The Administration put on a full court press this weekend to shore up Bernanke’s confirmation vote, which was looking increasingly doubtful as of Friday. Over the weekend, Democratic and Republican leaders in the Senate said they were confident that Bernanke would be confirmed. The media took up the call, with stories appearing in virtually every MSM outlet blaring that Bernanke was in.

But how seriously should we take this declaration of victory? Contrary to the efforts to present the confirmation vote as sealed, it is not in the bag:

Of senators who made statements or were contacted by Bloomberg yesterday and today, 27 said they would vote for or were leaning in favor of Bernanke, while 16 were opposed or leaning against him, and 30 were undecided.

Jim Bianco made a tally Sunday afternoon and this was his bottom line:

Bernanke’s reappointment vote is coming down to the wire, it is going to be close. Recall that Bernanke was reappointed in August by Obama and the Senate Finance committee approved him on December 17. Now with seven days until his term expires, his nomination has gone from a sure thing to in doubt.

And, if you think this is not political, consider the 36 senate senate up for election in December:

8 said they would vote “aye” (5 democrats, 8 republicans)

9 said they would vote “no” (3 democrats, 6 republicans)

4 are publicly declared undecided and all are retiring and not running again ( 2 republicans and 2 democrats)

15 have made no public statements, all are running for reelection (8 democrats, 6 republicans)

In other words, senators up for reelection are saying “no” at a rate of 47%, not enough to get Bernanke reappointed let alone achieve 60% for cloture. Party affiliation does not matter.

Bianco thinks that what might push the nomination over was the biggish down day on Friday, which as one equities trader correspondent noted:

Also, I love how the MSM perpetuates the idea that a market sell off simply reflects “investor fear” over what a less bank-friendly Fed Chairman might portend. It couldn’t be that the banks themselves are doing the selling in order to create that appearance.

That could never happen. Nope. Never.

So the US has become a country of democracy by financial markets rather than the ballot box,

Bianco believes, interestingly, that the market reaction is not over dismay at the prospect of losing Bernanke (as Matt Yglesias points out, Bernanke being replaces as chairman makes less of a difference to the Fed than one might imagine) than of the specter of the Administration floundering at the lack of a plan B.

So faithful (and promiscuous) readers, this is a long-winded introduction to saying this is a time when manning the phones and e-mails can make a difference.

Recall that on the first TARP vote, the House leadership thought it could push the vote through, and failed. And while the banksters won in the end, the groundswell came out of the blue and stunned Congress.

Here we have a very different fact set, and a key leverage point. A push to get the Senate to turn down Bernanke is not about Bernanke per se, even though Bernanke does not deserve to be Fed chair again. Per Steve Keen’s post today and other posts I have written, there is ample reason to replace Bernanke, starting with his intellectual capture and failed record. What kind of endorsement is it to say someone is a decent firefighter when he was the one that helped torch the house in the first place? And even if you believe he did a good job in the crisis (which I do not, the failure to examine the health of the major investment banks and plan for an failure in the wake of the Bear collapse ALONE is a shocking lapse), he is evidently satisfied to patch up the system with duct tape and baling wire. Unreconstituted, unreformed, and more concentrated, the financial system will break down again, likely in a more spectacular way.

The real issue is that that the election of Scott Brown in Massachusetts has finally begun to penetrate the Administration reality distortion field. Unfortunately, they still labor under the delusion that Obama’s smooth talking and mere Potemkin reform can assuage those clearly irrational voters. They just have to up their game, that’s all. So Tim Geithner momentarily retreats to the background, Volcker gets more photo ops, Obama scowls more when he talks about bankers, and they serve up some tough-sounding measures, like “limiting” proprietary trading….which it turns out will, like every other “reform” Obama has proposed, leaves the status quo almost entirely intact.

While the Administration is still shaken and trying to regroup is time to keep the pressure high. And unlike health care or bankers’ bonuses, the Fed is not considered to be of much interest to the average voter. So evidence of voter disapproval on a matter that would normally be off the popular radar screen will send a potent message that the public is engaged, is following the politics blow by blow, and is no longer easily snookered.

The Bernanke vote is a powerful way to send a message to the Administration that the public is NOT buying what they are selling on the financial front, and much more fundamental change is needed.

