Yves here. Expect more of this sort of thing. As stresses within the Eurozone increase, the once unthinkable, that of a country leaving, is now increasingly regarded as plausible, particularly with France’s Marine Le Pen promising France’s departure should she win in 2017.

By David Amiel, Graduate student, Ecole normale supérieure and Paul-Adrien Hyppolite, Graduate student in Economics, Ecole normale supérieure and Ecole polytechnique. Originally published at VoxEU

As the Eurozone crisis lingers on, debates on a potential demise of the single currency have been revived. Political parties advocating or contemplating an exit have not reached the same audience in every European country, but they are everywhere on the rise. A euro exit, which was once only contemplated for ‘periphery’ countries as a consequence of high financial distress, comes to be seen as a political choice worth debating in ‘core’ countries.

However, a crucial factor is often lacking in political and academic debates – the cost of the exit per se. What would be its short-term financial consequences? Exiting a monetary union does not bring a country immediately back to where it stood before entering – disentangling 15 years of financial integration entails substantial costs (Eichengreen 2007, 2010).

The conversion into the newly introduced national currency of private marketable debt securities issued by the companies of an ‘exiting’ Member State might be one of the trickiest problems. Indeed, if a domestic company earns its revenues in the new (devalued) currency while still having to repay its debts in euros, its financial situation may dramatically deteriorate. The argument has already been raised, but most proponents of a euro exit preferred to dodge the issue (Baldwin 2012). However, it has up until now remained mostly theoretical. What could be the magnitude of such an issue? We take France as an example.

Redenomination Problems and ‘Currency Mismatch’

We hold the governing law of euro-denominated debt securities to be the most predictive index of the extent of the redenomination. Naturally, contracts in foreign currencies (e.g. US dollars or pounds sterling) would be unaffected by the whole process. Regarding euro-denominated contracts, we assume that the ones under French law would be paid in the ‘new’ French franc (i.e. would be redenominated), while the ones under foreign law would still have to be paid in euros.[1]

We used a Bloomberg terminal in order to obtain the governing law of each debt security and to build a comprehensive database covering the marketable debt of the major French financial and non-financial corporations (Amiel and Hyppolite 2015). We considered the nationality of the ultimate parent company rather than the residence of the immediate issuer to determine the country of issue.

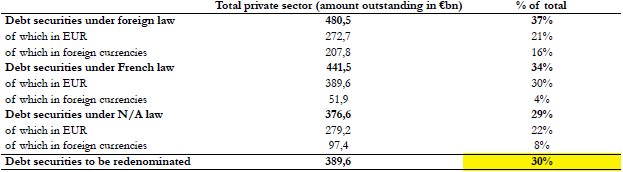

Table 1. Governing law of euro-denominated debt securities in France

Source: Bloomberg

Notes: N/A means non-available (i.e. the information is not available on Bloomberg). Debt securities to be redenominated are securities in euros under French law (worst case scenario).

What about debt securities with ‘non-available’ (N/A) governing laws? A close study revealed that most of them were issued on foreign primary markets, leading us to assume them to be under foreign law.[2] Thus, the amount of debt securities unlikely to be redenominated would be close to 70%.

Symmetrically, we looked at the share of domestic assets on the consolidated balance sheets of the selected companies. In the case where 70% or more of the assets would also not be redenominated, an exit would be financially neutral or even beneficial. The percentage of sales or revenues made in France is a good proxy for the share of domestic assets on the asset side of the consolidated balance sheets. For the whole sample, the percentage of debt to be redenominated is of 30% while the percentage of sales or revenues made in France is of 36% – at the aggregate level there is a ‘mismatch’, but of reasonable magnitude.

