By L. Randall Wray, a Professor of Economics at the University of Missouri-Kansas City. Cross posted from FireDogLake

Yves Smith set off a firestorm in her criticism of several progressive groups that have joined forces with Pete Peterson to whip up deficit hysteria. There are three issues that need to be addressed:

1. Can a progressive take tainted money and remain progressive?

2. Did the Roosevelt Institute (in particular) take tainted money and remain progressive?

3. What would a progressive approach to federal budgeting look like?

Let me dispense with the first question rather quickly. Pete Peterson’s money is tainted by his ideology and his mission, however, he has not so far been convicted of felonies. In my view, a progressive can take his money but only on the condition that the money is used to fight his agenda tooth and nail.

Turning to the second question, let us first examine the Roosevelt Institute’s defense of its research and the budget produced on Peterson’s purse strings. Here are two attempts, published at FDL:

[S]tudents from our Campus Network expressed serious interest in proving that their progressive vision for America’s future — originally captured in the Blueprint for the Millennial America — was not only innovative, but also achievable from a fiscal perspective. With that in mind, our organization, in consultation with our board of directors, agreed that our Campus Network should participate in a program sponsored by the Peterson Foundation to develop a budget plan. Other participating organizations included the Economic Policy Institute (EPI), Center for American Progress (CAP), Bipartisan Policy Center, American Enterprise Institute, and Heritage Foundation. It not only represents the unfiltered and untainted voice of the Millennial generation, it is also a powerful contribution to the current budget debate that can stand up in any forum.

Source: http://my.firedoglake.com/rooseveltinstitute/2011/06/06/speaking-truth-to-power/

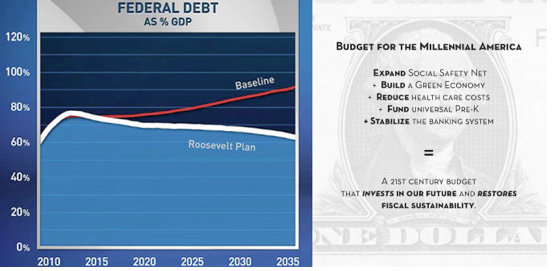

Our Budget for the Millennial America is based off this vision—a vision that was developed entirely independently of the Peter G. Peterson Foundation. Its contents represent the compromises that our students made in order to produce a coherent proposal. It’s a plan to build the future we want to inherit together; the fact that it reduces debt to 60% by 2035 is secondary.

Finally, if one actually goes to the RI’s website to look at the report, here is what one finds:

How can one take seriously the claim that debt reduction was only “secondary”? The homepage for the report prominently features “debt reduction”. One supposes that the title of the first defense (“Speaking Truth to Power”) is meant to be ironic—how is adopting Peterson’s view that debt must be reduced an affront to power? If the title of the report had been “The Roosevelt Institute Soundly Rejects Pete Peterson’s Attempt to Whip Up Deficit Hysteria”, that would be speaking truth to power.

So the answer to the second question is “No”—the RI produced a report that sent Peterson grinning all the way to the bank, as his investment paid off handsomely. He got a nominally progressive organization to endorse the view that producing a budget through to 2035 that shows federal government debt reduction relative to GDP is “progressive”. The RI signed on to the deficit hyperventilator’s agenda. As they say, that is “priceless”.

On to the third question: what would a progressive approach to federal budgeting look like? Here I need to (quickly) address three issues. Because of space constraints I will need to summarize some arguments treated more fully elsewhere (citations provided): a) cyclical deficits created by the global crisis; b) structural deficits (longer term fiscal stance); and c) federal budgeting. (For much more on all these topics, including some blogs by yours truly, please go to: New Economic Perspectives and to a “primer” at Modern Money Primer.)

With regard to current budget deficits, there is no question that the economic crisis has reduced government tax collections at all levels; at the same time, government spending to deal with the economic calamity wrought by Wall Street rose. No matter what Congress does, the federal budget deficit will not come down significantly until the economy improves—it can try deficit cutting “until it is blue in the face” but that will only make the economy worse, lowering tax revenues and increasing the lines at the unemployment office. You do not have to be a progressive to agree with this—all sensible economists across the political spectrum agree. Even the most conventional analysts would worry about the short-term deficit only once we recover and inflation picks up due to an overheated economy. We are somewhere around 8% of GDP and 15 million jobs, and many years, away from that.

