It’s taken vastly longer than we ever imagined, but authorities around the world have woken up to the fact that mis-named cryptocurrencies (which we will call “crypto” for sake of convenience) unique selling proposition is to facilitate crime, although it’s also proven to be not bad at sucking rubes into pump and dump schemes. So the question now is how quickly they will act and how bloody-minded they will be in crushing them.

We have pointedly avoided posting about Bitcoin and crypto because those articles would inevitably attract touts and true believers in comments. We didn’t like expending the considerable energy it often took to debunk them. We didn’t even like dignifying the concept by giving it attention (not that NC’s view would make any difference; this is a philosophical issue). The dot com bubble went on longer and became far more frenzied than we thought. Even though cyrpto has no legitimate use,1 there seemed to be little point in objecting to yet another speculative mania.

Having said that, Nouriel Roubini, who was early in calling out the housing bubble by starting to issue warnings in 2005, was acute in his timing on Bitcoin and crypto. He wrote a blistering op-ed in the Financial Times in February. That led to follow-up interviews in which Roubini recapped his critique:

The key flaw is simple. The cost and time involved in validating Bitcoin transactions makes it unusable in retail transactions. So they will always be foreign currencies, where you have to trade in and out of them into a real world currency. That means foreign exchange risk, as in price volatility, and frictional costs (the transaction cost of swapping in and out of the real world currency, which will be a combination of fees and spread). And in many cases, it will also mean doing the trade into the real world currency with a different counterparty than the one from whom you bought the crypto.

And this deficiency is fatal. It means it fails on its premise:

And having a whole bunch of crypto currencies makes matters worse. Fragmentation may further speculation, but it undermines any hope of much real world use.

The CNBC host broaches the idea of Bitcoin being limited to billion-dollar trades. Roubini pooh-poohed that as almost certain to be the province of criminals. Even if not, you’d see very few trades at that level, with resulting even more extreme volatility and large bid-asked spreads if any legitimate players were to step in as facilitators.

Even if most of this terrain is familiar, please be sure to listen Roubini at 8:55, where he eviscerates the widely-held view that Bitcoin is decentralized and democratic.2

The Colonial Pipeline hack appears finally to have focused a few minds. Out of gas signs and lines at gas stations have an oil crisis/stagflationary look to them. Even though Jimmy Carter inherited the 1970s economic malaise, his inability to do much about it was one of the key reasons for Reagan’s election. Similarly, Biden isn’t responsible for IT vendors and buyers for prioritizing convenience and cost over security or for a crypto offering a way to receive large ransoms at virtually no risk.

Colonial isn’t the only victim that would rattle the PMC. Interestingly, the management of this institution has managed to dampen down press interest, but word seems to have gotten around. This from our IM Doc on May 10, based on a May 1 “security incident”:

In the USA – we have multiple large tertiary referral centers that have quite the national reputation – I would include in that list MD Anderson, MAYO, Johns Hopkins, and …… The Scripps Clinic in La Jolla, California. I have innumerable patients that are seen there – they cater to that type of clientele. I first heard about this impending disaster over the weekend – and today things appeared to get immeasurably worse there…… see the following article……

https://www.nbcsandiego.com/news/local/what-we-know-about-scripps-health-cyberattack/2598969/

I know we have a major pipeline down from ransomware now – but this is just as scary if not more so. This is a major medical system in this country – and it has been hobbled. All of my patient’s appointments there have been cancelled until June – they are admitting no one – and no one seems to know if it will be back or not anytime soon. It has already been going on for a week.

ANNNNDDDDD – they use Epic – which has repeatedly touted itself (I have been in the meetings multiple times in my life) as completely impervious to hacking.

Again – I knew this day was coming at some point. These EMR systems are a complete disaster waiting to happen. The hackers have managed up to this point to take down non-EPIC systems at Bugtussle Memorial Hospital across the country – but nothing like Scripps.

Wow, just wow. And to boot – I honestly have not heard a peep about the whole thing on any national news source. Again – going on for a week – and I only learned about this because patients of mine were being cancelled and inconvenienced.

I am not saying anything about any certain celebrity – but I am looking for the day soon – when we have XYZ Oscar actor’s entire herpes history online, etc. We have all kinds of these patients here where I live – and this hospital has a former [as heavyweight as it gets org] as its IT guy – they take this shit seriously here. I wonder what happened in La Jolla.

The latest update was that only some Scripps systems had come on line. From HealthCareNews:

Three weeks after a cyberattack led to a network outage at Scripps Health, employees say some systems are coming back online.

According to reporting from ABC News, several Scripps Health workers said they’d regained access to “read-only” medical records from before May and payroll systems, along with some computers, emails and X-rays.

Its Epic-powered patient portal, MyScripps, was still down as of Thursday….

The San Diego-based health system continues to keep mum about the specifics of the attack…

The statement reiterated that in-person care was still available, and that patients could and should confirm appointments via phone. It noted that the Scripps team had backup workflows and paper processes in place, and that care providers currently had “view-access” to patient history and records. Virtual visits were also still available….

It advised that requests for medical records should be completed by mail…

“It’s likely that it’s taking a long time because of negotiations going on with the perpetrators, and the prevailing narrative is that they have the contents of the electronic health records system that are being used for ‘double extortion,'” said Michael Hamilton, former chief information security officer for the city of Seattle and CISO of healthcare cybersecurity firm CI Security, in an email to Healthcare IT News.

If that’s true, Scripps certainly wouldn’t be alone: The healthcare industry saw a number of high-profile ransomware incidents in the last year, including a cyberattack on Universal Health Services that led to a lengthy network shutdown and a $67 million loss.

Frankly, I have assumed that medical industry IT security was on a par with candy stores, and hence I have been leery of having my records in electronic form and centralized.3

Roubini assumes that the crackdown will the civilized sort that one uses on investor types with dough when they use banks and other financial intermediaries: complying with know your customer rules and being subject to reporting of income (as in trading profits). He points out that over 70% of Bitcoin mining takes place in 3 countries outside the US rule of law: Russia, Belarus, and China. By that, I assume he means none have extradition treaties with the US.

Doomsberg has a May 15 post I wish I had written on crypto (except he’s agnostic about the premise of crypto, where as I’ve seen enough financial innovation to regard it with prejudice). The money section:

My thesis begins with a simple observation. The power to control a society’s currency is the ultimate power over that society. The people who currently have control over the world’s fiat currencies have, by definition, a lot of power. Usually, people with a lot of power don’t like to give it up. When confronted with a risk to their power structure, those in power tend to fight back. They are often late to recognize the threat, especially in the Western democracies, but once they see it for what it is, they crush it.

I’m the first to admit that I’m shocked at how long the cryptocurrency game has been allowed to be played. The top cryptocurrencies globally have a market cap of over $2 trillion! Bitcoin alone recently traded over $1 trillion, although it has pulled back under that number in the past week. To put this into context, $2 trillion is equivalent to roughly the entire annual budgetary outlay of the US government in the early 2000s.

