By Lambert Strether of Corrente.

The non-partisan CBO report on the Senate replacement (the BCRA) for the House’s health care bill (the AHCA) and ObamaCare (the ACA) came out yesterday, to excitement predictable because waiting for the CBO “score” on a health care bill is an important Beltway ritual and source of hot takes[1]. Equally predictable was that the press would initially focus on the “headline number,” which occurs in paragraph 2 of the cover letter:

The Senate bill would increase the number of people who are uninsured by 22 million in 2026 relative to the number under current law, slightly fewer than the increase in the number of uninsured estimated for the House-passed legislation. By 2026, an estimated 49 million people would be uninsured, compared with 28 million who would lack insurance that year under current law.

(Here is the CBO page for the report; here is a link to the report in PDF). Considered as a work product, the report is a “cost estimate,” as explained by the CBO:

CBO provides formal, written estimates of the cost of virtually every bill approved by Congressional committees to show how the bill would affect spending or revenues over the next 5 or 10 years, depending on the type of spending involved. Each cost estimate describes the basis for the estimate. For most tax legislation, CBO uses estimates provided by the staff of the Joint Committee on Taxation, a separate group that works closely with the Congressional tax-writing committees. In addition to formal, written estimates for bills approved by committees, CBO provides a far greater number of informal, preliminary estimates as committees are considering what legislation to advance, as amendments to legislation are being debated, and at other stages in the legislative process.

A CBO “cost estimate,” therefore, is limited to spending and revenues within the scope of the Federal government[2]. Further, a cost estimate is produced by technocrats at the JTC from both parties, so even if the CBO estimates can be off, as some Republicans huffing and puffing for the gallery (indeed correctly) claim, the best and brightest Republican technocrats are fully implicated; these estimates are, in short, the best we have or are likely to get. Finally, “informal, preliminary estimates” implies that there’s a good deal of back and forth between CBO and Congress as bills are developed; this was certainly true for ObamaCare, and the Democrats went so far as to make programmatic changes to game the estimates. Informal estimates were unlikely to have been done for the AHCA (indeed, the House passed the bill without a cost estimate for revisions) and almost certainly not for the BCRA, given the speed and secrecy of the process.

