Yves here. I won’t bore you with details but the fact that it makes no sense for your humble blogger to avail herself of the microscopically small small business loan I could get under the PPP (“Payroll Protection Program”) is indicative of who it is meant to serve. And on top of that, even if I wanted to, per my accountant “both the SBA and banks are requesting that you use a professional agent to prepare your loan package, if you do not have an internal accounting department which can perform this function” when my new accountant lacks the bandwidth to handle mine.

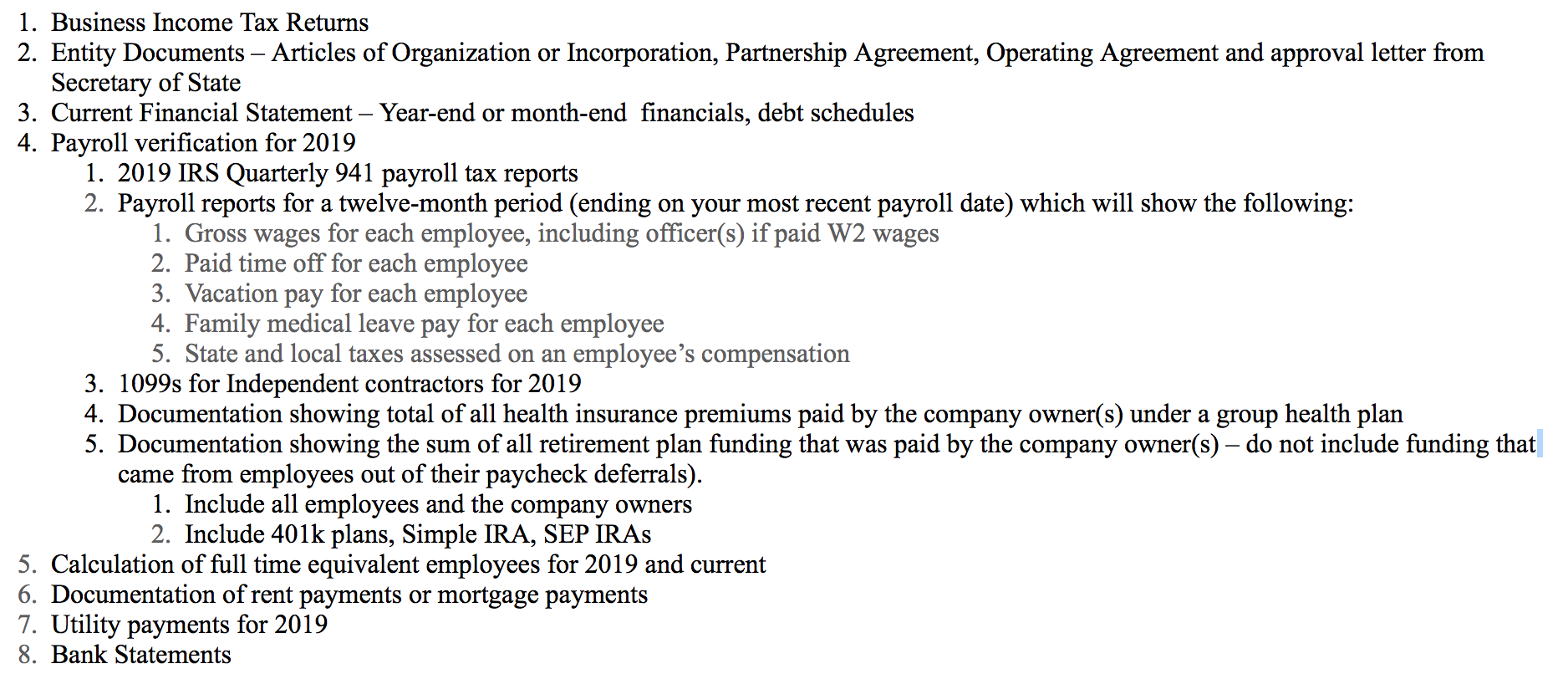

The requirements:

Let’s just start with the current financial statement bit. If you are a little business, those are prepared as incidental to doing your annual tax returns. Like many small businesses, I always get an extension (there are sound reasons why), so I don’t have a “current financial statement” nor could I even prepare one at this juncture even if I wanted to (for more idiosyncratic reasons that are nevertheless sound).