Yves here. If Roubini is right, that market cap has been pumped up by a lot of phony-baloney trades. However, today, the Financial Times is clutching its pearls over the fact that the Bitcoin crash appears to have pulled down bona fide assets:

A huge drop and snap back in cryptocurrency prices this week rippled into traditional asset classes, potentially offering a taste of what could happen in the event of a more severe shake-up.

Some government bonds gained in price on Wednesday, while futures on the US benchmark S&P 500 equities index dipped and oil also pulled back after the price of bitcoin plunged 30 per cent on signs that China was preparing a crackdown on digital tokens. The Japanese yen — a currency often in demand in times of stress — also popped higher.

Hours later, bitcoin rebounded sharply. But it was unusual for the ructions to catch the attention of mainstream market participants.

Correlation is not causation and the pink paper was short on explanations. However, it wasn’t that long ago that the markets operated in “risk on/risk off” mode, where “risk on” and “risk off” assets would move in synch. Here, the Bitcoin plunge, even if understood as the result of an official intervention, could spook the horses about other frothy positions.

Oddly, the article does not discuss leverage, when a quick Google search shows that services like Kraken allow crypto holders to leverage up to five times. And while the plural of anecdote is not data, some market watchers report they know investors who have borrowed against their stocks to buy Bitcoin.

As more and more people are acting like mini global macro players, the better operators among them will act as the big boys did during the acute phases of the financial crisis: when a position gets a margin call due to a downdraft, rather than sell into a falling market (and likely crystalize a loss), they’ll sell an asset in a market not under pressure (as in take a gain elsewhere if one is to be had). Bitcoin and crypto investing is big enough, and enough is in the hands of freewheeling players like family offices that we might be seeing cross-market selling to cover margin calls.

Doomsberg continued with a list of new rules, prosecutions, and other Bad News from Turkey, India, and the US, with the latest being an unusually blunt IRS warnings and the surprise (and in close succession) Bitcoins reversals by former fanbois Elon Musk and Jack Dorsey. We thought Musk must have been warned by a little birdie; so to does Doomsberg.

After this post ran, the IRS implemented its new rules requiring crypto transactions of over $10,000 be reported as cash ones are now, meaning that parties are also subject to “know your customer” style reporting. Bloomberg Tax says the IRS intends to pursue crypto-related taxes aggressively. China banned crypto exchanges and initial coin offerings and is now targeting miners, saying that their energy profligacy is at odds with China’s climate change goals. Individuals are still allowed to hold crypto.

If the US intends to gradually take the air out of the crypto bubble, or has other reasons for going after crypto a bite at a time, this approach might do. But if it wants to put a virtual end to extortion-via-crypto, it has to be a lot more bloody minded.

Cracking down on crypto crooks is easier than stopping, say, money launderers. There is a lot of cash floating around, particularly in the US. So it is easy for criminals to hide many of their activities in the stream of regular cash transactions. It’s only when they get to be big crooks that it gets more difficult. But even so, there are lots of businesses that handle cash that can serve as fronts. The trick for the money launderer is to get the cash into the banking system so he can do things like buy real estate.

By contrast, with crypto, there is not a large stream of legitimate commercial transactions to serve as protective coloring. There are only crypto transactions. And the IRS cutely demanding that transactions of $10,000 or over being reported is not going to stop any ransomeware artist from holding hostage your favorite pipeline or grid or hospital or local government. Said ransomware artist may not even be in the US or not plan to be here for very much longer if he is. I am highly confident crypto could make its way to Panama, which is supposed to be a decent expat haven and also has no extradition treaty with the US.

If the US is not hopelessly captured by libertarian ideology (and the volte face of Musk and Dorsey says possibly not), it is likely to find it necessary to criminalize crypto on a widespread basis. The fact that China is already ahead of the US in going that way may make it an easier sale.

Current holdings could be grandfathered, but query how one could sell them at any price if new purchases are verboten.4 Vlade came up with a simple but effective kneecapping:

You could start by making it a crime to be in any blockchain that includes a wallet that can be tied to a known criminal use, as participation in money laundering. Just the uncertainty of that would kill crypto.

I’m sure readers could come up with other elegant approaches.

Ironically, crypto-bashing could also serve as a way to at least marginally improve badly damages US-China and US-Russia relations. China is now in open warfare with its crypto industry. It’s hard to imagine that Russia is keen about theirs. By design, it is outside the legitimate tax paying economy. Even if Russia understands that it is a fiat currency issuer and does not need to tax, Putin has made a point of keeping Russian oligarchs at least somewhat in line. Crypto undermines that by letting the super-rich hide income and wealth and directly creating new oligarchs. Plus they can’t be keen about crypto mining competing with industrial uses of energy.

And please spare me the claim that blockchain is revolutionary. It is a clever mathematical solution still looking, after over a decade, for an application. I thought it could potentially be used to validate documentary letters of credit in trade transactions, but that has apparently come to naught. Roubini poured more cold water in his chat with Goldman’s Allison Nathan, as quoted in Heisenberg Report:

Finally, Goldman’s Nathan asked, “Doesn’t the concept of decentralized ledgers and networks have value, though?”

There too, Roubini is skeptical. “I’ve honestly spent a lot of time looking at this because more and more people are saying that while maybe these aren’t currencies, blockchain technology could be revolutionary,” he said, before noting that,

Something truly based on blockchain technology should be public, decentralized, permissionless, and trustless. But looking at DLT and corporate blockchain experiments, almost all of them are private, centralized and permissioned—because a small group of people has the ability to validate transactions—and most are authenticated by a trusted institution. And even among these projects, few have actually worked. One study looking at 43 applications of blockchain technologies in the non-profit sphere for reasons such as banking the unbanked, giving IDs to refugees, and transferring remittances found that zero actually worked.

In other words, our original “Prosecution futures” call for Bitcoin still stands, even though it is playing out in a remarkably leisurely manner.

_____

1 I do not consider speculation to be a legitimate use. And other “no bones about it” types of speculation provide more socially useful by products. Betting on sports supports those types of entertainment (look at what happened to horse racing); casinos provide employment; lotteries support little newsstands and state budgets.

2 Roubini gave more detail in a May interview with Goldman’s Allison Nathan. Per the Heisenberg Report:

The crypto ecosystem is not decentralized [as] an oligopoly of miners essentially controls about 70-80% of Bitcoin and Ether mining… and 99% of all crypto transactions occur on centralized exchanges.

3/sup> I have regularly and at length discussed in comments how the way I handle my legacy insurance policy has allowed me to avoid that, albeit at the price of my paying for treatments and later submitting for reimbursement.

4 Bitcoin may prove to be worthless anyhow. As reader vlade pointed out:

It is estimated that about quarter of all BC in existence is vulnerable to a quantum-computer attack (see https://www2.deloitte.com/nl/nl/pages/innovatie/artikelen/quantum-computers-and-the-bitcoin-blockchain.html for example). IMO, it’s not inconcievable that within a decade or two there will be something capable of that. Do you want to have an “asset” (never mind currency) that becomes worthless as a technology can advance?