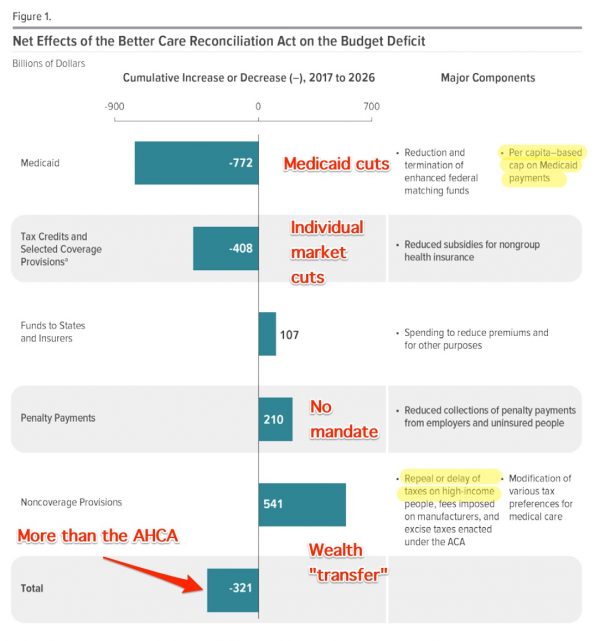

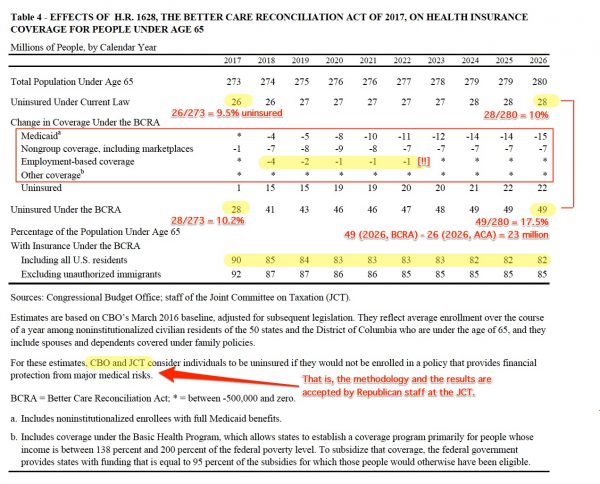

With that context, I think what’s important about the CBO report can be boiled down to two tables: Figure 1 (“Net Effects of the Better Care Reconciliation Act on the Budget Deficit”), and Table 4 (“EFFECTS OF H.R. 1628, THE BETTER CARE RECONCILIATION ACT of 2017, ON HEALTH INSURANCE COVERAGE FOR PEOPLE UNDER AGE 65”). So far as I can tell, and I do try to keep track, these tables encapsulate the content that’s driving all the media coverage beyond the headline number. I’ll present each of these tables, and then take a quick look at CBO methodology.

The BCRA and the Deficit

This is the money table[3]:

If you run through this table, I think you’ll see all the stories that have been written — and one or two that haven’t — but summarized in one place. Starting from the bottom:

“More than the AHCA” applies to the amount by which the BCRA reduces the deficit. (Yes, we ought to be talking about lives saved, and the upsides to eliminating the health insurance parasites from the body politic, but that’s not within the scope of a CBO “Cost Estimate.”) Politically, this implies that McConnell has some wiggle room; he could bring that figure down by handing out some goodies, and still reduce the deficit.[4])

“Wealth ‘transfer'” is the tax cuts for the rich high income people.

“No mandate” has already (kinda, sorta) been superseded; in an overly dynamic process, the Republicans released a version of the bill Monday that replaces the mandate with a “lock out”, not yet scored, if indeed there is time to score it[5]).

“Individual market cuts” has been little covered, at least as of this writing, but if you are one of the citizens ObamaCare sent to HappyVille with a good policy you purchased in the marketplace, you might want to watch out.

“Medicaid cuts.” Apparently, the Republicans believe you can cut your way to better health care, which is bad enough, but putting a per capita cap on Medicaid payments is an enormous change to Medicaid, and has been hardly covered at all. (The change is also audacious, given that Medicaid expansion is the one part of ObamaCare that can be said to be unequivocally successful, modulo estate recovery.)

The BCRA and Health Insurance Coverage

This is the coverage table:

Here again, if you run through the table, you can see all the press stories in one place. The stories started with the headline number of those newly without coverage (22 million in the cover letter, 23 million using this table’s figures, I assume due to rounding errors in the “*” (>500K) cells.) The stories then moved on to the next biggest number, drops in Medicaid coverage. I’m now seeing stories on how even employment-based coverage will drop (though it looks after some initial turbulance things straighten out, though I don’t see why), although as of this writing I have not seen stories on how even in the marketplaces coverage will drop. (You’d think if the BCRA were that chimera, a market-based solution for providing health care, that “Non-group coverage, including marketplaces” would increase? Cannot the conservatives up their game, and, through some neoliberal legerdemain, induce the JTC/CBO to fix the horrid bottom line of “Uninsured Under the BCRA?”)

Note also that you can see the shape of Matt Bruenig’s famous chart[6] if you compare “Uninsured Under Current Law,” which under ObamaCare stays more or less flat at 10% of the population, and “Uninsured Under the BCRA,” which starts at 10.2% in 2016, and ends up at 17.5% in 2026. (Again, shouldn’t “freedom” or whatever shibboleth the conservatives invoke have been able to fix this? Not so, says the bipartisan staff of the JCT, and the non-partisan CBO. And if there is such a solution, even in snake oil form, wouldn’t it already be in the bill, given that the Republicans have had eight years to think about it?)

Methodology

Here is how the CBO describes its methodology for the BCRA cost estimate (page 18):

This legislation would change the pricing of nongroup insurance and the eligibility for and the amount of subsidies to purchase that insurance. It would also lead to changes in eligibility for Medicaid and per capita spending in that program. The legislation’s effects on health insurance coverage would depend in part on how individuals responded to changes in the prices, after subsidies, they had to pay for nongroup insurance; on changes in their eligibility for public coverage; and on their underlying desire for such insurance. Effects on coverage would also stem from how businesses responded to changes in those prices for nongroup insurance and in the attractiveness of other aspects of nongroup alternatives to employment-based insurance.

