Yves here. Given the almost innate bullish bias of equity investors, when they start worrying about something, that means it actually has non-trivial odds of happening. So the idea that investors think it’s possible that a lot of current proven fossil fuels won’t be lifted is an unexpected bit of good news on the climate change front. Whether this comes to pass soon enough to save our collective bacon is another question entirely.

By Rory Johnston, a Master of Global Affairs student at the University of Toronto’s Munk School of Global Affairs where he focuses primarily on the intersection of geopolitics and energy markets. He has worked as a consultant in the Ontario electricity sector and is currently an Adjunct Junior Fellow at the American Security Project in Washington, D.C. Cross posted from OilPrice

The “carbon bubble” is a concept that has been gaining momentum over the past year. In brief, the theory claims that in order to avoid catastrophic climate change, the world must remain within its “carbon budget”—the volume of CO2 that can be emitted before the Earth’s temperature is pushed over the 2°C benchmark agreed upon by the international community. However, according to the IEA, “no more than one-third of proven reserves of fossil fuels can be consumed prior to 2050 if the world is to achieve the 2°C goal, unless carbon capture and storage (CCS) technology is widely deployed.” Following this theory to its logical end, the remaining two-thirds of global fossil fuel reserves are “unburnable”—that is, worthless.

Addressing the market implications of this reality, HSBC published a report that found that a carbon-constrained future could dramatically reduce the market value of major fossil fuel firms—up to 60%, depending on demand repercussions.

A group of 70 investors representing over $3 trillion in assets is pressing 45 major oil, gas, and coal companies on what they plan to do about this looming threat to their business model. In a letter sent to British Petroleum executives, they state that it is “important to understand how current and probable future policies to make these emissions reductions will impact capital expenditures and current assets in the oil and gas sector and how the physical impacts of unmitigated climate change will impact the sector’s operations.”

Anne Stausboll, chief executive of the California Public Employees’ Retirement System (CalPERS), said, “we have a fiduciary duty to ensure that companies we invest in are fully addressing the risks that climate change poses.” CalPERS is the largest pension fund in the United States with almost $260 billion in assets.

Exploration and development is extremely expensive, and investors are wondering whether this money is being spent to develop reserves that will never be sold.

The letter asks that “BP review both its exposure to these risks and its plans for managing them,” and to prepare a full response in advance of BP’s 2014 annual stockholders’ meeting.

The letter is part of a larger campaign organized by Ceres, a Boston-based non-profit whose stated mission is to mobilize “investor and business leadership to build a thriving, sustainable global economy.”

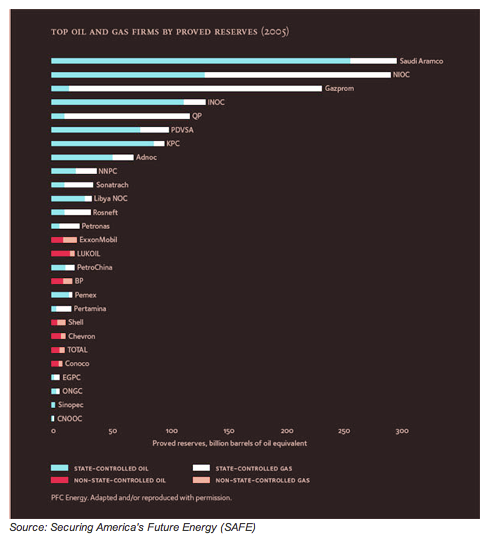

While the market repercussions of the carbon bubble are a serious threat to investment portfolios, the larger implications of unburnable assets will be felt by state-owned enterprises.

By current estimates, 90% of the world’s oil and gas reserves are in the hands of governments—not only does this make it more difficult to control their use, but it hints at future geopolitical shifts should the demand for these resources disappear due to prudential climate policies in West.

