Yves here. Readers rightfully often take issue with some of Gail Tverberg’s analysis, since she sometimes has to work overtime to fit her information into her energy scarcity thesis. But she generally has interesting data and her drive to reach conclusions often produces useful reactions from the commentariat. Here she turns to her big topic of the day, the resource implications of the war between Russia and Ukraine.

Tverberg’s core argument is Tainter 2.0: that rising costs of energy development/production lead to scarcity because producers can’t get paid enough to justify the cost of incremental extraction. The West had started early down the path of making it more costly via fossil fuel divestment and ESG policies that increased the cost of capital for fossil fuel companies, as well as putting social/political pressure on them to cut back on development. That’s all gone in reverse with the Russia campaign in Ukraine, but Tverberg would contend it doesn’t change the fundamental dilemma.

By Gail Tverberg, an actuary interested in finite world issues – oil depletion, natural gas depletion, water shortages, and climate change. Originally published at Our Finite World

Most people have a preconceived notion that there will be a clear winner and loser from any war. In their view, the world economy will go on, much as before, after the war is “won” by one side or the other. In my view, we are basically dealing with a no-win situation. No matter what the outcome, the world economy will be worse off after the fighting stops.

The problem the world economy is up against is the depletion of many kinds of resources simultaneously. This depletion is made worse by rising population, meaning that the resources available need to provide an adequate living for an increasing number of world inhabitants. Because of depletion, the world economy is reaching a point where it can no longer grow in the way it has in the past. Inflation, food shortages and rolling blackouts are likely to become increasing problems in many parts of the world. Eventually, the population is likely to fall.

We are living in a world that is beginning to behave like the players scrambling for seats in a game of musical chairs. In each round of a musical chairs game, one chair is removed from the circle. The players in the game must walk around the outside of the circle. When the music stops, all the players scramble for the remaining chairs. Someone gets left out.

In this post, I will try to explain some of the issues.

[1] In a world with inadequate resources relative to population, conflicts are likely to become increasingly common.

The Russia-Ukraine conflict is one example of a resource-associated conflict. The allies underlying the NATO organization have chosen to escalate the Russia-Ukraine conflict, in part, because the existence of the conflict helps to hide resource shortages and accompanying high prices that are already taking place. No matter how the war is stopped, the underlying resource shortage issue will continue to exist. Therefore, the conflict cannot end well.

If sanctions lead to less trade with Russia, (or even worse, less trade with Russia andChina), the world economy will have an even greater problem with inadequate resources after the war is over. In fact, many parts of the current economic system are in danger of failing, primarily because depletion is leading to too little energy and other resources per capita. For example, the US dollar may lose its reserve currency status, the world debt bubble may pop, and globalization may take a major step backward.

[2] There is a huge resource depletion issue that authorities in many countries have known about for a very long time. The issue is so frightening that authorities have chosen not to explain it to the general population.

Mainstream media (MSM) practically never mentions that there is a major issue with resource depletion. Instead, MSM tells a narrative about “transitioning to a lower carbon economy,” without mentioning that this transition is out of necessity: The world is up against extraction limits for many kinds of resources. Besides oil, coal and natural gas, resources with limits include many other minerals, such as copper, lithium, and nickel. Other resources, including fresh water and minerals used for fertilizer are also only available in limited supply. MSM fails to tell us that there is no evidence that a transition to a low carbon economy can actually be made.

[3] The big depletion issue is affordability of end products made with high priced resources. The cost of extraction rises, but the ability of the world’s citizens to pay for end products made using these high-cost resources doesn’t rise. Commodity prices do not rise enough to cover the rising cost of extraction. When this affordability limit is hit, it is the resource extracting countries, such as Russia, that find themselves in a terrible situation with respect to the financial well-being of their populations.

The big issue that hits because of depletion is a price conflict. Businesses extracting resources need high prices so that they can reinvest in new mines, in ever more costly locations, but consumers cannot afford these high prices.

In a sense, the higher cost is because of “inefficiency.” As a result of depletion, it takes more hours of labor, more machine time, and a greater use of energy products to extract the same quantity of a given resource that was previously extracted elsewhere. Growing efficiency tends to help wages, but growing inefficiency tends to work the opposite way: Wages don’t rise, certainly not as rapidly as prices of end products.

As a result, commodity exporters, such as Russia, are caught in a bind: They cannot raise prices enough to make new investments profitable. The problem is that the world’s consumers cannot afford the resulting high prices of essentials such as food, electricity and transportation. Russia reports very high reserve amounts, especially for natural gas and coal. It is doubtful, however, that these reserves can actually be extracted. Over the long term, selling prices cannot be maintained at a sufficiently high level to cover the huge cost of extracting, transporting and refining these resources.

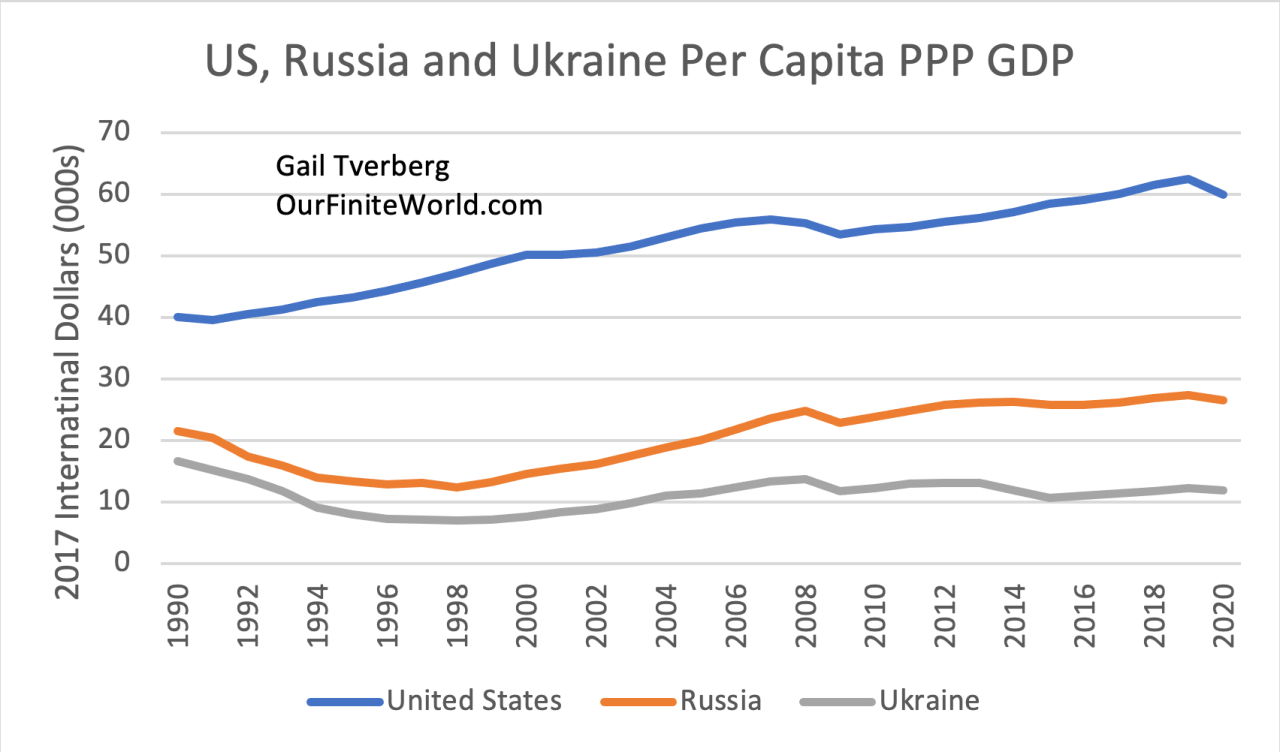

The success of a country’s economy can, in some sense, be measured by the country’s per capita GDP. Russia’s GDP per capita has tended to lag far behind that of the US (Figure 2).

Russia’s inflation-adjusted GDP per capita fell after the collapse of the central government of the Soviet Union in 1991. It was able to grow again, once oil prices began to rise in the early 2000s. Since 2013, Russia’s GDP per capita growth has again fallen behind that of the US, as increases in oil and other commodity prices again lagged the rising cost of production. Given these difficulties with depletion, Russia is becoming increasingly unwilling to ignore poor treatment it receives from Ukraine.

There may be another factor, as well, leading especially to the escalation of the conflict. The US seems to covet Russia’s resources. Some powers behind the throne seem to believe that Western forces supporting Ukraine can quickly win in this conflict. If such an early win occurs, the aim is for Western forces to step in and inexpensively ramp up Russian resource extraction, allowing the world a new source of cheap-to-produce fossil fuels and other minerals.

In this context, Russia launched an attack on Ukraine on February 24, 2022. Ukraine has presented Russia with problems for many years. One issue has been transit fees for natural gas passing through the country; is Ukraine taking too much gas out? Another problem area has been the rise of the far-right Azov regiment. Russia has also expressed concern that NATO has been training soldiers within Ukraine, even though Ukraine is not a member of NATO. Russia doesn’t want military, trained by NATO, at its doorstep.

[4] World economic growth very much depends on growing energy consumption.