The article I link above (a disclaimer – I’m not a crypto expert, never mind quantum computing one, and you’d need someone who can do both and has no dog in the race, which may be hard to find) also states that BC could be terminally broken if a quantum computer was able to break BC signature in less than 10 minutes (which is the time BC block takes to mine and this time is sort of in-built in the BC, being the whole point of “proof of work”. Making it shorter won’t help, as it means the problem to solve is easier which means that a quantum computer can also solve it faster. The relation between the two is unlikely to be 1-1, so it may be some hiccups but anyways).

Hence, for all the “BC is here to save the world”, _IF_ you’re a technology wonk, you’d ignore BC because it can become worthless overnight if someone builds the right quantum computer. Which we know is _theoretically_ possible is “just” a matter of engineering (which is more than can be said of cold fusion).

On the subject of medical record hacks, there has been a massive ransomwear attack on the Irish public health record system, with the loss of many records. Doctors are reporting that patients with rare conditions are getting emails from various countries offering them quick and cheap treatments, so the records are already on the open market. It seems to be the same or similar groups that previously attacked the Polish and UK systems.

The Irish government is not saying if they paid a ransom, but they did get an encryption key which strongly suggests to me that they may have done so.

There were NZ and canada hospital ranswomware attacks too.

As Yves says, most of the hospital security stuff is worth zilch (that said, I know a surgeon who does all his patient records on paper, on purposes, still using a few decades old typewriter. exactly for this reason – he says he’s a surgeon, not IT security expert). Therefore, it’s extremely worrying that there are still some places with the critical hospital infrastructure not air-gapped *). That said, the problem with ransomware is that the weakest link always is and will be is the human link, and there are many many ways to attack that. From disgruntled employees to a plant (and I know of situations where the plant was in place for years, so it’s not just “check your new hires” stuff).

*) meaning not connect to internet, and in general with inputs so blocked that they require a screwdriver at least to get anything on the computer.

I’ve heard from people in the know, but haven’t seen it reported, that the decision of whether to pay ransom to hacking groups isn’t made by the organization, but by their insurance company, when the inevitable claim is filed. I guess it’s a calculation.

Needs more investigation, though. No CIO is going to admit on the record that they paid a ransom, let alone that the insurance company told them to do it.

I believe it’s part-and-parcel of key-person insurance for some regions (kidnapping clause). Don’t know whether it’s now also a commercial interruption-of-business clause.

Wow, great point. Never considered the kidnapping insurance angle. My guess is that it’s right in there next to kidnapping.

I’m still reeling from the fact that a major corroboration actually thought it a good idea to name themselves Epic. Just Google ‘epic fail t-shirts’ to see what I mean. Was indifferent to bitcoin at first in spite of all the emails saying that this was the best thing since sliced bread. But when I found about the massive wastage of energy used to power all these crypto-schemes, that was it. Game over, man. Game over. As a civilization, we cannot afford to amuse ourselves with such wastage of energy, especially when you take note of the amount of pollution by-products of producing this crypto-crap. It would have been better to use the wasted energy into making more cat videos instead.

A friend who had emigrated to the US from Africa and survived wars growing up asked me to explain Bitcoin. I outlined the technical points including that if one party has More than 50 percent of the processing power it can control the system. I said “the government was against it at first, then one day it started to say nice things about Bitcoin, which I took to mean…:” and she finished my sentence… “The government has taken control.”

I think the US govt change in attitude towards btc simply resulted from rich people taking a liking to it. Similar thing happened with legalized pot. I certainly don’t believe the US government is controlling btc mining. The Chinese government, still unlikely but more possible.

That’s where the 51% aspect comes in. US soft power has dictated for years that you don’t need to control the resources, just the owners and operators of the resources. JPM et al move in lockstep with the Fed.

I never understood why a “currency” should go up in value – other than in relation to other currencies with regard to foreign exchange. If you say “they” (never mind who “they” is) are not going to make more, well, making more gold is pretty tough, but gold has not gone up even a fraction of Bitcoin.

https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

Currencies have collapsed, but is there a historical example of a currency appreciating in value that is anywhere near to the increase in value of Bitcoin?

And how to Bitcoin miners get paid? I assume they are not toiling in the mines out of the goodness of their hearts? What is their cost, fees, take – call it what you will?

Finally – the market. When I was young I believed in the market. As I have grown older, I realized the market is people, and a good many people are foolish, manipulative, and a few criminal. The price of tulips or Pets.com, or Enron and World Com just shows that the market can be very, very wrong.

Miners are the ones who validate the crypto transactions with computing power. They are paid in newly minted bitcoin each time a certain block of transactions is validated. The reward for mining is cut in half roughly every 4 years. There will ultimately be 21 million bitcoin, and that number is fixed.

True, but as Keynes famously noted and Yves hinted at above, the “market can remain irrational longer than you can remain solvent.”

I speculate that gold hasn’t gone up like BC because nowdays people are using BC instead of gold as shelter/hedge/speculation against traditional currencies. I like the term for NFTs I saw here a while ago, New Fangled Tulips. And I used to mock gold bugs for the uselessness of their asset…

“Something truly based on blockchain technology should be public, decentralized, permissionless, and trustless.”

And hence perfectly traceable. So very definitely NOT anonymous.

There is a reason why China and Gulf states are keen on digital currency. If you think that banning cash and going to electronic-payments only is bad, digital currency is at least as bad, and possibly worse, as the footprint if part and parcel of it, so tracking anything is infinitely easier.

Funny enough, and this gets into the more computational side of things, but I think Roubini is still being too polite about blockchain.

The thing is that word “trustless” doesn’t actually mean what I’m pretty sure most people mean (including critics) in these discussions. It’s actually shorthand for a very precise technical concept (Byzantine fault tolerance) that only applies to the underlying nodes (the “miners”) that do all the processing.

Any one (or a decent sized subset) of nodes can actually go rogue, either due to honest malfunctions or malice, without invalidating the overall computation. However, it does nothing to materially validate that the computation represents what the end-user actually wants (in the bitcoin context, that you ordered drugs from a surfer-dude in Cali and not poop-in-a-box from an intern at Quantico).

I have a suspicion that part of the reason nobody seems to bring it up isn’t that it’s a particularly difficult concept to explain. It’s that once you’re aware of it, google will instantly tell you there’s a long-standing family of algorithms (called Paxos), including a Byzantine fault-tolerant version.

So the only real “innovation” that blockchain offers is (invisible?) hand-waving away the material problems you want your system to solve and relying on human greed / the market to somehow make everything work. Sounds like a lot of other things nowadays, doesn’t it?

It’s that, but it’s also trust-less in the sense that once a transaction is entered into, you don’t need to trust your cpty, as in that there’s no theoretical cpty credit risk.

But it’s not an innovation either, in fact, payments system that DO accept credit risk were innovation at its time, replacing such payment systems as BC wants to bring in *). Because no-credit-risk payments systems turn all risk into a liquidity risk, which is way more dangerous, both short term and medium term.