And if the point is to preserve payrolls and perhaps cover other expenses, why the demand for anything beyond proving up who you are and that the payroll and other expenses are indeed paid by that entity?

By Jeff Epstein, host of the podcast, Activist #MMT (Twitter, Facebook, web), Managing Editor of Citizens Media TV, and author of several posts on Naked Capitalism (1, 2, 3, 4, 5, 6, 7). Jeff is also Naked Cap reader aliteralmind. Copy edited by Ben Szioli. Originally published at Citizens Media TV

The Payroll Protection Program (PPP), which is part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, is a Small Business Administration (SBA) loan program intended “to provide a direct incentive for small businesses to keep their workers on the payroll” during the COVID-19 health crisis.

Since its founding in 1953, the SBA, which is a federal program, has “delivered millions of loans, loan guarantees, contracts, counseling sessions and other forms of assistance to small businesses.” All SBA loans are approved and managed by local commercial banks. According to Modern Money Network Research Director Nathan Tankus, “the forgivable loans running through the Small Business Administration are underwhelming and have [historical problems], in terms of being administered by banks and being slowed down and filtered through all the biases that banks have.”

Some SBA-approved lenders also have difficulties following the law, such as Wells Fargo, which in January settled with the United States Justice Department for fourteen years of fraudulent activity against its customers, employees, and investors.

Although the PPP is a loan program, the loans are forgiven “if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities.” It is required that least seventy-five percent of the loan funds be used for these purposes.

The SBA processed more loan applications on the PPP’s first day than it did in the entire year beforehand. Unfortunately, large corporations have raided the PPP, with the vast majority of small businesses left in the lurch. A chaotic application process worsened the situation, ultimately resulting in only six percent of businesses receiving loans before the funds were depleted.

Huge Corporations Cut in Line

As reported by Reuters on May 5th, at least forty-one companies received PPP loans despite “already [having] enough to cover basic expenses for two months or more when they applied for the funds.” Some of these companies even showed optimism in recent press releases and regulatory filings. For example:

- Athersys Inc., a biotech company, had $37.5 million cash on hand (enough to cover around nine months of operating expenses) when it filed for a $50 million stock offering soon before securing a $1.3 million PPP loan. Soon after, its stock soared to a market value of more than $500 million.

- Accelerate Diagnostics reported that it had a market value of around $570 million and $92 million cash on hand, just two weeks before receiving a $4.78 million PPP loan.

- Enzo Biochem, with a market value of around $130 million and $48 million cash on hand (enough to cover seven months operating expenses), received a PPP loan of nearly $7 million.

Along with dozens of others, these companies certified on their PPP applications that “current economic uncertainty makes this loan necessary to support” their ongoing operations.

On April 21st, the Financial Times identified a total of “83 [publicly traded] companies that had collectively borrowed more than $330m from the PPP, on average $4m each.” On April 27th, the New York Times reported on Domio, a New-York based startup that “most likely had enough cash to last until 2021,” yet laid off staff, applying for and receiving a loan three days before the PPP’s funds ran out.

These companies took out loans despite already being flush with cash and despite also having access to capital markets, which means they have alternative methods for raising funds, such as by selling stock.

Some large companies like Shake Shack, which is worth $1.7 billion and received a $10 million loan, returned the funds in response to public backlash. In an open letter posted to their Linkedin page, Shake Shack executives argued that “the PPP came with no user manual and was extremely confusing.”

