Yves here. Finance people will immediately recognize that outside of loan-sharking, lenders showing profits on defaulted loans is unheard of. Yet my goodness, Uncle Sam is doing a very good job of kneecapping student borrowers who have trouble repaying. As this post explains, this is predatory lending in action.

Originally published at Angry Bear

I have known Alan Collinge of Student Loan Justice for multiple years now. He has been prompting some type of relief for those who will never be able to payback these loans or are in default.

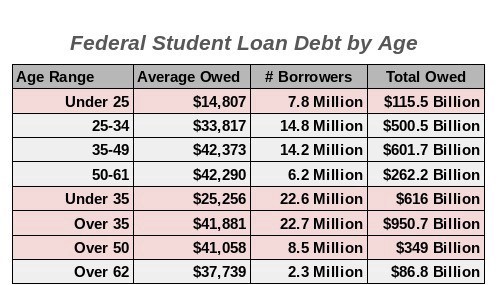

The information in the chart above is from EOY 2020 and the Federal Student Loan Portfolio, Federal Student Aid, “Portfolio by Age” The General Link and which Chart (link) the data is taken from to back up my numbers is also above.

For the over 62 tack on another $20 billion for EOY 2022. Three hundred- thousand more people are in this category. The average amount of time to pay back was 15 -17 years at $250/month. From over 50 and above, these debts will never be paid 100%.

Much of this is Joe Biden’s fault from his opposing Student Loan relief since 1990.

“The Government makes a Profit on Defaulted Student Loans,” Student Loan Justice Org., Alan Collinge

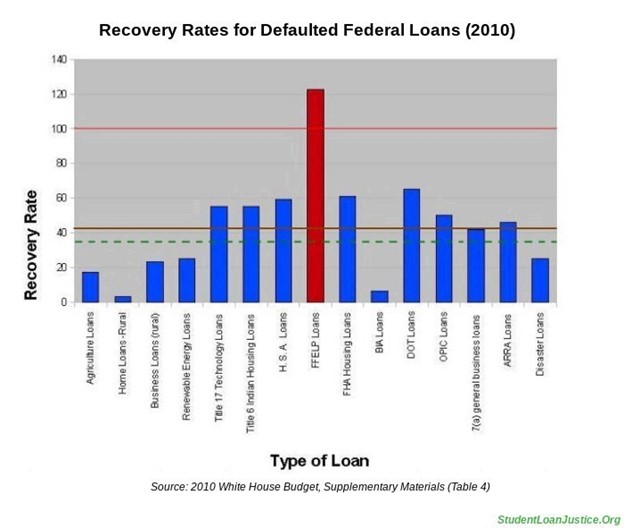

In 2010, we found the federal government was making a profit, not a loss, on defaulted student loans. This is a claim no other lender for any other type of loan (including governmental loans) can make. More recent White House Budget data shows that this is still true today The profitability of student loan defaults is certainly far greater today than in 2010. Making a profit on defaulted loans is a defining characteristic of a predatory lending system. Citizens everywhere should be concerned.

The 2010 White House Budget reported a recovery rate on defaulted FFELP (federally guaranteed) loans of 122%. All other loans the government made or insured that year had an average recovery rate of about 34%. No other loan types exceeded a 100% recovery rate, or even came close. At the time, the large majority of all federal student loans were of this category, where the government does not make, but rather guarantee.

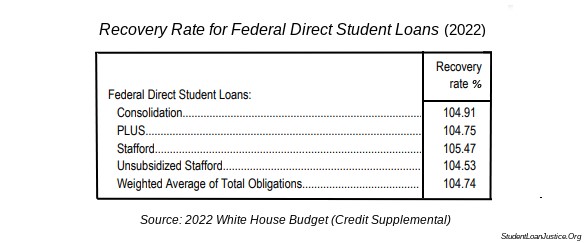

More recent White House Budget Data (2022), shows that this trend has continued for the Direct Loan Program (where the government makes and holds the loans, rather than just guarantee them), with an average recovery rate of over 100%. Similar to the 2010 data, student loans were the only type of loan that could be found in the federal portfolio for which the recovery rate exceeded 100%.

Recovery Rate for Defaulted, Direct Student Loans, 2022

Importantly: Unlike the older, FFELP (federally guaranteed) loans, Direct Loan recoveries are far more profitable than FFELP loans because the interest is built into Direct Loans.

For defaulted FFELP loans, the government, makes no interest on the loan prior to default. The claim amounts to the entire balance of the loan at the time of default, which includes both unpaid principal and interest.

