Yves here. The hawkish Fed relentlessly pushing up interest rates was bound to hit housing at some point. The open question is how large the price corrections will be and which markets and sectors are hit hardest.

What the present state of play also suggests is that housing prices got so far ahead of themselves in key markets that prospective buyers have not yet worked themselves into viewing housing as an inflation hedge.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

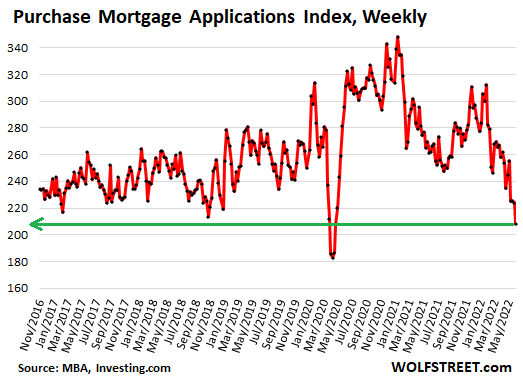

This just keeps getting worse: Applications for mortgages to purchase a home dropped 7% for the week, and were down 21% from a year ago, the Mortgage Bankers Association reported today. An indicator of future home sales: Potential homebuyers try to get pre-approved for a mortgage, lock in a mortgage rate, and then start house-hunting.

Mortgage rates have soared this year, and home prices have soared for years to ridiculous levels, causing layers and layers of potential buyers to abandon the market, amid “worsening affordability challenges,” as the MBA called it. And these applications to purchase a home hit the lowest point since the depth of the lockdown in April 2020 (data via Investing.com):

The MBA’s Purchase Mortgage Applications Index has now dropped below the lows of late 2018. By November 2018, the Fed had been hiking rates for years (slowly), and its QT was in full swing, and mortgage rates had edged above 5%, which was enough to begin shaking up the housing market. Home sales volume slowed, prices began to come down in some markets, and stocks were selling off. But with inflation below the Fed’s target, and with Trump, who’d taken ownership of the Dow, constantly throwing darts at Powell, the Fed signaled in December 2018 that it would cave, and instantly mortgage rates began to fall, and volume and prices took off again.

Today, raging inflation is the #1 economic issue, and the Fed is chasing after it, with backing from the White House, and so this issue in the housing market is just going to have to play out.

Holy-Moly Mortgage Rates.

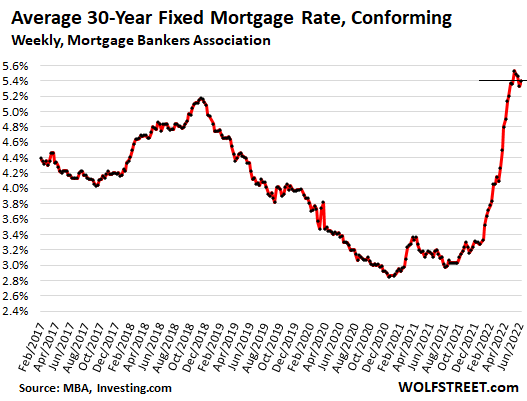

The average 30-year fixed mortgage rate with conforming balances and 20% down rose to 5.40% this week, according to the MBA today, having been in this 5.4% range, plus or minus a little, since the end of April, the highest since 2009.

I call them holy-moly mortgage rates because that’s the reaction you get when you apply this rate to figure a mortgage payment for a home at current prices and then accidentally look at the resulting mortgage payment (data via Investing.com):

“Bad Time to Buy a Home”

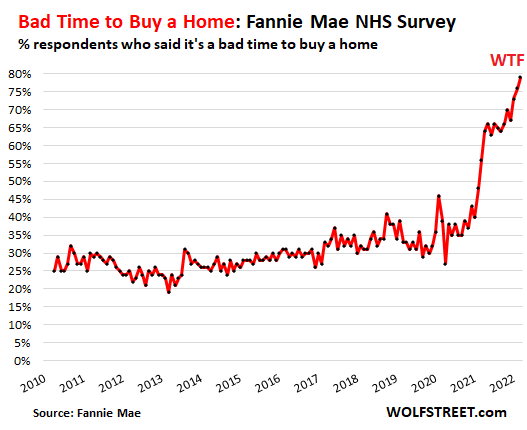

Turns out, sky-high home prices to be financed with holy-moly mortgage rates, plus uncertainty about the economy, dropping stock prices, and inflation eating everyone’s lunch make a toxic mix for homebuyers.

