Yves here. Ed Walker’s post below, on how mainstream economics tries to explain how wages are set, reveals that making them look market-determined is ideology that bears no relationship to facts. But that’s precisely why economics is so attached to theory and so leery of data.

In a bit of synchonicity, Ed’s post dovetails with our piece on Polanyi’s The Great Transformation last week. By e-mail, he quoted Polanyi:

Such precisely was the arrangement under a market system. Man under the name of labor, nature under the name of land, were made available for sale; the use of labor power could universally be bought at a price called wages, and the use of land could be negotiated by a price called rent…

Ed added:

The idea of buying people under the name of wages is exactly what Samuelson means when he talks about labor as a factor of production, like coal.

By Ed Walker, who writes as masaccio at Firedoglake. You can follow him at Twitter at @MasaccioFDL, and here’s his author page at Firedoglake.

Even as more low paid workers take to the streets to demand an increase in the minimum wage, there are plenty of people ready to tell you that labor markets pay you what you are worth, so if you get $9.35 per hour for 30 random hours a week, that’s what you are worth. I hear this from lots of people who should know better, college-educated people holding well-paying jobs in the corporate world, even women who must know that on average women are paid less than men doing the same job. One reason people believe this obviously false idea must be the theory of marginal productivity of labor taught for decades in colleges and high schools.

I wrote about the theory of marginal productivity as an explanation for compensation here, based on the analysis of Thomas Piketty in Capital in the Twenty-First Century. Piketty’s focus is on the enormous compensation paid to top managers, which is so obviously unrelated to marginal productivity as to make that theory laughable, and my post looks at payments to the top dogs at PIMCO as an example of the giggles.

Turning to compensation for the rest of us, here’s a short refresher. I have a copy of the 2005 edition of Economics by Paul Samuelson and William Nordhaus, partly because I’m too cheap to spring for the most recent edition, $255 at Amazon, and partly because I imagine a lot of people studied introductory economics from this textbook or an even older version. Chapter 12, titled How Markets Determine Incomes, is based on the theory of marginal productivity. The authors assert that labor is a factor of production, just like land and machines and plant and electricity. Wages are determined by the marginal product of labor, just like those other factors of production.

The authors define two types of demand, direct demand, which is the demand for finished products and services by direct consumers, and derived demand, which is the demand for products and services to be used in the production of other goods and services. Thus, the rental price for farmland to grow corn is derived from the consumer demand for corn.

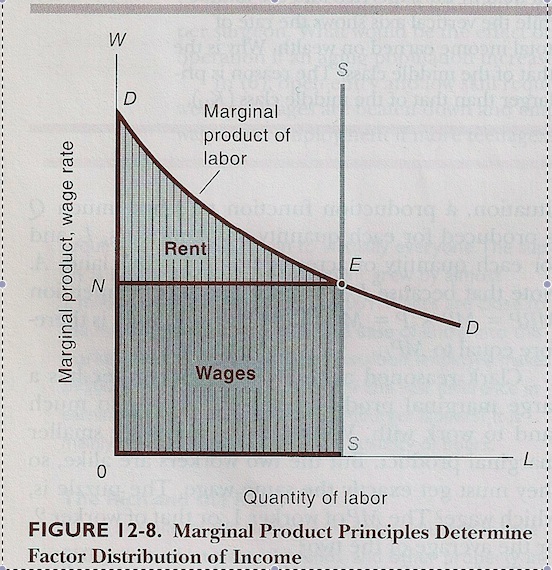

Then they define Marginal Revenue Product as the additional revenue produced by a unit of input of something (labor, steel, electricity, cash loans) while all other things are held constant. It is equal to the marginal revenue the firm gets from the sale of the additional output, if any, created by the additional unit. Hands are waved, and the authors tell us that the firm should add inputs of all kinds to the point that the marginal revenue product of the input is less than or equal to the cost of the input. Here’s a chart, Samuelson/Nordhaus at 238.

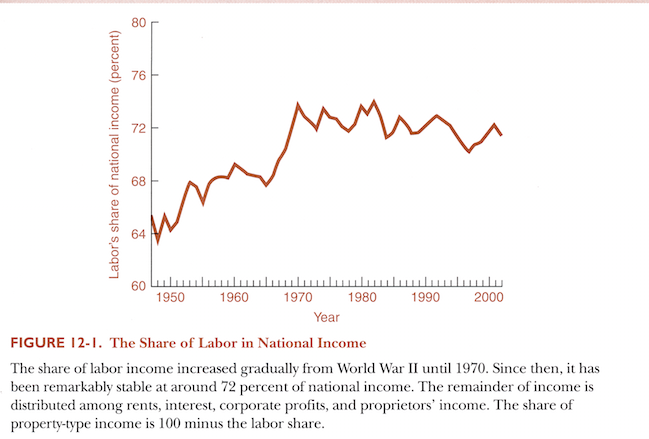

The authors explain that the rent triangle is equal to about 1/4 of wages, which “… reflects the fact that labor earnings constitute about three-quarters of national income.” Nice and simple. So then we calculate the supply and demand for the entire economy by adding up all the supply and demand curves of every firm. Then we have equilibrium at the point where the supply equals the demand. From here, it’s a short step to determining the distribution of money to wages. Samuelson and Nordhaus give us the model of John Bates Clark from 1900.

Clark reasoned as follows: A first worker has a large marginal product because there is so much land to work with. Worker 2 has a slightly smaller marginal product. But the two workers are alike, so they must get exactly the same wage. The puzzle is, which wage? The MP (marginal production) of worker 1, or that of worker 2, or the average of the two?

Under perfect competition, the answer is clear: Landlords will not hire a worker if the market wage exceeds that worker’s marginal product. So competition will ensure that all the workers receive a wage rate equal to the marginal product of the lat worker.

But now there is a surplus of total output over the wage bill because earlier workers have higher MPs than the last worker. What happens to the excess MPs…? The rest stays with the landlords as their residual earnings, which we will later call rent. Why…? The reason is that each landlord is a participant in the competitive market for land and rents the land for its best price. 237-8, emphasis in original.