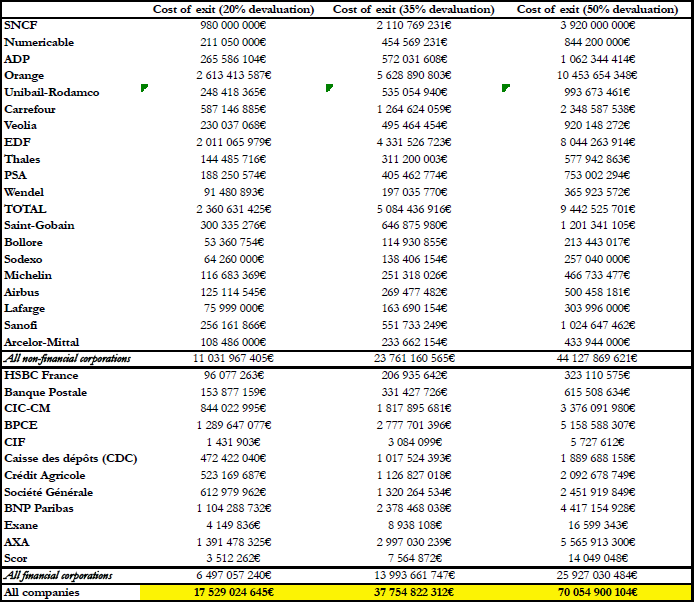

Things change when we look at firm-level balance sheets to precisely identify the main losers. Indeed, aggregate data tell us little about the risks of an exit. First, some companies – especially in the financial sector – are more strategic and systemic than others, and second, it is very dubious to bet on some forms of transfers from ‘winners’ to ‘losers’ of the euro exit. Overall, some specific cases are particularly worrying, such as some strategic non-financial corporations (SNCF, Orange, Carrefour, Unibail-Rodamco, and Numericable) and systemic banking groups (Société Générale, BPCE, and CIC-CM).

Drawing on these figures, we hold that the immediate financial cost of exiting the euro would be substantial if public authorities were to bail out the expected losses of exposed companies.[3]

Table 2. Costs of bailing out French companies in the event of euro exit

Source: Bloomberg, Boursorama, annual reports, own computations.

Is This Time Different?

At this point, it could be reasonable to cast some doubt on this argument. After all, some countries already succeeded in exiting a currency union without any financial turmoil. But in fact, historical examples support the idea that the ‘redenomination channel’ has always been crucial in explaining the successes or failures of exits from currency unions.

An often-quoted example of an orderly break-up of a currency union is the ‘Velvet Divorce’ between the Czechs and Slovaks in 1992–1993. Just as in the Eurozone, the financial systems (i.e. the banking sectors) of both countries were deeply intertwined, as a natural result of decades of political unity. Defining which debt should be paid back in which currency, after the Slovak crown had been devalued against the Czech crown, could pave the way for impossible legal challenges and many bankruptcies of unhedged Slovak debtors. The only reason why it did not happen is the existence of a massive financial support from Prague to Bratislava. Could one reasonably expect Germany to bail out an ‘exiting’ France?

On the contrary, Argentina provides us with a striking example of a country where the hazardous redenomination process in 2002 played an important role in the economic collapse. By the end of 2001, the vast majority of banks’ liabilities were written in US dollars, just as in France the bulk of private marketable debt is under foreign law or foreign currencies. When abandoning the ‘currency board’, the government chose to deal with it by converting dollar-denominated deposits in pesos at a rate of 1:1.4 and loans at a rate of 1:1. Roughly speaking, this almost amounted to a 40% devaluation of the banking sector’s assets. As detailed in our paper, this led the Argentine banks to the verge of collapse, virtually wiping out all their wealth. This impaired considerably the Argentine recovery – despite a massive devaluation that should have boosted exports, bank credit was almost zero and GDP collapsed by more than 10%.

Policy Recommendations

In France, the fundamental problem lies in the excessive recourse to foreign-law private debt issues to be paid with domestic income streams. Neither French public authorities, nor French private actors ever considered the possibility of the euro’s demise – they acted in a perfectly integrated financial system which resulted in inadequate incentives to hedge against foreign-law exposures on euro-denominated debts.

What is to be done? Depending on the opinion one has on the future of the Eurozone and the autonomy of actions nation-states should retain, two opposite courses of actions could be chosen: ‘nationalisation’ or ‘Europeanisation’ of contracts.