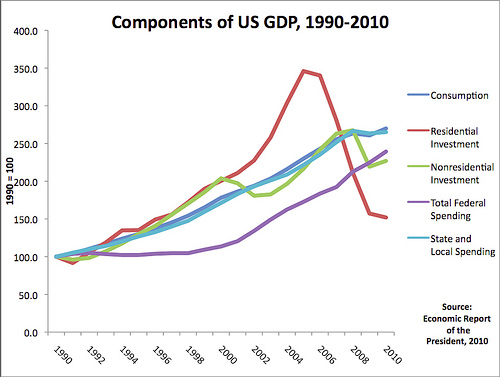

What about longer-term trends? The deficit hysterians like to talk about runaway government spending. First let us look at the past couple of decades—has government spending got out of control?

Recall from your Econ 101 course that the aggregate measure of a nation’s output of goods and services (GDP) is equal to the sum of consumption, private investment, government purchases, and net exports (for the US that is of course negative). We can further divide investment into residential (housing) and nonresidential (investment by firms). Finally, we can divide government spending between federal government and state and local government. The following chart graphs the domestic components of GDP (net imports are left out), indexing each component to 100 in 1990. (This makes the scale easier to show in the graph, and simplifies comparison of growth by component. For example, if consumption spending doubles between 1990 and 2000, its index increases from 100 to 200.)

What we see in this graph is that the slowest growing component over the two decades was federal government spending—it actually did not grow much until the term of President George W. Bush. (A substantial portion of federal government growth since 2000 can be attributed to our multiple wars, as well as to domestic spending on security in the aftermath of 9-11.) This graph certainly does not show that federal government spending has been growing fast.

But there are two blades to the deficit scissors: maybe tax revenue growth has been slow, causing chronically rising deficits? Indeed, many liberals blame “Bush Tax Cuts” for deficit woes. They contrast the post 2000 experience with the “Goldilocks” economy of President Clinton, when budget surpluses were achieved. In their view, the tax cuts for the rich have destroyed the federal government’s ability to raise sufficient revenue—which generates structural budget deficits.

Here is the reality. In the late 1990s (pre-Bush) the growing economy generated rapid growth of federal tax revenue, which reached a growth rate of 10 percent per year (far above government spending, which was growing at about 3 percent per year)—leading to the Clinton surpluses. (For an early, 1999, analysis, see this: Surplus Mania: A Reality Check–sometimes there is no benefit to getting it right!.) In truth, this rapid growth was due to the discovery of the “bubbleicious” pump and dump dot-com economy—it had nothing to do with “fundamentals”. The economy then crashed, and a deficit was restored as government tax receipts plummeted at record, nearly Biblical, rates—beginning an unprecedented four-year fall. Yes, the Bush tax cuts helped, contributing to a 15% annual rate of decline of federal tax revenue. But recovery turned that around—quickly, thanks to the pumping of two other bubbles: real estate and commodities. Bush had rediscovered bubblemania first used by the Clinton troika of Greenspan, Rubin and Summers and then by Paulson, Greenspan, Bernanke and Geithner.

By 2005 federal tax revenue was growing at an historic rate of 15% (over twice as fast as GDP and government spending) in what will be remembered as the biggest speculative boom in human history. Deficits continued to fall rapidly through the real estate, commodities and equity led boom, until the global financial collapse. And that is WITH the Bush tax cuts. In other words, even after the tax cuts for the rich, the federal government’s budget remained biased so that tax receipts grow at a prodigious rate (far above government spending or GDP growth) when the economy is robust. The problem is that this “fiscal drag” always crashes the economy—which crashes tax receipts and causes the budget deficit to grow.