John Bates Clark was one of the important neoclassical economists. This is from a recent paper.

Clark is best known for his marginal productivity theory of distribution, which famously says that “the distribution of the income of society is controlled by a natural law, and that this law, if it worked without friction, would give to every agent of production the amount of wealth which that agent creates”. Labor’s wage, which Clark interchangeably calls “standard,” “normal,” “natural,” and “competitive,” is thus determined by the value of its marginal product (what Clark ordinarily terms “specific product”). Fn and refs. omitted.

Samuelson and Nordhaus are teaching neoclassical economics based on Natural Law thinking a century old. Here’s how they explain themselves:

In reality, competitive markets do not guarantee that income and consumption will go to the neediest or the most deserving. Laissez-faire competition might lead to great inequality, to malnourished children who grow up to raise more malnourished children, and to the perpetuation of inequality of incomes and wealth for generations…. In a market economy, the distribution of income and consumption reflects not only hard work, ingenuity and cunning, but also factors such as race, gender, location, health, and luck. 239.

Here’s a version from Gregory Mankiw from 2006, offering some detail on what might be taught in an advanced economics class. He claims the model works well. He concedes that the data available on declining wage share is “not well understood”, but we shouldn’t be concerned, he claims.

Piketty says we should look at data, so let’s. Samuelson/Nordhaus offer this chart; take a look at the caption:

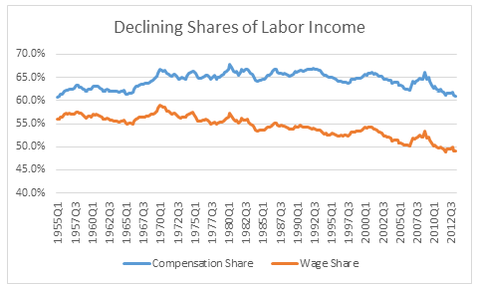

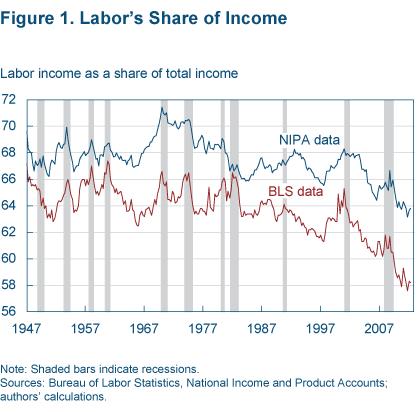

Here’s another version of that data in chart form, this one covering the period ending 2010, prepared by the Cleveland Fed.

Here’s how that paper describes the data:

These three data sources measure slightly different labor share concepts, which is why their estimated levels are different. But they agree in indicating a significant drop of 3 to 8 percentage points in labor’s share of income since the early 1980s, with the trend accelerating during the 2000s.

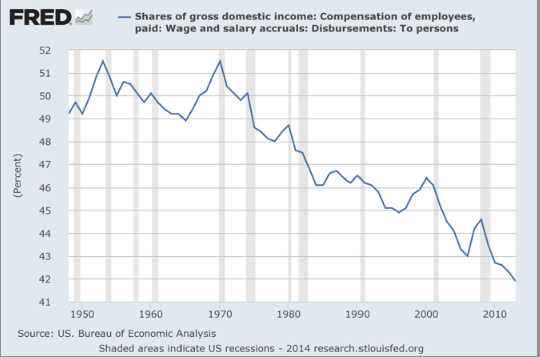

As best I can tell, the NIPA data, in blue in the second chart, is fairly close to Samuelson’s data. Many people today look at a third chart, the one from FRED:

The technical description of this chart is here. It differs from Samuelson’s chart in that the denominator is gross domestic income instead of national income. There may be other differences because the source of the Samuelson/Nordhaus data is the detailed NIPA tables, and what you get depends on which elements you decide to count. For yet another take, here’s Jared Bernstein, whose views are worth a read.

By all these accounts, labor’s share of gross income is falling.

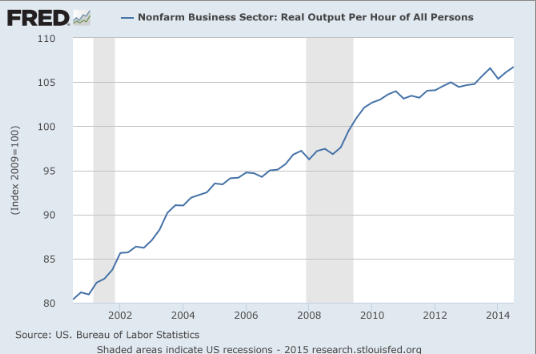

At the same time, productivity is increasing. Here’s a productivity chart from FRED.

For the marginal productivity theory to make sense, you have to assume that labor compared to other factors of production is less productive than it was before. It’s hard to see how this could be true in an economy dominated by the service sector, as in the US. So, not surprisingly, the data doesn’t support marginal productivity as an explanation of income distribution. To see why, here’s a relatively short but detailed criticism of this armchair theory through reality checking.

As the same writer points out, the theory is quietly being removed from most textbooks because it’s useless, except to dead-enders like Mankiw, who continues to teach it from his perch at Harvard. So if most economists think so little of it, why does it survive?

Maybe it’s because the distribution it describes is supposed to arise from the operation of Natural Law. As such, it fits neatly with Invisible Hand mumbo-jumbo. Natural Law isn’t a testable or usable theory. Instead, it is a normative theory. It tells you what the writer thinks is the moral and righteous position. People who tell you marginal productivity theory is true want you to think that current distribution of income is natural and just, and that any other distribution would be unjust, unfair to someone.

That’s what that Natural Law stuff means: the income you get from the labor market is what it Should Be, and if you get more, you’re taking it away from someone. Maybe that someone is another worker, but more likely, you’re stealing from the owners of the things used in production: the return to which the capital owner and the land owner are entitled by virtue of the Natural Law. Samuelson and Nordhaus teach their students that the economy as currently constructed is natural and fair.

