The incompetence of our financial regulators, most of all the Fed, is breathtaking. The great unwashed public and even wrongly-positioned members of the capitalist classes are suffering the consequences of Fed and other central banks being too fast out of the gate in unwinding years of asset-price goosing policies, namely QE and super low interest rates. The dislocations are proving to be worse than investors anticipated, apparently due to some banks having long-standing risk management and other weaknesses further stressed, and other banks that should have been able to navigate interest rate increases revealing themselves to be managed by monkeys.

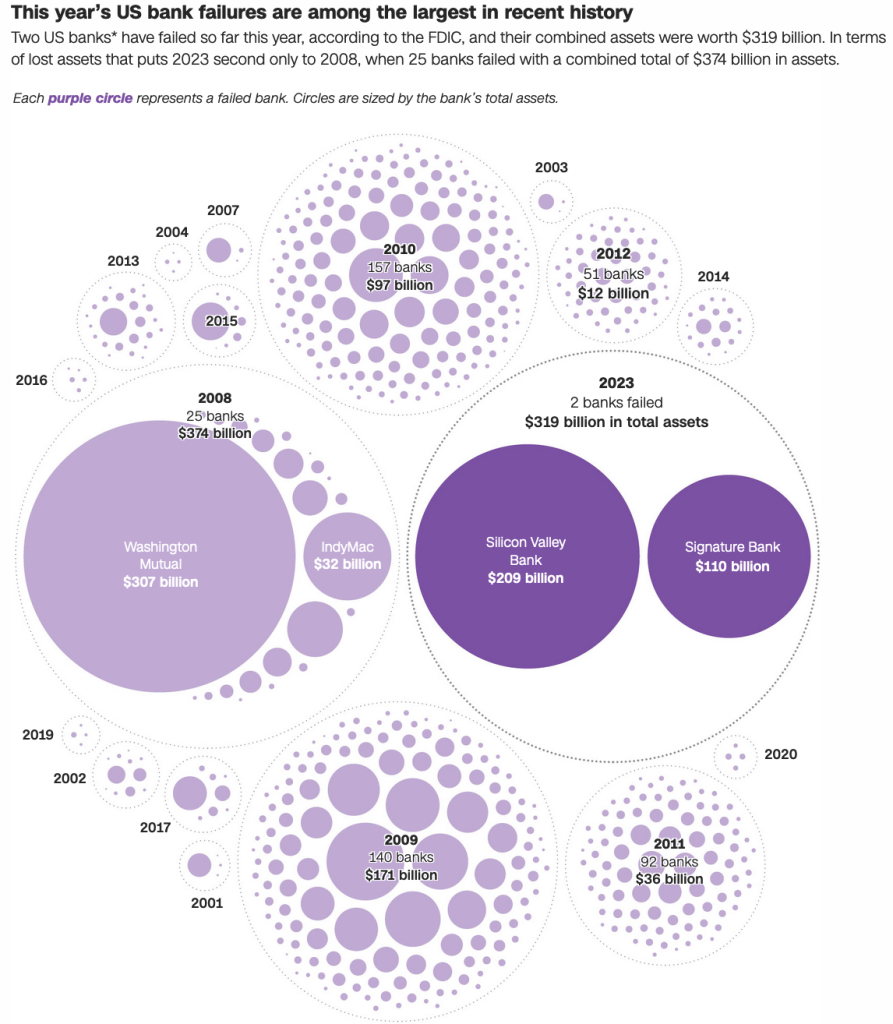

What is happening now is the worst sort of policy meets supervisory failure, of not anticipating that the rapid rate increases would break some banks.1 Here we are, in less than two weeks, at close to the same level of bank failures as in the 2007-2008 financial crisis. From CNN:

And even mainstream media outlets are fingering the Fed:

After SVB collapse, almost 190 new banks could fail, says new study ~ should be an interesting week. https://t.co/K3b6rURLwA

— What Goes Around Comes Around (@Turningoftheti1) March 19, 2023

As we’ll explain in due course, the regulators’ habitual “bailout now, think about what if anything to do about taxpayer/systemic protection later” is the worst imaginable response to this mess. For instance, US authorities have put in place what is very close to a full backstop of uninsured deposits (with ironically a first failer, First Republic, with its deviant muni-bond-heavy balance sheet falling between the cracks). But they are not willing to say that. So many uninsured depositors remained in freakout mode, not understanding how the facilities work. Yet the close-to-complete backstop of uninsured deposits amounted to another massive extension of the bank safety net.2

The ultimate reason the Fed did something so dopey as to put through aggressive rate hikes despite obvious bank and financial system exposure was central bank mission creep, of taking up the mantle of economy-minder-in-chief. That was in tune with the widespread acceptance of neoliberal views of minimizing not just oversight and regulation but also overt microeconomic policy. Can’t be choosing winners and losers, national interest be damned.

That orientation allowed the executive branch and Congress to engage in pork-oriented economic policy, resulting in industrial policy by default that bloated preferred sectors like the military industrial complex, the medical industry, higher education, real estate, and finance. But it is Congress and the Administration that have the much greater ability to devise and implement more targeted programs, and make a point of favoring ones that are countercyclical.

Instead we have the Fed using the blunt instrument of interest rates to try to crush labor, when unlike the 1970s, labor bargaining power is weak and this inflation is largely the result of supply issues.3 As we predicted, the only way for te Fed get inflation down via interest rate increase would be to kill the economy stone cold dead. It appears to be reaching that end faster than anticipated by killing banks.

Mind you, reversing super low interest rate policies would inevitably lower asset prices, particularly those of highly-responsive financial assets. But there are better and worse ways to administer painful remedies, and the Fed has been particularly inept. The central bank did do one thing right, which was to signal its rate increases way in advance. But it bizarrely ignored how the crypto collapse might affect depositor/investor perceptions of risk. And per the New York Times, it saw serious problems at Silicon Valley Bank, yet the official strictures didn’t rise to the level of wet noodle lashings:

In 2021, a Fed review of the growing bank found serious weaknesses in how it was handling key risks. Supervisors at the Federal Reserve Bank of San Francisco, which oversaw Silicon Valley Bank, issued six citations. Those warnings, known as “matters requiring attention” and “matters requiring immediate attention,” flagged that the firm was doing a bad job of ensuring that it would have enough easy-to-tap cash on hand in the event of trouble.

