By Katharina Knoll, Doctoral Candidate in Economics/Economic History, Free University of Berlin, Moritz Schularick, Professor of Economics, University of Bonn and CEPR Research Fellow, and Thomas Steger, Professor of Economics, Leipzig University. Originally published at VoxEU.

For economists there is no price like home – at least not since the global financial crisis. Fluctuations in house prices, their impact on the balance sheets of consumers and banks, as well as the deleveraging pressures triggered by house price busts have been a major focus of macroeconomic research in recent years (Mian and Sufi 2014, Jordà et al. 2014, Shiller 2009). Houses are typically the largest component of household wealth and the key collateral for bank lending, and they play a central role in long-run trends in wealth-to-income ratios and the size of the financial sector (Piketty and Zucman 2014). Yet despite their importance for the macroeconomy, surprisingly little is known about long-run house price trends.

In our new paper (Knoll et al. 2014) we turn to economic history to fill this void. Based on extensive historical research, we present new historical house price indices for 14 advanced economies since 1870. Houses are heterogeneous assets, and great care is needed when combining data from a variety of sources in order to construct plausible long-run indices that account for quality improvements, shifts in the composition of the type of houses, and their location.

For the construction of the long-run database, we were able to build in part on the existing work of economic and financial historians such as Eichholtz (1994) for the Netherlands or Eitrheim and Erlandsen (2004) for Norway. In other cases we collected new information from regional and national statistical offices, central banks, tax authorities such as the UK Land Registry, and national real estate associations such as the Canadian Real Estate Association. We are indebted to many colleagues for their help and guidance in sorting through the historical sources.

Hockey Stick Pattern of House Prices Since 1870

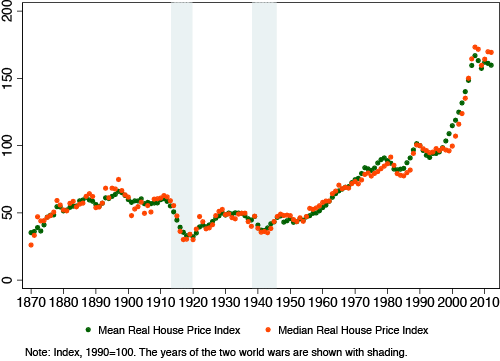

The (unweighted) mean and median of the 14 house price indices are shown in Figure 1. Adjusted by the consumer price index, house prices in the early 21st century are well above their late 19th-century level, and increased in all advanced economies in the long run. Yet their trajectory is distinctive. Using the new dataset, we are able to show that they follow a hockey-stick pattern – real house prices remained broadly stable from the late 19th century to the mid-20th century, and increased strongly in the following decades. Real house prices have approximately tripled since 1900, with virtually all of the increase occurring in the second half of the 20th century, as Figure 1 shows.

We also find considerable cross-country heterogeneity in long-run house price trends. While Australia has seen the strongest, Germany has seen the weakest increase in real house prices. Moreover, in the paper we also demonstrate that urban and rural house prices as well as farmland prices display similar long-run trends.

Figure 1. Mean and median real house prices, 1870–2012

Note: CPI-deflated nominal house prices for 14 economies.

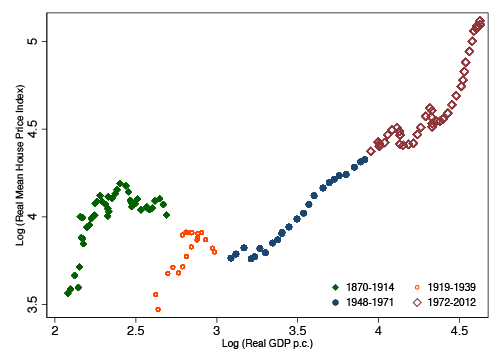

House Prices and Incomes

The trajectory of long-run house prices is all the more surprising since income growth was relatively stable in the long run, leading to pronounced fluctuations in the house price to income ratio. Figure 2 displays the relation between house prices and GDP per capita over the past 140 years. House prices declined until the mid-20th century relative to incomes. After World War II, the elasticity of house prices with respect to income growth was close to or even greater than 1. Finally, in the past two decades preceding the 2008 global financial crisis, real house price growth outpaced income growth by a substantial margin, as Figure 2 illustrates.