Add to that a desire to believe that the economic system is fair, and a constant media and political drumbeat about the wonders of capitalism, and you have the perfect setting for uncritical belief in a false and stupid idea. You are worth more than the “market” says.

Wages are set by public policy.

I’d say it’s not the public that is confused by this. It’s the academics that seem to mix that up. This is why there is so much secrecy around compensation practices – no less so in ‘public’ institutions than private ones.

One of the primary justifications of the looting amongst the intellectual class is that they are ‘worth’ their outsized privileges.

When of course most of the rabble laughs at such nonsense.

Indeed.

I like the ‘normative theory’ observation, which rings true to me. The ‘natural law’ importation to me seems risible; it deifies the very human (hence partially corrupt) actions and self-interest of individuals, and patently contradicts another precept of ‘natural law’, namely, that all humans are created equal.

It’s pretty obvious which precept of ‘natural law’ our oligarchs and their toadies accept, and which they reject.

Yeah, well said. I think that’s why upper income intellectuals get tied up in knots once you start challenging them.

They are trying to project an impression that they share broadly popular ideals like equality and meritocracy and fairness and justice while simultaneously acting like they are smarter and more valuable than the rest of society. Hence, one set of wages and working conditions for themselves, another for the commoners. Which is nothing new or special of course; PhDs and JDs and MDs and security clearances and so forth have simply become the titles of our era.

But it does create some interesting popcorn reading as neoclassical economists and MMT economists debate the finer points of exactly how much the working conditions should differ between academic economists and school cooks.

Volunteered for that paycut yet? If, afterall, incomes should be equivalent, it’s the only civic-minded choice you can make.

The precedents set by previous arms negotiations suggest one should not unilaterally ‘disarm’ one’s monetary weapons, but call for a comprehensive treaty implemented simultaneously.

Thus, one can call for ‘a job for everyone,’ as an advocate for the unemployed, while keeping one’s job.

There is no need to go all bodhisattva.

Thus, one can call for ‘a job for everyone,’ as an advocate for the unemployed, while keeping one’s job.

Giving up my work wouldn’t decrease unemployment. Giving up your excess income (which you appead to define as whatever L. Randall Wray earns beyond the federal minimum wage) will decrease inequality once you commit to transferring it to the poorest Americans.

Without your vision and example we shall surely fail: lead us on!

I enjoy being somewhat sarcastic with you Ben (the exchanges are why we love NC, right?) but I don’t quite follow this quip?

MMT, not me, advocates that some public workers should be treated differently than others. I say all publicly supported workers, from law to medicine to education to media to banking, should enjoy similar wages and working conditions. It really makes no meaningful difference whether you are a professor or a police chief or a cook or a custodian.

Or are you saying that economists are ‘worth’ more than cooks? Because that would be funny.

Wait, so you want the federal government to seize control of a state university and force the state to pay all employees the same wage? Look out Karl Marx!

Um, what? State universities are, ahem, run by the state.

Your strawman position isn’t capitalism vs. communism. It’s a federalism issue (ie, the exploration of the role of the national government relative to state and local governments).

And I notice you didn’t answer the question. Do you think economists are worth more than cooks?

the real money is in cooking the books

MMT is not a bit of esoterica kit, tho some are trying pretty hard to treat it like it is… that says more… than – what or what not – MMT observes… by those that insist it be so.

I’ll have a crack at the economist quire. If the economist[s seek reality rather than proscribe it, then there as good if not better than a cook. Both can kill you if their sloppy in their pursuits imo.

Skippy…. anywho… seems the mob that went semaphore crazy with the freedom meme needs more cortex lubricant, reality is asserting its self, don’t want the messaging to slip or people might just start thinking for themselves.

Ah, so you want a total federal takeover of all state and local functions! Stalin and Marx in one!

Please, I’m much more subversive than that. I want to shrink the federal role in higher education, not expand it. End predatory loans to teenagers. End the special protection of student loan debt in bankruptcy. End tax deductibility of contributions by the wealthy. End the various fascist research grants. End the nonprofit status of the major basketball and football programs.

Our universities in particular engage in three completely unrelated activities: teaching/training, research/networking, and sports/entrepreneurship. All the federal govt has to do is say it will only fund research projects at institutions whose sole purpose is conducting research.

Stalin + Marx × Mao.

Washunate: If this is about the JG and the supposedly princely remuneration of academics -nowadays most are adjuncts, with bad pay and conditions – and for which the existence of a JG would be a boon! But sure, public policy, taxation, spending, lending, banking regulation etc largely determines the gross economic structure of the rest of the society, including wages. I disagree, though, I don’t think the general public is that aware of this. Although there are always going to be differences based on training & individual differences. “Mainstream” economists, because they are mainly public relations flacks for plutocrats, may be overpaid relative to “heterodoxy”. If pay became determined by a market of people who want to acquire true knowledge, the situation could reverse.

But a JG is a proposal to pay a decent living wage to everyone who wants a job. This may not necessarily be perfectly egalitarian from some viewpoint. But I do not see any intelligible point of view by which it is not much more fair and egalitarian than a wage of nothing, no job for the jobseeker. Which from many past discussions, seems to be your proposal.

It was actually more of a swipe at net deficit spending than full employment, really. We have net deficit spent over $17 trillion over the past three to four decades, with the vast majority of it going to the New Aristocracy of connected insiders. It’s the government that has set wage rates, proclaiming that some workers are ‘worth’ more than others, which is the heart of this post and what interested me. I don’t think that’s due to academic economists or public misconception. It has happened because this is what public policy (ie, power) has been doing with our currency units. And what I find interesting in academia is that essentially no one from the far right to the MMT left opposes wasteful government spending. It’s the ultimate intellectual taboo.

But I’m happy to go more into the JG side of things.

If we’re talking about ideals, why settle for making things more fair? Why not simply advocate that they be fair, period? Compromise is what happens after you start from your ideal position. MMT essentially desires that some public employees be tenured and others be adjuncts. That’s the philosophical basis of the full employment buffer stock. JG employees shouldn’t displace regular public employees. After all, somebody has to be the price anchor.

