US public pensions, unlike their Canadian counterparts, generally set themselves up for trouble by using unrealistically high return assumptions. The effect was to make pensions look cheaper than they were by understating the value of the liabilities and exaggerating the odds of earning enough to make good on them. Some systems made matters worse, in some cases like New Jersey, much worse, by choosing not to fund the pensions adequately. And then repeated applications of the Greenspan-Bernanke-Yellen put, of negative real interest rates, have punished long-term investors by depriving them of safe-haven assets that generated reasonable levels of interest income.

Not surprisingly, public pension funds took a beating in the coronacrash, to the degree that that even loyal defenders are acknowledging the difficulty of making good on pension promises in the new normal.

First, from the Wall Street Journal:

Public pension plans lost a median 13.2% in the three months ended March 31, according to Wilshire Trust Universe Comparison Service data released Tuesday, slightly more than in the fourth quarter of 2008. March’s stock market plummet led to the biggest one-quarter drop in the 40 years the firm has been tracking.

“It was a horrible quarter for all public funds,” said Chicago Teachers’ Pension Fund Investment Chief Angela Miller-May….

As bad as the first quarter returns were, they likely don’t show the full extent of the pension losses because reports on the value of private equity, real estate, infrastructure and other private assets often arrive one quarter late…

Over the past decade, public pensions had ramped up stockholdings and other risky investments in an effort to meet aggressive return targets that average around 7%, according to a survey by the National Association of State Retirement Administrators.

For the 20 years ended March 31, public pension-plan returns have fallen short of that target, however, returning a median 5.2% according to Wilshire TUCS.

Since the last recession 10 years ago, governments around the country have jacked up their yearly pension contributions and slashed benefits for new hires, sometimes shifting the employees to 401(k)-type plans that don’t promise more than investments can earn. Some pension benefits promised to workers, such as cost-of-living increases, also have been cut, but courts have generally blocked cuts for people who have already been hired…

Municipal governments could have difficulty making their annual pension contributions if they face significant drop-offs in revenue collections, said Tom Aaron, a senior analyst at Moody’s Investors Service. States get much of their revenue from taxes on sales and income, and both are falling sharply amid a deteriorating economy and record unemployment.

“At this point the revenue losses could actually be the more impactful element here,” Mr. Aaron said. “We have to wait and see.”

Private equity doesn’t look like it will reduce the damage. As we’ve pointed out repeatedly over the years, one of the reasons public pension funds were so keen about private equity was that the funds would lower their valuations less than falls in the stock market, despite the fact that, as levered equity, private equity investments should show greater downside as well as upside. The accounting chicanery, called “smoothing”, was widely seen as a feature, not a bug.

The big funds are feeling compelled to show hits in line with stock market declines. From a different Wall Street Journal piece:

The value of Apollo’s private-equity holdings depreciated by 21.6% in the quarter, partly driven by oil-price declines. That compares with a 20% drop in the S&P 500 index.

Blackstone reported 1Q private equity losses of 22%. Carlyle curiously reported private equity declines of only 8%.

Public pensions funds, along with endowments and foundations, have taken to making heavy allocations to risky assets, which 80/20 more typical than the widely-touted formula of 60/40. But the core risky investment, stocks, looks set to disappoint.

Yesterday, Bloomberg featured former Soros Fund Management guru Stan Druckenmiller trash talking equities at current prices. That led to a broader piece today, Wall Street Heavyweights Are Sounding Alarm About Stock Prices:

The biggest names in finance are coming around to a view that seemed unlikely a few weeks ago: Stocks are vastly overvalued.

Legendary investors Stan Druckenmiller and David Tepper were the latest to weigh in after a historic market rebound, saying the risk-reward of holding shares is the worst they’ve encountered in years. Druckenmiller on Tuesday called a V-shaped recovery — the idea the economy will quickly snap back as the coronavirus pandemic eases — a “fantasy.” Tepper said Wednesday that next to 1999, equities are overvalued the most he’s ever seen.

Amusingly, MMT practitioners will see that a lot of the reasoning rests on faulty premises: that Treasury “borrowing” will crowd out private investment, that inflation is just around the bend, that taxes will rise. But these concerns can still generate the outcome they fear. As much as you’d think the whining about the stock market translates into “I want more bailout,” their stated concerns are reasons not to give much more.

So it should not come as a surprise that even those solidly on the side of preserving public pension funds are waving red flags. For instance, the Boston College Center for Retirement Research has put out a new report, Market Decline Worsens the Outlook for Public Plans, which we are embedding below and encourage you to read in full.