In particular, one finesse that some Senators are no doubt considering is a “yes” vote on cloture (with Senators threatening to filibuster, the motion to end debate and proceed to a vote requires 60 votes to pass) and a “no” vote on the confirmation (which requires only a simple majority for Bernanke to be confirmed). Thus Senators could say they voted ‘no” on Bernanke, yet have fallen in line with the vote that mattered, the cloture vote.

So it is important in contacting Senators to tell them specifically that you want a no on both the cloture vote AND the confirmation vote.

The vote could be as early as Wednesday, so calls and e-mails today and tomorrow are critical. And the longer the confirmation process drags on, the more the momentum of the weekend (the shoring up of Bernanke) starts to dissipate.

Remember, if you aren’t part of the solution, you are part of the problem. Turn up the heat. This is a juncture when a big show of public interest can have an impact.

Flood senator’s inboxes. Here is a contact info, which you can search alphabetically or by state.

Keep it short and simple. Michael Shedlock, who was effective in rallying his readers on previous votes, has this advice:

Whether they are in your state or not, please call 5 undecided senators.

Concentrate on the senate. The house has no say on this.

What To Say: Make it simple so as to not tie up the lines … “Vote No on Cloture to end debate on Bernanke. I am opposed to the reappointment of Bernanke [give your personal reason] and I think we should start all over on health care [or whatever you think about that issue]. ”

That part in bold is crucial. Specifically say “Vote No on Cloture”.

Be prepared to name your city and give a zipcode. Here is the Zip-Code Database.

Next call and email your senators with the same message.

Here is a directory sorted by state of all the Senators of the 111th Congress.

You can also look up the phone numbers in the Online Directory For The 111th Congress but the first link may be easier to use for just senators.

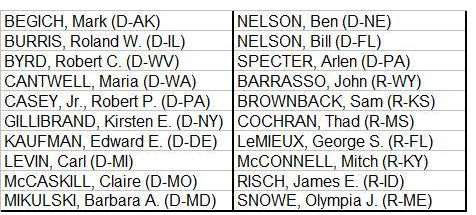

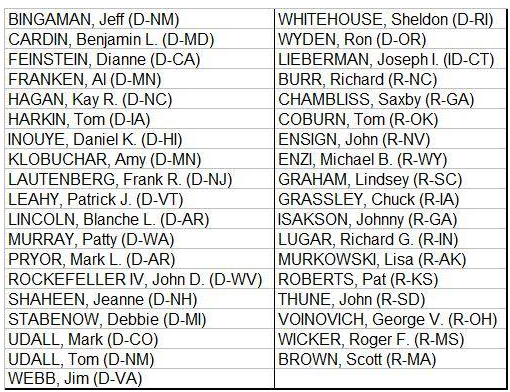

Here is the Sunday tally per Jim Bianco:

Senators who have said they are undecided:

Senators who have not taken a stand on Bernanke:

Time to quit complaining and take action. Make a difference.

Why say no to Ben B? There are other ways to reign in Wall Street and at this point aren’t there enough items of chaos and uncertainty where we don’t really need to tamper with that given the expected outlook for a replacement? It’s all ideologically driven so the academics that are blind to practicality such as Ben B, Summers, any U Chicago type would end up in the chair and tank us just the same.

The right legislation can help reduce the impact of the Fed moreso than a bungling Fed chairman.

If Bernanke doesnt get appointed this brings alot of attention to the fed and in turn makes more likely public support for fed audits.

I think even a new fed chairman wont take the pressure off the fed regarding the audit.

You asked, “Why say ‘no’ to Ben B?” I don’t mean to be abrupt, but – are you kidding me?

Here are some answers to your question: Simply stated, Bernanke is complicit in the administration of policies that guaranteed the US financial collapse.

Bernanke helped engineer that collapse by furthering volatile, causal policies. In doing so, Bernanke – supposedly and admittedly operating independently – colluded with both the banks and politicians regarding an agreed-on strategy to implement and/or further those volatile, harmful, policies – policies that clearly worked against America & its citizens.

Most reprehensibly, time after time Bernanke acted to protect his own hide & to guarantee his own personal benefit rather than undertaking actions that would benefit us and our country. A recent example of Bernanke acting in his own personal interest would be when Bernanke opted for and openly condoned the use of widespread secrecy, a policy he has repeatedly advocated. In this recent example, Bernanke once again worked against us taxpayers when he sought to shield the Fed’s monetary actions from those pesky “Government In The Sunshine” laws. And, Bernanke once again cited pretextual reasons to justify his abject failure at transparency, to the detriment of US taxpayers.