But the bank did not fix its vulnerabilities. By July 2022, Silicon Valley Bank was in a full supervisory review — getting a more careful look — and was ultimately rated deficient for governance and controls. It was placed under a set of restrictions that prevented it from growing through acquisitions. Last autumn, staff members from the San Francisco Fed met with senior leaders at the firm to talk about their ability to gain access to enough cash in a crisis and possible exposure to losses as interest rates rose.

It became clear to the Fed that the firm was using bad models to determine how its business would fare as the central bank raised rates: Its leaders were assuming that higher interest revenue would substantially help their financial situation as rates went up, but that was out of step with reality.

By early 2023, Silicon Valley Bank was in what the Fed calls a “horizontal review,” an assessment meant to gauge the strength of risk management. That checkup identified additional deficiencies — but at that point, the bank’s days were numbered.

This shows that the Fed actually knew what a hot mess Silicon Valley Bank was, using risk models that assured it would be positioned 180 degrees wrong in the event of the absolutely gonna happen Fed interest rate increases.

And what did the regulator do? Scold and restrict acquisitions. Help me. That plus restricting dividends was the sanction the Fed has sometimes applied to wayward big banks. But the Fed made public these big banks were in the doghouse, using shareholders to punish bank executives (remember all big US concerns have stock-price-linked executive pay). And these big banks are presumed to be in the business of consolidation, so barring acquisitions is a bit of a ding. By contrast, Silicon Valley Bank had just acquired Boston Private in July 2021, so it’s not as if it would be likely to be on the acquisition trail any time soon.

The New York Times makes much of weakening of supervision of banks under $200 billion playing a role in this affair. But the regulators were on to the problems at Silicon Valley Bank. What appears to have been missing was not recognizing the Silicon Valley Bank was train wreck in the making, but the failure to make adequate interventions.

The Times does serve up one idea:

Officials could ask whether banks with $100 billion to $250 billion in assets should have to hold more capital when the market price of their bond holdings drops — an “unrealized loss.” Such a tweak would most likely require a phase-in period, since it would be a substantial change.

First, this is not such a hot idea because when interest rates are rising, bank stock prices are weak. This is why banks can get into a doom loop: they need more equity precisely at the time no one except Warren Buffett (who is usually able to extract official subsidies) is willing to give it to them. The time to strengthen capital levels are when times are good. Rules like this could well wind up being prejudicial: if a bank was healthy but trying to build up more reserves pre-emptively in a tightening cycle, it could be assumed to be already in trouble.

Second, the regulators had already started dinging Silicon Valley Bank and were giving it more demerits, yet actual punishment was non-existent. Some think, as the Times mentions, that the SVB CEO being on a San Francisco Fed advisory board contributed to the overly deferential treatment. Bear in mind the regional Fed boards have absolutely zero influence over those bodies. They do not supervise regional Fed operations or staff in any way, shape or form.

However, cozy relations at the top could easily make staffers fear that their critical assessment would be watered down or ignored, even before getting to the general pattern in the US of undue deference towards the regulated This sort of thing has happened, witness the case of New York Fed whistleblower Carmen Segarra, who was fired from the New York Fed for not being willing to weaken her findings about deficiencies at Goldman.

Where are the Benjamin Lawskys, who threatened recidivist money launderer Standard Chartered with revoking its New York banking license?4 Without going down the rabbit hole of the finer points of procedure, if noting else, the Fed has the power to take formal enforcement actions. The New York Times account suggests things were going enough off the rails for the regulator to at least threaten one as of a date certain if Silicon Valley Bank failed to remedy some of its deficiencies. But obviously no serious action was taken.

Now to the other big news sick bank, Credit Suisse. Its collapse reflects the even bigger regulatory failure in Europe, whose post-crisis reforms managed to make ours look good.

Admittedly, Europe has the big misfortune to have universal banks. These are banks that do everything from retail banking to fancy Wall Street wizardry. They are also much bigger in GDP terms in aggregate than US banks because Europe has much smaller bond markets, so bank lending is an ever more important source of funding.

But these institutions grew up from being retail banks and never grew out of it. That means they are typically slow-footed and not well run. If more competent leaders come in, they usually can’t effect much change or like Jospf Ackermann of Deutsche Bank, succeed in “transforming” the bank so as to facilitate executive enrichment.

Europe had undercapitalized banks going into the 2008 crisis and failed to make them do enough in lowering their overall leverage levels. They also failed to undo the pernicious relationship between sovereign debt and bank balance sheets, where weak banks hold the debt of weak countries like Italy, where only the tender ministrations of the ECB keep those bond yields down, which helps these states fund at the expense of having ticking time bombs on bank balance sheets (if the ECB let sovereign bond yields go to market levels, a lot of banks would have big holes in their balance sheets).

So long before this crisis got a good head of steam, Deutsche Bank and the Italian banking system were widely recognized as wobbly. Monte del Pasci was bailed out in 2016. There have been complicated efforts to defuse UniCredit, the biggest, sickest Italian bank. Deutsche Bank, despite having raised nearly $30 billion in equity over time, looked positively green in 2017, with Mr. Market rejecting a turnaound plan.

But as Nick Corbishley has dutifully chronicled, Credit Suisse became the sickest European bank in 2021 due to weak earnings and some impressively bad business calls, most importantly being very exposed to the failed supply chain financier Greensil. Why didn’t the Swiss National Bank act after it took that body blow?

Keeping in mind that both of Switzerland’s behemoths, UBS and Credit Suisse, got in a heap of trouble in the crisis, with UBS being one of the most enthusiastically self-destructive users of CDOs. Not only did they eat a lot of their own bad cooking, but they were a leader in the so-called negative basis trade, which was a spectacular form of looting. The short version is traders bought other people’s CDOs, supposedly insured them with credit default swaps, and then got to book all the expected future profit in the current P&L and get paid bonuses on those fictive profits.

Switzerland, after an enormous rescue of UBS, ordered both big banks to get out of investment banking and go back to being private banks. That resolve to revert to the simple life was undermined by the US going after Swiss banking secrecy, leading sneaky American customers to decamp to “no tell” jurisdictions like Singapore and Mauritius. I am not up to speed on Swiss oversight, but l’affaire Greensil suggests the SNB was letting its big charges walk on the wild side again.

