By L. Randall Wray, Professor of Economics at the University of Missouri-Kansas City, Research Director with the Center for Full Employment and Price Stability and Senior Research Scholar at The Levy Economics Institute. Originally posted at New Economic Perspectives

This is part of a series, following on from the last installment that asked “Do We Need Taxes?”.

Previously we have argued that “taxes drive money” in the sense that imposition of a tax that is payable in the national government’s own currency will create demand for that currency. Sovereign government does not really need revenue in its own currency in order to spend.

This sounds shocking because we are so accustomed to thinking that “taxes pay for government spending”. This is true for local governments, provinces, and states that do not issue the currency. It is also not too far from the truth for nations that adopt a foreign currency or peg their own to gold or foreign currencies. When a nation pegs, it really does need the gold or foreign currency to which it promises to convert its currency on demand. Taxing removes its currency from circulation making it harder for anyone to present it for redemption in gold or foreign currency. Hence, a prudent practice would be to constrain spending to tax revenue.

But in the case of a government that issues its own sovereign currency without a promise to convert at a fixed value to gold or foreign currency (that is, the government “floats” its currency), we need to think about the role of taxes in an entirely different way. Taxes are not needed to “pay for” government spending. Further, the logic is reversed: government must spend (or lend) the currency into the economy before taxpayers can pay taxes in the form of the currency. Spend first, tax later is the logical sequence.

Some who hear this for the first time jump to the question: “Well, why not just eliminate taxes altogether?” There are several reasons. First—as we said last time–it is the tax that “drives” the currency. If we eliminated the tax, people probably would not immediately abandon use of the currency, but the main driver for its use would be gone.

Further, the second reason to have taxes is to reduce aggregate demand. If we look at the United States today, the federal government spending is somewhat over 20% of GDP, while tax revenue is somewhat less—say 17%. The net injection coming from the federal government is thus about 3% of GDP. If we eliminated taxes (and held all else constant) the net injection might rise toward 20% of GDP. That is a huge increase of aggregate demand, and could cause inflation.

Ideally, it is best if tax revenue moves countercyclically—increasing in expansion and falling in recession. That helps to make the government’s net contribution to the economy countercyclical, which helps to stabilize aggregate demand.

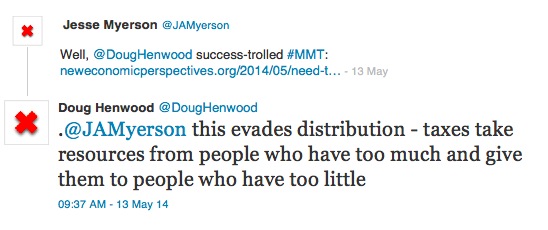

So, we covered those points last time, in part due to a silly twit by Doug Henwood, who likened this to “astrology”. Not one to be bothered with embarrassment he responded to the last blog with this exchange:

Well, no. Taxes on the rich might take “resources” from people who have too much—if he means that their demand deposit account is debited. But taxation does not “give them (the resources) to people who have too little”. Rather government spending directed to those who “have too little” is what gives the poor access to resources (they can use their demand deposit credits to buy food, clothing, shelter, and so on).

These are functionally two entirely separate activities. Government can spend to help the poor without taxing the rich or anyone else. And anyone who can understand balance sheets knows that there is no longer any balance sheet operation in which government “spends” its tax revenues.

Henwood seems to imagine that the rich roll their wheelbarrows full of coins up to the Treasury Department’s steps, where armored trucks load the cash up and take it out to make payments to the poor.

Doesn’t work that way. Tax payments debit the accounts of taxpayers. If you’ve ever gone to a ballgame you know that when the scorekeeper awards a run to Boston, he does not take it away from New York. Rather, he keystrokes runs to Boston. If after review of the video, the umpire has made an error, he “debits the account” of Boston. Where does the run taken away go?

That’s a question for the physicist, not the economist. Where do the taxes payments go? Nowhere—a bank account is debited. I think it has something to do with electrical charges changing from negative to positive, although some commentators told me it is all photons now. All I know is that taxes do not and cannot “pay for” spending.

All of this was recognized by Beardsley Ruml, a New Dealer who chaired the Federal Reserve Bank in the 1940s; he was also the “father” of income tax withholding and wrote two important papers on the role of taxes (“Taxes for Revenue are Obsolete” in 1946, and “Tax Policies for Prosperity” in 1964). Let’s first examine his cogent argument that sovereign government does not need taxes for revenue, and turn to his views on the role of taxes.

In his 1964 article, he emphasizes that “We must recognize that the objective of national fiscal policy is above all to maintain a sound currency and efficient financial institutions; but consistent with the basic purpose, fiscal policy should and can contribute a great deal toward obtaining a high level of productive employment and prosperity.” (1964 pp. 266-67) This view is similar to that propounded in by MMT.

He goes on to say that the US government gained the ability to pursue these goals after WWII due to two developments. The first was the creation of “a modern central bank” and the second was the sovereign issue of a currency that “is not convertible into gold or into some other commodity.” With those two conditions, “[i]t follows that our federal government has final freedom from the money market in meeting its financial requirements….National states no longer need taxes to get the wherewithal to meet their expenses.” (ibid pp. 267-8)

Why, then, does the national government need taxes? He counts four reasons:

(1) as an instrument of fiscal policy to help stabilize the purchasing power of the dollar; (2) to express public policy in the distribution of wealth and of income as in the case of the progressive income and estate taxes; (3) to express public policy in subsidizing or in penalizing various industries and economic groups; and (4) to isolate and assess directly the costs of certain national benefits, such as highways and social security. (ibid p. 268)

The first of these is related to the inflation issue we discussed above. The second purpose is to use taxes to change the distribution of income and wealth. For example, a progressive tax system would reduce income and wealth at the top, while imposing minimal taxes on the poor.

The third purpose is to discourage bad behavior: pollution of air and water, use of tobacco and alcohol, or to make imports more expensive through tariffs (essentially a tax to raise import costs and thereby encourage purchase of domestic output). These are often called “sin” taxes—whose purpose is to raise the cost of the “sins” of smoking, gambling, purchasing luxury goods, and so on.

The fourth is to allocate the costs of specific public programs to the beneficiaries. For example, it is common to tax gasoline so that those who use the nation’s highways will pay for their use (tolls on throughways are another way to do this).

Note that while many would see these taxes as a means to “pay for” government spending, Ruml vehemently denies that view in the title to his other piece, “Taxes for Revenue are Obsolete”. Government does not need the gasoline tax to “pay for” highways. That tax is designed to make those who will use highways think twice about their support for building them. Government does not need the revenue from a cigarette tax, but rather wants to raise the cost to those who will commit the “sin” of smoking.

Many would say that it is only fair that those who smoke will “pay for” the costs their smoking imposes on society (in terms of hospitalizations for lung cancer, for example). From Ruml’s perspective this is not far from the truth—the hope is that the high cost of tobacco will convince more people never to smoke, which thereby reduces the cost to society.

However, the point is not the revenue to be generated—government can always “find the money” to pay for hospital construction. Rather, it is to reduce the “waste” of real resources that must be devoted to caring for those who smoke. The ideal cigarette tax would be one that eliminated smoking—not one that maximized revenue to government. He said “The public purpose which is served [by the tax] should never be obscured in a tax program under the mask of raising revenue.” (1964 p. 268)

We can then use this notion of the public purpose to evaluate which taxes make sense. I won’t go through that today, but let me say that Ruml used the corporate income tax as an example of a particularly bad tax. He’s right. My professor Hyman Minsky always argued for abolishing that tax—and I wouldn’t be surprised if he got the idea from Ruml.