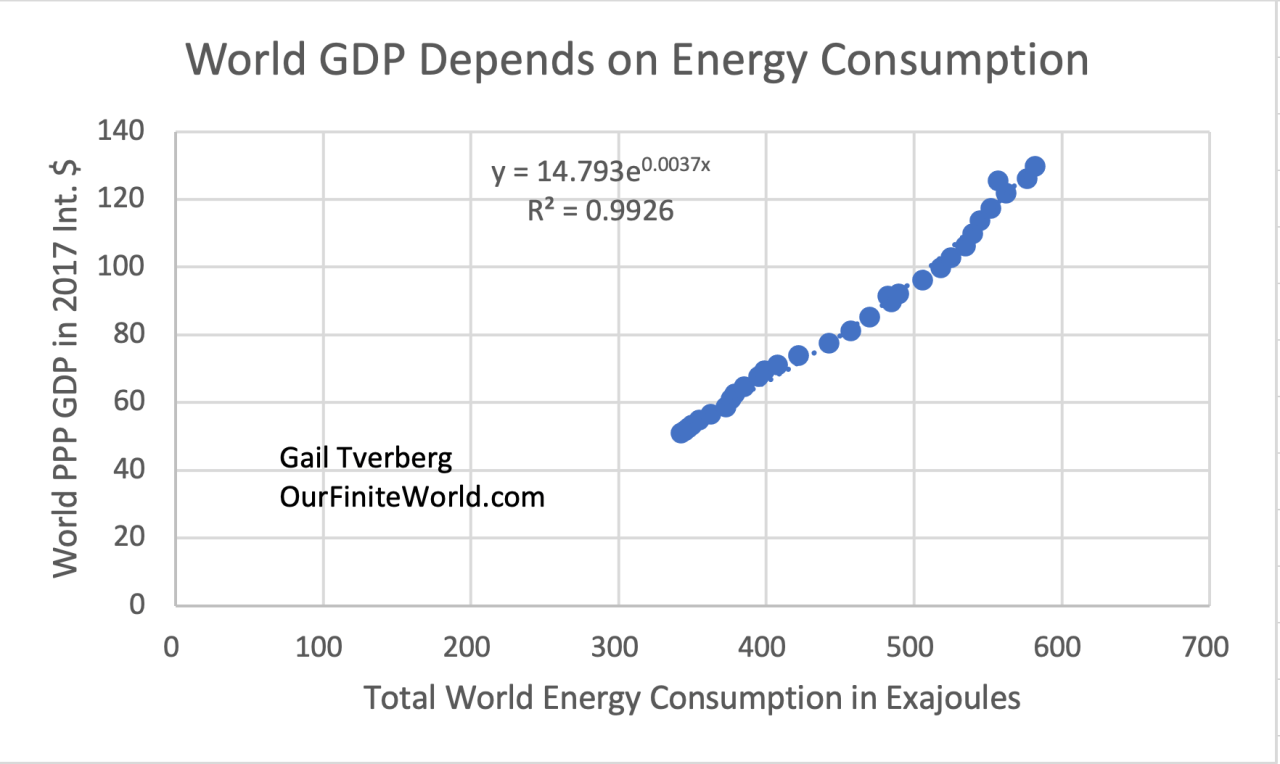

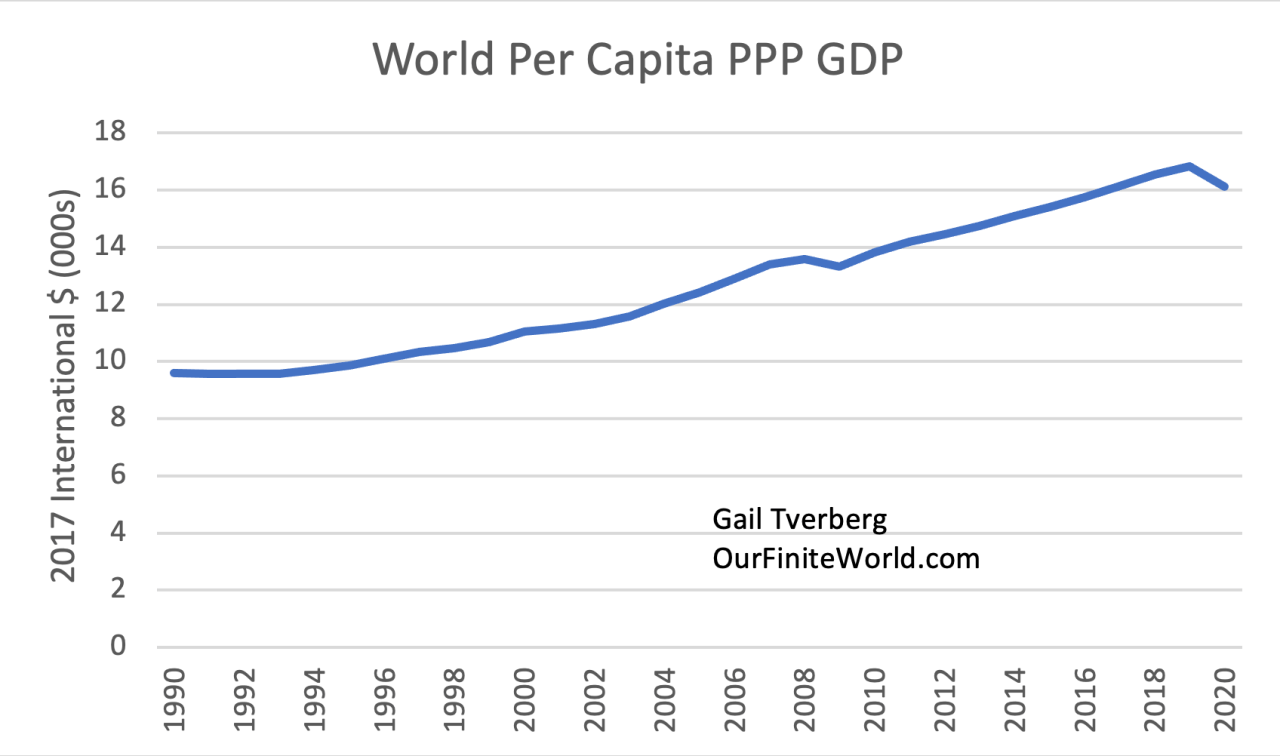

There are two ways of measuring world GDP. The standard one is with the production of each country measured in inflation-adjusted US$, with the changing relative value to the US$ considered. The other approach uses “Purchasing Power Parity” GDP. The latter is supposedly not affected by the changing level of the dollar, relative to other currencies. Inflation-Adjusted Purchasing Power Parity GDP is only available for 1990 and subsequent years. Figure 3 shows the high correlation between energy consumption and PPP GDP during the period from 1990 through 2020.

The reason for a strong association between GDP growth with energy consumption growth is a physics-based reason. Producing goods and providing services requires the “dissipation” of energy products because the laws of physics tell us that energy is required to move any object from one place to another, or to heat any object. In the latter case, it is the individual molecules within a substance that move faster and faster as they get hotter. The economy is a “dissipative structure” in physics terms because of the need for energy dissipation to provide the work needed to make the system operate.

Human beings are also dissipative structures. The energy that humans get comes from the dissipation of the energy found in foods of every kind. Food energy is commonly measured in Calories (technically, kilocalories).

[5] World economic growth also seems to depend on factors besides energy consumption.

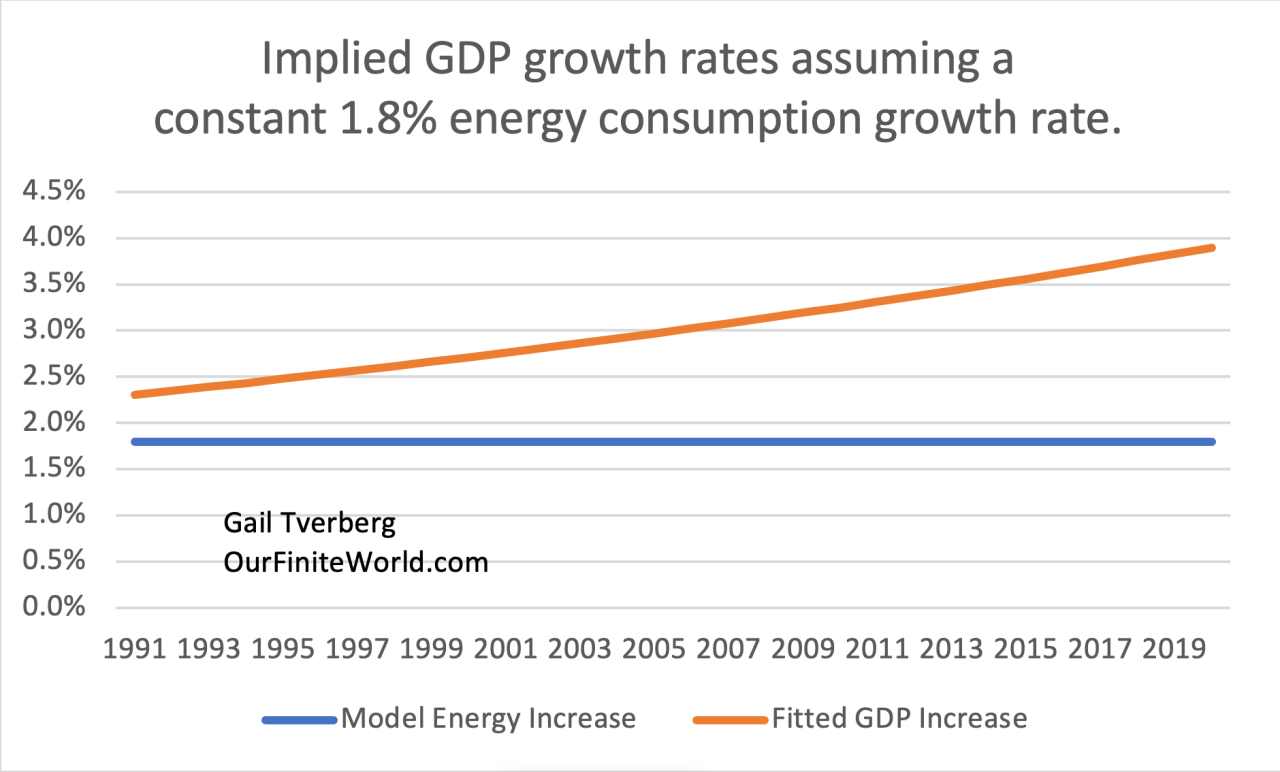

The fitted equation on Figure 3 (the equation beginning with “y”) implies that GDP is rising much more rapidly than energy consumption, almost twice as rapidly. Over the entire 30-year period, the actual growth rate in energy consumption averages about 1.8% a year. If energy consumption growth had really been 1.8% per year, the fitted equation implies that growth in GDP would have greatly sped up over the period. (In fact, the growth rate in energy consumption was falling over the 30-year period, but GDP grew at closer to a constant rate. In terms of the fitted equation, these two conditions are equivalent.)