To confirm the debilitated state of Credit Suisse has been well known, some snippets from Nick’s posts:

September 2022 Fast-Shrinking TBTF Giant Credit Suisse Is Living Dangerously:

It was in the Spring of 2021 when Credit Suisse’s current crisis began. And that crisis has revealed glaring flaws in its risk management processes.

As readers may recall, two of the bank’s major clients — the private hedge fund Archegos Capital and the Softbank-backed supply chain finance “disruptor” Greensill — collapsed in the same month (March 2021). By the end of April 2021, Credit Suisse had reported losses of $5.5 billion from its involvement with Archegos. Its losses from its financial menage á trois with Greensill and its primary backer, Softbank, are still far from clear, as the bank is trying to claw back almost $3 billion of unpaid funds for its clients (more on that later).

October 2022 Credit Suisse is One of 13 Too-Big-to-Fail Banks in Europe, But It Looks Like It Could Be Failing:

Credit Suisse is one of 13 European lenders on the Financial Stability Board’s list of Global Systemically Important Banks (G-SIBs). In other words, it is officially too big to fail, but it is nonetheless precariously close to failing. Yesterday it disclosed a whopping third-quarter loss of $4 billion — more than eight times average estimates of just under $500 million. The loss was largely the result of a reassessment of so-called deferred tax assets (DTA).*

This is Credit Suisse’s fourth quarterly net loss in a row. So far this year, it has posted $5.94 billion of losses. Net revenue, at $3.8 billion, was up marginally on the previous quarter but down 30% from Q3-2021. The value of its asset base has shrunk drastically, from $937 billion in December 2020 to $707 billion today. The group’s common equity Tier 1 ratio has also fallen to 12.6%, well below its target of at least 13.5%.

To right the ship, CS has presented a new strategic overhaul — its third in recent years….

I could give you more of what amount to interim reports from Nick, but you get the drift of the gist.

To keep this post to a manageable length, as most of you know, UBS entered into a shotgun marriage with Credit Suisse over the weekend. The nominal purchase price was close to $3 billion, but watch the shell game. From the Wall Street Journal:

The Swiss government said it would provide more than $9 billion to backstop some losses that UBS may incur by taking over Credit Suisse. The Swiss National Bank also provided more than $100 billion of liquidity to UBS to help facilitate the deal.

UBS and European bank stocks opened down, in a vote of not much confidence, although the bank stocks have pared their losses. Mr. Market appears to have worked out that merging two dogs does not produce one healthy cat.

Central banks are also signaling panic by opening emergency swap lines. This action is aimed at helping banks whose home county is not the US get dollar funding (their home country bank will create home country currency, swap it into dollars, and then lend it to their banks). This suggests that foreign banks are having trouble borrowing dollars, or at least on good enough terms. They would need to borrow dollars to fund dollar positions. Are we to assume that this intervention is occurring because haircuts on Treasuries used in repos have gone up? Informed reader input appreciated. From the Financial Times:

The Federal Reserve and five other leading central banks have taken fresh measures to improve global access to dollar liquidity as financial markets reel from the turmoil hitting the banking sector.

In a joint statement on Sunday, the central banks said that, from tomorrow, they would switch from weekly to daily auctions of dollars in an effort to “ease strains in global funding markets”.

The daily swap lines between the Fed and the European Central Bank, the Bank of England, the Swiss National Bank, the Bank of Canada and the Bank of Japan would run at least until the end of April, the officials said.

Of course, the Fed could have addressed the problem of interest rate increase overshoot directly by cutting interest rates by 50 basis points and making noises that quantitative tightening was on hold for the moment. But panic is too far advanced for that sort of simple intervention to now have much impact.

Finally, back to a main point, that yet more subsidies of banks will simply enable more incompetence and looting absent getting bloody-minded regulators, a prospect that seems vanishingly unlikely.

Elizabeth Warren is again taking up her bully pulpit of calling for more bank reform, but technocratic fixes are inadequate with a culture of timid enforcement. The only remedy in all the years I have read about that might have a real impact quickly creates real skin in the game. It proposed by of all people former Goldmanite, later head of the New York Fed William Dudley.

Dudley recommended putting most of executive and board bonuses in a deferred account, IIRC on a rolling five-year basis. If a bank failed, was merged as part of a regulatory intervention, or wound up getting government support, the deferred bonus pool would be liquidated first, even before shareholder equity. Skin in the game would do a lot more to curb reckless behavior than complex new rules.

Of course, Dudley’s proposal landed like a lead balloon.

_____

1 Interest rate increases from low levels hit asset prices harder than increases from higher interest rate levels. An interest rate increase from 0.5% to 1.5% lowers bond prices much more than an increase of 4.5% to 5.5%.

2 If you believe that the Bank Term Funding Program, because it offers loans against eligible collateral of up to a year, will therefore be around for only a year, I have a bridge to sell you. It will either be extended or some other backstop will be put in its place.

3 Careful analyses that look at the sectoral behavior of inflation find it is due to:

-Supply chain issues coming out of Covid (example: Toyotas being sold at dealers now at $2000 over MSRP due to the backlog of car demand still not being satisfied). Lots of evidence that the stubbornly tight labor markets are an artifact of Long Covid and Covid-concern or related early retirements (this is big in medicine here).

– Sanctions blowback

– Some agriculture issues due to weather, bad harvests, special situations like the US massive avian flu chicken cull

– At least in the US, corporate price gouging

4 This is no exaggeration. From the New York Department of Financial Services order dated August 6, 2012 (emphasis original):

IT IS NOW HEREBY ORDERED that, pursuant to Banking Law § 39(1), SCB shall appear before the Superintendent or his designee on Wednesday, August 15, 2012, at 10:00 a.m., at the Department’s offices located at One State Street Plaza, New York, NY 10004, to explain these apparent violations of law and to demonstrate why SCB‟s license to operate in the State of New York should not be revoked; and

IT IS HEREBY FURTHER ORDERED that, on August 15, 2012, SCB shall also demonstrate why, pursuant to Banking Law § 40(2), SCB‟s U.S. dollar clearing operations should not be suspended pending a formal license revocation hearing

Standard Chartered had a complete hissy in the press, as did the Federal regulators that assumed Lawsky had end run them (he’d gotten the Fed’s consent to go ahead on his own, with the Fed not recognizing what turning a former DoJ prosecutor loose might entail). However, Standard Chartered agreed to all sorts of intrusive things before the hearing date, proving the truth of the saying: “When you have them by the balls, their hearts and minds will follow.”