Figure 2. Mean real house prices and income per capita, 1870–2012

Booming Land Prices

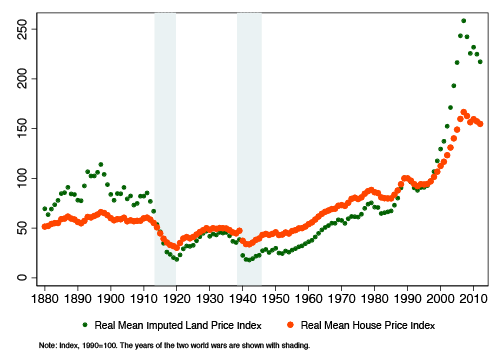

Houses are bundles of the structure and the underlying land. In the paper, we study the driving forces of the hockey-stick pattern of house prices. Using an accounting decomposition of house price dynamics into replacement costs of the structure and land prices, we demonstrate that rising land prices hold the key to understanding the upward trend in global house prices.

While construction costs have flat-lined in the past four decades, sharp increases in residential land prices have driven up international house prices. Our decomposition suggests that up to 80% of the increase in house prices between 1950 and 2012 can be attributed to land price appreciation alone.

Figure 3. Construction costs and house prices

Note: Average construction costs and house prices for 14 economies.

The pronounced increase in residential land prices in recent decades contrasts with the earlier period. During the first half of the 20th century, residential land prices remained constant in advanced economies despite substantial population and income growth. We are not the first to note the upward trend in land prices in the second half of the 20th century (Glaeser and Ward 2009, Case 2007, Davis and Heathcote 2007, Gyourko et al. 2006). But to our knowledge, it has not been shown that this is a broad-based, cross-country phenomenon that marks a break with the previous era.

Figure 4. Land prices and house prices

Note: Land prices derived from an accounting decomposition of house price trends into replacement value of the structure and land values.

Why Didn’t Land Prices Increase Pefore?

What explains the fact that residential land prices remained stable until the mid-20th century and increased strongly thereafter? Our explanation focuses on the different dynamics in land supply in these two periods. From the 19th to the early 20th century, the transport revolution – mostly the construction of the railway network, but also the introduction of steam shipping – led to a massive and well-documented drop in transport costs (Jacks and Pendakur 2010). An important side effect of the transport revolution was to substantially augment the supply of economically usable land.

In the paper, we develop a model with land heterogeneity to demonstrate how a sustained decline in transport costs endogenously triggers an expansion of land, such that the land price may remain low despite continuous growth of income and population. We also show that this land-augmenting decline in transport costs subsides in the second half of the 20th century, so that land increasingly became a fixed factor.

At the same time, zoning regulations and other restrictions on land use also inhibited the utilisation of additional land in recent decades (Glaeser et al. 2005, Glaeser and Gyourko 2003), while rising expenditure shares for housing services added further to rising demand for land. Yet our stylised facts are also compatible with other explanations that help explain surging land prices in the past few decades, such as growing subsidies for home ownership or easy borrowing conditions (Mian and Sufi 2014, Jordà et al. 2014).

Ricardo Might Have Been Right

Our results have potentially important implications for the much-debated long-run trends in the distributions of income and wealth (Piketty and Zucman 2014).1 We offer a lens for reinterpreting Ricardo’s famous principle of scarcity. Ricardo (1817) argued that in the long run, economic growth disproportionally profits landlords as the owners of the fixed factor. Since land is highly unequally distributed across the population, market economies produce ever-rising levels of inequality.