First, to diminish the exposure of their firms to a euro break-up, France and other Member States could further develop their domestic bond markets – in the wake of the recent Paris Europlace initiatives in France for instance. Special emphasis should be given to reinforce French-law debt issuances in order to better monitor any mismatch that could arise in a Eurozone break-up scenario for companies excessively relying on foreign-law issues. In this context, French authorities should adopt a clear medium-term objective to reduce bond issues under foreign law, and greatly restrict foreign-law debt issues of state-owned companies or systemic banking groups.

But public authorities may face a dilemma. The measures previously mentioned would take years to be implemented by the usual mechanisms of incentives and soft regulation. In the long run, the question of euro exit might be less relevant, either because the current crisis will have been overcome, or because the single currency will no longer exist. Speeding up the process of French-law debt issuances might also trigger speculation on the future of the single currency, thereby causing the very financial crisis it was precisely designed to prevent.

Second, one could argue on the contrary that better legal and financial coordination between Member States of the Eurozone is necessary, for instance through the implementation of appropriate legal reforms enabling European firms to issue debt securities under a unified ‘EU governing law’. It would further reduce incentives to depart from the EMU, whose current institutional structure “facilitates a break-up” (Scott 1998), and thereby quash the risks of speculative attacks against a given country. Such a reform proposal could be put on the agenda of the ‘capital markets union’ (CMU) given that a ‘EU governing law’ might also make European capital markets more attractive to institutional investors – on top of being a first step towards future issuances of ‘stability bonds’ (Eurobonds).

However, this would mean a significant deepening of the Eurozone integration. European countries would once and for all bet on the success of the euro. If, indeed, the Eurozone turns out to be either politically or economically unsustainable, the consequences of an exit would be even direr than they are today.

See original post for references

____

[1] The interested reader should refer to the legal part of our study for more details (Amiel and Hyppolite 2015).

[2] Most debt securities with ‘non-available’ governing laws have been issued on foreign primary markets as reflected by their respective ISINs (International Securities Identification Numbers) on the Bloomberg terminal. And, as stated by the BIS, there exists a close relationship between foreign primary market issuance and foreign governing law (Quarterly Review, December 2012).

[3] We consider that a measure of the short-term financial cost of exiting the euro would be the amount of cash that public authorities should inject in exposed companies in order to keep their debt service coverage ratios constant.

Coincidentally there is a nice article here in the Guardian on the costs of exiting. Unilateral withdrawl looks pretty uninviting even if you arent Greece http://www.theguardian.com/politics/2015/mar/16/eu-exit-norway-option-costs-thinktank

Lacking in all of these “analyses” is an understanding of the radical unsustainability of the capitalist system as a whole. Here’s one place to start:

http://www.amazon.com/Does-Capitalism-Future-Immanuel-Wallerstein/dp/0199330859/ref=sr_1_3?s=books&ie=UTF8&qid=1426503303&sr=1-3

Global economic growth has, if we are to believe the OECD statistics, been declining for more than four decades now. The capitalist world has responded to its concomitant threat to its profits by creating more and more vast Ponzi schemes, discussed euphemistically as “asset bubbles,” as if vast expansions of value (as the term was used by Karl Marx) did not have to have any connection with the actual aggregate of goods and services to be found in the world. So, for instance, Robert Brenner told readers at the end of his (2006, rewritten from 1998) analysis “The Economics of Global Turbulence” that “the odds therefore favour a still further opening up of the already enormous chasm between the income and profits actually produced by the world economy and the paper claims generated by it.” Has this situation radically changed since 2006? Wasn’t the Great Recession (for the most part) a mechanism for disposing of surplus corporate greed in light of the mid-2000s economic upturn, leaving the existing “enormous chasm” largely intact?

In this regard it will be easy to imagine a currency breakup as just another expansion of the regime of value. The “too big to fail” businesses in the exiting regimes will implore their governments to print more money while the banks look to create a new generation of “financial tools” to hide the debt morass.

Eventually, the real force impacting the regime of value will be the force of ecological simplification, as abrupt climate change further (and further) distorts global climate patterns in a geographic space already suffering from the depredations of neoliberal capitalist exploitation. Why should the expansions of value which we today call “growth” be anything more than a postponement of the eventual “adjustment” of paper value to real-life existence within the capitalist world-ecology? Won’t the breakup of the Euro be presented as more of the same in that regard? Oh, sure, all sorts of money will disappear. Won’t they just print more of the other money to compensate?