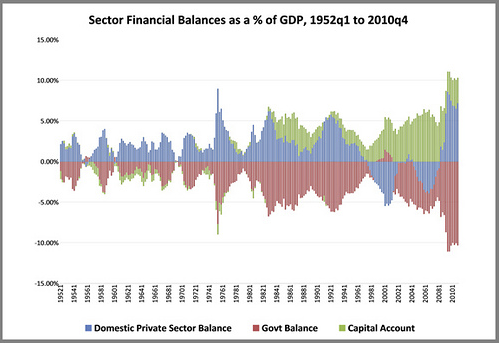

The following graph (produced by Scott Fullwiler) is doubly handy because it shows government balances as well as the balances of the domestic private sector and foreign sector. I will turn to those other balances in a second. Note that we have divided each sectoral balance by GDP (since we are dividing each balance by the same number—GDP—this does not change the relationships; it only “scales” the balances expressing each as a percent of GDP).

A government budget deficit (in red) is shown below zero—and almost all the red is below the line because the government almost always runs a deficit. The domestic private sector, on the other hand, almost always runs a surplus—so there is a lot of blue above the zero line. Finally, we have run large current account deficits on a persistent basis since the Reagan years—shown as green. Because we are viewing this from the perspective of the foreign sector, it is positive (the capital account is positive, so the green is mostly above the line).

This chart shows a “mirror image”: the sum of the government balance plus the domestic private sector balance plus the foreign sector balance must equal zero. For example, the government deficit from 1980 through to the Goldilocks years is the mirror image of the domestic private sector’s surplus plus our current account deficit (the rest of the world runs a positive financial balance against us). During the Clinton years as the government budget moved to surplus, it was the private sector’s deficit that was the mirror image to the government budget surplus plus the current account deficit. (Yep, yet again, yours truly warned about the likely consequences, in 2000—it reads like Nostradamus!: Can The Expansion Be Sustained? A Minskian View. But still no rewards for the wicked. I should have gone into hedge funds management.)

When we collapsed into the Bush recession, the private sector briefly ran a surplus (positive saving) and the government went into a large deficit; as we recovered, the deficit fell and the private sector resumed its spending spree (running big deficits). Finally, the global economic collapse after 2007 saw the return of record post-war government deficits and very large private sector surpluses as households and firms retrenched (trying to pay off debt). (See here: Deficit Hysteria Redux)

So here’s the real deal. For the foreseeable future the US will continue to run current account deficits. You can attribute that either to foreign “mercantilism” (policies to favour trade surpluses) or to American profligacy—it takes two to tango. Now, if the domestic private sector wants to run a surplus (spending less than its income) then by accounting identity the government budget deficit will equal the sum of the capital account surplus (the US current account deficit) and the domestic private sector surplus. Based on trends over the past three decades we can guess that is roughly 3% of GDP for each. By simple arithmetic that should not be beyond the capacity of any policymaker, 3+3=6, implying the overall government budget will be in deficit equal to 6% of GDP. Since state and local governments need to run balanced budgets and except in recession actually do run small surpluses, we are left with a federal budget deficit something above 6% of GDP. It will be lower in booms and higher in slumps; and it will be higher if our current account deficit is larger (as it has been in recent years whenever unemployment fell) and when the private sector wants to save (which it should do in order to de-lever its debt). (See here: http://neweconomicperspectives.blogspot.com/2011/06/mmp-blog-2-responses_23.html)

To be sure, any long term projection must be contingent—it will depend on those factors just enumerated. But anyone who is arguing for government deficit reduction and convergence to some small number (let us say below the Maastricht criteria of a budget deficit equal to 3% of GDP) must tell us what the implied private and foreign balances will look like. If the private sector is going to save 3% (equal to the budget deficit) then we must have a balanced current account—which implies a very large reduction of imports and increase of exports well beyond what any economist is projecting. If we are not going to bring down the current account deficit, then hitting the Maastricht criteria requires that our private sector move somehow from its current surplus that is well above 6% of GDP right down to zero. That is not only implausible, but it is dangerous. The implied implications at fixing a government deficit at a low level must be explored and justified. But that is not what Pete Peterson funds. He wants “research” that fuels the fires of hyperventilating deficit warriors.

