Yves here. At least for now, market action has confirmed our thesis that even though marked weakening of the dollar is baked in longer term, it would take a long time to play out. BRICS fans have touted the GDP level in the Global South as an indicator of destiny. However, financial markets are dominated by investment flows, not by population or even GDP weight. We have to point out often that the excitement over countries slipping the noose of dollar-system US sanctions by trading bilaterally in their own currencies is not even remotely enough to imperil the dollar. A BIS study found that trade transactions represent about 3% of the value of foreign exchange transactions. Similarly, a recent BIS survey found that the dollar share of foreign exchange transactions had increased since 2022:

Highlights from the 2025 Triennial Survey of turnover in OTC FX markets:

- Trading in OTC FX markets reached $9.6 trillion per day in April 2025 (“net-net” basis,2 all FX instruments), up 28% from $7.5 trillion three years earlier.

- Turnover of FX spot and outright forwards was 42% and 60% higher, respectively. Their shares in global turnover thus increased, from 28% and 15%, to 31% and 19%, respectively. Turnover of FX options more than doubled. Turnover of FX swaps grew modestly, resulting in a drop in their share to 42% (from 51% in 2022).

- The US dollar continued to dominate global FX markets, being on one side of 89.2% of all trades, up from 88.4% in 2022. The share of the euro fell to 28.9% (from 30.6%) and that of the Japanese yen was virtually unchanged at 16.8%. The share of sterling declined to 10.2% (from 12.9%). The shares of the Chinese renminbi and the Swiss franc rose to 8.5% and 6.4%, respectively.

- Inter-dealer trading accounted for 46% of global turnover (almost unchanged from 47% in 2022). The share of trading with “other financial institutions” was 50% (up from 47%). At $4.8 trillion, turnover with other financial institutions was 35% higher than in 2022, mostly driven by 72% higher trading of outright forwards and a 50% increase in spot transactions with this counterparty group.

- Sales desks in the top four jurisdictions – the United Kingdom, the United States, Singapore and Hong Kong SAR – accounted for 75% of total FX trading (“net-gross” basis2). Singapore gained market share, reaching 11.8% of the total (up from 9.5% in 2022).

Advanced economies still have much higher GDP per capita. That translates among other things into more funds available for investment.

What is therefore likely to prove detrimental to the dollar, perhaps sooner rather than later, is dollar investments falling out of fashion. The Liberation Day flight from Treasuries produced a corresponding marked fall in the dollar. That has not only been somewhat reversed but a VoxEU study even found that Treasuries have returned, at least for now, to their status as a haven in times of perceived high risk.

Trump is declaring war on the perceived safety of US financial markets with his continued deregulation push and promotion of crypto-scamming. An AI implosion and/or a private debt market freakout could also lead to flight from dollar investments and hence the dollar.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

A hot theme widely banded about to pump up cryptos, gold, silver, and even stocks is the so-called “currency debasement trade.” The idea is that enough traders rally behind a common theme to move prices in their direction for long enough to make a serious buck and generate fees from the trading.

This debasement-trade theme is a bet that government borrowing and money printing will erode the value of the US dollar dramatically and quickly, and that therefore enough investors will pile into cryptos, gold, silver, and even stocks, to cause prices of those instruments to explode. And they did.

But the huge bond market has taken the opposite bet, led by the $29-trillion Treasury market, the $11-trillion corporate bond market, the $9-trillion residential MBS market, the $4-trillion municipal bond market, plus the other segments of the bond market, where yields have fallen this year and have been in the same relatively narrow range for the past three years.

These bond investors bet that inflation will cool further over the longer horizon, and that the relatively low yields they get on their securities will therefore adequately remunerate them for inflation and for the risks they’re taking, and that the cooling of inflation will cause yields to decline further in the future, thereby pushing up prices of bonds that had been issued earlier at higher yields.

If the bond market were fearing a rapid and substantial debasement of the US dollar – the theme being hyped by the debasement trade promoters – it would demand much higher yields. But that hasn’t been the case.