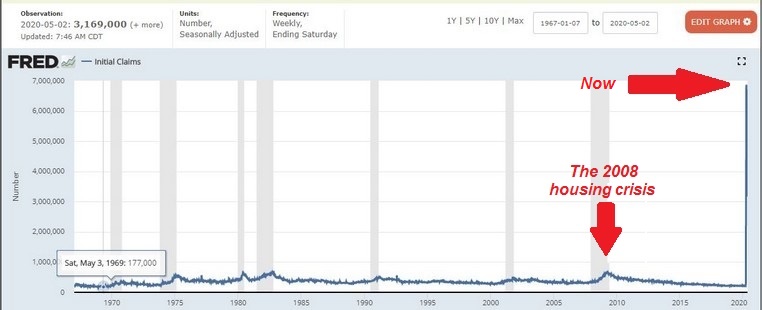

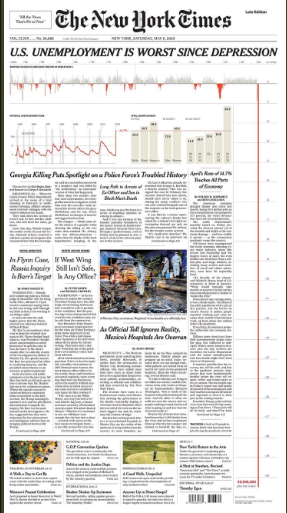

Unemployment claims during the crisis are unprecedented by orders of magnitude. Graph source: Federal Reserve Economic Data, or FRED, downloaded 5/7/2020.

Egregiously Designed

Large corporations would not have been able to take advantage of the PPP if the program had not been, again according to Tankus, “egregiously designed from a budgetary point of view.” Despite small businesses needing at least $700 billion to fund their payrolls for three months, Congress allocated only half that amount. It took less than two weeks for the PPP to be emptied, now with the vast majority of its funds not in the hands of small businesses, but rather large corporations.

This happened in large part, Tankus says, due to the structure of the PPP, which has provided loopholes for large corporations, put roadblocks in front of small businesses, could exacerbate racial inequalities, and discriminates based on immigration status. To add insult to injury, twenty-four hours before the PPP’s launch, in response to pressure by banks, the Treasury Department (to which Congress provided discretion over loan terms) doubled the loan interest rate and greatly shortened the time small businesses have to pay it back.

[Tankus’ blog documents the intricate details of the United States’ inadequate response to the COVID-19 crisis, with a focus on the role of the Federal Reserve. His work has been quoted bypoliticians in the United States and abroad, and in academic papers.]

Infectious Disease

In order to stop the spread of the virus, many who are ready and willing to work must stay home. In the words of economist Pavlina Tcherneva, “a recession is sadly necessary.” Instead of remaining in stasis until after the crisis, the lack of payroll funding forces small businesses to shed workers or their hours, beg for donations with GoFundMes, or shutter. This hurts employees and their families, and the businesses those families shop at. This in turn affects the employees of those businesses, and so on. In other words, the unemployment itself spreads like an infectious disease.