Finally, how would a progressive—free of Peterson purse strings–approach the budgeting process? The best recent piece is here: The Case Against Intergenerational Accounting, The Accounting Campaign Against Social Security and Medicare. Full disclosure: I was a co-author but I am not too immodest to recommend it as my fellow authors were James Galbraith and Warren Mosler—two of the very best on the subject of budgets and deficits. I cannot do justice to the argument in a few paragraphs, but here is a quick summary. We first take on the “infinite horizon” forecasts of people like Peterson and David Walker, who calculate tens of trillions of dollars of “unfunded entitlements” due mostly to Medicare. (The RI budgeters obviously take this nonsense at face value, proposing budget fixes to slow down growth of Medicare costs in the distant future.) We discuss how silly it is to make extremely long period forecasts that require assumptions about a distant world that we cannot even imagine. Recall that the Clinton administration projected budget surpluses for 15 years (by identity that would mean destruction of private sector wealth for 15 years); 18 months later we were back to deficits. Deficit warriors carry their nonsense to infinity and beyond. (Our RI friends carried it through to “only” 2035—but how many of us are able to make firms plans about 2035? What odds do you want to place on any bet you are willing to make about events in 2035? President Bristol Palin vs Malia Ann Obama?)

We show how the intergenerational warriors adopt assumptions rigged to guarantee unsustainable trends—and we refer to Herb Stein’s quip that unsustainable trends will not be sustained. No need to worry about a projection that Medicare is going to run up $60 trillion of budget deficits due to health care costs that rise much faster than GDP. It will not happen for the simple reason that all households and firms would be bankrupted long before that (since, after all, they pay the majority of healthcare costs, and if those costs rise faster than GDP and wages and revenues they are, as we might put it in highly technical terms, screwed).

More importantly, we remind readers that government is not like a household or firm. It must take into account the public purpose: its spending mobilizes resources for the public purpose; and its taxes reduce the ability of firms and households to access resources. When our deficit warring Republicans say today that they would never approve a tax increase under any condition, the only reasonable response is a hearty laugh, a reference to WWII, and a two-by-four across the brow. Would these morons have refused to give to the government the resources it needed to conduct the war effort? Would they have opposed war-time taxes, rationing, and forced patriotic savings that by design reduced the flow of resources to the private sector (in order to preserve them for the military)? In war or its moral equivalent (as Jimmy Carter put it), Republicans would not give the government the resources it needs to achieve the public purpose? Then they have no business serving in public office. Throw those bums out; their view is that government exists only to generate rents for Wall Street and other blood sucking vampire squids.

Now, I know that many will smirk when I talk about government serving the public purpose. That is, of course, the progressive’s audacity of hope. But remember, we are talking about a progressive approach to budgeting. Our Austerian friends want to destroy government; I presume that is not the goal of RI.

Deficit hysterians love to attack Social Security, indeed, it is the main target of hedge fund manager Pete Peterson. Let me quote from our paper:

For Social Security and other permanent programs, what matters for long-range projections are demographics, technology, and economic growth. Financing is virtually irrelevant. If by 2083 every U.S. citizen is over age 67, no financing scheme will allow us to meet our commitment to let people retire at a decent living standard at age 67. This, however, is most unlikely. Indeed, all plausible projections of demographic trends show only gradual and moderately rising real burdens on those of normal working age in terms of numbers of dependents (aged plus young) per worker. The Old Age, Survivors, and Disability Insurance (OASDI) part of Social Security currently moves less than 4.5 percent of GDP to beneficiaries, and that rises to about 6.5 percent over the next 75 years. On the one hand, this is a significant increase, but on the other hand, similar shifts have occurred in the past without generating economic crisis or intolerable burdens. And it still leaves over 93 percent of GDP outside OASDI.

In other words, we need to look at federal government programs in terms of command over resources; if it is too great, that leaves too little for the private sector; if it is too little we’ve got unemployment. And if we do not reduce private sector income as we increase the government’s command, we will get inflation. That makes it clear that the main issue about government spending concerns its command over resources. The main purpose of taxes from this perspective is to fight inflation—by reducing private competition for the resources. In addition—as discussed above—we need to factor-in private sector desire to save. When that is high, more resources are left idle—to be mobilized by government—but when it is low, there are fewer idle resources. All of this also depends on the foreign sector: if foreigners want to export to the US, pressure on our own resources is thereby reduced. We can simultaneously have more private sector spending and more government spending, without the need to ration resource use by increasing taxes or encouraging saving.