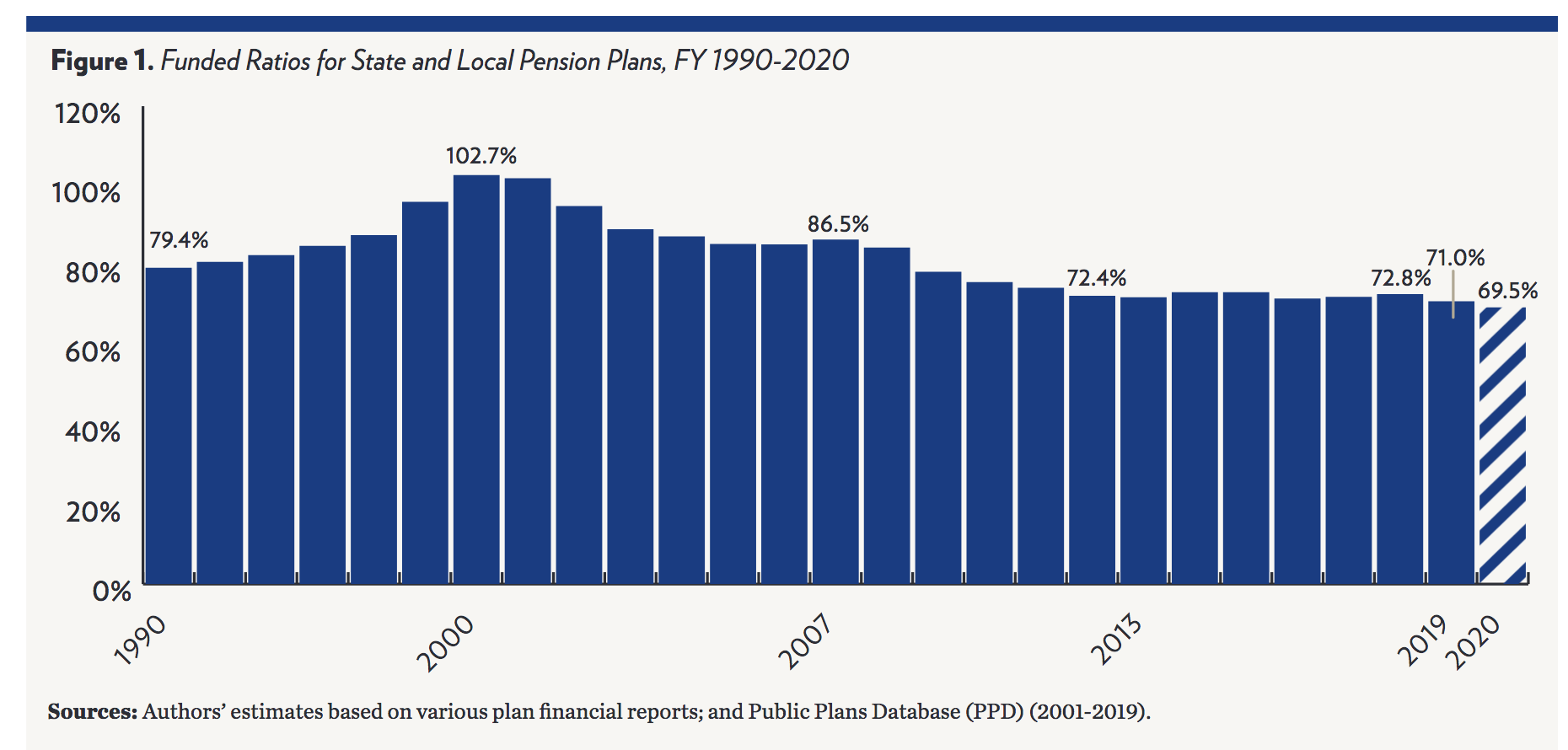

The first two charts set forth the sorry story. Average funded status has continued to decline:

Oh, and for you CalPERS fans, the giant fund recently ‘fessed up that its funded status is a mere 60%. And that’s after two state mini-bailouts on the order of $3 billion each in the form of pre-funding the underfunding. Whazzat? See below:

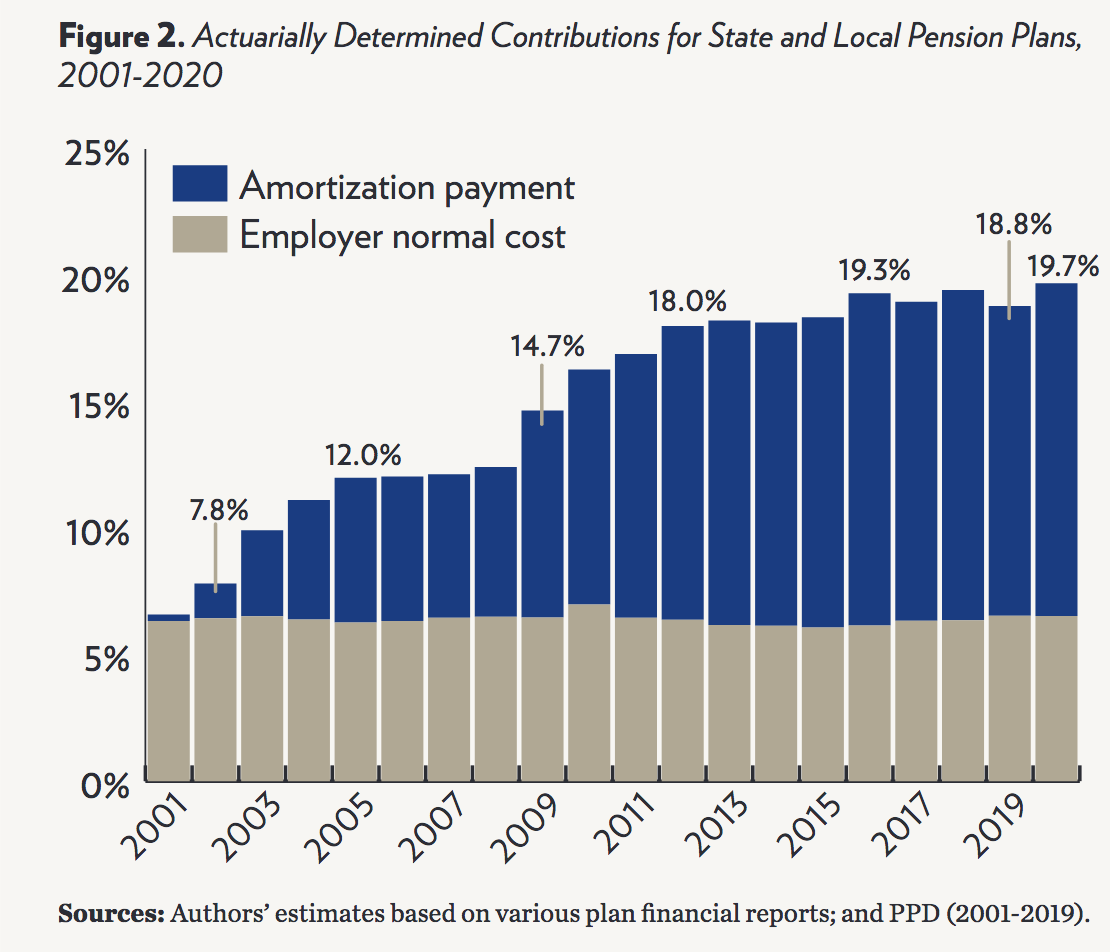

Even with unduly optimistic return assumptions, actuaries are having to make employers pony up not just enough to pay for employee contributions on a current basis, but also to make additional contributions to work off the shortfalls and get the plans back to fully funded or not that far away from it. And as you can see, that amount has risen from a bit over 5% of payroll to nearly 20%.

