Submitted by Tyler Durden of Zero Hedge.

“I don’t feel the sickness yet, but it’s in the post. That’s for sure. I’m in the junkie limbo at the moment. Too ill to sleep. Too tired to stay awake, but the sickness is on its way. Sweat, chills, nausea. Pain and craving. A need like nothing else I’ve ever known will soon take hold of me. It’s on its way.”

“I don’t feel the sickness yet, but it’s in the post. That’s for sure. I’m in the junkie limbo at the moment. Too ill to sleep. Too tired to stay awake, but the sickness is on its way. Sweat, chills, nausea. Pain and craving. A need like nothing else I’ve ever known will soon take hold of me. It’s on its way.”

I believe Mark “Rent-Boy” Renton’s words from the seminal movie Trainspotting could just as easily be attributed to any bank in the U.S., the vast majority of which are about to hit the lows of bailout addiction, however, without the benefit of a methadone clinic waiting on the other side of the heroin/bailout trip.

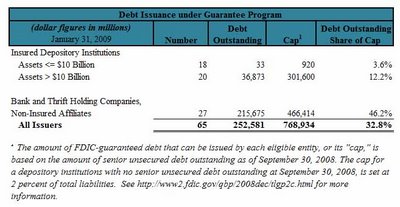

Among the various life-support and addiction-enabling systems designed during sleep-deprived brainstorming sessions in some dimly-lit small office in D.C., in the triage that was the post-Lehman financial world, was the FDIC’s TLGP (Temporary Liquidity Guarantee Program). The program, which became effective on October 14, 2008 and had an automatic opt-in clause for all participants, had the purpose of facilitating the issuance of senior unsecured debt at a time when credit financial markets had frozen and not a single bank was able to raise debt at reasonable rates. Many have speculated that of all alphabet soups designed to stabilize the financial system, the TLGP (especially in parallel with the other two liquidity-guaranteeing programs, the TAF and CPFF) has had by far the most pronounced positive impact: as banks can only function properly if their cost of capital is lower than the rate at which they lend out funds, finding a means to achieve cheap funding in the term markets was of life or death importance to banks. Furthermore, the TLGP being open only to Bank Holding Companies, was one of the reasons for the demise of the “old model” and the transition of such iconic investment banks as Goldman Sachs into BHCs (see here for a full list of terms of the TLGP). The importance of the TLGP is further underscored by the amount of FDIC-guaranteed debt issuance by financial institutions: over $300 billion of term financing has been raised by banks since the TLGP’s inception with only 2 non-TLGP issues having been completed.

The banks’ addiction to the TLGP is perfectly understandable as by using the explicit guarantee of the U.S. when issuing debt, banks do not subject themselves to having to compensate investors for taking on objective bank risk (subordinated bank CDS levels imply term interest rates multiples higher than rates at which TLGP issues come to market). However, like every addiction, the longer it continues the higher the likelihood we will all end up with just one more dead, zombied junkie.

It is unclear how credit markets would function (if at all) in the absence of guarantees: the longer liquidity guarantees remain in place, the harder it will be to remove them and the more damage they will do to undermining what little private market discipline remains. And while banks will be happy to suckle on the FDIC teat for ever, the latter is already approaching a degree of distress where even deposit guarantees (as measured by Deposit Insurance Fund reserves) will soon be impossible. It is against this backdrop, that Senate Banking Committee Chairman Chris Dodd is seeking to be the ultimate enabler to the financial system. In a little noticed bill submitted on March 5 entitled the Depositor Protection Act of 2009, Dodd is seeking to increase TLGP-guarantor FDIC’s $30 billion Treasury borrowing limit up to $500 billion. While on one hand, this action could be seen as the preparation for an ultimate bank failure, on the other hand, the funds thereby released will make sure that the addiction of the system to cheap money at the expense of market efficiency (and taxpayer cash of course) will persist, and eventually result in the virtually guaranteed overdose by the narcomaniac system.