I would counter that if you have A experience and B seniority and C whatever other variable you think is important, and you work X hours, you ought to get paid Y wages, whether you are a dean or a daycare worker, a hospital executive or a home healthcare aide, a college professor or a school cook.

As far as unemployment specifically, my personal answer is simple, and has two parts. It’s not to do nothing. And it’s not to offer make-work projects that wouldn’t otherwise be done at wages lower than what other public workers are making. Rather, for part 1, you introduce competition. Make employers have to pursue workers rather than workers pursing employers. We already have the framework in place. It’s called the Social Security Act. Just tweak it to turn our existing patchwork system of unemployment and health insurance into single, simple, universal, national systems for unemployment insurance and health insurance. And of course that wouldn’t just help unemployment. It would solve much of the inter-generational dependency, social stigma, and general horrific nature of what our various ‘welfare’ programs have become today.

For part 2, you address the public policies that destroy wealth in our country, from minor annoyances like I-9 forms to major sources of oppression like the drug war. It’s absolutely insane that police chiefs and prosecutors and judges are on the front lines of enforcing the two-tiered justice system and yet make far more money than the vast majority of workers. Plus, if you look at the actual, non-theoretical barriers that plague the chronically unemployed, it really has little to do with the labor market. Rather, they are dealing with a myriad of overlapping issues related to health, criminal justice, racism, environmental damage, gender and sexual discrimination, basic literacy (nothing to do with higher ed, I’m talking basic reading, math, and computer skills, both for native English speakers who were unserved by the education system and immigrants for whom English is a foreign language), and so forth.

There is certainly a lot of work to be done rebuilding the public commons, but that has nothing to do with full employment. Employment is the means to the end, not the end in and of itself.

***

If we’re talking practical implementation, things get tricky fast. For starters, the issue in the US is not what to do when in power. I would wager if you were President and I was Speaker of the House we would have rather constructive dialogue. The difficulty is how to get anyone in power who actually represents the public interest. Yves runs one of the most influential financial blogs ever, and yet here we are, a decade and a half after LTCM was bailed out – with the benefit of hindset of the S&L mess from the 1980s – and basically not a single major financial fraudster has been jailed. Not one. MMT simply offers no guidance on this front; if anything, MMT seems slow on the uptake to even acknowledge that fraud, not good intentions, describes our present system. The public knows it’s getting screwed. What we are still figuring out is how to arrest the fraudsters and throw the bums out. So far, the professional class seems unwilling to turn on the psychopaths above them.

Having said that, on a JG, no one can even agree on what the wage should be. That’s kinda like a central component of making a job offer. And the reason this matters is because the jump from unemployment to low wage employment is very small. To offer any kind of reasonable wage, you start attracting huge numbers of not just the unemployed, but the employed! The biggest practical impact of JG is on the existing workforce. So why not just regulate the workforce directly to address any unwanted situations? Offering public education isn’t what stops child labor. Prohibiting child labor is what stops child labor.

Secondly, no one can agree on what work needs to be done. That’s kinda the other central component of making a job offer. To return to the adjunct/tenure industry, the BLS OES tracks 1.5 million (!) postsecondary teachers who make mean annual wages of $74,600. We have way too many employees in our nation’s bloated system of higher education. We don’t need more academic consumption in this country. Quite the opposite, we spend way too much on it. Econ profs have a mean of $100,500. Health specialities $105,900. Law profs $122,300. And then of course there are the administrators, where the even bigger waste has exploded.

What’s more remarkable is that lower down the totem pole of higher ed, even graduate assistants, with a mere $31,800 mean, are competitive with many of the ‘lower’ levels of education. Preschool teachers are at $31,400. Substitute teachers $29,400. Teacher assistants $25,600. In other sectors, Pharmacy techs make $30,800. Vet techs make $31,800. Home health aides $22,100. Medical assistants $30,800. Security guards $27,600. Cooks $22,400. Houskeeping $22,100.

On and on, tens of millions of workers make far less than what the highly compensated employees make in publicly supported industries like education, healthcare, law, and finance. Offering $18K a year is simply exchanging one form of oppression for another. From a short-term perspective, offering $20K may seem better than nothing, and $25K better than $20K, and $30K better still.

But the point is, no matter how high you go – even $35K or $40K – there is still a technocratic class of rulers making more money working the same hours (or even working fewer hours – look at that sweet gig Michelle Obama had with the University of Chicago’s medical system a few years ago).

Then there is the logistical problem of truly offering a decent wage. Everyone would sign up. If you really offered $60K a year doing meaningful work with good working conditions and holidays and vacations and all the bells and whistles, you would have 100 million applicants. Maybe more. Because the actual working world sucks in this country. Not just for people out of work. For huge numbers of people who have jobs, too.

And so because of that reality, MMT seems to want to have it both ways. Claim on the one hand that JG will be a hugely successful program helping alleviate the oppression and injustice of poverty. But then on the other hand, claiming it won’t be inflationary or upset the existing order or cause anyone presently in the top 20% of the wealth pyramid any unpleasantness.

Because heaven forbid we simply tax currency units away from those with plenty and give currency units to those in need, no strings attached.

http://www.bls.gov/news.release/ocwage.htm

Wow, that was a great and radical (in the best sense) read.

agreed. I’ve been unsure exactly where the poster washunate really lived, in his/her views. but if they believe even half of what they wrote (heck, even if they don’t believe it, it was a whopping good critique!), they have won my eternal respect.

Thanks both of you, I appreciate it. She’s more modest than this, but it’s really a testament to Yves and what she’s created here, allowing extended exchange over time to take place in a public fashion where we can chip in when the mood strikes.

No dear. Firstly you cannot refer to the sum total of deficits as a net deficit, this is improper terminology and what you mean is the public debt. Secondly the public debt is the sum of deficits over centuries, not the last forty years.

If you can’t get the most basic facts right then what good is the remaining wall of text?