And here’s the killer: what happens if you use more realistic return projections? From the report (emphasis ours):

However, pension researchers (and some practitioners) have questioned the adequacy of actuarially determined contributions as they are commonly calculated – highlighting the use of overly optimistic investment return assumptions and relatively lax methods for amortizing the unfunded liability. If plans were to use investment return assumptions that more closely reflect their actual performance since 2001 and use more stringent approaches to amortize unfunded liabilities, the average actuarial contribution in 2020 would rise from 19.7 percent of payroll to 37.6 percent.

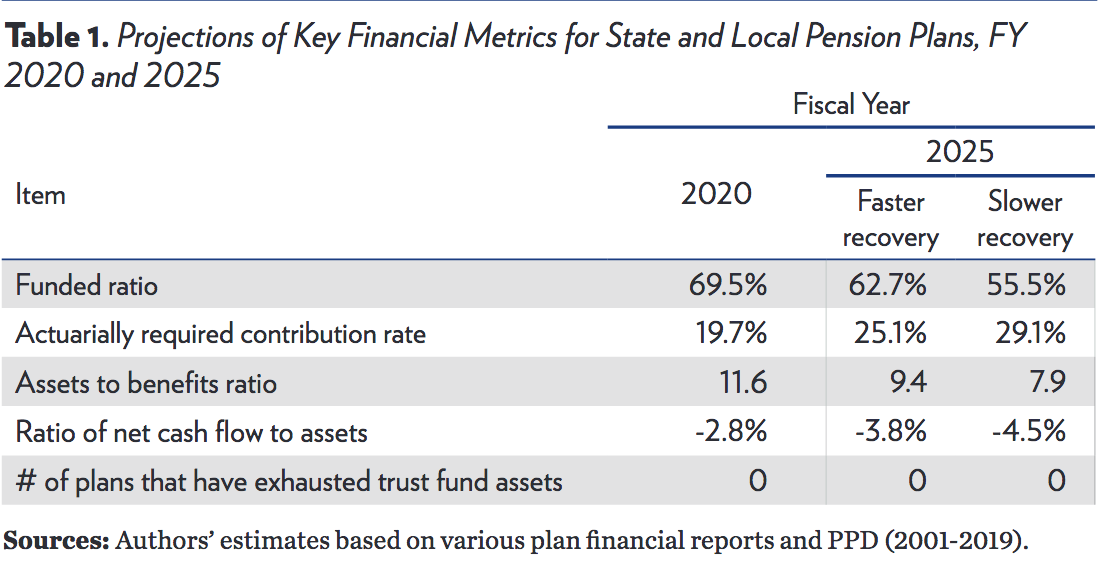

Needless to say, the future does not look pretty. Funded levels are set to fall further:

As much as it is easy to criticize these plans (and some have been horribly managed, it is also worth remembering that investing in financial assets isn’t a suitable approach for paying for retirement on a large-scale basis. As we’ve seen, higher levels of financialization impose a drag on the real economy, by diverting resources into unproductive activities like asset management and secondary market trading and rewarding rentierism. What might be tolerable on a relatively small scale becomes destructive on a large one. It would be better to have the federal government fund more services for the elderly directly (thus providing employment and boosting growth levels), including countering discrimination against those over 50 by devising work schemes designed to use older full and part time workers.

But regardless of long-term solutions, expect the fights over funding pensions to become bloody.

00 market-decline-public-plans

Pensions & investments has noted that lottery revenues in New Jersey have collapsed. Because New Jersey depends on that lottery revenue for funding its public pensions, that’s a problem. https://twitter.com/OS_Mitchell/status/1260674812378259458 Andrew Biggs has offered a solution–New Jersey should buy lottery tickets! https://twitter.com/biggsag/status/1260676247681523712

I would have liked to think that the quip about buying lottery tickets to fund pensions was a not-all-that-funny attempt at humor from some guy off the street, but it turns out that this Andrew Biggs is a resident scholar at the American Enterprise Institute where he makes a living studying public pension funds, which makes that crack even less funny and downright moronic.

Is there any competence left anywhere? Can’t anybody here play this game?

Of course we all know that pension funds could be made whole just as easily as the banks were, or better yet we could have a system like Yves suggested that isn’t dependent on a rigged casino in the first place. The infrastructure is already there with Social Security. We could increase benefits to the point pensions were unnecessary, and there is no need to fund those benefits through payroll deductions. The government could just spend.

Imagine pension funds liquidated because they were no longer necessary and a greatly reduced stock market was left as a playpen for the rounders. Let them play at Monopoly if they’d like, but there is no reason everyone else’s livelihoods should depend on their games.

“Imagine pension funds liquidated because they were no longer necessary and a greatly reduced stock market was left as a playpen for the rounders. Let them play at Monopoly if they’d like, but there is no reason everyone else’s livelihoods should depend on their games.”

Aye. One reason the Federal Reserve has been so quick to inject newly printed dollars into financial markets is to help prop up pension funds. However, that also props up the stock assets owned by the wealthy, and it’s helped drive income inequality through the roof.

Its working in the art market which seems to have no relationship with anything in the real world.

The art market is no market. It is a game of one upmanship by the wealthy.

A bit line children playing.

There are two steps which I think are inevitable and are not unjust:

1. Public employees with large pensions –say, over $7,000 a month if they do not have Social Security — would take a haircut.

Any public employee who started their pension before age 65 would take a haircut.

2. All funding for retiree health care would cease immediately, assuming that retirees have access to Medicare.

This is a completely nutty benefit. If a retiree can get Medicare, that makes them equal to any other older American.

(I realize that this reform will not save pensions, but it is still a reform worth making.)

Please note that I am a supporter of Bernie Sanders, and not an Ayn Rand type.

I want decent benefits for all Americans, not lavish benefits for a few.

I welcome pushback on this, and am glad to respond.

You won’t get any pushback from me. The oversized and unrealistic promises need to be scaled back. Not treated as inviolable deals that must be bailed out. Indeed, I would add a third step:

3. Eliminate all rules that permit pension “spiking”, where a well-connected employee is promoted to a much higher-paying position briefly before retirement, permitting them to draw a much larger pension. [Notably, a much larger pension than the contributions made over their career would pay for.]

