Disgraced crypto chief Sam Bankman-Fried has been talking to reporters, including at the New York Times (the famed Andrew Ross Sorkin Dealbook interview), the Financial Times, and the Wall Street Journal. Despite the fact that it’s generally seen as a very bad idea to say anything about your past conduct when you are a litigation target, and likely for a criminal case, and SBF has said his lawyers are opposed to talking to the press, SBF is nevertheless swanning about on his media tour.

Even though SBF got a bit of pushback from Sorkin on the question of co-mingling of funds when SBF tried playing, “Oh it was sort of allowed and anyway things were a mess,” he and other reporters didn’t probe very hard once they got his next layer of excuses: “Oh I didn’t mean to do anything bad, I don’t have access to records any more and my memory is fuzzy, and I really didn’t have anything to do with Alameda.”

Here is the Financial Times’s recap from over the weekend:

Core to Bankman-Fried’s account of how FTX ended up with a roughly $8bn shortfall of client assets was excessive lending by the exchange to Alameda, which ploughed the money into venture capital investments and doomed bets on digital tokens.

Bankman-Fried deflected the FT’s questions about the excessive borrowing and soured investments that ultimately sank Alameda, blowing a hole in FTX’s finances, and would not be drawn on the legal consequences he may face. He said he deliberately avoided getting involved in Alameda’s trading and risk management to avoid conflicts with his position as chief executive of FTX, and neglected to monitor the risk they posed to the exchange.

Got that? $8 billion hole at the hedge fund Alamada. We are supposed to believe that the was the result of FTX lending to Alamada and then Alameda doing stoopid things that burned up a lot of dough. Oh, and even though SBF is responsible for (at best) crappy controls at FTX that allowed Alameda, we are also supposed to believe SBF’s claims that he was not involved in what was happening at Alameda.

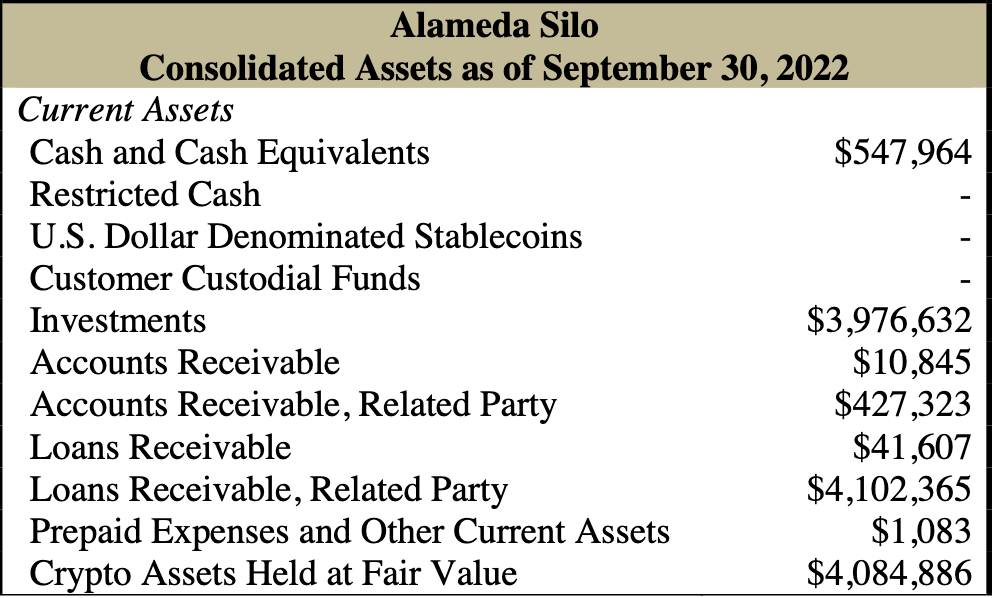

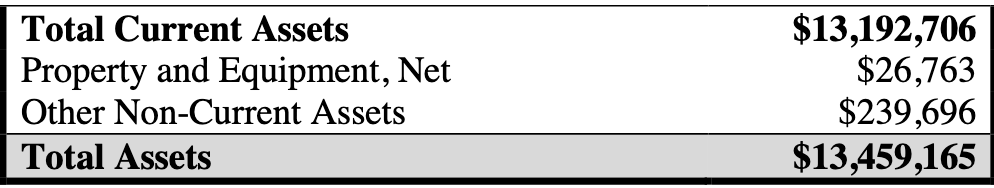

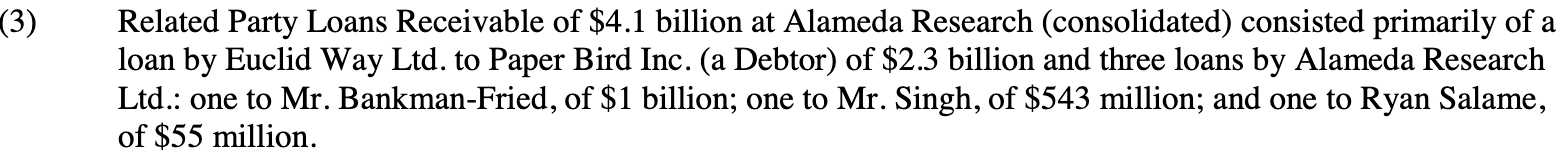

Aside from the wee problem that SBF owned 90% of Alameda and had its detailed financial information as recently as March, Alameda made $3.3 billion of loans to SBF, $1 billion as a personal loan, and $2.3 billion to a 100% SBF-controlled entity, Paper Bird, that is outside the FTX-Alameda bankruptcy.

