Lambert here: They do?

By Jordan Rau, a senior correspondent at Kaiser Health News. Originally published at Kaiser Health News.

Cone Health, a small not-for-profit health care network in North Carolina, spent several years developing a smartphone-based system called Wellsmith to help people manage their diabetes. But after investing $12 million, the network disclosed last year it was shutting down the company even though initial results were promising, with users losing weight and recording lower blood sugar levels.

The reason did not have to do with the program’s potential benefit to Cone’s patients, but rather the harm to its bottom line. Although Cone executives had banked on selling or licensing Wellsmith, Cone concluded that too many competing products had crowded the digital health marketplace to make a dent.

“They did us a tremendous favor in funding us, but the one thing we needed them to be was a customer and they couldn’t figure out how to do it,” said Jeanne Teshler, an Austin, Texas-based entrepreneur who developed Wellsmith and was its CEO.

Eager to find new sources of revenue, hospital systems of all sizes have been experimenting as venture capitalists for health care startups, a role that until recent years only a dozen or so giant hospital systems engaged in. Health system officials assert many of these investments are dually beneficial to their nonprofit missions, providing extra income and better care through new medical devices, software and other innovations, including ones their hospitals use.

But the gamble at times has been harder to pull off than expected. Health systems have gotten rattled by long-term investments when their hospitals hit a budgetary bump or underwent a corporate reorganization. Some health system executives have belatedly discovered a project they underwrote was not as distinctive as they had thought. Certain devices or apps sponsored by hospital systems have failed to be embraced by their own clinicians, out of either skepticism or habit.

“Even the best health care investors can’t reliably get their health systems to adopt technologies or new innovations,” said James Stanford, managing director and co-founder of Fitzroy Health, a health care investment company.

Some systems have found the business case for using their own innovations is weaker than anticipated. Wellsmith, for instance, was premised on a shift in insurance payments from a fee for each service to reimbursements that would reward Cone for keeping patients healthy. That change did not come as fast as hoped.

“The financial models are so much based on how many patients you see, how many procedures you do,” said Dr. Jim Weinstein, who championed a health initiative similar to Cone’s when he was CEO of the Dartmouth-Hitchcock health system in New Hampshire. “It makes it hard to run a business that is financially successful if you’re altruistic.”

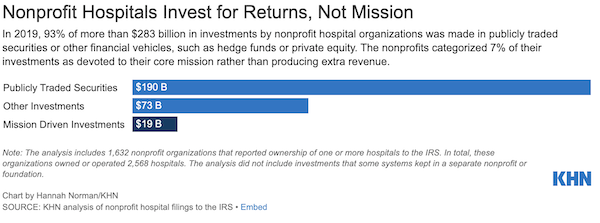

Though their tax-exempt status is predicated on charitable efforts, nonprofit health systems rarely put humanitarian goals first when selecting investments, even when sitting on portfolios worth hundreds of millions of dollars or more, according to a KHN analysis of IRS filings. Together, nonprofit hospital systems held more than $283 billion in stocks, hedge funds, private equity, venture funds and other investment assets in 2019, the analysis found. Of that, nonprofit hospitals classified only $19 billion, or 7%, of their total investments as principally devoted to their nonprofit missions rather than producing income, the KHN analysis found.

Venture capital funds are a potentially lucrative but risky form of investment most associated with funding Silicon Valley startup companies. Because investors seek out companies in their early stages of development, a long-term horizon and tolerance for failure are critical to success. Venture capitalists often bank on a runaway success that ends up on a stock exchange or in a sale to a larger company to counterbalance their losses. As an asset class, venture capital funds assets annually return between 10% and 15% depending on the time frame, according to PitchBook.

While they lack the experience of longtime venture capitalists, health systems posit that they have advantages because they can invent, incubate, test and fine-tune a startup’s creations. Children’s Hospital of Philadelphia, for instance, parlayed a $50 million investment into a return of more than $514 million after it spun off its gene therapy startup Spark Therapeutics.

Many hospital-system venture capital funds, both established and new entrants, have grown rapidly. The largest, run by the Catholic hospital chain Ascension, has been in business for two decades and this year topped $1 billion, including contributions from 13 other nonprofit health systems eager to capture a piece of the returns.

Providence, a Catholic health system with hospitals in seven Western states, launched its venture capital fund in 2014 with $150 million and now has $300 million.

Cleveland-based University Hospitals launched its own fund, UH Ventures, in 2018. “We were candidly late to the game,” said David Sylvan, president of UH Ventures.

UH Ventures yielded $64 million in profits in 2020, Sylvan said, which pushed University Hospitals’ net operating revenue from the red to $31 million. Sylvan said the largest income contributor from UH Ventures was its specialty pharmacy, UH Meds, which provides medications to people with complex chronic conditions and helps them manage their ailments.