Writing in the 19th century, Ricardo was mainly concerned with the price of agricultural land, and reasoned that as population growth pushes up the price of corn, the land rent and the land price would continuously increase. In the 21st century, we may be more concerned with the price of housing services and residential land, but the mechanism is similar. The decline in transport costs kept the price of residential land constant until the mid-20th century. The price surge in the past half-century could be an indication that Ricardo might have been right after all.

References

Eichholtz, P M (1994), “A Long-Run House Price Index: The Herengracht Index, 1628– 1973”, Real Estate Economics 25(2): 175–192.

Eitrheim, Ø and S K Erlandsen (2004), “House Price Indices for Norway, 1819–2003”, in Ø Eitrheim, J T Klovland, and J F Ovigstad (eds.), Historical Monetary Statistics for Norway 1819–2003, Oslo: Norges Bank, Norges Bank Occasional Paper 35.

Glaeser, E L, J Gyourko, and R Saks (2005), “Why Have Housing Prices Gone Up?”, American Economic Review 95(2): 329–333.

Glaeser, E L and J Gyourko (2003), “The Impact of Building Restrictions on Housing Affordability”, Federal Reserve Bank of New York Economic Policy Review 9(2): 21–39.

Glaeser, E L and B A Ward (2009), “The Causes and Consequences of Land Use Regulation: Evidence from Greater Boston”, Journal of Urban Economics 65(3): 265–278.

Case, K E (2007), “The Value of Land in the United States”, in G K Ingram and Y-H Hong (eds.), Land Policies and their Outcomes, Cambridge: Lincoln Institute of Land Policy.

Davis, M A and J Heathcote (2007), “The Price and Quantity of Residential Land in the United States”, Journal of Monetary Economics 54(8): 2595–2620.

Gyourko, J, C Mayer, and T Sinai (2006), “Superstar Cities”, American Economic Journal 5(4): 167–199.

Jacks, D S and K Pendakur (2010), “Global Trade and the Maritime Transport Revolution”, Review of Economics and Statistics 92(4): 745–755.

Jordà, Ò, M Schularick, and A M Taylor (2014), “The Great Mortgaging: Housing Finance, Crises, and Business Cycles”, NBER Working Paper 20501.

Mian, A and A Sufi (2014), House of Debt: How They (and You) Caused the Great Recession, and How We Can Prevent It from Happening Again, Chicago: University of Chicago Press.

Piketty, T and G Zucman (2014), “Capital is Back: Wealth-Income Ratios in Rich Countries, 1700–2010”, Quarterly Journal of Economics, forthcoming.

Ricardo, D (1817), Principles of Political Economy and Taxation, London: John Murray.

Schularick, M and A M Taylor (2012), “Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870–2008”, American Economic Review 102(2): 1029–1061.

Shiller, R (2009), Irrational Exuberance, New York: Broadway Books, 2nd revised and updated ed.

Footnote

[1] We are grateful to Thomas Piketty for pointing this out.

Another explanation could be the financialization of the economy, which really took off in 1979. As Thomas Palley explains in the 2007 working paper Financialization: What it is, Why it Matters & What can be Done:

ISTM that enabling increased borrowing and indebtedness needs to play a role in any explanation of the boom in real estate prices over the last half century. I would also note that in all of the graphs above, there appears to be a noted uptick in the rate of price increases starting around 1980 (after a previous, though lesser, uptick after WWII), which would tend to support Palley’s thesis.

This is imminently more logical, Diptherio, that leveraged financialization has primarily fueled speculative land price (real estate) inflation far more than transportation costs as the post supposes. It’s really not plausible that transportation costs mirror the parabolic vertical lift-off in house prices shown on the chart in the last two decades. Sure energy has surged but not nearly double, inflation adjusted, as housing has. Plus that’s been largely offset by fuel efficiency increases and infrastructure support. I think you’ve nailed the correct catalyst(s) —free money, deregulation, and exponential leverage.