Of course, which tax do “liberals” love? Corporate income tax. They all want to increase it to “pay for” all the goodies they want to shower on the poor. In other words, they compound their confusion—not only do they insist on being wrong about the purpose of taxes, but they also embrace one of the worst ones! Maybe a good topic for another blog?

Ruml concluded both of his articles by arguing that once we understand what taxes are for, then we can go about ensuring that the overall tax revenue is at the right level. “Briefly the idea behind our tax policy should be this: that our taxes should be high enough to protect the stability of our currency, and no higher…. Now it follows from this principle that our tax rates can and should be lowered to the point where the federal budget will be balanced at what we would consider a satisfactory level of high employment.” (1964 p. 269)

This principle is also one adopted in MMT, but with one caveat. Ruml was addressing the situation in which the external sector balance could be ignored (which was not unreasonable in the early postwar period). In today’s world, in which some countries have very high current account surpluses and others have high current account deficits, the principle must be modified.

We would restate it as follows: tax rates should be set so that the government’s budgetary outcome (whether in deficit, balanced, or in surplus) is consistent with full employment. A country like the US (with a current account deficit at full employment) will probably have a budget deficit at full employment (equal to the sum of the current account deficit and the domestic private sector surplus). A country like Japan (with a currrent account surplus at full employment) will have a relatively smaller budget deficit at full employment (equal to the domestic private sector surplus less the current account surplus).

I’ll continue this thread.

Randy Wray doesn’t explain why he thinks the Corporate income tax is “one of the worst”.

It may or may not be – but inquiring minds would like to know the reasons supporting that statement.

Would it kill you to type “Minsky corporate tax” into a search engine?????

A corporate income tax, which allows interest to be deducted prior to the determination of taxable income, induces debt-financing and is therefore undesirable. A corporate income tax also allows nonproduction expenses such as advertising, marketing, and the pleasures of the executive suites to be charged against revenues in determining the taxable income. As advertising and marketing are techniques for building market power and as ’executive style’ is a breeder of inefficiency, the corporate income tax abets market power and inefficiency just as the corporate income tax abets the use of debt-financing. Elimination of the corporate income tax should be on the agenda.

There are, of course, several different ways corporations could be taxed. Wray says only “Corporate income tax”. If he had a specific corporate income tax in mind, it was incumbent upon him to mention it and explain his reasoning. It is not up to us to read his mind.

There are, of course, several different ways corporations could be taxed.

Given Wray is discussing how corporations are taxed, rather than whatever fantasy tax you’re ruminating on, it’s remarkably easy to find out for one’s self. Given that Wray has written on corporate income taxes in the past, it’s quite easy to look it up. Given that Wray didn’t write this post for Naked Capitalism but for a blog with an audience familiar with his work, and that he isn’t responsible for posting it here, the responsibility is yours to find out more, not his to make sure you know.

This petulance that one wasn’t handed all the answers on a silver platter is silly. What happened to self-directed learning?

Wray mentions corporate taxation without any discussion. If he was unprepared to include any indication in the present text of what he was talking about, he should have left it out.

Please spare us the infinitely tired dodge of saying its our responsibilities as readers to go out and research and read endless articles by MMTers because they are unwilling or incapable of writing a coherent, stand alone post. This is a standard which seems to apply to no other group anywhere outside of theology.

What part of Originally posted at New Economic Perspectives do you not understand? His audience there doesn’t need to have it all spelled out for them because they’re familiar with his work.

Please spare us the infinitely tired dodge of saying its our responsibilities as readers to go out and research and read endless articles by MMTers because they are unwilling or incapable of writing a coherent, stand alone post.

This is intellectual laziness. To expect someone to distill the breadth of eighty years in Post Keynesian literature to one blog post and hit every topic you want them to in exactly the way you want them to is the height of absurdity.

Some of us spend years reading to gain a mastery (mastery meaning one is finally ready to begin learning) but you demand to be gotten there in fifteen minutes.

hehe. C’mon Hugh, it’s not that hard. Once you realize that it’s just Keynesian economics with cause and effect re-stated in Pig-Latin. Along with some redefinition of commonly accepted terms – by both laymen and economists – like for instance we learn here that “corporate income tax” means “corporate income tax deductions” – which is just a simple mathematical substitution of negative mathematical terms for positive mathematical terms. A 3rd grader can handle that! Congress does it all the time!

Besides, what else do you have to do with your time besides read and decode this stuff?

To respond to your general and proffer:

The “infinitely tired dodge” is more than justified in cases where the bogon in question has a sufficiently long wavelength; that is, if it persists over time and across many threads.

Trolls, for example, may certainly be asked to “do their homework,” as may MMT irrationalists. It’s entirely appropriate to ask people who can’t be troubled to read a given post to do their homework by mastering the material first.

Amen.

As long as corporations are going to be called “a person”, they ought to be taxed just like any of us “other people”.

“A corporation”, doesn’t add any real value to a society. We as a society do not need to mollycoddle them. If they can’t be profitable after tax, let them fold. If they get caught stealing or defrauding…. let them fold.

If they don’t like what goes along with being in business, let them get out of business.

What we need is less dodge-able taxes for corporations.and multinationals who use borders for tax -avoidance, the only thing to do is to punitively tax them. If they won’t pay our taxes, they ought to be denied access to our markets… lets see how good an idea they think those games are.

The problem is when corporations fold, people who have had nothing to do with the corporation’s predicament get harmed in the process. If they’re a larger corporation, a bigger impact is made economically. That’s why there should be constant checks on them to make sure they’re playing fair and square. The minute impropriety is detected, the Hammer of Justice should swing down, and swing down hard.

This is why the silly libertarian fantasy of free markets is so dangerous; it gives corporations open invitation to lie, cheat and steal.

I understand that little people get hurt when their employer is shut down.But really, there are a lot of people getting hurt these days.Why should a corporate employer get special treatment.

I think that these days these behemoths who are the main problem, need to be forced to close down, so those “free market forces”, have a chance to let a dozen groups, maybe new starter corporations get a shot at whatever game they were selling.

because really “corporation”, is a loaded term.Most “corporations”, are people who have incorporated themselves, or even the small public companies who are still trying to make something better and sell it cheaper than their competition.This vast majority in numbers,not market share,have nothing to worry about.They were never going to get preferential treatment anyway, and they keep their noses clean, as anybody can tell.

It is the behemoths, who have the majority of market share,yet are a distinct minority.These are our problem children that we spend the good will of American military and foreign policy might ,on.We sully ourselves for these bastards to run amok,the world over.While they avoid taxes in this country.

To leave out the possibility of taxing these multi-nationals,is a short sighted notion.People act as if these companies are living in some academic “vacuum-land”, where only forces being studied are active, and everything else, is “another issue”.

Based on the quote, the remedy is simple – eliminate those deductions.

It doesn’t follow you should eliminate corporate income tax.

Having high corporate taxes means the businesses that can hire the most tax accountants will rig the game the best in their favor. Apple, Google, Shell, GE, can hire an army of tax accountants. The guy running the small shoe store can’t.

If you treated corporations like a pass through (which is what they are), and taxed the income they generate progressively at the individual level, it would level the playing field. A vast company like GE wouldn’t have the “tax accountant advantage” anymore.

Don’t worry.

Wealth individuals will, instead of investing in corporations him/herself, invest through his/her next-level-smaller corporations with him/herself as the sole shareholder or his/her family.

So, GE goes tax free.

It’s income gets passed through to 1) slow-witted individual shareholders and 2) smart corporate shareholders.

The smart corporate shareholders then go tax (corporate tax) free.

