how the employers make up for that shortfall is at least as important as what the CIO can do. I should do a post based on the presentations to the Kentucky Retirement System in the pre-crisis period when they were 2/3 funded. Their experts told them it was impossible for them to earn enough to meet their liabilities. That was as you know in a higher return environment than now. CalPERS is pretending it can invest its way out of its hole when in this even less favorable return environment, no way, no how.

Having said that, I admit I do not know how granular the actuary is in specifying the near term cash needs and how far out the CIO’s planning horizon for them is. That component of what amounts to ALM I am pretty sure sit on the CIO’s desk.

Re the actuary and contribution by employers – but surely that is within some bands and/or subject to agreement somewhere? CP could never be really unfunded if it could dictate the contributions w/o any restrictions.

But it seems like CP (and others, but the sound of it) do not really have a proper ALM.

If they had, then say the KRS would be in clear that it can’t ever meet its requirements (based on your above) really quick, and CP CIO would know that avoiding losing a lot of money is way more important than making a bit more (if you have 7% target return, but lose 50% of your capital, you need >14% annualised return over 0 years to get to the same place).

As I wrote before, the CP’s primary goal is not to make a target return, it’s to pay its liabilities. Target return helps with that, but not making huge losses help even more.

I know something of the UK defined benefit pensions from a decade ago, and they vigorously hedged where they could – they liked inflation swaps and bonds a lot for example, exactly to hedge their liability profile, and from what I saw actuaries and ALMs were the ones who held the sway there.

Mind you, this was a decade ago, no idea what it looks like now.

One addition – I agree that the liability side on the CP is likely less dynamic than say at a retail bank.

But at the same time, it’s more important at CP, because CP is a not-for-profit and it’s whole existence is to meet those liabilities it incures (i.e. defined benefits).

IMO, making sure of that should be the first and foremost on the mind of all board members. That means protecting against catastrophical downside, unless the cost is prohibitive.

So if you have a strategy where you don’t give up a lot of your upside for a catastrophic downside protection, you take and keep it.

If none of your strategies can provide sufficient upside, but still can provide catastrophic downside, you’re doing something wrong.

Now, that is a story in itself, and Yves has been on it for years. Here’s a smattering, courtesy swisscows: https://swisscows.com/web?query=CalPERS%20legal%20counsel%20site%3Anakedcapitalism.com®ion=iv

I saw 0.04% cost of insurance in an earlier post, which I thought it was very cheap, at least much cheaper than my car insurance. Now it was 1% ~ 1.5%! My insurance broker won’t do this.

It was 4 basis points in comparison to CalPERS’ total portfolio. not the amount hedged, which was much much smaller.

Attorney General Becerra is gonna be all over this like white on rice!

Any day now.

I’d bet your pension on it.

My thought also but then I remembered he is as bad as the last state AG;-)

It’s hard to know where to start – it’s a long post, with a multitude of sins.

But IMO the cardinal sin is that Meng doesn’t seem to understand what CalPERs is.

CP is, primarily, a defined benefit pension scheme (I believe it has defined contribution plans too, but they are a minority). It has assets, it has liabilities. The first and foremost purpose of CP is to pay out the liabilities, which it can do only if it has the assets.

It is NOT CP’s mission to make as much money as it can. It’s not a hedge fund, it’s not even an investment vehicle. It’s asset-liability management company.

ALM _MUST_ hedge, unless their assets perfectly meet their liabilities, always. For ALM, it’s way more important to make sure their assets do not suffer catastrophic losses than that their outpeform. You cannot easily make up catastrophic losses, outperformance gives you “only” buffer in the future. A buffer in the future is a nice-to-have, catastrophic funding gap is must-avoid.

IMO CP should not even have an CIO, what they need is an asset-liability-manager-in-chief. Someone who understand the above. But if there was someone who understood the above, CP would not have engaged with PE firms in the first place (although it could have built an – in-house team that could buy and hold medium/small companies for the cashflow).

Hot diggity! Well done, Yves! And thanks are due to the persistence of board member Margaret Brown and former board member JJ Jelincek. Cal pensioners, current and prospective, you owe these three big-time.

Let’s not kid ourselves. Cui bono?

Meng is clearly out of his depth — on the YouTube video (which CalPERS apparently attempted to suppress) he sounds exactly like a Wuhan cadre trying to justify having invited 60,000 neighbors to a city-wide potluck just as the coronavirus hit. As for his CEO, someone with merely a high school diploma (high schools don’t confer “degrees”) certainly isn’t competent to understand what is happening here, let alone of supervising the CIO of a $360 Billion dollar investment fund!

Who is really in charge? Who benefits?

It’s quite evident that CalPERS has effectively been run since the scandal broke in 2012 by a politically-connected white-collar criminal defense attorney with no experience in banking, investments, or contracts — who was brought in as a Mister Wolfe-style “cleaner” to run a cover-up after the then-CEO got caught taking kick-backs from a former Board member acting as a “placement agent” for Apollo and others. Billions of dollars have continued to be skimmed-off in fees and laundered into mere millions of dollars in political kick-backs on his watch, while transparency and accountability have essentially disappeared.