Nice finesse by the Swiss. AT1s vaporized but Saudi/other equity owners alive. Would have some credibility and be consistent with the “rules” er…indenture were it not for the 9B CHF taxpayer backstop of the losses on the Tier 3 dreck. Clearly, the Swiss know that CS is insolvent and yet let equity owners live. Politicians always make up the rules as they go along and pay rent to the rent-seekers. See Janet’s farcical declaration of SVB as a SIB….

Careful not to trigger a CDS “event” now. That could get messy right quick.

Prospectus for CS AT1 said Swiss regulator FINMA “may not be required to follow any order of priority” meaning that the AT1 could be cancelled before the equity. “It was clear in the prospectus but people hadn’t read it.

https://www.reuters.com/business/finance/credit-suisse-rescue-presents-buyer-beware-moment-bank-bondholders-2023-03-20/

All of my PMC peeps seem to be on the conventional track: “Let’s go after the Deplorables to solve this problem.” Denial ain’t just a river in Egypt. Reminds me of one of Rod Serling’s many Greatest Hits: “How about you? You still on Earth, or on the ship with me? Really doesn’t make very much difference, because sooner or later, we’ll all of us be on the menu… all of us.“

It seems to me the Fed actions, in addition to incompetence and corruption, is locked into assisting USA foreign policy of putting pressure on foreign countries. Previous article illustrated IMF trying to force small countries, Zambia, to reduce ties with China.

High interest rates create chaos in the world. A little blowback is expected and accepted.

I know it”s easy to surmise that, but trust me, US interest rate moves are solely about domestic policy. The Fed has never cared about the overseas impact of its interest rate changes. As 1971 Treasury secretary John Connally said to European officials, “The dollar is our currency, but it is your problem.” In 2014, some emerging economy central bankers, led by the Princeton economist, now India’s central bank governor, Raghuram Rajan, visited Bernanke to complain about how the Fed’s rate increases were hurting them. Bernanke made clear he had zero interest.

I was under the impression that the Yellen and Bernanke FED regimes cared about the Eurodollar market. Clearly Powell doesn’t anymore as the Eurodollar market is getting hammered.

I think LIBOR vs SOFR is an important piece to this discussion as well.

Heightened interest rates only worsen Non-Western countries. Why? With all the IMF “Loans” aka DEBT, now those nations are forced to pay even higher costs for food, materials, and productivity. Poverty will grow even higher.

Economist Michael Hudson has pointed out this crucible more than once. And you wonder why Non-Western nations (exempting their Super Rich in those nations) are trying to leave the entirely corrupt Western Financial World?

One thing I’ve learned over the years is that if powerful people are making decisions that cause outcomes that seem stupid and ham-fisted in the aggregate, then it’s not because the decision makers are stupid and can’t see the damage they are causing.

It’s because they have motives they are hiding. And if they are continuing to pursue their ‘stupid’ moves, then somewhere, something they really want is working out for them. But, if whatever they really want to happen is not happening, then only then will they change their actions. We mostly do not know what the true motivations are.

And the self-named “elites” are a giant mesh of culture, beliefs and interests that have trapped us all. You can make more out of what is permitted to happen (rising interest rates) by the elite mesh, than by looking at discrete decisions. So imo if raising interest rates in the US harmed its interests abroad, it would never have been allowed to happen. Ergo, there are benefits for US hegemony in raising interest rates, and the post earlier detailed explained some.

Many thanks, Yves Smith: This is the first article about the crisis itself and its underlying causes that I finally understand thoroughly. I guess this is the reason that I come to Naked Capitalism to learn about economics…

Footnote 3: Well, those data are enlightening indeed.

Bill Black has a great explainer re the ridiculous failed risk management at SVB and Signature, and the general tend in “thinking”, if we can call it that, of the economists at places like the Fed, on bank regulation.

Its over an hour but highly recommended. Not only for the insight but for the humorous way he skewers these incompetent anti-regulators.

Bill Black: https://www.youtube.com/watch?v=n4axBfNjnZQ&list=LL&index=2

Thanks for this link.

new definition: “efficient banking”, noun, oxymoron implying safer banking but in practice makes banks much riskier for depositors.

Somewhat tangential but I have been surprised at the lack of attention to last week’s Frontline episode “Age of Easy Money”

Like so many historical reviews of financial crises it’s interesting to see what’s in and what’s out. The Tea Partiers get a shout out but Occupy doesn’t rate a mention (to be fair the TP elected a president more or less). Jospeh Stiglitz is interviewed at length and does a credible job of explaining the problems. Geithner is curiously absent. Etc.

I am not a fan of Frontline. I have seen them make abject misrepresentations to advance certain pet political interests and mangle other important stories. So I’m not willing to watch their shows, much the less imply they are reliable. However, your usage is informed, that of treating it as a reflection of orthodox thinking.

Speaking of that, I happened to catch the last minute of 60 Minutes last night . . . looking for the basketball game . . . and it was a perfect minute of reassurance that the Fed has done a great job in controlling this crisis and there is “nothing to see here”.

Which, when you consider the audience of 60 Minutes, is preaching to the choir, or as they used to say, the blind leading the blind.

Oh my, how the mighty have fallen. There was a time (now long ago) when 60 Minutes actually did some good investigative journalism. Now it consists mainly of sycophantic interviews with government officials, business executives, sports stars, and movie celebrities.

Hoping against hope, I still tune in to its opening summary of stories. I am always predictably disappointed. Last night’s edition? The Fed propaganda you mention, plus some war-mongering vis-a-vis China, plus a profile of some soccer hero. Needless to say I didn’t watch.

if you wanna watch a guy do a real journalism 60 minutes style, watch this. and please watch it all. he is entertaining, yet educational. plus i love brown bread.

amazing over view of how dope capitalists, a libertarian wet dream, flooded boston with 700,000 gallons of molasses, causing massive deaths and destruction, socialists had to clean up the mess, and of course the capitalists refused to take responsibility.

https://www.youtube.com/watch?v=KMWrk_94L8Y

The video is “no longer available.” Typical.

i just watched it.

Though I’ve been following this, to date I hadn’t been personally worried about my bank account as way too small, though of course taxpayers lose and rich guys win as always. But last night the local news brought on an economist to explain to us all that our deposits were safe.