For Direct Loans the government paid a much smaller principal when the loan was originally made. Whereas the value of the loan at the time of default typically includes a large amount of interest and accrues to the government rather than a private lender. The recovery rate for both is calculated by comparing the amount recovered to the balance of the loan at the time of default.

So while the recovery rate for Direct loans are lower than that for defaulted FFELP loans, the profitability of these recoveries is inherently far, far greater. There is no other lending system in existence in this country where the lender can claim to be making a profit on defaults.

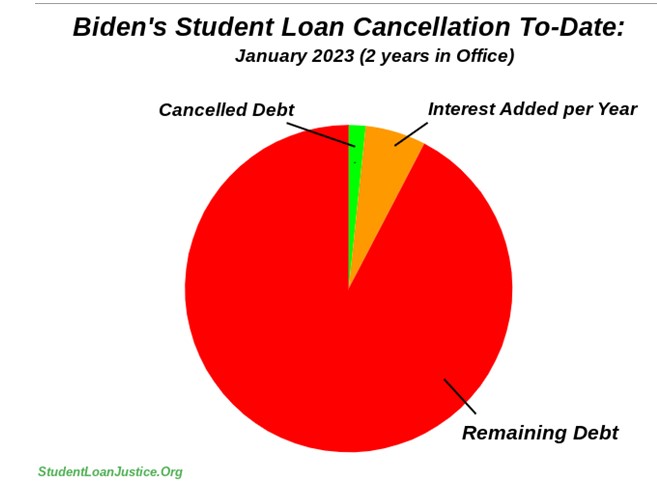

Student Loan Portfolio Accumulate Interest from Default

A loan portfolio which accrues nearly $100 billion in annual interest, where loans in default are actually profitable and very few loans are being cancelled as is the case with the federal student loan program. It is literally impossible to lose money on these loans. The program can only be making money from the defaults and a lot of it. All of this profit for loans, President Lyndon Johnson said would be “free of interest” when he signed the Higher Education Act into law in 1965.

Default profits depicted . . . .

What is most disturbing: The default rate for people leaving school in 2004 is estimated to be 40%, and is likely a low figure since the estimates were based on voluntary surveys. Many borrowers in default are inherently unlikely to fill out. The class of ’04, however, was only borrowing about a third of what students are borrowing today. Moreover, even before the pandemic, 85% of all federal student loan borrowers were underwater (ie not paying, or paying but with an increasing balance) on their loans, and nearly 60% weren’t making payments.

With 3 years of nearly universal non-payment due to the pandemic, this non-payment rate will escalate when repayment is again demanded from the borrowers. It is not at all unreasonable to expect that 70% or more of these borrowers will wind up in default on their federal loans when the system is turned back on. The student loan default is many multiples of the sub-prime home mortgage default rate of 20% in comparison. So, by all rational metrics, this lending system is in catastrophic failure.

Seventy Percent of Borrowers will be in Default

We believe it to be not at all unreasonable to expect that 70% or more of borrowers will wind up in default on their federal loans when the lending system is turned back on.

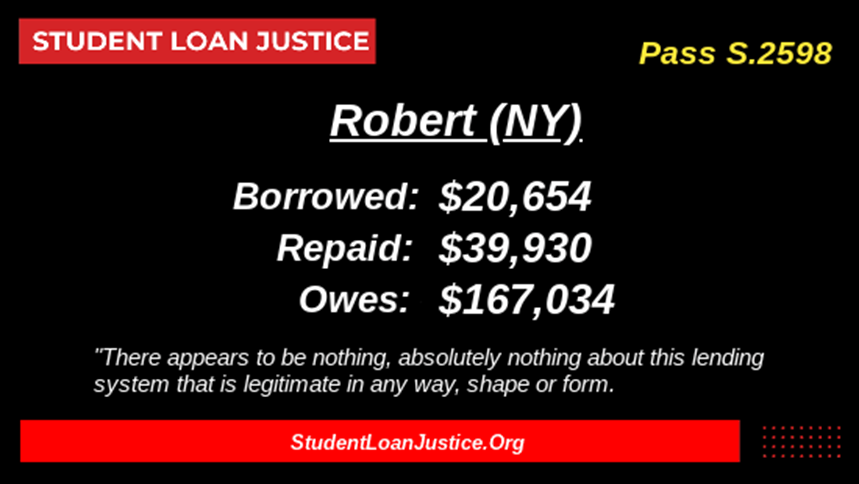

Unprecedented, and unwarranted of both bankruptcy rights, and statutes of limitations lie at the core of the student loan problem. In the absence of these protections, the lending side (up to and including the Department of Education) can- and does use this power to extract vast sums of wealth ruining the lives of borrowers, (one example below). The human cost of the predatory lending system has been massive. The harm that is poised to be exacted on the citizenry is incalculable.