So Alameda made $4.1 billion in loans to cronies, mainly SBF, and we are to believe that SBF had nothing to do with that?

I am at a loss for the failure to purse the question of what happened to the $3.3 billion SBF borrowed. This is already in the public domain. Yes, no doubt more will be revealed as the bankruptcy process winds forward. But help me. This is not hard.

Mark Karpelès compiled an FTX entity list, which confirms that Paper Bird is a “top” company, which is consistent with SBF being its sole shareholder. The bankruptcy filing states that Paper Bird owned 75% of FTX International.1 However, that does not make it part of the FTX bankruptcy. In fact, Paper Bird filed for its own bankruptcy, the same date at FTX did, with separate counsel: Adam Landis of Landis Roth & Cobb while the lead attorney for FTX is James Bromley of Sullivan & Cromwell.

Notice we have not heard anything about these lavish loans in SBF’s “Oh poor confused me and I feel sorry for all my chump victims too.” Since SBF seems unduly eager to try to ‘splain himself, it would improve appearances in the eyes of public opinion and perhaps later a court, if he could honesty say, “I scrounged up what I could liquidate readily and used to to try to save the company.” If that had happened, that would also mean any investor recoveries, however meager, were due in part to SBF trying to shore up his enterprise.

I have seen no claim in the press or the bankruptcy filing that SBF either did or expressed willingness to put his own money into FTX when it was collapsing. The failure of SBF to spend any of his own funds to salvage his empire no doubt contributed to its demise. If he’d put up say $3 billion of the $8 billion supposedly needed, there is a remote possibility that his napkin-doodle balance sheet would have been forgiven: “If SBF is willing to stake that much of his personal money on the odds that he can rescue FTX, there must be some real value in there despite the mess.”

And it would not be hard for a merely mildly dogged interviewer to press SBF on this topic: “You took $1 billion in personal loans from Alameda. When did that happen? You said in your Financial Times lunch earlier this year and then more recently that you had only $100,000 in bank. So where did the $999,900,000 or more go? Was it invested in real estate? Gambled away?”

Remember, he can’t play “I don’t remember” and act like he can’t get the information. This was personal money, under his control, and he still has unimpeded access to those records. The reporter could follow up: “If you don’t remember, could check your personal accounts and get back to us?” And if he demurs again, drive the knife in: “This will probably come out in court anyhow since the creditors will be looking into fraudulent conveyance. So this isn’t something you will be able to hide.”

Then an interviewer could follow a parallel line of questioning with Paper Bird. There SBF might give bafflegab about venture investments or crypto speculation, so if I were a member of the press, I’d start with the personal loan first since he has much less wriggle room there. Not being able to explain what happened to $1 billion, which is the route SBF is likely to take, is not a good look.

Separately, yours truly is becoming slightly more optimistic that SBF might wind up facing a real prosecution, as opposed to one designed to find as little as possible. From the Wall Street Journal:

In Cyprus, the country’s securities regulator is complaining that Mr. Ray’s decision to place FTX in bankruptcy has stymied investigations and is preventing European customers from getting their money back…In Turkey, authorities have seized the assets of FTX’s local subsidiary, an affront to Mr. Ray’s efforts to sweep FTX’s assets into the chapter 11 process in Delaware….

On Nov. 28, the chairman of the Cyprus Securities and Exchange Commission voiced concern about the bankruptcy process in a letter to Mr. Ray, a copy of which was seen by the Journal. FTX’s European arm, FTX EU Ltd., was licensed in Cyprus, allowing the crypto exchange to offer services elsewhere in the European Union’s single market….

The Cyprus securities regulator has ordered the company to return the money to customers, but the company has been unable to comply because its bank accounts are frozen by the chapter 11 process, the chairman said.

Mr. Theocharides also reminded Mr. Ray “that unlawful use of clients funds might constitute a criminal offense.”…

Trouble might also be brewing for Mr. Ray in Turkey, where regulators have already decided to take control of FTX’s domestic subsidiary’s winding-down. On Nov. 19, Mr. Ray said FTX had identified a number of subsidiaries with valuable franchises that could be sold to raise cash for the company’s creditors. One of them was FTX’s wholly owned Turkish subsidiary, FTX Turkey Teknoloji Ve Ticaret AS, where the company had found nearly $3.1 million in assets when it filed for bankruptcy, according to court papers.

Four days later, though, the financial crimes board of Turkey’s Treasury Ministry said it had confiscated the assets of FTX Turkey on suspicion that customer deposits were transferred or taken abroad through fraudulent transactions and that nonexistent crypto assets were sold to customers. Istanbul’s chief prosecutor began a criminal investigation into Mr. Bankman-Fried and other people associated with FTX, the ministry said.