Maybe

Please demonstrate who, other than yourself, is making this claim

Currencies removed by taxation are destroyed and cannot be spent.

And there we have your lack of morals in a nutshell: if paying a working woman more might indirectly benefit someone you don’t like, it’s better to let them suffer.

Hey Calgacus, just letting you know I was here. I’ll try to remember to find this post again in a couple months to see if you’ve offered any thoughts.

Happened to be looking when you just commented.

Washunate:If we’re talking about ideals, why settle for making things more fair? Why not simply advocate that they be fair, period? Compromise is what happens after you start from your ideal position. MMT essentially desires that some public employees be tenured and others be adjuncts. That’s the philosophical basis of the full employment buffer stock. JG employees shouldn’t displace regular public employees. After all, somebody has to be the price anchor.

There is as usual, a lot to dispute in your comment. But this is the core. This is NOT what the JG is. NOT what the philosophical basis of the JG is. MMT/ JG says everybody has tenure. It abolishes adjuncts forever. The JG is not a second-best idea that people settle for, but a human right. As I have said before, a money-using society without a JG is insane. One cannot say that of BIGs, Social Security, welfare, health care whatever – these are not as important rights as a JG, which is more comparable to the abolition of slavery. If you look at the world rightly, you see that people follow the logic of the JG everywhere, except national monetary economies, because people have a fantastically wrong abstract theory of money in their head.

JG employees not displacing whatever is not essential to the JG – in fact part of the purpose of the JG is to displace low-paid employment. I have been telling MMTers for a long time that they are giving too many details in their JG proposals, not too few. What everyone misunderstands is the core, because it is so simple it repels the mind.

All the JG says is that everyone has a right to a job at a living wage. PERIOD. The existence of public employees who make more than the JG wage is optional, and has nothing to do with the inflation-fighting characteristics, the buffer stock of the JG, the price anchor. That is a major misunderstanding , a major error.

What we have now is a tenured/adjunct economy. What MMT proposes is tenured, period. The JG = give all the adjuncts tenure. We could have Deans (who get paid more) & tenured, or not. Not for you or me to decide.

Finally, the “logistical problem” is imaginary – and also comes from the fantastically wrong theory of money. If the government decided to have a uniform wage of say $30 / hour for all employees, offered to every USAn, then (a) the USA could probably do this, albeit with some effort, without inflation – 30 may be near the high end & (b) everybody would not sign up. I have been saying for a while that you are jumping to an invalid conclusion with this.

More divide and rule (intellectuals vs working stiffs). I prefer to put my dividing line between those who have to earn an income with their labour (be it shoveling with a spade or writing papers for journals) and those who don’t. We are all trapped in this neoliberal cul de sac. At least some intellectuals are seeking a way out. Just hating for hatings sake is no solution.

you get what you negotiate and your negotiation strength improves when you are willing

to be a little hungry today to get a more secure tomorrow.

But…most are distracted by the carnival and some infused notion that you only get

one shot at the brass ring. How wrong that mindset is…As the great gretzky used to say, you miss all the shots

you never take…

no one cares or remembers the misses…so go for it…

Always be trying. The harder you work, the luckier you get…and remember there is no there there…there is only the here and now…

wages are paid from fear of losing market share. the wage provider wages they can convert and arbitrage the time needed to create the product and sell it with the capacity to insure you have an incentive to stay long enough to get the job done…there are very few who “care” about the community, unless you define the community as their left back pocket where they keep their wallet…

those who have a familial support system are in better shape than those who run off to the circus. Society suggests you should be “independent”…that you are a loser if you “live at home”…instead of saying it is smart for a family unit to regroup and share expenses, to build economic strength together…

you are soooo correct…there is not now and has never been anything that even comes close to a “free market” rate”…most enterprises raise money and do not function from internally generated capital flows…thus the “financing source” can play a major part in helping determine wages…

could krapitalism be better…that would require some type of psychological testing of business owners…one too many of them are more motivated by giving crassness a run for its money then on creating something of long term value…for one too many…being “the boss” is the motivator…which leads to massive inefficiencies from disruptive hegemonistic nonsense which creates natural resistance from those who could be creating real value for the enterprise…

But it’s not clear that “one shot” is always wrong. Suppose one is unemployed and one gets a job offer, and is debating whether to take it, as it isn’t really what one wants. Now a person may pay a very real price for taking it, but it may also be the case that they will not get a better job offer (depending on a lot of other factors having to do with personal “marketability”, the economic conditions, and also just pure luck). As there are clearly people in this society that do end up long term unemployed, not taking it may be an good option for some but not all people.

“those who have a familial support system are in better shape than those who run off to the circus. Society suggests you should be “independent”…that you are a loser if you “live at home”…instead of saying it is smart for a family unit to regroup and share expenses, to build economic strength together…”

This is seldom just an individual choice even regardless of whether “society says” this or that or the other thing. It’s a question of existing family norms as well as overall social norms.

Thanks for this. It’s good to see the dismantling of orthodox dogma handled so deftly–well done.

It’s embarrassing that modern economics is still so mired in out-dated ways of thinking. It is also embarrassing, and telling, that economics, despite claims to being a science, begins not with observation, but with theory. Anyone who has taken a course in a hard science knows that the first thing they teach you is how to observe. Look through the microscope, draw what you see. Examine the specimen, note it’s characteristics. Et cetera.

Economics, by contrast, starts with modeling. Whereas a biology instructor will begin by telling her students to observe, the economist begins by telling his students to assume. That such a methodology is referred to as a science by it’s practitioners would be hilarious, if the results of this methodolog’s appilcation in the real world weren’t so gawd offal/awful. What’s especially silly is that, when pressed, some economists will actually claim that part of economic’s claim to scientific status rests, in part, on the “fact” that it is based upon natural laws. There is the law of supply and demand, just like the law of gravity. Since there are natural laws in physics, which is a science, and economics has “natural laws” as well, then economics must also be a science. By the same logic, of course, all black birds are crows.