One example of the people who have been harmed by these loans:

This cannot and should not continue. At a minimum, constitutional bankruptcy rights must be returned to these loans. The catastrophic proportions of this failure, however, are such that it probably would be best to simply cancel the loans, end the lending system, and replace it with a more rational, rationally priced, and fair higher education funding plan.

If you agree, please sign this petition.

Don’t we all know that this framing is ludicrous and false?

The government doesn’t make profits off this stuff.

The government doesn’t make profits. They have the money printing machine.

They do need to rig up a complex financial system that regularly burns the money out of the system, and they decide where to create those incineration points and who has to use them.

The loans and these defaults consolidations are simply a targeted tax on the class of folks lucky enough to go to college, but not lucky enough to have their parents pay for it.

And the evidence is if you don’t pay, eventually you start dealing with IRS and you see it on your tax returns.

Its called “Debt Forgiveness Income” and it is a beeatch.

A profit is revenue in excess of costs, and the Federal Gov’t is collecting more from defaulted loans than it cost them to create those loans. Hence, they are making a profit. As they own the money-printing machine, in the institution of the Fed, they of course have no need to make a profit. But that doesn’t mean that they aren’t. That is what having a recovery rate in excess of 100% means.

Upon graduation, I had loans with ten different lenders and sought to consolidate. I received a letter from one lender stating that my payment was overdue, and there were sixty days to resolve the issue.

I phoned them and was informed that the loan had in fact defaulted. When asked about the letter stating that I had sixty days to resolve the issue, they explained that “that was a computer error” but the loan had indeed defaulted and I was on the hook for an extra $5K to “rehabilitate” the loan. I paid, and eventually paid everything off, but the predatory nature of the lenders had become clear as day.

I can’t wait to see the comments on this that say the data is false – one has come in so far. One of the main issues with getting the general public on board with the predatory nature of student loans as well as believing the accurate data that Alan Collinge has provided is the complex and highly unusual nature of student loans. There are no other loans like student loans including that there are no bankruptcy rights for student loans. They do in fact ruin people’s lives and they are in fact a gold mine for the government and loan servicing companies that are in bed with the government. Otherwise why would they still be in existence? There is a March on DC February 28, 2023 when the SC is scheduled to review Biden’s micro-mini cancellation plan, that has a lot of conservative’s knickers in a twist. I hope some of this activism makes a difference. I will never pay off my loans and I am not planning to retire (64 now) unless I get forced out of work due to ageism. Student loans are like having a mortgage payment where the principal NEVER goes down. I can’t even imagine wanting to pay my 6 figure loan off – if I had the money I am pretty sure I would get scammed and it wouldn’t go away for years anyway just like the public service loans for many that should legitimately be forgiven but the system is so egregiously poorly managed that many are still paying.

I won’t say that the data is false, but I do feel like something is missing. Because the student loan program is not a profitable program for the government. A couple of years ago, I tried to look up the net profits generated by the student loan program, but I instead learned that the Department of Education required infusions of ~$40 billion per year to keep the loans flowing. That number nearly doubled when payments were suspended during the pandemic. Alas, I was unable to locate that link again with a quick search today, but here are some more recent analyses:

https://www.gao.gov/products/gao-22-105365

https://www.nasfaa.org/news-item/25689/White_House_Forecasts_68_Billion_in_Long-Term_Losses_for_Student_Loan_Portfolio

But aside from that one point, I very much agree with your criticisms of the program. They’ve treated students shockingly unfairly at times. It’s been an unjust gold mine for the loan service providers and universities. [Don’t forget the universities!! They’ve greatly contributed to the severity of the crisis with their relentless tuition hikes.] The absence of bankruptcy protection is a travesty of justice. And WHY is the government lending such large amounts of money to naïve 20-year-olds when in many cases we know they won’t be able to pay it back?

The WSJ had a nice series on this back in 2021 (starting with https://www.wsj.com/articles/financially-hobbled-for-life-the-elite-masters-degrees-that-dont-pay-off-11625752773) and for a while it was freely readable, but alas, it’s now behind the paywall. $150k of debt for a field of study where annual pay averages $30k? Sheesh.