So far, the Cyprus regulator is just whining, but his criminal offense remark is arguably a shot at Ray, not just SBF. By contrast, Türkiye is saddling up. And remember, as SBF keeps running his mouth and the bankruptcy court unearths more information, they will soon have plenty of promising material.

Both Cyprus and Türkiye have bilateral extradition treaties with the US. Federal prosecutors and regulators hate being upstaged by state counterparts; that’s why state enforcement actions regularly have the effect of rousing formerly somnambulant authorities.

It would be staggeringly embarrassing for the Department of Justice to make no filing against SBF or only a very weak and limited one, and then have jurisdictions seen as less than upstanding (that’s why SBF chose them, after all) making forceful cases that SBF had violated their laws. That pressure, which at least from Türkiye seems to be genuine, will force the DoJ to do more than dial its investigation of SBF in.

____

1 An earlier filing is consistent with the bankruptcy information:

4/6 I was able to locate a document listing a lot of those names, including shareholders at the time of that document: https://t.co/5mCza1vrsw (archive: https://t.co/dObKpR5Eua)

Especially interesting is the information of who owns what near the end: pic.twitter.com/zIKoehqs8P— Mark Karpelès (@MagicalTux) November 13, 2022

Zero Hedge has stolen our post:

https://www.zerohedge.com/crypto/earth-reporters-why-no-one-asking-sfb-what-happened-33-billion-he-borrowed

I did not authorize them to use it.

I would very much appreciate it if all of you who have time and energy go to Twitter and complain that this is illegal and bad form, the more colorfully, the better.

https://twitter.com/zerohedge/status/1599763550465146883

Also complain in their comments section.

Thanks!

Two questions come to mind

1) How important is Crypto Currency to the three letter agencies as a means to launder money?

2) If, as seems likely, all the Crypto exchanges are essentially frauds ( Tether claims to have $60 Billion in LIQUID US Dollar denominated assets… ) is there a possibility of contagion spreading to the broader markets?

All ‘Intelligence” agencies need to move money covertly and they all want to be one more fish in a large school of fish when they do so.

Does crypto make doing this enough easier than traditional methods of obscuring the source and destination of $ that the Crypto ecosystem will be preserved by hook or crook?

Cryptocurrency is the only bargaining chip hackers have when holding businesses & governments @ ransom, what else could they possibly use that wouldn’t leave a telltale trail?

Now, why our political leaders wouldn’t want to ban it in order to get rid of the possibility, would be a profound mystery in the country I grew up in when I was a teenager, but makes perfect sense now.

Wukchumni: I would agree with your statement about “the country I grew up in”, but not really.

Not really because, being a teenager in the 1960s I had no clue as to what was real since all the visible signs to a young man hide the reality. Reality hit me when I read “JFK and the Unspeakable: How He Died and Why It Matters” because it connected with me regarding the Fed as presented in other sources. We were like normal people – totally unaware of the moving parts of global power politics. The news was the news, and we believed it.

Long walks are often needed these days for personal sanity.

“The country I grew up in” really means the country you thought you grew up in. I was the same.

In my very long term view, developed in the last 15+ years, is that the wheels were already in motion in the background where almost nobody was looking. That’s how it always starts in the struggles of empire.

The US literally sent pallets of dollars to Iraq. Crypto would require anyone on the receiving end to have new helpers unless they were deep into crypto. So that’s a big HUMINT risk for them. And they still have to get funds out of crypto into a real currency, which creates price risk too.

So I really doubt it unless recipient asked for crypto.

My question exactly. A prime example of the TLA dabbling in financial firms for nefarious ends was the Nugan Hand Bank in Australia in the early 1970s, which was in the shadows as regards destabilising a government.

One of the founders was found shot dead through ‘suicide’ and the other one disappeared after the Bank was no longer needed, as the government was kaput.

Term paper of the future. Compare and contrast the government treatment given to Julian Assange compared to the treatment given to Sam Bankman-Fried

Forbes asked that question, also:

“Sam Bankman-Fried And Three FTX Executives Received $4.1 Billion Of Loans From Alameda Research:

“Where Did The Money Come From And Where Did It Go?”

“There are three principal areas we know about so far: political donations, personal investments and the buyout of rival Binance’s stake in FTX.

$1 billion went to Bankman-Fried in the form of a personal loan.”

https://www.forbes.com/sites/mattdurot/2022/11/17/sam-bankman-fried-and-three-ftx-executives-received-41-billion-of-loans-from-alameda-research-where-did-the-money-come-from-and-where-did-it-go/?sh=41fb68ae79c7

I had missed that Forbes had also picked up on this so thanks for giving them credit. You can see the screenshot with the detail on the loans in the post above. It came out in the Ray statement in the BK so Forbes saw it the same place we did and wrote about it more or less the same time (https://www.nakedcapitalism.com/2022/11/ftx-new-ex-enron-ceo-finds-complete-absence-of-trustworthy-financial-information-3-3-billion-loans-to-sbf-customer-deposits-not-recorded-on-balance-sheets-confirms-software-backdoors-auto.html). But that statement was not long. It’s remarkable how few outlets have made noise about the personal loans

I commented on the tweet for what it’s worth, I never post on Twitter so I have like 0 followers and hardly any Tweets but the account is almost 10 years old.