The rich guy (or gal) parks his/her wealth there (the smaller corporations), drawing (and paying taxes) just the necessary amounts to support the desire lifestyle.

Corporations are artificial entities that can be easily structured to shift income, expenses, profits and tax credits to reduce (often significantly) state and federal taxes. If someone wants to tax businesses, a “corporation profits tax” is about the worse system anyone could devise, although the accountants, lawyers and economists love the system since it generates billions of annual fees whenever big companies restructure to avoid taxes. And wealthy lobbying groups are excellent sources of campaign cash for politicians who either support or oppose dozens of deductions, exemptions and loopholes that affect the marginal tax rates of various businesses.

The US has a particularly difficult problem with corporate taxes since many countries don’t tax “foreign income.” Thus, a US company can significantly reduce its US tax by merging with a foreign owner (eg, Budweiser). Back in the 1980’s and ’90’s we heard the term “foreign flips.” These days we hear about foreign “inversions.”

My view is a lot simpler. Taxing and spending (as well as legislation and regulation) are ways we the people redistribute our resources to accomplish our purposes both individually and as a society.

There are several lacunae in Wray’s presentation. He does not address the curious private/public nature of the Fed in money creation. He does not explain his point about corporate taxation. He ignores the problem of interest.

He skirts the issue of wealth inequality. He never uses the word “inequality” but does bizarrely slam Henwood who indirectly raises it and again briefly mentions it in relation to the second of Ruml’s 4 points. And he invokes government as if it were some independent agent and not what it should be the expression of the members of our society. In this way, the social purpose of government is obscured, and with it one of government’s main responsibilities and society’s concerns, the equitable distribution of wealth is marginalized.

All of these concerns are addressed in Wray’s articles, books and papers and most of the MMT literature in general. The purpose of this post is to explain the need to tax. Issues of public purpose can be found by reading Mosler, Kelton, Fullwiler, and Wray among many others in the MMT sphere. None of your issues are skirted. All lacunae will be filled.

That’s the thing, isn’t it? I’m only a casual student of economics, and I’d like to have things explained to me in an understandable format that doesn’t require me to chase down and master an entire field’s body of work to understand, because honestly I’ve got a few other things I’m busy doing in my life. Physicists have learned to write mass-market books and articles aimed at ordinary people — if economists can’t do the same, it’s only because they don’t want to. MMT will never become part of ordinary discourse if the response to someone saying “I don’t get that” is “well, go read a dozen technical books and articles first, then come back and I’ll talk down to you some more.” And that’s why even if the theory is right, at this point it’s as meaningful to public policy as a fart in a windstorm. It would take a tremendous amount of convincing to shake loose the ordinary person’s bone-deep acceptance of the meme that “government should be run like a household,” and MMTers just ain’t got the skills. Or don’t want to use them, whichever.

Cullen Roche at Pragmatic Capitalism and Randy Wray at his UMKC website both have “MMT 101” primers.

In this no tax world, I guess the IRS will be transformed into the DIE, the Department of Internal Efficiency, which will keep track of how money is flowing throughout the economy. It will be filled with financial wizards who all agree and work by consensus to determine exactly how little to give to the rich and how much to give to the poor…

And it will end up working so well that, over time, everyone will be equal so they will have no analysis to do. All they will need to do is have a printing machine and a robot that sends the same amount of everyone.

Like tomorrow, ‘cept the financial wizards know how redundant financial wizards are once the honest adding machine is “invented”. I have the idea of calling it new technology Moneta. Don’t tell anyone, or we won’t make any money and buy all the property, water and land before it starts working!

An amusing expression of general distaste. What, pray tell, does it actually mean?

Another

MMT irrationalist* comment pins the bogometer. Moneta writes:MMT is not a “no tax world.” Wray wrote:

He then goes on to discuss tax policy.

Please give consideration to actually reading the post, rather than adding the already thick bogon flux that some comments have already tired.

NOTE * My bad.

There is no “private/public nature” of the Fed. The Fed is a creation of Congress and can be dissolved by Congress just as easily. The separation of the Fed from the Treasury was intended to create an accounting fiction that said the people’s money is not their own. It has never been any more than that fiction other than in the people’s imaginations who fell for it..

“bizarrely slam Henwood”

Here’s a quote from Henwood taken from Twitter: “@JAMyerson @delong MMT seems only slightly more respectable than astrology, but maybe that’s just me”, https://twitter.com/DougHenwood/status/465219769650511873, Henwood goes on to say “@JAMyerson @MattBruenig Also Wray’s prose style does not make me want to read more.” Favorited by the somewhat dimwitted Matt Bruenig.

That Wray didn’t slam Henwood harder is what can only be called mercy.

Henwood writes “@JAMyerson this evades distribution – taxes take resources from people who have too much and give them to people who have too little”.

Wray was being generous when in this post he says “if he means that their demand deposit account is debited”, which Henwood didn’t know, which is why he made the mistake of saying resources.

How does a teacher correct someone that doesn’t understand the obvious, that which has been repeated ad nauseum and ignored by a student of economics who proclaims expertise in the subject yet can’t be bothered to learn the lessons that MMT teaches that are at the heart of economics, because he is alienated by Wray’s prose style? (An incisive prose style which rips through any arguments made by weak critics of a school of thought which teaches the operational realities of modern economic systems)

The teacher makes an example of the student in front of the class.

For Henwood’s own dignity I hope he takes the lesson and sits down and shuts up, and does his homework before speculating on something he can’t even be bothered to read.

Many MMT Irrationalists can’t be bothered to read. Not the books, not the posts. I’m constantly amazed by this, and after ten years of site administration, I’m not easily amazed.

Hugh: Taxing and spending (as well as legislation and regulation) are ways we the people redistribute our resources to accomplish our purposes both individually and as a society.

As I’ve tried to explain before, the kind of “resource view” is wrong because it is incomplete. In essence a classical mistake, made by many economists, philosophers and MMT fans, even in main NEP posts. That is not all of what state taxation and spending = state money does. State money organizes the division of labor on a national basis. Conversely, the division of labor is simply impossible without credit (= (pre)money) in any society. “Redistribution” -Robin Hood or robbing Peter to pay Paul or may be a good or bad thing. But it is not the only thing.

The more “advanced” and technological and monetized the society becomes, the more important the financial/investment/monetary side becomes over what could be thought of as “resource redistribution”, especially once it has modern banking, capitalist finance. So as Keynes, Lerner, Minsky, Vatter, Walker and Wray emphasize, perhaps channeling Marx channeling his teachers, so does the need for a countercyclical and growing government to accomplish essentially universally accepted public purposes, and the need for elites to lie, cheat and steal more and more to fight this.

The common, twin mistake that people make, when they have Bright Ideas to Explain Better, is to sneak the commodity theory of money in the back door. Mistakenly conflate money & commodities – what money, credit can buy from anyone, from the state. And then mistakenly not conflate what should be conflated – money and bonds, currency and debt, reserves & “NFA”. There really, really are two really different, really important things, “money/finance/debt” & “real stuff/commodities/resources”. And that is how they should be divided, instead of thinking of “finance/debt” as a superfluous addition to Real Analysis of “real stuff/commodities/resources/money”.

As for defensiveness, I don’t think I have been, and I apologize if I have – but the explanation mentioned before was characterized as “parody”. Sometimes people, including MMTers, including Wray, can be too defensive, true. The corporate tax point was an aside, and if I were Wray’s editor, I would have told him to leave it out, as it was a confusing distraction.