Secrecy stands in opposition to the essential functions of Bernanke’s job as Fed Chairman. In that regard, Bernanke has been a hapless failure to which submitting his resignation would be the most appropriate & justified response.

Hoorah glock8651

One can measure how far into the distortion field DC is located, if we have to force a “No” vote on a Fed Chairman for the first time in modern history.

I agree with Yves and Mish 100%; it appears to be the only way to tell the Administration AND Congress that politics as usual need not apply for the job to do on the economic and social front.

And yes!…this message goes for the Republicans too. We don’t need a Party of Maybe and neither do we want a Party of No.

Get down to do the business of The People…or else!

This is a call to arms. I accept.

BB once meant something luscious, delectable, kittenish, cuddly, take her home to Mom. On the other hand, today, BB means something far less desirable. Something that rings hollow when it pleads for reappointment, pleads for independence. Why for all the pleading? To make a mark in the annals of fiancial history as the great saviour? To cover the errors of commission and omission? I wonder.

On the basis of having trampled over 200 years of established contract and Constitutional Law, the current BB has jointed in the fiasco and is the great motivator of what is clearly a grandiose idealogical experiment gone south and relegated our Republic to the banana class.

Throw the bums out!

And here is the address of Santa Claus;

North Polar – Santa Claus P.O. Box 56099 North Pole, …

You can help keep the myth of Santa alive by validating and legitimizing him with your calls and letters. Don’t let anyone tell you that this is a complete waste of time and that Santa is non responsive to the will of the people. Santa does exactly what the people want each and every time!!!!

You are not giving up your power and you won’t look stupid when you write to Santa. Santa is just as real and responsive as the Tooth Fairy. Remember when you were a little kid, and you put that tooth that had fallen out of your precious little head under your pillow before you went to sleep and woke up the next day and magically found all of those coins there instead? Well, that’s proof! Santa is just as real!

Keep your calls and letters SIMPLE and be direct …

Tell Santa that you want the the gang rapists at the fed to stop fucking the victims up the ass (pernicious greed with Bernanke) and please go back to the old missionary position (vanilla greed with somebody new).

Remember: If you don’t write to Santa — YOU are part of the problem and YOU can not complain! Turn up the heat! Flood Santa’s in box because Mike Shedlock, who thinks, “Clearly the market can set interest rates far better than the Fed did.”, says so.

Deception is the strongest political force on the planet.

the ball is back!

c’mom ball, try it just for kicks. give some hapless phone answering staffer a mouthful of four-letter up the ass analysis and see what they say. Could be amusing.

I got off the 5 train at 86th and Lex a few months back and this hot little babe was standing there shaking hands. she was running for city council and she had a few handlers around handing out flyers with her picture on it. She was hot.

And so she reached out to me and introduced herself and I said “What does a city council person do” And she answered in generalities.

and so I said “Can you kick Goldman Sachs out of Manhattan?”

And she sort of hesitated and kept in campaign mode and said “I’m not sure if we’d want to do that.”

And I said “Sure we do. They’re a bunch of criminal looters, we want them out of here . . . Can you kick them out??””

And she began to back away and smile nervously at me and her eyes began to look for other passerbys and her handlers were laughing nervously.

I repeated “They’re a bunch of criminals.” And they smiled at me with a nervous grin.

So I said to them all “Well, I guess that’s not the kind of question she expected . . . But thanks for your time.”

And I smiled and walked away.

I will call 5 senators today and tell them to Stop the Rape of MOther America. My rear hurts and I’m crying.

I’m sticking with Santa …

C’mon craazyman, with all due respect …

… you really don’t want me to put my hat in my hand and beg the same disingenuous sell out phonies who intentionally created the global credit bubble and allowed the creation of counterfeit money in the form of unregulated derivatives to be spread all over the planet so that they could selectively; consolidate wealth, squeeze the middle class out of existence, bust unions, renege on social contracts, steal the life savings of ordinary citizens, create perpetual conflict by pitting the prudent against the not so prudent, make geopolitical gains, and overall create a two tier ruler and ruled world. Why would I do that when I can write to Santa?

Santa would never do that!

