In case you’ve been paying attention to market action rather than economic news, some key data releases for July have been less than cheery. For instance, consumer confidence has taken a nosedive, the US trade deficit unexpectedly worsened (meaning one of the few key sources of good news, the export sector, has hit an air pocket), retail sales continue to decline. The elephant in the room is the continued scary high level unemployment, While the markets liked last week’s report of an improvement in initial jobless claims, we are so far from a real recovery here that it isn’t funny.

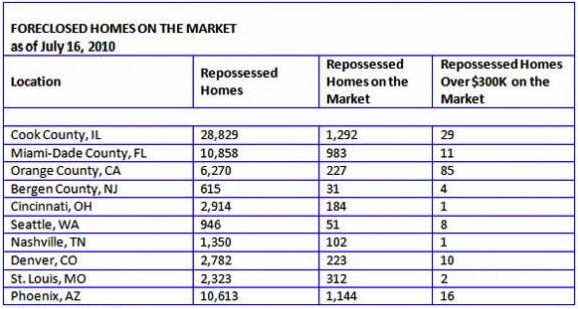

Another big source of pressure is the poor outlook for housing. Even though prices showed some improvement in May, there is good reason to think this is a blip in the current trend towards continued declines. Bank analyst Meredith Whitney and economist Robert Shiller, both of whom did a good job of projecting the trajectory of housing prices pre-crisis, call for further declines, Whitney a scary additional 10% by year end. This chart of bank inventory suggests why (hat tip Michael David White):

And as Alan Greenspan points out, falling home prices probably means bye bye recovery.

The Administration has already thrown a lot of ammo at the housing market, via having the Federal government provide over 96% of housing finance this year (either directly or via guarantees) and through its subsidies to home buyers, first an $8000 first-time home buyer tax credit, then by providing a $6500 tax credit to all home purchasers.

Mortgage investors are now concerned that the Treasury will pull a new rabbit out of the hat in its efforts to validate home prices and save banks via widespread refis. Bear in mind this view amounts to an investor rumor, and no indication from the officialdom that a program like this is in the works. However, given the importance of housing to consumer balance sheets plus the upcoming elections, I would not underestimate what the powers that be might do to shore up home values. And the pressure to take more aggressive moves could become more acute if more and more banks face trouble foreclosing due to lawyers increasingly finding and contesting mortgage trust failures to take the steps needed to establish that they own the note (the IOU), which is necessary in 45 states for them to have standing to foreclose.

From the Financial Times:

There has been speculation among investors that the government might decide to offer homeowners a way to refinance mortgages and replace them with cheaper loans…

There have been no comments or specific suggestions from Washington about such a programme, but it has been discussed in the past as one potential policy response to the economic downturn…..

even though mortgage rates are at a record low, refinancing has not recovered, in spite of a small pick up last year.

This reflects the stricter standards many mortgage lenders are applying when considering new applications, as well as the fact that the drop in house prices across the US has left some homeowners with mortgages which are worth more than their houses.

A government programme aimed at making it easier to replace mortgages with cheaper ones could reduce monthly home loan bills and boost consumer spending, an important driver of US economic activity.

The US Treasury is planning a conference this month to discuss the mortgage market, including reform of state-backed mortgage financiers Fannie Mae and Freddie Mac, which are now financing nearly all new mortgages.

“The mortgage summit planned later this month has begun to attract a lot of attention among mortgage investors and has led to growing speculation of a massive [refinancing] wave,” said Steven Ricchiuto at Mizuho….

A rise in mortgage refinancing activity would particularly hurt the value of the $700bn-worth of so-called “high-coupon” mortgage bonds. Many are trading above 100 cents in the dollar, meaning they cost above par value.

“The elephant in the room is the continued scary high level unemployment,..”. Call me an unreconstructed conservative, but I’d have said that government economic policy really should have at most two purposes – or perhaps one purpose and one over-riding constraint. (i) Do nothing to obstruct people finding gainful, productive employment, and (ii) Insofar as a government monopoly of currency is to be imposed, protect the purchasing power of that currency.

All else is secondary.

In an ideal world, that would make sense.

In a world that has very smart amoral scumbags – with lots of time on their hands, over many generations – you end up with the government working for the benefit of those who own it.

There’s no other system possible.

I thought one of the most compelling factoids from the Michael David White link was that the total value of residential real estate in the US currently sits at $13 trillion, against which there is $11.68 trillion owed.

If prices drop another 10% in the final half of this year as Meredity Whitney prognosticates, there will be no equity left.