Cal – not sure what you are saying here (proll my fault). I can demonstrate division of labour in non-money society – bees, African Hunting Dogs, Bushmen hunting down a deer. Once we have money it is some kind of promise to have a fairly stable share, pay your way beyond the project giving you a share. This money doesn’t have to be accumulated and re-invested or have to imply banks – though we have a system of these institutions and investment.

Money for projects could always be thin-air money, money saved just attracting inflation proofing with an accumulation limit. This brings allocation issues into question and motivation and control of getting the right work done well.

I’m talking half-baked pie in the sky here, from which we might have to create all the old cogs and the old system – I do so only to question what the assumptions you are making are and whether they are necessary -plus whether we can make a leap from ‘typewriter to wordprocessor’ on money. Our definitions and practices with money pre-date new technology.

And? I don’t think MMT has ever denied money has a history; in fact, it’s grounded in it. So what’s your point?

Spades are not shovels. They have different purposes.

You don’t do speculative thinking at all well Lambert. I was asking Cal for some clarification, hoping he could see we might be jumping into money definition.too ‘soon’. Clearly there are times before money with division of labour, even in human societies. And clearly, nearly all our institutions and definitions of money pre-date widespread new technology. To the extent money is embedded in the new technology, we may have embodied the old ‘manual money’ and this might not be the best solution. We might be able to find a better understanding of division of labour and money, as we might better understand money by recognising it didn’t come about from barter (Graeber).

I don’t know why you have to point out MMT deals with some history of money to someone who teaches the stuff and isn’t claiming the opposite. Cal has said something interesting on assumptions made, whether right or wrong. They made help me ground some speculations I have on capacity and project-based money. He has been helpful before.

OK, that was your point. Thanks! Perhaps I’m finding genre-mixing commentary that includes questions that are “prolly wrong,” what others call flow of consciousness, tendentiousness, really interesting information, snark, and bogosity difficult to manage; not “speculation” as such. Since some of these genres have bad impacts on NC, perhaps I’m too quick on the bogosity trigger, as I see I was in this case.

If you untether money/finance/debt from the real world, what is the rationale for it? Society’s primary resource is its people, their talent, skills, knowledge, labor, and goodwill. Money in whatever form it takes simply allows access to human and physical resources so that society can accomplish the purposes we assign it, which is to build and maintain the society we wish to live in. This is not a static or zero sum process. Resources will be created, consumed, and transformed in it.

If you came at this from a social purpose perspective, you would see that neither government nor the economy has any reason for existence beyond the purposes we assign them. Government and the economy are there to express and effect the purposes we set for them. They have no autonomous existence outside these purposes. Government is never separate from us. The economy never just is. Only when they are stolen and hijacked from us, as now, is this the case.

Hugh writes:

Yes, real resources. MMTers urges that we have the resources, the money follows.

Hugh writes:

MMT calls that “public purpose.” A cursory reading of the post, or a cursory reading of the literature — do feel free to give a cry of pain if that’s too hard — will show that.

Finally, Hugh writes:

Yes. MMT calls that “public purpose.”

So far, Hugh and MMT are on the same page. Remarkably enough. Finally, Hugh writes:

First, Hugh’s dead wrong. Government might be said to have a “relative autonomy.” Even a better version of the government, like FDR’s, that “expressed and effected” public purpose still doesn’t reflect the will of the public in a simple or mechanistic way; for example, the rule-making and regulatory processes surely have relative autonomy within the framework of the purposes set for them.

Next, let’s take Wray’s policy prescription as a text:

How does this argue that governement is “separate” from us? (Modulo the argument on relative autonomy above). Wray’s making a policy argument; we reify government in prose all the time to do that. Hugh’s elevating a prose treatment of government as an object of study to an ontological claim about the nature of government. That’s bogus.

Social and public are not the same. What is social exists before and often independently of government whereas public occurs within a legally, i.e. governmentally sanctioned space. Both the economy and government are products of society. So yes, they should never be separated from the purposes we as a society assign them. The reason this is important we see everyday. When government and the economy cease to be our creatures they become the creatures of others. The rich and elites use this specious autonomy and/or independence of government and the economy to justify their looting and the power and fortunes they gain thereby.

By emphasizing the public and not the social, MMT is profoundly conservative of current political and economic structures because these define and validate what is public. MMT has some interesting insights into fiat money but it comes out of and remains firmly embedded in the current politico-economic system, which is to say neoliberalism and kleptocracy. In its current formulation and with its current practitioners, I do not see it ever successfully freeing itself from what is its intellectual heritage. It comes back to those two simple words, public and social, public inside the system, social outside it. From a social purpose perspective, it is trivial to note that government and the economy are suffused and subsumed by their social purposes at all times. From the public purpose standpoint, they aren’t and therein lies the problem for us in the 99% because that discrepancy provides the gateway to our looting, a discrepancy which MMT embraces, and defines it.

Well put: “By emphasizing the public and not the social, MMT is profoundly conservative of current political and economic structures because these define and validate what is public. ” This to me is a very clear and useful formulation.

But from a process perspective, I vehemently disagree: I think that “public” is contested, and it’s for us denied public space to seize and redefine “public.” But that’s not MMT’s job. It’s our job. And that job is not aided if we don’t have a clear notion of how money is created, and our options for policy if MMT’s notions prevail.

Although the concept of social purpose might be more comprehensive than that of public purpose, that does not mean that public purposes are restricted to those that can be achieved through the existing public institutions. To the extent that MMT is sometimes conservative about existing institutions, I think that is mainly a practical judgment, and the attitude is “Why reinvent the wheel when the existing wheel is perfectly capable of doing the job when steered correctly.” But some of the MMTers seem more interested in major institutional reforms than others.

lambert:

I think one problem is that, for Hugh, MMT doesn’t call that anything. It doesn’t address what the government and economy are there to do. If MMT does make that claim—not a claim about using “public purpose” as a way to evaluate a particular policy but a claim as to the purpose of an economy—I think it would help matters if you could point to it.

There is a normative claim about making normative claims for the economy lurking here: it’s not enough to say how we can evaluate this function or that within it—you should state what an economy is for. (By contrast, you can certainly evaluate organisms on the basis of their fitness to an environment but you would not state what “fitness to an environment” is what evolution for or that you should state it is for that.) That in itself—that the economy is for something—is a normative claim that Hugh seems to be making that he says, I think, is absent from MMT.

JeffW: Here’s Wray’s discussion (realizing there’s no MMT bible because MMT is no a religion) in the MMT Primer, 2012, Chapter 37, The Public Purpose:

So far as I can tell, Wray has said what Hugh wants him to say. (Yes, it’s “evolving.” The “public purpose” is contested.)

MMT writers don’t generally make formal statements about the various value gaps they believe comprise the various dimensions of public purpose. But I’ve developed a list based on my reading of the MMT literature. It’s in this piece.

In addition, my reading of Warren Mosler, Randy Wray, and other MMTers leads me to the conclude that they believe MMT is, “economics for the public purpose,” a play on the title of one of Galbraith, the elder’s books. So, I think MMT economists do have normative commitments, ad the distinction some f them try to make between the normative and the descriptive isn’t one that holds up under philosophical analysis. In my view the failure of this distinction goes back to the collapse of logical empiricism during the 1950s and 1960s.

Well, I think this is the kind of frustration people are going to run into anytime they take any branch of macroeconomics and start treating it as though it were some grand political philosophy. Can you think of any other schools of economic thought that have a comprehensive theory of the purposes of government and society? Maybe the Austrians, since they have such a minimalist and negative view of government. But otherwise, these kind of theories go well beyond the territory economists are usually willing to stake out for themselves.

“Can you think of any other schools of economic thought that have a comprehensive theory of the purposes of government and society?” Marxism.