And these sell out puppets that you want me to write to are the same sub human scum that are drone bombing little kids to death in Pakistan and Afghanistan — right now as we speak. You know who they are, they are the ones that lied us into that Iraqi invasion where they used our money to kill over a million innocent civilians. Why would I trust them? Why would I want to call or write to those scum bag ass wipes? Especially now that they have turned their greed and elite attitudes on you and me! Intentionally created credit bubbles and counterfeit derivative products are just another form of bunker busters and carpet bombs being dropped on domestic populations.

Santa never invaded anyone and he doesn’t have a big ass mean and scary military.

Santa is pure and genuine. You should write to him and tell him you have visions of sugar plums and a little hotty in your head and he will send you those sugar plums and a cute little hotty right away.

Then you and your new little hotty can eat sugar plums together and plan the ‘No confidence In Government’, election boycotts. You can publicly demonstrate and burn your useless voter registration cards together. And then you can go home and you can snuggle together and work on a plan for a debt jubilee and a constitutional rewrite that will eliminate the fed — and eliminate parasitic banking — and enact utility banking with interest free money allocated directly to citizens.

Why the fuck should citizens be taxed to give money to the fed that turns around and then gives that money to a bunch of fat ass bankers at ZERO interest that then turn around and charge the same overtaxed citizens TWENTY NINE PERCENT interest on their credit cards? That is not only stupid. It is grossly unfair. That is not privatization, that is slavery and corruption.

Tell Santa i on the ball says hello.

Deception is the strongest political force on the planet.

Amit Chokski, to get “the right legislation” that you prescribe, the right message has to be delivered and that means saying ‘no’ to Bernanke.

It should be recalled that Bernanke failed to foresee the Great Recession that has unfolded. We are advised by Simon Johnson and others that the recipe for another great financial failure continues to be in place and that it is only a matter of time. Why would anyone give Bernanke a second opportunity for failure when the risk is so high and the damage is likely to be equal or greater than now.

Saying ‘no’ is not a matter of politics but of averting another financial crisis.

Arlen Specter can’t decide whether it’s time to hang his albatross back on the Republicans again.

Bob Casey, Jr. has decided on his next campaign slogan – “Still not Rick Santorum”

And both of their Web sites require topics to be selected when responding which provide no option for this topic. So, just pick anything close, send your message, keep your fingers crossed and hope they actually take the time to read it…I mean comprehend it.

It’s interesting to note that the pro-Bernanke forces’ torch bearers–Dodd and Gregg–are both retiring and so don’t have to face the voters next year.

In a conference call with reporters on Thursday to discuss his withdrawal from the Commerce Secretary nomination, Gregg also said he did not intend to run for reelection in 2010.

http://belowthebeltway.com/2009/02/12/judd-gregg-announces-retirement-from-senate-in-2010/

Francois T said, “And yes!…this message goes for the Republicans too. We don’t need a Party of Maybe and neither do we want a Party of No.”

I beg to disagree. We’ve had two parties of individuals who for several decades have said yes to more power, more spending, and more influence from lobbying. A Party of No (and not just to healthcare bills) means a Party of Yes for decentralizing power, bringing fiscal restraint, and not giving lobbyists what they want.

The idea that the cloture vote is the vote that matters is a terrible condemnation of our system. Cloture is a techincal procedure. The idea that it is somehow dishonest to vote to limit debate and subsequently vote against a measure is crazy. Each senator has a vote and it is not the responsiblity of any collection of senators to prevent a vote of substance on any bill or appointment. Yves, this is one of the elements that is making the country increasingly ungovernable and I am frankly appalled that you seem to go along with it so easily. I think Chairman Bernanke should not be continued in office, but I think a majority of our senators should cast those votes, not a minority deciding that it should never come to vote.

Well, that’s the system we have right now and it would be crazy not to use it for good since it’s so often used for ill.

Bianco thinks that what might push the nomination over was the biggish down day on Friday, which as one equities trader correspondent noted:

Also, I love how the MSM perpetuates the idea that a market sell off simply reflects “investor fear” over what a less bank-friendly Fed Chairman might portend. It couldn’t be that the banks themselves are doing the selling in order to create that appearance.

That could never happen. Nope. Never.

Agreed, it is time for the Fed to disprove PPT charge of government manipulating markets for political purposes.” http://www.marketwatch.com/story/time-for-fed-to-disprove-ppt-conspiracy-theory-2010-01-05

Jan. 5, 2010, 4:19 p.m. ESTPost:

Time for Fed to disprove PPT conspiracy theory

Commentary: Analyst charges that government is manipulating markets

WASHINGTON (MarketWatch) –“The massive stock-market rally in the past nine months is mostly due to secret government buying of stock-index futures, a respected stock-market analyst said Tuesday.”