Defaulted loans are making a profit, is what the article is saying, not that the loan program as a whole is. And, anecdatally, I know a more than one person who’s paid more than they borrowed, by a lot, and still owe a bunch more, and are technically in default because they’ve either given up making payments, or just stopped in protest (and despair).

Maybe it would be a good idea to have universities guarantee at least a portion of student loans – right now the incentives are completely messed up.

I don’t know what the proper word might be, but the word ‘predatory’ is not an accurate description of the system.

A predator, such as a lion, captures and eats one wildebeast and also shares that kill with other lions. The lion does not attempt to eat the entire herd of wildebeasts that exist on the Serengeti all by himself, which describes the student loan system as is.

The ultimate sub prime. Also a competitive advantage for the children of wealthy families. In my own circle/family not saddling the kids with debt is seen as quite virtuous. And think of all the rent getting paid to scoundrel landlords, IMO this was a major crutch for the con-omy after 08. We live in a right wing authoritarian (see supremes on NSA) oligarchy. When I do watch the “news” it feels a lot more like being preached to by a calvinist

Violently captures is the key phrase. Wildebeast is not voluntarily walking into lion’s mouth. Shouldn’t we address the demand side? Perhaps a bit of education about the higher education industrial complex scam would go a long way towards alleviating the problem.

> . . . Shouldn’t we address the demand side?

I was addressing the language side. Describing a monstrous system as predatory is an insult to predators and misdirects thinking.

Violently captures is not the key phrase, but it does show that the predator takes risk. As eventually happens, a Wildebeast kicks the predator in the jaw and that predator can eat no moar.

In the case of the higher education industrial complex scam, it attempts to eat all that enter, but in tegnost’s extended family, their young Wildebeasts will not avoid being eaten but escape digestion through not having debt when getting out. Note how ‘education fraud’ is not mentioned in this post. Young people are sold a lie they cannot easily escape before the ink dries from their signature obliging themselves to a corrupt system. Who would sign up for that were the actual expected results made plain? No one, that’s who, so the scam continues.

Moar language tricks.

‘Wage price spiral’ makes the victim think it’s their fault when the truth is ‘price wage spiral’.

‘Health care’. No less than Goldman Sachs lets a tiny beam of truth out. There is no profit in cures, therefore there is no funding to find cures, only funding for ‘treatment’ which generate ongoing profits. Wall Street has taken the money allocation function to mean ‘fuck society, what’s in it for me’.

‘Value’. Using that word to describe a ‘price’ is a mental straight jacket. When I encounter that, my guard goes up and look for other sleights of idea.

‘Monster’ is a human creation and ‘capitalism’ is a human creation and the word that describes this is ‘monstrous’.

It’s no wonder these educated, ‘children of a lessor god’>(as in self-funded), are late, but not lost, to the false promises…(lending language)…of the predations of the institutions they ‘once believed in’.

I guess people just want to pick and choose what parts, or parts of parts, of the constitution one wishes to care about. For example; the one sentence second amendment “A well regulated Militia, being necessary to the security of a free State, the right of the people to keep and bear Arms, shall not be infringed.” … point being, what well regulated Militia did those mass shooters belong?….yea, no talk about that but just the last part please.

Freedom of speech…. hell yea . and so what? if it offend me or cause some kind of stampede or mayhem that causes somebody to lose their life (sarc)

Equal rights except when it come to the Police.

Constitutional bankruptcy protection to avoid debtors prisons and social breakdown….except for debts imposed by courts (go to jail poor boy or girl) and of course students with loans….can’t have educated folk around protecting democracy…got to get em stupid to go off and fight for the survival of the financial hucksters and parasites feeding on this here constitution and multiplying in the body politic.

+27 to your whole, very excellent, comment! BTW, I took out student loans decades ago, and had no problems paying them back. That helped me establish credit. But, to repeat, that was decades ago.

Why did college costs go exponential the past 40 years?

In my own study of this question, I read books by Elizabeth Warren, who hails from the left side of the political aisle, and Richard Vedder, who’s decidedly on the right. Both of them came to the same conclusion:

They charge THAT much because they can.

All those admins, deans, provosts, associate deans, vice provosts, etc., raking in $250K a year, and then there are the coaches, whose compensation is really something else.

I wonder how the various repayment programs such as REPAYE, which calculates monthly payments based on “discretionary” income is factored in.

https://www.ed.gov/content/your-federal-student-loans-just-got-easier-repaye

The repayment period is 20-25 years, during which the payment may not even cover the interest. Then the massive debt will be “forgiven” and the IRS reaps taxes on this “gift” to this misfortunately educated soul.

