Matt Stoller is a fellow at the Roosevelt Institute. You can follow him on twitter at http://www.twitter.com/matthewstoller

Today, both JP Morgan Chase and Wells Fargo released their earnings, beating expectations on revenue and profit. Nonetheless, their stock prices fell throughout the day. I went through their earnings releases to see what kinds of interesting information they’ve put out relating to mortgages. Here’s the JP Morgan Chase release, and here’s the Wells release. Deposits are up at both banks (Move Your Money campaign notwithstanding), and new regulatory guidance on second liens seems to be having a very modest effect at both banks.

JP Morgan Chase

– JPM earned $1.8 billion in its retail banking operation (p. 4), which is entirely due to the $1.8 billion in reduction for loan losses. Its loan loss reserves dropped $3.9 billion from one year ago (p. 17). These bank earnings seem like funny money, with loan loss reserves used to plug holes when necessary to smooth earnings.

– JPM Chase’s direct mortgage servicing expenses for the last quarter were $1.151 billion. JPM Chase’s direct mortgage servicing revenue was … $1.151 billion. (p. 6) What a coincidence! I’m guessing that this is not an accident. The servicing model is just not profitable with the current fee structure in place.

– JPM Chase’s HELOC book dropped from $102B to $99.1B in the quarter, a fall of $2.9B. About 20% of that drop was due to charge-offs of $542M. (p. 7)

– JP Morgan is now reporting $1.6B of “high-risk” seconds due to new regulatory guidance we noted two days ago.

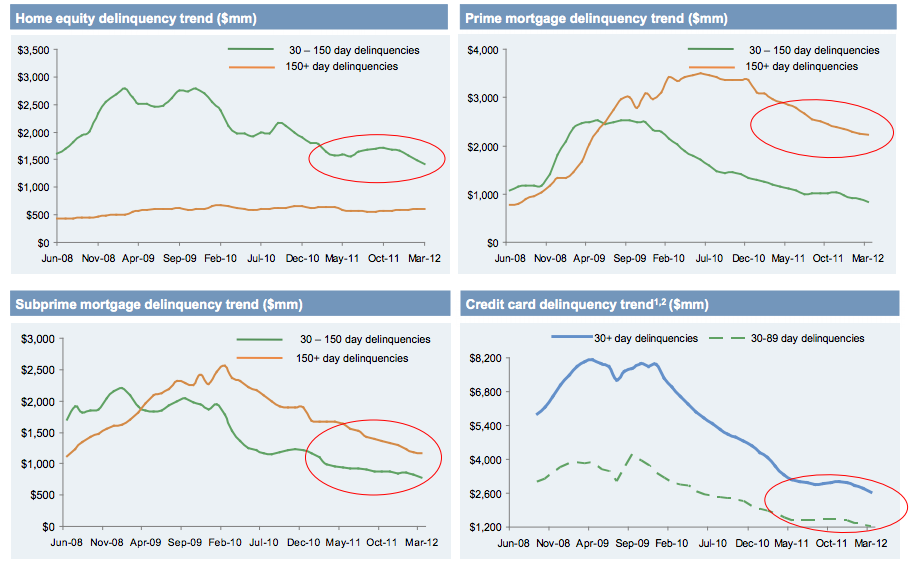

– Deliquency trends for second-liens seem bizarre. Check out these charts from page 16.

The top left hand chart is the Home Equity Line of Credit deliquency trend. For the the other three types of debt, when the number of borrowers that are late in the 30-150 segment goes up or down, the number of people that are late 150+ days follows that trend, on lag. This makes sense, if more people are missing or making payments on a short-term basis, eventually some portion of them will miss or make payments on a longer-term basis. For HELOCs, though, there seems to be no relationship between the number of loans that are 30-150 days late and those that are 150+ loans. This is consistent with some of the weirdness on HELOCs described in a post on seconds a few days ago (there’s a great comment thread on that post, fyi).