John Crudele in his NY Post column had been reporting on this in some detail since 2006.

Unfortunately, I think it has become pretty clear that our politicians are not there for us, but for their own agenda, and this extends across party lines. It is always amazing how they seem so astute and able to talk the talk, but they almost never actually walk the walk. One of my senators is on the list and I will be writing and calling today…

Thanks for providing all the information & making it easier for people to act.

I called my two VA senators, plus MD, VT, and WV, plus the White House, who I told I was very distressed, as a lifelong Democrat, to hear that the WH is interpreting the MA vote as a problem of “not communicating clearly” !

Au contraire, they are communicating very clearly: Wall ST and Big Banks are more important than We the People.

I also suggested to the WH to consider listening to Simon Johnson, William Black, and Joseph Stieglitz instead of the current crew.

I have little hope we’ll be listened to, just like with the TARP vote, when I called all these people, to communicate my distress………it happened anyway.

I’ll get another chance in November.

Bernanke is not ignorant of debt markets and aggregate demand. With Gertler and Gilchrist he has developed one of the most accurate models of debt market and GDP. Please examine the work of his co-authors prior to passing judgement.

Bernake WAS ignorant of derivatives and the limits of self-regulation. These are reason to fire him. However, I think he gets it now.

Title: The Financial Accelerator and the Flight to Quality

Author(s): Ben Bernanke, Mark Gertler, Simon Gilchrist

Source: The Review of Economics and Statistics, Vol. 78, No. 1 (Feb., 1996), pp. 1-15

Publisher(s): The MIT Press

Stable URL: http://www.jstor.org/stable/2109844

Abstract: Adverse shocks to the economy may be amplified by worsening credit-market conditions–the “financial accelerator.” Theoretically, we interpret the financial accelerator as resulting from endogenous changes over the business cycle in the agency costs of lending. An implication of the theory is that, at the onset of a recession, borrowers facing high agency costs should receive a relatively lower share of credit extended (the flight to quality) and hence should account for a proportionally greater part of the decline in economic activity. We review the evidence for these predictions and present new evidence drawn from a panel of large and small manufacturing firms.

Simon Gilchrist, Vladimir Yankov, Egon Zakrajsek, Credit market shocks and economic fluctuations: Evidence from corporate bond and stock markets, Journal of Monetary Economics, Volume 56, Issue 4, May 2009, Pages 471-493

Irrelevant if Bernanke “gets it” now with regards to derivatives, and other criminal “innovations”. The question is, will he stand up for breaking up Too Big to Fail into Too Small to Matter? Will he move up for regulating the crap out of these criminal syndicates rather than looking on like an over-indulgent father upon his out-of-control kids?

I daresay that he and Geithner STILL speak with one voice: the voice of Goldman-Sachs, et al, and that means Bernanke has to go. When Bernanke bites the dust, it is a likely bonus that shortly thereafter Geithner will get the well-deserved boot too.

And then we need to get Summers and Emmanuel out of the Administration too.

House-cleaning time!

“Tell Senate “No” on Bernanke Cloture”

Tell Senate, NO, GODDAMIT on Bernanke Cloture

There, fixed it.

It is a standard political ploy to pre-emptively declare victory. It is a way of making something in question look inevitable.

Still I think Bernanke should be reconfirmed. There is considerable doubt whether he or Greenspan was the worst Fed chairman in US history. Another term would, I think, clinch the title for Bernanke.

I did my 5.

Webb (VA), Byrd (WV), Kaufman (DE), Casey (PA), Gillibrand (NY)

I don’t feel empowered, just disemboweled by Mammon’s Morons.

But I’m not doing it for this life, I’m doing it for Karma and for what comes next, built, as it will be, on all we do when we’re here. Grasshopper.

I must say that when the Right and the Left come together and agree on something, more than likely they are right. So they are probably right that Bailout Ben should be thrown out of the Federal Reserve before he does even more damage to our already damaged economy. What worries me most about Ben Bernanke is that he comes across as someone who’d like to pattern our economic system after something you’d find in oligarchical Russia.

Cass Sunstein is someone else that the Right and the Left can agree upon. So they are also probably right that he should be thrown out of the Obama Administration before he influences Obama to do even more damage to our already damaged Constitution. What worries me most about Cass Sunstein is that he comes across as someone who’d like to pattern our judicial system after something you would’ve found in Nazi Germany.

