Yves here. The idea of “greedflation,” that profits are playing a significant role in our current inflation, has been treated as controversial among economists. Some experts have even treated it as crankdom. Yet overwhelmingly, businesses have not accepted reduction in their returns to preserve market share. This is a big departure from past bouts of marked inflation, where companies did accept lower profits when inflation was high.

The fact that the IMF has confirmed that corporate profits are a major contributor to this inflation should put this question to bed.

Needless to say, this validation also shows that the Fed’s higher interest rate medicine is the wrong remedy.

By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK

As the IMF has just reported:

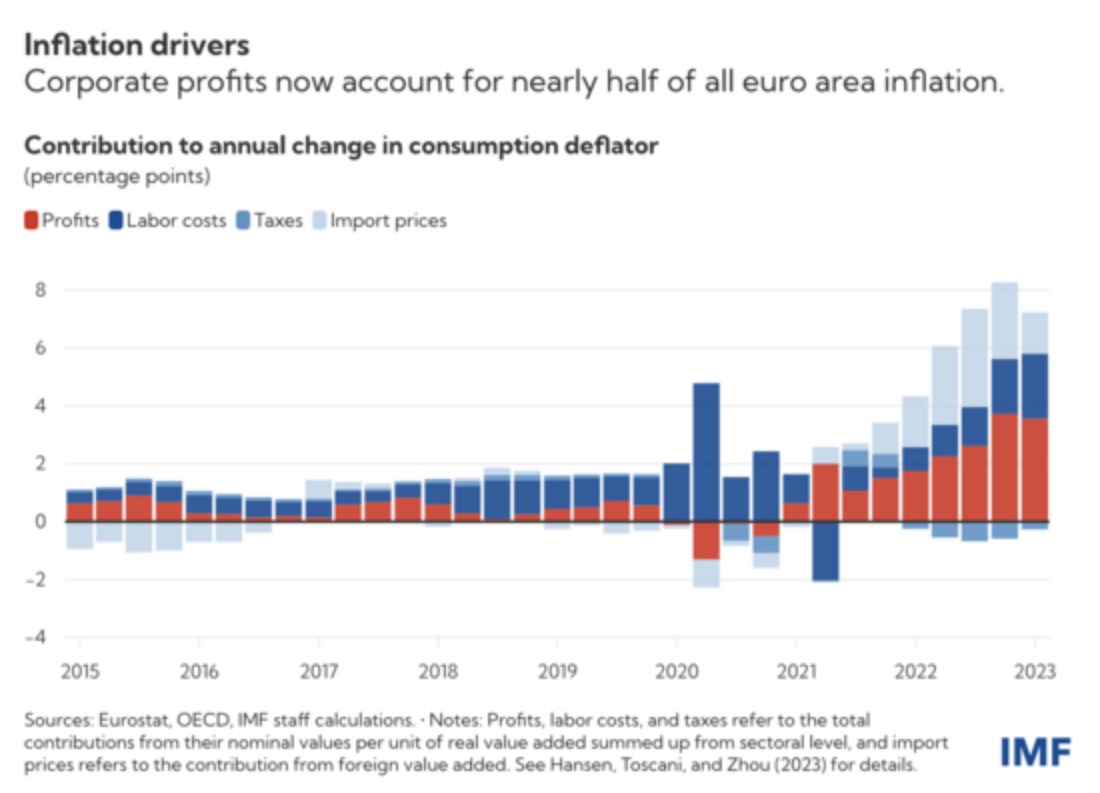

Rising corporate profits account for almost half the increase in Europe’s inflation over the past two years as companies increased prices by more than spiking costs of imported energy. Now that workers are pushing for pay rises to recoup lost purchasing power, companies may have to accept a smaller profit share if inflation is to remain on track to reach the European Central Bank‘s 2-percent target in 2025, as projected in our most recent World Economic Outlook.

I stress, this is the euro area. It does not change my suggestion on the role of interest rates, which are a peculiarly UK phenomenon. But this chart is still telling:

Wages have driven only a small part of inflation in Europe. I also suspect that is true here too.

I also note that the IMF say:

Europe’s businesses have so far been shielded more than workers from the adverse cost shock. Profits (adjusted for inflation) were about 1 percent above their pre-pandemic level in the first quarter of this year. Meanwhile, compensation of employees (also adjusted) was about 2 percent below trend.

This does not necessarily mean profits have risen, but there has been a major shift in the distribution of rewards.

As they also note:

Assuming that nominal wages rise at a pace of around 4.5 percent over the next two years (slightly below the growth rate seen in the first quarter of 2023) and labor productivity stays broadly flat in the next couple of years, businesses’ profit share would have to fall back to pre-pandemic levels for inflation to reach the ECB’s target by mid-2025. Our calculations assume that commodity prices continue to decline, as projected in April’s World Economic Outlook.

Should wages increase more significantly—by, say, the 5.5 percent rate needed to guide real wages back to their pre-pandemic level by end-2024—the profit share would have to drop to the lowest level since the mid-1990s (barring any unexpected increase in productivity) for inflation to return to target.