Wells Fargo

– Wells Fargo wrote off $1.7 billion of second liens due to more aggressive examinations by regulators (see page 13)

– On slide 13, Wells says that HARP accounted for 15% of its mortgage originations in the quarter. Total mortgage originations in the quarter for Wells are up to $129B. HARP is a government program that allows for refinancing of underwater borrowers. Shahien Nasiripour has a good article on this at the FT.

The scheme was part of the Obama administration’s early response to the stagnant US housing market but it was overhauled last year to make qualification easier, removing a loan-to-value limit and giving participating lenders immunity from paying compensation on loans that broke underwriting guidelines.

Banks have seized on “Harp 2.0” as a highly profitable generator of new fees, according to lenders and analysts. John Stumpf, chief executive of Wells Fargo, told the Financial Times in February that Harp was “much more workable” in its new guise. Analysts expect $2bn-$4bn in additional revenue for Wells this year because of the programme. Wells and JPMorgan Chase, two of the three biggest mortgage servicers, both report earnings on Friday.

Borrowers with negative equity have largely been unable to shop around for finance because banks refinancing loans they already service enjoy the best terms in the government-sponsored scheme. That has led to mark-ups by banks refinancing their own borrowers that may lead to $12bn in additional revenue this year, according to analysts at Nomura….

“The largest banks are clearly taking advantage of the opportunity the government [unnecessarily] gave them,” said analysts at Amherst Securities in recent research.“In a competitive environment, we would expect some of the benefit to be passed on to the borrower. However, we are not in a competitive environment.”

– Wells still has $65B of “pick-a-pay” loans on its books, or as the bank puts it, “non-strategic loans” (p. 24). You’ve got to love bank-speak. Sorry, your flight is delayed by a “non-strategic” three hours. I think you should get rid of your “non-strategic drug habit.” My love handles are “non-strategic.”

– 20% of Wells Fargo HELOCs are in a first lien position (p. 35)

– Wells will be releasing reserves in the future (p. 29) if the economy does not deteriorate, adding to earnings.

All in all, the status quo of a thinly capitalized servicer model and odd second lien accounting continues. What did you notice?

Bank stocks generally getting nailed again – not to mention Spanish and Italian banks.

Loan loss reserves as profits (and bonuses) are just too strategikally funny. Like someone is gonna pay you money for your love handles. Ha! Lots of luck with that.

Perhaps the market is beginning to acknowledge that, in our New Normal of regulatory forbearance, bank earnings statements are just a bunch of creative writing with numbers thrown in for a more scientific look?

So, as a result of the new “regulatory guidance” issued, JP Morgan is reporting 1.6% of its 2nd liens as ‘high risk’. The new regulatory guidance is six pages but can be summed as follows:

“An estimated loss from a loss contingency shall be accrued by a charge to income if both of the following conditions are met:

a. Information available before the financial statements are issued or are available to be issued indicates that it is probable that an asset had been impaired or a liability had been incurred at the date of the financial statements.

b. The amount of loss can be reasonably estimated.”

and then

“Estimates of credit losses should reflect consideration of all significant factors that affect the collectibility of the portfolio as of the evaluation date.”</i

It then discusses the factors that should be taken into consideration.

http://www.occ.treas.gov/news-issuances/news-releases/2012/nr-ia-2012-15a.pdf

The problem is the nature of the regulatory guidance. It is all subjective and open to interpretation, there is no specific language. When discussing factors to consider, there are statements such as the following:

Generally, this information should include the delinquency status of senior liens associated with the institution’s junior liens and whether the senior lien loan has been modified.”

How vague is that? Perhaps my expectations are unrealistic. My background is in science/engineering and my vocational background in healthcare, where outcomes must use measurable criteria, rather than having experience in the world of finance. However, what you don’t see are statements such as ‘if a senior lien is x+ days delinquent, writedowns of y% on 2nd lien must occur’. That would be the type of guidance that would be easy for everyone to interpret and easy for regulators to come in and judge if was being followed. How can regulators even be expected to enforce such subjective expectations when the banks can merely say they considered all the factors, which for example, could include the 1st lien being 180 days delinquent, and don’t think the 2nd lien is significantly impaired? For that matter, is there anything to stop them from making the same claim if the 1st lien is in foreclosure? It sounds like this is exactly what is happening.