Having FDIC’s Cake And Eating It Too

The FDIC would likely be more than happy to perpetuate the image of all being well in its bid to restore systemic confidence (which is after all the heart of the problem), if it weren’t for one small snag: the FDIC is on the verge of insolvency. At its heart, the FDIC is an insurer of deposits. It does this not so much with actual cash which would pay off depositors if there were a global run on the bank (which is negligible when compared to the total size of roughly $5 trillion in deposits), but by being a symbol of the U.S. guarantee to protect its depositors. After the money market fund broke the buck in late September, the FDIC had its job cut out for it, yet it did what it could, primarily by increasing the depositor insurance amount from $100,000 to $250,000 until December 31, 2009, to restore some confidence. However, because since then the FDIC’s core role has become diluted due to its bank issue guarantees under the TLGP, the actual cash guaranteeing individual deposits has dwindled.

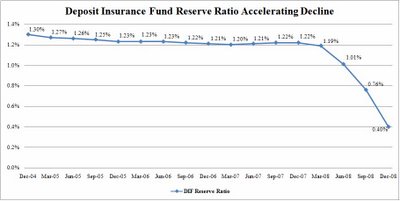

The heart of the FDIC depositor guarantee program is the Deposit Insurance Fund (DIF), which is actual cash set aside to, as the name implies, insure deposits. Yet recent data indicates that for the quarter ending December 31, the DIF has dropped to a staggeringly low number of only $19 billion, and the DIF reserve ratio (ratio of funds in the DIF to total insured deposits) was just 0.4% of total insured deposits, much lower than the statutory minimum ratio of 1.15%. Below is a graphic representation of the DIF reserve ratio over the past 4 years: based on the number of Q1 bank failures it is likely safe to assume that at this moment this ratio is significantly below the year end number of 0.4%.

The declining DIF is a scary prospect for the FDIC: after all, if the insurance money disappears (through a thousand small cuts by subsidizing all those bank failures which we read about every Friday night, or one massive cut such as the failure of a Citi or a BofA, which would immediately wipe out the DIF), even the implicit guarantee of depositors assets will be lost, leading the an instantaneous $5 trillion run on the bank.

The most recently disclosed amount in the DIF of $19 billion was an almost 50% reduction from the $36 billion at the end of September, and seeing how there have been 17 costly bank failures already year to date (all else being equal) it is easy to see how the FDIC is bleeding cash hand over first (while it would not surprise me at all if the reserve ratio was 0, or even negative, at this moment given all the recent activity to shore up funding, I will not hypothesize about this as the last thing I want, is to be accussed of causing a mass panic).

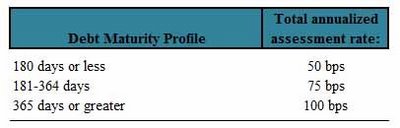

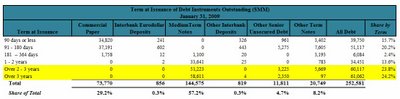

All these considerations have forced the FDIC to propose increasing the fees it currently charges TLGP-issuers including both depository institutions (by 25 bps) and bank holding companies (by 50 bps). The incrementally generated fees are expected to assist with replenishing the DIF. The current TLGP fee schedule is presented below:

It is curious that the FDIC is using the TLGP, which was supposed to be a sacrosanct debt issuance guarantee, as a cash cow to salvage its core deposit insurance product. And as always, the law of unintended consequences rears its ugly heads… But before getting to that, just how much debt has been issued under TLGP and what fees has it generated so far?

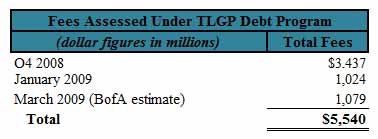

According to the FDIC, at January 31, 2009, there was $253 billion in insured debt outstanding under the TLGP, and since then at least another $50 billion of FDIC-backed debt has been issued based on market data. This roughly $300 billion amount has translated in approximately $4.5 billion in fees through January, and Bank of America estimates that February and March added another $1 billion in fees. Thus, the FDIC has collected roughly $5.5 billion, or 2% on the $300 billion it currently guarantees under TLGP.