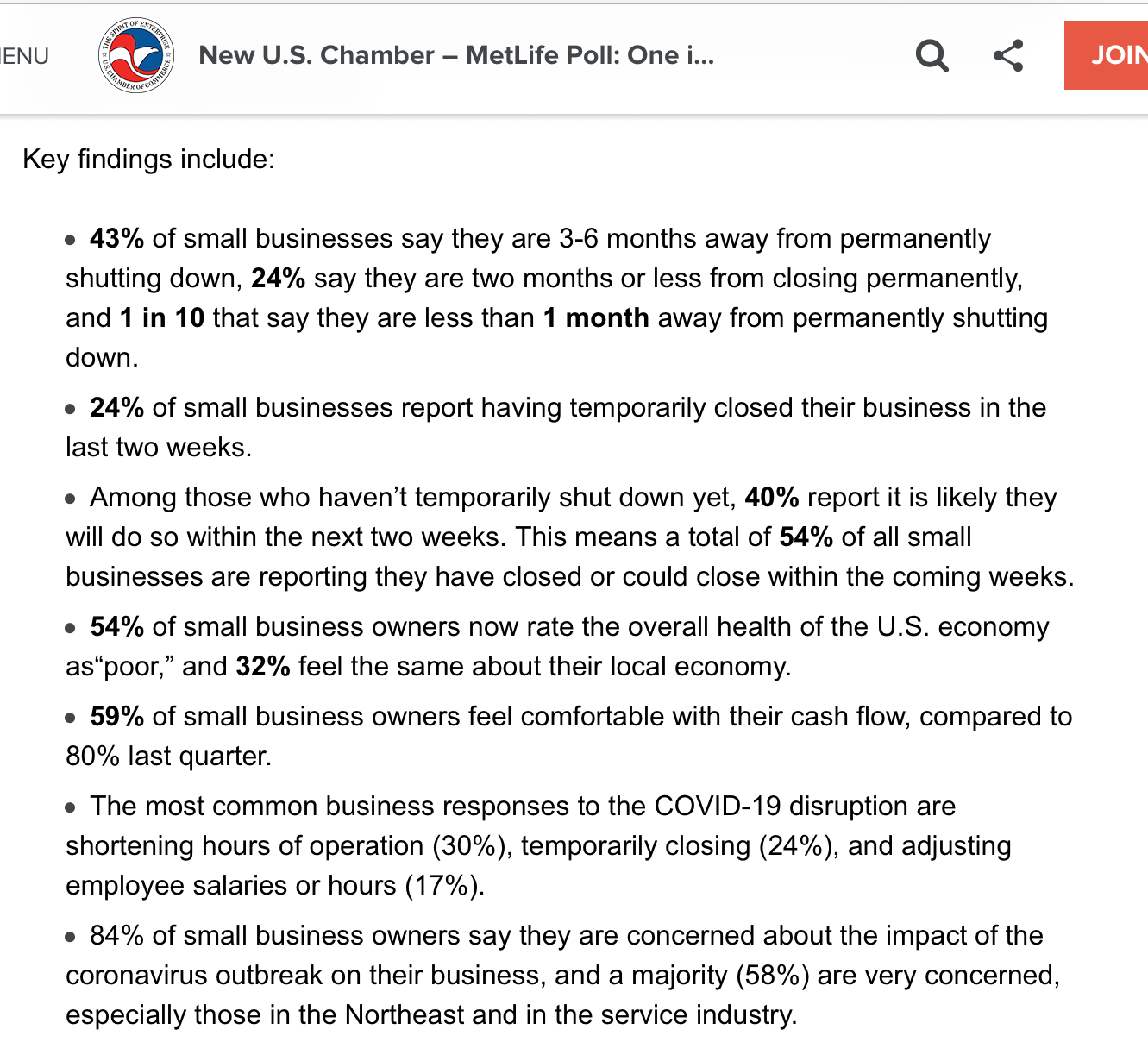

In fact, an April 3rd poll from the U.S. Chamber of Commerce [a pro-business organization unaffiliated with the United States government] and MetLife shows a large percentage of small businesses are considering permanent closure within the next three to six months:

The Reality of Federal Finance

Worst of all, the suffering is completely unnecessary. It’s an arbitrary political choice. As is the case with all federally administered programs and benefits, it is impossible for the United States Congress to “run out of money” with which to fund the PPP. According to Texas Christian University economics professor John Harvey, “there is 0% chance that the US will be forced to default on the debt.” According to former Federal Reserve Chairman Alan Greenspan: “there is zero probability of default.” And finally, economist Stephanie Kelton, who served as the Democrats’ chief Senate Budget Committee economist in 2015, and as senior economic adviser to Bernie Sanders’ 2016 and 2020 presidential campaigns:

The appropriations pen is out of ink?

I can’t believe we’re hearing, “We’re out of money” in the early stages of a crisis. AGAIN. The truth is, Congress can appropriate whatever it chooses. It literally cannot run out of money. https://t.co/P1RZ1wOMHR— Stephanie Kelton (@StephanieKelton) May 10, 2020

Congress is the only entity on Earth constitutionally empowered to create US dollars, which it does out of thin air, and not so differently from how you or I enter the number 100 into a spreadsheet: by pressing one, then zero, then zero. [To be more specific, Congress authorizes its creation, which is executed by its delegated agent, the Federal Reserve. To be even more specific, see here.] In addition, because the United States has full financial sovereignty, there is no purely financial constraint preventing Congress from funding the PPP for the duration of the quarantine and beyond, regardless its length.