Here it gets _really_ funny, because for the BC exchanges to provide leverage they have to, in fact, provide credit risk to their customers, except of course it’s an exogenous to them.

*) it often seems that techno-folks jump in with a solution to a “you’re doing it wrong!” perceived issue, w/o understanding _why_ the system works the way it does, including its imperfections. Many examples abound, but the financial ones seem to attract them most.

The fact that Russia and China are both involved in a major way makes Bitcoin seem like just a new theater of operations in Cold War II.

China is going to digital currencies but is blocking crypto currencies:

https://www.rt.com/op-ed/524676-china-cryptocurrency-regulation-bitcoin/

“Recently, Chinese regulators released a statement saying that the country would effectively ban any financial institutions and payment companies from doing business related to cryptocurrencies. This ban refers specifically to cryptocurrencies such as bitcoin and not China’s official digital yuan, which is in development right now.”

No one is bringing up the child pornography angle, so I’ll do it. It’s not that Bitcoin can be used to pay for that, it’s that in the blockchain itself there’s child pornography burned in. And it’s immutabale. This was discussed in the past, for example here. Quote:

It’s not just quantum computers. One day some clever mathematician may come up with an algorithm that can break public keys or do mining so efficiently that he can break trust in the system. While a quantum computer is likely to be widely announced, this can happened stealthily at any time.

If someone can prove NP=P, then crypto (and the whole encryption relying on factoring large numbers) as we know it today is dead, because that would tell us there IS a polynomial algorighm to factor a large number into two primes. A quantum computer makes it really a non-issue, as quantum computer effectively works the solution in the NP space (NP stands for “Non Deterministic Polynomial” Turing machine). Anyone who proves P=NP is going to be world famous, think Newton, Turing, Einstein etc. and also fairly rich in the process (books, talks, a few rewards here and there etc.)

It’s possible that an evil genius could do it, and use it for their gain, but IMO fairly unlikely.

Then there are specific “holes” in the algorithms, which usually can be patched reasonably. These are much more likely to be misused, but will tend to be open only for a time.

Thinking about it, you could look at bitcoing a publicly sponsored award for solving P?NP problem. If ? is =, then you could make an absolute killing by shorting BC.

Ahem, cryptocurrencies use the same types of cyphers that secure everything else on the Internet (e.g. HTTPS), so if these cyphers are cracked you can pretty much say goodbye not only to crypto security but to all forms of secure commerce, banking, email, etc.

Or, everybody (including the implementors of crypto applications) will upgrade their code to use more secure cyphers, as has been done in the past (e.g., MD5 is no longer used for security), and the problem will disappear until the next generation of cyphers are cracked.

Basically, I gather it’s an arms race, and there’s a lot more at stake than just cryptocurrencies.

“and the whole encryption relying on factoring large numbers”. I.e. anything that uses public/private key. The same actually holds for discrete-log problems (elliptic or not), but anyways.

And your point is? The point of the post is not that NP=P (which I use as a short hand for either that or implementing NDTM via a quantum computer) would break a lot of existing things. The point is, that it would _destroy_ BC forever.

More secure cyphers that are thought to be invulnerable to to quantum computer attacks are in development, but they are nowhere as practically developed with the exception of sufficiently large symetric key (AES etc.), which is really what we already have but with massively larger keys. But these have their own problems, for example the actual key-sharing for the symmetrical cyphers, which may invite different sort of attacks. I don’t follow this world too closely, but I believe the current state of the game is that there’s no go-to solution for a post-NP=P world to replace what we have. Because if there was, they would have start rolling it out already.

My point was simply that the stakes here are much greater than cryptocurrencies, and that security professionals have been here before with other cyphers.

Bitcoin could be “destroyed” by some hypothetical breakthrough as you describe, but I submit that losing all secure transactions on the Internet would be a much bigger issue.

Bitcoin currently uses double SHA-256. Is this set in stone? I.e., could BTC be upgraded to use a different hashing algorithm? I don’t know the answer to this, but if so, then cracking SHA-256 isn’t the end of Bitcoin. Conversely, even if Bitcoin is wedded to SHA-256 and can’t be upgraded, what about the 10,000+ other coins in the cryptocurrency space? Not all cryptos use the same cypher and have the same design.

Finally, my impression (not an expert on this) is that quantum computing is following its own curve of development, and that it’s still in the “someday … could be… maybe real soon now” phase. Ergo, the arms race metaphor.

There is a difference between having to revert a business model and literaly instant destruction of trillion (or whatever it is these days) in assets. There are many ways around the world where say internet shopping transactions do not rely on instant card payments and the system works. Things like SWIFT etc used to run on dedicated private lines, and likely could be moved to them in an emergency again (although I could be wrong here, it would require someone with a much better knowledge of the actual physical stack than I have).

re BC. Read the article linked in my original comment that Yves quoted. A hash is actually fairly QC proof at least to brute-force attack (for the same reasons as large-key symmetrical cyphers are, the space of possible solutions is exponential), but the problem is not the hash.

Re QC: – sure, and I wrote in the original comment that QC has “only” engineering issues (we _know_ they are theoretically possible). We know that better nuclear reactors were having “only” engineering issues for the last 4-5 decades. But having a world economy (i.e. widespread adoption of crypto) dependent on an assumption that no-one’s going to solve that engineering problem ever (when many people have an incentive to do so, and that incentive has nothing to do with BC), is IMO just silly.

It may be a silly assumption, but it’s already kind of in place.

Well, the security stack is used by almost everything that communicates sensitive info via the Net because there is no way to revert the entire Internet to use private lines. HTTPS is now more or less the default, and encrypted communication is used for anything involving money, email, cloud storage, and any kind of server management via ssh, etc.

The scenario you describe would mean that all of those heretofore secure channels would “instantly” be in principle no more secure than plain text. No online credit card transactions would be secure. No app or remote logins would be secure, etc. No email. No WiFi networks would be secure. Etc. Your online shopping, banking, bill payment, phone, utilities, and the management of all server farms, utility systems, etc — all of those would no longer be secure. Literally tens of thousands of IT professionals would tell their mangers “it’s gonna hit the fan and sorry, I can’t help you”.

If it were to happen suddenly… “emergency” is the word, as we could see a crime wave and collapse of online retail like nothing witnessed before.

Unfortunately, the security of the entire Internet lives or dies with the same algorithms we find inside cryptocurrencies. I don’t see that it’s possible to have one and not the other. “Silly”? Yes, but that’s where we’re at.

My guess would be that QC will take longer to materialize than many people expect, and as it gets closer, security technology will adapt.

I wrote expliticly “physical stack”, i.e. dedicated lines etc. When you have that, you don’t really need public-key encryption, as fixed-endpoints mean that you can have a large symetric-key encryption on the line easily enough.