I think it’s safe to say that the Rahm Emanuel is someone who wouldn’t mind seeing our country turn into a fascist state. But Cass Sunstein, I’m afraid, as Glenn “Glennzilla” Greenwald points out, is someone who is willing to use his power in the Obama White House to turn our country into a fascist state:

http://www.salon.com/news/opinion/glenn_greenwald/2010/01/15/sunstein/index.html

Gun-totting teabaggers are afraid that if Sunstein gets his way, he’ll take away our right to bear arms. But if you think about it, they should have little to fear that he’ll do this because Obama has a strong track record for 1) supporting gun rights and 2) caving to teabaggers’ demands. So for these reasons, Obama isn’t likely to appoint Sunstein to the Supreme Court, where he could do lots of damage to the second amendment.

Leftist civil libertarians, OTOH, are afraid that if Sunstein gets his way, he’ll take away our freedom of speech. They really do have reason to be fearful of him doing this not only because Obama has a strong track record of undercutting liberals, but also because he has done next to nothing to scale back, much less give up, any of the ill-gotten, anti-American, unconstitutional presidential powers that Bush so ruthlessly accumulated during his years in power. So for these reasons, Obama may indeed extend his presidential powers to Sunstein so that he can silent those of us who speak out against our government.

I find it ironic that loud-mouthed media pundits, like Beck and Limbaugh, are making a lot of noise about Sunstein being a threat to our second amendment rights, when he’s really not much of a threat to this, while media pundits, right and left alike, remain silent about him being a threat to our first amendment rights, when he is very much a threat to this. So I find this to be doubly ironic that media pundits depend on our first amendment rights in order stay employed, but they’d rather use these rights to defend our right to bear arms than our right to free speech.

I loved Steven Colbert’s take on the Bernanke confirmation:

“Who better to solve the problem then the person who helped create the problem?… If you are cursed by a witch, you have to get the original witch to take the curse off you.”

Pretty much says it all, I think. I wrote my Senators, we’ll see if that does any good.

Yeah, they’ll really listen to us just like TARP.

RH

@8:21

“Given Walter Burien’s revelations about the massive

gov’t shell game, does it matter much?

Either of his videos is mind bending, the old one:”

Mind bending? GMAFB. What is this guy saying that is so mind bending again? I didn’t hear a damn thing that caused me to bend my mind.

Just what we need another wannabe ponytailed pundit looking pensively like Rodin’s ‘The Thinker’ in front of a roaring fireplace telling us his ‘No Sh$t’ opinions about where we are, and by gum, where he thinks things are going.

Mind bending indeed. Sheesh.

RH

Given Walter Burien’s revelations about the massive

gov’t shell game, does it matter much?

Either of his videos is mind bending, the old one:

http://video.google.com/videoplay?docid=6703413885850200097#

or the new one:

http://www.youtube.com/v/Y2ClJ3Mvzt0&hl=en&fs=1

@8:21

“Given Walter Burien’s revelations about the massive

gov’t shell game, does it matter much?

Either of his videos is mind bending, the old one:”

Mind bending? GMAFB. What is this guy saying that is so mind bending again? I didn’t hear a damn thing that caused me to bend my mind.

Just what we need another wannabe ponytailed pundit looking pensively like Rodin’s ‘The Thinker’ in front of a roaring fireplace telling us his ‘No Sh$t’ opinions about where we are, and by gum, where he thinks things are going.

Mind bending indeed. Sheesh.

RH

Oops, hell it belongs here instead. We all make mistakes, some more than others.

@RH, no doubt your mind is already bent. But

to the other non-medicated population who have

learned how to interact w/ humans, they’ll be

quite surprised by Walter Burien’s pieces.

Go ahead mind bender give us an example, synthesize it if you will, why this guy is so mind bending.

I think he sounds like he’s FOS of himself to be quite frank.

RH

Rick:

Interesting.. very old political strategy.. falsely attack the messenger and sidestep the message..

It is not I that is mind bending, it is the comprehension brought forward of the “facts” behind governments own accounting. Collective totals and true gross income. My site CAFR1.com brings it forward rather clearly and it is NOT I that has impact, it is what I point you to and then say “look and learn” the Biggest Game in Town.