The percentage of people who said that now is a “bad time to buy” a home jumped to 79%, another record-worst in the data going back to 2010, according to Fannie Mae’s National Housing Survey for May. Sentiment has been deteriorating since February 2021:

“Consumers’ expectations that their personal financial situations will worsen over the next year reached an all-time high in the May survey, and they expressed greater concern about job security,” according to Fannie Mae’s report.

“These results suggest to us that increased mortgage rates, high home prices, and inflation will likely continue to squeeze would-be homebuyers – as well as those potential sellers with lower, locked-in mortgage rates – out of the market, supporting our forecast that home sales will slow meaningfully through the rest of this year and into next,” said Fannie Mae.

Sagging Stock Prices Keep Getting Blamed

The stock market is on the front pages every day. Only a small percentage of Americans own any significant amount of equities, but that doesn’t matter. Stock market declines, with many high-flying stocks plunging 70% or 80% or even 90% since February 2021, have rattled a lot of nerves. Which is in part why Fannie Mae pointed out, “consumers’ expectations that their personal financial situations will worsen over the next year reached an all-time high.”

The MBA also had previously pointed at the financial markets as one of the reasons for the plunge in purchase mortgage applications.

In the tech and social media sector, the big declines in stock prices have now triggered the first hiring freezes and a few layoffs. And this too – just the idea of nirvana being somehow over – is shaking up some folks.

Sharp increases in stock portfolios, stock options from employers, or cryptos empowered potential homebuyers and enabled many to borrow against their portfolios to come up with down payments. This option has either vanished or is looking very shaky for many.

Refi Applications Collapsed to Lowest Since Year 2000.

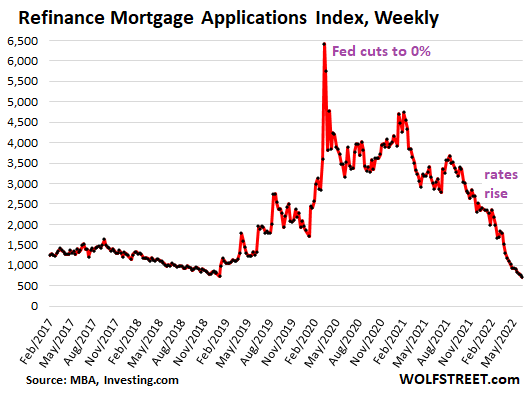

Applications for mortgages to refinance an existing mortgage dropped another 6% for the week, and have collapsed by 75% from a year ago, to the lowest level since the year 2000, according to the MBA’s Refinance Mortgage Applications Index. The MBA obtains this data from a weekly survey of mortgage bankers.

With these holy-moly mortgage rates, just about the only reason to refinance is to extract cash from the home via a cash-out refi (data via Investing.com):

Cash-Out Refi Mortgage Applications.

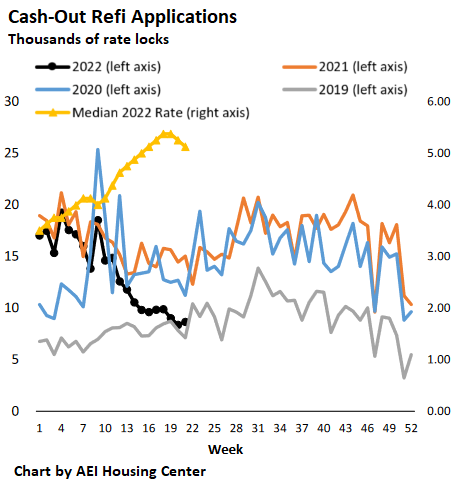

According to the AEI Housing Center, which tracks mortgage applications by the number of rate locks, no-cash-out refi applications have collapsed by 92% from a year ago. But cash-out refi applications are primarily driven by the desire to extract cash from a home, with mortgage rates being a secondary issue – and so they continue but a slower pace.