The progressive approach to budgeting is to first identify the public purpose: what do we want government to do. Second we determine whether our society has the resources or can develop our capacity to produce them. Third we examine potential conflicts between the government and the private sectors; that may modify what we expect government to provide, or it might lead to taxes or other policies to reduce private sector demand. And, fourth, we put together a budget to achieve those goals. In that regard let me close with a long quote from our piece that lays out the purpose of budgeting:

The purpose of a program budget is to discipline the program. It is to hold managers accountable and to discourage fraud. This is why specific amounts of funds are appropriated to specific programs. Without budgetary constraints (as well as oversight and other means of exercising control), it is likely that “mission creep” would lead to continual expansion of any particular program. Thus, it is certainly appropriate to hold programs accountable to ensure that they do what they are supposed to do. However, there is little public or government interest in reporting long-range projections of the “fiscal balance” of particular portions of the budget. And while officials in any program should be held accountable after the fact, there is little public purpose and no economic interest served by reporting the resulting, after-the-fact fiscal balance of particular portions of the federal budget. For example, if Congress appropriates $100 billion for a transportation project, those in charge should provide an ex post accounting for all spending. They should explain the reasons for cost overruns and their careers should depend on acceptable performance. However, whether the total tax revenue received from any particular source (e.g., gasoline taxes) equals spending on transportation over some arbitrary period adds nothing to this.

We do understand the desire to provide an ex ante projection of total federal government spending and revenues for coming quarters, or even years. This facilitates analysis of the expected impact of fiscal operations on aggregate demand and thus on economic growth, inflation, and employment. There may also be some interest in disaggregating spending and taxing to match in an ex ante manner transportation-related spending and transportation-related tax receipts. This is not because fuel taxes actually “pay for” transportation spending, but because such a process can perhaps help to discipline the budgeting process by “allocating,” in an ex ante sense, expected revenues among program spending. However, the success of the transportation projects should not be measured by the ex post balance between total spending and total tax receipts related to transportation over the course of a fiscal year or any other arbitrarily chosen period. It might be very poor public policy to cancel a vital transportation project merely because projected fuel tax revenues fall short of expected program spending.

Now that would be a progressive approach to budgeting. And clearly, it would focus on the near term. The RI exercise that budgeted through to 2035 is silly at best. At worst, it plays into Peterson’s hand.

Let us conclude with some comments on the current Washington political game that involves the debt ceiling. It is almost too stupid to deserve comment. As a parent of teenagers, I know that the best way of dealing with stupidity is sometimes to ignore it. But these Bozos in Washington can cause real damage. It is very striking how our Washingtonian fiscal Austerians who are trying to tie up the Treasury’s purse strings never apply the concept of “affordability” or “solvency” to issues of national defence. You want to attack Iraq or Libya? Or Canada? Constitutional issues aside, the funds are always appropriated immediately. We never talk about a war (even one of choice) “bankrupting” the nation. Nor do we submit our defense budget to Beijing on the spurious grounds that they are “funding” our deficits. Nor for that matter does the Pentagon consult with Pimco’s Bill Gross and the other bond market vigilantes before bombing the heck out of some developing nation. Yet somehow, their views become paramount when it comes to a discussion of what the Pete Peterson crowd derisively calls “entitlements”—that is to say government spending that does not flow to the top tenth of one percent of the income distribution where Peterson resides.

Even more absurd are the arbitrary limits we place on spending via Congressionally imposed limitations, such as the debt ceiling. Leaving aside the dubious economics underlying this foolish self-imposed constraint, the debt ceiling does raise issues of Constitutionality. Even one of the President’s (and Wall Street’s) prime deficit warriors, Treasury Secretary Timmy Geithner, appears to understand this. According to accounts from the Huffington Post, Geithner actually cited the 14th Amendment to the Constitution, which stipulates that “The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.” During a Politico-hosted interview on May 25th the Treasury Secretary quoted this passage and noted: “I think there are some people who are pretending not to understand it, who think there’s leverage for them in threatening a default,” he said. “I don’t understand it as a negotiating position. I mean really think about it, you’re going to say that– can I read you the 14th amendment?” [HuffPost]

The economics of this are even more clear than the politics and constitutionality. A sovereign issuer of the currency cannot be forced into involuntary default on its commitments. The reason is simple, and follow on from Bernanke’s statements that the Fed spends by “keystrokes”. If Congress relents in its silliness (or if President Obama asserts his Constitutional authority to spend allocated funds), the Fed and Treasury can coordinate to ensure all payments are made as they come due. They do this by “stroking keys”; all it requires is some electrons judiciously sent to the right balance sheets. At a minimum, RI college students should have been taught that. If they had been, they would have realized that “affordability” is a Pete Peterson red herring.