How can GDP rise so much more rapidly than energy dissipation? There seem to be several ways such a higher rate of increase can occur, on a temporary basis:

[a] A worldwide trend toward an economy using more services. The production of services tends to require less energy consumption than the production of essential goods, such as food, water, housing and local transportation. As the world economy gets wealthier, it can afford to add more services, such as education, healthcare, and childcare.

[b] A worldwide trend toward more wage and wealth disparity. Such a trend tends to happen with more specialization and more globalization. Strangely enough, a trend to more wage disparity allows the world economy to continue to grow withoutadding a proportionately greater amount of energy consumption use because of the different spending patterns between low-paid workers and high-paid workers.

Analyzing the situation, the world is filled mostly with low-paid workers. To the extent that the pay of these low-paid workers can be squeezed down, it can prevent these workers from buying goods that tend to use relatively high amounts of energy products, such as automobiles, motorcycles and modern homes. At the same time, growing wage disparity allows the higher-paid workers to be paid more. These higher-paid workers tend to spend a disproportionate share of their income on services, such as education and healthcare, which tend to use less energy consumption.

Thus, greater wage disparity tends to shift spending away from goods and towardservices. The main beneficiaries are the top 1% of workers (who buy mostly services, requiring little energy consumption), rather than the remaining 99% (who would really like goods such as a car and their own home, which require much more energy consumption).

[c] Improvements in technology. Improvements in technology are helpful in raising GDP because technological improvements tend to make finished goods and services more affordable. With greater affordability, more people can afford goods and services. This effect is favorable for allowing the economy, as measured by GDP, to grow more quickly than energy consumption.

There is a catch associated with using improved technology to make goods and services more affordable. Improved technology tends to increase wage disparity because it nearly always leads to owners and a few highly educated workers being paid more, while workers doing the more routine parts of processes are paid less. Thus, it tends to lead to the problem discussed above: [b] A trend toward wage and wealth disparity.

Also, with improved technology, available resources tend to be depleted more quickly than without improved technology. This happens because finished goods are less expensive, so more people can afford them. Once resources start getting exhausted, improved technology can’t fix the situation because resource extraction costs are likely to rise more rapidly than can be offset with the impact of new technology.

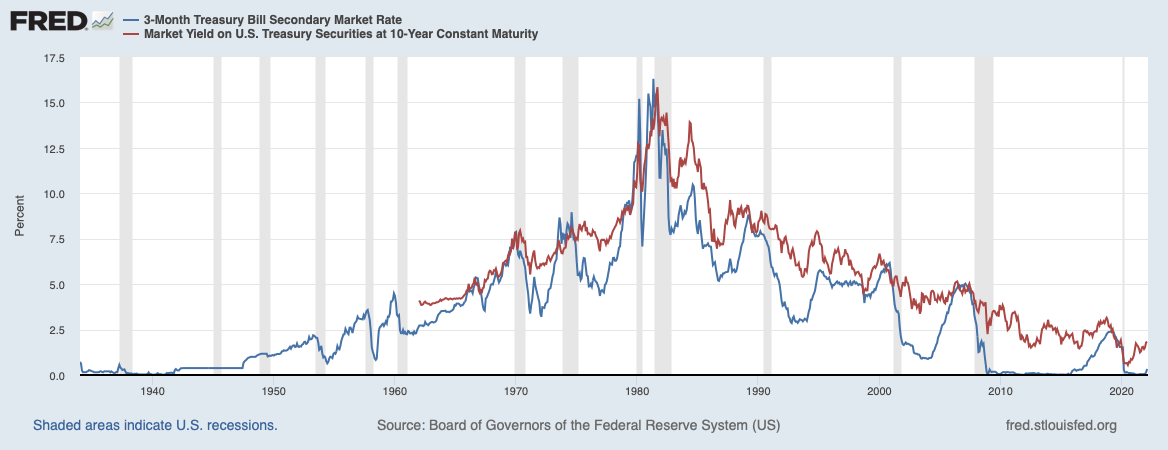

[d] A worldwide trend toward more debt at ever-lower interest rates.

We all know that the monthly payment required to purchase a car or home is lower if the interest rate on the debt used to finance the purchase is lower. Thus, falling interest rates can make paychecks go further. Both businesses and citizens can afford to purchase more goods and services using credit, so the overall level of debt tends to rise with falling interest rates.

If we are only considering the period from 1990 to the present, the trend is clearly toward lower interest rates. These lower interest rates are part of what is making the GDP growth higher than what would be expected if interest rates and debt levels remained constant.

[6] The world economy now seems to be reaching limits with respect to many of the variables allowing world economic growth to continue as it has in the past, as discussed in Sections [4] and [5], above.

Figure 6. World per capita GDP based on Purchasing Power Parity GDP in 2017 International Dollars calculated using World Bank data.

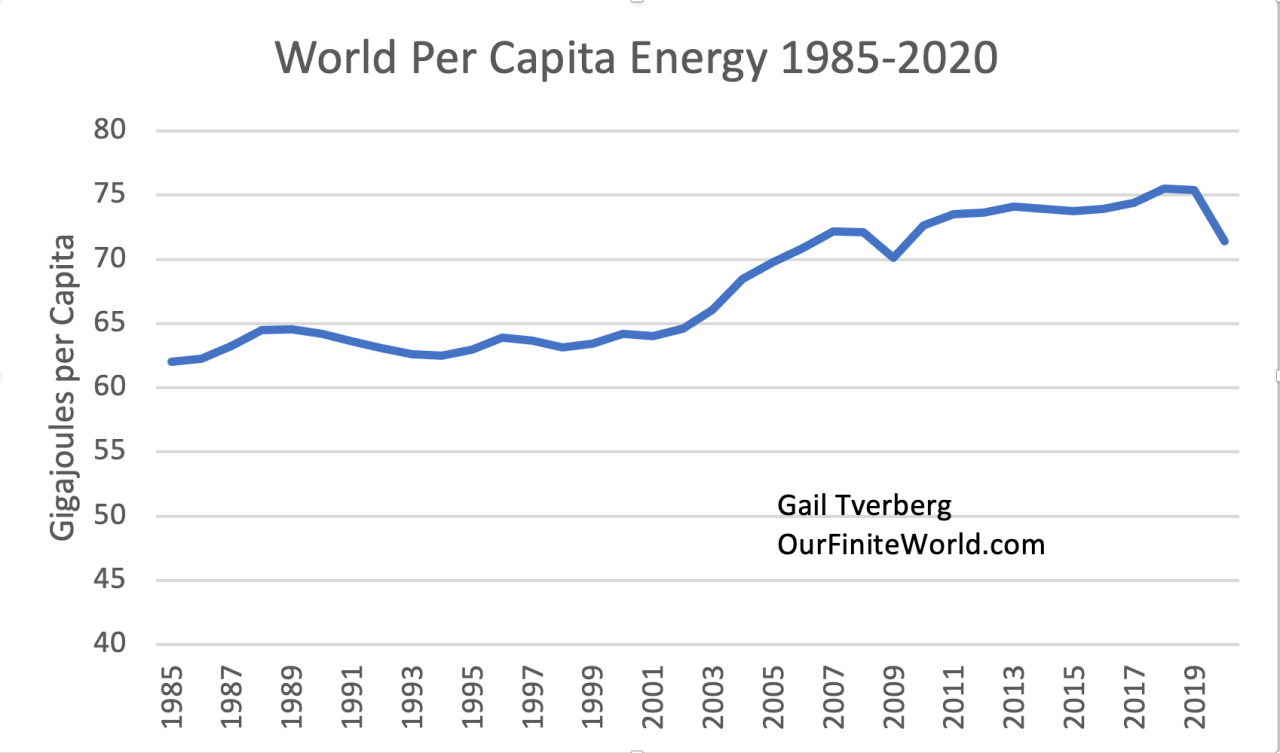

Figure 6 shows that there have been two major step-downs in world inflation-adjusted per capita PPP GDP. The first one occurred in the 2008-2009 period; the second one occurred in 2020. Figure 7 shows the sharp dips in energy consumption occurring in the same time periods.

Figure 7. World per capita energy based on data of BP’s 2021 Statistical Review of World Energy.

In 2021, energy prices started to rise rapidly when the world economy tried to reopen. This rapid rise in prices strongly suggests that energy extraction limits are being reached.

>Another clue that energy production limits are being reached comes from the fact that the group of oil exporters, OPEC+, found that they couldn’t actually ramp up their oil production as quickly as they promised. Once oil production is cut back because of inadequate prices, it is hard to get production to rise again, even if prices temporarily rise because the many pieces of the chain supporting this extraction are broken. For example, trained workers leave and find jobs elsewhere, and contractors go out of business because of inadequate profits.

If we think about it, Items [5a], [5b], [5c] and [5d] are all reaching limits as well. Item [5d] is probably clearest: Interest rates can no longer be lowered. In fact, nearly everyone says that interest rates should now be raised because of the high inflation rates. If interest rates are raised, commodity prices, including prices for fossil fuels, will fall.

With lower fossil fuel prices, there will be pressure for oil, gas and coal producers to reduce their production, even from today’s lower levels. Because of the tight connection between energy and GDP, lower energy production will tend to push economies further toward contraction. Of course, this will make resource exporters, such as Russia, worse off.

As the world economy enters recession, we can expect that Item [5a], the shift from goods toward services, to turn around. People with barely enough money for necessities will reduce their use of services such as haircuts and music lessons. Item [5b], globalization and related wage disparity, is already under pressure. Countries are finding that with broken supply chains, more local production is needed. In the US, recent wage gains have tended to go to the lowest-paid workers. Item [5c], technology growth, cannot ramp up as resources needed from around the world are increasingly unavailable, due to broken supply chains and depletion.

[7] We are likely facing a collapsing world economy because of the limits being reached. Adding sanctions against Russia will further push the world economy in the direction of collapse.

Many sources report that Russian exports of wheat, aluminum, nickel, and fertilizers will be “temporarily” disrupted. A few sources note that Russia plays an important role in the processing of uranium fuel used in nuclear power plants. According to the Conversation:

Most of the 32 countries that use nuclear power rely on Russia for some part of their nuclear fuel supply chain.