To capture those complex interactions, CBO uses a microsimulation model to estimate how rates of coverage and sources of insurance would change as a result of alterations in eligibility and subsidies for—and thus the net cost of—various insurance options. Based on survey data, that model incorporates a wide range of information about a representative sample of individuals and families, including their income, employment, health status, and health insurance coverage. The model also incorporates information from the research literature about the responsiveness of individuals and employers to price changes and the responsiveness of individuals to changes in eligibility for public coverage. CBO regularly updates the model so that it incorporates information from the most recent administrative data on insurance coverage and premiums. CBO and JCT use that model—in combination with models to project tax revenues, models of spending and actions by states, projections of trends in early retirees’ health insurance coverage, and other available information—to inform their estimates of the numbers of people with certain types of coverage and the associated federal budgetary costs.

It’s worth noting once more that the best and brightest technocrats of both parties accept this methodology. Anyhow, Republicans seem divided on how to respond to the report. (Let me caveat that since I came up as a Democrat, I’m still not as familiar with Republican factions as I should be.) The AEI seems to regard CBO microsimulation model as the best we have:

The GOP should listen to the CBO

No one agrees with everything that comes out of CBO. I don’t. The agency has gotten plenty of things wrong over the years. But it would be hard to find an agency that provides more useful information to the policymaking process in the legislative or executive branches of government. In many legislative debates, the only useful information available to the House and Senate that does not come from interested parties is produced by CBO.

Ironically, it was CBO’s cost estimate of the Clinton health care plan in 1994 that helped sink the effort to pass it.

[T]here’s no reason to question CBO’s basic assessment of the AHCA, which is that it will cut spending and taxes substantially, and that there will be a large increase in the number of people going without health insurance.Republicans complain that CBO is overly invested in the effectiveness of the ACA’s individual mandate. And it may be true that CBO assumes the mandate is more effective than it is in practice. But even assuming an ineffective mandate, there’s little question that the AHCA would lead to a rise in the uninsured because of the rollback of enhanced funding for the expansion population in Medicaid and the reduction in the value of refundable tax credits available to lower income households.

Instead of complaining about CBO, Republicans should listen to what the agency is telling them about the House-passed bill and use that information to produce a better plan in the Senate.

Others want to shoot the messenger. Aptronymic HHS Secretary Tom Price, interviewed in The Atlantic:

HHS Secretary: The Congressional Budget Office Is ‘Not Accurate’

If the goal of the bills is to get health insurance to more people, and the CBO score says the House bill, at least, will not—how to explain that discrepancy? Goldberg asked. “Is the CBO wrong?”

“Yes,” Price said. “The CBO does a great job on budget; they do a relatively poor job of what the coverage consequences of a healthcare plan are. Their ability—anybody’s ability—to predict what human behavior is going to be without looking at the entire construct, is difficult. I would suggest to you that the numbers the CBO had before with the ACA, and the numbers they have now, are not accurate.”

Price’s view has been summarized more succinctly:

FACT: when #Obamacare was signed, CBO estimated that 23M would be covered in 2017. They were off by 100%. Only 10.3M people are covered. pic.twitter.com/A7Kthh3gDQ

— The White House (@WhiteHouse) June 26, 2017

Since the figures are sourced to “The White House,” and not to the President personally, I’ll accept them; the big picture is certainly correct. What’s odd is that in trying to set fire to the CBO, Trump ends up burning down his own house; what the CBO mis-estimate shows is that the neoliberal, market-based ObamaCare “marketplaces” performed below expectations, and the big gummit, in fact single payer Medicaid program performed above expectations. Perhaps there’s a lesson for us there, Democrats as well as Republicans?