Economics begins by assuming at the beginning that which they should be proving at the end. If economics were a science they would, like any other science, start by observing the world, coming up with a question, forming a hypothesis and then trying to falsify the hypothesis through experimentation. When any real scientist talks about “laws,” they are referring to concepts that have been through this process.

Economists, however, formulate their economic laws by thinking about things while sitting in their offices (or eating dinner, or evacuating their bowels) and assuming that whatever seems logical to them must be the way things work. They assume their laws at the beginning of the process and then create models that describe the world on the basis of these assumed laws. When data from the real world conflict with the prognostications of the assumption-based models (i.e. when their hypotheses are refuted by reality), the response is to claim that some sort of political interference has hindered the operation of the natural law, or that the data are incomplete or not fully understood and that if we had all the relevant data and understood it correctly, that the natural law would indeed be seen to be at work. Hence, the practice of economics becomes largely about trying to figure out ways to explain data in terms of the “laws of economics,” despite the data seeming to largely contradict the assumed laws. On the whole, a rather different methodology than biology or physics.

There are some humorous parallels though. A physicist will try to think of all sorts of ways to refute their hypothesis, even when the initial data seems to support their understanding. An economist, on the other hand, will try to think of all sorts of ways to prove their hypothesis, no matter how many times the data seem to refute his understanding. If economics is a science, it’s the bizarro version of one.

I’ve never been able to find out much about it, but supposedly there was some kind of conference between bigwigs in econ and physics. Maybe sponsored by one of those nonlinear studies institutes (Santa Fe?).

The takeaway was that they looked at toy problems, and the phyisicists were amazed at how the economists proceeded by setting up overly simplistic models and then working from there. Whereas the physicists tried to stay reasonably close to the data.

People like to say that economics suffers from “physics envy” (based on the idea that they want to try to make everything into optimization problems), but in fact they suffer from “mathematics envy”—as you say, they’re not a science but rather are a bunch of second-rate mathematicians who think they’re practicing science.

And that’s all putting aside the whore/shill factor.

You describe the process of Thomas Piketty and his colleagues precisely. Perhaps that is why his book is so welcome among a certain segment of the population that doesn’t include the likes of Kenneth Rogoff and Gregory Mankiw. He reminds us that we have real problems in our society, and we need to look hard at our assumptions and our data before deciding how to solve them.

Hypothesis: the percentage loss in labor share of income since 1970 is mirrored by the percentage gain in payroll taxes, as employers seek to keep wage costs constant.

Thus, while your pay packet may have shrunk, your government is correspondingly richer, and will surely look after you.

As ol’ G. H. W. Bush proclaimed, ‘Message: I care!’

I don’t know about your hypothesis Jim, but if you look at the Fed data graph of corporate profits as a % of GDP compared to wages and salaries as a % of GDP, 1970 to now, it look likes likes this: X

Mission to suppress wage inflation accomplished!!!

Mission to nurture profit inflation? Accomplished too!!!

In fact, from the bottom, it looks like profit hyperinflation.

But, hey, government printing money doesn’t lead to profit hyperinflation.

Not even close. The individual tax burden has been nearly as flat as real wages. And both divergent from corporate profits to the extreme.

Employers have not merely sought to hold the line on wages in order to offset (imaginary) parabolic taxes. Employers have systematically slashed wages expense on both real and nominal terms.

The only parabolic item in compensation is health insurance, which is of course due to rent extraction transfers to private companies in health care.

don’t overlook the impact of health insurance. Companies have historically paid some significant portion of each employee’s health insurance costs as a benefit. Thus the total cost to a company of a given employee goes well beyond just cash wages. With the health insurance rising at levels well above inflation since the 70s it’s not surprising that the cash to pay for it has to come from somewhere – namely, worker wages – in order to keep total costs of each employee in line with inflation (i.e., how much they can raise their prices).

Nearly flat, I guess, it depends on how you define nearly. To be fair to Jim H he said “payroll taxes” which doesn’t include income taxes usually. So payroll taxes seem to have been entirely flat since 1990 (except for a brief “payroll tax holiday” where they briefly went down). But payroll taxes are more than say in 1975 (and for every employee half there is also the employer half), much more than in 1960 or 1950. But I wouldn’t guess it would be enough to offset productivity gains. But yes there is health insurance and that could be huge.

I have looked at data previously where I (non-professional economists that I am) found OVERALL inflation adjusted taxes have been pretty flat for the middle class, but it’s more because payroll taxes going up some were offset by income taxes going down.

Bernstein links to a 2012 paper by Larry Mishell of the EPI, http://www.epi.org/files/2012/ib330-productivity-vs-compensation.2012-04-26-16:45:37.pdf. He characterizes it this way:

That first finding suggests that your hypothesis is wrong. The second supports the power theory of wages, which probably explains why Bill Gross got all the money at PIMCO, despite his bad results, and explains why workers are so screwed in an anti-union environment, and why computer experts got screwed by Apple and Google in that deregulatory environment so beloved of libertarians that refused to enforce antitrust violations and allowed massive H-1B visas to undercut their wages. Odd, isn’t it, how many computer guys are libertarians?

Well yea but many of those who aren’t libertarians are socialists and anarchists (far far left as in let’s abolish capitalism – which I don’t much disagree with). True political moderates would be the hardest to find.

But if they’re just working corporate, there’s something about the white collar corporate environment that produces political conservatism as a byproduct almost, or so it sometimes seems.

We have 7 billion people on earth. It’s projected to increase to 9 billion by 2050. All those people want the same standards of energy consumption as been utilized in the West. But it’s impossible because earth is a finite, closed system, and unless you utilize some other forms of energy that don’t result in earth heating up, we are all set for extinction.

We need to reduce human population to sustainable 2 billion people, and distribute resources equally, with scientific management of earths resources to be in sustainable growth rates with humans. And keep those 2 billion people away from reproduction. The jobs, the wages, – its all outdated. We have technology to make robots do the most mundane jobs, if only we had the political will.

Are you volunteering to be one of the 7 in 9 who are “surplus to needs”?

No, but iIm sure she’ll be willing to help pick out the “useless eaters”.