Another UH-supported startup, RiskLD, uses algorithms to monitor women and their babies during delivery to alert clinicians of sudden changes in conditions. It is used in UH’s labor and delivery units. Sylvan said it is being marketed to other systems. UH Ventures’ webpage touts the financial advantages for avoiding lawsuits, calling RiskLD “the first and only labor and delivery risk management tool designed to address birth malpractice losses.”

But sustained commitment is harder when the return on investment is not clear or immediate. In 2016, Dartmouth-Hitchcock, which operates New Hampshire’s only academic medical center, tested its remote monitoring technology, ImagineCare, on 2,894 employee volunteers. ImagineCare linked a mobile app and Bluetooth-enabled devices to a health system support center staffed by nurses and other Dartmouth-Hitchcock workers. The app tracked about two dozen measurements, including activity, sleep and, for those with chronic conditions, key indicators like weight and blood sugar levels. Worrisome results triggered contact and behavioral coaching from the Dartmouth-Hitchcock staff.

Dartmouth-Hitchcock found health care expenditures for the people with chronic conditions dropped by 15% more than matched controls. Nonetheless, in 2017, with the product facing unexpected technology challenges and the health system saddled with a short-term deficit, Dartmouth-Hitchcock scrapped the experiment and sold the technology to a Swedish company in return for potential royalties.

“We didn’t have the capital as a small health system,” said Weinstein, now senior vice president of innovation and health equity for Microsoft. “It wasn’t a venture investment to make money; in fact, we probably would have lost revenues on admissions. But it was the right thing to do.”

ImagineCare has found a more receptive home in Sweden. Two regions of the public health care system as well as a private health care organization have decided to deploy it as their remote monitoring service, according to ImagineCare’s CEO, Annette Brodin Rampe. The company expects to have 10,000 patients enrolled by year’s end.

Wellsmith, Cone Heath’s diabetes platform, suffered an even rockier trajectory. The concepts were similar, but Wellsmith was initially tailored to people with Type 2 diabetes. Data on weight, activity, blood sugar and patients’ compliance on taking medication was uploaded manually or through Bluetooth-enabled devices and sent to a small team of nurses and health coaches at Cone, who would contact those with disquieting signs.

Cone tested Wellsmith on 350 employees with Type 2 diabetes and reported encouraging results in 2018. Users’ physical exercise had increased on average by 24% and their A1c levels, which measure the percentage of red blood cells with sugar-coated hemoglobin, had dropped by 1 point on average. “We believe that the future will be carried by those who can invest in and create models of care like Wellsmith,” said Terry Akin, Cone’s CEO at the time.

But Cone grew apprehensive about Wellsmith’s commercial prospects, especially when other companies started pitching similar products. In its 2018 financial statement, Cone wrote that “management has determined that the existing technology will not be marketed for sale and licensing.” In October 2020, Cone decided to end its relationship with Wellsmith and shut it down this year, according to its financial statement.

Cone declined requests for interviews. In an email, Cone spokesperson Doug Allred wrote: “Unfortunately, a number of well-funded competitors established similar platforms. This has made it difficult to scale our platform to more customers and develop more partnerships. Due to these factors we made the difficult decision to sunset the Wellsmith platform.”

In interviews, Teshler said Cone had originally viewed the product as complementary to its efforts to move away from a traditional fee-for-service payment system. But she said alternative models — such as those in which insurers pay a set fee for each patient, providing doctors and hospitals with an incentive to keep spending low — remained the arrangement for a minority of Cone’s patients: those enrolled in Cone’s Medicare Advantage plans and accountable care organizations.

“The problem with these kinds of solutions — not just us — is it requires people to have digital devices that aren’t normally covered by health insurance,” she said.

Wellsmith’s business plan was to charge a per-member monthly fee to organizations using it. Teshler said Cone did not want to pay Wellsmith a fee when it had already lent it millions, since it couldn’t bill insurers for the service.

Other obstacles arose as well, according to Teshler. She said Wellsmith’s development was delayed when the second version of the software was a “dismal failure” and needed to be revamped. To further complicate matters, Cone began entertaining a merger with another health system, making the long-term financial commitment to Wellsmith uncertain. “And then we hit covid and it was game over,” Teshler said.

Teshler said she is still developing her concept, though, under her contract with Cone, Wellsmith’s software had to be destroyed when they split ways. She wants to market Wellsmith’s successor to primary care medical practices that contract directly with employers — groups that benefit when medical claims are reduced. She does not see other hospital systems as viable customers.

“It’s very simple for their attention to be diverted by the fact that their job is to keep people alive,” she said. Also, unless an innovation is unique, she said, “everybody’s got a fund, and nobody is going to buy anyone else’s product.”