As things stand today, things are grossly unfairness. Many younger employees won’t get a pension, and they’re having to endure smaller paychecks to leave room in the budget for shoring up the pension funds. In some cases it’s so extreme that the public is having to endure service cuts. Bailouts would reward the least responsible state and local governments the most, while those governments that sacrificed more (for often smaller pensions, which means their employees also sacrificed more) would benefit the least. And younger employees without pensions wouldn’t benefit at all.

Perhaps the right answer is to force pensions plans to only pay what their funding will actually allow, but then expand the scope of Social Security so that all Americans benefit.

Why is it always the employees that get screwed? How about raising taxes if you don’t want service cuts instead of proposing to cut benefits to those retired?

Funny how fickle union support is even here.

‘Lavish benefits’ and ‘oversized/unrealistic promises’?

Wow, we are fighting for table scraps now aren’t we.

Unions often pushed for “higher” benefits in exchange for lower contributions. Easy for politicians at the time to make since they wouldnt be there any more when the bill came due, and most lay union members didn’t know all the details and were happier to see “higher” benefits.

Some criticism of unions is necessary here. Part of their negotiating should have been to ensure the promises that were being made were actually possible.

As you note, In some instance raising taxes (or lowering services) is actually possible, but for many, taxes would need to be raised so drastically they would drive people away and thus be self-defeating

Some criticism of union leadership, certainly. American unions are probably the most undemocratic unions on earth.

@kevin: Aye. Raising taxes can be self-defeating. That’s pretty much what’s happened in Illinois. They’ve been losing residents and businesses faster than other states for quite some time now. There’s nothing to discourage immigration quite like saying, “We’re going to charge you lots more in taxes while providing no more services.”

And there’s also the question of fairness. Is it really fair to raise taxes on everybody so that a small number of public sector workers get bigger retirement checks? It doesn’t seem to so me. After all, the private-sector fund that will pay my retirement benefits has been mismanaged as well. Can I then demand that everybody pay higher electric bills so that me and my colleagues in the power sector get everything we were promised?

If we proceed down this path, we’ll end up killing ourselves over pension promises that were made with bogus math and unrealistic assumptions many years ago. We shouldn’t be enslaved to bad promises. Especially when many would have to sacrifice so that only a few are made whole.

My husband was an English High School teacher for nearly 30 years. His salary at the end was no doubt something nearly all readers of this blog would think beneath them. He paid (and gave up) real money for this pension, was promised its support, and will get NO social security if it is cut. How do you propose we survive after all promises are simply ignored, while rich people, meanwhile, end up paying no support for the country all all, just taking our taxes? It’s not like he can just go back to work for another 30 years and start all over under the new rules. You can’t let the rich elite who rule our government to just pull the rug out from under people when it comes time to pay up. You will be next!

We are so sick and tired of people saying the equivalent of “Oh, thank you for your service” when my husband mentions his job. They expect teachers to literally act as parents, keep kids off drugs, coach them, raise them when parents aren’t up to the job (plenty children in his classes were abused), pay for supplies the district can’t be bothered to provide, etc., but then denigrate the teachers as public employee mooches. If you all gave a d@mn about teachers, you would pay them for taking care of your children instead of attacking them for what was promised, and counted on, for 30 years while their salaries were sh!t. If you all believe in MMT so much, what is the issue?

Sueliz,

Thank you. Great post. Somewhere on the interwebs, Corey Robin posted a brilliant defense of public school teachers. Everyone should do the work of tracking it down and reading it, like the A + students they are.

Is this the one that you mean?

https://www.youtube.com/watch?v=xACJ8SBn9vs

Perhaps the right answer is to force pensions plans to only pay what their funding will actually allow. Wisconsin’s public pension plan does just that. Those that take the variable pension vs fixed pension have their pension adjusted based on the funds performance I believe it is for the previous 5 years. Plus Wisconsin’s pension fund is 100% funded.

It does not matter what you or anyone else feel is reasonable or fair. It’s about power. In CA and many other states, government unions and their bosses dominate and set policies to benefit themselves at the expense of everyone else. CalPERS assumes high expected returns not because they should, but because they can. They hire 70 staff and pay tens of millions to PR and law firms to spin and dissimulate, not because they should waste taxpayer dollars this and many other ways, but because they can and it advances their interests. Reform will never come from within CalPERS.

In California there is the California rule that holds that state pensions cannot be diminished unless replaced with a similar benefit.

“The California Rule has its origins in a case from 1955 called Allen V. City of Long Beach. The idea behind the California Rule is simple: workers enter a contract with their employer on the day they begin work and the pension benefits they are offered as part of that contract cannot be diminished, unless replaced with similar benefits. To cut or reduce pension benefits without an equivalent benefit to offset the cut would be a violation of the employment contract. California courts have continued to uphold the precedent of the California Rule in multiple cases over the past six decades.”

This is from: https://protectpensions.org/2018/05/21/california-rule-matter/

Yves suggested that this rule might not be as sacrosanct as widely believed.

https://www.nakedcapitalism.com/2020/04/taleb-questions-calpers-ben-mengs-competence-and-honesty-in-defending-missed-1-billion-hedge-gain-taleb-estimates-calpers-net-loss-on-mengs-alternative-mitigation-over-two-years-at-19-billi.html#comment-3343886

We’ll have to see how much kicking the can down the road occurs in California.

Umm, yes the government should be expected to live up to its promises. What a concept!

Some of California’s pension funding problems result from a 1999 bill (SB400)

From: https://www.latimes.com/projects/la-me-pension-crisis-davis-deal/

“More than 200,000 civil servants became eligible to retire at 55 — and in many cases collect more than half their highest salary for life. California Highway Patrol officers could retire at 50 and receive as much as 90% of their peak pay for as long as they lived.”

“Proponents sold the measure in 1999 with the promise that it would impose no new costs on California taxpayers. The state employees’ pension fund, they said, would grow fast enough to pay the bill in full.”

“CalPERS had projected in 1999 that the improved benefits would cause no increase in the state’s annual pension contributions over the next 11 years. In fact, the state had to raise its payments by a total of $18 billion over that period to fill the gap, according to an analysis of CalPERS data.”

In the mind of this Californian, the promise that the sweetened pensions “would impose no new costs”, without any clawback provisions if the assumptions proved incorrect, damaged the public’s perception that the state’s unions and Calpers were trustworthy in their pension advocacy.

