By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

A terrible deterioration.

It got somewhat lost in the hoopla of the jobs report and the blistering rally in the stock market on Friday. But the US trade deficit worsened by 3.4% in October to $43.9 billion, according to the Commerce Department, once again disappointing soothsayers who’d hoped for an improvement in the trade deficit.

But as bad as the overall trade deficit is, the trade deficit in goods (without services) is much worse, and even then, the oil trade covers up just how terrible the underlying trade of non-petroleum goods really is, how far and how fast non-petroleum exports have plunged, and how much US manufacturing is getting whacked.

The worsening trade deficit was a nasty “surprise” – nasty because it dings US economic growth; and surprise because it appears inexplicably difficult for Wall Street economists to predict a downhill slope.

Exports add to GDP, and imports reduce GDP. So when imports exceed exports, the sacred US GDP figures get hit as they have been since the 1990s. But October was bad: exports of goods plunged 10.4% year-over-year to $123.8 billion, the worst level since June 2011.

The culprits: the strong dollar that makes US goods more expensive in other currencies, and tepid economic growth in the rest of the world, with some major markets in a recession, or a deep recession, such as Russia, or even worse, such as Brazil. The China slowdown isn’t helping. But in the case of exports to China, the dollar can’t be blamed since the yuan is pegged to the dollar, and the recent devaluation was tiny compared to the moves of other currencies.

Imports of goods fell 6.6% year-over-year to $186.8 billion – despite the strong dollar, though a strong dollar, in theory, should have caused imports to rise. This testifies to tepid demand in the US. Imports of petroleum products were blamed. The US is – despite the oil bust – pumping so much oil for domestic consumption that imports of petroleum products have been falling for years. And in October, the value of petroleum imports hit the lowest level since 2003!

In fact, the US is pumping so much oil that exports of petroleum products have been booming, and the net petroleum trade deficit – the difference in value between imports and exports of petroleum products – dropped to a minuscule $4.47 billion, the lowest since April 1999.

Credit must be given to the shale oil revolution – and to the many billions of investor dollars that have been drilled into the ground where they have now disappeared without trace!

But this flourishing oil trade covers up the terrible deterioration in the non-petroleum trade deficit. It’s volatile from month to month, but the trend is clear: in October, it worsened by 25% year-over-year, to $56.8 billion, after an all-time worst of $59.3 billion in August. Before this year, the worst had been $47.8 billion – in December 2014!

This chart shows just how fast and how far the non-petroleum trade balance (blue line) has plunged, while the net petroleum deficit (black line) is on the way, if this trend continues, to a surplus:

The reason for the rapidly deteriorating non-petroleum trade deficit: declining exports. In October, non-petroleum exports fell 9% year-over-year to $115.9 billion. The trend is worsening: year-to-date, non-petroleum exports dropped only 4%, but October and August were the worst months since 2011.

This swoon in non-petroleum exports explains in part the malaise in US manufacturing. What the regional manufacturing indices have been saying loud and clear for months, the national Manufacturing ISM Report On Business finally confirmed: for November, the index fell to 48.6 (below 50 = contraction), with new orders dropping to 48.9, not a good harbinger for the future. It was the first contraction since November 2012.

Bad as it is, it has been propped up by the massive US auto manufacturing sector that has been flying high, pumped up by cheap credit, loose underwriting standards, extended loan terms, loan-to-value ratios that exceed 100%, the rising proportion of subprime loans, and of course, securitization of these loans [read… What Happens When the Auto-Loan Boom Blows Up].

And auto manufacturing is still hot, fired up by US auto sales that might soon set an all-time record in unit sales and has already set all-time records in dollar sales due to higher vehicle prices.

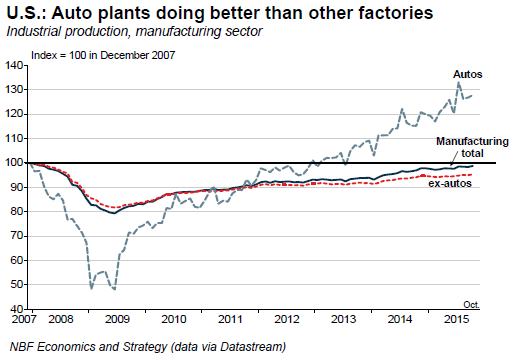

But the rest of US manufacturing can’t be so easily propped up with loosey-goosy consumer debt. In these sectors, there has been no manufacturing renaissance, as this chart by NBF Economics and Strategy shows. It compares the soaring output of the auto sector (dotted blue line) to the languishing output of the rest of manufacturing (dotted red line):

NBF’s report notes that factory production excluding autos is still 5% below the pre-recession peak, “having stagnated in the last year or so.”

But auto manufacturing in the US isn’t for export; it’s mostly for the US market. Once the auto loan boom hits rough waters, as all loan booms eventually do, auto manufacturing too will get into trouble. This will pull out the last prop under overall manufacturing in the US.