HTTPS is not about physical stack, it’s primarily about securely sharing a one-time symmetric encryption key in an environment where you don’t know who you want to share the key with before hand. For known endpoints, you can solve the problem in other ways.

In terms of internet, it’s really mostly about e-commerce’s convenienc eof pay-at-purchase. There are ways how to do it differently even now.

I’m not claiming that it would NOT be a disruption, it would, and a large one. But not one that could not be dealt with, and even reasonably quickly. Because it would disrupt _process_ not a _state_.

BC could not deal with it overnight, because for BC, the disruption would be to its _state_ as well as the process, permanently (and for part of BC in circulation, you’d rewrite not just current/future state, but the historical too).

Out of curiosity, on what basis do you believe that the sudden loss of all security on the Internet could be dealt with “reasonably quickly”?

From my vantage point working in the IT sector for several decades now, I see little support for such a claim. It sounds like you’re assuming the “mythical man-month” or some such. Please consider again the long list of services that would be affected, all of the hardware (e.g. WiFi routers) and software that would need to be fixed. Bear in mind there are many unsupported, legacy systems in the world, limited resources to upgrade/fix them, and a lot of inertia. E.g., there are estimated to be a minimum of 100 million PCs — some say up to 200 million — still on Windows 7. That’s an OS over ten years old, past EOL, and just one example.

In any case, per the article you mentioned above, the hypothetical QC-based attack on the blockchain would only work on 25% of known addresses. The other 75% would be vulnerable only during the process of executing transactions using those addresses. The “state” of those other 75% of all blockchain addresses would not be affected.

According to Chainanalysis, around 20% of all Bitcoin mined are probably lost — mostly old wallets —, so the 25% vulnerable is likely lower, too (I think we can say “likely” because of the age of those 25% and the way lost coins are calculated). Of course, somebody could use QC to crack the private keys of those old addresses and recover the coins. But money isn’t “stolen” if it was already lost years ago, and why destroy such a cash cow — unless you’ve got tons of money to burn on QC hardware and your motivation is just some kind of pure rage(?)

And per the article you cited, I gather the other 75% of the blockchain addresses would only be vulnerable during the ten-minute window in which blocks are mined — again, during a process, not a state.

Here, it’s probably also worth considering that the current ten-minute block processing time was a compromise chosen by Nakamoto. It’s not set in stone. There has already been discussion of lowering the block processing time to speed up confirmations, and were QC to become a reality 10 to 20 years from now, it would almost certainly be done before then.

Another thing to keep in mind is that if QC becomes commercialized (as Google hopes), and if it becomes inexpensive enough to use for attacking the mining process (and fast enough to still achieve this as the block processing time is shortened), there’s nothing in principle to prevent Bitcoin miners from also using QC technology to generate hashes (along with one of the emerging post-Quantum cryptography libraries).

On balance, then, given how far off it is, I don’t see QC as a meaningful threat unless we imagine that QC technology advances at warp speed whilst blockchain technology remains unchanged. Given the number of people working on cryptos and blockchain projects (Coin Market Cap lists over 10,000 coins), I doubt it will stand still for that long. Especially with all the talk now of the “flippening”, Bitcoin could be supplanted by Ethereum or some other cryptocurrency in the not-so-distant future, at which point it would become history on its own, and we’d have to re-think all of these assumptions.

At the end of the day, it rather looks like the genie is out of the bottle. Any “solutions” will probably have to be legislative, not technological.

So people are leveraging bitcoin 5X?

Is Sofbank financing this?

I can’t think of anyone else dumb enough to take that degree of risk…

“Dumb” is the wrong word to use. Unless we make the equation of, Dumb = Greedy. Given the ‘rewards’ attendant upon most instances of “Greed” performance, I’ll stick to considering “Greed” as being, in our present degraded World, a rational behaviour.

Therefore, using the Theorem Zero above, Dumb = Greedy, being ‘Dumb’ is rational.

When you’re hooked on CrackCoin, you always need another fix, and it doesn’t matter how big the high (price) is, all you want is more.

5X is nothing in the world of crypto leveraged gambling. Kraken is one of the more “responsible” players in that regard. 10, 20 or 100X leverage is available for the truly degenerate, although you may need a vpn if you are in the U.S.

3X is the maximum leverage I’ll personally use.

I feel like the fascination with bitcoin has a lot to do with modern eschatology about the end of the USA, or the end of the world in general. It has a certain nihilism to it, or a prepper mentality that the world is about to end. Hence why BTC comes across as amoral.

From talking with young people who have thrown way too much money at BTC, I have two impressions:

1. One said to me that he will do whatever Elon Musk says, that the man is a genius and to follow what Elon says toward riches (strange, cultish).

2. The other set of people see things like Doge coin as a massive bit of dark humour and do not care about the outcome (nihilism).

So there’s cult mentality and nihilism. Not the greatest recipe for investment.

I think part of it is the libertarian types, who are some of the most militant supporters of crypto. I know this isn’t universal, but I have seen many hype crypto and claim that crypto will replace fiat currencies. How in the world would such a thing work? In regard to the unit of account alone, would we get rid of pricing things in dollars and then price everything in a bunch of crypto currencies? How would taxes be paid in this alternate reality? We need comprehensive economic planning, their utopia of a world without fiat currencies would make planning all the more difficult, which may in part be the point. Beyond that, it seems that to exist in such a world, the people participating in that system would need a very sophisticated understanding of how to operate. While that may be true of relatively well off people with a background in investing and finance, do we expect this of working class people with no background in those things? This system is already crushing them, and now we are going to add tons more complexity to their day to day existence? Towards what end? Seems that this is just the further spread of financialization and neoliberalism. The end result is a further fracturing of society.

Good observations. That fracturing is fascinating. Originally, it was just gold bugs who were the social and economic doomers. Now you have a whole new group worshipping not a golden coin but an online coin that relies on computing power. Meanwhile, the imperial greenback goes on and on.

We haven’t come far from trading cowrie shells or women wearing gold bands to show off her dowry.

Not even that far from worship of idols. We just have a pantheon of idols whose miracles happen in the form of currency.

At first I looked at Bitcoin’s value as being that of, say, an Andy Warhol etching: No intrinsic value, but a trophy, whose price depended entirely on the ability to convince people that it was a valuable trophy.

Plus, it was a small, portable object.

But why should the price RISE, except for “bubble” riders?

There is indeed a good reason for their rise. What gives Bitcoin and other cryptocurrencies by far their main valuation is precisely that they are crypto – secret.

Who wants to be secret: criminals, kleptocrats, corrupt heads of state and public officials, and of course scammers and data hijackers.

These are all GROWTH INDUSTRIES. They need a means of payment – secret from government prosecutors, regulators and tax officials. So as crime grows, so does the value of storing the savings of criminals and money laundering.