The California Constitution is oddly not like what most people would understand a constitution to be; it’s bulky and gets modified pretty often. For instance, the provisions bunkering CalPERS were added in the early 1990s. But legislators seem unlikely to go to war with state and municipal employees by enacting constitutional provisions to weaken the California Rule.

The other route would be a ballot initiative. Above my pay grade, but a CA government lawyer thinks a successful initiative would cause a major shit show and it is far from certain that the California Rule would survive intact.

So much of modern American life consists of gaming the system, or trying to. That applies to any and all who can, whether private equity, public employee or others. That indicates that there isn’t much of a common notion of system, just a trough fed by someone else. It didn’t need to turn out that way and was helped along by many policies along the way. I tried to not be cynical but I couldn’t keep up.

In the case of public pension funds, there are private benefit and public cost aspects that allow for and even encourage some malfeasance. When treated by politicians as a type of patronage reward for loyal minions, is it any wonder about what has been happening to various entities and constituencies like CalPERS, Illinois and others? Promising lucrative benefit access without an honest disclosure of risks, costs, cyclical impacts and other seemingly-normal components of what used to be a social contract. Toss in some pension spiking, earlier exit to full benefits of both pension and health and flexible application of sick leave and that is just asking for trouble.

Private equity treatment of pensions and other benefits is, in a distressing way, more transparent. They have demonstrated time and again that they are going to F Over employees and won’t hesitate to exploit any and all line items on their financial statements to do so. Feudalism, or worse, it is.

The average person trying to hold on, find and keep some job, any job, just to try to eat, be sheltered, maybe even care for loved ones has had a pretty, pretty bad time, so all they can do is not curb any remaining enthusiasm and maintain any sense of humor left. Managing that pension? Those disappeared long ago. Try with the 401k, and get lied to by all parties about risks, costs and 1000 points of red laser targeting lights, aided and abetted by Congress. they have their own pension and benefits club, and you ain’t in it.

At some point, what is left of the system comes under increasing stresses from too many vectors. We are fast approaching that stress point so civil unrest likelihood increases. Thanks Trump, Obama, Bush, Clinton, the other Bush, Reagan, ad infinitum ad nauseam.

From now on I’m thinking only of me.” Major Danby replied indulgently with a superior smile: “But, Yossarian, suppose everyone felt that way.” “Then,” said Yossarian, “I’d certainly be a damned fool to feel any other way, wouldn’t I?

They can do anything we can’t stop them from doing.

They all heeded Yossarian and got that piece of the action, so where is yours or mine? What a choice.

Interestingly, the American Federation of Teachers has long publicly supported many of the ideas which would help create a manageable public pension system. https://www.aft.org/strengthening-retirement-security-and-building-better-america Risk sharing, along the lines of New Brunswick, would go even further to a fair, secure and sustainable solution. https://crr.bc.edu/wp-content/uploads/2013/07/slp_33_508.pdf

And then repeated applications of the Greenspan-Bernanke-Yellen put, of negative real interest rates, have punished long-term investors by depriving them of safe-haven assets that generated reasonable levels of interest income. Yves Smith [bold added]

Except the MOST a risk-free asset should return is ZERO percent minus overhead costs = NEGATIVE. Otherwise we have welfare proportional to account balance.

That said, we should exempt individual citizens from negative interest up to a reasonable account limit. The most straightforward way to do that is to allow them debit accounts at the Central Bank itself, an idea you once dismissed as “balmy” – until Central Banks themselves floated the idea. Well, live and learn…

Safe haven is not risk free. It is low risk.

The traditional way to provide for life insurance claims and pension liabilities back in the day when people though stocks were speculative were highly rated bonds, reasonably well matched to the expected payout profile.

Man tough crowd here. Pensions are supposed to be part of the tradeoff for taking considerably less on a month by month basis than similarly educated counterparts in the private sector. You folks working in banking with your useless MBAs are taking lavish vacations at age 35, while public sector folks with M. Ed.’s and MFA’s have to hunker down till our knees are bad at 60. Now that states and municipalities raid the till from us, we’re supposed to suck it up. Explain that fairness.

Agreed. I find it disturbing that the answer to these problems is to raid the public sector employees because the system is bad. Much of this is simply the warmed over “lazy, overpaid, government employee” schtick. Very few public employees are drawing large pensions. If they are, it is because they usually have more than 30 years of service and they retired under the old pension schemes that began disappearing in the late 80s and early 90s.

Many of these people are teachers and other professionals who are required to get advanced degrees for their posts in return for much lower pay relative to private sector counterparts. In return they get greater job security and some form of pension. They have already been taking haircuts in the form of increased retirement and healthcare contributions and little or no salary increases. Raiding their pension benefits will destroy any vestiges of a good deal. We want a better and more competent government and we will do it by making it truly awful for people to work for the government…

The problems are that the pension and healthcare systems are a racket and a house of cards. You can reform them without destroying benefits for those that took the deal in good faith. The US has continuously put off real healthcare and social security reforms that benefit people, not corporations.

Not a racket, exactly. The first graph in the op is interesting. You see db pension funding levels rise to 100%+ from 1990-2000. (First chart: Funding ratios.)

During that period the Dow, SP500 and Nasdaq when up and up and up. During the same period B.Clinton and many states were declaring the era of big govt and associated funding for govt was over. States, many states at least, started passing tax cuts for citizens, and at the same time cutting their required contributions to their db pension while thinking the stock market would fill the gap left by their reduced direct funding. In 2000, after the Y2K worry (which pulled forward into the 90’s a lot of computer purchasing, ramping up the Nasdaq and associated Dow stock prices) had passed the markets took a tumble. Instead of re-evaluating using the stock market to fund pensions instead of the old state income to fund pensions (because that would have required pulling back a lot the big tax cuts handed out during the good times) the db pensions doubled down on using the stock market as the funding mechanism. The tax cuts increased in tandem with increased investments in the market. (That’s trickle up economics in action: tax cuts mostly going to the well off, and investing in the market which is mostly owned by the well off.)

Fast forward to now: the market has tumbled again, again with huge tax cuts being handed out to the favored, and the talking points become ‘cut pensions’. Again. Sigh. Sure, lets make the little people – like public school teachers and firemen – pay for the Wall St. party and for state/fed govt handing out tax cuts to curry favor with the “right sorts of people” . Again.