Thanks for this interesting and enlightening post. The idea that there is something just about the status quo seems to be quickly gaining traction among those not trained in economics as well. In my Introduction to Philosophy class we discuss distributive justice, and while there have always been differing opinions, lately I find it harder and harder to dislodge students’ ideas that the distribution we have now is a justified starting point, one from which the only question would be whether we have duties of care or charity. Even bringing up colonialism and discrimination and fraud, it doesn’t seem to sink in that the number on someone’s bank account might not reflect the result of natural, just, law-like processes.

While this topic (how wages are settled) is extremely important, by far and away the most important issue regarding economic justice is land ownership, both in urban and more rural economies.

Henry George understood more about inequality and its causes than most people alive today. Seems like Joe Stiglitz understands, FWIW.

I would have thought the belief in what Chris Hedges calls a “just world hypothesis” would have been greatest in the least educated (the Faux news stereotype I guess). But then I just may not be educated enough myself (which is true, and only 2 college economics courses) to have picked up the view via education. What a pity huh? Education can be good, but that particular education seems of dubious value.

It seems to me a very different education would NOT lead people to that view. Never even mind moral philosophy let’s just look at the IS and not the OUGHT. A more MATHEMATICAL education I don’t think would lead people to that conclusion, although this is speculation on my part. If people seriously studied say game theory would they really think the world was just or would they be more open to the view that wages are set by those with the POWER in the negotiation (usually the employer). If they broke it down mathematically would they really think the income distribution was just when there is no way the average person “saves” their way to the .1% no matter how thrifty and hardworking. If they saw what the odds really were and could analyze them and analyze correlations (likelihood of having that income if one came from a certain social strata, if one was a certain race etc.). Even distributions of talents and personality traits (let’s even say “hard work” is a personality trait) would probably be more likely to follow a bell curve distribution (sorry if even this speculation annoys) than to map to the lopsided income distribution at present.

my time in college taught me that most there, no matter how beleaguered by student loans and tuition cost rises, are some of the most privileged individuals on our planet (myself included). no matter that I attended a 2nd tier state Uni, and not Haavahd.

there is an inherent bias in all people to assume that they, in the main, have received exactly what they deserve. too much cognitive dissonance otherwise, or guilt and shame, or bitter spite (which is totally frowned upon a million times more in this ‘positive thinking’ culture than guilt/shame) would drive each one insane.

psychological self-preservation dictates. none of us wants to believe that we are worth so much more than what we have been allotted, and have received so much more than we ‘deserve’ at the same time. and yet, that conclusion is inescapable, upon a wider recognition of just how hard many people work, and for how little. even while some of us are working hard for only a little more.

The whole idea that a wage is set by marginal productivity is bizarre. Sure, there are some simple cases where one could imagine it’s true–e.g. a bunch of artisans making pieces of furniture, where each artisan makes a piece from beginning to end (no assembly line, etc).

But in almost any “firm” as we understand it, no one frankly knows WTF the production function is—it’s too nonlinear, and has too much interconnectedness between everyone’s contributions. It’s a great example of the “marginal revolution” being a damn joke (economists looking at calculus in the late (nineteenth?) century and running way too far with one of its ideas).

“Even” the janitors make a huge difference. If you get rid of them, the place is eventually going to look and smell like a sh*thouse, and work will grind to a halt.

What I love is the current efforts of economists to justify cream skimming by e.g. CEOs with such rationalizations as “We find a positive correlation between firm complexity and CEO salary.” Jesus, what a bunch of whores.

This post reminds me of a wonderful book: “Lies My Teacher Told Me: Everything Your American History Textbook Got Wrong” by sociologist James W. Loewen (1995).

For those not familiar with it, here’s a little background:

“High school students hate history. When they list their favorite subjects, history always comes in last. They consider it the most irrelevant of twenty-one school subjects; bo-o-o-oring is the adjective most often applied.

James Loewen spent two years at the Smithsonian Institute surveying twelve leading high school textbooks of American History. What he found was an embarrassing amalgam of bland optimism, blind patriotism, and misinformation pure and simple, weighing in at an average of four-and-a-half pounds and 888 pages.

In response, he has written Lies My Teacher Told Me, in part a telling critique of existing books but, more importantly, a wonderful retelling of American history as it should – and could – be taught to American students. Beginning with pre-Columbian American history and ranging over characters and events as diverse as Reconstruction, Helen Keller, the first Thanksgiving, and the My Lai massacre, Loewen supplies the conflict, suspense, unresolved drama, and connection with current-day issues so appallingly missing from textbook accounts.”

http://sundown.afro.illinois.edu/liesmyteachertoldme.php

Ed Walker’s post could be a chapter in a book we really need: “Lies My Economics Teacher Told Me” or maybe “Lies Economics Teachers Are Still Teaching.”

‘The Economic World According to a Serf’ would be a good book.

Or ‘Unemployed Like Me.’

Or ‘How to Survive Profit Hyperinflation.’

Or ‘Debunking Manorial Household Economics.’

First of all, you, each of you, are priceless.

It doesn’t matter how that priceless lifespan is divided, it’s still priceless. As the free-market blogger Mish would say, it’s just math. Impossible to be mathematically less than priceless.

And then, you check out where the rich hang out – those art auctions. You look at some lots that are even more precious than priceless ones in major museums, ones one would say are national or world heritage treasures. But thanks to the ‘market,’ you can put a price on each and buy/sell them.

Isn’t life wonderful?

EOS (put the arrow back into the quiver, please).

The takeaway is that there is no labor market. It’s a fiction.

The scary part is that more than just the labor market is fictional.

‘Natural Law’, Invisible Hand, Divine will, Karma – all seem to be a ways of laundering responsibility.

” laundering responsibility” !like it !

This is definitely good news, but how much more are we worth if you had to put a number on it?

42

If that’s in thousands, it sounds about right.

