By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

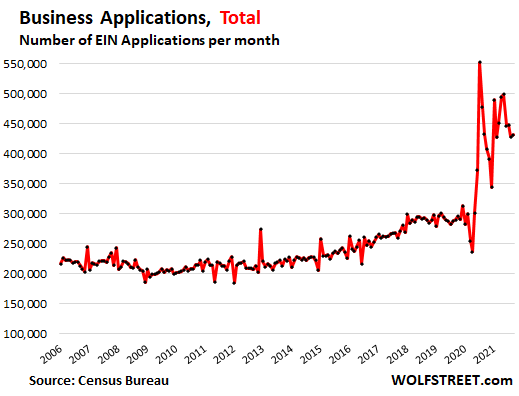

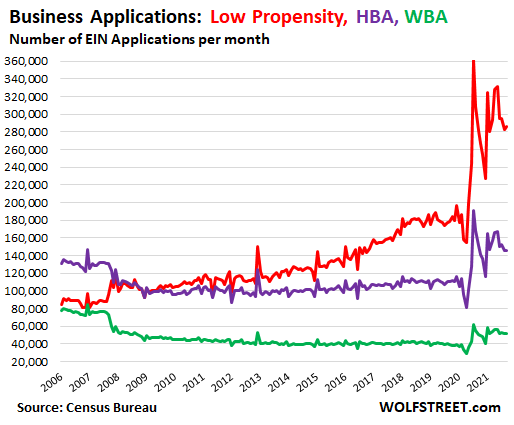

New business formations, based on applications for an Employer Identification Number (EIN) with the IRS, exploded in June and July last year, then zigzagged up and down, and then this year exploded again and remained far above the historical range.

In September, 431,381 EIN applications were filed with the IRS, 49% above September 2019, and at the same red-hot level as September last year, according to data released by the Census Bureau today. For the first nine months of the year, EIN applications were up by 58% from the same period in 2019:

The historic high level of new business formations every month is part of the bizarre puzzle that this economy has become: The strange phenomenon of labor shortages, the enormous stimulus payments that went out, the federal unemployment payments that are now ending, the $800 billion in forgivable PPP loans that went to just about everyone last year and earlier this year, the 3.2 million people who still haven’t returned to the labor force….

Last year and earlier this year, there were suspicions that EIN applications were spiking because fraudsters were creating businesses to get their hands on these forgivable PPP loans. But an EIN wasn’t required for PPP loans. Businesses had to have been around for a while to qualify. And the PPP ended in May. Yet business applications have continued to be sky-high every month since then.

The Census Bureau removed from these EIN numbers those applications that were unrelated to typical business formations, such as for tax liens, estates, trusts, etc.

Most new businesses will create a job for the owner and maybe for a few other people and never become large employers. It can be very exciting and rewarding on many levels to own and run a small business. My WOLF STREET media mogul empire is one of them. Those types of small businesses pay other businesses or people on a contract basis, from accounting to IT work. But they don’t add many employees.

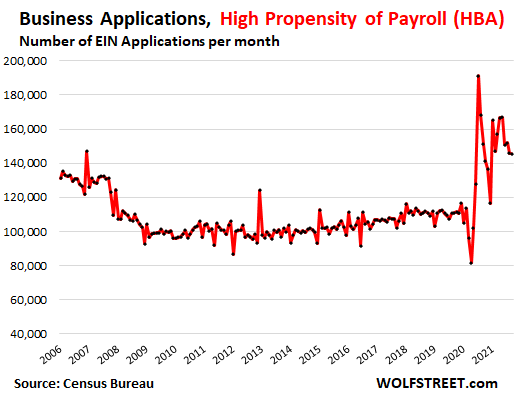

The potential job creators.

Using the information in the EIN application, the Census Bureau categorizes businesses with a high likelihood of creating a significant payroll as “High-Propensity of Planned Wages” business applications (HBA).

In September, there were 145,628 EIN applications by businesses that the Census Bureau deemed to be HBAs, up 31% from September 2019. In the first nine months of this year, there were 1.40 million of these business applications, up 41% from the same period in 2019:

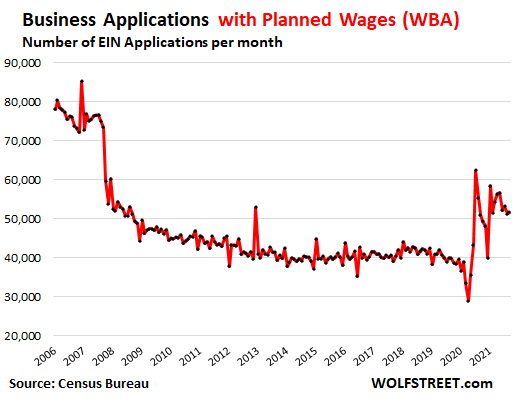

The real potential job creators – with planned wages.