Now I’m worried.

And their “serious” voiced narrators really rankle given how wrong they are on most subjects. Its more a vehicle for PMC arrogant bolster to their false-confident sense that they’re the “reality-based” community when they really haven’t much of a clue. Trust the experts seems to be the tone they’re going for. After the last 20 years, why ever would one trust any of these failures. And so they lose it even more and try to censor us and jab us for our own good of course. Frontline, NPR, even Nova stinks now.

On the flipside, Poker Face was a great little entertainment. Throwback to Columbo and other great early detective shows with a twist and strong contemporary, Gen-X feel (thanks to Natasha Lyonne). Highly recommended.

@Bjarne, 9:21

Thx for the tv show recommendation.

I find the current crop of tv generally unwatchable: predictable, boring, super woke – yawn. When I do watch tv (ca. 5 hours/week) I watch shows from 20-40 years ago.

Then I think you’ll like Poker Face. Doesn’t take itself too seriously yet written very well, excellent cast with different actors you’ll recognize in every episode. They got real talent for this one and it shows. Lots of fun little digs at all the right (more or less) contemporary silliness as well, but doesn’t get in the way of fun storytelling. Enjoy!

Like the most of PBS and NPR, Frontline has become a vehicle for delivering official narratives approved by our ruling elite to supposedly “educated” viewers. Russiagate and the demonization of Vladimir Putin are prime examples. I stopped watching after the 2016 election, when the program degenerated into rank propaganda.

By taking aim at the financial elite and the Fed they kind of missed the All Everything Asset Bubble. Many of the people watching have much of, if not all of, their nest egg in their oh-soo-valuable homes. The complacent home “owning” viewers were probably a bit less concerned about their own situation due to the oblique presentation. Only a small percentage of Americans directly own stocks and bonds. The less astute viewers may have been left with Alfred E. Newman’s nonchalance.

I watched the Frontline episode last week. My husband, the engineer, had loved it because, as a non-economist, non-financial person, it gave him an easily understandable overview of how how all that money came to be sloshing around the system. As well as the fact that many of our current problems are caused by ‘too much money.’

So, he recommended it and, I found it very watchable and, mostly, on track. And, yeah, I’m like, where is Occupy?

Yeah it was all the weirder because the 2008-9 video clips clearly have Occupy protesters/signs but they never identified or mentioned the protests by name at all. Only the TP types.

No Bernanke, No Rubin, No Geithner, but we get a lot of Neal Kashkari cheerleading for the Fed. I was also surprised they featured Roubini.

I didn’t mention the program because I thought it was great just curious at the way the narrative ended up being captured. And the program did center the victims of these policies in some sense, they do seem to suggest by the end of the program that the end of easy money is also likely the end of support for certain standards of living, retirement, health care etc.

> . . . the only way for te Fed get inflation down via interest rate increase would be to kill the economy stone cold dead. It appears to be reaching that end faster than anticipated by killing banks.

The banks being killed would be the Peasant’s banks presumably or at least not the TBTF banks, and since we are being lied to all the time, the claim by the liars that bank consolidation, whereby the TBTF banks eat all the small ones is not the desired outcome, is a lie. The SVB failure was anticipated by the FED and precipitated by the billionaire deposit rug pull so it is the exception. Yellen clearly told the questioner from Oklahoma that if a small bank there failed the depositors with amounts greater than a quarter million would not be bailed out.

I find it to be too credulous that the FED is incompetent. We are being rug pulled by them as planned.

(Not a fan of offering flattery in commentary sections but items like these above make NC a standout online. And the comments that come with it. Since substance in the entry will draw substance in comments, more likely than not.

And not just this one. Lately several other entries too.

So, many thx.)

Thanks for this Yves, alarming. So, where are we headed?

Best…H

Yasgur’s farm.

An observation from someone who dwelled upon the edges of the old Hippy movement.

The phenomenon of the original Woodstock was an expression of the freedom granted to a significant portion of the American population by the distributionist tendencies of the New Deal social contract. The children of the newly emergent Middle Class were given the freedom from want and privation that allowed them to focus their energies elsewhere than upon simple survival. This loosened the elite’s control over the general population to such an extent that a concerted campaign was enacted, decades in the doing, to roll back the New Deal freedoms. Today we are seeing the fruition of that reactionary program.

The old Hippies lived in hard scrabble communes, wandering tribes, and enclaves of free thinking within the population centres of the West. This was only possible because those social experimenters were free of fear. Their society at large promised them solid backstops.

Today’s “deplorables” live in similar hard scrabble communes and wandering tribes. However, those modern day “hippies” live under the shadow of fear in all it’s guises. The main fear being sudden and unexpected death, from preventable causes. Starvation in America is not a technical problem. Starvation in America is a political problem. That it is allowed to continue and grow is a reflection upon the Political ethos at the top in America today.

What I am saying above is nothing new. It has been pointed out again and again throughout recorded history. Those making the important decisions concerning how the society is run will not change their course until force is bought to bear on them.

Everything that was old is new again.

Stay safe and try to survive with dignity.

I live with the deplorables, they are great neighbors. Thanks Ambrit.

Best…H

Thank you for being brave in being the Vanguard. The phenomenon of the ‘Example of the Possible’ is what you are doing in your political struggles. Keep up the good fight.

Now you’re gonna make me cry. Xxoo

Best…H

Well put, thank you. The shadow of fear is everywhere these days.

Too true! Franklin Roosevelt was exactly correct. We do have to fear “Fear.”

When I understood the power of fear upon the Terran human psyche, it was an epiphany.

My second existential discovery was that everything is in motion, continuously. There is no sitting still. Likewise, there is no automatic movement towards the future. Cribbing from Marshal McLuhan: “The movement is the message.”

Enough pseudo profundity for now. Stay safe.

Nice comment, ambrit.

Agreed. It seems this force can only come from enough people — neighbors, co-workers, etc. — uniting on the basis of what they share: precarity, insecurity, and an early death arranged by elite decisions made in their name but not their benefit.

Yes, but . . The campaign to roll back the New Deal and its collateral freedoms was ratcheted up about 1968 but it had begun 24 years earlier while FDR was still living.