Thanks! For this purpose, what matters is that it appears in the replies to the tweet. That is why Lambert likes Twitter, he can and apparently has called Rochelle Wallensky a eugenicist to her face on Twitter.

I pointed this out on Twitter and have received 9 likes in as many hours. The algo really does work!

Arithmetic typo?

“You took $1 billion in personal loans from Alameda. When did that happen? You said in your Financial Times lunch earlier this year and then more recently that you had only $100,000 in bank. So where did the

$900,000$999,900,000 or more go? …”Big oops! Fixing! AM drafting!!!

In college I got those after PM draughting! /s

I have been following this story rather obsessively since I learnt of it about a week ago.

Drop everything (if you are doing the same) and look up Coffeezilla on Youtube. He has done several absolutely scathing “ambush” interviews with SBF and let’s just say the latter, er, doesn’t come across too well. Not to say that he did much better in the Sorkin 60 minutes interview (complete with nauseating round of applause at the end), but Coffeezilla really cuts to the chase with very defined and forensic questions of what happened to the monies and what did SBF know at the time. Two thumbs up.

Here is one of the most recent interviews:

Coffeezilla: I Accidentally Interviewed SBF And He Hated It

Enjoy!

Thanks for this link.

(an aside: I gotta wonder about that white heart-in-circle shirt design on SFB’s icon …

https://www.nbc4i.com/news/code-for-pedophiles-ends-up-on-childrens-toys/

Damn, the cryptomuppet is either the most stupid criminal I’ve seen in a long time or the most arrogant one. What is he doing just giving interviews all day on the interwebs to whomever wants to call in? This “I don’t remember, it was all so confusing” schtick is really pretty lame for a supposed genius. The man took the time to create some incredible web of cut outs and shell companies which is usually done to obfuscate one’s shady financial dealings, and we’re supposed to believe he just didn’t have any idea what was going with his own prop trading?

It’s his defense. Appear as a stupid moron or an imbecile and get off wit a reduced sentence.

There are rumors on twitter that Caroline Ellison is in NYC, not in Hong Kong, and is cooperating with prosecutors. There’s a pic of her but who knows: https://twitter.com/AutismCapital/status/1599466158893432832.

She is smarter than SBF if she is doing so. He’s been trying to throw her under the bus when the misused customer monies came from FTX, not Alameda.

Can’t link it but ZH put this up last night including the rumor that she has lawyered up

While I haven’t been following any of the interviews mentioned above apparently he in turn has been trying to put all the blame on her? So she has motive….

Stanford Law professor father of disgraced FTX founder Sam Bankman-Fried cancels his classes next year to help with his son’s legal defense

“The Stanford Law professor father of disgraced FTX founder Sam Bankman-Fried has canceled his upcoming classes reportedly in anticipation of helping his son who could face criminal charges.

Joseph Bankman was on the docket to teach tax policy next year at the prestigious university. But as of November, the most recent course catalog shows that his classes were canceled, the San Francisco Standard reported.”

It also talks about his mother and her “Mind the Gap” PAC.

Joseph Bankman might also want to consider his own legal defense in this matter. According to his wikipedia page:

“Bankman was involved in FTX, including raising funds for the firm before its bankruptcy.”

It doesn’t make sense that FTX raised so much money with so little due diligence, especially from established VC firms. But what might make sense is FTX being perceived as a sound investment because a Stanford Law professor endorsed it to his former students at established VC firms. To understand the power of uninformed endorsements, just look at what George Shultz was able to accomplish for Theranos.

Haha, good point about the father!

Why would she need to be in the US to cooperate with prosecutors? Wouldn’t she have more leverage staying outside the US until she got the most favorable deal?

Also wondering if she thinks some of their former “customers” might be more hesitant to kill a woman, one theory being that SBF is staying the spotlight to make himself a harder target.

Plea deals depend on giving “substantial assistance”. Here you can bet it would include testifying if SBF were tried. She has to come to the US for that. If I were a prosecutor, I would regard her offer to cooperate as unserious otherwise and possibly a fishing expedition from SBF.

https://www.tpatrialattorneys.com/federal-cooperation-agreements/

There have been several “twitter spaces” about SBF/FTX. It seems the twitterazzi is doing a better job looking into the fraud than the MSM. Today’s purports to be about the “twitter files” but will inevitably include more comment about its confrontation with Bankman Fried which, as Pavel points out, put little Sammy on the spot. It’s an overtly pro crypto group, which might explain its passion for the truth, and has included Musk himself and other prominent players like Kim Dotcom and Richard Heart: https://mobile.twitter.com/MarioNawfal/status/1599501069822099456?cxt=HHwWgIDUyfPvyLIsAAAA

I don’t do twitter anymore. I tried over the past year, with several accounts, all of which were banned or shut down (haven’t checked to see if the new boss has unbanned me and probably won’t). They want a phone number to prove I’m not a bot. Not a chance that’ll happen. But anyone can listen to the “spaces” (they are very long, btw) without signing into an account.