Hugh

which is exactly what Stephanie Kelton says:

It was clear in Hugh’s prior comment as well. I don’t understand your objection, Calgacus.

“Emphasise” is a legitimate secondary spelling (Also, especially British, em·pha·sise ) and the source is not Dr. Kelton but the transcriber of a lecture given by Dr. Kelton, Felipe Messina.

Jeff W:

I see how useful it is to emphasize the writers in bold, but the formatting confuses me and therefore, I imagine, others because in rapid scanning I mix up your bolding with the author names at the bottom of comments, which are also in bold. I’m wondering if you could adopt underlining or all caps or italic as a convention? Thanks!

Sure, I’ll be happy to give something else a try. I just have a feeling that if I am actually going to refer to someone by name (which I try not to do that often), that person deserves the courtesy of being able to see quickly that I’ve done so. (Underlining always strikes me as a throwback to when typewriters couldn’t do italics or bold but I might overcome that bias here.)

You do? I never thought of that. Maybe italics would work, if the name started with initial caps. I think an italic lowercase name would be confusing in a different way. Quotes would be confusing. craazyman, CRAAZYMAN, craazyman, [craazyman]…. Of course, if you made the name a link to the comment in question, it would stand out for that reason, and provide functionality for the reader, but it’s more work and does risk Akismet.

But I nearly went very wrong on a comment when I thought your bolding was the comment source, and I don’t want to do that. Fortunately, I didn’t press submit.

It seems to me that the basic point should be fairly easy to understand. A government like the US does not have to tax as much as it spends, either in the short run or over the long run. That’s because the fiscal policies of such governments are integrated with monetary operations that lead to continually increasing quantities of government currency in the private economy. As long as these operations are carried out in a sensible way, they do not destabilize the currency or prices, and in fact help to enhance stability.

Another comment scarred by MMT irrationalism pins the bogometer. Hugh writes:

I call bogosity. Wray cites Ruml approvingly:

Ruml says “express public policy” which is not in substance different from Hugh’s “expression of the members of our society.” Hugh says “equitable distribution of wealth” and Ruml’s “penalizing various … economic groups” enables that to be done (more below). Wray goes on to say in his own words:

Once again, “public purpose” is not in substance different from Hugh’s formulation. Since I’m reluctant to conclude that Hugh is arguing in bad faith, I can only conclude that, for whatever reason, he’s not willing to give Wray’s text more than cursory attention (in common with other “any stick to beat a dog” types).

* * *

But, one might urge, Wray does not address class warfare!* And that is true. (Bloggers constantly hear the cry: “You didn’t write on the topic I want you to write on!” Clue stick: If you want that done, write a check (which might not be accepted)). First, Hugh writes that (presumably) mitigating class warfare is “one of government’s main responsibilities” (emphasis mine). Well, Wray wrote on others “of” government’s responsibilities, so what’s the beef? Is class warfare a shibboleth, a magical talisman that must be rubbed before entering into any discussion?

Less trivially, where is public purpose to be defined? Hugh seems to think that if only Wray wrote the book or post that Hugh would like him to write, the matter would be handled. This is cargo cult thinking. Public purpose is decided by the public. Granted, our current political arrangements obscure this, but we may hope to reverse that. That’s done by a long collective process, in which the NC comment thread plays a small part. Rather than making tendentious statements based on sloppy reading and ending in false claims, good faith commenters might consider making their own contributions, rather than demanding that others, including Wray, do their work for them.

One such might be build on Ruml and Wray to, say, advocate for a steeply progressive inheritance tax. Given that taxes don’t fund spending, we can focus on the real reasons for such policy: To prevent the 0.01% from putting the state on the market, and purchasing bits of it; to prevent the formation of an aristocracy of inherited wealth; and for the psychic and familial health of the rich themselves, many of whom are said to regard their wealth as a burden.

* Let us, as the Australians do, call spade a bloody shovel, and not putz around with wussy circumlocutions like “equality distribution of wealth,” let alone the career “progressive” equality.

The bogosity as you term it is this deeply irrational hyper-defensiveness that any criticism of MMT elicits from its believers. It is insufficient to know the general principles of the theory. We are required to recite chapter and verse. Citing what the author actually says in a post is likewise insufficient. We must be prepared to quote from their whole body of work, indeed the whole corpus of MMT. On the other hand, if the author is unclear, vague, or simply sloppy, we must read into his/her words their unstated intent so as to resolve any issues in their favor. These demands are not only unreasonable. They are outrageous. Any honest discussion of MMT is quashed. We are left not with MMT as evidence-based economic theory but as theology and dogma. It is just so contrary to the whole progressive ethos of open intellectual inquiry that I want no part of it.

I deployed “Why are you do defensive?” when I was younger a good deal. It’s a real conversation stopper.

As here.

Again a straight, to the heart of the argument, answer; which is ignored in the other replies. What is the functions of the various parts of an economic (and political) system? The MMTers, like too many other schools of economic thought, ignore this question (or answer it incorrectly in their breathlessly stated first paragraph). The function of a government is to try to make the society fairer and to set the standards by which fairness is measured. The function of business is to make money by selling a good or service at a profit (not return wealth to its shareholders!). The function of other groups is to support that’s group identity and purpose. In a properly functioning society, all three groups are in tension and have a give and take with each other.

The two government goals on which MMT has placed the most emphasis are full employment and price stability. Both very worthy and important goals. I agree that it would be good if they would turn more attention to broader questions of social justice and concentrated private power and corporate power.

Yes, with the qualification for those permanently disemployed, and there are a lot of them, as Hugh demonstrates monthly.

For those, full employment is a matter of social justice. Links on request, but the health and social effects, including suicide, of unemployment are well known. (Modulo the discussion on whether capitalism should exist, “jobs” should exist, etc.)

So the rich should be forced to work as a matter of social justice? Or is it only the non-rich who should be forced to work?

And don’t confuse the ill effects of lack of income and not being able to work (What work can an apartment dweller do, for example?) with not working for someone else, i.e., work does not necessarily mean a job.

How many times have the MMT people said the Job Guarantee is NOT a requirement to work? It’s an option. You persistently straw man their policy. This is bad faith argumentation and against house rules.

How many times have the MMT people said the Job Guarantee is NOT a requirement to work? Yves Smith

It isn’t? So one can merely show up to pick up his check or better have it direct deposited and avoid even that trouble?

A Guaranteed Living Income plus land reform offers a true option of someone working either for himself on his own land or for someone else.

Or is it that Wray offers either a job or enforced boredom for those without land?

What a sorry society when the choice is wage-slavery or boredom with justice not even on the menu.

Good faith? Please get LR Wray to explain why people would choose to have a job when they could receive the same income for doing nothing with the option of volunteering?

But look. If Wray is simply offering a Federal Volunteer Placement Service (for people who can’t find their own work to do) in addition to a generous Guaranteed Living Income then let him say so.

You need to read the logic behind the job guarantee. You haven’t made a good faith effort and your insistence on making it into something it isn’t is tiresome and intellectually dishonest.

He does not address the curious private/public nature of the Fed in money creation.

Is the Fed the subject of the post?

He does not explain his point about corporate taxation.

Maybe he thought you would be intellectually curious enough to bother to look it up for yourself?

He ignores the problem of interest.

What problem?

He never uses the word “inequality” but does bizarrely slam Henwood who indirectly raises it and again briefly mentions it in relation to the second of Ruml’s 4 points.

So he does discuss inequality, but because he doesn’t use your preferred word and owns a thesaurus he’s “skirting the issue”. He is bizarre because Henwood made an incorrect statement. Wow.