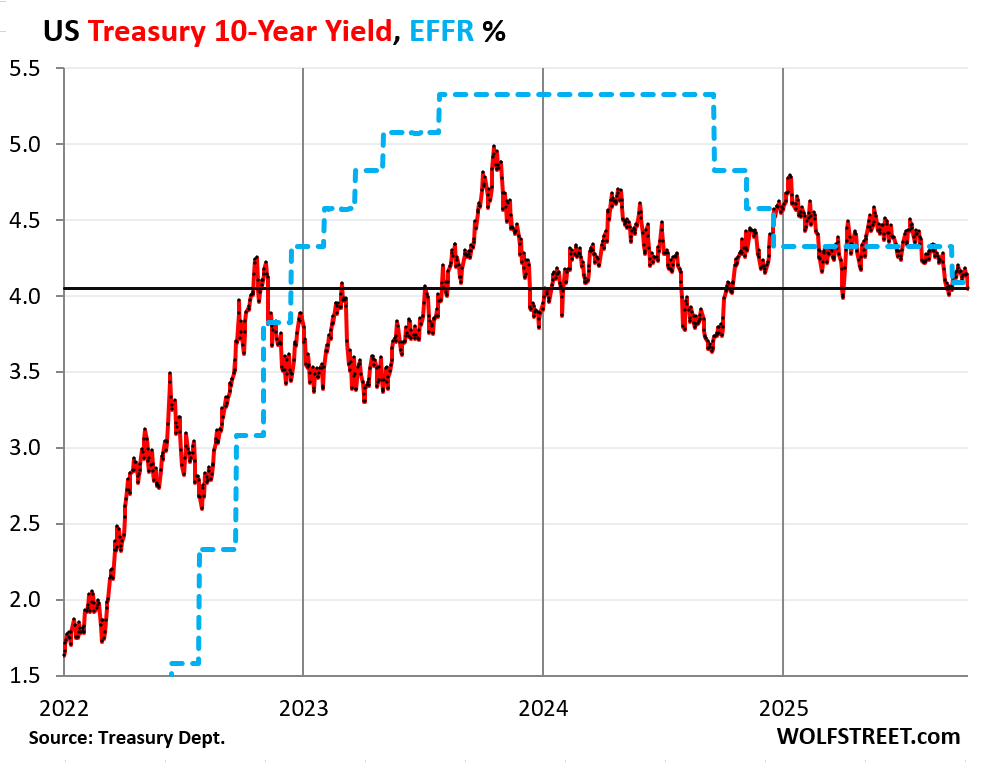

The 10-year Treasury yield, for example — now barely above 4% as of Friday evening (bond markets are closed today) — has been on a downtrend this year and has been roughly in the same range for three years:

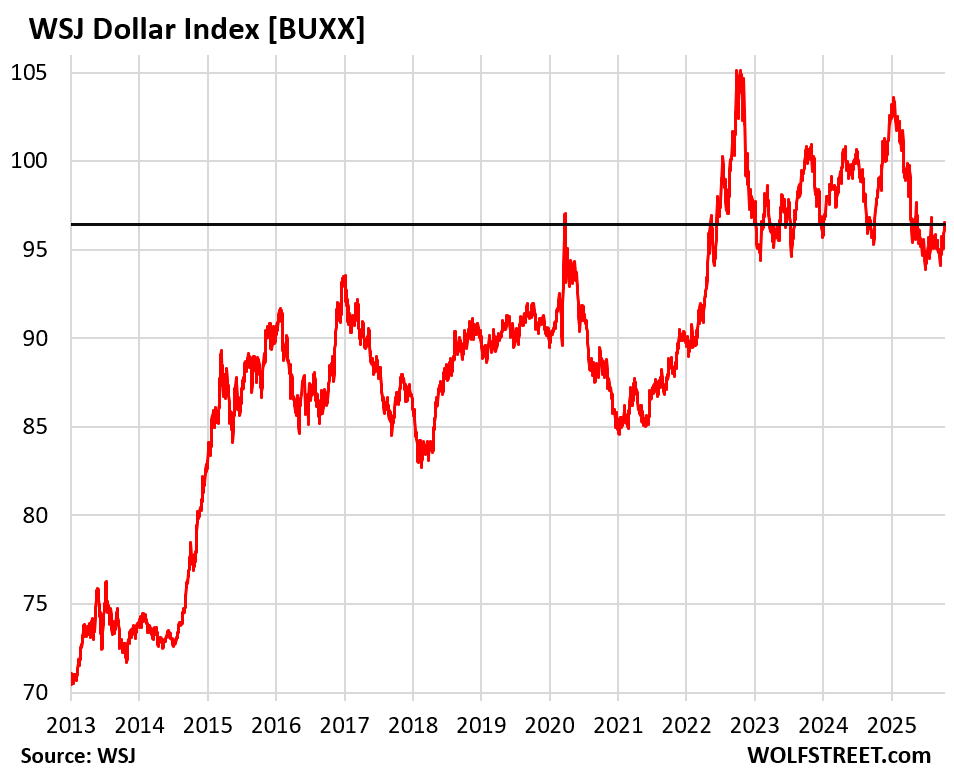

But, but, but, the US dollar…. The dollar’s drop during the first half of 2025 has been falsely promoted in clickbait headlines and by braindead manipulative talking heads on TV, as “the steepest decline in more than a half a century,” or whatever.

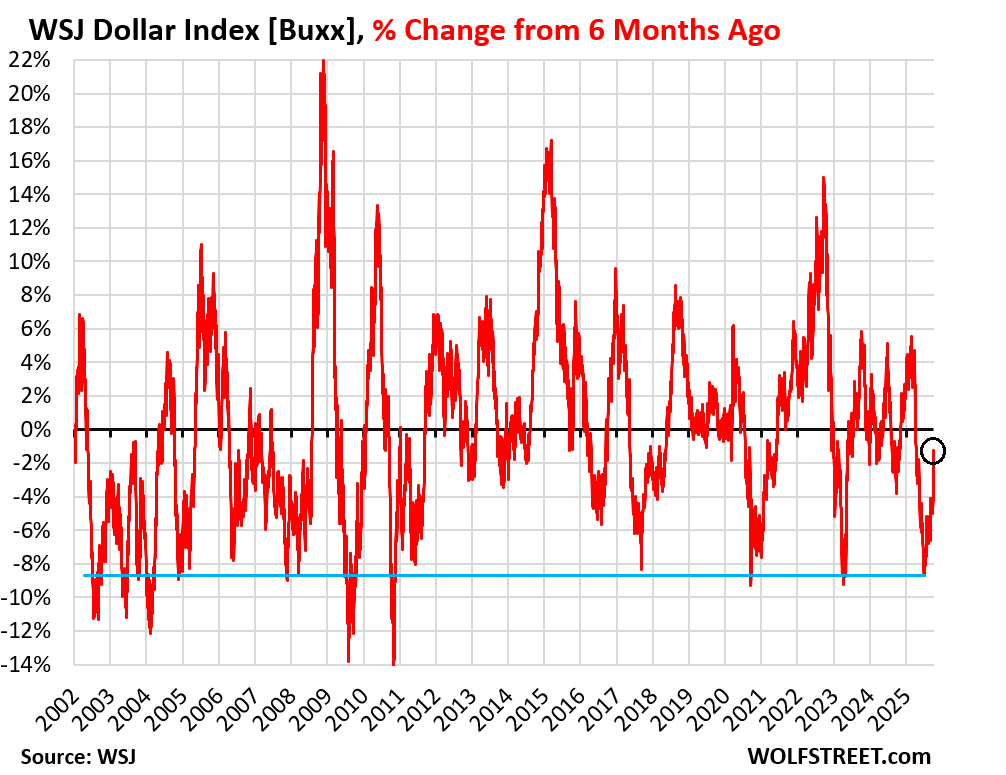

What did occur is that the dollar indices had spiked in the last four months of 2024 and topped out at the very end of December. And that four-month spike was then unwound-plus-some over the six months exactly from the beginning of January through the beginning of July, with the euro and yen dominated DXY Dollar Index dropping 11% and the broader WSJ Dollar Index [BUXX] dropping 9% over the first six months of the year.

But even bigger six-month drops were common and bottomed out in:

- April 2023

- September 2020

- November 2010

- August 2009

- April 2008

- June 2007

- Etc., all the way back to Adam and Eve.

The only thing that was unique about the 6-month drop in 2025 was that it started at the beginning of January. Only the start date was unique.

This chart shows the 6-month percentage change of the WSJ Dollar Index [BUXX], which tracks a basket of 16 major currencies.

The blue line indicates the 6-month 9% drop from the beginning of January through the beginning of July. Note all the even bigger 6-month drops that have dropped through the blue line over the past 23 years.