Congress indeed has limitations, but they’re real, not financial. Sam Levey, Research Scholar at the Global Institute for Sustainable Prosperity, distinguishes between “real” and “paper” problems. Renowned economist Abba Lerner argued for federal finance to be geared towards achieving “functional”, not “sound” goals.

The Button Works Fine!

The 2010 Citizens United v. Federal Election Commission and 2014 McCutcheon v. Federal Election Commission Supreme Court decisions made it possible for unlimited money to drown out small donors. On the ten-year anniversary of the Citizens United decision, the New York Times concluded: “The world Citizens United created — unlimited money in politics and legally unchallenged corporate personhood — is now simply the toxic civic air we breathe.”

Further cementing this reality, on May 8th, 2020, the Supreme Court ruled that many forms of political corruption simply do not violate federal law, “embracing a view of the world that is unbearably bleak.” Attorney, author, and Fordham University associate law professor Zephyr Teachout describes the “shell game” being played by the Supreme Court:

Here’s what should madden you: In his decision in Citizens United, Justice Kennedy said that we should not worry corporate spending would lead to greater corruption, because bribery laws would still deal with our corruption problems. Then the Court went ahead and weakened bribery laws.

Yes, the Payroll Protection Program has serious problems. The cause, however, is not just those who abuse the system, but those who designed it to be abused, chose to needlessly throttle it on top of that, and then voted it into existence. Once it became law, these legislators looked the other way while the abuse happened. Now when it’s too late, they turn around and act surprised.

Considering all of the above, it is not surprising that programs like the PPP, along with many other United States laws, prevent help from reaching those who need it most, while allowing those who need it least to plunder without limit or consequence.

As the monopoly issuer of the US dollar, only the federal government, led by Congress, can backstop the economic devastation we currently face in a way that leaves all parties whole. Congress has decided instead to artificially cap the PPP at levels that are woefully inadequate. Congress uses its full authority at the push of a button when it comes to large corporations, corporate lobbyists, the military industrial complex, and the fossil fuel industry. Unfortunately, when it comes to supporting American small businesses and the millions of workers and consumers who depend on them, Congress has decided – even though the button works just fine – to leave it unpressed.

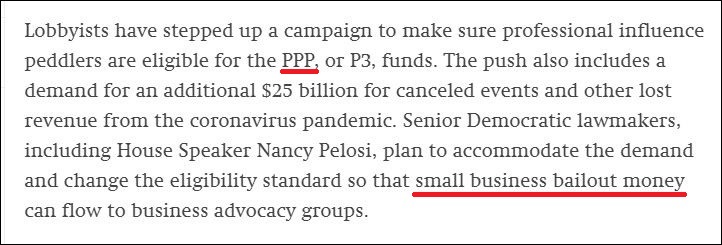

The Intercept reported on May 5th that House Speaker Nancy Pelosi supports an effort to divert small business bailout money to corporate lobbying firms. Here is the full bill, which expands coverage such that almost all 501(c)(6) groups would be eligible for PPP loans. (The Intercept article states “Many of the largest lobbying forces are organized under the 501(c)(6) section of the tax code as trade groups.”)

Not that Great

Let’s give the final word to Nathan Tankus, written on March 21st, when unemployment claims were only around a third of what they are today (from here, emphasis added):

[Many] don’t seem to realize how unprecedented a crisis this is. This is no mere recession. This is not even the Great Depression. This is the largest, fastest economic crisis that has ever happened. We’re hanging on a precipice and we need 3.5 trillion dollars distributed to households at a minimum – let alone the support system we need for businesses. … This is the biggest crisis we’ve ever faced and we need quick responses with trillions out the door now.

Another view of the data from the New York Times. Photo source.

Postscript: Sabotage, Defund, Claim It’s Dying, Repeat ’til It’s Dead

The larger issue is that Congress imposes false scarcity on federal programs under the guise of concern for “fiscal responsibility.” The same false scarcity threatens to permanently shutter the United States Postal Service (USPS). As reported last month by Naked Capitalism:

Under the terms of PAEA [Postal Accountability and Enhancement Act, passed by Congress in 2006], the USPS was forced to “prefund its future health care benefit payments to retirees for the next 75 years in an astonishing ten-year time span” – meaning that it had to put aside billions of dollars to pay for the health benefits of employees it hasn’t even hired yet, something that “no other government or private corporation is required to do.”