Within the HBAs, there are the “Business Applications with Planned Wages” (WBA) by businesses that have a planned date for their first payroll. They have funding, and they’re ready to pay wages. They’re most likely to grow their payroll and become significant employers.

In September, 51,617 WBAs were filed, up 30% from September 2019. In the first nine months of this year, 485,155 WBAs were filed, up 34% from the same period in 2019.

But they remain down by over 35% from before the Financial Crisis:

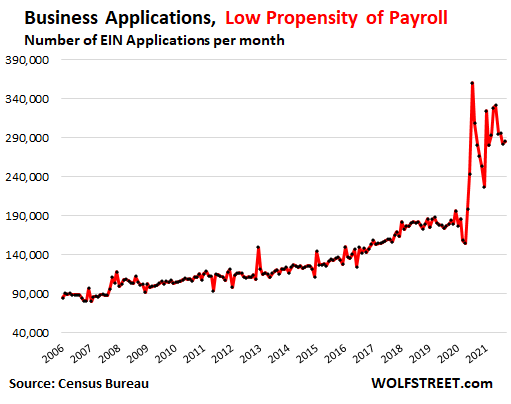

So how many new businesses with a low propensity to create jobs?

To get the number of applications for businesses with a “low propensity” to become significant job creators, I subtract the number of high-propensity applications from total EIN applications. These are the businesses that might only employ the owner and sometimes a few other people.

These types of business applications have risen for years, roughly doubling from 91,000 per month on average in 2007 to 183,000 per month on average in 2019, or 2.2 million for the whole year 2019! And they did so while the HBAs and WBAs fell over the same period. Then came the spike during the pandemic:

The huge number of these largely one-man shows and one-woman shows delineate a big shift in American society, with ever more people striking out on their own.

Much of that was made possible by the Internet which allowed these entrepreneurs to gain visibility, promote their goods and services, use convenient third-party platforms such as eBay and Amazon, and payment platforms such as PayPal and now many others, and engage in direct relationships with potential customers.

This was already a big trend when the pandemic hit with the flood of cash it unleashed that provided funding to strike out on their own, especially people who got laid off by their employer.

But applications by businesses with planned wages (WBAs) in September were back at levels where they’d been in late 2007 and far below where they’d been before the Financial Crisis.

Here are the three types of business applications: Low propensity to create jobs (red), high propensity to create jobs (purple), and with planned wages (green):

The top seven industries, by number of business applications in September, and the % increase from September 2019:

Retail (red): 73,884, +70%.

Professionally services (light blue): 82,272, +34%.

Transportation & warehousing (green): 41,229, +112% related to the delivery needs of the ecommerce boom.

Construction (black): 39,484, +30%.

Administration and support (yellow): 30,290, +50%

Accommodation and food services (gray): 24,014, +50%

Health Care and Social Assistance (brown): 24,297, +22%

My 2 Cents about Failure rates.

The “failure rates” of small businesses are high. The alternate term used by the Bureau of Labor Statistics is “survival rate.” The commonly cited metrics for failure rates:

20% of the businesses fail within the first year; 50% fail within the first five years.

Sounds discouraging. “Failure” is defined as the business not being around anymore after x number of years. But in many cases, the owner of a business quietly ends the activity and retires, or gets a job with a company, or starts a new business. It doesn’t necessarily involve bankruptcies and upheaval, or even “failure.” Just a change of plans.

The metrics of the number of businesses that aren’t around anymore after x years and call them “failures” don’t sort that out. So these high “failure rates” are misleading about the risks of starting a business, and they can be discouraging even if reality for many of the owners that shut down their businesses looks very different.

Glad to see you are back Jerri-Lynn.

Hope all is good with you now and all dealt with.

‘A nation of shopkeepers?’ Napoleon’s contemptuous dismissal of Georgian Britain was later embraced by the Whigs, and then variously by Edwardian Liberals, Thatcher’s ‘Stakeholder Society’ and Blair’s ‘New Labour’ (others too, I think).

…. But as I read the (unusually) cheery comments on WolfStreet, whose commentariat trends a little more libertarian than here, I found myself recalling with discomfort the following snips from Prof. Hudson’s recent NC post on the immiseration of the ex-Soviet Republics….

Every economy is managed by some class or another…. Banking, real estate, natural resources and public utilities were privatized in the hands of appropriators…. The ‘rule of law’ sponsored by Western backers enabled managers and political insiders to register public land, oil and mineral resources, [prime housing and marketplaces], public utilities and factories in their own names, and ‘cash out’ in hard currency by selling shares in their new companies to Westerners. The new owners were free to maximise whatever they could squeeze out.

Most of the proceeds were kept abroad, leaving local economies (in the absence of domestic savings which had been wiped out by hyperinflation) in need of foreign credit to function.