At 10:00 PM on the evening of July 20, 1944, as the delegates to the Democratic Party National Convention in Chicago were returning to their seats after marching around the Chicago Stadium in celebration of the renomination of the president by acclamation, the convention was about to do likewise for Vice President Henry Wallace when a cabal of big-city bosses and southern Democrats convinced the temporary chairman to gavel the session closed. After an overnight flurry of wheeling and dealing Wallace fell short of a majority in the first ballot the next morning. His support collapsed and Harry Truman, a machine pol from Kansas City won the necessary majority on the 2nd ballot. Wallace was all in on the New Deal program, however Truman was not. Among history’s great “might-have-beens” are how differently things might likely would have gone if FDR had lived out his 4th term or had Wallace been renominated in 1944.

I often wonder “what if”. The world would have been a better place if Wallace had become president instead of Truman, is my bet

So there will be music?!?

Best…H

There will always be music! Cheers.

Thank you for this. Aside from the nostalgia high, one thing that I noticed was that hippies were thin. Compare and contrast.

They hadn’t been ‘Super Sized’ yet. Food was still fairly simple. Life was more physically active.

Today’s younger cohorts do seem to highlight the dangers of adverse evolutionary selection.

Be safe!

This is an observation I have noted many times myself, relating to young people in the US, the UK and here in Australia.

Further to that, the observation that Australians in SE Asia during the late 1970s were frequently referred to as “Jelly Bellies”, because of the physical effects of copious beer drinking. In those days it was hard to find overweight locals in SE Asia.

However nowadays overweight locals are common in SE Asia, in particular children, sadly. Increased affluence, combined with the ubiquitous availability and consumption of western fast food and soft drinks, has taken its toll.

Re Silicon Valley: What kind of management team and board ignore outside warnings that their liquidity levels and their asset/liability matching are problematically risky? They were so advised not only by their regulator but also by consultants from BlackRock,it has been reported. Regulatory enforcement was weak and management may have been driven by personal greed, yes, but those factors alone do not explain why a “bank” supposedly key to the “innovation economy” of venture capitalism was not supported by its community. Why didn’t the VC community come to its rescue? What did they know?

re: “bloated preferred sectors like the military industrial complex, the medical industry, higher education, real estate, and finance.” I think Yves has hit on a new acronym for rentier troublemakers: FIRE ‘EM2 (finance, insurance, real estate, education, military + medical industrial complex.)

Education is short-hand for student loans; provided by the Finance sector. And un-disposable through bankruptcy proceedings (in part, thanks to Joe Biden).

Just a general comment. By the sounds of it, it looks like the Feds are rapidly running out of options. They sought to raise interest rates (from what I understand) to put pressure on wage earners but as the banks were actually much more brittle than realized, this helped trigger a collapse in the banking sector. So maybe interest rate rises are out for now. The US and the EU had a great opportunity to reform the banking sectors after 2008 and make them much more resilient but of course that did not happen. And reforms like Dodd-Frank were wound back because Wall Street did not want any restrictions at all. The US can help solve some problems temporarily by making the printing presses go BRRRR but this creates larger problems down the track. And at the moment, that track looks more like a cul-de-sac. With the FIRE sectors actually running the government, I cannot see any vital reforms being made as it would cut back on their profits. In short, this is not looking good.

I look at it this way, the Fed raised rates not just to hurt the little guy (that may be a side effect) but to address insufficient supply issues. Arguably this was pushing on a string – the Fed can’t do anything about a lack of widgets, or energy. The fed policies can only really effect demand. We would need a competent Congress, not the clown-gress we have, to really address supply-side issues.

And certainly the Fed had nothing to do with dumb foreign policy mistakes like sanctioning Russian oil and gas which essentially killed Europe and made the supply-side inflation problems worse in the US.

So they pushed the only lever they had, interest rates.

Of course I agree that the failure to do meaningful banking reform post-GFC was really the root of the problem. Had we done that, then the Fed would have had a stronger hand to play. Now it looks like the only move they have is to pander to the “muh pivot!” crowd and bailout the banks, or at least the TBTF ones.

Depressing.

dodd frank was a smokescreen for not reversing bill clintons disastrous polices. glass-steagle had decades of precedents behind it, dodd franks had nothing, and when it came time to use it for enforcement, without precedent, it was easy for doubt and confusion to step in, the currency of deceit, and unravel what little protections it afforded.

I think the Powell types don’t want to allow a BBB and hated CARES, he can have impact on how much congress is going to distribute in their budget if congress now has to start talking about debt interest instead of actual line item expenses. I think the old fashioned wall street types would prefer the type of corruption they are used to (low interest, ability to write regulation, protection of monopolies, bailouts) not the type of straight up WEF/commie initiatives like ESG. I think Powell falls into the old fashioned wall street type as his nickname is Private Equity Powell. I’m not saying he is good but he is different.

Dumb question – all else constant, including the rapid succession of FedFundRate increases, had pre-Reagan Glass–Steagall law were in place, and the currently weak regulators were actually doing their regulatory oversight at Pre-Reagan levels, would SVB and these other bank collapses would have still occured or not?

I recall reading more about this in ’09-’10, but I think it Glass-Steagall hadn’t been repealed, it wouldn’t have allowed some of the gambling debts of the investment banks to become problems for depository/commercial banks, like Citigroup or BoA.

But of course the gamblers couldn’t resist seeing a big stack of untouchable cash *just outside* the casino…

Thanks for this post.

B wants to strictly regulate the cook stoves we use, wants to regulate the light bulbs we use. But strictly regulate the banks we use and trust to keep our money safe? Oh hell no!

The Fed wants to oversee the US economy, with no accountability. Fire the Fed. The Treasury can issue and the Mint can print the money. The FDIC can examine and regulate. / my 2 cents (which I’m keeping under the mattress. heh)

adding: in 2008 25 banks assets were the same as today’s 2 banks assets. There’s a reason more banks are better that fewer banks: dilution of the problem to more manageable sizes. Instead, since the 1990’s the Fed and pols have worked toward concentrating banks (and their potential problems) into larger TBTF entities. That concentration should be slowly reversed going forward, imo.

Or, echoing the (in)famous quote from Hemmingway; “The concentration was slowly reversing until it suddenly fully reversed.”

“Creative destruction,” it’s not just for VCs and “Innovators” anymore.

Also Hemingway:

“How did you go bankrupt?”

Two ways. Gradually, then suddenly.”