And he invokes government as if it were some independent agent and not what it should be the expression of the members of our society. In this way, the social purpose of government is obscured, and with it one of government’s main responsibilities and society’s concerns, the equitable distribution of wealth is marginalized.

And now we’re back to the metaphysics and normative judgements regarding a post on accounting. Despite the hundreds of pages Wray has written over the years on social well-being and public purpose, Hugh continues his one-man crusade of pretending it didn’t happen.

We seem to have lost any appreciation of what has been termed the ‘Commonwealth’. It may be that our blind desire to achieve personal wealth has led us astray.

Long ago Lorenz von Stein’s wrote: “What I am, what I have, and what I do, belongs in some part to the community. The strength of the community resides in what each individual surrenders to it from his personal life- material, spiritual, and social matters. It is thus -even mathematically- impossible that the community should offer individuals the conditions of economic accomplishment, unless the individuals return to it part of their earnings made possible by the very existence of the community. As long as human beings and nations exist, this reciprocal process will continue, even though the individual may neither want it nor even be aware of it. This is the economic principle of human society.”

As Oliver Wendell Homes said, “I like to pay taxes. With them, I buy civilization.”

‘We have to get it to the market ASAP. Gotta beat our rivals. Time…is of essence here!!!’

What does that mean?

It givens an example of the Non-Uniqueness of Billionaire-hood.

If he/she doesn’t do it (gives the ‘supposed’ contribution or service to the society), someone else will.

That’s is why we say, it takes a whole village to produce GDP.

And therefore, GDP Sharing is the most natural, most logical world order.

Teamwork…everyone together to make it possible.

MLTPB,

It appears that nobody wants to hear it….. cooperation is not held in high regard these days. Too bad we all will share in the failures of a poorly regulated market.

The hyper-defensiveness of MMTers makes any reasonable, rational discussion with them impossible. It relegates their theory by their behavior to a cult. You are either a true believer or an infidel. If only we had read all their holy texts we would understand. Somehow they remain oblivious to how self-defeating and marginalizing this attitude is to the mainstreaming of their theory.

Hugh that’s about as big as a projection I’ve seen from some Austrians and Neo classical’s. The Rub always comes when MMT’ers try to describe the functioning system architecture only to have morality [metaphysics] and politics attached to it. Its people that try to ascribe agency to it that always ends up in tears.

Agency Skip? When did the MMTers ever mention the CIA? Their theory is ‘intelligence neutral’ after all …

I think the situation Hugh describes comes about because economists generally do not understand they are in defeasible argument, not proof. Reasoning is defeasible when the corresponding argument is rationally compelling but not deductively valid. The truth of the premises of a good defeasible argument provide support for the conclusion, even though it is possible for the premises to be true and the conclusion false. In short, the relationship of support between premises and conclusion is a tentative one, potentially defeated by additional information.

Agree with you allcoppedout on defensible argument versus proof. (And I hope I’m not missing the nature of the argument because “defeasible” is non-American English and my vocabulary has deteriorated over the past 20 years. Awesome, Perfect you Brits and how ya’ll talk so good and all!) Sector balances from Wynne Godley is solid theory with good empirical support. The rest of MMT leaves me some combination of enlightened and confused. That said, one of my favorite blogs is Bill Mitchell – billy blog; maybe cause I just like the guy. His libertarian-left spirit is so close to my own and his logic is impeccable – but you’re right, it’s not proof. And this from a country that formally conceded control to the CIA circa 1974 (when America was still a glorious democracy in the throes of Watergate and the Church Commission at least had a potential to exist). Hat tip to Rupert Murdock for help with that one!

The Pragcap blog of Cullen Roche has created a rift, as Cullen has, with help from Warren Mosler and others, propounded “Monetary Realism” that puts more emphasis on private bank creation of money, and jettisoned the Job Guarantee as too political. (My summary is poor, so read it for yourself! The theory has mainly moved to its own MR website.)

Weirdly, MMT may have been at the heart of Reaganomics. Mosler early on went to his one-time mentor, Art Laffer. I think Laffer got it (and Cheney?), so maybe Laffer knew his famous curve was all BS.

Monetta’s comment that they bring out MMT when Debt to GDP ratio is high is ahistorical. What “they” do is practice MMT when they want a war. “They” don’t want the voting public to have any idea about MMT. We might to start a war on bad infrastructure, college tuition debt, or Anthropogenic Global Warming. Can’t have that, or else the cost of labor would go up! And please – the R&R paper is fundamentally flawed, not just an Excel spreadsheet error.

Monetta’s comment that they bring out MMT when Debt to GDP ratio is high is ahistorical

——

My point is that the form of MMT we are currently using is still accounting for debt and some taxes. MMT Turbo will be MMT not accounting for debt or taxes.

Essentially MMT, the way it is being debated, can figure on a spectrum.

1970s to 2009 – MMT SE

2009 to ? – MMT LE

? to ?? – MMT Turbo

“MMT Turbo. That’s a nifty turn of phrase.

Sectoral balance equation is best understood when reduced to the case without foreign holding.

In that case, the more the government owes, the more you and I have.

When money is via government borrowing, that means, the more money the government spends into existence, the more you and I have.

That is, the more it prints, the more you and I have, in straightforward British English as well as American English.

Of course, you can rebel against this ‘descriptive’ reality, and ask, is there another way?

Yessiree.

We can let the Little People spend it into existence.

Then, the more the Little People spend for government products and services, the more money the government can have (by working to serve the Little People).

MyLessThanPrimeBeef – I am sure you have good intentions – but don’t you know where the road they pave goes to? Take your words seriously, with the usual meaning – and see this is a prescription for the hell we have.

“We can let the Little People spend it into existence.” is the plutocrats fondest dream. Spending money into existence = going into debt. That’s what you do every time you spend with a credit card – a Little Person issues money.

If you issue money = debt it has to be redeemable in principle for something for it to be real money. There has to be some way for the Little People to become creditors, rather than the debtors they become by issuing money. And the only thing that the Little People have is their labor.

So thinking of your proposal generously, the only way it could work is if it is a Job Guarantee, in which case I am 100% for it. The Little People’s money is backed by the money they get from the gov or another employer, for their work.

The Little People spending money into existence does not have more problems than the government spending it into existence, only it empowers the Little People.

It’s as simple as that, the Little People doing the hard work that is being done currently by an overburdened government.

You may have answered this, but I will lazily ask it again: You can spend it into existence, but why should I accept it?

I think it’s because we have to redeem the iou’s we’ve issued, with killer interest added. No getting out via bankruptcy, and our wages will be garnished should we balk.

Warren denies that he contributed to Cullen’s rift, except perhaps in Cullen’s mind. See my dialogue with him at the time of the rift.

I love the concept that private bank creation of money isn’t political. It would be kinda sweet, if it weren’t so dangerous.

…modernity’s Sophists?

You have to admire the cunning of a plan to actually use MMT in full view and create a department of dupes at UM@K who think they’ve discovered something new. We await the next of Moneta’s ‘Prison Notebooks’ with baited breath. How are they going to feed their Orwellian ‘Schacht and the Mefo bond’ to us? Bring back Al Gore and the ‘Green Peace Voucher’?

Defeasible is just a philosophy term. To be an economist one must be stripped of philosophy – q.v. Adam Smith. Almost no modern philosophy is taught, including paraconsistent logic that accommodates inconsistency in a sensible manner and treats inconsistent information as informative. It’s tough stuff, so we teach rhetoric to dullards in graduate schools instead.

That was rather hateful. Congratulations.

Have you seen ‘The Pope’s Toilet’ Ben? Wonderful use of ‘congratulations’ in this fine film from Uruguay.