It is obvious that even with the $3.5 billion generated via TLGP issuance in Q4, the rapid decline in the DIF is unlikely to be dented at all via any adjustments to the fee structure on new guaranteed debt, although this is just the route that Sheila Bair seems to have set out on. However, under the advice of Perella Weinberg, she must realize the futility of this action, which would explain the March 5 bill proposed by Senate Banking Committee Chairman Chris Dodd…

The Depositor Protection Act of 2009

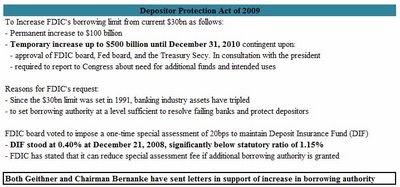

In a very aptly named bill (full text here), Chris Dodd proposes a massive overhaul to the capitalization of the FDIC, so much so that it would make the limitations on the widely criticized TARP seem like child’s play (with all the staged bellyaching in both Senate and Congress of how banks will not get even a penny more in bailout funding). Dodd, cunningly, is proposing adjustments to Treasury borrowing limit by the FDIC under the pretext that it will benefit depositors, when in actuality it is only bank holding companies and further TLGP issuers that will be the sole beneficiaries of this bill. The DPA 2009 effectively increases the implicit bailout capital available to banks by up to half a trillion! The terms of Dodd’s DPA 2009 are presented below:

It looks like quite soon, with the blessing of the Godfathers of bailout enabling Geithner and Bernanke, the DPA 2009 will be a fact, more failing banks will become subsidized by taxpayers, and another half a trillion will have to be raised in the Treasury market, adding to the already significant backlog of over $2 trillion in new TSYs which the U.S. is praying can find a home both domestically but mostly in China. On the flipside, when (not if) this legislation passes, the FDIC should be able to rescind the incremental and totally useless fees it is planning on levying to issuer banks. Which brings us to the topic of…

Law Of Unintended Consequences

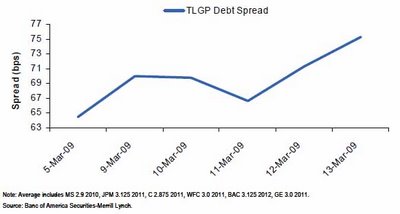

When the news of the proposed 25 and 50 bps increase in FDIC fees hit the market, there was a dramatic sell off in the secondary market of existing TLGP issues, demonstrated by widening spreads as investors expected a surge in issuance ahead of April 1, when the new fee structure is implemented.

This substantial widening has the potential to destabilize a majority of the to date efforts implemented in shoring up confidence in the credit system, especially the financial term markets.

Another troubling unintended consequence has to do with the term distribution of fixed-rate TLGP debt, which based on FDIC data, tends to be clustered around the 2-3 year mark.

When this fixed-rate debt is swapped back to floating, there tends to be pressure on 2 yr and 3 yr spreads to tighten. This has been empirically proven: 2 yr spreads have tightened dramatically over the past several days, coincident with a sharp uptick in TLGP issuance. Assuming TLGP issuance remains elevated until the end of March, ahead of the April 1 new fee schedule, swapping flows will keep short spreads abnormally tight. Then, once we enter April, spreads will be driven wider by the dramatic drop in TLGP swapping activity from reduced issuance.

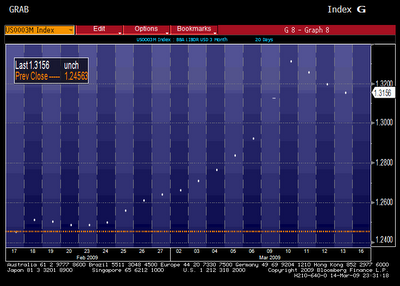

And the last unintended consequence will likely implicate the much suffering LIBOR: as banks become TLGP-issuance averse and seek to borrow in the pro forma cheaper Eurodollar market, LIBOR is likely to spike and short spreads to widen. The threat of a widening LIBOR is perfectly evident just by looking at its trading levels over the past 10 days as banks have already starting looking at Eurodollar conduits as an alternative to TLGP.

