Yves here. The media has focused on Covid developments, and in the US, the pitched battles over the stimulus package. What is widely acknowledged by those paying attention is that the European stimulus is way too small, and that was before the prospect of yet another set of lockdowns was in the offing. Italian banks were looking plenty wobbly even before Covid took hold, and they’ve long been seen as big enough to have the potential to set off a wider conflagration.

Thomas Fazi gave a full rundown of different estimates of the size of the EU’s rescue package versus ours. They range from 50% (which Fazi questions) to nearly double and even, per the IMF, four times larger.

Given the serious and continuing costs of Covid, the EU’s budget short-sightedness will produce avoidable damage to businesses. That will blow back directly to banks, since unlike the US, most corporate financing comes from banks. Interestingly, the authors think a meltdown scenario is possible and recommend direct rescues of businesses over banks.

By Johannes Kasinger, Head of Policy Center, Leibniz Institute for Financial Research SAFE; Doctoral Researcher, Goethe University Frankfurt; Jan Pieter Krahnen Professor of Finance, Goethe University Frankfurt; Steven Ongena, Professor in Banking, University of Zurich, the Swiss Finance Institute and KU Leuven; Loriana Pelizzon, Professor of Law and Finance, Goethe University Frankfurt and Senior Researcher, SAFE; Maik Schmeling, Professor of Finance, Goethe University Frankfurt; and Mark Wahrenburg, Chair of Banking and Finance, Goethe University Frankfurt. Originally published at VoxEU

Once moratoria and other Covid-19 support measures are unwound, European banks will likely be confronted by a wave of non-performing loans. This column provides empirical insights on the current levels of such loans in Europe and draws lessons from previous financial crises for their effective treatment. It highlights the importance of early and realistic assessment of loan losses to avoid adverse incentives for banks. Secondary loan markets would help in this process and further facilitate bank resolution as laid down in the Bank Recovery and Resolution Directive, which should be upheld even in extreme scenarios.

The current pandemic crisis is challenging the banking system along both known and unknown tracks (Carletti et al. 2020, Beck and Keil 2021). While the accumulation of non-performing loans (NPLs) on banks’ balance sheets is typical for country-wide macroeconomic crises, there are several other characteristics of the pandemic that are not: first, the extraordinary cross-sector differences in the crisis’ impact (Demmou et al. 2021); second, the significant fiscal support addressing firms and households (Aussiloux et al. 2021); and third, the high degree of uncertainty concerning the economic consequences of serial lockdowns (Woloszko 2020, Ornelas 2020). The high degree of uncertainty is also the reason why policy proposals on NPL resolution should take a scenario-based approach (i.e. they should be designed as conditional on the events unfolding).

Empirical Assessment of NPL Levels

In the empirical analysis of our study (Kasinger et al. 2021), based on the most recent available 2020Q2 data, we find that aggregated bank capital seems to be large enough to absorb potential NPL losses, even in an adverse scenario. In contrast to these aggregate numbers, our results show substantial heterogeneity across countries, both in terms of the size of NPLs as well as in the relation of NPLs to bank capital.