Health care in the US can be summoned up in one sentence. It is all about money and the bottom line. Even systems that are so called nonprofit, are top heavy with high paid administrators that are MBA’s instead of people with medical degrees.

There is a lot of profit in non-profit, just a question of who gets it. Salaries, perks, investments, etc.—lots of ways to game away. The Financial Engineers are busily at work in this sector.

For instance read about the WE “charity” in Canada:

“Initially, the decision of Trudeau’s Liberal administration to award a sole-sourced, nearly $1 billion government contract to the charity group WE was deemed problematic because members of the prime minister’s celebrity family had performed paid labor for the group in the past. Trudeau was conceivably using tax dollars to subsidize future work for his relatives, in other words.”

https://www.washingtonpost.com/opinions/2020/07/20/we-charity-scandal-arrogance-canadas-progressive-establishment/

A careful study of non-profits I think would reveal a rats nest of nepotism, patronage, influence peddling. The tragedy is that these dodgy non-profits corrupt the social agenda and prevent real reform which in the intention of Governments and Financial Engineers.

Will these Hospital Holding Companies (HHCs) eventually merge into one behemoth that cares for us all, perhaps going by the name of Wellness United?

By doing so, it might be easier to nationalize the whole shebang.

“Wellsmith’s business plan was to charge a per-member monthly fee to organizations using it. Teshler said Cone did not want to pay Wellsmith a fee when it had already lent it millions, since it couldn’t bill insurers for the service.”

So the issue is that the financial benefit goes mostly to the healthcare funder, but the cost is to the healthcare provider…

In contrast, my health insurance provider pays for various programs (with apps!) to manage weight, exercise, various metabolic issues, and now even includes mental health.

We would be seeing superior preventative healthcare systems if we were not seeing for profit privatization of our overall healthcare system. Privatization is the disease of our nation.

Public schools were meant to be “free or as close to it as possible”, which is Article 9 of the UNCH State university charter. Is 17 thousand dollars a year as free as possible? What is there to say but that is less than what it costs to go to Duke.

Originally the King owned everything. They would give their favorites the Deeds to great tracts of land, or install them as Governors. What was is in a nation such as Pakistan. It was because of the draw that was the United States other nations had to change in order to compete for the best talent.

There is little hope of changing your situation or that of your family’s if public education is not free.

The path to wealth still starts from what is inherited.

The purpose of these “innovations” in health management appears to be increasingly to substitute surveillance for care. Vital signs and key indicators are monitored and alerts are generated by the algorithm and trigger the application of guidance or drugs. The streamlined, leaner professional staff can be freed to spend more time at their keyboards quantifying, reporting, and interfacing with the billing software.

I’m unimpressed by the author’s focus and what they elide, and the lack of continuity with the past. In their worldview the actual fabric of the startups is so benevolent. It’s taken as a given. If the startup eventually failed a ROI test, they are also subject to having a perverse change of direction imposed on them partway through when disappointing numbers come in. Where is the discussion of how a user in that situation should approach the fact that an important medical service is now subject to wild swings in quality over just a few years as they do or don’t raise a round or the board demands things?

– Inline reference to algorithms with no particular valence to them, as though there aren’t a hundred other expressions of alarm about ML, happening outside of this article. “The app [ImagineCare] tracked about two dozen measurements, including activity, sleep and, for those with chronic conditions, key indicators like weight and blood sugar levels. Worrisome results triggered contact and behavioral coaching from the Dartmouth-Hitchcock staff.” Great, and then the data was bundled and sold for the Zuboff story, futures markets in user behavior? Or did they escape this somehow? If the founders are the bulwark of honesty, then past history needs to be brought in in assessing how well they are likely to do under pressure from financiers even if they want to.

– I learned from NC here,

https://www.nakedcapitalism.com/2020/02/cybernetic-opioid-pushers-ehr-vendor-practice-fusion-to-pay-145-million-to-resolve-criminal-and-civil-investigations.html

that PracticeFusion, the first cousin of ImagineCare, Wellsmith and RiskLD, “…in exchange for ‘sponsorship’ payments from pharmaceutical companies … allowed the companies to influence the development and implementation of the CDS (clinical decision support) alerts in ways aimed at increasing sales of the companies’ products…” What’s different? Past history should imbue our awareness of future medical startups, but not from Rau. Theranos wanted to be where the doctor sends you for blood tests, in place of Quest. You could swap out the apps in the article and swap in Theranos. But there is no apprehensiveness about the future based on the past, from Rau. What’s so different about founders Jeanne Teshler and Annette Brodin Ramp that they don’t either have a Randian self-regard, or susceptibility to have their idealism undermined partway through by the need for ROI? They would say “we’re completely different people and it’s unrelated,” but they are subject to common VC dynamics dictating their degrees of freedom.