Huge fan of your work, and I agree. What I find ironic is the people that talk about replacing fiat currencies, but really relying on those currencies to make their case. For example, how do they know that a crypto currency is increasing in value? The unit of account the fiat currency provides. How else would they determine that? Certainly couldn’t if we replaced the US dollar with a sea of crypto currencies. How much of any rise in the value of a crypto currency is the result of banks creating credit money? If they want to talk about currency creation by a powerful central authority, shouldn’t they direct most of their critiques at the large banks that create so much credit money? Some proponents of crypto do, but the libertarian types don’t from what I have seen.

When I lived in Egypt, it was Baksheesh that made the world go ’round. Same idea here.

This is actually an interesting one. Because technically, _all_ BC transactions are public, so traceability of BC transactions is much better than normal accounts. I could be wrong, but I don’t think it’s actually that easy to liquidate a large amounts of BC into a “normal” currency these days, or at least not significantly easier than through normal banking. (it used to be very easy in say times of Mt. Gox).

That said, the criminals did wise up to this, and I believe there’s a booming industry in buying “clean” coins directly from the miners, as those are orders of magnitute easier to launder into real currency. I _suspect_ but do not have any even x-th hand proof that this is one of the reasons China is cracking down on miners, as they are starting to be taken over (voluntarily or not) by organised crime, because why not cut out the middleman, when you can literally print your own currency (i.e. you launder the money by mining crypto)?

Indeed, the public nature of all the transactions means your anonymity is only as good as the rest of your security layers separating your ‘digital identity’ from your real identity, and your ‘coins’ from something useful.

So many insightful comments here, thanks to all. When I explained BC and NFT to my 15-year-old she said “I didn’t think my opinion of humanity could get any lower”.

Can I be a pedant for a sec?

they do still need to tax in ruble to control the price level. They just don’t need to tax in order to issue ruble or pay obligations in ruble.

This is pertinent because it’s precisely why tax-driven currencies cannot be undermined by crypto. Crypto is a major social problem for all the OTHER reasons Yves, vlade, PlutoniumKun and Roubini mention. It was an excellent write-up.

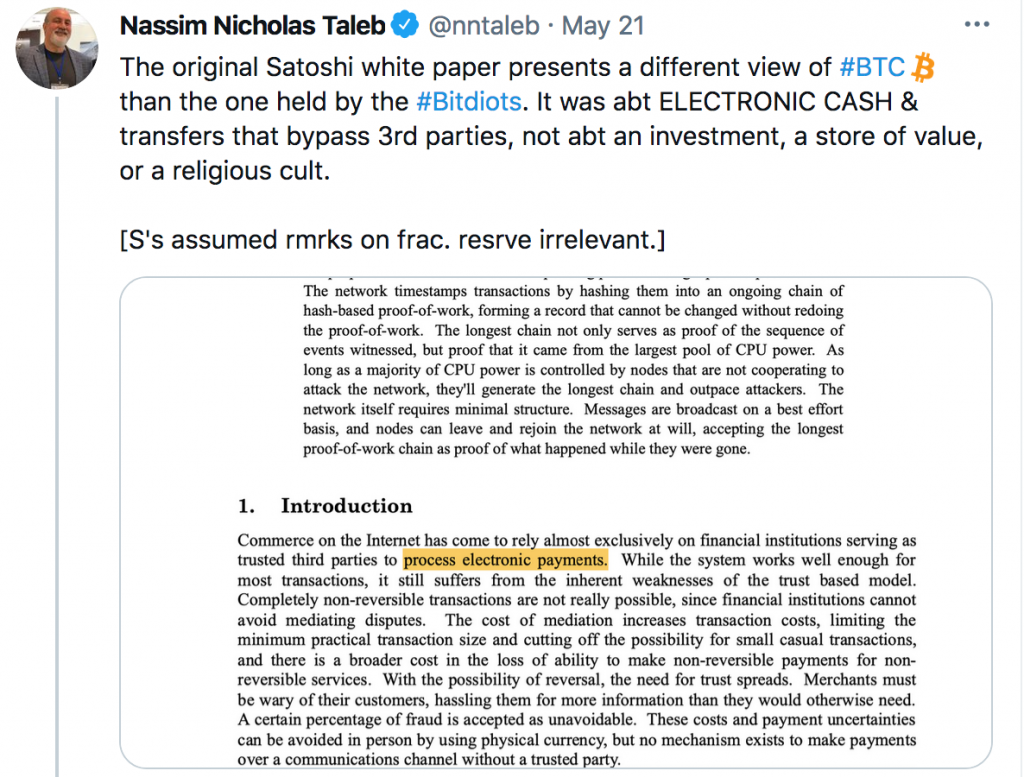

BTW: I found Nasism Taleb’s take a bit rich. He was a major booster of bitcoin. Fancies himself as a proper libertarian rather than a pseudo-libertarian. Fine. But not such a smart guy if he thought libertarian collective togetherness and peace would stop bitcoin becoming a mess of untethered speculative waste of human endeavour, create a bitcoin elite, and ransomware attacks.

Distributed ledgers have a possible use-case in short-term journalistic verification of “truth” in reporting standards in the coming age of deep fake video and other dystopian use-case AI tech.

Please don’t attempt to finger wag when you are incorrect. Russia does not need to tax.

Tax is only one way to control prices. There are other tools, as we explain here: Clarification of Spending/Inflation Constraints According to Modern Monetary Theory

Rohan Grey explained:

We gave other non-tax ideas in that post.

I am a Scripps patient/customer. I just checked a few minutes ago and the patient portal is still down.

They have been very quiet about what has happened so everyone is still in the dark. It has been a little over 3 weeks now…

That is absolutely wild. Both that it’s happened and that there is a seeming media blackout on it.

So much of the discussion here is fascinating, alarming, and well beyond my knowledge level, but definitely makes me want to totally unplug and live in a cabin in the woods.

Thanks for sharing your insight, and to all the others here for sharing such detailed and interesting info on the subject.

More imperialist illogic from people who should know better. Many underprivileged people are unbanked in the USA. Privileged people prefer the fiat status quo because things just stay the same and that’s what they like: oppressing those who aren’t them. Now consider the rest of the world, especially the speed of remittances via crypto. If you want to check your financial privilege, then expand your minds. Either that, or admit you don’t want the less fortunate to more options.

Do better because the usual conflict of interest, privileged econos who are more often wrong than correct, want their cozy lives. They care for little else. Did you even bother to read the benefits to others or ask about this with a pro bitcoin person? Do better. Read this as a start.

https://bitcoinmagazine.com/culture/check-your-financial-privilege

Ah yes, the unbanked are out there speculating on bitcoin…riiiiight. Now pull the other one.

As much as I’d rather not be fair to woke capitalist word salad billed by the shibboleth, people in inner-ring Detroit suburbs, of signicant color, are never more than a couple of km from the nearest Bitcoin “ATM” so such an assertion isn’t entirely implausible.

The more important question is whether such speculative activities are negative-sum games that only serve to get more people vested in ownership culture, as I suspect drove the suburbs in part.

As a satirical piece demonstrating yet again that variants of the privilege argument can be deployed in support of literally anything, this works pretty well. Sadly, it seems to be intended seriously.