This is why the trust fund has struggled to recover from the 2008 GFC and will see its funded status plummet in the coming pandemic Depression. I have become so cynical about CalPERS that I suspect that they want to suffer huge losses and are intentionally dumping hedges and insurance, so that the leadership can then shrug and claim “who coulda node?” just like the bust-out in Goodfellas…

Follow the money.

“Cui bono? … Who is really in charge? Who benefits? … Follow the money.”

Yes – that boils down my take on this mess after reading many of Yves’ articles on CalPERS. (Expressed much more coherently than I could have)

Per CalPERS latest survey shown in this report, engagement of CalPERS Investment Staff has markedly declined over the past year. Why? One reason is probably because Meng has centralized decision making. Decisions that previously were made by the asset class heads and routinely approved by the CIO are now made by the CIO.

Each asset class used to decide which external managers or general partners to hire. Not anymore. Now Meng decides. As Gillers and Lim reported in the WSJ Dec 11, 2019 article, soon after Meng rejoined PERS as CIO, a CalPERS public equity internal portfolio was revamped to include buying and holding nearly 100 additional Chinese companies. This decision to adjust a public equity internal fund was not made by the public equity unit, it was made by Meng. For private equity and real estate, Meng decides which general partners to retain. The recent decision to hire two fixed income managers were made by Meng who told staff which two companies to hire — minimal investment analysis solicited or performed.

With detailed decisions now made by the CIO, many staff are now shut out of the decision making process, and feel marginalized, which they expressed in the latest staff survey. This is for the best since Meng is a brilliant investor as he claims, rendering superfluous any need for investment analysis, or for other staff to provide independent perspectives or for oversight by the Board or its consultant.

I got to wondering whether CALPERS beneficiaries had gotten outraged enough about all this to seek legal redress. A whole lot of cases have been filed, it appears, by people making all kinds of disparate claims and seeking what might amount to a “preference” in a bankruptcy action, wanting a bigger slice for themselves out of the common pot.

Too bad there does not seem to be a concerted effort by all the beneficiaries to get some organized relief, with maybe a court ordering the fiduciaries themselves to pay damages or exercising judicial oversight (though politics in California might be putting a judicial fox in charge of the hen house.)

What a demoralizing mess. Bless you, Yves, for keeping up with all this. Hopefully it is not a completely thankless task.

After reading this whole saga, the sad thing is that all this was baked into the pie a very long time ago. Incompetent untrained leadership, a Board going missing in action and determined to remove all reason for their existence despite this being actually illegal, an inability to cope with a black swan event and Meng is right there in the middle of it. The guy is a dead man walking at this stage. He just doesn’t know it yet.

From his history, he should have never been awarded this post but if you are going there, Frost should have never been brought in from Washington State either. Perhaps in normal times you can get away with a lot of corruption, especially when it is widespread. Well now here we are and not only has there been a black swan event but a whole f****ing flock of black swans has just turned up and they are all about to crap all over CalPERS.

There will be no cavalry over the hill coming to their rescue. They will not be able to tap any of the trillions coming out of Washington DC. No politician will put their career on the line to save the CalPERS leadership either as Coronavirus has put the Californian budget in chaos. I do wonder if the FBI will be brought in as CalPERS operates across State borders in its operations.

And the sad thing is that if they had done the right thing such as recruiting competent leadership, having the Board exercise proper oversight and keeping their budget in the black, they could have awarded themselves bonuses to infinity and beyond based on this performance. Now just waiting for the other shoe to drop. The meeting this week is going to be interesting but I am betting that they are going to double down because as Tacitus once said-

“Crime, once exposed, has no refuge but in audacity.”

I read the recent transcript of Kyle Bass’ interview with Epoch Times earlier today. I’m sure many others will. He refers to Ben Meng, CIO of CalPers as a member of the CPC. Its timely then to remind oneself of NC’s essay in Feb-2020 on the notion that Ben Meng is a member of the CPC :

https://www.nakedcapitalism.com/2020/02/calpers-dishonest-response-to-representative-jim-banks-regarding-chief-investment-officer-ben-meng-and-calpers-chinese-investments.html

Thanks, NC for being on top of this. For myself, I’ll keep what I reckon the likelihoods are to myself.

Just another example of the pathetically bad leadership in California. The voters light their hair on fire in their justified hatred for president Michael Scott, while their back yard burns out of control and they pretend there’s nothing to see.

The voters in this state are fools.

If CalPERS is, in effect, immune from oversight, then, as if he were working for Trump, the only thing Meng need do to keep his job is to keep Marcie Frost happy.

If the only way out of this Fire Swamp is for the California legislature to act, it needs to do so, or else it will face fantastic calls on its budget to keep CalPERS solvent – or see the pensions of millions of Californians go poof.

NC keeps sending one alarm after another concerning CalPERS operations, yet CalPERS stays the course. Why is that?

CalPERS beneficiaries are government employees who always go to the head of the line at the taxpayer buffet. There is no risk because their pension “tail” is covered by the same immutable insurance policy that covered their entire career.

So one CEO or CIO is just as good as any other CEO or CIO because it doesn’t affect the beneficiaries’ pension check by a single penny. It’s called Public Service because the Public is there to Serve Us – simple.