The increase in LIBOR rates will have a cascading impact on a plethora of other credit market viability metrics, such as the mundane and mainstream media favorite Ted-spread, to the much more sneaky, under-the-radar and significantly more critical to term liquidity LIBOR-OIS spread.

Lastly, as the name implies, every action that the administration can and will come up with to postpone the inevitable day of reckoning for its cheap-liquidity addicted, zombie bank patients, will surely have even more unintended, unforeseen and definitely negative consequences.

Summary

There is nothing that can be done at this point to prevent the administration from leeching every last dollar out of its taxpayers to benefit the terminally addicted and zombied bank system. Using pretexts, subterfuge and lies, the administration’s charade triage will only end once there are no more gullible taxpayers to provide their cash, no more demagogue senators and congressmen who will bend reality to make it seem that their actions benefiting a select few are for the benefit of all, and no more naive investors who buy into the promises that U.S. debt is the “safest investment.” However, for the scope of this post, I can only hope that Perella Weinberg quickly realizes the futility of the TLGP fee increase, and that the goals of that particular action will be magnified when Dodd’s hilariously titled DPA 2009 bill passes, as the negative consequences are likely to substantially surpass any positive ones.

In the grand scheme of things, at this point it doesn’t really matter: at best, any FDIC action buys the U.S. financial system a year or so to delay the inevitable moment when the heroin addict decides it is time to seek the help of a methadone clinic before it is too late, only to realize that in its quest to feed the addiction, the administration forgot to provision for any precious methadone… but then again its availability would imply someone actually believes U.S. banks will, at some point, get to a point where detox is even a remote possibility which is obviously not the case (at least for now).

And if the unimaginable does happen, and the administration does comprehend that the wisest and correct thing is to use the cold turkey approach on U.S. financials, Zero Hedge provides some more sage advice from the protagonist of Trainspotting, who succeeded where so many U.S. banks have and will fail:

Relinquishing junk. Stage one, preparation. For this you will need one room which you will not leave. Soothing music. Tomato soup, ten tins of. Mushroom soup, eight tins of, for consumption cold. Ice cream, vanilla, one large tub of. Magnesia, milk of, one bottle. Paracetamol, mouthwash, vitamins. Mineral water, Lucozade, pornography. One mattress. One bucket for urine, one for feces and one for vomitus. One television and one bottle of Valium, which I’ve already procured from my mother, who is, in her own domestic and socially acceptable way also a drug addict. And now I’m ready. All I need is one final hit to soothe the pain while the Valium takes effect.

Kudos! Great Post!

i on the ball patriot

Wow Tyler,

This is a pretty substantial thread along with the various other tentacled memes you have introduced with this ever-morphing monster.

Spare us the melodrama, if we want that we can go elsewhere. The basic facts are sobering enough. Also, portraying Chris Dodd as an evil conniver is unfair to him and makes you look bad. He’ll still be chair of the committee after Geithner is long gone, and don’t you forget that.

PS Trainspotting is a great movie, and I say that as someone who read the novel before its first American printing.

Restoring faith in the financial system? good luck.

This post doesn’t adequately distinguish between FDIC’s cash flow needs and its forecasts of losses on insurance paid. FDIC either pays out deposits by check (rare) or wires the amount of insured deposits to an acquiring bank (net of assets purchased by the acquirer). FDIC also has to clear FHLB borrowings and Fed Window borrowings by wire immediately after a bank closes, and those number can be very large. There are other types of immediate outflows but these are the major ones. Thereafter, it may take years for FDIC to realize on the assets of the failed bank. The loss comes well down the road; the cash flow requirement is immediate. That’s why Dodd wants to raise FDIC’s borrowing limit from its current $30B. Will some portion of FDIC’s Treasury borrowing be a loss? Sure, and the loss could be over 25%, but it’s not the entire $500B in temporary borrowing authority.

Hard hitting and highly detailed – nice work. Wish I could follow 100% of it, but that’s my failing. I was unaware of the stealthly ruse of the FDIC recap being for bank holding companies.

Very interesting. The tendency toward fanciful histrionics is nicely balanced by factual observations.