Cash out refi applications in week through May 30 (black line) plunged by 42% from the same week in 2021 and have stabilized roughly level with 2019:

A cash-out refi provides a big lump sum for the homeowner to spend on all kinds of things, from cars to home improvement projects. They are also used to pay off high-cost debts, such as credit cards so that these credit cards can then be used for more purchases. The plunge in cash-out refi reduces the availability of these lump-sums, and therefore reduces the stimulus to the economy they provide.

No-cash-out refi mortgages at lower mortgage rates also boost consumer spending, as the lower rates reduce payments that then leave some extra every month to spend on other stuff. But the spike in mortgage rates, and the subsequent 92% collapse of no-cash-out refi mortgage applications ends this program.

my brother moved last year. he recalculated the numbers and his monthly mortgage would be $1,000 more if he moved into the same house right now.

IMO, we’re soon going to see 2008 housing shock + $3 loaves of generic white bread + a Bank of Japan crisis + another Euro bank crisis + $1/therm natural gas + national $5-something gasoline + no growth….all at the same time.

Worst timeline ever!

If you are paying for housing at current prices, that is, signed a recent lease or are buying now, all the other inflation seems so minor. So what if I pay another $200 a month for gas if I am paying $2000/month to live in a slum whose construction costs were paid off decades ago? Most people can drive less but they can’t find a cheaper place to live.

The focus on gas costs just reminds me of the media bias toward affluent/older people who are extremely housing secure.

Gas costs are also a much bigger deal for the non “affluent/housing secure”. (even if they drive less) Should the media dedicate more time to housing/rental increases?.. Probably, but its not as easy to compare/report on as the commodified, apples to apples comparison of gasoline prices

Let me run the math: if I spend $2000/month on housing and $200/month on gasoline…housing is, in fact, a bigger deal than gasoline, by a wide margin.

Meanwhile, if you bought a house in 1983 and your mortgage has been paid off, housing costs do not affect you.

I am in the process of moving to Fargo, ND. Cheapest rental prices I could find. Can’t wait. I am a climate and economic refugee.

I hope you checked the heating costs and the predictions for heating costs this coming winter at your prospective property. You could end up paying more to heat your place than for rent.

Is anyone else getting downright terrified at how bad this potential recession may be?

The Fed is not going to be able to ride to the rescue, like they did so many times before.

The only positive catalyst I can see would be a resolution to the Ukrainian conflict, and that seems months away. At best. Our so-called leaders sold-out to the MIC here in the West, and they are going to just push it as far as they can.

All they are saying … is give war a chance!

They will slash interest rates at any sign of major recession.. and then stimulate the asset inflation again. It’s really the only tool they will use because Congress won’t do much.

Exactly. And then the most connected will get first dibs on the cheap money to purchase distressed businesses & cheap assets.

And the rest of us will get hit with negative interest rates on our deposit accounts?

no, just 0% interest while inflation is at 5% (which will be the new definition of price stability)

Op-ed pages wil fawn that Yellen didn’t do negative rates

Well, as you probably know, a ZIRP and 5% inflation is a negative real interest rate.

And for those of you who still keep an interest bearing bank account, go to TreasuryDirect (online) and get a return 4x’s what your bank offers. If you have a stash of cash, you can use Series I Bond to hedge inflation, or play a shorter inflation hedge with Treasury Inflation Protected Securities (TIPS). {No middleman needed.}

Yes, I’m terrified about what could happen in a few months domestically given the crazy economy we’re seeing.

As for the war in Ukraine… I don’t know. I feel like the domestic costs to the EU will decide a lot of things. Given when they start to experience colder weather and when fuel contracts have to be locked in, or at least fuel purchased for cold weather that can certainly begin in October, it wouldn’t surprise me if we see the fuel crisis for places like Germany and Poland drive the Ukraine crisis to a resolution. If Putin were smart, he’d keep up the ruble only system he’s got AND he’d triple costs for NG and heating oil as long as NATO is supporting Ukraine with materiel. The people suggesting that they have any leverage in this situation are ridiculous. Much like our PE landlords who demand rents that can’t be afforded. This is all a situation that can’t last much longer.