While it is unlikely that the international community will prevent the global climate from breaching the 2°C benchmark, current fossil fuel consumption patterns will need to be altered in order to avoid truly catastrophic climate change in the future. When that happens, the world is going to run headlong into the fact that the current financial and geopolitical system has been built up around the consumption of carbon—transitioning to another system is going to be painful, both economically and politically. The sooner markets and states recognize and begin planning for this inevitability, the better able they will be to handle that transition when it is thrust upon them by necessity.

We’ve got to keep the grease in the ground, regardless of the immediate costs to capital:

http://www.dailykos.com/story/2009/09/24/785731/-Keeping-the-grease-in-the-ground-a-challenge

“transitioning to another system is going to be painful, both economically and politically”

Well to be quite blunt, that could end all life on earth too, depending on whether or not we can end the scourge of nuclear power and stash the insanely toxic spent fuel rods in some geologically stable place deep within the earth’s mantle (To date, exactly 0 of these rods have been put into such safe keeping–instead they just bide their time, building up at the nuclear plants. Real smart that).

As is, there may not be enough fossile fuel energy left available to civilization to put all these rods underground and as far as I know there is no serious movement anywhere to even get started on this project. Therefore, we’re all pretty much Fuked. That’s short for Fukashimaed.

Oh, and I realized something important tonight while I was out for my usual run: run away green house gas emissions and climate change aren’t just about burning too much carbon. There’s also the fact that the earth natural carbon sink, functioning forest ecosystems are being wiped out due to crappy agriculture techniques and unsustainable over production/consumption of resources by the idiots in the “developed” world (in quotes because these will be the most horrible places to live once the rug is pulled out from under the fossil fuel economy. Until all of us die from radiation exposure anyway). As per the greening the desert video, if we make a concerted effort to turn all the deserts of the world into healthy forested ecosystems, that would go a tremendous way towards eliminating global warming from the list of things we should be worrying ourselves to death over.

deserts ARE healthy ecosystems. we just don’t need to be creating any more of them. guess you’ve never watched “The Desert Speaks”?

we will turn our entire world into one or the other of agfarm or suburban wasteland with McChicken shacks rather than leave forests alone or regrow them in areas where they used to be.

except, also too, water

in water-plentiful countries (don’t laugh! I know what i’m deliberately mis-saying, here) where people are practicing irrigation-farming, they should be applying the same kind of strictures on water usage that places in the middle east do now. I think Israel (don’t pillory me!) has done some innovative work on minimal-water farming.

also—no till ag.

also–why do you poop in fresh water? even more ridiculously, why do you pee in it?

even more—most industrial processes take thousands of gallons of water (36k for one vehicle manufactured, was a number I read somewhere). isn’t there any way to make what we need that does not use so much of these precious resources? i’m no guru on industrial processes, so that’s why i’m asking.

“also–why do you poop in fresh water? even more ridiculously, why do you pee in it?

”

The reason I do it is because I know that other people get to drink it later. haha

As far as industrial processes, I think a lot of the use is for cooling water – so maybe that is recycled easily.

But the main constraint is nature’s way of providing clean water – evaporation, then rain over a land mass – seems to be finite. But may get worse with climate change, if we get more rainfall over the ocean than land.

The reason is simple: liquid waste is much easier to move than solid waste. Historically that waste was piped to the nearest river where it became someone elses’ problem. This generally isn’t the case anymore for municipal wastewater systems (in the US anyway – all but the oldest/biggest have been separated), but it is the case for farms.

The bulk of sanitary wastewater is easy to treat ($$$), but medications (antimicrobials, anti-depressants, caffeine, etc.) and hormones (especially ovulation inhibitors and perfumes) effectively pass right through the treatment process. How these affect the environment is poorly understood and only recently has research started.

Silly and uninformed scare comments about nuclear waste, which can be reprocessed in LFTR small reactors.

We’ll be all right, just not so comfortable. Entertainment will make the reduced travel, junk food, giant cars and houses tolerable

I choose optimism.

It appears to me that if we can summon the will to turn Saudi Arabia into a giant pyrex casserole lid, we can eliminate the largest single source of carbon warming and the largest source of funding for destabilizing sunni extremism at the same time.

