Yves here. Hubert Horan’s predictions about how the major airlines would give Washington the run around are panning out. Hubert described long-form how the airlines had become masters of persuading the official to support an inefficient industry structure. He argued that the airlines were acting to preserve shareholders at all costs rather than revamp bloated operations to wring out efficiencies. It’s much easier for the Feds to keep writing checks rather than crack down. His latest piece: Hubert Horan: The Airline Industry Collapse Part 5 – The Battle to Protect Airline Investors From Economic Reality Enters a New Phase.

Funny how Congrescritters are no where near as solicitous towards individuals and families that are struggling to get by thanks to Covid.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

Top 4 airlines burned $45 billion on share buybacks since 2012. If airlines run out of money, Chapter 11 bankruptcy works. Airlines proved it.

Airlines in the US will get another $17 billion taxpayer-funded bailout if the $748 billion “bipartisan” stimulus proposal that the four most senior Congressional leaders are discussing this afternoon makes it into law.

There is a commitment now to pass something. Many items that either party wanted but that the other refused to yield on have been trimmed out of this proposal, including the $1,200 stimulus checks. But their airline bailout is in it.

Democrats and Republicans may not agree on much of anything these days, but they both love to bail out airline shareholders and bondholders. And that’s what this is – dressed up as payroll protection and airline support program.

The Democratic-backed $2.2 trillion stimulus package that the House passed at the end of September but that was not taken up by the Senate included $25 billion to bail out airline shareholders and bondholders. The airline industry has been lobbying with all its might to get this money. So now, it looks like they will have to make do with $17 billion.

This new bailout comes on top of the original stimulus bill, which was passed in March and which came with $25 billion in so-called payroll support for the airlines, an additional $25 billion in loans for passenger airlines, and over $10 billion in grants and loans for cargo airlines and aviation contractors. The payroll protection provisions expired on September 30, under the assumption that by then the airlines would be operating more or less back at normal.

But they’re not. Delta Air Lines, American Airlines, and United Airlines have warned in recent days about once-again declining bookings following the Thanksgiving surge of Covid infections. Airlines have reported spikes in cancellations. Leisure travel had picked up, but the very lucrative business travel and international travel remain in a zombie state. The V-shaped airline recovery that Wall Street had promised in late spring and early summer has gotten crushed

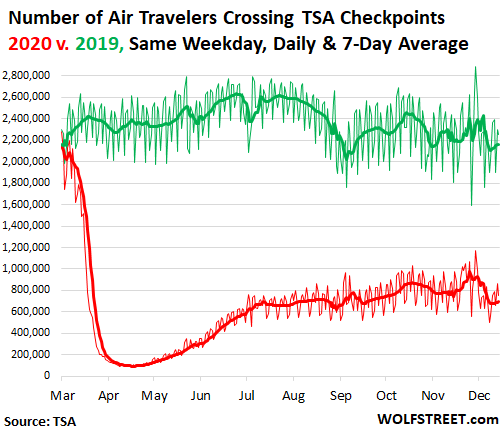

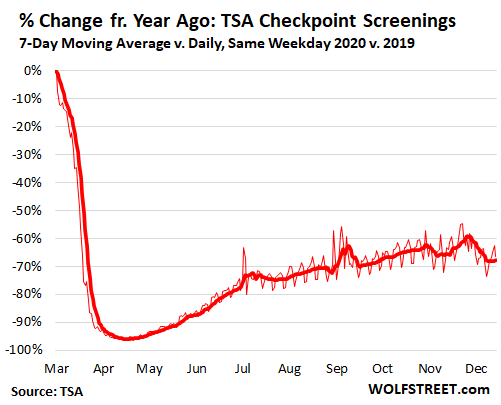

The number of passengers going through TSA checkpoints to enter the secured areas at US airports through December 14 has dropped sharply since late November. The chart shows the number of TSA checkpoint screenings in 2020 (red) and 2019 (green) per day (thin lines) and the seven-day moving averages (bold lines):

The daily checkpoint screenings are now down 68% (seven-day moving average) from where they’d been on the same day in the same week a year ago, the worst levels since early September:

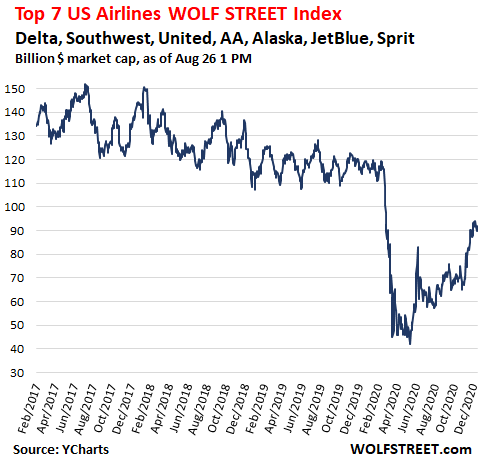

The airline lobbying group, Airlines for America, said on Monday when the bipartisan proposal was presented that it “enthusiastically” supported the $17 billion handout for the airlines. And airline stocks rallied. The WOLF STREET index of the top seven airlines in the US rose 2.4% today and is up 23% since mid-November:

Airline shareholders feel the money. And taxpayers feel the pain. This rally comes as revenues at the largest airlines have collapsed by 60% to 70%, and as debt has piled up in previously unthinkable amounts, and as airlines continue to report huge losses and – despite massive capacity cuts and layoffs – dizzying “daily cash burn” figures.