The effect was not to empower the population but to marginalize it, while driving smallholders into debt at effective interest rates between 25 and 50% and then depriving them of their homes….

Many rural migrants to cities, as well as women previously employed as factory workers, teachers and healthcare specialists, were then forced into petty trading. To pay for services, such as health care and education, which were previously available for free, they then borrowed through Western sponsored microcredit schemes, typically bearing 80% annual interest and denominated in dollars.

Petty trading.

But in our updated version, largely carried out on [and revocable at the will of] totalizing, snooping, rent-extracting platforms.

On my latest trip to Sweden, it was before COVID, I came across an anecdote to support the ‘petty trading’ scenario:

While on the flight I had a conversation with a woman who seemed to be very intelligent, competent and focused. She had years of experience from working in London and for personal reasons (love) she had decided to return back to the city she grew up in. Despite years of experience, references and coming across (at least to me) as being very competent she could not find a job in city where she grew up. She had, like I also had, become an outsider/stranger in the city where she grew up in and as jobs often are filled through connections she could not find a job. She ended up starting a business, importing from China and selling.

I chose to move abroad again, she decided to stay and to do so then the only option she found was to become a trader.

A similar story might be about the man with a very foreign sounding name who graduated from the university in my city. Engineering degree from an (at least locally) well known university but he could not find a job either so started a job, importing from China and from Eastern Europe.

Sometimes people chose to start a business, other times they do what they have to do to survive and start a business. If there is a surplus of job-opportunities then the ones who start their own business are likely to be the kind of people who want to have their own business. If someone has limited or even no job-opportunities then they might be forced into the risky business of running their own business.

The numbers do look strange and I suspect that the best way of finding out why it is happening is asking the ones who started their own business why they chose to do so. A large survey might possibly give more clarity. Not sure if one will ever be done on this. The ones who consider the many startups to always be good news might not want the good news to be questioned.

I am skeptical that increased issuance of EINs represents an explosion of business formations in a traditional sense. First, COVID wiped out millions of small businesses. Look at the number of closed restaurants and empty store fronts. Many of these entities were forced into closure and bankruptcy to stop bleeding cash. Some may now be reconstitution. Secondly, because of WFH, some former employees turn into contractors. While an EIN is not always necessary, there are advantages of having a business certificate or incorporation over getting paid using your personal Social security number. Lastly, outfits like Amazon have exploded and now have 700 delivery trucks operating out of their fulfillment center. All those vans are operated by several contractors that bid on routes; FedEx has done the same thing here, we never see FedEx employees, always a contractor, usually in a U Haul rental truck.

I kindof think the business formation is indicative of crapification or getting rid of employee benefit costs in many cases. Of course many have told their employers to “take this job and shove it”.

I know some young entrepreneurs who have great creativity, energy and motivation to establish their own businesses. They saw older people experience too many dysfunctions, and then voted with their feet, brains, networks and wallets. They reject conventional businesses with the supporting hierarchies, media narratives and, well, lies. They are not afraid to try, try again.

The Richter article and the Spinoza link are timely, supporting a strong notion to question. Here is one of the snippets from the latter article source that sheds light on the younger views:

Agreed. Though there is probably some merit to Wolf using it, EIN issuance feels like a very noisy statistic to use as a proxy for business formation. I work in commercial real estate and every time we begin a new project, we form 2-3+ new legal entities as part of the ownership structure, each with its own EIN.

I’d hardly say I’m starting a new business each time.

I am in agreement, I think there is probably another data set that would clear this up, like business name registration or something like that.

Business name registration is a state function with different kinds of databases. Makes gathering data a challenge.

While it might give you a better metric, some (most?) states don’t require a name registration when you use your own name.

Years of breathless media praise for “entrepreneurship” and the creator economy, both of which have extremely unsuccess stats, meet the pandemic-induced uncertainty and the take-this-job-and-shove-it precariat to drive a lifestyle fad that is extremely hard to make work.

It costs very little to get and EIN number and an Instagram account.

I can’t see that these trendy stats are a sign of anything other than people trying things out. I certainly don’t see significant new business formation in my daily life.

@upstater

October 17, 2021 at 8:53 am

——-

In my experience as a Tax Accountant, I have applied for at least 10 EIN’s for clients over the past year and a half, all for new businesses, mostly single-member LLC’s. That’s a lot more than usual.

In addition I have several new clients with new companies who obtained their own EIN’s.

Only three of the above are likely to have employees, but they are all serious about being successful.

Welcome back JLS. I hope you’re feeling better.

Start the party! JLS is back in da house!

Thanks! And I’m on the verge of launching another original post.

I’m really glad to see you back, Jerri-Lynn.

Me, too. Welcome back, JL.