And the guts of it: 3 “testimonials” (which speak for millions because the author says so), one of which is from a person whose very business consists of Bitcoin shilling.

Oh, being in a currency that is used nowhere for commence and is wildly volatile is a great solution for the unbanked.

And you also make clear you didn’t read the post in full or are choosing to make a bad faith comment. Either one is a violation of our written site Policies.

Roubini explained why bitcoin will never be using for retail transaction: it’s too costly. And that’s before getting into the IRS reporting that would be required of businesses.

Are you paid to be this stupid? I don’t like going ad hom but the rancidness of your position demands it.

I have heard BTC promoters claim that crypto can be used to significantly reduce transaction costs in currency exchange. Certainly cheaper than getting ripped off in the airport.

To play devil’s advocate: the US fed and other westerner central banks are all examining their own digital currency possibilities. Too foily to suggest they’ve decided to get rid of the crypto “competition” at this time. ? / ;)

What? The USD already is a ‘digital’ currency. No competent authority is going to cryptoize their economy.

There’s also actual cash. (btw, has your local bank received any brand new $100 bills in the last few months or are they all ‘used’ bills? very odd a lot of community banks didn’t get any fresh new $100 bills from Treasury this winter or spring — graduation, and wedding givts season creates a demand for same. Not foily, just wondering how wide spread this is, it’s definitely an odd state of affairs. I don’t think it’s ever happened before. )

My community is awash in crisp 100 dollar bills – I’m in a legal marijuana state (both medical and recreational) and in a college town. I wonder if the banking needs of this business drive distribution? The Fed keeps printing more:

https://www.federalreserve.gov/paymentsystems/coin_currency_orders.htm

So they are going somewhere… I have a small number stashed away as emergency vet money.

That’s an interesting data point: “I wonder if the banking needs drive distribution?” I live in a medium size town in a not-legal marijuana state.

I know several of the biggest national banks, Chase etc, started offering $100 bills in some of their ATMs a couple of years ago but that was a couple of years ago and didn’t seem to affect distribution to smaller community banks.

It’s not clear that governments can ever make cryptocurrencies go away. After all, gold is still inflated way beyond its equilibrium usage value. That inflation is effectively the first instance of a non-fiat “crypto”. Both gold and cryptocurrencies are sustained by a libertarian ideology that is increasingly hostile toward the collective action (government) which protects us from warlords and would-be barons. The lunatic fringe of libertarianism may have started with liberal disdain for societal constraints on individual liberty; but it has been transmogrified into crazy anarchism in service of racism, and barbaric contempt for expertise and civility (i.e., into MAGA). Bitcoin, having no special virtue over centralized forms of technology-aided payment methods, other than in aid of criminality, is an attack on government and civilization.

Sublation, including the private property relation, is the sole object of conservatism. They want us to pretend it’s a suicide pact and not a flight of fancy. Whatever anarchism you are attributing to the neoliberals is dubious.

Yes well they call themselves AnCap. Is it really anarchism? I don’t know.

Gold is not sustained by libertarians. Gold has long-standing real world uses in industry, in jewelry, and fine arts. And plenty of investors dabble in it as a punt. You can buy it when it seems cheap and sell when high without being a true believer.

Since the dawn of history the problem has been much more about collecting the ransom than taking the hostages, or whatever. If you could arrive at a situation where data theft of this kind was still possible in some cases, but extracting ransom money was not, then you’d have done a lot to put an end to this type of crime. It’s analogous to Situational Crime Prevention: the harder you make it for criminals to profit, the less they will try. Which suggests that going after crypto-currencies, and even criminalising their use, would be a very good start.

Cryptos are electronic gambling tokens prized primarily by criminals of various sorts. They will go the way of the Caribbean Pirates and their ilk …

Have you looked at the ‘stablecoin’ Tether, with it’s 1:1 dollar peg, and it’s role in pumping up the prices?

eg yesterday at the low, they ‘minted’ 1,000,000,000 new tethers (on a Sunday).

https://www.singlelunch.com/2021/05/19/the-tether-ponzi-scheme/

Sounds like the noose might be tightening there, and if it does, where will the billions in new funny money come from to keep the party going?

Tether by its own admission has 70% backing in commercial paper. Which makes it extremely hard to judge how collateralised it really is. CP would, on mass liquidation, require potentially substantial haircut, and since there are no data on what CP it owns and how over-collateralised (if at all) it is, Tether is as likely to be full of hot air as of USD.

TBH, Tehter would be IMO the prime candidate in crypto-world for detailed money-laundering investigation (that could, while it’s being conducted, stop all its activities of course).

Uh oh, is this the beginning of the end? It could be a turning point. Looks like the walls are closing in on this ponzi.

The colonial hack was done by a group using the Darkside ransomware. This ransomware is provided as a service to cybercriminals, but despite it sophistication it appears it either requires an initial account or an easily hackable account for initial access. Typically a cybercriminal needs to steal that initial account using a phishing email or message before the Darkside code can really be used. My take is that the ransomware actually highlights slovenly IT practices like using cookies for web sites, allowing storage of passwords within browsers, system admins being able to assign themselves remote administrator permissions. It now appears Darkside have upset a lot of cyber criminals by not paying their debts and by breaking a code of conduct which is to avoid notoriety. Apart from facilitating criminal activity and replacing gold ,diamonds or bags of cash it feels a little unfair to link all crypto currency to crime.

Most of the argument here about crypto currency and its usefulness I would mostly agree with but there are some ideas behind some blockchain implementations which I find interesting. Smart Contracts which can be used to optimize multiple party workflows or to bypass certain actor like banks. Decentralised autonomous organisations which can be used in business or government to replace management levels or effectively removing business cost by changing to a coop management structure. Voting based decision making which prevents personalities hijacking strategy. Medicine research funding mechanisms. All of these technologies have issues and weaknesses but that does not mean they are worthless.

Is crypto the best thing since sliced bread then definitely not and the currency aspect of the technology is for me the most troubling. That the currency nodes are not exactly in safe hands makes me shy away even if it is supposedly secure. Some of the technology ideas coming out of blockchain could be world changing particularly with respect to inequality and I worry that there is a danger these ideas will get thrown out with the bad parts of cypto and blockchain.

Smart contracts are a mis-nomer. They can basically cover only relatively simple situations (technically, the most they can do is Turing completeness, which pales compared to real-world contracts), for which tons of workflow solutions exists already (and existed for years). The only difference would be in “trusted”, but in reality pretty much all those workflows are already executed in a highly trusted environment, and will have to continue being so.

There are other drawbacks on the smart contracts, which is that most really important contractual relationships has some flexibility in them (which is not stated explicitly). Special-purpose-vehicles tried to govern-by-contract, and trust me, those contracts weren’t simple. Yet, they often run into unintended-consequences exactly because of the lack of flexibility (because the trustees could not often show any flexibility, even if it was in the interest of all the parties involved. At best in situations like those they had to go to the stakeholders and get an explicitl consent, which sort of beats govern-by-contract purpose).