Meanwhile, the usual suspects are hysterical about the result of the Munk Debate between Douglas Murray and Matt Taibbi and Malc (you have to read the account by Taibbi or listen to the recording) Gladwell and Michelle Goldberg last Wednesday in Toronto. Before the debate the audience was 48-52 on the question “Be it resolved: Don’t trust mainstream media.” At the end of the debate the score had flipped to 67-33. Link to unedited transcript of the debate is here.

I read Gladwell and Goldberg basically sunk themselves by accusing Taibbi of racism and lying about his record, which was corrected live. The funny thing about that is it’s all the thoroughly discredited MSM have left: lies and declaring every new Dem scandal a “nothingburger”.

Sad!

Link to the video: https://vimeo.com/munkdebates/review/775853977/85003a644c

I watched the entire debate.

I remember the supportive US media during the earlier part of the Vietnam war, so I don’t have the rather golden view of the journalism of the past that Taibbi has.

But I remember when Cronkhite editorialized against the Vietnam war, and to consider that he was willing to broadcast:

“We have been too often disappointed by the optimism of the American leaders, both in Vietnam and Washington, to have faith any longer in the silver linings they find in the darkest clouds”

,,,,,

“For it seems now more certain than ever that the bloody experience of Vietnam is to end in a stalemate. This summer’s almost certain standoff will either end in real give-and-take negotiations or terrible escalation; and for every means we have to escalate, the enemy can match us, and that applies to invasion of the North, the use of nuclear weapons, or the mere commitment of one hundred, or two hundred, or three hundred thousand more American troops to the battle. And with each escalation, the world comes closer to the brink of cosmic disaster.”

https://billofrightsinstitute.org/activities/walter-cronkite-speaks-out-against-vietnam-february-27-1968

And now we have lightweights such as Goldberg and Gladwell to give us the mainstream news,

Maybe Goldberg and Gladwell realized they were playing a weak hand.

THE Cronkite statement appears germane to the Ukraine war,

Not so fast with the Cronkite (and Dan Rather).

Buying In

CBS News jumped onboard the blue-ribbon Warren Commission’s findings as soon as they were released on Sept. 27, 1964, just over 10 months after President Kennedy was assassinated in Dallas, Texas, on Nov. 22, 1963. In a special report, CBS and its anchor Walter Cronkite preempted regular programming and, with the assistance of reporter Dan Rather, devoted two commercial-free hours to endorsing the main tenets of that report.

https://dickatlee.com/issues/assassinations/jfk/jfk_cbs_coverup_dieugenio.pdf

“it is difficult to get a man to understand something, when his salary depends on his not understanding it.” – Upton Sinclair.

Thanks much for the link to the video of the debate. I went looking for it a couple of days ago on youtube and couldn’t find it. Now I know where it is.

Taibbi and Murray’s memories obviously retain details of many MSM scandals. Thank God they can do it. Listening to Gladwell and Goldberg you’d think they’d forgotten anything about any of’em, if they’d ever retained for even a month the most basic outlines of each in their heads.

By “hysterical” you mean MSM defenders are saying the debate was an unfair set-up?

Does the billionaire class have a record of pulling large amounts of money from their own funds to shore up their sinking empires? What are the precedents?

It might be the right thing to do, but billionaires are basically criminals. SBF talks like he understands how a conscience works (as do most sociopaths), that doesn’t mean he has one. Another little something he’s probably not going to admit to.

Walking the walk and talking the talk of normalcy is part of the sociopath’s disguise, but right now his mask is slipping. His attorneys should step in a fix it, or quit.

For LTCM, the partners and employees did not participate in a big return of capital in 4Q 1997. They had all their net worth in LTCM and lost it all.

And the general billionaire case is not comparable. They don’t pull cash out of companies on remotely this scale. The usual route is lavish lifestyle perks: huge expense account, flying on private jets, renting apartments.

{slips on Reynolds Wrap toque and peers in the mirror…}

I was shocked by the few VC (Sequoia & Singapore) investors in FTX that admitted ponying up astounding amounts of money, but you didn’t really hear anything from Wall*Street and huge losses, which makes me think that as long as SB-F isn’t in jail, they feel there’s still a chance they can get some of their money back.

They still have a chance with the end-of-quarter window dressing option, where one mistake gets buried among others.

Could it be that a few billion lost here and there are just not what we mean by “real money” anymore?

There was a time when I felt the need to capitalize the word ‘billion’ but then it became so commonplace that I occasionally wrote Trillion-a forbidden pleasure before the turn of the century, obviously still in respect of the additional zero that gave it gravitas.

Isn’t it 3 zeroes?

You’re still only a billionaire even if you’re worth 999 billion.

A ‘donation’ to some guy showing up at your front door selling magazine subscriptions even though you know he isn’t (?).