You aren’t wrong. The Fed is mostly out of options, and our elected leaders are incapable of addressing any issues, fiscal, monetary, or otherwise. People talk about other options besides the Fed raising rates to address inflation, and while they aren’t wrong the chances of our legislature addressing it in a timely manner are slim and none.

I think the chances that Ukraine gets thrown under the bus and US leaders start trying to quietly walk away from they absolutely disaster they helped create get more likely every day. Most Americans will only support the war in so far as it doesn’t require major personal sacrifice on their part, which it soon will.

Could supply of homes to take out a mortgage on be also a factor at work here? Corporations have been buying up a lot of houses to turn into rental homes the past few years and you would expect this to have an effect on the mortgage market as the number of homes available to take a mortgage out on to decrease over time.

Dunno about nationwide, but in my neck of the woods….there was sparse building of single family homes post-2009. Most of the money went into urban multi-family buildings for single millennials, childless couples, empty nesters.

Now many of those millenials are married, want/have kids, want a yard, and want to work from home but there isn’t matching supply of single-family homes, even in boom areas like Texas or Miami.

The potential supply didnt just disappear. At a certain price to rental ratio those homes that were bought as rentals start making more sense as primary homes/non rentals again. Its price growth and/or increased rental demand that keeps those houses as rentals.

This isnt to say corporate landlords didnt play a role in affordability. All that investor money pouring in was a shock to the system and is reflected in permanently higher prices — we can all thank the Fed’s easy money policy for that

I believe that about 75% of homes are bought with mortgages (per a previously Wolf Street article, if I recall correctly).

I think your are correct that currently the market here in Hawaii has responded by reducing inventory. For owner/occupants I don’t see a near-term reason to force them to put their property on the market — these weren’t purchased with liar-loans. More likely is if rents have to go down that would bring inventory onto the market and consequently downward price pressure.

As far as upward pressure on rental rates don’t neglect the tax burden on rental real estate.

And don’t neglect the Air Bnb effect, especially in areas that are desirable to tourists. The supply of long-term rental properties in my small town on the North Olympic Peninsula was reduced to almost zero over the course of one year in 2016. Some homeowners are making a killing with short-term rentals — a cancer on the body politic IMO. As noted by Wukchumni below.

What Wolf did not mention is the number of people who stretched a little to buy a home in the last two years.

Let’s assume they saved that 20% Down Payment and were reasonably prudent in the Monthly payment they took on, such that at the end of the Month they are putting away $1K after all expenses.

Their Jobs are secure, their investments are doing well on top of the $1K per Month in savings and they just know that things will get better now the adults are in charge.

And then gas goes to $6.50 a gallon ( Regular at the cheap station yesterday), food prices jump,the portfolio gets the sads and that $1K a Month cushion becomes a $200 surplus that threatens to become negative.

And those jobs are looking a little iffy.

And then home prices begin to fall in the very nice area they stretched to buy in.

The low end always gets hit first and hardest, but inflation corrected drops of 25% in good neighborhoods ( Glen Ellen,Sebastopol) are about average for a real estate correction.

Keep in mind that here in the SF Bay Area that couple would need an income of not less than $250K to do this.

And their equity will be dissolving like a tooth in a glass of Coca Cola.

These are people who matter (In their own minds) and they are going to be very unhappy….

My advice?

If you stretched to buy,if look at your expenses honestly and determine that a further 25% rise in costs will make your 3% loan unaffordable sell while you still have equity or ride it down to short sale territory and get cash for keys.

The advantage of a fixed mortgage is that the cost doesn’t rise. Rent will.

You make a good point re: people stretching. If you didn’t have to commute to work, and your kids were getting free lunches, and you received some government assistance, etc. you might not have realized that you were house poor. But with expectations to return to the office and all those programs ending… suddenly you feel every bit house poor.