And riding to the rescue of the addicted, zombied banks, our rehab clinic counselors Larry Summers, Moe Bernanke and Curly Geithner. Does it get any better than that? Sit back and watch the show, but beware, the humor is rather twisted.

Steve,

Thank you for injecting a note of sanity into this half baked analysis. It’s easy to make a point if you leave out half the facts.

This post doesn’t adequately distinguish between FDIC’s cash flow needs and its forecasts of losses on insurance paid. FDIC either pays out deposits by check (rare) or wires the amount of insured deposits to an acquiring bank (net of assets purchased by the acquirer). FDIC also has to clear FHLB borrowings and Fed Window borrowings by wire immediately after a bank closes, and those number can be very large. There are other types of immediate outflows but these are the major ones. Thereafter, it may take years for FDIC to realize on the assets of the failed bank. The loss comes well down the road; the cash flow requirement is immediate. That’s why Dodd wants to raise FDIC’s borrowing limit from its current $30B. Will some portion of FDIC’s Treasury borrowing be a loss? Sure, and the loss could be over 25%, but it’s not the entire $500B in temporary borrowing authority.

March 15, 2009 9:54 PM

Holding cash at home or some gold is looking better all the time even though it probably all go towards paying taxes.

I find the Depositor Protection Act of 2009 to be skillfully crafted subterfuge aimed to be an easy sell to the American public, but not aptly named.

Under this new act, the FDIC will now require that the taxpayer insure their deposits and becomes a vehicle to extort taxpayer money for the banksters. This bill essentially requires us, the depositing taxpayers to self-insure our own deposits. And Dodd has the nerve to call this “protection” for the depositor? No, it is a protection racket designed to extort money from the taxpaying depositor. This is tantamount to buying protection from the mafia. The Act needs to be properly renamed the Depositor Protection Racket Act of 2009. This has a much better ring to it, and has the benefit of being at least an honest sell to the taxpaying depositor.

As defined by Wikipedia,

The term racket comes from the Italian word ricatto (blackmail). Typically, this usage is based on the example of the “protection racket” and indicates that the speaker believes that the business is making money by selling a solution to a problem that it created (or that it intentionally allows to continue to exist), specifically so that continuous purchases of the solution are always needed. Example: in a protection racket, a representative from the racket informs a storeowner that a fee of X dollars will be required every month for protection money, though the “protection” that is provided comes in the form of the racket itself not causing damage to the store or its employees.

The italics added are mine. On October 15 1970, The RICO Act, Racketeer Influenced and Corrupt Organization Act, became law and made racketeering illegal. In short, the Depositor Protection Act of 2009 is an attempt to overturn the RICO Act of 1970 and make legal the practice of “selling a solution to a problem that it created and intentionally allows to continue to exist, specifically so that continuous purchases of the solution are always needed.” The Fed, the FDIC, and the US Treasury are now explicitly in the protection racketeering business. And they are asking lawmakers to make this business legal under this new act. In short, these three entities ought to be indicted by the Supreme Court of the United States.

john bougearel said…

“On October 15 1970, The RICO Act, Racketeer Influenced and Corrupt Organization Act, became law and made racketeering illegal. In short, the Depositor Protection Act of 2009 is an attempt to overturn the RICO Act of 1970 and make legal the practice of “selling a solution to a problem that it created and intentionally allows to continue to exist, specifically so that continuous purchases of the solution are always needed.” The Fed, the FDIC, and the US Treasury are now explicitly in the protection racketeering business. And they are asking lawmakers to make this business legal under this new act. In short, these three entities ought to be indicted by the Supreme Court of the United States.”

The RICO act can not be used to prosecute a single legal infraction. This Depositor Protection Act of 2009 therefore is not an attempt to overturn (sidestep might be a better word as the RICO statute itself is not affected here) the RICO act. However it does play into what is punishable by RICO, engaging in a “pattern and practice” of such crimes. This Depositor Protection Act of 2009 is just one more of many such abuses of law where laws that favor the wealthy ruling elite are made contrary to the will of the public. It adds to and reinforces the pattern and practice of corruption.