Neither seems likely to me. This entire incident is a more farcical re-run of the MF-Global collapse with even more glaringly transparent fraud, but again the single most important consideration is that the players involved have enough political connections to ward off any serious scrutiny, inquiry, or investigation. SBF is Jon Corzine in a hoodie, with even more money.

The only realistic conclusion is that investors in the US, in certain towns in particular, need to be keenly aware of the political nexus they are buying into. And it’s not so simple as shying away from limelighted meth addicts. Eventually the political class will come looking for dues and faults with those funds and investors who are not politically graced. Such is the path that re-regulation and financialisation has lead us down.

Oh, come on. Everyone was made whole at MF Global. That is why it went away. That is not even remotely going to happen with FTX.

And your comparison of SBF to Corzine is ludicrous. Corzine has been CEO of Goldman. He had been Governor of New Jersey, which also meant a monster fundraiser for decades. He mentored a whole generation of traders on Wall Street. He was ousted during the Asian financial crisis due to being from the trading side and taking too many risks going into it.

I don’t like the man much but comparing him to SBF is absurd.

And even though Corzine was arguably responsible for the sloppy systems, an employee lied to him about the emergency wires not coming from customer funds. There’s again nothing like that with SBF.

On top of that diverted funds were 1/10th what is alleged with FTX.

Customers initially got 93 cents on the dollar and eventual full restitution. The government did prosecute but settled:

https://en.wikipedia.org/wiki/MF_Global

Corzine was also not implicated in the misconduct:

https://en.wikipedia.org/wiki/MF_Global

BTW $1.2 billion in restitution is more than the amount of pilfered funds, $891 million (might include interest and trading losses). Think SBF can pay more in restitution than the disappeared $8 billion?

That is why MF Global didn’t lead to prosecutions. The investors got all their money back.

Hateful Martin Shkreli got jail time and hefty fines yet none of his investors lost a penny, they all made out lots of money and said so during the trial. Yet he was severely punished.

Probably naive question: any chance that Fidelity or CALPERS invested in this and there’s going to be a pension hit? Or are they not allowed to put money in such?

No it is not naive and thanks for asking. Fidelity has some funds that invest in late stage VC companies so it would have been possible. But the press has been all over the big names in FTX so the odds say not. CalPERS was very eager to invest in late stage VC (this was one of its four pillars in that scheme that finally fell apart under its own contradictions) but does not seem to have yet organized itself to do so. Again you’d expect that to be in the news. However, CalPERS did make statements to the effect that it had crypto exposure, or had to check that it didn’t (!?!?) so there may be shoes to drop there.

https://www.pionline.com/cryptocurrency/institutional-investors-measure-damage-ftx-collapse-portfolios

At least a number of them have indirectly, through Sequoia Capital.

CalPERS is not an investor in VC. It has too much money to put to work.

CalPERS has said it has some crypto exposure in PE but doesn’t know how much.

It’s probable that the LPAs would prohibit disclosure. Even if they don’t I’m sure CalPERS will use Calif Gov Code 6254.26 to hide it. Who want’s the beneficiaries to have embarrassing information. After all it’s only their money.

It is SO nice to have Naked Capitalism as my “go to site” on these types of things because I know that Yves knows what she is talking about, and she won’t shy away from the truth. I have not seen a decent explanation of FTX anywhere but here.

I think that officialdom and the media have been very, very generous to Jon Corzine over the MF Global collapse, and that has in part lead to the FTX collapse. Customer funds ended up in the losing prop desk run by Corzine and were promptly themselves lost. Corzine appeared before congress and claimed it was all too complicated when it was not really complicated. That customers were made whole, eventually, or that congress and the SEC etc were unwilling to seriously look into misconduct at MF Global does not go to the core of the issue, which is the effect of light touch regulation and the tone set by that very public lack of regulation. It was a signal to anyone that those with enough clout and political backing were free to do as they please.

I think you can draw a direct line from the likes of the MF Global collapse to FTX. FTX and Alamada would not have dared a scam two orders of magnitude smaller if MF Global and Corzine had been seen to face the full fury of the regulator and/or law in 2011. Instead a generation have learned to be smirk at the idea of regulation and have been emboldened to push and push the line so far out that instead of a savvy Governor in a suit, you end up with a quaking drug addict in a hoodie and 10 times the losses. God only knows where we will end up after another decade of regulation by Dorsia reservation.

I’m seriously starting to wonder if Sam is the new Epstein, remembering that Epstein’s biggest frauds were financial and he had lots of dirt on important people. All that dirt made questions go away.

adding: what’s with the design on his icon?

https://twitter.com/SBF_FTX

He’s absolutely a made man. Waiting for the intelligence connections to be unearthed. As they were with Epstein. Since the ‘left’ has turned on Matt Taibbi lately, it may take a bit longer to get out to the general public.

And I added a sour comment on ZH. Least I could do

Exactly, he’s a democrat party operative, of course nothing will happen to him.

The guy is obviously a crook. Why he hasn’t been arrested with a bail set at… $8B eludes me, apart from the usual kid-glove treatment of white-collar criminals.

That said, while Elizabeth Holmes’ investors were nearly as credulous, she didn’t get anything like this level of uncritical coverage of transparently bogus excuses.