We bought our house 7 years ago and it was a stretch. But over time, and with the low rates available, it is easy to manage now.

I wish the US didn’t feel like the most sadistic game of musical chairs ever.

The ‘X’ factor this go round in the new and improved housing bubble is short term vacation rentals and mass ownership of rental homes by too big to fail concerns, neither of which existed in the 2008 blowout.

In the wake of the earlier bust, tourism faded badly and they were just about giving away motel rooms, and short term vacay rentals were only a gleam in the distance.

To put things in perspective how dead it was, the present day Hoover Dam Lodge was selling rooms for $10 a night. It was a bit more spendy @ Whiskey Pete’s casino @ the Cal-Nev border, they wanted $15 a night for a room.

Also note the backlog of unfinished homes, mainly due to supply chain issues. If this reservoir of housing breaks loose, expect a further lowering of prices. A vicious cycle could result. Excess homes meets lowered ability to purchase resulting in strapped builders cutting prices to try and stave off bankruptcy. Rinse and repeat.

The other societal effect not mentioned is property taxes. Local governments, who rely on property taxes for much of their annual budgets, will get squeezed by dropping tax revenues as homeowners say either “screw this, come and grab my home, if you dare,” or “we’re voting you out” to local apparatchiks. In the former case, we’ll see just what a militarized local police force can do in the way of terrorizing the populace, and vice versa.

The upcoming ‘dislocations’ are going to be, as has ever been the case, perfect recruiting tools for real Fascists. The people who think that Trump is a Fascist will get a very rude awakening when they encounter the real thing. Indeed, they may not survive the experience. My question is, who will be the new, new and improved scapegoats that the Neo-Fascists focus the public’s fear and anger on?

We live in interesting times.

Bad time to buy…worse time to rent…the free cost of money Era is on hold for now…but the cost of keeping a roof overhead is going down no time soon…yes, in the legacy media markets at the higher end, there might be some savings by renting but…in the rest of the country, the tax right off and long term payment stability of owning vs renting…unless the renting is 40% below the current cost of owning…the market will not be talked down…buying/owning is still the better option in most of the country…and many a twenty something are still living at home but making decent money…no real estate bubble…and let us not confuse the shiller real estate rainbow index with the rest of the country…the Uber urban disproportionism is often overlooked and is a driver but not reasonably reflective

My views on the housing crisis are conflicted. Yes, there is a definitely a shortage. It does not the explain though the constant foaming at the mouth hysteria to buy a home and a bull market for 10+ years.

Throwing cheap money everywhere and giving access to cheap money to the wealthy distorted everything to where banksters and tech-bro’s are buying 1.45$+ million dollar homes near center city.

Not a single classical urban planning book I have read recommends this. The demographics do not support building massive single family homes near center city. Household sizes are shrinking and they don’t need 3,000 square foot homes. It’s just wealthy people rushing to horde land and shelter along with the labor and materials required to do it. It’s naked and flagrant class warfare.

The problem is just building at a higher density doesn’t work either. Missing middle (four-plex) houses and small apartments still need relatively affordable land and an available labor market with materials. Yet I’m competing with McMansion builders and the few massive apartment buildings that are permitted.

.33 acre lot… twelve minute to light rail walk but would be a perfect cycling location. 800,000$. A fourplex still deals with 200,000$ in land costs per unit. I am pretty sure the morons at the planning department wouldn’t allow it and I have to go through a lengthy rezoning process. But splitting the lot and building two McMansions would be allowed by right. Permits within a week.

So yes… there is a supply issue. I just think the people using ‘not enough housing’ are going through some circular logic. We will forever be stuck in shortages at this rate. There has to be a bubble psychology in this and sadly a correction that could be devastating.

Please… no more cheap lending for mansions. No more expectations of 15%+ price gains a year.

I hope not for a full 08′ disaster… maybe something in the middle that kills the frenzy and then the slow process of letting the market truly recover. Yes, even drop interest rates again but for the low end of the market. Publicly funded co-ops. Take some of those McMansion and convert them into condo’s.