Time for a progressive approach. If Peterson will not fund it (do not hold your breath), cut the purse strings.

*Thanks to Scott Fullwiler and Marshall Auerback for comments on early drafts.

Can a progressive take tainted money and remain progressive?

No.

Well, not if they want more money.

It’s really that simple.

So you’re saying Vespasian was wrong?

Money doesn’t smell? Maybe not as a when it’s tax revenue, but when it comes with (explicit or implicit) strings attached, then the yes, V.’s wrong.

Same bilge that comes out every time….cut the rates…eliminate the loopholes….blah…blah…blah. Head Start…Universal Pre K….more of the same from the lefty laundry list!

Do have to give them credit for taxing carbon! Not because it has anything to do with the climate but that they are finally being honest that it was always intended as the additional revenue stream. Just one more push and we’ll get socialism to work.

What a pack of rubes!

You didn’t read the article again, right?

Stop wasting comment space.

When the only “rebuttal” is irrelevant YAF boilerplate, you know it’s a good piece.

Oops, pardon me for violating fish’s First Amendments rights and being so judgmental. I regret the error.

Otto,

You are the one who is out of line here. Calling out a lame comment is perfectly legitimate. And this is not the a public space. This is my private domain. Concepts like the First Amendment not germane here. He and you can make noise in the public square, but this is private, hosted space and don’t you forget that. Comments are a privilege, not a right.

What I want to know is…who the hell is Otto to adjudicate redmeatlover’s adjudication?!

Fish grew a couple of legs and wandered onto dry land. Tried breathing, tried some words.

Oops, didn’t work.

Back to the deep blue sea, fish. Maybe your grandkids will manage it.

Patricia:

The word hiel is interesting, init? I mean: it can refer to blood and water, heels, or the reciprocal property of ice and heat.

Amazing. It’s one of those words from the middle-age of inventive metaphors that just keeps promising more gravy! Like logos on a polo-pony.

Pero, lo siento. Tengo hiel.

Nice threadjack. I hope the incentives make it all worthwhile.

Peterson: Reduce this nation destroying government debt your selfish babyglut parents will have racked up. It’s *your* future.

Millennials: Sir! Yes, Sir. …um, but may we please still have universal Pre-K?

Honestly, if you accept Peterson’s debt crisis premise, then there are only two things worth discussing at this point in time: the damage that the financial sector is wreaking in the US and around the globe (with no end in sight and who knows what’s next) and the permanent (expanding, illegal) war in the Arab mid-east.

So, I’m with Fish. There’s no need for a limpid laundry list of dreary middle class baby puke if we all agree with Peterson that the Republic is in dire crisis.

It’s just so timid, I can’t even stand it. Nothing that timid could ever be remotely progressive.

No, they aren’t paying them 5 bucks an hour, those are interns posting. Interns who are grateful that their beloved masters will give them some free work experience working in the new knowledge economy! The interns are just “paying their dues” while their bosses are just getting paid.

That’s the free market at work folks!

Wait– are we still talking about the paid trolls or are we talking about the Roosevelt Campus Network? I lost track.

What’z the name of this site?

Do be called Naked Capitulate-ism.

Y’all is jokin’.

Nope.

Wahl, don’t sound like a videeo game.

It ain’t. They speak Angle-ish here.

Is that like fishin’?

Wahl, Cleetus, it do be a bit like fishin’ with the right style bait. Gotsta use the right waggle-worm to get a bite.

Hope they don’t get-a-turtle.

Nope. Turtles done put their heads inside-see in this heat.

Wahl, I like it hair.

Yep. Feels like Loo-wee-see-anna!