Taxpayer money props up those shares and is a basic transfer of wealth from the American public to airline shareholders and to airline bondholders.

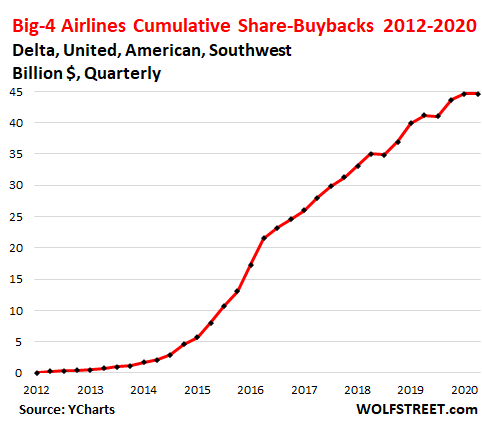

This is the same industry where the top four airlines — Delta, United, American, and Southwest — willfully blew, wasted, burned, and annihilated $45 billion on share buybacks since 2012 to enrich their shareholders, including their own executives:

The other solution, if airlines run out of money to burn, would be to restructure their debts and their operations in bankruptcy court with a chapter 11 filing. Delta, American, United, and other airlines already restructured in bankruptcy court, and it worked fine. They know how to do that.

I was on an international Delta flight when Delta filed for bankruptcy, and never noticed the difference. The plane didn’t crash, and the connecting flight was there, and everything continued as normal and my frequent flier miles remained intact. Airlines know how to do that.

The cost of restructuring the debt falls on shareholders and creditors – not taxpayers. If an airline filed for bankruptcy today, the ownership would be transferred from shareholders to certain creditors. Shareholders would be wiped out, or nearly wiped out. Unsecured creditors would get a big haircut. The airline would continue to operate through the proceedings and would emerge under new ownership, with less debt, and with a scale of operations that would be appropriate for the new environment, and it would allow the airline to thrive going forward.

But no. There is universal consensus in Congress that Shareholders and bondholders have to be bailed out. And since that sounds unpalatable, the bailout gets dressed up in payroll-protection and airline-support lingo. And so, there’s another $17 billion for a shareholder and bondholder welfare program.

So how long do we bail out the bankster until we nationalize the airlines AGAIN.

I believe you don’t understand how capitalism works. The banks get the money from the Fed. They buy the stock of the airlines with the free money and then get the public to subsidize their investment with free money until the banks go bust then we give them more money so they can invest it in other industries that they want the government to subsidize.

It’s a big club….

That’s a good story, there are also others. Little Red Riding Hood can be walking to her Grandma’s, while, in another part of the woods, Three Little Pigs are building houses.

In another story, banks and bond-buyers can loan money to an airline, and the airline can spend the money on buying its own stock*. Then the creditors can collect interest indefinitely, paid for by the passengers. When there aren’t enough passengers to pay the interest, then it has to be bankruptcy.

* Even if the stock had been bought by the banks with Primary Credit Program loans from the FED, which would be a nice touch, and I can’t prove it would never happen.

Whar purpose does this really serve? Once upon a time, subsidizing commercial travel airlines was a subtle way of maintaining a large but possibly necessary strategic airlift capability. So how many airlines do they really need for that? I can drive up to Olympia Washington and there’s probably enough heavy purpose-built transport aircraft to move the entire 1st Marines.

It’s a subsidy for someone. why not just write them a cheque and have only maybe 3 commercial airlines. Scrap the excess and be done.

I think the reality is that behind the scenes, the Fed and gov entities are scared stiff of any implosion in a major sector of the economy reverberating through the markets and causing a crash.

Add into that regulatory capture, lobbying, etc. and you get the gov backstop of any large corporations. The crazy part to me is that they give these billions with no real rules. For example, you would think they would demand the companies keep everyone on payroll. But no. United and Southwest have laid of 10’s of thousands already.

inhibi good point. I agree. Preserving the airlines has a definite propaganda result, in that the appearance of “normality” prevails to some extent. That is not to say that the lobbying does not have some influence as well. From what I read in the WAPO today, the only reason any action on a stimulus bill is being taken at all is that definite cracks in the “all is well” economic facade are beginning to yawn wider. I think the Repubs are going along with it because they are desperate to not have everything slide off the cliff while Trump is still in office and the GA Senate races have not been decided.

But no. There is universal consensus in Congress that Shareholders and bondholders have to be bailed out.

This isn’t capitalism. I’m not sure what to call it. Market Stalinism? Market Socialism?

How much of this is Congress bailing out their own portfolios, bailing out themselves, and bailing out their all important donors?