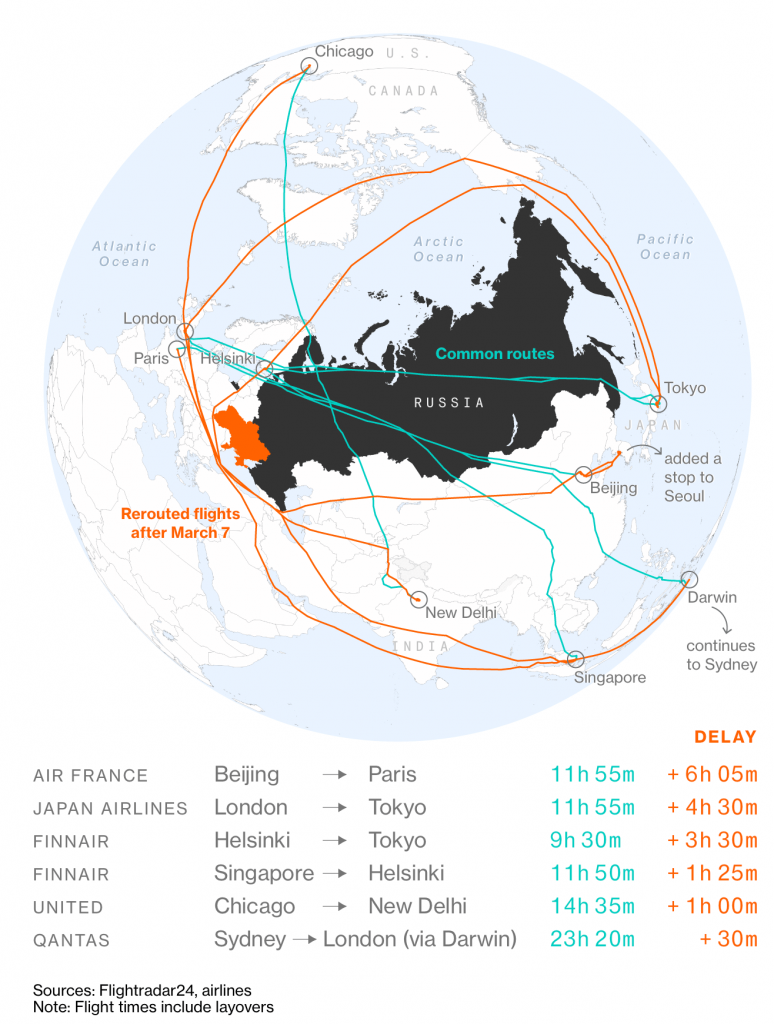

We have become used to efficient air travel, but sanctions against Russia make this less possible, especially for flights to Southeast Asia. A Bloomberg article called Siberian detour requires airlines to retrace cold war era routes gives the example of direct flights from Finland to Southeast Asia being canceled because they have become too expensive and are too time-consuming with the required detours. It becomes necessary to fly indirect connecting routes if a person wants to travel. Many other routes have similar problems.

US President Joseph Biden is warning that food shortages are likely in many parts of the world as a result of the sanctions placed against Russia.

According to a video shown on Zerohedge,

“It’s going to be real. The price of the sanctions is not just imposed upon Russia. It’s imposed upon an awful lot of countries as well, including European countries and our country as well.”

If the world economy was doing well, and if Russia was a tiny part of the world economy, perhaps the sanctions could be tolerated by the world economy. As it is, the Russia-Ukraine conflict acts to hide the underlying resource shortage problem. This is possible because, with the conflict, the resource shortages can be described as “temporary” and “necessary” in the context of the terrible things the Russians are doing. The way the West frames the problem provides a scapegoat to deflect anger toward, but it doesn’t fix the problem.

Russia started out being very disadvantaged because commodity prices, in recent years, have not been rising high enough to ensure an adequate living for Russian citizens and high enough tax revenue for the Russian government. Adding sanctions against Russia will simply make Russia’s problems worse.

[8] There is little reason to believe that Russia will “give up” in response to sanctions imposed by the United States and other countries.

The attacks by Russia of Ukrainian sites seems to be occurring, for many related reasons. It can no longer tolerate being inadequately compensated for the resources it is extracting and selling to Ukraine and the rest of the world. It is tired of being “pushed around” by the rich economies, especially the United States, as NATO adds more countries. It is also tired of NATO training Ukrainian soldiers. Russia seems to have no plan to gain the entire territory of Ukraine; it is more of a temporary police action.

Russia’s underlying problem is that it can no longer produce commodities that the world wants as inexpensively as the world demands. Building all the infrastructure needed to extract and ship more fossil fuel resources would take more capital spending than Russia can afford. The selling price will never rise high enough to justify these investments, including the cost of the Nord Stream 2 pipeline. Russia has nothing to lose at this point. The current situation is not working; going back to it is no incentive for stopping the current conflict.

Russia is in some ways like a heavily armed, suicidal old man, who can no longer earn an adequate living. The economic system of Russia is no longer working as it should. Russia is incredibly well-armed. The situation reminds a person of the story of Samson, in his old age, taking down the temple of the Philistines and losing his own life at the same time. Russia has no reason to back down in response to sanctions.

[9] Leaders of the world, including Joe Biden, appear to be oblivious to the situation we are facing.

Leaders of the world have created ridiculous narratives that overlook the critical role commodities play. They seem to believe that it is possible to cut off purchases from Russia with, at most, temporary harm to the rest of the world economy.

The history of the world shows that the populations of many civilizations have outgrown their resource bases and have collapsed. Physics points out that this outcome is almost inevitable because of the way the Universe is constructed. Everything is constantly evolving, even economies. The climate is constantly evolving, as are the species inhabiting the Earth.

Elected leaders need a story of everlasting growth that they can tell their citizens. They cannot even consider the physics-based way the world economy operates, and the resulting expected pattern of overshoot and collapse. Modelers of what are intended to be long-lasting structures cannot accept this outcome either.

Limits which are defined based on affordability of end products are incredibly difficult to model, so creative narratives have been developed suggesting that humans can move away from fossil fuels if they so desire. No one stops to think that economies cannot continue to exist using a much lower quantity of energy, any more than an adult human can get along on 500 calories a day. Both are dissipative structures; the ongoing energy requirement is built in. Factories close when electricity, diesel and other energy products are cut off.

[10] The sanctions and the Russia-Ukraine conflict cannot end well.

The world economy is already on the edge of collapse because of the resource limits it is hitting. Intentionally stopping Russia’s output of resources like fertilizer and processed uranium is certain to make the situation worse, not better. Once Russia’s output is stopped, it is likely to be impossible to restart Russia’s production at the same level. Trained workers who lose their jobs will likely find jobs elsewhere, for one thing. The shortfall in output will affect countries around the world.

The United States dollar is now the world’s reserve currency. The sanctions being applied indirectly encourage counties to use other currencies to work around the sanctions. There seems to be a substantial chance that the US economy will lose its role as the center of international trade. If such a change takes place, the US will no longer be able to import far more than it exports, year after year.

A major issue is the huge amount of debt most countries of the world have. With a rapidly slowing world economy, repaying debt with interest will become impossible. Debt defaults will further wreak havoc with the world economic system.

We don’t know the exact timing of how this will play out, but the situation does not look good.

Dumb question — is this a reference to an earlier article? (can’t find it on the site)

Throw in EV vehicles for the west are a false primrose path, particularly when Russia and China control a plurality or majority of the elements needed in the powertrain and batteries.

Hybrids and conservation/demand destruction are the only path for transport, barring big near-term science breakthroughs on energy storage.

For moving people, mass transit, high speed rail, bike-friendly and walkable neighborhoods are the real answer, but the US doesn’t want to be a rich country, just a country of and for the rich.

I never understand this emphasis on high speed. Surely we should organise society so high speed isn’t necessary. Slow is more sustainable.

Here here! All of the wild critters sharing this planet would agree…70mph is already hard enough for them to deal with.

Much of suburban America is perfect for electric cargo bikes.

That R^^2 in Figure 3 is pretty persuasive: 0.9926.

Why do higher interest rates cause commodity prices to drop? I apologize if this is a stupid question, but I honestly don’t understand the nature of the linkage…

Great article though, I really enjoyed it. Especially the part about physics.

But a discussion of physics leads to another possibly dumb question:

While I understand that an adult human can’t get along on 500 calories a day, it doesn’t follow for me that economies cannot continue to exist using much lower quantities of energy. Can’t they reorganize? 100% of the electricity in Uruguay is supplied by renewable resources. Some people use gas for heating, but electrical options are available. Fossil fuels are also common for cooking, and of course transportation. But the fleet of buses has been moving to electric buses. Our economy here feels resilient. Even when it comes to fertilizer, our largest export of beef, is grass-fed. And hopefully, Latin America will benefit greatly from being able to maintain trade with China, india, and Russia. So, while I understand the articles point that there will be no winners, Uruguay feels once again to be a place removed.

Perhaps a clue to the answer for my first question lies in Yves’ introductory commentary as quoted above. But I must admit I am still not clear on the implied automatic connection asserted by the author.

I think the reason for the commodities price drop is that higher interest rates mean higher cost of living, which implies people have less money to spend. Less money to spend means that commodity prices must fall so as to still be affordable. Of course, producers will not continue to sell at a loss, so they will cut back on Capex investments & production will fall resulting in economic collapse.

…but that economic collapse is not shared equally across a nation. (And a hungry population can be an angry population—more collapse.)

Yes, and she carried that thought pretty far out. What is keeping the economy going is more debt at ever-lower interest rates. Otherwise growth would come to a halt; everything would shut down. So, of course I shorted-out remembering something about Central Banks looking at negative interest rates and that it was possible to push interest rates into the negative much more easily if we are using digital banking. Since it’s all 6s in the end? Super low interest or negative interest makes commodities affordable (or even “we’ll pay you to take them”) because it allows currencies to devalue; and all things being equal, lotsa devalued currency is sufficient to maintain production and capital investment… because everything is being simultaneously devalued? And it’s all symbolic anyway. So I guess the big question is, What happens when everything is worth nothing because money is worth nothing. Back to barter? And, oh yes, oil and gas are not renewable, so there’s that too. That pesky brick wall.