It’s for the birds! (umm, for us too for the birds, I mean, er, for us period, but more birds please)!

Argg…, It’s Just Great that you’re OK !!!

Thanks for all the kind words. I’m really touched. And I just launched my original post. So now I can kick back and rest. Just in time for a nice afternoon nap.

Alas, no birds.

Instead I bring you:

SHARKS!

Great JL! I love your posts. (I’ll never look at textiles the same way…. ;)

Glad to hear that. I’m going to be editing an Indian textiles issue for a Calcutta-based journal in January and I’ll link to it once it’s available.

I think it is a good sign and yes of course some part of the data is probably not including brand new businesses. But so what. I think it is a sign the people who have been repeatedly laid off, not treated well by employers when they were employed and individual deep re-thinking of what life should be like is creating this situation. It is clear that the US does not take care of its people. The stimulus payments and unemployment were too small and did not last long enough. We have no universal health care. The remnants of the idea that a government or a corporation is going to take care of your needs is dying. And most people are finally getting the drift that the corps own government so it’s all the same big machine that exists just to reward itself. Many of these businesses will fail but then may restart over and over as people learn how to make it work. Many may just be at their wits end and will try starting their own business as they have nothing left to lose. The risks are less based on the bleak employment landscape. IMO.

I agree with you. The US doesn’t take care of its people. Just yuuge businesses.

The lying cheating politicians always chant “It’s the small business that helps the economy” but they don’t walk their talk. Right from the get go, the cards are stacked against small business. Workmens comp for companies with few or no employees, unemployement compensation, registration with the local, state and fed govt., reports and so on. There are no small business loans from banks unless backed up by collateral. The SBA backed loans charge a higher interest. No SBA help. If you’re in a construction, the business has to get liability insurance and bonding. No help from SBA on these. They’ll have seminars on how to get insurance and bonding (they’re lobbying for the insurance robbers). No health insurance help either. It’s an uphill task for a new business to get off the ground.

Well I certainly got this wrong, from a personal opinion standpoint. When COVID first hit and the massive PPP program was launched, I figured small business creation would tank, because no entrepreneurs would want to risk their own money launching a business to compete with zombie-fied existing ones that had PPP support. Also PPP money probably helped prop up commercial rents, making the usual bargain basement opportunities for getting a place to rent after a recession less likely.

Not sure exactly what is going on, but one observation is that here locally, there are still lots of vacancies or for lease signs at shopping plazas, but only the very small stores, like the kind that would be for a coffee shop or a dry cleaners. The big boxes have stayed open. Some restaurants have gone out of business and not come back. I do know of one example where a independent restaurant closed because the landlord refused to give them a break on the rent. They’re reopening at a different location where presumably they got a better deal.

I do think there is some contribution also of ex-corporate warriors getting laid off or just quitting and setting up shop as one person consultants. That can tide them over until retirement. We have a lot of 55-65 year olds who are basically unemployable in corporate America due to ageism.

I will add one anecdotal comment, because without a lot of number and research, we are only guessing at what’s going on. But I have a small wholesale to retail specialty food business that’s been around for 25 years. We sell in pretty much all channels: distribution/grocery, e commerce, small independent stores etc.

We are getting a lot more inquiries from new businesses looking to buy some of our products to turn around and sell on Amazon. Far more than before the pandemic when we might get a few of these every now and then.

This may be a part of what’s going on.

Good to see you back Jerri-Lynn……an acquaintance of mine committed suicide a few weeks ago – mutual friends experienced something of what we/readers had…disappearance, confusion, quiet. I thought oh nooo, again? Thankfully not…….here’s to a long life!

So glad to see you back, Jerri Lynn – I was worried about you. I’m not sure about the “explosion of small business” that Wolf references. Call me a skeptic. Please take care of yourself..

This would be more interesting if Wolf didn’t spend all his time complaining about how “free money” has destroyed the incentive to work, and that the employer’s ability to find workers to exploit is a god given right that’s going to doom the economy if it’s not fulfilled.

He’s actually gone out of his way to shut down and rebuke commenters (including myself) that maybe the stimulus checks allowed people more economic autonomy instead of being wage slaves, all because Wolf thinks anything perceived as “debt” is akin to a cardinal sin.

PS: Hi Jerri, Weclome Back. :)

Given the failure rate for small businesses, I view the current cheerleading for start-ups as part of “The Great Resignation” as kicking the can down the road, and ultimately leading to two, three, many Ashlee Babbits (“struggling to keep a pool supply business afloat”).

It also dovetails with NC’s recent articles on reluctance of workers to return to unsatisfactory wages, time for reflection on life spent heretofore spinning one’s wheels, etc. Valuable messages being relayed here, and a very good team conveying said messages, this post being welcome reinforcement of that. Choppy seas ahead, and best wishes to oarsmen – pace yourselves!