― Ernest Hemingway, The Sun Also Rises

I’d hoped that old maxim wouldn’t apply to the virtually or incompetently unregulated banks. Of course, I’d hoped banks would be really and truly and competently regulated. “Disruptive” and/or “innovative” banking isn’t what I’m looking for.

Reminds me of the old joke, “We lose a little money on every transaction, but we make it up in volume.” / oy

and adding, to quote John Milton’s Paradise Lost, methinks this: that neoliberal economics and economists

“…exalted sat, by merit rais’d

To that bad eminence; and from despair

Thus high uplifted beyond hope,…”

And, I’d wager, they cannot see their despair.

How do we get to the endgame of this?

Hyperinflation has been the tried and true method since Austria first went through it circa 1921 in the 2nd hyperinflation episode in Europe, the other instance previously being Assignats in the midst of the French Revolution.

But you can’t get there from here, as yes there are vast oodles of money in the system, but they aren’t obvious as what would happen in a classic hyperinflation scenario, you see all that lucre is hidden away from prying eyes, who would otherwise recognize the sting which comes with money frittering away to nothing in value.

Rarely were hyperinflation epochs short either, it was the methodology of essentially creating a biblical jubilee, in that debts were largely abrogated, imagine being an Argentine in 2000 and buying a house on a 30 year fixed (a hypothetical) for 100,000 Pesos which at the time was US $100,000, and now 100,000 Pesos is a whole $500.

I’d suggest that the whole financial shooting works falls apart at once, there being no other way @ present.

@Wukchumni, 10:05

I don’t think we’ll get hyperinflation. Our financial overlords wouldn’t like it. Their holdings of treasury securities and corporate bonds would drop to zero.

I’m expecting whatever anti-worker measures will get current inflation to drop back to 2-3% followed by permanent semi-austerity with bailouts for the connected.

>”I don’t think we’ll get hyperinflation.”

Neither do I, for what it’s worth. Generals always fight the last war and the last war Powell, Yellen, et al remember was the inflation of the 70s and early 80s. So, while they are distracted battling inflation, they make themselves vulnerable to an attack on the flank by recession or depression. I think this is beginning to play out now.

The problem today is excessive debt. There are only two ways to liquidate that debt: The first is inflation, the second is repudiation. My money’s on repudiation

I think people should be careful about using the word hyperinflation. definition: “…typically at rates exceeding 50% each month over time”

A lot of damage can be done well before hyperinflation actually sets in.

inflation is “result of supply issues.”…….

takes 2 sides to tango

the supply chain price explosion was only possible in the face of cash infusions, with no work/output to justify them.

a few trillion in $ created by the pols needs to be burned!

weimar or wait for a 1933 event!

The issue with SVB that I don’t see discussed hardly enough is the requirement that many of the depositors had to keep their cash in SVB. When people discuss the complacency of those running the show I keep wondering if this played a large role in leading the complacency. I keep visualizing in my mind the PTB at SVB and the regulators looking at the warnings and saying: “What are the depositors going to do? They have to stay put because of their covenants.” Another question that comes to my mind is: Did many of the depositors violate their covenants when they withdrew their cash? And, if so, is everyone just saying, oh well? Maybe term TBTF should be changed to TPTHA? (Too powerful to hold accountable). Seems more like what is really going on.

We have mentioned this several times in posts but not this one.

They also has a lot of deposits from wealthy individuals. Peter Thiel had $50 million. The $10 billion they got from Boston Private would have had not-sticky deposits.

So many actual businesses were stuck but not their executives nor the VC funds or their principals….and people like Oprah, also rumored to be a depositor.

This was intentional by the FED to get their digital currency in place. The FED lowered the amount banks had to keep on hand for depositors to zero. If they succeed we will be slaves. If they don’t like what you are doing or buying they kill your account. Canada was first to do something like that. To gauge reaction I think. Also everything will be taxed. Yard sales, mowing lawns, etc. Please wake up.

Yes, this does have the whiff of Build Back “Better”, (after we/they destroy it all first).

yep, those 80,000 plus new IRS agents, were never going to go after the rich, its e-bay sellers they are after. just like bill clintons so-called tax hike on the rich. but he never touched capital gains, so the tax hike fell on us, as planned. later on bill clinton gave the rich a massive capital gains tax cut, we got stuck with the hike.

Do not Make Shit Up.

The IRS does not have enough people to answer the phones, FFS. The hires were to replace expected retirements, to hire enough people to handle customer service since that staffing has lagged increased in taxpayers for years (many complaints about difficulty of reaching anyone, including on the line for tax professional tax preparers), and IT staff.

No, please, no conspiracy theories. A digital currency would not have facilitated a rescue.

The authorities may want this but the US is full of guns and enough conservatives to prevent this from happening.

an aside: I agree. However there’s a stealth move, imo, to pave the way by amending the Universial Commercial Code by amending the definition of what can and cannot be regarded as money. This is from , yes, Fox, but it’s a good explainer of the efforts underway.

‘Many of the proposed amendments to the code in H.B. 1193 are valuable, but the drafters of the legislation also included a few extremely troubling, completely unnecessary, provisions. Those would make it easier for consumers to use a programmable, traceable, controllable central bank digital dollar in certain kinds of commercial activities, should the federal government choose in the future to create one. ‘

https://www.foxnews.com/opinion/politicians-quietly-preparing-digital-dollar-its-not-good-your-freedom

What Fox is saying is nonsense.

It’s the Uniform Commercial Code, not the Universal Commercial Code. It’s the provisions of law used to create security interests for borrowing, like collateralizing a home mortgage.

The UCC is state law, not federal law.

The last update to the UCC took something like 13 years to be ratified by most states. New York has yet to implement. it.

I think they are losing the digital currency battle in the US and that argument is smoke screen to distract from legitimate issues. The reason I say this is because payment systems in the US have competing interests; commercial banks, FED shareholders, digital payment systems (paypal, zelle, mastercard, etc.). Too many competing interests in my opinion to hammer through a digital currency. I think they are more likely to control us via straight up government spending like BBB.

“This was intentional by the FED to get their digital currency in place. The FED lowered the amount banks had to keep on hand for depositors to zero.”

You make it sound like paper currency (paper dollars with pictures of dead presidents) is disappearing.