Back to sharing with neighbours, not barter.

Part of the push to central bank digital currencies can be understood in this way also, especially for “programmable” currencies, since they can implement negative interest and “force” consuming. How long that can last of course, is another question…

>If interest rates are raised, commodity prices, including prices for fossil fuels, will fall

Basically low interest rates are associated with higher GDP which is also associated with higher commodity demand and thus a higher price. Although, a case could be made that low interest rates increase investment which could increase commodity supply, so you are correct–the case is more spurious then most economists would have you believe

“100% of the electricity in Uruguay is supplied by renewable resources.”

Uraguay is a special case, as it has massive hydroelectric resources relative to the size of the population. 60% of electricity comes from hydro. And because the hydro resources are so large, grid operators can effectively use reservoirs as supply-leveling batteries for the wind and solar that provide most of the remaining 40%. Such a scheme works very well in Uruguay and other lightly-populated and hydro-heavy countries like Norway.

But unfortunately, most countries don’t have nearly this much hydro relative to the size of their population. The US produces less than 7% of its electricity with hydro, and reservoirs are not nearly large enough to act as “supply levelers” for a grid 93% powered by wind and solar. So the US would have to explicitly deploy energy storage facilities. Stupendously massive ones that would increase grid energy storage capability a thousand-fold. Which won’t happen anytime soon.

“Lightly populated countries….” You have hit the nail on the head there. The fundamental issue we face is that most countries are overpopulated, with clean energy supply capacity one of the many problems that result.

In the US it seems a lot of hydro power potential has been neutered by water extraction. Hoover Dam is very low.

“While I understand that an adult human can’t get along on 500 calories a day, it doesn’t follow for me that economies cannot continue to exist using much lower quantities of energy. Can’t they reorganize?”

not with current and projected population levels.

not enough Nature left…both for exploitation(from topsoil to water to hunting rats in the alley) as well as for the reverse process, e: “services” like “waste management”*, chemical weathering of numerous stuff back into constituent substances, etc.

even if something like cold fusion were suddenly discovered and shared with one and all, our continuing poisoning of the environment means it has less ability to absorb and recycle the crap we produce, from plastics to actual humanure.

population growth has tracked, 1:1 over time with energy use per capita…with a slight deviation since the 70’s with efficiency gains.((the Road to the Olduvai Gorge, while rightly wailed on for some things, wasn’t wrong about everything).

there’s only so much efficiency can accomplish…without THX-111 style totalitarianism.

(* consider services provided by insects. heard an hour long interview on NPR a month(?) ago with an author who wrote a book on just that topic…and it was frightening to contemplate the insects’ demise…we’d be covered up in shit and corpses. related, i’ve been thinning the coon herd of late…(somebody has to do it)…and i’ve placed those corpses where i can observe them up close without smelling them when i don’t want to….and so i can observe the buzzards doing their thing….and remember stories from India where a widely used pain med caused the mass death of vultures, and the problems that then ensued(not least because of Indian burial practices))

Uruguay suffered from the sort of governments we peacenik hippies have been glad we could escape either through educational deferments as long as they lasted, and then the variety of options such as their brain drain moves to Sweden and Canada. Bob Dylan was right time after time and said and sang: “Your don’t need a weatherman to know which way the wind blows.” It was during the Vietnam war that in the Universities where scientists get paid to find out things worthy of teaching to new students that so much evidence of climate change presented that curriculums were invented to teach it. What has been missing has been engineering that takes the essential science and applies it.

The majority continue to not be any more intelligent than others. There are the king rats. ‘

I heard the Astrophysicist Laura Mersini Houghton on the radio. I found out that my wife knew her. I arranged to have a meeting over coffee. She brought along her husband who advises governments and her daughter.

Here and there I am nobody. I do not have enough currency of fame to push humanity across the line and save it as we enter the bottleneck. I did publish another book, the paperback The Red Dot.

One important thing PHD. Mersini Houghton told me was for my problems to be solvable it was the science and engineering brought on with superconducting science to turn to.

So there you have it: Superconductors. It has only been this year for superconductors to been made to work at room temperature.

I am amused by the description “Russia is in some ways like a heavily armed, suicidal old man, who can no longer earn an adequate living.” The next point does deal with the delusional nature of the West, but I think Tverberg is working very hard to put Russia on the same psychological level as the United States. If there is any heavily armed, suicidal old man in any aspect of this it is America (and our leader is a perfect representative of this. Seriously, Russia was less worried about not being able to sell its resources at a reasonable price than being Native Americans on land wanted by Americans.

I am not addressing most of Tverberg’s points, because I am sure that she is right that a great deal of this, not all but a slot, is about control of Russia’s natural resource wealth. However I am going to correct that simile.

Russia is, in some ways like a wily and heavily armed old man, who recognizing the land barons advancing on his property, has not only fortified his position but has booby trapped their usual weapons of choice eroding their wealth and power. And stands there daily saying, you will collapse before I go.

Yes, her dire predictions for Russia’s ability to sell oil is contradicted in today’s link from Oil Price:

Russian Oil Is Too Cheap To Resist For China And India OilPrice (reslic)

https://oilprice.com/Energy/Oil-Prices/Russian-Oil-Is-Too-Cheap-To-Resist-For-China-And-India.html

And that’s the name of that tune! This person , Tverberg, appears to be under the illusion that the US and its vassal states are operating on solid ground.

But she is right about US wanting part of the Russia/Ukraine resource pie. Although yall are right re China is (and will be) able to afford it…though she is right re: who else?

Seems like the world is in for a “special period” like Cuba’s. Cuba remarkably focused on REAL LIFE…biology/physiology, not robots. Good choice. Nature seems to go through elaborate means to get products…photosynthesis. But that’s our problem. Our labor is not a challenge; it’s become dumb. What’s “hard” about it is only the sadism that trickles down from the top…down to management. The work is not involved or skilled. It’s only skilled in terms of how well one adjusts to a Kafkaesque world.

As long as China can afford it, things seem to be going like Alfred W. McCoy sees them going. I’m not down on China. The THING is bigger than them that they got into…”technique” according to Ellul, etc. The Chinese people are not to blame, not the gov either. They ran into Marx. They ran into Hudson. Too bad they didn’t also run into Ellul. Too bad we didn’t.

The answer (if there is one) would seem to be an upsetting thing. Old roles becoming useless. Exhausting democratic pow wows on what should be the new ones. But all we need is faith and trust to go (IMO) the way Vandana Shiva and Cuba have gone. Taking note and having respect for the way nature gets things done.

Well our industrial “civilization” is reaching its limits on many levels. The long descent (thanks, JM Greer) is well under way. And it will not be consistent, nor distributed evenly.

We live on a living planet in a living universe. And our industrial “civilization” is programmed to fail, based as it is on a false ideology of unlimited growth on a finite planet, and on the massive release of millions of years of sequestered sun energy to power our flying carpets. We may as well admit our “civilization” is a death cult, which has explanatory power of the corruption of our ruling elites. They are ghouls, death worshippers, who advance through deception. I mean, the basis of capitalism, unlimited growth, is itself a deception.

Those who build sustainable futures, such as the Mennonites or Russian old believers, may survive long-term. At least they have the best hope. The cities packed with drones and useless eaters will go the way of the prosperous cities of the bronze age collapse. Sacked, depopulated, and left in ruins.

IN any event, despite our depredations, the living planet will survive. Life is eternal and emergent, powered by sun energy. Our beloved creations, the fruits of our clever monkey minds, cars, rockets, cities, and so on, will not.

Well, mostly “eternal” — until the Sun swallows the Earth, eh?

IMHO, here are the two most important points made;

And;

Russia is not a heavily armed, suicidal old man, who can no longer earn an adequate living.

Russia is not like Samson, other than the fact that she is beset by Philistines.

Russia is actually much more like Clint Eastwood, telling the USA;

I prefer Biden as Grandpa Simpson: “Get off my lawn, you pesky kids! (I’m frightened and alone.)”

Eastwood’s best line is from Unforgiven: “Deserve’s got nothin’ to do with it.”

But Clint Eastwood IS a heavily armed, suicidal old man in the movie I think you refer to. Just because he gets badass oneliners does not change this fact.

And Russia, of course, is pretty much decrepit, demographics-wise. The low average male life expectancy does not change the fertility rate, which is pretty average for Europe. In other words, very low.

Most recently, the aftereffects from the widespread COVID infections could be a death blow if they actually include any direct or indirect long term fertility issues. Not only in Russia, of course.

So, Russia as the heavily armed old man that still looks menacing, talks with a growl and can still kick any one young punk’s ass if they come across their lawn… but has recently received a cancer diagnosis and is now suicidal. Yup, Clint Eastwood movie indeed.

All: this is the A+ writing and analysis you cannot find elsewhere. Spot on across the board. Enjoy and support NC, I’m now headed to my bunker….

Why not support Gail T., who actually wrote the article?

We all know that the monthly payment required to purchase a car or home is lower if the interest rate on the debt used to finance the purchase is lower. Thus, falling interest rates can make paychecks go further. Both businesses and citizens can afford to purchase more goods and services using credit, so the overall level of debt tends to rise with falling interest rates.

Grave doubts about this assertion. Lower interest rates means banks will lend more money, and if banks will lend more money, sellers will charge more money and you will get an asset bubble. Asset bubbles are why GDP is rising faster than energy consumption rates, because GDP includes increases in housing and equity prices. . . but it doesn’t mean “paychecks go further,” it means those that own assets in a cycle of a perpetual asset bubble become wealthier on paper, and the GDP grows on paper.

Michael Hudson (among others) often discusses “fake economy” (FIRE assets) versus “real economy” based on production, and it goes directly to the neoliberal sleight of hand which treats asset inflation (which requires manipulation of interest rates) as the same thing as an increase in the quantity of goods and services (which requires energy inputs). If someone were looking a theoretical way to quantitatively distinguish between the two, it would be based on incorporating actual energy consumption, because for the most part, you do not have actual “wealth of nations” without actual increase in energy consumption (with the caveat that technological efficiency gains provide a free lunch of sorts–sort of like mitochondria and the Krebs cycle in biology).