No, I haven’t seen The Pope’s Toilet. But I have seen The Augean Stables. IMDB doesn’t have quotes for this movie, and I can’t find a script.

So, you’ve managed or at least attempted to squelch Ben with a quotation whose meaning you do not explain and whose existence cannot be verified! A rhetorician might be proud.

Er, congratulations!

http://www.viewster.com/movie/1197-15604-000/the-popes-toilet

I’d be more worried about ‘hateful’ abstracted from a fictional series of comments between friends and assuming people can’t google.

You need to watch the film to get the joke, which would rather spoil with advanced notice. Have a think about your own actions on this Lambert and ponder of what Hugh said on defensiveness. In fact, you haven’t read the line of dialogue in context at all..

This subthread could have been brought to a conclusion easily had the snippet of dialog from the movie been quoted in context, so that all NC readers could have understood what was meant.

That’s why I spent the time to try to find the script, since that, at least would have improved the thread. Alas! Therefore, since that seems to be impossible, I will conclude now, lest I be seen as “defensive,” etc.

What is it in the nature of this MMT stuff that gets people who seemed otherwise to be getting along just fine all riled up at each other?

New ideas.

The consistently avoided fact that printing coupons redeemable for real goods and services in and of itself creates no increase in the amout of real goods and services.

Debt based fiats are inherently unstable and subject to all manner of accounting subterfuge. A stable currency will most likely require backing/convertability to a measure of calories/energy.

Making energy companies even richer? What’s this? The latest gold-standard attempt? “Here a scam, there a scam, everywhere a scam-scam. Ole McDonald …”

And you’re wrong anyway. A fiat currency can expand without price inflation if the expansion rate is less than or equal to the real GDP growth rate.

But in case you say the real GDP growth rate is a subjective measure then allow genuine private money alternatives for private debts only and then only government and its payees need suffer from price inflation in fiat.

The consistently avoided fact is that in functioning modern economies it is lack of money that limits activity, and that if people had more money they could buy the real goods and services which the economy already could produce.

I was referring to economists in general.

Wray, Kelton, Hudson and Black don’t strike me as Sophists or dupes. And I wouldn’t still be reading them if I thought they couldn’t take our kind of rib-tickling. There are deep questions on why we don’t have a money and economic system as easy to drive as a car – something that fades into the routine background.

Allcopped out there:

Allcopped out here:

To my simple mind, these two sentences could be seen to contradict. The only way I can see to make them consistent is to make the claim that Wray, Kelton, Hudson and Black are not, themselves, dupes, but are intellectually dishonest and unethical scholars in that they make dupes of their students.

Is that what you mean? If not, please clarify what you do mean.

*** crickets*** Ah, I now see the response is misplaced.

What a shame that such dislikeable people came up with a useful way of understanding the economy that nukes the neo-liberals and enables the policy outcomes so many of us prefer!

NOTE That’s “bated” breath. Unless your subconcious is calling attention to the “fishy” nature of your passive aggressive snark with a spelling slip. Worth a thought?

Good Lord. What a fine pedant you’d have made as an Englsih teacher. The ‘contradiction’ would only been ‘seen’ by an inattentive reader. The first was descriptive of Moneta’s rather lovely ‘theory’, relating to that. The second concerns me rather liking the MMTers and relating to that.

Not much point in me explaining the role of fiction in adventures with ideas, so I left something for you to red pen.

To:

You respond:

and then argue those words are descriptive of a theory and not of persons at UMKC, however likeable? Whatever you say!

As for Moneta’s lovely theory, to which you say the words above respond, you’re leaving readers guessing as to which comment you mean. A link would have helped.

To my simple mind, a comment that the common reader cannot distinguish from fiction is probably best revised or left unwritten. (Craazyman makes this distinction stylistically to brilliant effect.)

* * *

Re: “Red Pen”

Since you’re relatively new, you probably don’t understand that NC admins, being already overloaded, don’t take kindly to the assignment of extra work, as for example comments being left for them to “red pen.” None of us have any sense of irony about that whatever.

ALL economic theories are wrong and are a product of their time.

The economy is multi-variate with a feedback loop. It is so complex that the way to prove a model is wrong is by simply using the proof by contradiction. Yes, the intended goals of MMT could work for a while, just like many other economic theories did in the past, but for how long? However, it is also very easy to show how it could go wrong.

I’ll be honest and admit that I have not read the whole works. Why? Because as soon as I can poke a few holes in a theory, I move on to other stuff.

The biggest issue with economic models is that they do not account for externalities and human nature. MMT included.

In my mind, Western governments are going to end up printing because that is what is needed. They will find ways to hide the debt… PPP, guarantees, etc. And in the end, the true debt-to-GDP ratio will drop whether the US is counting the debt or not. Is it going to make people more equal? Perhaps, if all goes well. But I doubt it. In my mind, equality in the US means disaster for the planet.

I believe that quick and drastic action from government typically leads to huge corruption. Particularly money printing.

One thing for which I am 100% sure iis that our leaders in due time will use a new ideology that fits their needs at a particular point in time and that this ideology will be shoved down everyone’s throat.

And everyone will maximize their quality of life accordingly, just like water finds the path of least resistance. Whether the sum of all maximisation grows or shrinks is the trillion dollar question

I started poking holes in economic theories while in university. None of them met my standards since they were all flawed and can never work over long periods of time. So my goal was always to assess how the teacher interpreted the theory to make sure I wrote what he wanted to see.

One starts writing what teacher wants and then writes what the boss wants. The simple basis of work education. Yep.

Hmm. What if MMT were viewed not as a “theory” or “model” but as a description of Complex Adaptive System?

It’s surely not that. There are people who study complex adaptive systems, but I see little significant overlap between what they are doing and what MMTers are doing. MMT seems to take a fairly standard Keynesian view of an economy.

Oh well!

and enables the policy outcomes so many of us prefer! Lambert

Except euthanizing the banking cartel, which MMT is perfect for. Instead, it appears Wray and Co want to saving the cartel from itself. The 50-65 million killed in WWII might find that contemptible.

I should have said “some” policy outcomes. Not sure about a linear relationship between WWII and banking cartel. Or, for that matter “perfect for.”

There is a linear relationship between the banking cartel and WWII. To wit:

1) Ben Bernanke agrees that the Fed caused the Great Depression:

Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve System. I would like to say to Milton and Anna: Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.

“Remarks by Governor Ben S. Bernanke at the Conference to Honor Milton Friedman,University of Chicago, Chicago, Illinois,” federalreserve.gov (2002-11-08)

Commenting to Milton Friedman’s public statement that the Great Depression was caused by the Federal Reserve Bank

from http://en.wikiquote.org/wiki/Ben_Bernanke [bold added]

2) The Great Depression was a major cause of WWII:

The main causes of World War II were nationalistic tensions, unresolved issues, and resentments resulting from World War I and the interwar period in Europe, in addition to the effects of the Great Depression in the 1930s. from http://en.wikipedia.org/wiki/Causes_of_World_War_II* [bold added]

Note also that the Fed financed US entry into WWI which led to an unjust Armistice which was another major cause of WWII (“and resentments resulting from World War I and the interwar period in Europe”).

Notes:

* Note that the wiki entry has since been edited to blame WWII on a few evil characters.

I don’t know what you’re talking about with this one.

Thanks for the reference to the concept of defeasible argument, which I had never heard of before. Not knowing what it was, I found this paper [PDF], which is tough going, as philosophy papers tend to be, but explains pretty well what it is all about (at least for a lay person like me, I guess). I have to say that there is something immensely satisfying for me about reading the conclusion “Defeasible reasoning is the norm and deductive reasoning is the exception.” My tendency to say “Well, for now, unless we find out x, it seems likely that…” is vindicated.