And of course, the dollar has bounced back some since the beginning of July with the WSJ Dollar Index rising today to 96.4, up by 2.6% from the low at the beginning of July.

The 16 currencies in the trade-weighted index are: Euro, Japanese Yen, Chinese Yuan, Canadian Dollar, Mexican Peso, South Korean Won, New Taiwan Dollar, Indian Rupee, Hong Kong Dollar, Singapore Dollar, British Pound, Australian Dollar, New Zealand Dollar, Norwegian Krone, Swiss Franc, and the Swedish Krona.

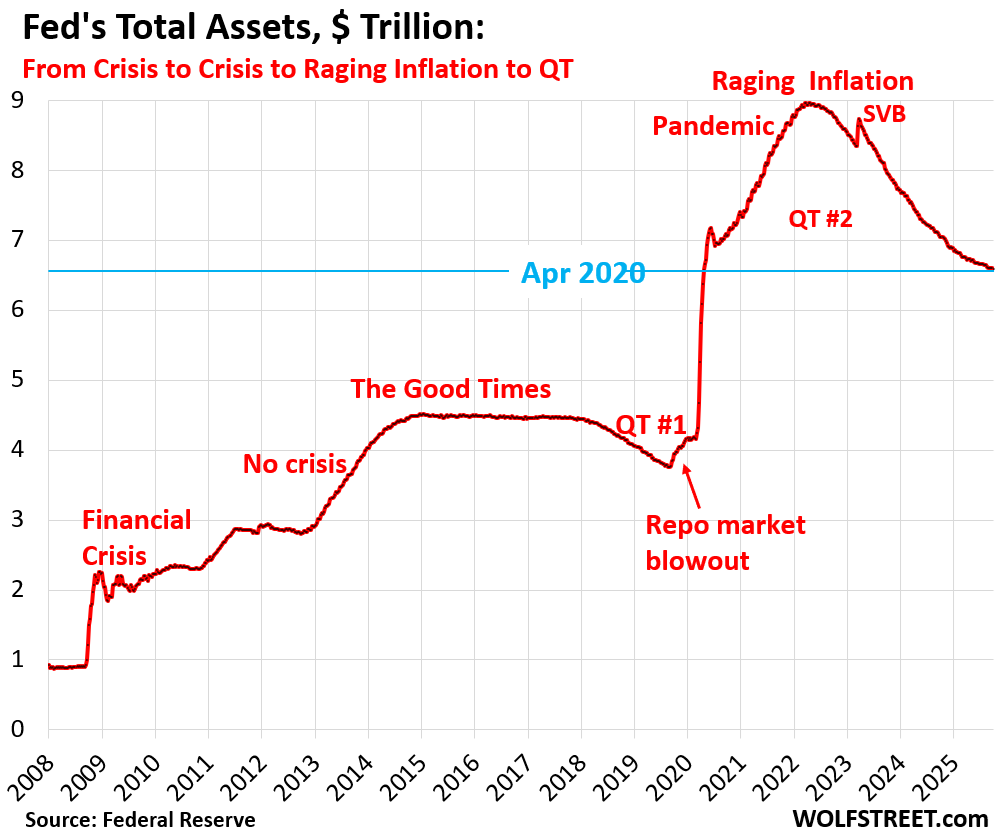

The Fed has been doing the opposite of “money printing” for over three years, having shed $2.4 trillion in assets by now – “money unprinting?” – and it continues to shed assets under its Quantitative Tightening program, and folks promoting the debasement trade need to take a look at this:

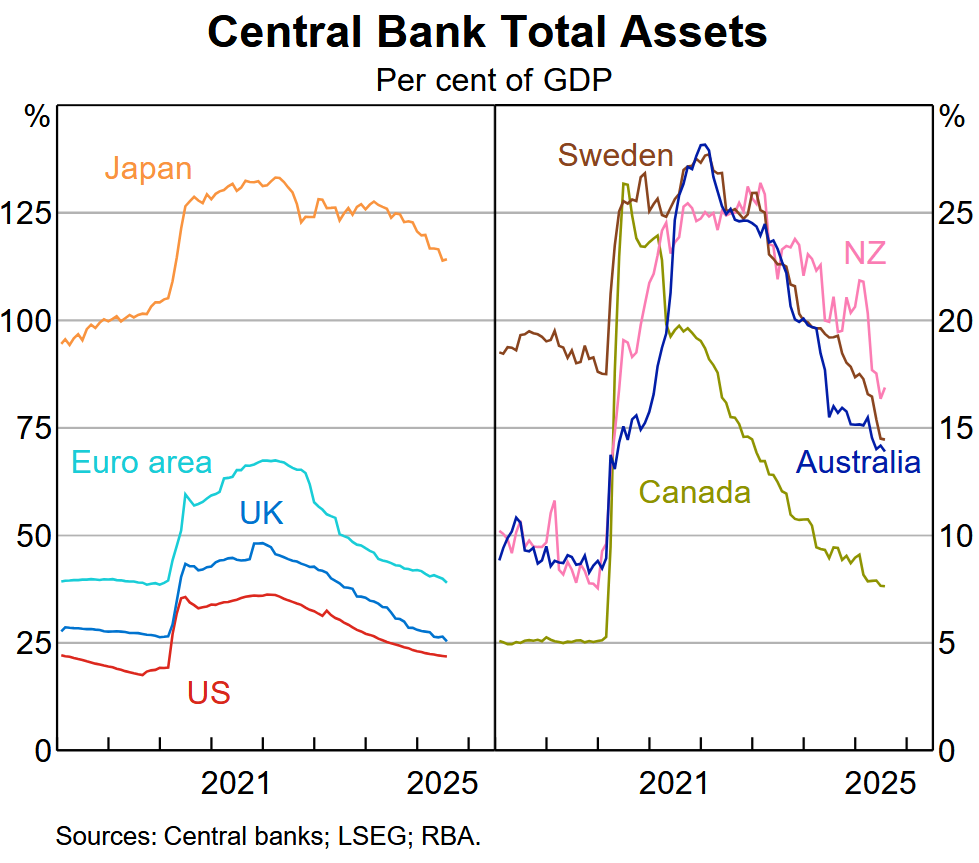

Other central banks too have been shedding assets under their QT programs, most notably the ECB and the Bank of Japan. Here are the balance sheets of some of the major central banks in relationship to the size of their economies, another eye-opener of what the debasement trade faces: Amazing How the Money-Printing World Has Reversed.

Color me unconvinced. When the next financial cataclysm gets tripped there is little doubt that the great font of liquidity, the Fed, The Great Helmsman, will generate dollar swap lines for everyone on the golf courses both foreign and domestic. And there will be mountains of debt to soak up with outright purchases. The financial markets will be stabilized…after the carnage.

Wolf fails to mention that the Fed has issued $6T in debt since QT began in early 2022, and that is before the impending deluge. Wolf is an insightful fellow, but he is like the butcher who manages at all times to keep his thumb on the scales. As for CEPR, go to the website and click on People. It looks to me like none of these People are likely to get off the bus to Consensusville anytime soon.

Debasement? Ask the gold-bugs. The olde-timey gold-bugs were kind of cranks. Nobody really took them seriously. These days there appears to be a better appreciation of tail-risk. And as the tail-risk gets fatter…shit-coins, off-balance sheet crashes, ballooning debt, deregulation, endemic corruption, and on and on, new-timey gold bugs enter the market.

They could be fleeing equity, munis, REITs, who knows, but they are having an impact. Check out the price of gold Maple Leafs in the last couple of years. Gold coin buyers are retail people. They are not the behemoth central banks currently gorging on gold. They are just riding the current, and given the monsters below the surface they will not be capitulating any time soon.

Yes, one doesn’t have to go back to Adam and Eve to understand 6-month drops in the dollar. Just to 1971 and the elimination of gold backing the dollar. Now the schemers have to guess on the true value of a fiat currency (dollar).

In an abstract way, money is a human construct. It is worth whatever “value” that humans give it. If it’s not the almighty dollar, it’s something else. How long will the rest of the world “believe” in the dollar?

Tbh I wish I had invested all my savings into either crypto or gold once Trump got inaugurated.

It sucks watching everyone around me be flush with returns and not work and buy all these new cars and houses.

Someone told me about Rocket Lab last year when it was 5$ and now that stock is plus 60.

Or Intel Stock when it was down to 20 and then Trump decided to get involved and it jumped to almost 40 which would have doubled my money.