And trouble, deep trouble, is already hitting manufacturing of heavy trucks. Read… Toxic Mix Hits Trucking, Orders for New Trucks Totally Collapse, Pummel Manufacturers

This shouldn’t be surprising. Despite all the trumpeting of the jobs numbers, which are meaningless given that they do not count the actual number of people out of work who have stopped looking (or rather they are still looking but since they have tapped out their unemployment benefits they are not registered). The real indicator is how much money the populace has to spend. Not much as evidenced by the poor retail numbers this season. Take a look at this chart; Real Mean Household Cumulative Growth. Household income for the majority of consumers has not recovered from the 2008 recession and in fact has been going down since 2000.

Of course they have to ignore it. Or downplay it. Unlike the utterly ridiculous meme that we cannot have nice things because our deficit is too high (but don’t raise taxes), that deficit is NOT the problem. The problem is that our trade deficit is astronomical AND the people who own the government do not want that dealt with. Although fixing that deficit problem would be better policy, and have a massive good impact on so many of our current problems.

a couple things…

exports have been hit since July because Congress did not reauthorize the Ex-Im bank, so big purchases could not get financed; commercial jet orders were down nearly 40%, for instance…that was finally passed & signed by Obama Friday, so that should improve by January…

price is a factor; raw trade data is not inflation adjusted like GDP is…if oil prices were still $100, our oil deficit would be twice what it is on the chart above…

the last 6 months were also revised with the October report; the trade deficit for September was revised from $40,812 million to $42,457 million, the trade deficit for August was revised from $48,017 million to $48,811 million, while the trade deficit for July was revised from $41,807 million to $42,433 million…that gives us a total increase in the trade deficit of $3,065 million for those months vs previously published figures, or worsening of the trade deficit for the quarter at a $12.3 billion annual rate, which will be subtracted from 3rd quarter GDP when the 3rd estimate is released December 22nd..

Ex-Im bank?

If a foreign airline can’t finance their own airplanes, why should the US tax payers?

Look, if Boeing were still a great American company (as in it made great products, which of late it hasn’t thanks to its short-sighted policies re its factory workers and engineers), I’d feel less conflicted about making the counter-argument.

First, airline manufacturers create spillover effects, in that their product and process advances are deployed by other companies.

Second, Airbus is massively subsizided.

Third, you seem to be in denial that America practices industrial policy. Banks, defense firms, big pharma, health insurers, sugar (!!!!), oil & gas and the universities are among the big beneficiaries. You can see that in the funding and tax breaks they get (and in the case of defense and big pharma, explicit R&D subsidies). So the questions is not “should we subsidize this industry?” but “are we subsidizing them too much” and “are we getting the societal benefits we should be getting?” Honestly, even with all its faults, Boeing is a lot less ugly than the most of the players I have on my list of welfare queens.

Not sure that Airbus is more subsidized than Boeing but Boeing is doing its best to catch up. We in Wa. are just learning how much our legislature sunk into the latest Boeing blackmail. Our good Senators jumped to attention when the Boeing CEO snapped his fingers and put their feet on the neck of the Machinists when they wanted to keep their pensions. Patty Murray won the tanker contract back from Airbus after various Boeing managers were caught in several nefarious schemes. GE and Boeing are the main benefactors of the Export Import bank despite believing that paying taxes is beneath them. Even Forbes magazine has written an article hinting at how bad the outgoing CEO was for Boeing – so that kicks further sand in the taxpayers faces. And said management seems to have stumbled once again in completing the tanker contract(behind and over budget) so they will probably have to be bailed out. What they do best is pat themselves on their backs and get paid more and more money.

I think that Mr. Richter should admit that the debacle is caused by expectations on the Fed rising rates, just what he is asking for, that in turn is rising dollar exchange rates.

The debacle is the combo of US Fed’s financialization gone utterly amok, the insane US policies of regime-change in concert with the Saudis, GCC, Turkey, Israel, NATO and epic stupidity re Russia, which is what the oil price war is all about. In other words, simply terrible US financial and foreign policy has taken the globe right up to the edge of the cliff – the global economy is stalled, tottering, and will either crash, or not, depending on whether the US can clear the garbage out of its thinking, and soon.

The very best thing for the global economy would be a US-led initiative for an immediate cease-fire, and finally, real negotiations with all important players to sort out Syria, Iraq, Yemen, Libya, Turkey, Saudi Arabia etc. Who is going to invest in long-term, productive and peaceful activity when all the elements for a catastrophe are at hand?

A good part of this has to be tied to “free trade” agreements that encourage export of manufacturing jobs to slave labor, environmental hellhole countries. Or do US slave labor manufactured good from hellhole island country X not count as imports when the products come in because they are “US” companies?

I’ve been wondering with the increasing export of petroleum and the continued rising to a net surplus, that this is a contributing factor the the strengthening of the dollar. One of the key mechanisms of supplying dollars to the rest of the world is through running a trade deficit in Oil.

Supply of dollars has been falling faster through this particular mechanism than demand falling. Possibly giving a rise the the strengthening of the dollar and hurting other areas that we are only now seeing.