What was once hailed as the centerpiece of household wealth will have disappeared.

Give some thought to the idea that the word value should be replaced by price. Then consider that the word wealth in the instance of home ownership is really an expression of riches.

Next consider the relationship between easy credit and prices. Easy credit becomes money when the loan credit is spent. Thus, easy credit leads to an excess of money in the economy, that excess quantity of money leads to a loss in purchasing power and that means higher prices. It’s not that the homeowners house has lost value, its that the money that the house is valued in has lost purchasing power.

Your conclusion is correct in the sense that as a nation we have no equity in our homes because our medium of valuation has been severely devalued.

This recession and its offspring of a muted recovery is the child of a fiat currency, fractional reserve banking, abrogated regulatory responsibility and unprosecuted fraud. Were it not for the fact that I dislike Mexican food, I’d join you down south.

Re: Were it not for the fact that I dislike Mexican food, I’d join you down south.

If you keep going south (a long way, and a bit west) there’s a country that has similar food as the US – as well as a relatively functional western government and a clean environment. Something to think about.

And you think that they would want you? Or even let you in on more than a tourist visit! Think again.

A nice post. Thanks. For a more in-depth look on the role of fiat currency, easy money and the resulting asset bubbles in the Crash of 08, check out:

The Dollar Crisis (2004), by Richard Duncan. Mr. Duncan predicted the economic/financial carnage a number of years before the crash (and he did not even address in any depth the role of the economic/financial malignancies known a Fannie and Freddie)

Aggregate equity is not a meaningful concept for contracts that are not linked (i.e. the vast majority of mortgages). If I have notional equity of $40,000 and my sister has notional equity of -$40,000, together we have $40,000 and my sister’s lender is nervous. The fact that you can add up numbers representing equity doesn’t make the sum a meaningful number.

Do I read your comment correctly? You are Positive $40 and your sister is negative $40 that means: $40 – $40 = 0.

Do you want to restate that?

In the specific the sum has limited meaning; however in the general as it was written, it means that the banking system has a serious problem. To the extent that the 40 – 40 is situated in a single bank it means that its assets as represented by loans has just taken a huge hit.

The more homes the Fedscam Refi Corp can get on the books , the more paper that can be validated ( who holds the deed nutshell game will abate) . And with 96% of loans , subsidized money by Fed , all on the consumers tabs ( more taxes) , why not go for owning the whole market . Next step . telling you where you may live , where you can’t, regardless of price . Gotta keep the low life middle class away from the Hoiti- Toi. All a game to take away hard asset ownership from the people . Money is power , and they want us to have neither.

I fail to understand both Bill and dearieme. The economy fails to provide employment to about 17%-20% of the workforce. Is it difficult to understand that with such huge percentages we are stuck deep in the mud?

Dearieme statement “Do nothing to obstruct people finding gainful, productive employment” is nothing short of a cruel joke. Why not use the well worn “let them eat cakes?” Bill talk about the government turning into Big Brother is downright laughable when you realize that the big banks oligarchy controls the government.

I don’t quite understand the assumption that higher house prices are good for everyone and the government needs to prop up these prices. It seems to be only good for banks and investors.

From the perspective of people my age 25-35 group of soon to be first time house buyers: the lower the better!

Higher house prices mean a higher percentage of my income for the next years going into paying financing on my house, ultimately money going to banks.

Lower house prices mean I will have more money to spend in the real economy, creating jobs outside of banking/financial. If the prices can stay low in the long term it means continuously more money in the real economy instead of in banking.

House prices settling down to more affordable level will help everyone in the long term. Sure it might hurt for the short term those who bought high, or those who bet part of their pensions on high house prices but, overall, house prices going lower and staying there is POSITIVE!

Keeping house prices high is just another way for the financial sector to control an ever larger part of the economy.

You are seeing it right. Fight dearly to preserve your clear vision of what is before you.

Yup. The financial system can’t survive real prices. Unfortunately for people in your generation, you will lose either way. If prices stay high you’ll never get into the Ponzi scam. If prices go down the financial system collapses.

Your parents did a great job with their government, didn’t they? Enjoy your “inheritance”!

You’re spot on. Low and stable home prices are far better for everyone and for the economy. The problem is getting there.