Is this the norm for the finance industry or was the guidance intentionally written this way to give the banks the leeway they wanted in charging off second liens?

Oops. Problem with one of my closing italics tag messed up my attempts to differentiate quotes from my own words. Sorry. I know the smart people here will be able to figure it out. We really need an edit feature.

Why can’t we close the differential between deposit interest and credit interest charges?

“Credit” creation suppresses the interest rates banks must pay savers since “credit” is essentially counterfeit money.

Thus if credit creation was banned then the gap between what savers earned and what borrowers are charged should shrink.

Thank You.

We really need an edit feature. LucyLulu

Can anyone recommend a good HTML previewer?

Try writing you comments in Word and then junst pasting them in. I do that for the long ones which are generally rejected by the censorbot.

You can also edit using your mouse but no the backspace key.

whoops, guess I should do it on the short ones too!

When you have “government” type writing rules you can for get specifics!

Black may be any thing from grey to white!

That doesn’t hold true in the world of health care. And Medicare/Medicaid absolutely enforce regulations. A couple years ago, one of our competitors had gotten into the habit of the staff writing in the date next to patient signatures on initial treatment plans. I understand why, sometimes it can take 10-15 minutes to get a signature, then the patient thinks they are done. Getting the date can be another 5-10 mins and time is valuable. But the state/Medicaid did their audit on this competitor and refused to pay any claims for 3-6 months of treatment for every patient it applied to. We see patients in their homes 3x/week, and profit margins are slim as it is, most patients are Medicaid, so this was a big hit for them. In fact, that year our agency/location was the only one of its type to make a profit in the entire state. Our program and others in the state like ours are also the only type of mental health program proven to save taxpayers money, an average of $55,000 annually per client, as we care for those with the most severe difficulties who suffer frequent hospitalizations and provide the resources to stabilize them in the community………… but when budgets are tight, mental health is always first on the chopping block. Our clients don’t get out and vote.

Maybe they’re not so crazy.

Jamie Dimon: Aristotle described the worst kind of man as the “Incontinent Man,” namely he who knows what he does is wrong and does it anyway.

John Stumpf: John is a gangster, plain and simple. Wells Fargo has a ‘playbook’ they use to steal people’s houses.

That Jamie is a pisser.

I guess that all ‘Depends’ on what he was trying to say

It’s harder to trust the delinquency numbers these days when banks can modify a loan that is sure to stay current for only one or two months and then go back into default.

The four large money center banks are the new GSE’s, capturing half the profit of all mortgage origination, but now getting HAMP credits from the U.S. gov’t and subsidized borrowing costs from the Federal Reserve. We also see from TBA price spreads vs new mortgage rates which have widened, that lower interest rates are not translating into the reduced borrowing costs they should and the answer is that there is far less competition and free market pricing in mortage lending today than existed pre 2008. In short we have four GSE’s aka an oligolopoly.

“- 20% of Wells Fargo HELOCs are in a first lien position (p. 35)”

The odds of these going to foreclosure are almost nil, unless they are significantly underwater compared to the value of the house, which is unlikely. These are the kind of loans you WANT to foreclose on, cause presumably, there is a lot of homeowner equity to acquire and profit from. And, these HELOCS may well have been taken out to renovate, leaving a nice home you can sell for better prices in this artificially propped up real estate market (Silicon Valley).

If you’re gonna foreclose, you only want to foreclose on the first position loan. Any loans subsequent to this are sh**-outta-luck. PAYDAY!

Clarification above:

WANT to foreclose on, meaning, the Bank just takes over vs allowing an open market foreclosure. They can sit on these forever and sell them at leisure, cause there is usually so much value in the property. Juicy returns for the bank when it sells!