Dearest major oil industries, how can you protect our investments from vicious attempts by consumers to avoid extinction?

Signed,

1%

P.S. And assuming you succeed (species extinction = reduced media and other marketing costs), what are the long term prospects of growth on our investments?

This is a nothingburger. Ceres (and Stausboll) will always be pushing an agenda to invest in renewable projects essentially funded via tax payers. That is their model. Calpers has about 10% of their equity portfolio in coal/oil/gas. Stausboll obviously isn’t putting money where her mouth is, and is perfectly ok retaining an investment in XOM with a 3% dividend yield. If Calpers wanted to they could become a purely renewables fund or fund only focused on green technologies, and see how that would turn out for the members. I’m no climate change sceptic, but very wary of yet more bs from investors who say one thing and do another.

There is no “unburnable” carbon. All carbon that can be extracted and burned will be burnt, notwithstanding the warnings of climatologists. The predicted extreme weather conditions will accelerate the demand for energy, not reduce it. Crop failures will mean more movement of food across the globe and hence more energy use than otherwise. Destruction in hurricanes, cyclones, typhoons and floods means more repair and reconstruction work meaning more energy use than otherwise.

The only “unburnable” carbon is that has an EROEI (energy returned on energy invested) ratio of less than 1.

Not necessarily… I’ve read there are $20 trillion in proven reserves that need to stay in the ground. What if government purchased these on the installment plan with the caveat that the proceeds would fund a (well-regulated) renewable energy infrastructure?

After all, Lincoln offered to buy the slaves (and look how well that worked out!)

I do know someone with a portfolio of minerals. I asked her whether she’d considered donating them to some environmental organization. First: no such organization exists to sequester minerals. Second: She said “I’ve been so hurt by the economy and a recent divorce that I can’t afford to discount this stuff at all…”

Talk about disaster capitalism! What does it profit one to gain a better-funded retirement and lose the planet to global warming?

Sad but true.

If the predictions of the climatologists are correct there is nothing that can be realistically done to avoid a 2 degree celcius rise in global average temperature (after which the positive feedback effects will ensure a runaway warming) other than an immediate global financial collapse leading to a global economic collapse. Perhaps that is what the global elite are planning. They may not be as uncaring of the environment as they are accused of!

However, progressives may not like the transition to a carbon neutral society. It will be marked by extreme wealth inequalities, collapse of healthcare systems, drastic reduction in food supplies, increased societal violence, increased intolerance etc. In a nut shell, the world will resemble today’s Afghanistan or Iraq, if not Somalia. After a couple of generations of the transition, the world may settle down into a neo-feudal situation where a privileged few, who will be in control of the technology and critical resources, will govern the world affairs in a centrally planned way.

No resource is 100% recoverable, so there will ALWAYS be some unburnable fossil fuel left in place despite the best efforts of those trying to extract it.

Understand that replacing fossil fuel will require other resources (e.g. copper, silver, REE for solar) to be extracted, changing the environmental issues (and corporate players) but not entirely eliminating them. There is no free lunch, unless we care to revert to a pre-industrial revolution economy which would require the deaths of billions of people to be sustainable.

interesting. so, you don’t think it would be possible to ‘ease the descent’ by only utilizing those fossil fuel resources to keep people comfortable while lowering population to a sustainable–yes, I know. ‘sustainable’ is relative–level?

meaning, there is no path down at all? only crash, or burn?

It’s fairly obvious (to me anyway) that global warming is the least of our worries given the very real danger of Fukushima radiation causing the “real” end-of-the-planet scenario. If just one thing goes wrong with the attempted removal of 400 tons of rods from the damaged buildings, there will be no escape for billions of people who will get life shortening cancers. Already the Pacific Ocean is dying with none of its bounty fit to eat, and California produce is showing evidence of cesium 137 far above acceptable levels. Note: there are NO accptable levels, despite the propaganda from the nuke lobby. It’s amazing that even the truth telling sites like NC have been effectively muzzled.