By writing and then passing the PAEA, Congress has forced USPS to do the impossible, which, unsurprisingly, it has been unable to do. It is now being claimed with faux consternation that USPS is “going broke” and may have to be shuttered – forever empowering private shipping services such as UPS, FedEx, and Amazon.

[According to Ph.D. political scientist Joseph Firestone, the onerous provision was rammed through by the then-Republican controlled Congress. The subsequent 2009-2010 Obama administration, which had control of both houses of Congress, could have repealed the provision but did not choose to.]

While the USPS, a federal agency, must pre-fund all its retirees for seventy-five years into the future, the executives at many large private corporations across the country get to further enrich themselves by brazenly plundering the pensions of their past, present, and future employees. Congress and the justice system have enabled this criminality for nearly a century, while providing essentially no justice for pensioners. [Here is an episodeof the podcast Historic.ly that I recorded last year, where I discuss this topic in depth. The written description also contains a substantial overview.]

When the #MMT coin drops and you realize the suffering is gratuitous. https://t.co/BvSFF8rgxi

— Stephanie Kelton (@StephanieKelton) January 27, 2019

My son in law from CA has a small Architect business. He applied and was approved for a loan in the first round. Unfortunately by the time he was approved there was no money left.I’m not sure about his present status because I don’t like to ask personal questions about his business.

I went through a whole mess with my soon to be former bank, but let’s say screen shot and email everything. It’s funny though I worked the phones (I’m very good at this and know how to get through) and was on the line with a senior vp and after dropping proof of their lies and her specific lie which I told her was probably cooked up by a lousy attorney they should fire my loan was funded in less than an hour. I did tell add that the SunTrust people were probably at fault and should be purged.

What the bank claimed was incomplete on my app at one point was absurd as its on the app in multiple spots and I had proof it wasn’t incomplete.

Interesting that you should mention SunTrust. A company I’m familiar with banks with Suntrust and tried to get one of the loans through them. They ran out of money before Suntrust processed the application.

On the next round, rather than going with SunTrust, the company used a smaller local bank. That loan got approved pretty quickly.

This whole tragic mess could have been avoided with a simple line of credit made available to any business, backed by the federal government.

The attached proposal was prepared in the right-wing Mercatus Institute, incidentally.

https://www.mercatus.org/publications/covid-19-policy-brief-series/government-backed-line-credit-would-help-small-businesses

Wow! What a great idea. Put people deeper in debt. Where are the unemployed going to come up with the money to pay it back in a year? That is about as smart as stopping the withholding tax, which will insure Social Security runs out of money quicker.

One day, you’re a more or less successful entrepreneur, a vocation you’ve chosen because the dog collar of employeeship doesn’t fit you, and you want to be free to make your own decisions, go your own way, do your own thing, proud to be part of the universe of small enterprises that ultimately is the foundation under any healthy economy.

The next day, with the stroke of a pen, you are reduced to an non-entity having to go begging to some sniveling bureaucrat for a few crumbs from the cake that’s being ravenously eaten by big corporations disposing of armies of lawyers and accountants trained to suck every advantage they can out of whichever government program is halfway open to them.

Small entrepreneurs are ruined, crushed, mistreated and discarded. It’s a travesty. My heart goes out to all of you.

My local burrito shop is the livelihood of one elderly woman. She was denied a loan.

I’m thinking through what help I can offer her personally. It’s not going to be enough to keep her off the street if things don’t change. But I will be there for her, at least to the extent of meals and information about resources, if she lets me stay in contact after things go bust.

The shutdowns are necessary, but the government should take responsibility for what they broke.

It seems that the Government forgot the Pottery Barn rule. No word from Colin Powell yet-

https://en.wikipedia.org/wiki/Pottery_Barn_rule

The EIDL program – the SBA program ostensibly designed to help small business – was written into the CARES Act to provide “up to $10000” within 3 days of the business owner application being received by SBA.