In other words, the correct call for those now wanting to maintain purchasing power in the economy whilst controlling inflation (which together are a totally reasonable goal) is for profits to be sacrificed now to restore appropriate wage rates.

Very oddly we are hearing nothing like that from the Bank of England, politicians or supposed economists in the UK. You would think they all agree wage-earners should suffer instead. But at least their agenda is becoming increasingly clear.

Maybe this explains companies half-hearted anger when the Fed started raising rates.

I heard it a ton when they started “you are going to kill business!” But now that companies have kept profits stead and it’s putting the screws to labor they have said almost nothing about the hikes.

No wonder unions are starting to sound attractive to even knowledge workers

Yves, is it possible that the Fed is raising interest rates in an attempt to support demand for the dollar outside of the United States, given the geopolitical environment and the move away from the dollar in all of the bilateral trade deals we are seeing?

I mean, I do understand they also want to push wages down, but it seems like there might be more going on. I think it’s obvious to anyone paying attention that it’s not really about trying to tame inflation.

No, the Fed looks strictly at domestic models. It’s required to report on its deliberations and they never include that. Foreign governments have complained for decades about US indifference to the impact of its policies on foreign countries. One of the few times the Fed cared was when Volcker drove rates so high it caused a Latin American bank crisis, which was engulfing US banks, particularly Citi. That was in a cheap, not high, dollar era and Volcker relented sooner than he wanted to. It was the end of his high interest rate policies that ushered in the strong dollar era.

It looks like the Europeans have taken a page from us and are now buying imports while letting their domestic industries go under. This conveniently filters through the charts and graphs as inflation control. Maybe a reflection of the deindustrialization of Germany? And the high price of imported LNG. I always have the sneaking feeling that we neoliberal countries are pre-disastering our economies. When the Fed talks about the always-out-of-reach “soft landing”, what exactly is landing? When it comes to the EU, Germany is the driver of the entire economy. So naturally it was a shrieking nightmare when Germany got friendly with Russia and began to focus on the East instead of the West. It kinda makes sense for those domestic corporations to fluff up their profits ahead of the rough road.

All one can say to that, if true, is good luck with employment and balance of trade. Britain is a poster child victim of this process, and appears to be engineering massif unrest.

As Boris discovered. One predicts that national leaders can enjoy their sinecures is to copy the Ukraine model and continually blame Russia, India and China in no particular order.

And blame the Martians.

The only human response to this exacerbates the problem, by increasing the number of human on the planet..

For years I’ve assumed the EU economy has been a hostage of Germany: especially after the Euro the periphery has been doomed to be merely a market for German products with no chance of ever becoming competitive.

Germany deindustrializing may, just may, bring a glimpse of hope to members who have so far only been able to helplessly watch their Euros to gravitate towards Germany.

The de-industrialization of Germany courtesy of the blowing up of the Nordstream pipeline will impact other countries as well. It’s not as if Germany did it voluntarily.

If the Fed’s higher interest rate medicine is the wrong remedy, as the IMF and several economists have suggested, why is the Fed pushing the bad medicine. Why is it pushing that bad medicine relatively quickly after so many years of pushing the opposite easy money medicine? Given that the Fed looks strictly at domestic models, do the Fed wizards sincerely believe they have the right medicine to cure the domestic inflation, foreign impacts be damned? Cui bono? Several banks have already taken a hit. Is domestic business so well consolidated that no one is worried that businesses can keep increasing their profit margins — or what[?] to maintain share prices and ideally keep share prices going up to maintain executive bonuses? Nothing makes much sense to me.

Is this just more evidence of the collapse in operational capabilities in the West as described in an earlier post?

https://www.nakedcapitalism.com/2023/05/the-collapse-in-operational-capabilities-in-the-west-and-some-knock-on-effects.html

Monopolies or near-monopolies need not be concerned about limiting profits in order to maintain market share. There are no competitors that can draw customers away. That explains why “greedflation” is a real thing in our current economy. Monopolies are everywhere.

Yes, and then we have blatant collusion, and the not-so-obvious cross sectoral ownership that creates de-facto oligopolies and monopolies that may not be obvious at first glance.

Yves Smith: “Some experts have even treated it as crankdom.”

Exactly, the “experts” are usually hacks, ideologues and apologists for institutionalized corruption and the status-quo. That’s why they are considered “experts” in most public discourse.

The IMF has to maintain a shred of credibility I guess, they have to admit what is fairly obvious to us “cranks”.

I recall a couple of other articles posted on NC that said similar things that is confirmed here. Also, profs Radhika Desai and Michael Hudson did a segment on this months ago: their conclusion was more price- gouging. Financial parasites have oligopoly/monopoly power to squeeze more.

Also, very crudely: BigOil started posting RECORD profits last year (that says a lot) and since there is a knock-on effect when energy prices rise we can see the pattern. Wage rises have lagged CPI inflation, so labor is taking a de-facto cut. This should be great news for the oligarchy.