Yes, i wonder why the worl powers seem to be whistling past the graveyard regarding the possible extinction event about to unfold given the proven incompetence of tepco. Maybe it’s too terrible a scenario for even the supposed ‘adults’ in the room to contemplate for long.

I dunno, maybe something is happening behind the scenes where a team of experts, organized by the usa will wrest this clusterfuck from the japanese whether they like it or not. I hope so but i’m not optimistic.

All the talk of climate change and economic collapse seems so besides the point. Sort of like the warring political factions in polish shtetls ignoring the oncoming doom from the west.

Mild radiation improves DNA repair rates. That’s science, not propaganda.

It is unlikely that most of the so-called ‘reserves’ will be burned, not because society will suddenly decide to “transition to another system,” but because the economic system cannot accommodate permanent high costs of oil extraction.

Most current estimates are that it requires prices of about $100/barrel on the margin to produce oil from new, increasingly expensive sources of unconventional oil. (Deep sea drilling, tar sands. ultra-heavy Venezuelan crude, Fracked, Arctic, etc.). These costs will almost certainly continue to increase, further destabilizing a global economy based on easy access to cheap oil.

Another major shock to the system could (Probably will?) result in further global depression, resulting in commodity price deflation.

When people can no longer afford to pay for the oil they consume, (something that in my opinion is already happening) oil production, especially from unconventional sources, will drop precipitously exasperating an already dire economic dilemma.

One further thought- The major oil producers have used their ‘proven oil reserves’ as collateral to provide capital for further petroleum exploration and production. When it becomes obvious to creditors that much of this so-called collateral is essentially worthless, capital will quickly dry up, furthering the collapse of the system.

I think maybe you and the author of the article, Rory Johnson, are saying similar things. Essentially this passage from Johnson encapsulates what you are saying, with the addition of a couple of changes, which I have added in bold:

There is a good deal of expensive oil out there: the massive oil shales in the Permian Basin (which dwarf those in the Williston Basin and the Eagle Ford, and are by far the largest oil field in the United States with reserves currently estimated at 50 billion barrels), the Orinoco in Venezuela, which dwarf the Permian Basin oil shales and are the largest oil reserves in the world, and so forth. Most of these are probably economically viable at $100 per barrel oil price. Then there are the gas shales, which are not economically viable at $3.00 or $5.00 per MMBTU gas prices, but at $15 or $20 probably are. (The energy content of the typical barrel of oil is about 6x that of an MCF of gas, so if we look at energy content, $100 per barrel oil = $16.66 natural gas.)

But I’m like you, but perhaps less deterministic, because I do not state it as a predetermined outcome, but certainly wonder if the current economic and political system can survive $100 oil and $18 natural gas.

Japan is already paying in the range of $18 per MMBTU for the LNG it imports, and I don’t think that includes the cost of regassification.

You are completely correct. What these new sources of hydrocarbon power entail is a new base price. James Howard Kunstler always says that a world designed and built around $20 per barrel oil cannot function effectively in a $100 barrel reality. His argument is that much of the money creation operations like QE and massive public and private indebtedness are attempts to paper over this new reality.

I would also add that the Orinoco and other tar sands are incredibly environmentally destructive to get at and process. Nobody seemed to point out that crude oil is not easily or hugely combustible, but the “product” being taken through that town in Quebec literally blew up and wiped out the town. They now wish to pipe this rather toxic, explosive stuff everywhere. Good luck with that.

Pipelines are safer than rail or trucks. Fact.

Try them, they’re yummy.

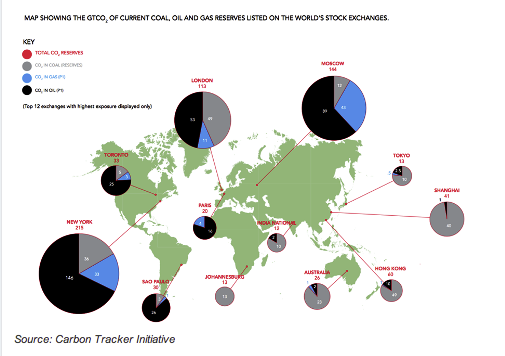

Is there any way to make the images larger?