Both my wife and I applied for our businesses as our rent, insurance, utilities, etc still need to get paid even though our businesses are off by over 50%. Both of us got confirmation that our applications had been received the day we applied.

I received $1k and my wife received nothing. We both applied on 3/31/2020, so we’ve been waiting for over 40 days. I received the$1k in late April.

Even though we were eligible for unemployment benefits through the revised rules, we didn’t feel right applying for that knowing a lot of people in much worse shape needed those funds more than we did.

I used to buy into “we’re a nation of laws” bs, but the SBA ignored the law.

Republicans ought to be shamed during this election by small business owners who were treated like cannon fodder while the SBA ignored it’s mandate to loan this funding source to small businesses like ours while writing checks to shake shack.

SBA lending, from the perspective of someone who more exposure to it than desired, has been a cluster-f from the beginning. It is a system that is designed to ignore the obvious, and can be manipulated by lenders, loan officers and their sinister enablers, read liars, in the loan brokerage world.

There are so many legitimate borrowing requests for decent businesses run by honest people, and those get tainted by a process that grinds down all with numbingly detailed minutiae while willfully allowing that missing of the obvious.

The first question ought to be:

Does this business make sense?

Then, can it be consistently profitable?

Those pesky questions can get glossed over in pliable organizations when pushy lenders need to make quotas for volume, for bonuses and to maintain some type of temporary standing in the SBA good graces, whatever those may be. The audits might come later and might not be very effective in a carpet-bagging sub-industry. Talk about a Rube Goldberg approach. PPP is version 2.0 with all the modern conveniences you’ve come to expect.

The third question, along with some other comments, highlights an important point: in a truly small business, “profit” is actually someone’s pay; a return to labor, not capital. The clearest case is if the business is one person: unless they’re getting returns on a large investment, ALL the net is pay for their work. This is one reason the “petit bourgeoisie” – shopkeepers – generally allied with the proletariat, not the capitalists.

“Profit” is an extremely protean and frequently misleading term.

Those truly small business borrowers are among the fondest memories, seeing someone nurture a business and thereby helping themselves, their families and their community.

Senate resolution to condemn MMT:

https://www.perdue.senate.gov/imo/media/doc/MMT%20Resolution.pdf

I’d love to be wrong, but I’m struggling to find a positive spin to your sharing this piece of high-class dreck here, especially without commentary. I am grateful that a large percentage of the commetariat on Naked Cap know better.

The idea that Modern Monetary Theory, which is a **field of study** not unlike mathematics or biology, is something to be implemented or not implemented, is as ridiculous as saying that we should “implement mathematics” or “not implement biology.”

The idea that applying the knowledge of MMT inherently “causes inflation” or “will lead to hyperinflation” is just stupid.

One example from the resolution (which quotes not a single MMTer or their work): “Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, said:‘‘The idea that deficits don’t matter for countries that can borrow in their own currency I think is just wrong’’; ”

You will not find any quote or citation from any reputable MMTer saying “deficits don’t matter.” MMT says the *size* of the deficit is never a problem, inherently, in and of itself. For the issuer of the currency, the idea that “higher deficits” is inherently a bad thing, in and of itself, is silly. The *inequality* of deficits what’s always a bad thing. The solution is to stop spending so much of our deficit on bad stuff and start spending more of it on good stuff!

Same with the national debt: The problem is not its size but its inequality – that the obscenely rich have too much of it, and the rest of us have hardly any of it. The idea our “having wealth” (“too much debt!”) is a problem in and of itself, is, again, silly.

The authors of that resolution don’t know what the hell they’re talking about – or they *do* know what they’re talking about, but realize that if people started understanding the reality of federal finance, that those they might start asking the authors of this resolution some very uncomfortable questions.

Also interesting that, at the moment, this is the only comment you’ve ever made on this site under that username.

https://www.nakedcapitalism.com/?s=antidlc

I posted it because it’s ridiculous. I didn’t think any commentary was necessary.

I have posted on this site for a long time and have contributed to fundraisers.

Then thank goodness my first words were “I’d love to be wrong”.

Phew. I’m relieved. Thanks for clarifying.