As discussed above, it does not follow that higher interest rates mean lower commodity prices, it means lower asset prices (in general). If you have a bunch of resource extraction firms who purchased assets in the height of a bubble, and they cannot produce petroleum at a profit and service their debt on overpriced assets, they go bankrupt (as some of the shale producers did in 2020/2021), and they either get a debt restructuring or they get sold off and a new firm produces energy without the same level of debt service. In the long term, energy prices will have to exceed extraction costs less interest, taxes and amortization or the producers will go bust.

This plays out in commodity-fueled inflation that wage earners cannot keep up with, leading to declining living standards. Declining living standards result in declining energy demand, which leads to declining production, which continues in a vicious circle unless extraction costs start to go down.

The final problem is that consumers do not go into debt because rates are low, consumers go into debt because they cannot afford purchases from either their existing income stream or savings. Declining income and depleted savings mean either debt expands or consumption collapses (like the 1990’s).

A few paragraphs later . . .

[family blogging] horse[family blog]

Yes, and you’ve only scratched the surface of it.

I was puzzled by this also. Could the reasoning be that for the Kremlin to raise the capital to extract these reserves the borrowing costs would be prohibitive?

However if USA-NATO puts their oil companies in charge of extracting the oil and gas, said companies could be eligible for low interest loans from the various governments, thus a subsidy?

Has there been any further explanation of this by Gail T? Thanks.

Yeah she does work hard to fit data into her scarcity thesis. One thing I always found lacking in the analysis of modern malthusians, particularly of the Ehrlich variety, is their lens that the world = West and the assumption that Western consumption patterns and levels are “the bar”.

There is definitely resource scarcity with regards to the consumptive power of Western “economies” that have used leverage and quantitative easing to bring forward decades of future growth as consumption. So a new geopolitical arrangement would destroy this consumptive power, inflation and the rate shock as a response from Western central banks would do a lot of this damage.

This doesn’t apply to resource producing nations like Russia or goods producing nations like China, that have also been more prudent with their use of leverage. Where it’s been used it has gone into physical capital investments and not consumption. This is contrary to the notion in the article above that resource producers haven’t been able to make new investments profitable. The Chinese spend trillions on BRI. The Russians and Iranians invest in cooperative co-owned energy projects. Even the shuttered NS2 pipeline could be seen as profitable if one understands what the Western reaction to its completion did to gas prices. Of course the picture changes if you analyze this in USD terms.

So the new de-globalized world will seem particularly constricted if you were a beneficiary of the present crumbling order: investment banker, IT sales, influencer, think of the “professions” that posit their resource consumption as productivity.

But it won’t be truly de-globalized. This won’t be a Bronze Age collapse (unless northern Virginia pushes us to WW3). Massive amounts of capital and trade will still move across that 85% of the world that isn’t the West, most of which has been getting the short straw since Vasco de Gama and Columbus sailed.

This new dynamic may even help “debtor nations” who owe in USD or Euro. After all those global currencies seem to be on the precipice of being inflated away.

I posted this link in the Rouble-Gas discussion and will share here. I see that it’s also a link in the Z site (they paywall other peoples work!!)

https://plus2.credit-suisse.com/shorturlpdf.html?v=51io-WTBd-V

It’s a good thesis for the mechanism that constrain the present situation but will perhaps govern the future global financial order.

Last thought, people outside the “West” will win. Military battles aside, which the Russians will specifically win, the dethronement of the Unipolar order and the ripping away of its Dollar dog collar are good for the world. Maybe not for me personally, but I’m just one guy.

There is definitely resource scarcity with regards to the consumptive power of Western “economies” that have used leverage and quantitative easing to bring forward decades of future growth as consumption. So a new geopolitical arrangement would destroy this consumptive power, inflation and the rate shock as a response from Western central banks would do a lot of this damage.

Thanks for putting into words the sense I had when looking at the high rate of US GDP…

The old saw “the bigger they are, the harder they fall” comes to mind

Yes, she was comparing fake US FIRE Asset GDP against the true producing GDP of Russia. You can’t really compare them.

BINGO!

Are US citizens prepared to live with less? The reality of conservation at the individual level is going to be rough for a society which has been encouraged to expand its consumption at every turn. Those of us who remember the Carter years will recall how unpopular the national 55 mph speed limit was. President Carter was also ridiculed for a national pr campaign calling on the masses to keep their auto tires inflated properly. These two policies, despite being simple ways consumers could meaningfully help the nation navigate the then ongoing energy crisis, were considered a joke by many.

Many US voters, and more importantly, political campaign donors are not willing to even consider the systematic changes to cushion our society from fossil fuel price shocks.

Easier measures like conservation and higher fuel efficiency standards are obstructed at every opportunity, and considered personal affronts. Necessary measures like true universal mass transit and land use changes are idealogical non-starters.

We can look to example for water in Western US, and see that same dynamic play out in a faster time scale.the exception being that the they can’t invade the Great Lakes or Mississippi watershed.

I have always lived with “less” as defined by Americans. Who needs extra stuff aka junk? The Keeping Up With The Joneses baloney always made me laugh as a kid cos it was so ridiculous. Simplicity and Basic Common Sense have always been my guiding lights. And, I’m not the only American who feels this way.

you have to remember, when the dim wit carter was preaching belt tightening and conservation, he was unleashing haters of labor onto the american public by the likes of alfred the great Kahn, and paul volker who spewed hatreds of the deplorable right out in the open.

its pretty hard to get people on your side, when your economic policies are pure economic nonsense based on hatreds and bigotry.

And the sweater. He was hated for the sweater.

Quite a bit of extensive material here though I would suggest that it is the US and not Russia that is going around grabbing as many resources as they can through either Wall Street and if that does not work, the Pentagon, hence that network of 800 bases around the world. And that airlines diversion map that she has is only for sanctioned airlines – not those that have not signed up for this insanity. I am beginning to think that a real problem for the world is the lack of negative feedback and that perhaps it was the wealth of oil production the past century or more that stopped this from happening. So it hid the fact that we are well past the planet’s carrying capacity for example. But now through resource deletion, we are starting to experience actual negative feedback which can take the form of wars, climate change, water depletion, etc. If so, it is going to be a rough century.

“Wars, climate change and water depletion”, and you can add ever increasing species extinctions, diseases, famines and pollution. Today on my 69th birthday this leaves me pondering that my dying regret will be the s…hole of a planet I will be leaving for my daughters and two grandsons.

I have to say this struck me as a series of jottings rather than a finished article. Some of it is reasonable enough, but there are bits where I literally have no idea what she means: why is war like a game of musical chairs, for example?

Then there’s this.

“Some powers behind the throne seem to believe that Western forces supporting Ukraine can quickly win in this conflict. If such an early win occurs, the aim is for Western forces to step in and inexpensively ramp up Russian resource extraction, allowing the world a new source of cheap-to-produce fossil fuels and other minerals”

Which powers? Which throne? What evidence does she have that people actually think these things? Which western forces are supporting Ukraine now? Nobody else has noticed them. Well, maybe she means “political forces.” OK, so Ukraine “winning the war” seems to mean Ukrainian forces defeating the Russians and then pursuing them back to Moscow, with NATO forces at their side, and then, having cunningly avoided a nuclear war, taking over the country and ruling it directly, then looting all the resources. Even in Washington, I don’t think anyone is quite as deluded as this.

Nul points.

RobertC March 31, 2022 at 7:08 pm shows France, Germany and the US who stepped in and inexpensively ramped up investment in Ukraine’s human, mineral and agricultural resources following Victoria Nuland’s 2014 Euromaidan revolution.

Brunches with Cats April 1, 2022 at 2:23 am shows the US government was in a leadership position for this effort.

There is no demonstrable reason this would not occur for Russia.

And the US is furious China is now investing better, faster and cheaper into Russia while locking itself out of any future investments.

We are in Mackinder’s The Geographical Pivot of History territory.

“I have to say this struck me as a series of jottings rather than a finished article.”

I expected it to end with: “So let ‘er rip…”

The Nulands, Blinken, Bolton, Pompeo, Power et al. You would be surprised how delusional a lot of people in positions of power are in Washington. Who could imagine a year ago that the washington Russophobes would be so desperate they would try to ‘cancel’ Russia? The West NEEDS Russian resources, Russia doesn’t need western trinkets (Chanel, mercedes, Louboutin etc) like most of the rest of the World they enjoy western bling but they do not see it as essential, it is not culturally intrinsic to their worth. America thinks everyone is like them or wants to be like them, around 6 billion people aren’t that bothered and most of those people are doing trade with Russia, China or both, that will only increase.

On multiple levels this is a massive wake up call for the US and its European vassals, cognitive dissonance is ending in a high speed impact with reality.

There’s delusional and then there’s delusional. What’s being asserted here is that there are some people in Washington who believe that the West and Ukraine are going to conquer and occupy Russia, and then let the West freely exploit Russian resources. I haven’t seen any evidence of that, and I rather think that the author simply made it up. But the article is so badly written, I agree, that it’s hard to know what the author is trying to say.

Upto now, the US has gotten away with grabbing and/or controlling resources of other countries via invasion, cajoling, threatening and bribing. Previously, they stole a bunch Russian resources under Yelsin’s regime. I believe that the author is alluding to the fact that the US and its co-consipirators are hoping to somehow get rid of Putin so that they can start looting again. As we have seen before they don’t have to conquer and occupy Russia to do that

the sooner we expose the mental midgets like carter, nafta billy clinton etc. that put the creatures you listed into positions of power, the sooner we will no longer get the most progressive president since FDR, nafta joe biden who has been in the thick of this since the 1970’s.

for the youth to be scammed by nafta joe biden proves my point.

Since Judges 15:20 notes that Samson judged for 20 years, there is no reason to think of him as “Samson in his Old Age” at his death in Judges chapter 16. Hair grows back in just months.

Are corporations who manufacture and sell weapons “no one”? Last I heard, the Ukraine conflict was a boon to them–as it is and was to the Pentagon, seeking (as always) to have its life on public welfare padded further. It’s dangerous to throw around “no one wins” when there are actors who are quite pleased at the conflict, and who never cease seeking more. p.s. Bob Dylan (the young one, before money became everything to him) wrote a song about this. Perhaps you know it?