As far as CBO’s microsimulation model goes, I’m not equipped to evaluate it, although I’d agree it’s the best we have. However, I remember very well the health care debate in 2009, where Democrat consultant Jon Gruber serviced his clients with output from his own proprietary model that simulated the CBO model (and if that’s not meta enough for you, I don’t know what would be). In other words, the CBO’s microsimulation model is as political a document as any other in this process, including the “cost estimate,” the bills themselves, and the stories in the press.[7] And there I will leave the methodology discussion, since it looks like we are, at this point, well into sausage-making stage, and “cost estimates” will lag the poltical process.

Conclusion

I hope readers find the two tables useful in cutting through the clutter!

On the politics of it, I still don’t know. The intuitive part of me says the Republicans are too feral and tribal not to succeed (and the House, after an initial debacle, did pass its own horrid bill). McConnell has a few hundred billion to play around with, and that should be enough to buy a vote or two (and a vote or two is all he needs). The logical part of me says there’s no solution space, since how do you square Ted Cruz, who’d rather abolish big gummit entirelyMR SUBLIMINAL But the billions! The billions! with Susan Collins, who at least as the decency not to want to screw over the citizens of her old and poor state (more than they are already), who depend on big gummint, and especially Medicaid. And then there are the Medicaid expansion states (only two Senators, but several governors). Are they really going to go for those Medicaid cuts, and take away already-delivered direct material benefits from their constituents? Though maybe they can be sold with a combination of magic of the marketplace snake-oil and a shiny new opioid program (which gawd knows the Democrats don’t care about, because that would imply they cared about the working class in the flyover states, which to say the least they don’t).

Anyhow, it’s fun to speculate, but the Republicans should have gone into their big gut check lunch by now, and we’ll see what they have to say when they emerge.

NOTES

[1] The House passed the AHCA despite an initital furor over its CBO score, showing that (a) a poor CBO score isn’t dispositive, and that (b) Republicans, in general, are more feral and effective than Democrats. But then you knew that.

[2] Back in 2009, a career “progressive” talking point for why single payer wasn’t “politically feasible” was that it would get a terrible CBO score. Since the CBO speaks only to Federal spending, and not to society-wide benefits, that was a foregone conclusion; the $400 billion (or so) that single payer would save annually doesn’t show up in the accounts that CBO tracks.

[3] Note, with “net effects,” how deeply embedded the idea that Federal taxes fund Federal spending is embedded in the political class, or at least the JCT, CBO, and consumers of its products.

[4] Yes, reducing the deficit is a bad thing, but not in official Washington, and especially not to the establishments of both major parties.

[5] This sort of wild experimention with a program involving human lives might strike an objective observer as frivolous. But then, ObamaCare was frivolous, given the existence of a successful single payer program — they call it “Medicare” — in the great republic to our north. And so it goes.