No, unfortunately. They were small in the post at OilPrice and if I make them large, the resolution is lousy.

Dear 1%:

You guys aren’t that smart. For over a decade we’ve been waging a political and propaganda war to prevent, delay or defang any attempt to tax or limit carbon emissions. With any luck we’ll still be selling this stuff long after Miami becomes a shallow salt water sea.

Hugs,

The Major Oil, Gas and Coal Companies

If CO2 legislation is Mr. Johnson’s biggest worry, he clearly has no grasp of the real energy problems at all.

To be quite frank, all hydrocarbon energy sources that can be exploited will be, regardless of cost to the environment. The more realistic issue is this. Getting those hydrocarbons is getting more and more expensive, while yielding less and less real net energy over time.

Long before we have to worry about human trivialities like CO2 legislation, which will, in the end, be universally ignored, we will be unable to get enough usable net energy to run the world’s transportation grids, which will make the world’s current interdependent web of just-in-time supply chains impossible to sustain at anything resembling current levels. This breakdown will be anything but linear or predictable, particularly when the supply chains necessary to produce hydrocarbon energy are no longer viable.

In 30 years, think electric and natural gas transportation. In 100, think sailing ships. Think electric trains (if we’re lucky). Think horses. That’s what the remains of the world’s “supply chain” will run on.

But, but, what will we feed the horses? Catfood? Also too, methane. 100-200 times the GHG effect of CO2!!!

Methane is a gas that can be burned as fuel. Bring on the horses!

But you gotta admit there gave never been a whole lot of volunteers to collect the stuff.

I decided to name this article “Peak Worry”.

The definition of “Peak Worry” is when you worry that something will reduce/replace demand for hydrocarbons.

Tell tale symptom: looking peaked

You guys are funny. Pique oil. Mmm. Listened to BBC last nite, late, late with insomnia, and there was a bizarre report I’m sure the other networks will never mention. Murray Energy (Coal – so is this ith infamous Robert Murray whom I hate with all my impolite pssion?) just bought up the rest of West Virginia coal mining. Why would Robert do this? Just to go broke? The guy who gladly let all the miners in the collapsed Price, Utah mine die without a rescue effort. And to show how humane he was he placed a gravestone of sorts commemorating their heroism. What a shit.

sick!

the overlords profit, no matter what happens to the rest of us. and they have no shame.

The energy will be extracted as long as EROEI remains positive. It’s simple really: hydrocarbons are needed to produce food, so we extract them, or we starve. People will vote for pollution before they’ll vote for starvation.

Like people ever get to vote on anything…

70% want Single Payer.

QED

I knew this would happen and sold my oil stocks around 2008. They’ll crash the same way the cigaratte stocks crashed in the 1990s. (I see nothing wrong with making money off evil behavior as long as I vote against the board of directors every year.)

Thisson wrote: “The energy will be extracted as long as EROEI remains positive.”

It’s already negative for fracking, it’s already negative for deep-sea drilling, it’s already negative for tar sands. The rest of the oil and gas has been found, there isn’t any more to “explore” for.

EROEI is still positive for coal, but coal-burning is being phased out anyway, much to my amazement. The phase-out is probably because of the “ordinary” pollution from coal (mercury, lead, smog, etc.) which is very high — and because return on investment is simply better for solar power. Utility companies are actually making that decision as we speak, building utility-scale solar rather than replacing condemned coal plants.

“there was a bizarre report I’m sure the other networks will never mention. Murray Energy (Coal – so is this ith infamous Robert Murray whom I hate with all my impolite pssion?) just bought up the rest of West Virginia coal mining. Why would Robert do this? Just to go broke? ”

Obsession. He defines himself as a “coal mining” owner, so he will continue to put money into coal mining even as the business dies.

You can see this behavior in soooo many other firms. BP had the chance to become an “energy” company rather than an “oil” company, and it was a profitable move, but a later CEO reversed the policies because he was an “oilman”.