“Human beings are also dissipative structures. The energy that humans get comes from the dissipation of the energy found in foods of every kind. Food energy is commonly measured in Calories…”

With recycling features….just like the Earth.

IMHO, this is article by Gail Tverberg is more on the level of an opinion piece, so I feel entitled to offer mine.

Love all the home-made graphs, but they all reference the USD, and assume that the Hegemon will continue to maintain the status of the USD as the parasitic ‘reserve currency’. In the near future, it seems likely there will be alternatives. Especially if they are backed by actual resources rather than force or faith, then all her graphs become meaningless. The U.S. GDP figures are already revealed as mostly froth, the product of a bankrupt nation with an unpayable debt that no–one in their right mind would want to hold.

The U.S. was the first to mine oil and gas in a big way, and exploited that to build a huge economy. But it has mostly wasted this gift, this patrimony, and now depends on looting of others. On the other hand, Russia is pretty much self–sufficient, has a very advanced economy, has a very well educated workforce, has huge reserves of energy, and the most efficient military in the world, spending but a fraction of the U.S. and equal or surpassing it in every important way. This is real power, unlike the froth of the present U.S. economy with a hollowed out industrial base and a bloated military, led by incompetent and corrupt politicians who have swallowed their own propaganda and have come to believe the lies they tell.

The U.S. empire and the British empire before it (and more or less successful European competitors also) grew to prominence mostly by piracy and looting, imposing their world view and economic and religious regimes on the rest of the world by force. That system is collapsing before our eyes.

Gail Tverberg has a lot of catching up to do, IMHO.

Well said. I had a hard time reading the article.

all well said,

because i have been predicting this since 1993. i was well aware of what a scam free trade was in my early teens reading about it in my school library back in the mid 1960’s.

first off tariffs are terribly misunderstood, and have been demonized by both the right and the left.

lincoln understood what a tariff is, its a tax on the rich, period. if you are rich enough to buy a foreign made product that is easily made here, guess what, if you are that rich, you get to pay a tax, just like the producers do here in the u.s.a.

the importers are the rich, not the end users.

so trumps tariffs on chinese imports were not aimed at the chinese, they were aimed at trying to get back some our our production. regardless of what trump said they were, its a fact, tariffs are sovereignty, drop tariffs, now your country is open, you have very little sovereignty to chart your own economic destiny, you get asset stripped and forced into specialty.

in the end, you are now serfs of the world oligarchy.

i remember in the 1990’s when dupont warned nafta billy clinton we will lose our supply chains, the treasonous dim wit did it anyways.

so trump was not after china, trump was after the supply chains.

now GDP and the size of your economy, that is a absurd way to measure the power of your country.

first off americas GDP is bloated by way way to high of profits. its bloated by the billionaires and millionaires that reap just about all GDP.

its bloated because its built off of the treasure and blood of america, and the worlds treasure and blood.

so what we are watching today in europe, is nothing less than the making of history that will be poured over for decades, perhaps centuries to come if we survive it.

a country with about 1/3rd the population of america, and a tiny sized economy is taking a so-called economic super power to the mat.

americans never understood the soviet system, as the the average american. they were so confused and befuddled of it.

but the weapons that russias tiny economy has produced, were either on the soviets drawing boards, or going into production then, or built upon what they produced, and they are still producing somewhat under the soviet system which was mostly profitless.

russia still owns a majority of the economy today i understand.

you can bet china is watching this carefully. there is no way china could be doing what russia is today. their GDP is bloated also by billionaires.

and the proof is a severe lack of internal demand, it goes to the rich there also. that is what the belt and road is all about, they are exporting their unemployment, deflation and poverty onto others.

so they are in no position to do what russia is doing, all they can do is support it, because they understand they are next.

Deng may have understood what lenin said about a nafta billy type, but he also misunderstood what he was stepping into.

no way could china survive what empty suit hollowman obama, and nafta hillary clinton were about to do to china, when they were rudely interrupted by trump.

Reply ↓

It seems to me that GDP is not a good measue of our economy. To compare GDP of two nations is a fallacy because I’m not sure the two countries measure it the same way.

correct. russias is based on production, ours is based on plunder, exploitation and pillage.

Gail’s “…the economy is an energy-dissipative structure.” Yes. Entropy rules everything including the forces of overpopulation which seem relentless. And now it is almost 70 years after Hyman Rickover (her link) told us that oil was not a renewable resource. His 1957 speech set the standard vocabulary for our energy depletion problem. He didn’t address global warming, even though there was talk as far back as the 50s on how using fossil fuels could keep a new glaciation at bay for hundreds of years, unless, of course, it is all used up. Rickover kept in his lane on the subject of depletion of oil reserves. He referred to best choices for renewables; all the same stuff. Interestingly he did not mention geothermal which now looks to be the most promising. Gail is maintaining that the economy will collapse. Rickover said we’d run out of oil between 2030 and 2050. Is it coincidence that global warming experts estimate the point of no return on CO2 levels to be around 2050? So let’s go one step back to Gail’s economy as an energy dissipative structure. There’s dissipation – like just irresponsibly burning off the methane rather than capturing it and using it. Or there’s a descending scale of the use (dissipation) of energy, like using an ox, feeding it grass, using its muscle power to pull a plow, using its poop to fertilize the field, showing appreciation by giving it a nice wam stall with fresh straw and water. Back to pre-industrial methods is actually an option. Simply slowing down is another. When we can see that our precious economy is simply a race to exhaustion we should believe our eyes. The one thing Rickover seemed most concerned about in 1957 was that the military needed large amounts of fossil fuel. And he believed in strict conservation to make it last. Since we’ve blown strict conservation by our neoliberal methods it now looks like the military might run out of fuel. And among the most painful contradictions of our capitalist system is that the military was the enforcer of neoliberalism economics. Gail’s right. Depletion of oil is the cause of the war in Ukraine. It’s Greek tragedy all over again.

The other unexamined proposition is that to grow GDP, we must grow energy consumption. That .99 R squared is no lie. Growth in GDP requires growth in energy consumption.

But every use of energy (transformation) produces waste heat. And exponential growth grows, er, exponentially. With reasonable assumptions of future transformation efficiencies, and 2% energy growth per annum, in about 400 years, the waste heat turns the earth boiling hot.

“The upshot is that at a 2.3% growth rate (conveniently chosen to represent a 10× increase every century), we would reach boiling temperature in about 400 years. [Pained expression from economist.]”

The entire article is a fun read

https://dothemath.ucsd.edu/2012/04/economist-meets-physicist/

Love that article, I had it tagged a while ago as well!

I’ve also wanted to point to Tom Murphy’s blog to NC crowd.

IMHO has clearly given tools to do it yourself basic science via a text book on energy/resource depletion.

free book starting from basics

Hope NC crowd finds it useful

Very good read. The keeper, at the end, was: (after the delusion of growth is accepted and we create a steady state economy) it will be “an unrecognized economy” of quality improvements for civilization which will not require our current push for “economic growth.” Except that I think it will readily be recognized for the value it creates. Not to mention the relief it brings.

Nice comment, one of many.

This has long been my thought. We can either slow down now of our own volition, or stop dead (literally) in our tracks sometime shortly thereafter.

Geothermal causes the emission of large amounts of hydrogen sulphide (rotten egg gas), which is not only poisonous, but is a potent greenhouse gas. It’s not a solution to climate change.

I know someone who works in geothermal.

What comes to mind for me is our wastefulness of these finite resources. We make things that break; that aren’t easily and cheaply repaired. Companies want to own the downstream expensive parts supply or prefer replacing the entire thing for another sale. We have optimized in company profit and not resource utilization. Why couldn’t a washing machine last 200 years?

“MSM fails to tell us that there is no evidence that a transition to a low carbon economy can actually be made”

Does it need evidence? If the resources needed for a high carbon economy all get depleted, then a low carbon economy is what you get.

When my grandfather was born they released 1/40th of CO2 we do. If that counts as “low carbon economy” then I’m only a generation away from it, and he didn’t make it sound too bad.

My quicklook:

* No One Will Win in the Russia-Ukraine Conflict — concur. There will only be survivors and losers.

* [1] In a world with inadequate resources relative to population, conflicts are likely to become increasingly common — concur. China is preparing for them: its people and associated social contract; its borders; its resource access (eg, BRI); and its military, especially the three prong fleet: hundreds of thousands of fishing ships; the world’s largest coast guard; and the world’s second largest navy. Russia is a core part of this preparation. Hopefully India will join.

* [2] There is a huge resource depletion issue that authorities in many countries have known about for a very long time. The issue is so frightening that authorities have chosen not to explain it to the general population — concur with China as an exception. Examples include addition of food security to national security strategy last November; the Clean Your Plate initiative for children; Xi’s Common Prosperity initiative for everyone, etc.

* [3] The big depletion issue is affordability of end products made with high priced resources. The cost of extraction rises, but the ability of the world’s citizens to pay for end products made using these high-cost resources doesn’t rise. Commodity prices do not rise enough to cover the rising cost of extraction. When this affordability limit is hit, it is the resource extracting countries, such as Russia, that find themselves in a terrible situation with respect to the financial well-being of their populations — concur except for the such as Russia example. Russia’s entering a partnership “closer than an alliance” with China ensures the financial and food security well-being of its population.

* [4] World economic growth very much depends on growing energy consumption — concur except for China who is aggressively pursuing energy efficiency. For example, “smart” cities; banning energy-wasting crypto currencies, etc.

* [5] World economic growth also seems to depend on factors besides energy consumption — concur. Put this in the category of “Working Smarter.” But it looks to be fragile.

* [6] The world economy now seems to be reaching limits with respect to many of the variables allowing world economic growth to continue as it has in the past, as discussed in Sections [4] and [5], above — too complicated for me.

* [7] We are likely facing a collapsing world economy because of the limits being reached. Adding sanctions against Russia will further push the world economy in the direction of collapse — it doesn’t have to be this way and won’t for the Russia-China-India(?) led part of the world.