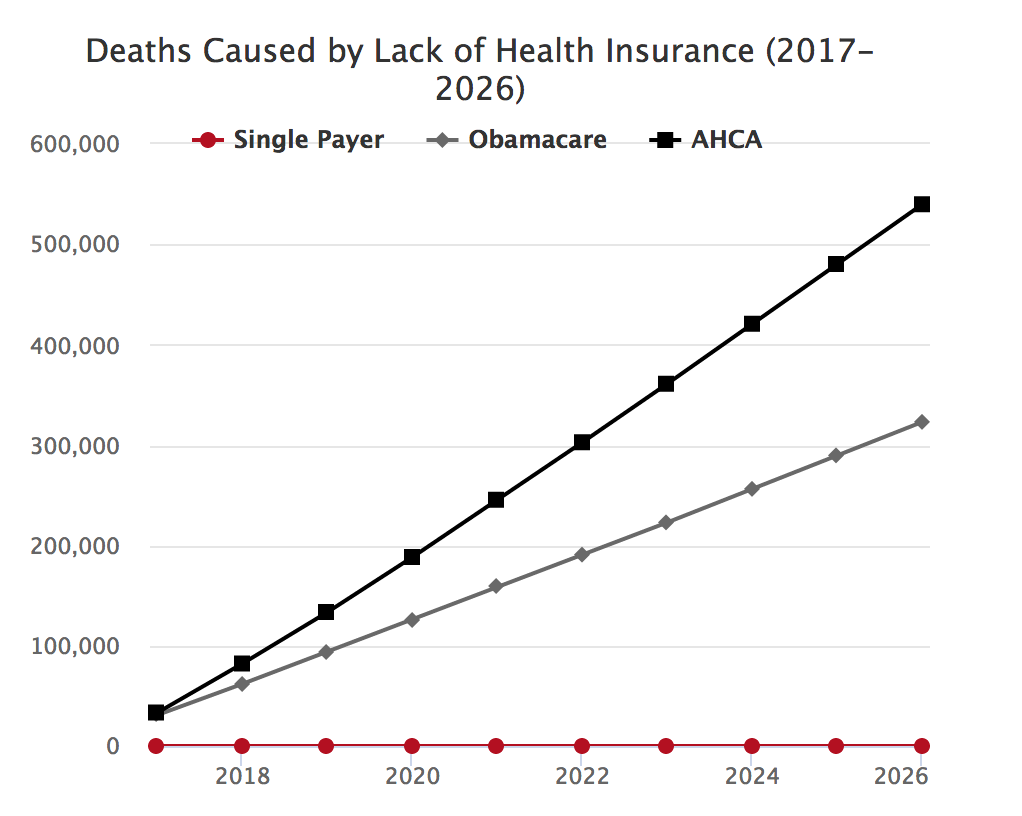

[6] Here is Bruenig’s chart:

There’s your Democrat softer hammer.

[7] A document on one such model, CBOLT (and I’m not saying CBOLT is a dependency for the BCRA estimate, I’m just using it as an example:

In CBO’s modeling, the historical pattern of rising earnings inequality continues for the next two decades, but earnings inequality generally ceases to rise by the mid-2030s. The method for projecting individuals’ earnings that was developed for CBOLT and described in this paper closely follows the method first documented by Carroll (1992), but it is also informed by the work of other researchers. In general, individual earnings are perturbed by a pair of estimated earnings “shocks.” The first shock is permanent and measures the long-run gap between a worker’s earnings and the average earnings of that worker’s group (where the group may be defined by age, sex, and education). Permanent shocks could be caused by, for example, receiving a promotion or attaining a higher level of education. The second shock is transitory and measures any additional but temporary variation in a person’s earnings. Transitory shocks could arise from, for example, receiving a bonus or missing work because of illness.

I’d be very interested to know what political economists and labor historians think of this model. I’d also be interested to know if it accords with experience in the commentariat. I’m a little perturbed myself by the notion of “shocks,” which reminds me of Naomi Klein’s work.

Tom Price has a self serving comment. He should note people like him prevented the spread of Medicaid that kept millions off ACA. No one expected idiots to forego the expansion of Medicaid considering it was essentially free to states for five years. Not only did this leave millions of people without ready access to care, it prevented creation of thousands of American jobs. Trump’s job plan is a dismal failure, now he can add thousands more to his unemployment job plan!

Not so sure about that. It appears Trump can shrink unemployment by having the not working die quickly (Cut Medicaid).

Jackpot!

Though to be fair, the Democrats are helping; their jackpot is kinder and gentler…

Decent size protest at the CA house speaker who kill single payer’s office.

https://www.facebook.com/Lauren.Steiner.LA/videos/10213307533539684/?hc_location=ufi

Completely left out of this discussion in everything I’ve read is the fallacy of comparing those “insured” under ObamaCare and those “uninsured” under BCRA. For the simple, well-documented reason that many, many of those newly “insured” under ObamaCare couldn’t actually afford to use their insurance policy because they couldn’t afford the co-pays and deductibles.

If those unfortunates are counted as functionally “uninsured,” I wonder if there’s really much difference between the two plans in terms of the number who can actually obtain medical care. The decimation of Medicare, of course, is an entirely different obscenity.

As an aside — just to reinforce the irrefutable ridiculousness of the US medical care system — my daughter just finished her first year at the University of British Columbia. Like all international students, she was required to purchase health care insurance under BC’s universal provincial health care plan. Her premium FOR THE ENTIRE YEAR was $900 for complete doctor and hospital coverage with no deductible, no cap and (as I recall) no co-pay.

> Functionally uninsured

Good point! (And a nice way to say “health insurance is not health care,” which is so obvious we forget to say it.)