That said, apart from causation, the post is still hugely significant in graphically showing how dramatically, mathematically unsustainable the current trajectory is, considering that CPI-deflated median icomes have actually fallen during that same period. This market (housing and stocks) is seriously, fatally broken. Housing prices must fall precipituosly unless or until (fat chance) broad-based incomes rise dramatically. That tiny downtick at the end of the chart is nothing compared to the free-fall it portends. I’ve never seen such a clear picture of this crisis on a long enough time scale. It’s a stunner.

The “Fed” has really created an inevitable train wreck with its unlimited “printing” for casino insiders. As Ilargi says, “don’t buy a house.” Repeating Bush’s warning in 08, “this sucker’s goin’ down!”

Don’t forget too the millions of people who went the landlord business after the 1960’s since it’s often much easier to make money investing in real estate than working a 9-5 job. At least on the west coast it was very rare for for a house to be owned by a landlord, but when the Fed started pumping out money in the 1970’s it seemed all the rage to jump into the landlord business. Now maybe 1/2 the homes are owned by investors and speculators, all hoping to become ever richer off the backs of working people. Millions of homes that once were merely the roof over a family’s head became a great source of cash flow and favorable tax write-offs for wealthier families. Tenants don’t report their rent payments to the government either, so oftentimes the rent income goes unreported too. Another nice loophole.

Most of us are paying 40% or more of our income for rent and another 40% for (mostly) regressive taxes to fund the significant expansion of federal, state and local governments since the 1960’s. It seems there’s always another war to fight, more drugs to make illegal, another highway to build, more gangs to imprison or some sleeper terrorist cell hiding around the corner. In fact that’s changed too, with government jobs often being a much better financial deal with very generous pension plans and even lifetime health benefits compared to the private sector.

These days the west coast is in the cross hairs of landlords and speculators coming from both the eastern seaboard and Europe, as well as freshly made money from Asian landlord/speculators, all hoping to increase their fortunes by investing in west coast real estate. The airports were built by the local population. The roads too. But it’s the families from far away places with extra money that are making the big money swooping in to buy our homes so they can charge us rent, plus profit.

My feeling is that many of the people shouting “deficits don’t matter,” “government money printing doesn’t matter,” are often from the same families that own much of the rental real estate and government bonds. They don’t want the gravy train to end. Deflation might help working families by reducing their cost of living, but deflation can destroy the fortunes of the economic elites. So central banks and government printing presses need to keep working full-time to keep the “free” cash flowing to help preserve those asset values at all cost.

Monetary policy has brought the developed countries nothing but more misery and financial insecurity, when the real action is fiscal policy. Whenever the government starts reducing taxes on working people (repealing payroll, VAT and sales taxes) and replacing the tax revenue with graduated 20-60% excise taxes on rent, interest and dividend income above a certain threshold (say over $30,000), and adopting at least a 75% capital gains tax on all asset sales other than a family’s personal residence (and with no “step-up in tax basis” between family generations), then the economy will begin to turn around with increasing prosperity for the masses. Until then, expect the government, landlords and Wall Street to squeeze as much vitality as possible from working families with higher taxes and higher rents.

Most landlords report rental income. Most landlords lose money on a cash flow basis, so they are happy to report their rental income to the government and others with positive cash flow report because they’re good citizens. Saying that landlords are making their money ‘on the backs of working people’ is insulting, and delusional, as being a landlord is hard work. Our tax code makes it attractive for the spouses of high earners to spend a lot of time managing property, particularly in high tax states like California. Otherwise, I think owning rental property is a marginal proposition. Growing timber is a much better idea.

NOt necessarily. You are thinking in terms of the obsolete nuclear family. Immigrants are the future demographic. They live in large extended families, congregated in small rentals, using bathrooms and kitchens communally. (One only has to see the myriad China Towns in NYC to view this.)

In that case, a large amount of pauperized extended families can still make obscene rent by pooling resources.