I think I’ve been on Twitter too long :)

Here’s one bright spot in Response:

Is your restaurant at risk? Wealthy NC donor wants to cut you a check.

Read more here: https://www.newsobserver.com/opinion/article242676961.html#storylink=cpy

In Raleigh, one man is launching such an effort by offering the city’s beleaguered restaurants loans with terms that sound like they were written by Santa Claus: less than 1 percent interest and no payments for seven years.

Now that is pretty good, but this takes the REAL PRIZE:

If a recipient can’t pay on the loan after seven years, it’s unlikely to be a problem. “Any lender who is prepared to lend money on these terms is likely not to be hostile in the event of nonpayment,” he said.

and of course he doesn’t want his name revealed–y-know-’cause it isn’t about him.

Read more here: https://www.newsobserver.com/opinion/article242676961.html#storylink=cpy

When I read “Wealthy NC donor” I read NC as Naked Capitalism. Maybe I spend too much time here ;-)

I think that armed takeovers of government buildings, similar to the one that recently happened in Michigan’s state capitol, will soon become commonplace.

I’m sorry but those requirements don’t seem that arduous for a small business. Maybe for a mom & pop shop or side business, yes.

There are bigger problems with the CARE act and it sounds like ‘if only’ those were the requirements instead of lending institutions coming up with their own.

Wake up and smell the coffee. 90% of small businesses have fewer than 20 employees. Many small accountants, law firms, architects, decorators, and mini medical practices (chiropractors, physical and psycho therapists, my current GP) have one to three employees and the rest 1099s. They would likely have the exact same issue with the financial statement part that I do, that they generate them only as part of their annual taxes and they haven’t done them for 2019 yet.

The federal system, Congress and the Administration, and the Judiciary which only analyzes how many angels dance on the death of a nation, all of them have failed the nation. We have not gone bankrupt – our nation has gone bankrupt at the hands of the most incompetent people on the planet.

You cannot go bankrupt with pie in the sky fiat, its impossible. Real hard physical assets are what are necessary and these elite dont have their billions in them its all on paper and can go poof overnight and it will very shortly now. My spending has been reduced by more than 50% as I am in one of the most stringent lockdown states in the US, it will remain so even when all is opened back up. I have learned I dont need all that junk that they push down our throats and that is their most virulent fear, that many like me will figure it out and never go back to the way of spending that existed prior to the pandemic.

Indeed.

One less obstacle. Senator Burr has stepped down from his role as Chair of the Senate Intelligence Committee!

Best news I’ve seen today, and the day is still young in news terms. One down from the Gang of Eight, so a good start.

Small businesses are a large part of the US economy. How can they willfully destroy so much of the economy and expect everything to just keep going on normally? This seems big enough to be a threat to national security and could pull down the entire United States. Are they really that stupid or is that their intent? What do they think is going to happen if even 25% of small businesses (which are 44% of the economy) fail which means 11% of the economy vanishes, with subsequent knock-on effects that destroy even more of the economy? Is there something I’m not understanding here?

My PPP experience: I applied for and received a PPP loan (in the second round). I submitted my application on the evening of April 22 and my loan was funded on May 1. The application for took me ~30 minutes to fill out. The only supporting documentation I had to submit was scanned copies of my Form 941 payroll tax returns for the previous four quarters. My company is an S corp with only one employee (myself) and I do all my own accounting, so the process was admittedly much easier for me than for virtually all other businesses. Also, I applied immediately upon receiving an unsolicited email from my bank informing me that they had just been approved as a PPP lender, so my application was at the very front of the queue at my bank.

Wow, that list of requirements is crazy. I would be interested to know how it compares to the requirements for the TARP, which I believe followed the principle of “get the money to them ASAP and we’ll work out the details later.” They could very easily have done the same for small business if they were serious about offering relief.

My greatest wish is to see 435 new congressmen and 33 new senators in Washington.

On a whim I thought I’d look up the votes for the Postal Service Gutting Act of 2006, to see if any Dems (or rather how many) went along with the charade. Silly me, thinking they would have left a paper trail after committing such a such an atrocity.

https://www.govtrack.us/congress/bills/109/hr6407

Best democracy money can buy.