In this regard I can imagine myself as a Romantic advocate of Euro breakup. In this Romantic sentiment which I can see myself having, the patrons of the Euro appear as a bunch of money-hungry capitalists looking for their next so-many-billion Euros, while the Euro breakup promises that maybe someone, somewhere, will have the responsibility to pursue the regime Romantically named “ecosocialism” by a few marginal academic types. But this is probably a false hope. Is anyone sober anymore?

All this money talk around the cost of exit to determine the potential of exit is futile.

Imagine if, a couple of years before the credit crisis, the pundits had done a cost analysis around the potential of bailouts and QE. They would have said that it was impossible. They could never let AIG and others fail or the entire system would collapse…. somehow they all managed to paper the whole thing over with trillions and here we are!

All we need is another crisis and everything will become very possible. And the costs will not determine whether the exits happens or not. They will only determine the power struggle.

I’m wondering if there is a simple equation, like fractalization, that describes how, at every blow-out of capitalism, it costs many multiples of the old economy to get the new one going again – because where money is concerned time is a compounding factor that makes simple geometric fractals reach some critical economic mass… and then the whole thing just blows up again.

that’s what John Merryman said the other day. I was kind of blown away at how right he got it. But I was too lazy to post a comment.

It occurred to me that somebody like the ECB could sell redenomination insurance. You could pay the ECB to insure you, as the investor, from redenomination risk and then when your euro bonds go back to French francs you get the francs and the ECB gives you any euros you need to get whole. This would be revenue without cost! It costs the ECB nothing to make euros but they can sell them to you for quite a lot of money. And they may not even have to give them to you. That’s amazing just to think about.

If you consider that if you have money in a bank there may be no moving parts at all to any of this. It’s like a scene in nature with no movement, not even the air moves, not even light moves. Absoutely nothing happens. It’s like a landscape painting. But it would somehow change everything. That’s weird, to think like that. That’s really what a painting sort of does, assuming it’s well done. It just sits there doing nothing but in doing nothing it’s constantly changing the way things are perceived. That’s weird.

Otherwiise, who the hell knows what would happen. It may be one loss is a gain somwhere else and it all nets out in an unimaginably tangled knot of cause and effect. It might even be a form of stimulus, depending on the time frame over which it’s measured.

Yep the ECB and and Wall street think that they should be able to sell bonds at par, anytime anywhere. Perhaps we should just call it “credit sure thing” instead of credit risk.

This is a rather unsatisfying dilemma – either wait years for national industries to negotiate their borrowing under France’s laws – or kiss and make up with the EU, further eroding sovereignty. OK, 70 billion euros is a bunch of francs, but here’s what Le Pen needs to know: If France were to leave the EU and it decided to pay off the debts (or exchange euro bonds for franc bonds) how would that affect the value of the franc? And how would that affect the well-being of the French people? Even if bailing out major industries would cost a lot and result in a substantial devaluation of the franc, then all things being equal, exports would soar, leading the economy to grow. Again, I feel like I’m missing something, but really, those big, scary numbers aren’t all that scary in the context of a sovereign national economy operating under MMT. Even the Germans would like it as their next meal in Paris would be much cheaper than a meal in Berlin. Besides, it would be fun to watch.

What about the argument that, if your debt is in the national currency, and is under local law, it can be reimbursed in the national currency, even if it has changed in between? I do not know the anwser to this legal finesse but it seems to me an argument with merit.

€70 billion is cheap when you weigh it against a €2.6 trillion economy that has stagnated for years on end. Furthermore, as Mosler has pointed out in the case of Greece, there is no reason to suppose the neo-franc should trade below the euro provided the government does not pull an Argentina and convert existing deposits en masse. All the government needs to do is ensure demand for the new franc by taxing it at a sufficient level (and not creating an instant tsunami of francs), value will take care of itself. It may be tempting to grab all those euro deposits, but that is monetarist dinosaur thinking… their asteroid landed in 2008.