You have a selective memory of the Holmes story. When John Carreyrou was writing his articles about Holmes, there was tremendous pushback. He was depicted as a journalist hater who was out to smear a brilliant woman. The Journal was full of critical comments.

It was only when it came out that Walgreens had been given fabricated test results from Theranos, meaning many were wrong and potentially put patients at risk that the perception of Theranos and Holmes finally started to change. Even so, Holmes kept defending herself until litigation started.

Did you miss that SBF is under what amounts to house arrest in the Bahamas? That the fact the collapse was such a records-deficient mess that it will greatly slow prosecution. You have to have a decent sense of facts to file a case. The prosecutors will need to wait for the BK process to produce information they can leverage in a case.

Funny, I had a conversation the other night with a “feminist” friend (I don’t keep up on all the 1st, 2nd, 3rd gen feminism stuff, but suffice it to say that she’s the type who supported Hillary because she’s a woman. Explained away all of Hills horrible behavior, and just focused on her gender qualifications). Anyway, we were talking about the parallels between Holmes and SBF – mostly about how so many “smart” people were duped, and she made the comment “Well, it’s not like Holmes’ fraud was about making money and living a high lifestyle”. Wait, what?!?! “Yeah, she was just trying to start a business to help people, and it got out of hand. If a man had done that, they’d probably have been able to walk away.” I said what about the people that got bad test results? That’s OK? What about the fake voice? To me, that showed fraud from the very beginning. But… you never win arguments with these people, and I’m pretty sure she has a lower opinion of me now since I’m clearly misogynistic.

Excellent point on SBF’s loans to himself. Prosecutors everywhere are going to have to unravel all the details of ownership for every single entity both within the scope of the ‘main’ FTX bankruptcy, and all the other entities. This will tie up legal teams for quite a while — the fact there’s a separate firm handling the Paper Bird bk is somewhat of a sign that somebody knows that the overall structure is flimsy, and having a separate firm handle Paper Bird will help separate (i.e., protect) assets.

It may be a while before US DoJ makes their case: Much of the activity is in offshore entities, in theory beyond the reach of DoJ (at least in the short term). It may take an agreement among country prosecutors to coordinate efforts and set aside jurisdictional posturing in order to make speedy headway (although the technical issues of jurisdiction will have to be carefully sorted, as a case can’t be successful if the governing jurisdiction isn’t correctly identified).

While there’s proabably a class action fraud case to be made (re the violation of the terms of service about using customer funds), there also may be AML / KYC / money handling issues that governmental entities can latch onto — some of the FTX entities were licensed as ‘payment services providers’ or ‘money transmitters’ (or whatever the local term of art is), and as such are gov’t-regulated (generally at the state level in the US).

Meanwhile, I imagine the SEC and CFTC are working on something, probably along the lines of ‘operating an unauthorized securities exchange’ or ‘unauthorized derivatives dealer’. I don’t immediately see a strong case for ‘failure to segregate customer funds’, other than as a violation of the customer agreeemnt, as most of the FTX entities that were handling customer funds weren’t regulated by a regulator with that requirement built into their licensing model (i.e., SEC, CFTC, Fed, OCC, state banking regulators).

After that’s over, the IRS might have a field day with the tax returns of the US entities (including the charitable organization), but that will only happen after somebody has put together an actual set of books and records that can be analyzed.

I’d be really interested in seeing a rundown of specific regulatory violations that could be applied to which entities.

Seriously I am quite pleased that he continues to keep at it, gee guys I also wonder where all the money went ? It’s like poof, once it was there and now it was gone! Criminal intent may be reasonably assumed by many but it has to be proved in the proper avenues. The dude still strikes me as a silly villain combo from a variety of Bond films ( mostly the Sir Roger Moore films ).

After all, most everyone here knows how it went down with the Holder doctrine after the financial crisis ~ 2009. Not trying to draw a false comparison but just to say watch what the US authorities say and do.

Are reporters really going to grill this creep and get him to give some honest answers? The danger is that he might. And if that happened, that would be lifting a rock showing all sorts of creepy, crawlies underneath. You think that organizations like CNN, MSNBC or Fox would welcome this? It would make them the target of the entire political establishment and we are seeing what this looks like with the release of the Twitter files. Matt Taibbi is being made an enemy of the people and the media is trying their best to cover up what these files show. So if an intrepid reporter did make SBF admit the truth, then likely that reporter would be soon seeking new employment in an industry that would turn their back on them.

RK

The most impiortant, obvious, and relevant questions are always the questions NOT asked by the MSM. Indeed, these are the questions that can’t be asked, because there be agendas…

Somewhere, there must be evidence of back-channel communications about what to avoid and what to push. There is too much missing across the board from what used to be called News for those errors of omission and commission to be an accident. Now, if only there were some saved DMs or whatever. Hmmm.

I have a burning question that no journalist seems to be interested in. Who brought in John Ray, the new CEO? It could not have been SBF, he would not have chosen somebody with the Enron experience. He would have preferred someone more malleable. This seems to have happened on the early morning hours of November 11th.

good question… and where is Daniel Friedberg, FTX’s “compliance” lawyer who was also involved years ago in the online poker cheating scandal?