We have a very nice example of the effect of zoning and transport where I live.

“Where” is Luxembourg (the country, not the province in Belgium for the avoidance of doubt) where zoning is quite restrictive and land prices have therefore increased significantly. Just across the border in Germany (or Belgium or France) houses cost about the same to build, but as land is much cheaper you either end up with a more affordable property or a larger plot of land. Since many people commute to Luxembourg to work daily, land prices in the surrounding regions have been increasing, but they have increased most in the areas which are most conveniently located in terms of transport. Now that the motorways are getting close to saturation point in rush hour, I wonder if this will continue.

@Irrational I think yes. Other things being equal, the chocked motor ways will only exacerbate the differential. You can see this most readily in the large metros of the world. It can also be seen in almost real time in some emerging market cities where the size of the cities increased dramatically and the infrastructure growth was lumpy. No sooner does a transport infrastructure get started or even announced with some certainty the prices of the areas benefiting jump hugely and retain a large part of the differential in any subsequent pull back.

This is the story of the west coast too. In the major metropolitan areas where the high-paying jobs are located (Seattle, Portland, SF, west LA and San Diego) the federal, state and local governments have been upgrading and building transit, along with bike lanes, within the urban cores. Rent costs and home prices have skyrocketed in the surrounding areas, with gentrification and the displacement of lower-income tenants quickly following. In contrast, 40 years ago the smart developers would learn where the state highways were going to be built or expanded and then buy up the raw land for their future sprawl subdivisions. But in the past 10-15 years the development dynamics have dramatically changed, with various government agencies pumping billions of dollars into transit infrastructure closer to urban cores, with housing prices and commercial rents rapidly increasing.

Another interesting trend is some of the west coast state governments are considering charging gas taxes based on the miles driven rather than gallons of gas used. (More cameras watching over us and checking license plates, yeah!) This switch is heavily discussed in CA and is being tested in Oregon. Thus, the poorer people who live far away from the urban cores, where most of the lower cost housing is available, will soon see a large increase in their commuting costs. With cheap gas and government subsidized road building the suburbs once were a more idyllic and cost-effective place to live. But soon the houses in the far away suburbs will be more akin to upgraded jail cells, where poorer people will live far from the employment and cultural centers, and where it will cost a small fortune to leave their house to drive anywhere.

The tight correlation between higher land values (and house prices) created by the government’s investment in roads, transit, schools and other infrastructure is one of the many insights by US economist Henry George, who advocated for zero taxes on labor and promoted collecting taxes solely from land values that are increased, in part, from these government investments. A strong resurgence of populist Georgist economics would solve many of the developed world’s economic problems, but these policies might hurt the top 20% of the population since it’s the economic elites who own most of the rental real estate and government debt.

How about increases in population?

I have the same question – given the fact they mention it as essential to Ricardo’s argument I find it curious they did not include it in their own analysis.

The great change from rural to urban living throughout the mid twentieth century and the effect there of on the costs of land for residential building seems to be excluded from their studies and considerations too.

Interesting piece. I think the high cost of housing has to do with the way we live which tends to be in either nuclear families or as single people. The ideal, of course, is to live on your own so you can do as you please in the privacy of your own space. This creates demand for more housing units and each individual, aside from direct housing costs, uses more resources per capita than in the past. Despite the development of the notion that we live in a limited environment with limited resources which logically demand tighter communities we are trending towards isolation.

I don’t know about other parts of the world but in the U.S. one of the drivers of high prices is the intense pressure for people to “buy” houses sometimes every few years this creates a lot of market churn and opportunities to make money for originators, banks, brokers and the whole industry that surrounds real-estate. I think that industry tends to pump up prices not just from skimming points off the value of the house but in promoting houses as worth more than they really are worth.

“Higher prices simply mean more debt overhead.