The problem of course is that the ‘rule of law’ is a selectively enforced scam (RICO has already been neutered by the ‘supreme court’ when used against big business, don’t hold your breath waiting for those indictments) that is owned and controlled by the wealthy ruling elite. Chris Dodd is just another of their puppets – a really slippery slime ball – assisting in the financial coup by kicking the can down the road so as to meter out the intentional pain that will reduce the middle class to zip!

Deception is the strongest political force on the planet.

i on the ball patriot

In summary then whatever the US government tries distorts the market and causes further damage. Whilst it might be conceivable that banks will be weaned away from all the government bailouts any attempt to wean the consumer away from cheap mortgages will just tank the economy.

So we should be watching Libor and as it rises mortgages and loan interest rates rising as the FDIC attempts to bail itself out by charging more. Still if they throw enough money at Fannie and Freddie I am sure it will be ok.

Meanwhile the dollar value holds up while all other currencies drop and the US consumer buys all those cheap imports saving foreign jobs while exports tank and the bailouts achieve exactly the opposite of there intention with more US jobs lost.

John Bougearel writes:

“Under this new act, the FDIC will now require that the taxpayer insure their deposits and becomes a vehicle to extort taxpayer money for the banksters. This bill essentially requires us, the depositing taxpayers to self-insure our own deposits.”

What did you expect?

The FDIC is established to protect depositors from banks. It achieves this objective by collecting money from the very institutions it is protecting depositors against. It’s a recipe for ketosis as the snake dines on its own tail.

In an 80/20 world, the FDIC makes a lot of sense when applied to the 80% of the banks that make up 20% of the deposits.

The configuration of the FDIC does not make a whole lot of sense, however, from the other perspective in Pareto’s Principle: When it’s applied to 20% of the banks making up 80% of the deposits.

Ah, but no worries, Big Ben just says we need to get confidence back into the system. As if this whole problem were simply a loss of our mojo.

It’s so annoying when commentators claim this crisis is about confidence. Prior to this day of reckoning, it was about suspending reality…and if by “getting confidence back in the system” they mean we need to suspend reality and live on unsustainable debt accumulation…then, OK, fine…

But beyond that, if the commentators persist in pursuing this confidence theme, then I say to them this: I am VERY confident. For years I questioned whether the “implicit” guarantee of Fannie and Freddie was a reality or just another Uptown Urban Myth. Additionally, I questioned whether our government really would step in and protect those companies which really are too big to fail. Along those same lines, I wondered about our government’s choices in the time of crisis—specifically would our government go 80/20 Rule Squared and brazenly support the 1% that is Wall Street at the expense of the other 99%?

Now, like a testimonial on a bad infomercial, Dan D says, “At first I wasn’t sure, but now all of my doubts have been erased. Now, I am truly confident. Thanks US Congress!”

For What It’s Worth…..

Deposit Insurance.

Unnecessary, UNLESS the deposits are put at risk. How to eliminate?

The concept of fractional-reserve lending is that the deposit is the BASE of all the lending at the bank.

The fractional-reserve lending system is the definition of PRO-CYCLICAL.

We are experiencing the downward side of the cycle.

In spades.

The FDIC was created after the huge threat to deposits caused by the monetary contraction phase of post-29 banking cycle.

At the time, the Chicago Plan surfaced as a means of eliminating the risk to depositors, through reversion to a 100 percent reserve banking system.

Banks would be limited to lending equal to its deposit base, and the government would replace the private bankers as creators of the nation’s money.

The way to eliminate the threat to the deposit insurance fund is to eliminate the threat to deposits, and the way to do that is to implement the monetary reforms contained in Milton Friedman’s 1948 paper “A Financial and Monetary Framework for Economic Stability”.

Only the names of the players have changed.

If you want economic stability, remove the banker’s power to place our deposits at risk.

The Chicago Plan.

Greenbacks.

Would have loved to see a mention that one of the main reasons the FDIC is having problems is because they didn’t collect premiums from 95% of banks between 1996 and 2006.