When you do and the pieces fall in place from GOVERNMENTS OWN REPORTS; Investment totals; gross income revealed; and all that it entails, then “reality” hits and yes, some could call it mind bending, I just call it opportunistic on the part of our government in cooperation with the corporate institutional players over the last century DUE TO THE EASY MONEY INVOLVED… Taxation is not needed… Learn why!

And PS: I am just one person who learned and now tries to pass on what I know as “fact” to be important to those that have not yet learned themselves.

You people are NUTS. The only thing that a NO VOTE on BB will result in is more CHAOS in the financial system that will allow the crooks to loot even more money than they have already. Are you really dumb enough (at this point) to think this system has any chance of being reformed in a passive and nonviolent way?? It has NONE. The entire paradigm has to crash and BURN before “reform” is even possible. Therefore, this vote is irrelevant.

WISE UP.

THINK SANTA.

Doug

Notably I think, today Paul Krugman damned Bernanke mightily with very faint praise:

http://www.nytimes.com/2010/01/25/opinion/25krugman.html?hp

Yes, it was a real lashing, with cooked spaghetti. Bernanke must even now be nursing the welts. Still Krugman endorsed him. His reasoning was especially lame. Ooh, Senators, those crass blowhards, who did so much to facilitate this disaster might give another candidate a hard time.

As for the stock market going down if Bernanke or a clone isn’t Fed chair, well, duh. It would have to deal with the fact that it’s a bubble and its run up over the last ten months and all the profits and bonuses attached to it were air. What kind of an argument is that we can’t have a real Fed chair because the stock market is too fragile to deal with reality.

Contacted Tom Coburn (regrettably my Senator), since 1) he’s hasn’t committed yet and 2) he’s up for re-election (albeit by a safe margin here in Jesusland). Unfortunately, I believe Coburn was a “yea” vote for TARP back in the day, so I’m not holding out much hope for him doing the right thing.

Tell them the vote will tell us if they are for the people or for the banks.

Note that Obama HIMSELF is now CALLING Senators to ask them to vote Yes on Bernanke Cloture.

Here is the list of Senators who are Democrat, Undecided, AND running for Election. These folks MUST BE called!

Specter, Arlen – (D – PA) Class III

711 HART SENATE OFFICE BUILDING WASHINGTON DC 20510

(202) 224-4254

Mikulski, Barbara A. – (D – MD) Class III

503 HART SENATE OFFICE BUILDING WASHINGTON DC 20510

(202) 224-4654

Kaufman, Edward E. – (D – DE) Class II

383 RUSSELL SENATE OFFICE BUILDING WASHINGTON DC 20510

(202) 224-5042

Gillibrand, Kirsten E. – (D – NY) Class I

478 RUSSELL SENATE OFFICE BUILDING WASHINGTON DC 20510

(202) 224-4451

Burris, Roland W. – (D – IL) Class III

387 RUSSELL SENATE OFFICE BUILDING WASHINGTON DC 20510

(202) 224-2854

Thanks everyone!!

Ask the senators to go through this link and see why it is not politics it is economics that dictates that you do not confirm this lunatic

http://www.marketwatch.com/story/capt-bernanke-sinks-the-uss-titanic-2010-01-26

Meanwhile in the bathroom of The Dark Star Ship:

Innovation needed for growth (destruction?), say regulators

Paulis underlined that a key issue in resolving the debate was rebuilding trust in the banks, drawing a connection between distrust of banks and distrust of complex structures. “Investors have discovered that products they thought of as ‘risk free’ were far from it… Guarantees attached to such products failed and ratings proved worthless.” But, he said, restoring this trust does not involve restricting innovation, but instead taking a more mature look at this sector and finding a new regulatory equilibrium between innovation and investor protection.

http://www.risk.net/asia-risk/news/1588092/innovation-growth-regulators

When in doubt about which bet to make (for your bank or country) use this: http://cheatsheet.mathfinance.com/

Opps, Obama acts as shill for mutual funds … hmmm?

Great job there dude,connecting your bullshit to more pension and retirement fraud… Well, yah know, Bush had his pig-like snout in the Pension Protection Act, so it just makes sense that Obama gets his snout as deep as possible into some financial shit…. that he doesn’t know a F’ing thing about! Maybe Bush should come back as a consultant from SIFMA?

http://www.risk.net/life-and-pensions/news/1588492/obama-push-automatic-individual-retirement-accounts-state-union-address