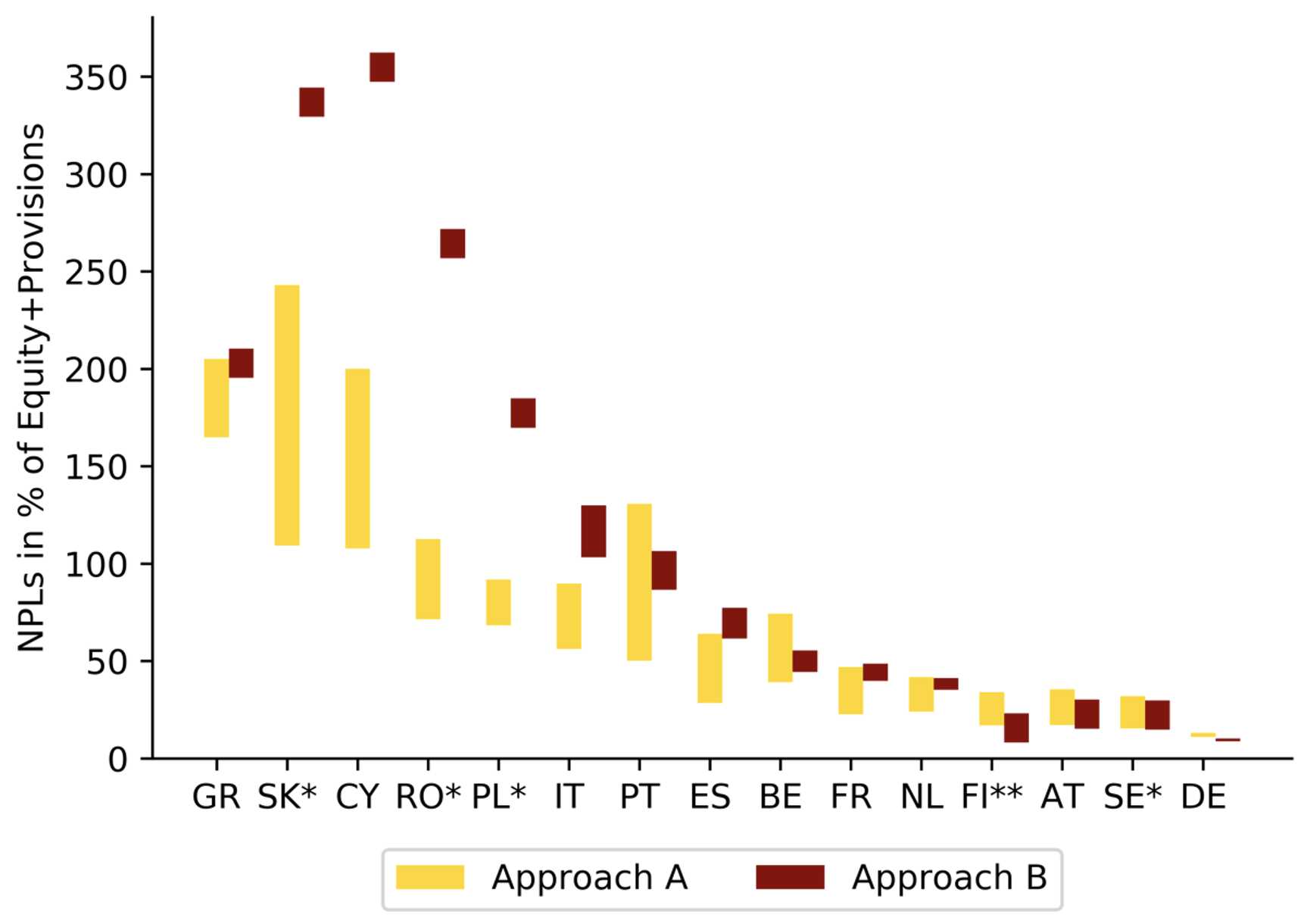

Starting from loans that are under moratorium as of 2020Q2, we apply scenarios assuming that 0% to 50% of these loans become non-performing (‘Approach A’).1 The yellow bars of Figure 1 illustrate our projected NPL ranges as a percentage of domestic banks’ equity capital and provisions (as reported to the ECB in 2020Q2). We find that NPLs exceed in some countries (e.g. Greece, Cyprus, and Slovakia) the amount of equity capital and provisions even in the most optimistic scenario in which there are no additional NPLs at all, whereas NPLs in other countries (e.g. France, the Netherlands, and Austria) only make up for about 30-45% of equity capital in a severe scenario, in which 50% of all loans currently under moratorium would end up as non-performing (see Figure 1). To complement our findings, ‘Approach B’ starts from the total volume of outstanding loans in each country and asks how much NPLs would increase if a certain percentage of total loans become non-performing, employing estimates from previous crisis episodes and/or projections for the current crisis episodes.2 Our finding of substantial cross-country heterogeneity is further solidified (see the red bars in Figure 1).

Figure 1 NPL projection for different scenarios

Source: ECB, European Banking Authority, EulerHermes, own calculations.

Notes: * Projections under Approach B for these countries have been approximated by data for similar economies. ** Data on provisions for Finland is not available for 2020Q2, only equity is used as an estimate.

Our finding of strong cross-country heterogeneity suggests two key problems, even in the absence of outright bank failures. First, less-capitalised national banking systems are especially vulnerable to credit crunch situations, potentially creating systemic risk, if a significant share of loans ends up as non-performing. Second, there is a considerable risk of zombie lending by banks in response to the large share of NPLs and insufficient equity capital. Any measure taken to address future NPLs should take these considerations into account.

Together with the high uncertainty about the future path of the pandemic and limited data availability, this implies that it is too early to rule out very severe scenarios with substantial levels of systemic risk, in which government interventions may be justified. Therefore, policymakers are well advised to plan ahead and prepare for the worst in order to prevent a systemic banking crisis early on. However, there are good reasons why measures taken to address a potential NPL problem should start from within the banking system.

Lessons from Past Crises

To find an effective and efficient strategy, we examine previous crises and draw lessons for NPL identification, recognition, and resolution that are all likely to be of importance during the COVID-19 pandemic.

During a financial and economic crisis, some firms struggle to survive, spurring a rise of NPLs on banks’ balance sheets. In these times and in the case of inadequate incentives for banks, NPL identification and recognition tend to be prolonged by banks in an effort to delay recognition in the profit and loss statement, and to conceal the loss of capital. This behaviour may lead to continued financing of non-viable firms, so-called zombie lending, and delay much needed restructuring efforts at the firm level with negative consequences for economic growth (Laeven and Valencia 2018). These issues are further exacerbated, and more desirable measures such as internal workouts or the transition to more market-based solutions are prevented, if forbearance measures are kept in place for too long.3

The resulting costs to society justify a general recommendation to foster a proactive NPL management that aims at setting the right incentives for the necessary restructuring at the firm but also at the bank level. To avoid zombie lending and bank zombification, regulators and policymakers need to ensure that banks realistically assess current loan values, for example through effective asset quality reviews (AQRs), stress tests and adequate accounting rules, such as the new IFRS 9 standard. Importantly, this will also foster the early identification and recognition of NPLs on bank balance sheets.