Socialism is for the people (at least in theory), so its more corporate fascism than socialism.

for the top 0.9% it is defacto bipartisan f a s

cism—-fusion of corporations and state.

the mere threat from CEOs/lobbyists of 1000’s of layoffs in the major airport hubs is enough for Ds and Rs to open the public checkbook, coincidently bailing out senior management as well

Pretty sure this is how capitalism worked for most of the 19th century. Post-FDR era capitalism was an aberration caused by political will, and Capitalism is returning to the form it was in during the late Victorian era, where government pumps up monopolies.

Let’s see…. Hank Paulson did a 1 page write up on the bank bailouts. He had help from turbo tax timmy, but it was Hank’s. The airlines appear to have burned the midnight oil , put their powerpoint skill to use and did their version of a whoa is me act. Future stock buybacks and bonuses are at risk…. Can’t leave those on the table! Definitely can’t let us plebes get out dirty hands on it.

It will be a long time before the travel industry comes back. This is only ‘foaming the runway’ for the executives/stockholders/debt holders to get their money out until the next ‘bailout’ or the before the proverbial excrement hits the rotary air flow stimulator.

That squares with what I’m seeing in the skies above my house.

In normal times, I’m below the base leg that commercial aircraft fly before they turn for final approach. Nowadays, I hardly hear a plane.

The question with all these bills (and nearly any desperately needed piece of legislation or even things as simple as the Pfizer data) is: what’s in the [bleeping] bill?

I can’t find the language about what exactly the airlines are going to get? It’s always couched as “payroll support”… is that money that the airlines are going to send to the furloughed employees? For example, American furloughed 32K employees in October. Do more than 100 people in the United States know what’s in this bill before it’s voted on?

The people are not to be trusted I suppose to look at and evaluate bills. We must be told all the benefits but never see the final product until passed.

The restaurant industry is also hanging on by its fingernails. They don’t have bond holders in most cases but the do have landlords. And I bet almost as many employees or more. What they don’t have are lobbyists and politicians on speed dial.

I also seem to remember an airline which got a loan from the last relief bill who tossed employees the moment they could.

People don’t matter, states don’t matter, real small businesses don’t matter, the Post Office and actual healthcare doesn’t matter.

The contempt they hold for the public and for the public good is overwhelming.

I believe this is the very definition of “unsurprising.”

Wouldn’t nationalizing the airlines have been the rational thing?

I notice that the total giveaway is almost half the current market cap of the seven biggest US airlines. Basically enough money to buy controlling interest in them. Also pretty close to how much the top four spent since 2012 burning money by buying their own shares back since 2012.

I believe $748 billion works out to something like $7000 per US household. Why can’t we just have the money?

I’d really like to see that question asked in the mainstream news.

If the Dems don’t, Josh Hawley will.

I saw the FOX interview w/Hawley on the stimulus checks. He will eat up every potential Democratic contender in 2024.

“Taxpayer money props up those shares and is a basic transfer of wealth from the American public to airline shareholders and to airline bondholders.” Taxpayers don’t prop up anyone. It isn’t a ‘transfer’ of wealth it’s the simple creation of new money that’s given to airline shareholders and bondholders. It is an increase in wealth for a chosen group of people. Instead of creating new money to increase the material well being of the majority of citizens, Congress creates new money to add to the wealth of a chosen group of people. That’s all it is. Whether it is bankers, or shale drillers, or to whomever Congress wants to bequeth new wealth, it can be done. And no new taxes are required to do so. It gets even worse, of course, because Congress also agrees to issue Treasury debt, dollar for dollar, in deficit spending. Which is another creation of wealth to the favored few. Because they buy the debt and become creditors, the owners of debt Congress created that was never needed in the first place. A monetary sovereign governrment’s spending needs no debt. Debt is not intrinsic to funding Congressional spending. Another subsidy, again to the favored few. This is neoliberal macroeconomics. It was designed expressly to funnel money up to the favored few. I do not believe in coincidences.

The CONgress is playing games to ensure that their donors get the money. They don’t their known regular duty of passing the federal budget – it’s been flim flam extended appropriations since the Clinton days.

The Ameican people are absentee landlords. They gave CONgress the key to their houses and have gone off on vacation.

Good News! Mayor Pete will be on the job next month.

It is worth watching Richard Wolff’s latest economic update, with an interview with Sara …union rep for airline employees, showing how sometimes the employees actually have been able to get some success with their claims on the airlines, but this is very very rare.

The whole system of share buybacks should be made illegal, as it was until relatively recently.

Sadly there are very few private sector unions and they are powerless. Sara’s union is relatively powerless since the airlines are hardly in a position to even keep functioning. We are way over airlined worldwide. Our unions should be spending money and dues to organize Amazon certainly. And in so doing outlaw outsourcing deliveries. Let the Teamsters do it. Then Amazon would be a union shop and it would lose its competitive advantage.. When I grew up no one crossed a picket line ever. But our current unions are bought out and completely useless. And I am a Teamster, many years from paying dues but a Teamster nevertheless. If Nafta included allowing the UAW to unionize Mexican auto workers it might not have been such a disaster. Unions need to work transnationally. The UAW should be organizing Chinese auto makers as well. If not they are doomed by our neoliberal democratic and republican leadership.

“New State Capitalism” in the West is the state corporate partnership to assure that share and bond holders always increase their wealth no matter what.