Those of us from the South are insulted that everyone seems to assume that we think with an accent as well as speaking with one.

as well as = in addition to

mea culpa

Randall Wray would have you believe the choices are limited to government intervening where the private sector cannot. However, there are other options that still leave his precious accounting identity intact without leaving the US in a more precarious financial situation.

Example 1: Default on debt. In this scenario, the public sector runs a surplus, which is explicitly covered by the private sector. However, the private sector does NOT pay for the deficit via declining GDP. Instead, the private sector pays via wealth reduction. A nice side effect of this action is to reduce the bloated wealth inequality in the system. (There are of course wealth effects, but it is not the clear zero sum game that Randall is suggesting).

Example 2: Let current account fund the reduction.. There is no reason why declining spending can’t be explicitly directed toward external country products, explicitly as a result of national policy!

This reduces the deficit and reduces wealth, but does not does not directly impact GDP. In fact, using his simple accounting identities

Dear Scott,

In example 1, you can be the first in the private sector to do without.

In example 2, it takes two to tango. Who’s going to buy our stuff? Work harder and for less pay, you say? Again, you first!

Both of your examples are a race to the bottom. You can recommend them only because you’re sure you wont win the race.

Ugh…

“…the public sector runs a surplus, which is explicitly covered by the private sector.”

So, the private sector ‘magically’ stops deleveraging and borrowing again? No… So, the private sector stops spending as much… and this doesn’t affect GDP growth. Peterson… is that you?

“There is no reason why declining spending can’t be explicitly directed toward external country products, explicitly as a result of national policy!”

Protectionism then? Yes, this could be done. But its no panacea. It might reduce public deficits a little bit. But not much. Maybe by 1%. And this 1% would pretty much directly translate into reduced consumption for people who buy cheap foreign goods. (Hint: NOT rich folks)

And on an aside personally I like when the world’s big nuclear powers have trade dealings. It makes me feel all warm and cuddly.

The first two questions look like a segue for the third, what a progressive approach to budgeting, as opposed to the programs of a progressive budget, would look like.

The problem is, of course, that we will never get a budget that concentrates on good jobs, homes, education, healthcare, and retirement as long as we have a kleptocracy and the current two party stranglehold on elected office and the corporatist and looting policies they promote and defend.

Watch Julian and Slavoj, Frances. Might help:

http://www.democracynow.org/blog/2011/7/5/watch_full_video_of_wikileaks_julian_assange_philosopher_slavoj_iek_with_amy_goodman

Thanks for the link. Žižek is great, and it’s good to see Assange still a free man.

Assange was wearing ankle bracelet and had to leave tout de suite to make curfew or whatever they call it there.

He also made an interesting comment about why he didn’t yet release the BoA documents — apparently he’s being blackmailed and it should be a no-brainer for us to figure out about what…

Another interesting part of that Assange & Zizek conversation moderated by DemocracyNow’s Amy Goodman, is where Assange explained that he is suing Visa/Master Card over “Economic Blockade” of Wikileaks.

http://www.democracynow.org/2011/7/6/wikileaks_sues_credit_card_companies_over

I hope to sometimes see some analysis here about this “Economic Blockade” and how corporations are using this strategy.

Psychoanalystus

Discussion of Progressive budgeting absent a broader economic platform seems a tad myopic. For example, federal revenues would increase without any change at all in the tax structure, if wages rose. Since Ronald Reagan (or a tad before, truth be told) America has lost higher paying manufacturing jobs and has replaced those jobs with lower paying service sector jobs and its leaders have often lauded such changes as “progress”. I believe this mistake is a primary cause of the current financial calamity as it caused Americans to take on more debt to maintain a middle class lifestyle, which itself fed the bubble blowing machine. A central part of any Progressive economic plan must be increasing wages by increasing domestic manufacturing. Whether that would be best accomplished through trade policy or taxation, is a fine subject for intellectual investigation, but ignoring this engine of catastrophe renders discussion of budgets almost superfluous. Similarly, income disparity and the corruption of the public good purpose of government through the influence of money in decision making (hello Mr. Peterson), while not an economic issue per se, is certainly a Progressive one. In short, this discussion of budgetary considerations from a Progressive perspective absent a more thorough discussion of Progressive political-economy thinking tends to generate cognitive dissonance and snide remarks from conservatives who see the world through a completely different frame. Progressives need to do a better job of conveying a cohesive political economy plan as it is my opinion that such a plan would resonate with a large number of working class conservatives and truly undermine the moneyed power of the likes of Mr. Peterson.