FCB: In my opinion the crowd here is sympathetic to and understanding of the situation of public workers. They regularly get the back-handers and the sneers of the PMC and the oh so superior ruling class shoe shine boys for performing public service for chump change. Incessant libertarian feather-bedding propaganda allows states and municipalities to abuse their workers and retirees with impunity. All this is magnified by Public Pension Plan Trustees that are not up to the job of staff or contractor oversight. Additional (and more severe) complications come with the arrival of Private Equity and Hedge Fund grifters taking large bites out of almost every public pension fund. This vicious circle is joined by state legislatures permitting and encouraging all this incompetence and theft with their fabulous magical thinking. I think that the tough crowd here at NC gets all this.

I’m not seeing many paeans to the working stiff in this thread. Lol. Just backbiting that teachers get something that they pay for out of their pockets.

In my small state, police and firefighters can retire with pensions after 20 years of employment, with the pensions based on their final 3 years of income. In consequence, the cops with the most seniority grab all the special detail work (sitting in a police car at road construction playing games on the phone, providing extra security at large events, etc) to pump up their earnings, then “retire” in their late 40s and collect 2 years of pension for every year of work, while continuing to work, often in university police forces.

The starting pay is typically in the mid $50,000s, not bad for a 21 year old with no college debt.

Teachers are a completely different story: they need to have multiple degrees and lots of debt to get employed in the first place.

In Massachusetts, there’s a scandal involving overtime fraud and the state police – they were paid for shifts they didn’t work and the shifts were included in pension calculations. Although some were charged, others weren’t, those who weren’t are still collecting their pensions, including the amounts that are fraudulent.

https://boston.cbslocal.com/2020/03/21/troopers-implicated-overtime-pay-scandal-keep-pensions/

There was at least one similar case at the police department in a city outside of Boston. And many people suspect that there is some funny business at the MBTA. Last year 41 MBTA workers made over $100,000 in overtime (some of them had base wages of over $100,000 as well). In the past one of employee had over 2500 hours of overtime and approved his own request

https://www.wbur.org/news/2016/02/22/mbta-employee-with-most-overtime-approved-his-own-extra-pay-audit-finds

Before trying to cut benefits for honest employees, state governments should be looking at these individuals who committed fraud.

You’re making a lot of assumptions here. The biggest one is that a PD or FD can actually make it to the 20 year goal line without incurring some injury or disability during those years. I don’t mind good pay for those who put themselves in harms way for the benefit of others. Nor am I jealous of them.

The NYS Teachers Retirement System is generally quite ratioanl and fair. It is basically structured so that somebody with 30-35 years of teaching can retire with pretty close to full pay when you add the pension and SS together. The rules are here: https://www.nystrs.org/NYSTRS/media/PDF/Library/Publications/Active%20Members/handbook.pdf#page=27

It is difficult to game the three year income average – the years need to be consecutive and the pay has to be student-contact activities. They can’t give you fake OT etc.

NYS has done a good job funding it as well ,so it has been better than 90% funded .https://www.nystrs.org/NYSTRS/media/PDF/NYSTRS_Numbers.pdf

That’s fine, but all you’ve done is make the case for a defined contribution level payout, not a defined benefit payment. That second chart shows that what was paid in on your behalf and what it earned is way short of what’s needed to meet the pension payments. You can complain about “not fair” but with state and local revenues collapsing, if you think they’re going to be willing and able to make up that shortfall, I have a bridge I’d like to sell you.

And I don’t like sounding harsh, but were you complaining about the mismanagement of your pensions? Anyone who hired a private sector manager who screwed up like this would have fired them a long time ago.

…were you complaining about the mismanagement of your pensions?

In most states, the state db pension members are not equivalent to stock owners; they have no vote and no voice wrt pension boards, trustees, or staff. California may be the exception.

No, he is saying a deal’s a deal.

That’s the agreement people make with government when they submit to being governed.

“And I don’t like sounding harsh, but were you complaining about the mismanagement of your pensions?”

I don’t like sounding harsh but its sounds like you are complaining about the mismanagement of your pension fund.

Don’t complain about pensioners when the bills are due.

40 years of neoliberal anti-union propaganda still prevails in the minds of people that call themselves left here.

Yeah, Hoppy, I’m kind of icked out myself. This thread is devolving into Randian mush. People with advanced degrees despise workers. That I know.

Kind of amazing people still fall for the Randian ‘rugged individual’ bs and fight amongst themselves while the richest at the top are organized and work in unison for their own financial interests.

(And about Rand’s rugged individualism: she rushed off to get her SS and Medicare cards when she needed expensive medical treatment.

https://www.rawstory.com/2018/11/ayn-rand-raged-government-benefits-grabbed-social-security-medicare-needed/ )

Oh, what noble sentiments. When you’ve profited from breaking private sector pensions.

Public pensions funds are the biggest investors in private equity, accounting for 25-30% of their contributions. 91% of the public pension funds in a recent sample have invested in private equity, and public pension funds have been increasing their allocations to private equity.

Private equity in turn has been the biggest force in gutting private pensions as well as cutting private sector pay and employment levels. This is such a big issue that Elizabeth Warren included it in her “Stop Wall Street Looting” Act.

Please show links to stories or even press releases of public sector unions standing in solidarity with their private sector union brethren and defending their “deal’s a deal”.

Or even show preserving private pensions being included in all of those noble “environmental, social, governance” principles that public pensions funds wrap themselves in.

Since you need the reminder:

You didn’t speak out for the trade unions. Even worse, your pension almost certainly made money from their distress. And you expect sympathy and support now when you failed to given any when you had influence over private equity by being their biggest sugar daddy?

And go look at the numbers in that article. By 2025, even under a “faster recovery”, only 62.7% of the money needed to pay your pension on average will be there. As Michael Hudson says, “Debts that can’t be paid won’t be paid.”

Links to prove causal relationship between public pensions’ investments and the destruction of private union pensions, which have been been decimated for three decades or longer.

But again, more to the point: the private sector broke trade unions, the public sector unions didn’t. So now immiserating public sector workers is the answer. Ok. Got it. How about you Reagan Democrats stop believing in the shit that got your throats slit by the private sector. Start there.