Quite the opposite is true. The amount of currency in circulation was about 4-1/2% of GDP in the 1980s

In 2020 it reached an amount equal to almost 10% of GDP. The highest since 1950.

https://fred.stlouisfed.org/graph/fredgraph.png?g=11Aes

Nobody cares but the story of why currency in circulation grew to towering heights in 2020 is at the very heart of the current banking crisis.

I’m in the camp of viewing the FED as sus since 1913.

Howver, the mismanagement, fraud, and choosing to blow the assest bubbles instead of other types of investment is not the fault of central banks.

Regulators are compromised and they could do better investigations. However, the increasing levels of fraud and incompetence in the economic system makes law enforcement doubtful.

For over a year, the Fed has said it is raising rates and been doing that.

However harmful that may have been, it was time to begin making changes to minimize losses.

I’ve read misrepresentation after misreprrsentation of ever FED rates meeting all over the internet for a year. A lot of jackasses making money on volatilility caused by people worrying about bets on a “pivot” instead of managing their portfolios and budgets for a rising rate environment (that is not historically out of whack).

Easy money or no easy money, rate hikes or rate cuts…there will be no trickle down.

I just sense that rate hikes are what probably should be done – to some extent – because it is the only thing that has gotten billionaires and their minions to scream in a long time.

I keep remembering the early parts of Kurt Vonnegut’s Galapagos (1985). Humans are wiped out by a disease that renders them all infertile shortly after a global financial panic. The crisis is triggered because people everywhere lose their minds when everybody realizes all their paper (including the numbers in computers) is worthless.

And of course there is the hilarious Monty Python sketch wherein residents in an apartment building keep it standing by their faith that it will not fall down…

That was before the use of flammable cladding……

What’s the end goal of allowing troubled banks to merge? I’m no expert on any of this, but I can see only two possible goals for the regulators signing off on these deals:

1) creating a big enough pile of money/income that it buries the holes in the balance sheet, such that the now-larger banking behemoth is too big to collapse into any one of them; OR

2) fewer banks mean less competition, and less alternative places for banking customers to run to, meaning they can raise fees for just about everything from checking accounts to fees for issuing/servicing loans, and THAT higher income stream allows them to fill in the gaping holes in their balance sheet so they don’t collapse.

I always thought many in finance lusted for bad models.

todays headlines. its not incompetence, its feverish idiotologies that craft reality to ideology. or simply put, a free trader will never ever allow reality, to trump ideology.

“at least another 200 capitalists banks are insolvent, of course idiot capitalists have inter connected all banks to each other, which socialist FDR stopped, this will spread to another 200, rinse and repeat.

capitalism only works with hard working socialists monies. ”

“the entire capitalists run banking system has been downgraded to crap: under socialism there had been no major Fed bailouts for 66 years:)

capitalism works till they run out of other peoples monies ”

and remember, stormy daniels will be applauded by Hillary’s feminists as she joins the view, or she will get a cabinet position, or a special ambassadorship in a country with lots of children, ripe for predation.

Emperor Powellpatine.

Thanks, Yves. Another excellent writeup. A few miscellaneous thoughts.

1) SVB gambled that the Fed would not continue on their interest rate increases. Every investor who has had falling investments knows the situation: sell now and accept small(er) losses or hold on and risk bigger losses. I’ve noted before in NC comments that the difference between finance professionals and amateurs is that the pros take money off the table on the way up to lock in profits and especially don’t hold on to a declining position out of sentimentality, stubborness, or greed. They get out and live to fight another day. SVB didn’t and now they’ve been bailed out.

Seen in this context, what SVB did with their Treasuries and MBS tranches was totally explicable and totally incompetent. The Fed should have stepped in last year and replaced the bank’s management but we all know that SVB was so connected to the political establishment that it would have been impossible. What the giant question now is: how many other banks have been incompetent/derelict in their risk management responses to the raise in interest rates both here and in Europe.

2) A few years back I went on a Richard Koo binge on YT to try to get a handle on the deleveraging task that awaited us when QE ended. I came away somewhat confused and definitely uncertain about the future. Now I think I know why. Even Koo’s answers were tentative and basically guesswork. We’re in uncharted territory.

3) Credit Suisse deserves what it’s received, if for no other reason than their participation in the Archeogos fraud, by which I mean the ‘total equity return swaps’ that Archeogos used to hide its equity positions in companies like Viacom so they could execute a bid-up corner on these stocks. I also think all the other too-big-to-fail banks that participated in that should have been punished as well but they observed Rule 1) above and liquidated their Archeogos positions early. CS was either inept or greedy. What I wonder is how many more hedge funds are there out there with shady positions created with frauds like TER swaps. The SEC allowed these? Shame.

Anyway, at times like these I always rely on the ‘law of cockroaches’: if you see one, there are ten more in the shadows.

Cheers

P

Great comment. Thanks.

I do not believe the first figure is adjusted for inflation, so it makes the 2008 failures seem smaller than they are compared to today.

I found another one here that claims is inflation adjusted: https://i.redd.it/bd0lzhwq7hoa1.jpg

I think a line chart, by year, inflation adjusted, would be a better depiction for comparisons sake.

I agree and should have made a qualification. But the 2007-2008 crisis had four acute phases spanning 14 months. This is after only two weeks!

In related news, First Republic stock currently down 30% for the day. This despite a $30 billion infusion of cash last week from a consortium of banks. Oops. The problem with FR must be pretty big if $30 billion can’t solve it.

https://www.cnn.com/2023/03/16/investing/first-republic-bank/index.html

From the link: “This show of support by a group of large banks is most welcome, and demonstrates the resilience of the banking system,” the Treasury Department said in a statement Thursday. The major banks include JPMorgan Chase, Bank of America, Wells Fargo, Citigroup and Truist.”

Note to Janet Yellen: A 30% decline in stock price in one day suggests something other than “resilience”.

Look on the bright side — the accelerating collapse of the u.s. Empire, of which the present finance disaster offers yet more evidence, makes it easier to forget the many impending collapses foretold by Climate Science, Limits to Growth, and the depletion of fossil fuel resources, and the other components of multi-crisis.

Krystal and Saagar on Breaking Points.

Biden Sec CONFIRMS Small Banks SCREWED In Bailout | Breaking Points

https://www.youtube.com/watch?v=kUujZVe3uIw

Some people are saying this is part of the plan to bring US citizens to heal around large central banks that would force them to accept CBDC.