* [8] There is little reason to believe that Russia will “give up” in response to sanctions imposed by the United States and other countries — concur. Russia has moved past sanctioning.

* [9] Leaders of the world, including Joe Biden, appear to be oblivious to the situation we are facing — this is motive-complicated but the evidence points to inappropriate and ineffective responses.

* [10] The sanctions and the Russia-Ukraine conflict cannot end well — see my first bullet.

Gail — thank you for your perspective and analysis. I learned much and hope I provided some value in return.

This article is largely a continuation of Tverberg’s highly provocative post from 2 March:

https://ourfiniteworld.com/2022/03/02/russias-attack-on-ukraine-represents-a-demand-for-a-new-world-order/

Though I always enjoy her thought-provoking analyses, I think she’s going a bridge too far with these ideas. RU’s invasion of UKR has little to do with long-term commodity pricing and everything to do with national security (as seen from the viewpoint of the people who govern RU).

Her charts showing per capita GDP and energy usage are badly misleading, because she treats pre-1990 data the same as post-1990 data. They’re not the same thing, at least for the large chunk of humanity which abandoned central planning for the free market. Soviet factories (and factories in Eastern Europe and China) were wildly inefficient pre-1990. Nobody cared two licks about saving energy. Perfectly good raw inputs (which might have been sold to the capitalist west for hard currency) were transformed into worthless consumer goods (anyone for a Trabant?) that no sane consumer would freely choose to buy. What was measured as GDP in the USSR of 1989 was a completely distorted and inflated figure. At least today’s ex-communist countries produce things that are actually competitive and sellable on the global market. And all their governments (even energy-rich Russia) have been trying to encourage careful energy usage by introducing market pricing.

She makes many good points, but I remain unconvinced by her overall thesis.

per capita charts give vastly different results as medians compared with means. means reflect the super rich mostly.

mean incomes have been growing nicely in recent decades. but it’s an illusion.

I thought we were going to get a revelation that Covid vaccines caused zombi-ism long-term, or that the presence of an alien invasion force had been detected on the far side of the moon, or that – well, choose your favourite conspiracy theory.

I didn’t read anything in the article that isn’t widely ‘out there’ for those with the wit and time to put 2×2 together, and a great many people have. Perhaps Ms. Tverberg sees herself as Liberty Leading the People picturesquely bare-breasted and waving the flag of revolution against a cunning plot to destroy the world for pleasure and profit, but telling us what we already know with varying degrees of intellectual clarity is just the doctor giving you the latin for what’s going to kill you.

It would be more useful, Ms. Tverberg, to know the cure. “The authorities” have had meeting after meeting to deal with the very open ‘secret’ that if we don’t stop/reduce global warming by x% by 20?? the result will be disaster. Everyone knows we need to stop guzzling gas, the oceans are full of junk and ever fewer fish, everyone knows we’re paving over Paradise and turning it into a parking lot, but are ‘we’ demanding “the Authorities” really do what’s necessary to save our children’s future – including a restriction on the number of children we can actually have? Would a party standing for election anywhere on ‘the Truth’ with a manifesto of the kind of Draconian program we’d need to implement to avoid Ms. Tverberg’s future and a promise of enforcing it with guns against those who for whatever reason take a counter view, have a hope of being elected. Should they even have a hope?

Let’s not blame the authorities for failing us. The blame lies with those who elected and supported those authorities even since the ‘secret’ Ms. Tverberg claims they are now hiding from us to avoid frightening us became public knowledge sixty years ago with the publication of ‘Silent Spring’, and has since then become ever larger, brighter and more public.

Whatever Tverberg knows about real resources (which appears to be substantial) she clearly doesn’t understand fiat monetary operations. The natural rate of interest for a fiat currency is zero — anything above that has to be “defended” either by open market operations (the old fashioned way) or by paying interest on reserves (the current arrangement).

Likewise, monetary sovereigns are not currency constrained — there is no amount of interest upon the bonds (debt) they have issued in their own currency which they cannot pay.

In the late 1960′ and thru the ’70’s we were inundated with death-spiral analysis via Lyndon LaRouche and his NCLC. Of course, if we continued to circulate death-spiral futures eventually somebody will be right, or sort of right. LaRouche also offered fever-dream programs to deal with the weeks’ downhill slaloms. If such analyses aren’t accompanied by smart tactical analysis for what working people can do, then what use are they? If we are all headed into the Eves of Destruction, just say so. Spare us of the unwashed any more eye-damning graphs. I along with my comrades can probably find one of the paths to hell regardless.

I do find it interesting that global warming / climate change is mentioned mainly as a parts problem. It’s also a “problem” that a lot of us expect to halt our history much sooner than our extraction problem.

we took the decision to turn the planet into cash, no amount of word-painting will disguise that reality

we then used the planet as collateral for our children’s future

https://extranewsfeed.com/the-life-i-stole-from-you-f609f8db6353

simply said. this lands hard as truth. does ang if the evidence presented not support this?

Norm, this doesn’t make any sense, because “cash” isn’t something people want for no reason whatsoever. I’m sure your children and grandchildren use cash to buy housing and food, and are glad thereof. While there are fictional aspects to it, still it’s not like cash exists in some separate universe entirely. There just happen to be eight billion “children” from 3 billion parents and grandparents as of 1960s-ish, as you well know.

Who are “our children” who are eating their way through what you call the “collateral?? Aren’t they your children, too?

“Ukraine has been a military partner of the U.S. dating back to the mid 1990s”

– https://www.army.mil/article/141396/us_army_europe_commander_visiting_ukraine

My one criticism of Gail’s work, particularly in connection with the transition to renewable energy sources, is that it seems to be based on numbers that assume continued business-as-usual (CBAU). Of course, the whole thrust of that work is that CBAU isn’t going to happen. But I don’t think that means we are all going to have to wear hair shirts, at least if those who believe in the right to life will buy into the proposition that means the right to a quality life. The real elephant in the room is WASTE. The most obvious and absurd example is trillion dollar ‘defense’ budgets to produce weapons that can’t be used without ending all higher forms of life on earth – and that in the face of a pandemic that has killed over 1 million citizens in the last couple of years.

But perhaps an even bigger problem is attempts to preserve economic rents tied to the continued use of fossil fuels. This goes well beyond the automobile industry and includes especially privately-owned utilities. In the run-up to WWII, FDR didn’t buy the utilities’ argument that no more dams should be built because their power could not be sold at a profit. Today concerning renewable energy, we have the analogous situation that not enough storage is available because it can’t be built and operated at a profit. There are all kinds of gravity-based storage technologies but it looks like they are not being explored because people like Elon Musk can not package them and sell them to utilities which in turn can use their cost to add to utility commission-sanctioned profits from rate-payers.

Then there is the case of bidirectional charging, Tesla and Elon Musk. Bi-directional charging would allow electric utility customers to power their homes in increasing frequent grid failures and if they have solar store the excess power generated during prime time for use after the sun goes down. But Tesla/Musk, who has sold 250,000+ battery backup PowerWalls and hopes to break into the grid-scale storage market, argues his customers would want to go for a drive during extended power outages and not want their EVs tied up powering their homes.

Readers are invited to extend this list ad nauseam.

Nice well written article. Thanks Yves for posting it and Gail for writing it.

i could not finish the article because it misses the real reason for hyper resource depletion. she may have covered it latter on, but most of her types do not.

ya wanna see resource depletion and how it got supercharged? look no further than Chesapeake bay.

https://www.seatrade-maritime.com/casualty/general-average-declared-ever-forward-second-refloat-attempt-fails

can you imagine all of the fossil fuel being burned to free that monstrosity from the mud. it should be left there to rot.

i remember when nafta billy clinton was tooting his horn saying we must prepare our ports for the new ships that will come on line because of free trade. well they are here.

the amount of fossil fuel that has been burned shipping and flying stuff back and forth all over the world, just so a few parasites can make a penny or two more per unit is the real resource depletion/environmental destruction story.

high prices were surely the results of those disastrous free trade policies, but that is still not the whole story.

when nafta billy clinton deregulated commodities, i watched a wall street parasite walk out on the steps of a building on wall street, and say at the top of his lungs, the era of scarcity is here.

since then i have watched commodity prices boom. parasites feeding off of starving people.

russia has said loud and clear that’s what theirs is theirs, and under free trade whats mine is mine, whats yours is mine. they will have none of that.

Russia, China, and India will be the big winners.

You’re analysis is based on the Western concept of the world which means it’s comprised essentially of the EU, US, AU, NZ or what is commonly called the Anglo Sphere or Global North, a handful of the 193 UN member countries. It represents 10% of the worlds population. The Global South represents the other 90%, with Eurasia, Asia representing 70%.

Russia’s survival is postured on its pivot to the East. RU, China have 1 gas pipeline operating and building 2 more. They’re also working cooperatively in Artic exploration. Commodities, Ag, rare earth, minerals, aluminum, and all others are, and will be diverted to Eurasia, Asia, Middle East, and African buyers. It’s already happening.

It’s likely Russia will come out holding East Ukraine and some of Central Ukraine producing wheat, barley, uranium, iron ore, coal, etc. Eventually these resources will be diverted East and into Africa where much of the grains were exported. Russia will likely close Ukraine from its ports on the Black Sea controlling all sea trade coming in and out of UKR.

RU has no need to export ANY of its resources to the EU, 100% will be consumed by the Global South. EVERY Western product, service, everything can and is being replaced by Eurasia, Asia, India and Chinese products, etc. Manufactures just change the label on the same product and export to RU.

One example. The Western Pharmaceutical Industry left Russia. India’s Pharmaceutical Industry (largest) and China’s Pharma (major chemical supplier) are quickly moving in. These $ billions losses will never be recovered by Western Parma.

The US SWIFT sanctions on RU Sovereign bank broke the worlds financial system based on the US petrodollar as it’s reserve. Middle East oil producers are siding with RU and the East, China. Saudi’s are supplementing the US petrodollar with the Chinese petroYuan. Local trade is being conducted country to country in their own currencies. BRICS countries (Eurasia, Asia) are creating their own currency similar to the Euro. China’s CIPIS (like SWIFT) is growing rapidly contributing to the decline of the USD over the next 3 to 5 years.