When Calpers funds Pirate Equity, Pirate Equity buys up companies and destroys them for short term profit by loading the aquired companies up the wazoo with debt, eventually killing them.

A few months ago a furniture retailer in Michigan was the latest victim. All the workers, many there for decades have no pension anymore. Bankruptcy wiped them out.

This playbook is run all the time. The public sector workers in Michigan now no longer have that formerly profitable company to pay tax and their employees that used to pay tax on their income are broke and collecting unemployement, a quadruple negative. No tax from the company, no tax from former employees, and former employess now collecting state aid and Pirate Equity avoids taxes like the plague. The Pirates made out like bandits and their investors, some of which are public sector pension funds got a small cut of the take, once.

See where this is going? A very few will have almost everything and all the rest almost nothing.

My guess is, it’s bankruptcy for thee, but not for me. And now we have a paradigm shift in life and there is no going back to what it was a few months ago as far as the “economy” is concerned, with what will likely be 50 million or so out of “work” eventually, so who is going to pay your bill? The billionaires?

Telling that you refuse to provide evidence to disprove public unions sitting pat when private sector unions were gored, but you demand evidence of the obvious.

And your attitude is “I got mine, those private sector guys, they took their chances.” Project much?

Huffing and puffing does not alter history. Public pension fund and public unions did nothing as private sector defined benefit plans were gored. And it’s pretty rich to see denials that public pension plans profited from this abuse.

That three decades decimation dates to the leveraged buyout era of the 1980s.

Before that, most companies were fat, including both bloated executive ranks, corporate art collections, too many private jets, and defined benefit plans. It was the LBO artists that went after all of them. Even establishment Wall Street was initially opposed to the Mike Milken crowd.

But public pension funds were all in. The State of Washington’s pension fund was an early, big investor in KKR’s funds, and even proselytized other public pension funds to invest! The State of Oregon’s pension fund was another early LBO backer. Documented long form in Barbarians at the Gate and finance rags back in the day. Barbarians at the Gate makes clear that public pension sponsorship legitimated the raiders and that the amount of their participation took the LBO funds to an entirely different level.

It was the actions of these LBO artists that led companies to skinny up defensively, and then when executive pay became equity linked, AGAIN as a result of the LBO artist behavior (if the execs working for private equity companies got a piece of the action, why shouldn’t their public company buds get the same deal), they started screwing workers more aggressively, particularly on the pension front, because the incentives to do so had gotten even bigger.

Did you miss that private equity bankrupts companies? Cuts wages and pay levels? As if this needs to be demonstrated. NC interviewed Eileen Appelbaum and Rosemary Batt:

And that defined benefit pensions get cut or eliminated in bankruptcies? From the press release for the Stop Wall Street Looting Act:

This practice is so advanced that PE funds have even being taking care not to be >80% owners so they can screw the Pension Benefits Guarantee Corp on its liability assessments…..and an appeal court just validated two PE funds working in cahoots to achieve that end.

One current example: McClatchy has declared bankruptcy because it can’t make its pension payments. The quote is from a pre-bankruptcy story; they filed in February.

And who is driving that bus?

CalPERS is a substantial investor in Chatham. And McClatchy wanted to restructure out of court but Chatham would not play ball.

As I said, your position is rank hypocrisy. Public unions have been all on board with investing in private equity because they wanted the returns, and pretended as you do not to know that they were screwing workers.

So don’t sell solidarity tripe when public sector unions were nowhere to be found when they actually had some clout and even now are missing in action in defending non-government workers.

I’ve never made a defense of the notion that equity firms are legitimate actors, but let’s move through the alternatives to pensions funded by the Masters of the Universe’s pirate antics:

1. Instead of the 15% contribution that public school teachers make to their pensions every paycheck, taxpayers could pay that 15% upfront. This is almost certainly a nonstarter. Completely untenable. No taxpayers anywhere, even in the pinkest of geographical regions, would tolerate that. Instead of the $31,000 I took home for years while my salary was frozen due to the 08 collapse, I would have had $7,000 more in my pocket from my nominal salary of $50,000. That would have made a big difference. Especially when I average about $1200 a year out of pocket to purchase supplies for students. But having said all that, it would cut out my pension’s reliance on equity firm shenanigans and shift it back to taxpayers.

2. Public workers everywhere simply take a massive haircut. I think this is the alternative that you are angling for. And why not, right? You got stiffed. Better make sure the next poor slob does too. This would also remove the bad actors from pensions because the pensions would vanish or they would be so meager as to not require the shenanigans that equity firms pull to rake in the funds to pay out those pensions.

Ignoring for a minute the beyond dubious claim that public pensions’ adoption of private equity firms to finance pensions as the principal driver of the destruction of private sector unions—as opposed to say leveraged buyouts begun in the 80’s, or offshoring every industry that wasn’t nailed down, setting that argument aside for a minute, your argument leaves two scenarios that either are completely impossible—let the taxpayer kick in that 15% upfront—or allow further destruction to workers’ wages. That means, in essence, you believe the solution is to have to have working people with even less in their pockets.

To your related point that public sector unions should have scraped off the Reagan/Bush ‘84 bumper stickers off auto workers trucks—-I would have loved to, but I was twelve at the time.

Do I wish there were a mechanism other than private equity to fund pensions? Absolutely. I also wish the computer you and I are typing on and the clothes we are wearing weren’t made by slaves. But sometimes the game is so big and powerful, you just have to play it.

We all have blood on our hands. That’s the inescapabilty of capitalism.

You keep sidestepping the issue of the role of public pensions in being far and away the biggest funders of private equity, which in the 1980s was called leveraged buyouts. Public pension fund support was absolutely essential to the growth of the leveraged buyout business. Wall Street and establishment America were 100% on other other side in the 1980s.

KKR became the biggest buyout firm by virtue of the State of Washington investing in its fund AND promoting investing in KKR and LBO firms to other public pension funds. That sponsorship both helped these raiders bulk up and do must bigger deals and legitimated them.

NC even wrote about this years ago:

And NC has also debunked your other claim, so often that it’s tiresome, that private equity is somehow necessary for its performance.

Properly measured, PE does not outperform. And there are public markets strategies that deliver the performance levels that PE funds claim to deliver.