Both of SBF‘s parents are Stanford law professors, reportedly expert in the area of corporate compliance. Both reportedly recipients of luxury properties in the Bahamas.

What a mess. Holmes and Muttering Sam. Beauty and The Beast.

https://www.nbcnews.com/news/ftxs-regulatory-chief-4-job-titles-2-years-was-really-rcna57965

I’m assuming that he was appointed by the courts once FTX declared bankruptcy and the cryptomuppet resigned as CEO –

https://fortune.com/2022/11/21/new-ftx-ceo-john-ray-hired-clean-sam-bankman-fried-mess-paid-1300-hour/

“He isn’t really a big time crook unless you must let him alone to prevent the loss of public confidence.”

Unknown author sometime in the 1920s – yes 1920s

What that guy Hegel said.

Or

Never let a crisis go to waste – Rahm.

Need more government regulation! = CBDC.

Caroline Ellison spotted (and photographed – sure looks like her) at a coffee shop in Manhattan which is only blocks away from an FBI field office – speculation that she’s cutting a deal and turning witness against SBF. Probably hopes to salvage her parents’ reputation as well, if it’s true: https://www.youtube.com/watch?v=Rboxe1ZBVkU

A commentor (David Corin) posted this at Zero Hedge (2 hours ago).

I mean, yeah, basically it is a habit for them. The quality of the comments there is…sure something.

The SBF caper seems to be similar to a magic act.

He is very smart. He knows that it is hopeless to try and convince the world that he “crooked Sam” is innocent. His magic act, in my view, is designed to divert attention from Sam’s real plan which is not to convince the world of his innocence, but something much more achievable.

By misdirecting everyone’s attention to just the guilt/innocence issue, the true purpose of Sam’s foolish interviews may be to give Sam the time and space he needs to remain free of secure in jail incarceration long enough and to plan and execute his getaway to a safe jurisdiction with all his ill gotten gains securely in his possession.

Yes, normally reliable sources have him being outsourced to Djibouti-which has no extradition treaty with the USA, and from there he’ll strike it rich pimping DigitalBooty, the next best thing in mirage money.

I think he would favor Switzerland, which, although it has an extradition treaty, does not extradite for certain financial crimes—which is why real life financier Marc Rich and Showtime’s Billions’s Bobby Axelrod both fled there.

There’s a little bit too much ‘William Tell’ in young Sam-he’s got diarrhea of the mouth, and an untouchable.

Besides, you can’t help but smile when saying Djibouti out loud.

A question for the Commentariat, especially those with legal knowledge: it’s my understanding that the government must prove intent when prosecuting fraud. If that’s the case, then might there be a even an remotely valid rationale for his seemingly self-destructive interviews and tweets, as in laying the groundwork for his defense and poisoning the well of public opinion? If the dude has done just a fraction of what it seems, then he’s facing tough choices, and perhaps he (and others?) think this incompetence schtick is the only one available.

Also, that “disorganization, bad record-keeping and incompetence” thing? I’m confident we’ll eventually find out it was integral to the scam.

Frankly, I think that if the government wants to indict him, then he’s done, even if the Southern District doesn’t flip Ellison or someone else. The bigger question regards further contagion in the “industry.” In all we likelihood, we should probably be more alarmed about Blackstone freezing redemptions on one of its commercial real estate REITs, but the SBF/FTX story is too delicious to ignore.

My view as a former prosecutor is that SBF is “market-testing” his criminal defenses in hopes of obfuscating the government’s circumstantial proof that he formed the specific intent to defraud FTX depositors. Structuring his transfers and withdrawals as “loans” is clearly designed to support the “I always intended to pay it back” defense while blaming the “run” on FTX for the actual losses suffered by depositors.

The FTX “‘terms of service” that Yves shared as this all began to unfold suggest that SBF may believe that he can negate intent to “permanently deprive” required for the crime of Larceny and also negate the “conversion for unsanctioned use” required for the crime of Embezzlement. Not saying this is going to work for him but he is getting a free shot at testing these defenses from soft-ball insider financial media outlets like Dealbook.

I’ve had some personal experience with NYT Dealbook that suggests to me that preserving access is more important to Sorkin than actually reporting on wrongdoing. The $1 billion personal loan and $2.3 Billion loan to a wholly-owned shell company are such obvious problems for SBF that Sorkin’s failure to inquire about them can only be intentional. My strong suspicion is that Sorkin didn’t torch SBF because of his own self-serving desire to maintain access — in order keep the clicks and the $2500-per-attendee “conferences” going.

I have no legal expertise. I do think a DWI lawyer could convict this guy in front of a jury. He is as obvious as a lying 5 yr old.

Your alert about the theft of Zero Hedge has shut down its comments.

” We’re sorry, we were unable to load comments at this time. Please try again later.” Don’t forget try again later.

title says ‘SFB’ when his acronym seems to me to be SBF?

You are the first to notice!

Take your pick:

1. Because I have name/acronym dyslexia

2. Because I was testing readers to see if they were paying attention