The Role of a Secondary Loan Market

Pushing banks towards early NPL recognition also promotes the development of secondary loan markets as discussed in the European Commission’s action plan to “tackle non-performing loans in the aftermath of the COVID-19 pandemic” (European Commission 2020). The higher the sale price for NPLs, be it via outright market sale or via a bank merger, the lower the eventual capital loss incurred by the originating bank. A strong and well-developed secondary loan market, therefore, contributes to the stability of the banking sector in an economy and has the potential to be an important component of successful NPL resolution. Moreover, it improves the loan quality information that is available for investors and originators alike.

Because a secondary loan market would raise the value of outside options, and increase information at the market level, we also see a positive feedback effect between the secondary loan market and the working of the Bank Recovery and Resolution Directive (BRRD). Thus, if the surge of NPLs on bank balance sheets is concurrent and significant, some banks will lose their capital and may have to exit the market, directed by the Single Resolution Mechanism (SRM). The more developed, liquid, and transparent the secondary loan market, the easier it will be to achieve relatively high prices for loans, and the lower will be the ultimate capital loss of banks resulting from NPLs. Therefore, whatever is needed should be done to facilitate the functioning of a secondary loan market, including the increase of transparency and the access to data on loan books and trading prices.

The Case of Systemic Risk

Assuming an extremely severe pandemic scenario, all or many banks lose capital simultaneously. This potentially leads to fire-sales as all banks find themselves on the sell side of the secondary loan market. The resulting market imbalance may invalidate the supportive role of the secondary loan market for banks with NPLs. In fact, a one-sided secondary loan market will pull banks down further as the resulting loan pricing will feed into a downward spiral, infecting loan valuation on banks’ balance sheets even for otherwise healthy banks. Thus, a self-enforcing process of falling secondary prices, lower loan asset values and loss of capital may develop that destabilises the financial system at large.

This process is summarised by the term ‘systemic risk’, a situation in which the self-healing properties of the market cannot operate. In fact, a systemic risk event is an externality, which requires a government bailout. Government support for banks may then be justified because a market-driven restructuring process tailored along the Bank Recovery and Resolution Directive rules might not be feasible anymore. However, government support can come in different forms. For reason of sustainability, channelling rescue money to banks directly may not be the optimal solution. Direct subsidies to viable firms and borrowers seem, in our opinion, more reasonable as adverse incentives in the banking sector are prevented and the working of the BRRD is upheld. Therefore, any plan to deal with NPLs should consider bank restructuring and resolution as the alternative, probably the preferred alternative, to recapitalisation or any other rescue measure.

Authors’ note: This column is composed of excerpts from the briefing paper “Non-performing Loans – New risks and policies?”, commissioned by the European Parliament’s Committee on Economic and Monetary Affairs. Copyright remains with the European Parliament at all times.

See original post for references

Thank you, Yves.

I wonder if this had anything to do with the CEO of Deutsche becoming head of the German banking trade association. He will also be influential at European and global trade bodies, which the German association and DB feed into.

Having worked in this field from 2007 – 16, including six years at trade bodies, it’s rare for CEOs to take up such positions. Their chairmen usually do so and CEOs sit on one of the committees.

The banks should be nationalized and/or regulated as utilities.

Their business model is a fraud, borrow money, pay bonuses to each other and get a taxpayer bailout from taxpayers every 10 years or so to cover their abuses.

Banks should have never been allowed to issue shares, only partnerships with their own money and skin in the game should be allowed to do banking if we ever are to find some restraint and sanity.

This reminded me of the push, after 2008, to domicile large banks in large tax bases. If the goal is to prevent a fire sale of NPLs because it is the equivalent of burning up capital which in turn “destabilizes the financial system” (crash) that really doesn’t address the underlying problem of too much “unproductive” money and speculation in the system. And so preventing a fire-sale only produces zombies, and stealth austerity. On the other hand if there is a mandatory restructuring of banks that do not have big enough “tax bases” to bundle up the garbage and sell it off in the secondary loan market (?) and thereby dilute the damage to the financial economy, and at the same time subsidize the economy by funding borrowers directly then there is an infusion of new money into the economy which will also trickle up to the banks. This shines a new light on the theory of a “large tax base” because doing all those bank resolutions (instead of kicking the can to the stock market) and at the same time subsidizing businesses and individuals can be very expensive. So bigger tax base, bigger market, bigger mess, huge expense. That must explain why the US used the secondary loan market to dilute the damage instead of stopping it. And because they (we) made that decision it followed – just knee-jerk reaction – that there was no money to help out the actual economy. Just the faux economy of financialization wizardry. So, new theory? How about small tax bases? And make most banks be utilities.