Again from the post quoted above (emphasis in the source):

On top of that, a strategy using five Vanguard funds beats the performance of 90% of public pension funds.

And you’ve again revealed your true colors. You think your pension matters more than private sector jobs, pay levels, or their pensions. So that’s now official.

As for your pension benefits, it appears you don’t want to understand. The Boston College Center for Retirement Research is a long time advocate for public pension funds. Even they are having to say that the math doesn’t work. At 55% to 63% funding (and this assumes all the municipalities make their contributions, which is in doubt), there is absolutely no way the pension funds will have enough money to pay the promised benefits. The numbers are the numbers. And the chart shows how high the contributions have already had have to become.

You are shooting messengers. The money isn’t there.

You and your fellow beneficiaries need to get in front of this problem, because it’s pretty certain that any solution imposed on beneficiaries will be even worse than the fixes (and yes, cuts) you’d devise yourselves.

“The money isn’t there.”

Lol. At least you admit it’s a race to the bottom and by God those folks taking home $30,000 a year despite having two Master’s degrees better just lump it. Freeloaders.

As long as all of us continue to take less, we’ll eventually reach fairness.

I don’t believe my pension matters more than any of those things. Pay us that 15% contribution upfront and you can whinge about something else.

How deep of cuts would have to be enshrined to satisfy public employee bloodlust? There’s literally no end to the pent-up desire to flog public workers, regardless of political stripe. I learned that in 08. How minute should public sector compensation be? Put a number on it. A dollar over poverty wages? Would that work?

When you factor in paid time off, health care benefits, and job security, most public employees are better off than their private counterparts even during the working years.

Even if a public employee’s salary is a little lower than in the private sector — and that is not always true by any means — the public employee is better off overall.

The private sector employee with zilch for pension and working until age 70 (that is me, incidentally) should not be paying taxes to bail out a public pension plan that has people retiring at age 55 or 60.

I would look closely at those pension plans. Even though people can retire after 20 years, it doesn’t mean that they will draw full benefits. After reforms, most people that retire at 20 or 25 years (depending on the scheme) do not draw a full pension or the percentages are adjusted downward. Additionally, one reason that people are granted retirement in 20 or 25 years as opposed to 30 is that the jobs are often more physically strenuous or dangerous. Firemen and policemen are jobs where this tends to be the case.

Moreover, your reasoning leads us to the race to the bottom that has been the story of employee benefits since the 70s. The answer is to mandate that the private sector provide paid sick leave and increase annual leave minimums. It’s no surprise that most of the “public sector has it better” crowd are the ones that are interested in taking it away for everyone.

The public pension system is a mess and both private and public sector employees should be able to have one. But the answer is not to bankrupt public pensions and destroy them without making social security much stronger and generous than its current state.

Teachers take home (after contributions to pensions for example) considerably less than their counterparts in the private sector. There are plenty of data on this. It’s a trade-off.

Private sector? Some 90 year old nun?

When you factor in paid time off, health care benefits, and job security, most public employees are better off than their private counterparts even during the working years.

That tells you just how bad the private sector employment has become for most people over the last 20 years. The best thing, imo, would be working to make the private sector employment better, as strong as it once was, which was once much better than public sector employment wrt wages. Triple the wages in many cases. Instead, libertarians promote the idea of tearing down the public sector employment conditions, making everyone worse off, and trying to sell the idea as “fair”. The libertarians and Wall St want, at all events, to keep their tax cuts and bailout money.

I would be glad to pay extra taxes to make Social Security more generous. That would benefit everyone in the private sector.

That is where I want my extra taxes to go. I do not want them going to public pensions.

Better SS is the answer. I agree. More untenable than Medicare for All by a metric tonne but an excellent suggestion. Me I’d prefer sticking with the fight for M4A since it helps everyone not primarily older people.

Baloney. I have been a hired gun on government contracts.

I got paid a hell of a lot more than the public employees. They had job stability and the older employees had a pension. The younger employees only have job stability as pensions have been basically axed.

Why are you so bitter about people working in public service having paid time off, health care benefits, and job security and retirement benefits that you propose taking from them to allow the crooks on Wall Street and K street to get a pass?

Agreed. I was friends about 15 years ago with an alphabet soup agency tech employee, and he told me they did all sorts of contract work with IBM, and lots of people left to go to IBM because the pay was so much better – my friend was offered double his gov salary. My friend stuck it out because he liked the gov benefits better.

Haven’t kept in touch, so I don’t know what he’s up to now.

Government employees could do what they did in Argentina. Take money from the non-governmental retirement programs. What cannot be paid will not be paid. We can’t have them starving on the streets.

It’s been a while since I bothered to follow this. IIRC, Federal employees have always had the option to either join a conservative Federal Retirement account with half of the money that was headed for SS, and or open 401Ks in addition to SS. After the dot.com crash some of those private accounts were wiped out. But Federal Retirement and SS operated from a much more secure position of mutuality. It’s been up and down for 401Ks and IRAs. So to be rational about the whole retirement paradigm, why aren’t we looking at lyman alpha blob’s common sense suggestion. We’ve been trying to deny reality once again – after the 2008 crash Goldman Sachs was hustling African investments that paid 8% returns. The magic number. Which didn’t save anybody for long. The whole idea behind retirement accounts is security. Not speculation. But clearly something is not working. For public pension funds to be draining so fast is not good. If the economy could bounce back, maybe it would be OK to talk about a downturn. But what we all pretended we had was really never there in the first place. And throw PE into the mix, let the fund managers fight over risk v. reward without understanding anything about the economy at all (CalPERS) and lose their shirt in a time when that money will never be replaced is enough evidence of incompetence and delusion to force the Federal Gov. to take over retirement money altogether. Everywhere. Social Security is there and it works. It’s time to fold public pension funds into the only system that has the ability to keep retirement benefits flowing. And stop speculating with it.

I assume that this would have an effect on pensions in California.

‘The largest cut listed in a budget summary released by the state is the elimination of $2.4 billion in supplemental payments to the state’s largest public pension plans, CalPERS and CalSTRS.’

https://deadline.com/2020/05/gavin-newsoms-revised-california-budget-cuts-pensions-spends-reserves-extends-carryover-film-credits-1202934807/