The downwards adjustment bankrupts banks, homeowners, cities, counties, etc…

But letting that happen won’t get you re-elected. :)

Exactly. The whole flaw in this recovery plan was propping up unsustainable housing prices. The way for housing to recover is the expunge the bad debt that can never be repaid, recalibrate the market and let prices drop to the levels where average families can buy again without stretching themselves to the financial breaking point. Yeah, this is going to suck for the banks and everyone who bought or HELOCed from 2003 to 2007, but it is what has to happen.

When the pricing is right, the housing overhang will solve itself. Holding prices at current levels just means fewer and fewer move-up buyers and first time buyers who can enter the market.

Either incomes rise (not likely) or housing prices go down. It’s one or the other.

Well put.

The (apparently) universal acceptance that house prices must remain high/rise in order to preserve the “recovery” is evidence of how deeply the bubble pricing model for housing is ingrained in current thinking.

The only reason people are surprised at current levels of refi activity is that they are looking at those levels against the entire pool of outstanding mortgages, erroneously including the underwater or negative equity situations in their assessment. Unless the homeowner brings new money to the table, those are refi-ineligible without some kind of workout. If you back out the negative equity situations, rates of refi activity are consistent with recent interest mortgage rate movements.

“There has been speculation among investors that the government might decide to offer homeowners a way to refinance mortgages and replace them with cheaper loans.”

Observing the decline in value of the US as a nation overall, plus the miraculous disappearance of decently-paying jobs, there is a need not only to replace huge home loans with cheaper ones, but there is an acute need to replace them with greatly smaller ones. For instance, an $800,000 mortgage in, say… Santa Barbara, CA, should (and I believe it eventually will) be replaced with one no greater than $150,000. The banks and the government should just write off the difference. Only then will your average Walmart employee be able to afford the “American Dream”.

I think this is the only reasonable way we can revive and sustain a viable housing market. Now, will the Fed and this Wall Street infested administration jump on this idea anytime soon? Probably not. Most likely, they will continue to somehow delude themselves into thinking it is possible to export every decent job to China and still maintain a reality where a vampirish banking industry continues to suck the blood out of a rapidly-vanishing American middle class. Sorry, but that’s a mathematical impossibility, if I may use that famous quote from Titanic. Meanwhile, THIS Titanic continues to take on water…

My 2 cents.

Vinny

Vinny,

As true as your statement is, it would mean that the vampires would have to stop sucking on this econo-corpse, and that’s not going to happen easily. Of course, refis (even for those with jobs) are at too high an interest rate. If I was paying 1.5%, then I could afford a 750K house with a 2500/mo payment. But if the big banks don’t get their vig, they can’t earn their way out of this mess (not like that’s working either). Further irony is that my bank probably has my house values for accounting purposes as far higher than they would be willing to lend or refi me for.

I have to stop now, my irony gland is almost burnt out.

The thing that is needed to reverse the decline in housing prices is to reverse the 30+ year stagnation/decline in wages for the average worker – i.e. to put more purchasing power into the hands of the majority of buyers – not just the top 10%. Unfortunately that’s exactly what isn’t going to happen as that would require reversing the ideological doctrine that created the problem in the first place.

I agree. That’s why I think house prices should come down a lot more.

Vinny

You’re going to get your wish IMHO. But the only people that are going to be helped by that are those that don’t already own homes. And have stable jobs. Everyone else is going to suffer. That means more red ink on lender’s balance sheets, making them even more loathe to lend than they currently are. And a continuing downward spiral that will lead to a disinflationary environment, which general consensus says is bad. Be careful what you wish for.

A lot of folks used to think they could finance their retirement on the equity in their house. So to some extent house prices were driven by inter generational transfers.

calculatedrisk did a great slamming of these rumors, not the least is over $6K in closing costs.

http://www.calculatedriskblog.com/2010/07/slam-dunk-stimulus-ms-missing-something.html

There were two simple things the government could have done at the very beginning of this financial crisis had they cared about individuals (which the government doesnt) which would have avoided this housing market crash, or at least dramatically lowered its impact. First, whether by executive order or congressional vote, impose a permanent moratorium on ARM rate mortages.. all ARM mtgs would be set at 5.99% and give owners the opportunity to continue making monthly payments on time. Second and in conjunction, the govt purchase the value of 10% of all the mortgages meaning while the duration of mortgages would remain the same, the monthly fixed payments would be 10% less. But of course government never has cared about the survival of americans as individuals.

Another big source of pressure is the poor outlook for housing. Even though prices showed some improvement in May

Yves, from your writing, it appears that you’ve really bought into the David Learah line of thinking (high house prices = good). For any other product, when people talk about good prices, they mean low prices. Why are you reversing things for houses?