There’s more on argument that explains how easily we get confused concerning its purpose here:

http://plato.stanford.edu/entries/logic-informal/

The site has some belting summaries generally.

Is double entry book-keeping “defeasible” or not?

not a good example – the arithmetic bit is not defeasible if you can do the arithmetic – but if you claim the accounts are a fair representation of the business that is defeasible as you may have cheated of what went into them – the challenge not being against the convention itself

Is that a yes or a no? Or are you saying the question implies a category error?

NOTE I’m talking about double-entry book-keeping as such, not instance of it, as for example a set of books.

UPDATE OK, I see that only an instance could be defeasible; so indeed, a category error.

I doubt we’d ponder much on defeasibility over arithmetic, though attempts to make even that logically based have failed. Russell and Whitehead’s three volumes should get you up to speed of never wanting to lift a book cover again. I was stopped half-way through (the first page) by an urgent desire to walk along a riverbank and talk to squirrels. They told me about Godel, so I never went back to the library. It’s more about heuristics with applications in AI.

Double entry book-keeping is a convention not an argument.

Right, on heuristics, which is why my question was a category error. As you say, “I doubt we’d ponder much on defeasibility over arithmetic.”

We might ponder the defeasibility of a complex arithmetical calculation, like Moneta’s bookkeeping example.

Or we might ponder the defeasibility of complex economic applications used by hedgies, PEs, and looters of all sorts.

Yes.

Government does not use accrual accounting. And even accrual accounting is full of subjective values.

I can go in any corporate balance sheet and poke a hole in an item’s valuation… for example, goodwill and intangibles are often huge… I can typically argue many reasons for write-downs and a couple of reasons for markups.

I was trying to test the limits of defeasible, but for reasons you point out, I got them wrong. Not because of accrual but because as I understand it (the term is new to me) a construct like “double entry bookkeeping” is neither defeasible nor non-defeasible (?); it’s just an inappropriate use of the term.

Just as arithmetic does not describe inventories, but inventories satisfy arithmetical propositions, so does geometry not describe Asia, although geography is an application of geometry.

Moneta rightly points to the subjective nature of many entries in book-keeping. Estimates are usually better than guesses. There are many accounting conventions (100s at least), often firm-based.

Any booking can be considered defeasible in “non-monotonic logic”, a family of formal frameworks devised to capture and represent defeasible inference, i.e., that kind of inference of everyday life in which reasoners draw conclusions tentatively, reserving the right to retract them in the light of further information. Such inferences are called “non-monotonic” because the set of conclusions warranted on the basis of a given knowledge base, given as a set of premises, does not increase (in fact, it can shrink) with the size of the knowledge base itself. This is in contrast to standard logical frameworks (e.g., classical first-order) logic, whose inferences, being deductively valid, can never be “undone” by new information.

Given what Moneta says of practice, it makes sense to consider book-keeping as defeasible. Remember, Lambert, this doesn’t defeat a form of book-keeping as being a good thing. And MMT does not necessarily fall for being defeasible.

Yes. This is why my question was a category error.

The only one being ignorant and hyper-defensive is BJ. I try to overlook his bullheaded defenses, all ad homs and insults, when considering MMT. In any case, what I don’t get is why government the government needs to LEND currency into the economy at all. Interest rate policy by the central bank fails to stimulate the economy in a healthy way and in fact enriches the banks who have free reign to use the money to invest in risky assets. The banks are in charge of money creation and the government is dependent on them. Just saying the Fed is part of the government sector doesn’t make it so. I have not heard a good argument from JH about why debt free fiat is not a better way for a sovereign monetary system than running our money through the banksters hands.

“In any case, what I don’t get is why government the government needs to LEND currency into the economy at all.”

It doesn’t. However, it might want to. It is possible that having two types of money circulating – money that pays interest (ie government bonds) and money that doesn’t (the stuff we pay bills with) – has benefits within a capitalist system. I don’t know the arguments, but I am sure that other people have considered them.

I don’t assume anything that I haven’t thought out for myself, particularly in a soft science like economics. Too much TINA embedded in such thinking for me.

Right, lending money into the economy is one way of promoting economic development while exercising some discipline over it. If a guy wants to open a shoe store and lacks the financial capital, then by lending it to him and binding him to pay it back, rather than simply giving it to him as a grant, you help make sure he uses it for the intended purpose rather than, say, for a sex tourism binge trip to Thailand.

That said, governments do have lots of options in principle. For example, a public bank would enable the government to target particular kinds of economic development goals by subsidizing them with special interest rates. If the government decided there were not enough shoe stores, wind farms, etc., it could offer qualified and promising entrepreneurs in these areas negative interest rates, thus requiring the borrowers only to pay back some portion of what was lent them.

So what if the shoe guy can’t pay back the loan? What are you going to do? Put him in debtor’s prison? Or shall loans only be made to those with collateral, i.e. the non-poor? With the biggest loans going to the those with the most collateral, i.e. the richest?

A monetary sovereign should neither borrow nor lend since both are welfare for the rich at the expense of the poor. Grants, otoh, do not bring in the bogus concept of being worthy of the public’s and especially the poor’s stolen purchasing power.

Non-monetary sovereigns (state and local governments), otoh, should be able to borrow but never lend.

Ethics is the key to fixing this mess as distasteful as that is to some.

Credit and debt are not just things that are related to government operations. The basis of modern economic life is the contract. People and enterprises enter into deals and make binding promises to one another. If they break their promises and can keep them, the promises will probably get the law involved to make sure the promise is kept. If people make promises that they subsequently can’t keep, the terms are usually retroactively adjusted in some way with both the promiser and the promisee taking a hit. Credit and debt relationships are just one particular kind of contractual relationship.

Almost our entire advanced economic life is based on well-calibrated and predictable flows of goods, money and labor that result from enforceable contracts.

Straw man! I have nothing against purely private credit so quit pretending I do. What I am against is the use of the public’s credit for the rich since it should be for the general welfare only. General welfare easily includes grants to the poor but never special favors for the rich even if disguised as loans.

So you do intend to put the shoe guy in debtor’s prison if he doesn’t or can’t pay? Under sanctity of contract?

There’s no way around it, loans by the monetary sovereign are an attempt to disguise welfare for the rich since welfare for the poor should simply be given to them.. The concept of “creditworthiness” is entirely bogus wrt the monetary sovereign. It should simply spend or give away it’s fiat and tax some of it back; lending or borrowing it is disguised welfare.

Government spending is debt free fiat, which MMTers are in favor of. If you want a world without banks, you may need a really big mattress.

Full reserve banking should be reconsidered, imo. The criticisms of the past should be reexamined in light of the corrupt and broken financial system we are stuck with today. Postal banks could provide free checking accounts for citizens who value safety above returns. Banks would still have a place for those willing to risk their deposits.

Full reserve requirements will not limit banks’ ability to create debt. It would under a fixed rate system but we have a floating-rate in which there is no such thing as reserve scarcity. It would be possible to do what you suggest with higher capital requirements, but the reserves path is a dead end.

I don’t buy that a 100% reserve requirement would not limit the banks’ ability to create credit IF:

1) The central bank’s ability to create fiat was eliminated.

2) Government deposit insurance was eliminated and a Postal Savings Service that makes no loans assumes the role of risk-free storage of and transactions with, fiat.

Then, except for deficit spending by the monetary sovereign, the supply of fiat would be fixed and credit creation would be risky, as it should be.