What am I supposed to do now that I’m 41 and the US has turned into a financialized economy? I work my ass off in the French quarter tending and trying to save up for a house which is gonna cost me about 300,000?

Bitcoin has been around since what 2012, and Yves and y’all have kept telling me it’s PROSECUTION FUTURES and whatever so I’ve listened to y’all since y’all are a money blog.

But HFS have I missed out on a ton of get rich opportunities now that I’m making somewhat decent money.

Buy whatever physical gold you can afford is my (non-financial expert) advice.

I started buying a little at $1400 over ten years ago, bought a bunch more at $2900 earlier this year and it’s now at $4100+.

https://economictimes.indiatimes.com/news/international/us/gold-price-today-gold-price-tastes-record-high-again-amid-market-volatility-and-us-china-trade-tension-gold-surges-to-4132-bofa-lifts-2026-gold-price-prediction-to-5000/oz/articleshow/124552213.cms?from=mdr

Like actual gold bars?

US gold coins are the best. They have a known quantity of gold in them. Bars must be assayed if you take possession of them, so you have storage fees for bullion. You avoid fees and testing with coins.

Agree, coins are the best and they don’t have to minted in the USA.

Herd.

Maybe this is what Paul saw when he had his vision of the Golden 🏦Thread?

I’m gonna try not to nuke my eyeballs 👀 out participating in this…

You don’t have to buy gold bars to gain from the frenzy. I own stock in Newmont Mining and it’s stock price has been rising along with price of gold. The stock was up 5% in 1 day last week and has more than doubled since Jan. 2025. Dumb luck…

Silver, poor man’s gold, is hot as well. It’s up 42% last three months.

Silver takes up way too much room though if you’re buying coins.

Silver, poor man’s gold …

Emphasis on the word poor. Silver just finally broke to a new all time high after just 45(!) years of waiting. It will go up like a rocket in a bull market and crash and burn in a bear market. Meanwhile, the bullion dealers make out like bandits charging 5%+ premium to both buyers and sellers. People balk at that for an ounce of gold, but don’t think twice about it for an ounce of silver. After all, that’s less than a cup of coffee …

Yes – I own some shares of Newmont (NEM) and Kinross (KGC) gold miners. Also Wheaton Precious Metals (WPM) is up over 60% since I bought it.

“Yves and y’all have kept telling me it’s PROSECUTION FUTURES and whatever so I’ve listened to y’all since y’all are a money blog.”

John Maynard Keynes once said, “Markets can remain irrational longer than you can remain solvent.”

Of course, Keynes comment is targeted to those shorting a market in the bubble phase, but shorts have end dates and even though by definition a bubble is economically irrational that doesn’t mean they pop before your short/bet comes due – hence you can go broke before reality sets in on the other market participants.

If you agree there is a big bubble brewing now, then I suggest you stick to secure assets.

In my opinion we are in the phase where people like you really get screwed. This is the phase where everyday Joe’s start throwing money at the bubble… and the market keeps going up until it doesn’t. And then those everyday Joe’s lose their money.

You see there is a flip side to what Keynes said… for those who pour their money into the market and don’t know when to leave, they too can become insolvent too.

And yes, maybe you didn’t invest in Bitcoin back in 2012, but what if you did? Would you be out now? What happens to the value of Bitcoin when a major liquidity crisis hits the system?

What secure assets?

***

Thank you, NCrs, for replying.

Y’all truly are the best.

🫡

@ Jonathan Holland Becnel

FWIW Mark Spitznagel of Universa investments is calling for a blow off top and then a like 80% crash in the stock market and thinks we are currently in the middle of that rally. IIRC he said we, ”could see” SPX around 8000 before the massive crash, so maybe 20% higher from here- obviously predicting exact numbers is a fool’s errand but still… so if that is what comes to pass then getting in now could be lucrative short term but potentially devastating if you don’t get out in time, so pretty high risk. As painful as it would be to remain in cash/t bills and watch this go way up before the big down, if this sucker goes down 80%ish that is like sp500 at 1800 or 2000 or so, and then one could buy assets at a much more reasonable price. Could hedge by keeping like 80-90% of savings in cash/4 week t bills and gamble with the other 10-20% so no risk of getting totally wiped out and having no cash to spend when financial assets are way cheaper but still not feel the depression one gets from missing out completely on a parabolic rally in basically all financial assets. I think Spitznagel compared what is happening right now to the beginning of 1929, euphoric high ahead, then massive crash. Good luck man, probably don’t let FOMO lizard brain overtake rational brain and make you put all your chips on the table at a time of irrational euphoria though, always be in a position where your gonna have $ to buy stuff when its cheap. I believe Spitznagel thinks there are lagging effects from the Fed raising rates so quickly and for so long that are going to be the catalyst that pops the bubble. I just finished his book ”The Dao of Capital” check it out if you get a chance, interesting book. None of this is financial advice lol

Ok got it.