I suspect that was a reference to the works of Douglas Adams, and possibly also Lewis Carroll:

http://en.wikipedia.org/wiki/42_(number)#The_Hitchhiker.27s_Guide_to_the_Galaxy

Economies are built from the bottom up and destroyed from the top down. The empire assumes a given input, what it can see, increasing scarcity in a closed system, and seeks a particular outcome, wealth transfer through natural resource exploitation, creating income inequality, from a growing body of poverty to a shrinking population of excess.

My wife is much slower than her bosses like, because she is intercepted by people they don’t know, increasing quantity and quality, and the more they try to replace her, the more people they don’t know intercept her, until I decide to drop the load.

Uber is being fed toilet paper by the Fed, through pensions, foundations, etc., while bypassing legislation created for the purpose, and rolling over leverage with more M&A, to distribute I-phones, increasing capital control. What do you suppose happened to all those other critters who tried to bypass taxi regulation?

Those planets are revolving and the critters can’t see the HVIAC. The sun does not create energy. Those black boxes keep surprising the critters. Maglev is about to be three generations behind the curve, and not everyone was keen to let Brown & Co steal that land, for more of the same, licenses denied to residents and given to illegal immigrants.

Funny, you come back after 35 years and the critters that have since moved in to steal everything they can lay their hands on with artificial business cycles, to grow G economic activity market share, think that they have the advantage. Real wages increase with RE and associated activity deflation.

The State can give you back your licenses or blow itself up. Labor doesn’t care either way, or what monetary policy is applied next. The critters are bewildered because all they can see in that scope is the past.

What’s new?

Ok geniuses here’s the deal I will only explain this once, I, will broker no arguments, and if you don’t understand, what I am saying, may, I, suggest, you get out of the business. Interest is loss, a way to understand this, is you can create principle, but interest is never figured into the equation, but for and as a feature; it’s loss, by someone along the trail. The Federal Reserve System is, merely, a high stakes gambling casino, at the people’s expense, in more ways than one.

Money spent on suppliers, labors receipt of payment and so on, do not, equate to more than the actual principle, in circulation at the time; in, any way you figure it. So any gain is another man’s loss, no matter, how you spell it. A cycle, of, booms and busts facilitates the illusion, of a healthy system, thus providing the money to pay interest. A system of ups and downs that serves to give the impression the market is for everyone, and, everyone has the same chances.

One action puts money into circulation, booms, one collects it back along with assets, these being busts, therein serving as the conduit to pay savers, then the other winners of the game, on, Wall Street, and then the, croupiers, of this Casino, the Banks.

Which would be, a reason, that savers are being discouraged, from, being such, with, negative interest rates, because, savers aren’t part of the game, but as a casualty, a savings account is a silent accusation, of, the systems immorality. One can accrue interest on animals and seed but one cannot attain interest on sterile inorganic money.

It’s a race to the bottom with the Federal Reserve, who only accepts gold and property in specie, and those who play this rather sick game of resources, there to accept the proceeds. The reason no one can model it, and have any accuracy for any time, is all the models are built on this, misguided perception, people have, that, the system they work with, is neutral.

When, in fact, it is a predatory rents, asset/property, wealth, extraction system and is immoral. Economists fail to demand or postulate, that, a moral component, should be a part, of, any economic model and therefore, a, lack of said, will never show up on their radar, as, the reason for the current shape of things and apparent bad decisions on the Banks part. Therefore “Gresham’s Law” is unfettered in its effects.

The sooner you figure this out and design a more, fair, system the better off you will be. Doesn’t really require a fancy theory or a lot of work to understand. If you have no demand for moral behavior as a component of your models, of, expectation, then, moral behavior will not be a part of any result.

No it is not true that one man’s gain is another’s loss. The reverse is true. The more someone has, the more they can spend, boosting the revenues of those goods producers and service providers. That is why the high wages that Henry Ford was forced to pay to retain skilled workers is widely depicted as the foundation of the American middle class economy. It created a virtuous circle: higher wages meant more spending, which meant more prosperous businesses that could hire more workers, driving up wages and kicking off a new cycle.

Yves,

The high wages to retain skilled workers is a myth.

Ford paid high wages not to retain _skilled_ workers, but to retain workers. He didn’t need skilled workers, he needed stable workforce. Indeed, the work they were doing was so dull, dumb and monotonous, that it was the reason for a lot of workers to leave few weeks/months later (since the wages weren’t good enough to support a family).

No argument with the good positive feedback cycle though. That’s something that the current crop of capitalists and politicians is too dumb to see.

This works until you kick in the factor of extreme inequality. In order for there to be a money multiplier and no losses to others, all of the money has to be spent back into the economy, and interest on debt must be supplied by the government.

As soon as there are people that make get much more than they spend, it begins to break down and resemble what Mr. Butler describes. Inequality, from what I’ve been observing, basically throws wrenches in all the theories. As soon as money lodges out of reach of the majority, economic rules cease to operate. Which is logical when you think about it, tho suggesting it in some circles engenders great frothing at the lips and roaring…

Doesn’t work that way. Interest doesn’t rob from someone else, liquidity hoarding reduces the income of another. That’s why government spending in excess of its income is necessary, to replace the financial assets removed from circulation by spending less than our incomes.

Interest does rob from someone else if the government doesn’t print new money to cover it. Banks don’t issue the money to pay their own interest, obviously. This is why crashes occur when governments attempt to “balance” their budgets. They *must* spend more to cover the private sector’s credit obligations.

Ideally, the government would spend enough that no one would be induced to even take on credit. Before the disastrous Clinton surplus, consumer loans were unheard of, and few people even had credit cards. That’s a much healthier situation. It was the disappearance of government cash–cash which never has to be paid back–that caused the credit hyperinflation we’ve experienced since.

You’re right that there are strange paradoxes about interest, loans, and money creation by banks. But there were millions of credit cards prior to the Clinton administration.

Banks spend profits back into the economy, excepting that part which is hoarded or saved. They could make as many loans as they can find customers for at whatever interest rate they can charge; even with a static money supply there would be sufficient financial assets so long as 100% are spent back into circulation. Government doesn’t need to print to provide for the payment of interest but to replace those assets lost to non-government sector saving and taxation.