And then there’s the main premise of the whole thing – trustlesness. Long-term relationships are based on trust, and that tends to elicit behaviour which often is not easily codified. I do not consider promoting a trustless environment a public good.

Stacco Troncoso is both tech and co-op savvy (a member of Guerrilla Translation cooperative and a one-time DAO fan). His take is that blockchain is utterly useless. They started their co-op thinking that blockchain/smart contracts would play a big part and quickly discovered that everything they might use those technologies for could be done easier and cheaper in some other way.

If you have to hand someone a bag of diamonds, they expose themselves. The BTC ransom can be sent across extradition-proof borders. Of course like a bag of diamonds, turning bitcoins into cash is a pretty trick that will also involve exposure and/or a steep discount.

> prevents personalities hijacking strategy

Ah, the PMC dream: Removing politics from policy.

I agree it seems that much of this space is just bringing accessibility to the attributes of “Money land” to the average person so you no longer have to be a billionaire or be able to have a have someone set up a PO box in the caymans to be outside the law. So far it seems that governments have only been competing with each other to garner as much of the huge flow in moneyland for themselves so while I hope there will be better regulation, I’m not optimistic. I do believe there is a lot of useful tech that is being developed in the crypto world, Difinity’s Internet computer project seems like a very promising example, though the space in general feels a lot like when the big banks stockpile commodities in warehouses so they can create an artificial shortage and run the price up allowing them to profit from their long futures contracts or the reverse with gold and silver, selling what they don’t have in the form of paper promises to profit from their shorts. Tether feels like another version of Wachovia making the majority of its income from laundering the drug cartels money and then being fined a small fraction of a percent when caught. I do feel the transition to a more distributed network will be beneficial in the long run, but it seems we really need a financial crash to reset the tone from speculation back to investment.

I would suggest that the super rich don’t need crypto for that. I mean the super super rich, i.e. these guys:

… in other words the criminals who are so big they are legitimate. For whom the entire banking and financial system was created and to whom it serves: the actual heads of the ruling class. And make no mistake, that is the horse we’re backing here whether directly or indirectly, with our calls for the destruction of crypto by whatever means, the locking up of miners and the vilification and mockery of anyone who supports cryptocurrencies. I’m no crypto-zealot. I’m just saying there’s more than one side to this phenomenon.

Panama, Treasure Islands, enormous tax breaks via tax shelters, what percentage of profits’ tax did Amazon or Bezos pay last year for example, etc.

adding just for fun:

You don’t get this rich without serious govt help in the regulations and tax department, imo.

Wealth Shown to Scale

https://mkorostoff.github.io/1-pixel-wealth/

Switzerland was busted. Lots of accounts in Panama exposed by Panama Papers. NYC will not longer let anonymous shell companies by real estate. The UK is going after many of its shell company registers.

It’s slow but the places to hide are getting fewer in number.

For the record, Roubini is wrong about not being able to pay for bitcoin conferences in bitcoin. You can, in fact, pay for the 2021 conference in bitcoin, and get a discount for doing so. Just sayin’.

https://b.tc/conference/registration

He said “some” or “many,” not all.

Ah, ok. Thanks. Not listening closely enough.

Does anyone on NC know who Packy McCormick of Not Boring is? I keep getting articles (Own the Internet being the latest) regarding the crypto space that he’s written. I feel like I should read them….that I should pay attention to this “revolutionary” and “transformative” technology that is unfolding, especially ETHE/Solana/Blockchain, and yet, my eyes glaze over after a few paragraphs. My gut instinct is that it’s a total scam, but I also have a nagging sensation I’m turning into my dad. I suppose both could be true….

Just wish all these crypto hawks would channel their energy into understanding the policy implications of MMT and fight to take back ownership of the sovereign currency system they’ve given up on…

(clicked the wrong reply button… this is just a general comment)

Seems to me that there is a major effort underway to get rid of specie as a way to keep cash out of the hands of citizens. As it is, our government counts on criminal organizations to suck up inflation-causing paper money.

Birds of a feather, obviously.

That’s an initiative in the EU. The stuff in the US is middleman-driven, not officialdom-driven.

The US saw an increase in use in cash prior to Covid. It fell then due to worries about handling dirty bills. We’ll see if it reverts to the old normal or not. Those contact payment devices are slower than cash or credit cards.

I recall once hearing a presentation from a vendor that was using blockchain in IoT devices. Our CIO noted that blockchain is computationally intensive and didn’t seem like a great fit for edge devices, given that you usually want them to be as low power/cost as possible. He asked what problem blockchain was solving for them.

The answer was somewhat long-winded, but eventually boiled down to “investors seem to give us more money if we say we’re using blockchain.”

This article seems to display the kind of wiling refusal to understand that I don’t expect from NC. Attempting to devalue Bitcoin on the basis of rationality or legitimacy is entirely missing the point – as you briefly mention; ‘this is a philosophical issue’.

Bitcoin and all cryptocurrencies represent the simplest way for most powerless people to make a ‘vote of no confidence’ in all of today’s interconnected systems. If it were possible to anonymously buy, sell and store gold as easily as bitcoin, most holders of bitcoin would happily swap over. And while a large portion of Bitcoin’s utility is derived from both money laundering and pump-and-dump schemes, an ever-increasing proportion consists of the stimulus checks, bonuses and christmas gift money of normal people who don’t trust banks, publicly listed stocks or issuers of fiat currencies with their money due to the shenanigans of the past twenty years.

I do not own any crypto and certainly don’t plan to now, but it is worth understanding the true dynamics behind the hype instead of taking the mental shortcut to ‘they are just irrational and morally repugnant’.

“Evans-Pritchard’s (1940, p. 120) classical argument about the Nuer can help us here. “A man of one tribe sees the people of another tribe as an undifferentiated group to whom he has an undifferentiated pattern of behavior, while he sees himself as a member of a segment of his own group.””

Bitcoin will wash away as a cryptocurrency as it has many technical faults (too power hungry and too slow). But when BC is done, other cryptos that work better will take it’s place. And cryptocurrency will always have a place in regimes that frequently crush their currency (see Venezuela, Argentina & others), as it allows for ordinary people to be protected from inflation.

Who would want to put its wealth in an asset as volatile as cryptos? Well, cryptos are all the rage right now. Volatility shouldn’t come as a surprise. But a couple of years down the road, after governments create regulation (thus removing uncertainty), and after the hype dies and we can finally learn what can and cannot be done with cryptos, I would imagine volatility would subside.

If governments end up banning cryptos, it will not be because of the environmental impact or because of them being used for criminal activities. Green cryptos are already there to solve the first issue, and there are plenty of criminal activities where fiat currency is used, yet no one would think of banning fiat for it. Cryptos are a tool, and can be used for legal and illegal activities. As long as the share of illegal activities stays a small part of the whole, it will mimic real life and won’t be banned. The way I imagine cryptos might end up being banned is if they threaten banks and/or governments. And that’s something that certainly could happen in the near future.