And, no amount of calling for-profit 3rd-party intermediated (dubious value-add) pre-payment “insurance” will make it so.

Don’t forget the 4th party “wellness plan”.

I don’t think wellness has been proven to have medical benefits, despite ObamaCare subsidizing it.

$900 a year for EVERYTHING?

It’s probably best that I don’t list off the filthy things I’d be willing to do for that policy….after all this is a family blog! :)

Unencumbered by data, I’ll bet she gets dental for that $900 as well…

I’m a bit slow and it just dawned on me. The only business that doesn’t want single payer is the Healthcare business.

All other large businesses are penalized by being forced to pay into private health insurance through regulations.

Wouldn’t it be better for businesses if health insurance became another payroll tax and levelled the playing field a bit between part time and full time employees?

Am I missing something?

Does the health care industry carry more lobbying weight than all other business lobby’s combined?

I know with immigration reform they were able to involve the unions and chamber of commerce to progress the agenda, why should single payer not be able to do something similar?

That’s a good question for which I have no answer. It sounds like a good plan to me, but I’m not sure why it would or would not work.

It’s an issue of control. Many large employers do not want single payer because it would make employees less desperate for jobs and reduces their leverage to exploit their own employees. Just imagine the growth in small businesses or cooperative businesses if people did not have to worry about the financial side of healthcare.

On a related note, one connection that people have not made but is important is the relationship between healthcare costs and college/university education costs. Much has been written about how growth in higher education costs is driven by an enormous increase in the number of administrators and in their pet projects (like fancy new recreation centers, hotels, and stadiums). However, colleges/universities are also being constrained by the growth in healthcare costs — which they either pass on to students through increased tuition and fees, or through increased privatization schemes. Single payer would drastically reduce budgetary strain on public colleges/universities, and hopefully create some room to reduce tuition/fees (though equally likely would be the administrators siphoning away the savings).

There was a spot on yesterday’s All Things Considered program on NPR (or Marketplace, maybe), which talked about community hospitals in smaller towns, which are reliant on Medicaid to provide funding for that portion of citizens on it. I believe the town they focused on was Steubenville, OH, which has fallen on hard times as steel and other industries have died and left. Of course, in Ohio, they also have a massive opiod addiction problem as well.

I’m really paraphrasing from memory, but two major points made by this program were: a) if Medicaid funding is cut, it’s likely the hospital would close. This would mean the locals would have travel a much longer distance for certain types of care, including obstetrics. And b) the town would lose one of its few remaining sources of good, well-paying jobs.

The message was clear that the Republican Death Panel Legislation would be devastating for towns like Steubenville. They didn’t hesitate to include clips of Trump at some of his rallies adjuring his adoring fans that he would “repeal and replace Obamacare with something much better, much cheaper with much better coverage.” Yeah, right… Ye olde bait and switch from the Master CON man.

Thanks as always, Lambert!

“Politically, this implies that McConnell has some wiggle room; he could bring that figure down by handing out some goodies, and still reduce the deficit.”

And this I suspect will be the game plan. Start with a proposal that is truly outrageously bad, and migrate to one that is only horrible. Voila…

If there are about 11.4 million people enrolled in non-group plans, how is it that 7 million will drop their plans because of eliminating the individual mandate? Or for that matter, for any reason? Since 85% of people in marketplace plans are subsidized, why would the drop out?

Anyone know?

Maybe because they realize they’ve been coerced into buying a defective a product they cannot actually use.

The proper term is “nudged.”

Lower subsidies, higher deductibles, higher premiums

Overview; https://www.nytimes.com/2017/06/26/us/politics/senate-health-care-bill-republican.html

Additional analysis:

http://www.kff.org/health-reform/issue-brief/premiums-under-the-senate-better-care-reconciliation-act/

In Bruening’s chart, there are two lines called AHCA and Obamacare.

I thought those were the same thing? Did I misundertand something?

David Troutman

Obamacare = ACA. ACHA is the House version of the Republican bills.

The future health plan under the “Free Market Capitalist Systems” and their criminally corrupt political handmaidens: Assisted Suicide…..RIP….