Yeah I’m not a gambler at all even tho I’m a former alcoholic, so the 20% makes sense and putting the other 80% in T bills. I’m not greedy with money in any way but I would like to have a small bailout fund for my family (parents/siblings) if something happens to them.

Thank you for taking the time to explain this.

I tell my family my family that I’m becoming a GOOD CAPITALIST MAN 👨 NOW after solely focusing on the humanities for pretty much my whole life.

Let’s just say I’m actually focusing on making money for the last 5 years, especially when I was working at Intel up in Hillsboro, OR and seeing the AMC/GAMESTOP Meme stocks blasting high and DOGECOIN shortly thereafter in 2020-2021.

🫡

Also, if you did want to buy some precious metals an ETF you can purchase in a brokerage account like PHYS for gold or PSLV or SLV for silver is more convenient in a lot of ways. Dealers of physical coins will charge a premium for the purchase of physical metal and you also run the risk of losing the coins/getting robbed. Just buying an ETF takes that risk and anxiety about getting robbed away. Holy F are metals expensive compared to earlier this year though wow

https://vonnegut.fandom.com/wiki/Noel_Constant

“His father was an anarchist, although this caused him no trouble except with his wife. The family could trace its lineage to an illegitimate child of Benjamin Constant, a political thinker and activist of the French Revolutionary period.[1] One night, at the age of 39, Constant was staying in Room 223 of the Wilburhampton Hotel in Los Angeles, California. He decided to become a financial speculator using $8,212, his share of his deceased father’s estate, which had mostly been in government bonds”

The US budget process gets increasingly chaotic as time goes by, do the figures even add up any more ? Does it still matter ?

Recent upturn in the dollar is because of the whiff of crash in the air. Mr Powell was out today saying the labour market is sick and he will be cutting rates. Mr Trump is taking the US past that event horizon and budgets will not count for much, he will take what he needs wherever he can find it and use it for what he wants.

It is all about the next bailout now, $ 10 trillion will be needed quickly, how to create it and who to distribute it. Krugerrands are the go for gold at home, 24 carat is not suitable for manual handling.

Bond market is calm assuming low inflation. But west is cutting itself off from Russian resources and low cost/high quality Chinese mfg goods that are deeply embedded in western supply chains. Imo west is rapidly becoming high cost producer. Why would row trade with such a source? They’re already buying fossil cheaper from Russia/iran than us, and far cheaper than sky-high eu prices. Hope for mild winter.

I’m noticing attic exhaust fans listed on Amazon with ‘5 available, order soon’… and no ‘more on the way’. Imo shortages likely by year end that will make it hard for many mfrs to stay in business.

Inflation has been low (and the dollar risen in value relative to other currencies?) Over the past few decades in large part because of globalization and offshoring production to low wage countries. Trump appears to be dead set on removing that offset.

It will become much harder to hide Fed money printing in this new environment, even if the the Fed lowers printing slightly as this article points out is the current case (And as other commenters have pointed out, things could get messy real quick if Fed printing increases due to a new emergency).

With total US (private + public) debt north of $100T, shouldn’t the government be printing at least $5T a year just to cover interest on that debt?

I think Dollar did debase itself when it ceased to be non-political neutral reserve currency. Now it is gradually being displaced by Gold which is a most non-political neutral asset with no counter party risk. President Trump’s arbitrary, indiscriminate, and often politically instigated imposition of tariffs across almost all countries is a trifle less blatant debasing of Dollar primacy than Biden’s freezing of Russia’s dollar billions.

The displacement has only just started. And it looks, it is irreversible.

Yeah but the problem of the gold standard still applies though right?

Like you are only allowed to spend what you have in physical bouillon?

Especially when the Rich hog it all, and “there’s none left.”