College costs went exponential about 15 years ago, around the time of the 2008 financial crisis, and this is the reason that we now have a student debt crisis. This chart indicates when student debt jumped from numbers in the low hundreds of billions to trillions. It ironically occurred during a period of record low interest rates ( see Fed ZIRP policy ).

U.S. universities have created a student loan crisis that has saddled generations of Americans with unmanageable debts which they may never be able to repay. While a university education was always expensive, the cost and debt required to finance it has skyrocketed since 2009. According to Wolfstreet:

“Student-loan balances on the government’s financial statement skyrocketed from $147 billion in 2009 to $1.37 trillion at the beginning of 2020, despite the 11% decline in student enrollment since 2011.”

There have been countless articles explaining the unmanageable burden of student debts, including ones that estimate borrowers may need over 100 years to repay their student debts. And so in March 2020, the U.S. federal government took the extraordinary step of pausing all federal student loan payments as part of its COVID relief CARES Act. Think about that for a moment – the U.S. government needed to freeze all payments on one of the largest categories of consumer loans for over two years. This was good in that it helped to temporarily lift the unmanageable burden of student debts, but it also made it impossible to determine the true delinquency and default rates of current student debt ( those numbers are likely now calculated from non-federally funded private student debt which is only 8% of the $1.7 trillion in student debt ).

Universities are designated under our tax code as 501(c)(3) educational organizations, which are exempt from all federal and state income taxes, because they are supposed to be nonprofit businesses that have a mission to inform and educate individuals or the general public. They also don’t pay any property taxes on university land, and can issue tax exempt bonds to fund construction, renovation, and operational costs. This does not include the $50 billion per year the U.S. government pays to universities in federal contracts and research grants. These institutions are eligible for almost every government subsidy and tax loophole imaginable.

All of these privileges do not mean that universities pay most of their front line staff generously. According to a Berkeley study “25 percent of “part-time college faculty” and their families now receive some sort public assistance, such as Medicaid, the Children’s Health Insurance Program, food stamps, cash welfare, or the Earned Income Tax Credit”. The real picture is that only a few illustrious professors, administrators, and university contractors ( famous architects come to mind ) gorge on outsized compensation, while the rest of its staff receives only leftover crumbs.

By far the biggest of all these subsidies is our federal governments willingness to loan trillions of dollars to a universities customers ( students ), without any evaluation of their ability to repay, so these students can pay whatever tuition the university decides is reasonable. It is in this environment of supreme privilege and protection, that tax exempt and supposedly not for profit universities have chosen to shockingly overcharge their students. And because none of these institutions considered the long term consequences of these actions, we are just now starting to realize we are in a student loan crisis. The debt burdens they foisted on all these students will likely hinder our national economic health for several generations. While temporary fixes like student debt relief will just encourage universities to continue these unethical practices.

To give you an idea of what comparable schools cost in different countries, undergrad tuition at Switzerland’s Swiss Federal Institute of Technology ( ETH Zurich ) is $1,300 USD per year, undergrad tuition at Japan’s University of Tokyo is $4,000 USD per year, undergrad tuition at the UK’s University of Oxford is $11,000 USD per year, and undergrad tuition at the USA’s Harvard University is $54,000 per year. Can you spot the outlier?

So forgiving some portion of past student debt is a good start to helping currently indebted students. But if nothing is done to manage university fees, then future student debt will just end up with the same problems.

I recommend we have someone investigate the precise nature of how universities and banks created this student loan crisis, and make suggestions for how we can prevent it from ever happening again.

Have universities guarantee at least a portion of the student loans – give them a reason for students graduate with useful degrees and succeed in the job market.

Truth! Lincoln, great comment, thank you.

Same questions as for the hospitals. If they are nonprofit and charging massive sums above the cost of services, WHERE IS THE MONEY GOING? Somebody is getting rich. WHO IS IT?

Thank you for the informative comment. I would add that the person ,most responsible for this situation is Joe Biden. It is also Joe Biden that said even if the House and Senate would pass a bill for universal health care he would veto it. Joe’s foreign policy is also a disaster. His reaction to the threat of global warming was to lease more public land and waters to the oil companies than Trump. His promises usually turn into lies.

Looks like the Uncle Sam and the university administrators (the ‘badmin’) believe that the Gambino family are great management consultants