Philip Pilkington: Marginal Utility Theory as a Blueprint for Social Control

By Philip Pilkington, a journalist and writer living in Dublin, Ireland

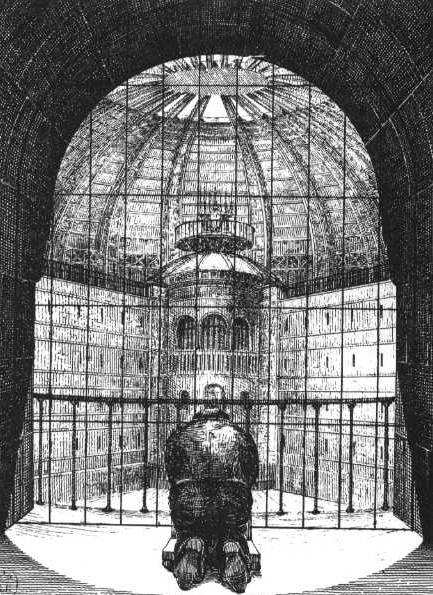

A prisoner kneels before the watchtower in a drawing of Jeremy Bentham’s ‘Panopticon’. The Panopticon was an architectural form that Bentham envisioned for a variety of social institutions. The idea was to have a central platform where an observer could cast their gaze over all the observed, thus making them feel constantly under watch and ensuring, in Bentham’s own words, “a new mode of obtaining power of mind over mind, in a quantity hitherto without example.” Jeremy Bentham is also the father of modern utility theory – a theory often associated with individual liberty, which is actually at heart a blueprint for social control.

It’s not hard to forget just how nonsensical, simplistic and childish the so-called theory of marginal utility is.

Read more...