A simple example should make the problem clear. Suppose Mary Smith owns home free and clear of any debt that had cost her $ 100,000 to buy. Suppose Jane Doe later buys the same exact home, but the price has risen to $ 250,000. To buy it, Jane needs to take out a $ 100,000 mortgage. Who is in a better financial position? On paper, Jane has a $ 50,000 equity advantage ($ 150,000, as compared to Mary’s $ 100,000). But she only owns 60% of the home’s value, and must pay her bank $ 600 a month — payments that Mary does not have to make.”

-THE BUBBLE AND BEYOND by Michael Hudson

Doesn’t Mary have the equity advantage since her home is worth $250K free and clear, whereas Jane owes the bank $100K? An asset’s purchase price is often irrelevant to its “equity value,” which is one way home flippers make money by identifying undervalued home prices (sweat equity too). Many families that bought homes in 2006-2008 discovered that the purchase price can be much higher than the home’s value as they watched their home “equity” melt away.

It seems like we need further conversations about the distinction between “price” and “value”…and what inflates and what deflates…and cui bono from the conjuring of magi-maticians..

fiat money leads to circular lending and a positive feedback loop for collateral, ie, land.

the other factors are important, but they do not explain why the prices of assets in general exploded after the dollar lost the gold peg.

in the fiat money system money is basically ex nihilo, just nothing except a favor by the issuing authority, the bank which wants an infinitely rising collateral.

it is obvious that a fiat money system will disproportionately benefit the gatekeepers, ie, finance. in fact most billionaires are now financiers.

repeat after me:

inflation hurts those who cannot afford protection against it, ie, the poor and trusting.

Coming off the gold standard and easily manipulated inflation.

No matter the causes for the price of land, one thing is becoming clear, the once low cost of transportation no longer keeps urban land prices in check. Urban centers will attract more of the population because it’s going to be too expensive to travel and commute, and rural towns will fold unless they can survive on self-sufficiency. City real estate will continue to go up as a result of high demand. Cities can even grow the food they need with good inner-city land management. The UN is (today) on a campaign to reduce greenhouse gas emissions as fast as possible. The world can not take a chance on ignoring the warnings about global warming. And the biggest culprit is cheap modern transportation – all the cars spewing all that smoke all over the world. It’s probably a miracle that any of us can still breathe.

It makes sense for literate people who can telecommute or who can find something remunerative to do on the internet to live in inexpensive rural places, but nobody wants to do that. They’d prefer to live in cities, because country isn’t cool. South Carolina has so many small towns within an hour of larger cities like Columbia or Charlotte where your total real estate cost for a three bedroom two bath house would be under $500 a month.

Schools are a big factor in determining where families live, and, as Elizabeth Warren has pointed out, the failure of the public schools to provide a quality education explains a large part of the increase in real estate prices, as people change their locations to flee declining public schools. I say choose an attractive rural area and home school. Self reliance solves lots of problems.

how might these charts look if

1) values were shown in log scale?

2) size and amenities were taken into account?

3) equity rather than price was selected for valuation?

There’s also a full-scale (and I mean that) paper, downloadable at SSRN:

Or the most obvious explanations, sloshing liquidity and putting assets on steroids. Again, back to the problem being less one of applied theory and more of political and social reality and irrationality. The population is certainly growing but there is no rationale for exploding real estate prices. Particularly when there is a Hong Kong flat going for 13,500 British pounds with zero arable land and no useful minerals beneath the surface other than granite. If anything food prices should be exploding if we are to account for population, though here the data is skewed to the point of uselessness when one acknowledges that we price fossil fuels far below their true value as a source of energy (this is why food is so cheap). Remember, Ricardo developed his theories within the context of his political reality. One that was far different from the one we are experiencing today.

*13,500 BP per square foot

You guys are forgetting the easiest: massive economic growth. That drove the initial wave in the 60’s. Then financialism of the 90’s drove the last surge. Though alot of the price rise is due to wealthy upper middle class bidding up prices. Take a different mean, total price isn’t that impressive.