Everything I know about finance, I learned in this blog, Paul Krugman’s and Robert Reich’s:-)

The reason I also waste blog space here is from a well-meant but probably misguided effort to provide a view from outside.

Progressives, Democrats, Socialist and beyond, I think it is just a matter of haggling about the price of sellout. I cannot condemn, however.

I used to differentiate myself as a European style leftie, but recent events taught me that there aren’t any of those remaining either!

There is a way for progressives to take Pete Peterson’s money and remain progressives. Take all of Pete Peterson’s money and put him in Guantanamo for financial terrorism.

>> Can One Take Billionaire Pete Peterson’s Money and Remain Progressive? <<

Sure they can. They call that "pulling an Obama".

Works great with Wall Street money too.

Psychoanalystus

Wow. Randy’s been writing a lot of stuff recently. He’s just put up a new Wednesday blog on Roubini’s site. And then there’s the tutorials over at NEP.

Methinks the Levy Institute are running an illegal cloning program…

There is much to respond to, but I will focus on what I think is the central issue.

“That makes it clear that the main issue about government spending concerns its command over resources.”

This is true. However . . .

“The main purpose of taxes from this perspective is to fight inflation—by reducing private competition for the resources.”

. . . this is not.

The ugly reality is that the government has access to whatever resources in the nation it cares to take control of, because it has full power of coercion. There is no “competition” with the private sector, because the government can take as much as it pleases, and there is little to nothing the private sector can do about it.

Governments in the past have taken full control of resources in the economy. Ours does not, for the simple reason that the founding principle of the nation is that the rights of the people, while protected by the government, are also protected by virtue of the fact of limitations on the government’s power. The government taking full control of resources is a possibility, but one that would deprive the people of their rights; and since it is in their interest that the nation is being run, there are limits to what the government can take control of, and how.

In that light, the budget issue should be seen as another facet of the ongoing debate over the relationship between government and the rights of the people. The government must appropriate some level of wealth from the people, but if it is too much, or if it is done in a way which is deceptive, the rights of the people are infringed. Also part of the same issue is the currency – the currency contains with it an implicit promise from the government, that it will maintain the currency in such a way as to preserve the people’s ability to store value with it; and surely the people’s ability to have a store of value for their personal property is also a rights issue.

In that light, inflation is a secondary consideration – it is a symptom of the fact that government has violated its commitment to serve the people, by undermining the value of the currency which they have relied on as a store of value. That violation of commitment may be more or less serious than the violations of other commitments to the people, e.g. to pay out future benefits, but neither should be celebrated in any way, as both are serious violations of trust.

The role of the budget, then, is to prevent, or at least mitigate, such terrible “lesser of two evils” decisions. Ideally, deficits would be minimal such that the government would not have to debase the currency to meet its obligations. Deficits can be run even for extended periods of time, but the larger they are and the longer they are run, the greater the risk is of a financial emergency forcing the government to choose between meeting its financial obligations and debasing its currency, either way infringing on the rights of the people.

“All of this also depends on the foreign sector: if foreigners want to export to the US, pressure on our own resources is thereby reduced. We can simultaneously have more private sector spending and more government spending, without the need to ration resource use by increasing taxes or encouraging saving.”

This is dangerous thinking. The problem with imports is that importers must be paid. We frequently forget that, because those who import to the U.S. have, in the past, been willing to be repaid with U.S. currency (funded by expansion of debt). That will not always be the case. If and when importers begin demanding foreign currency – a virtually inevitability if the U.S. debases its currency – we will be forced to borrow it and will therefore become subject to foreign lenders and their terms, and will find ourselves in precisely the same predicament that many other nations now find themselves – heavily dependent on external financing to maintain our way of life. If that is not a serious risk to our sovereignty, I do not know what is.

“We discuss how silly it is to make extremely long period forecasts that require assumptions about a distant world that we cannot even imagine.”

“Extremely long period forecasts” may not be reliable, but at a minimum, certain clear facts should be included in the planning process; among them being that things that cannot be sustained forever will not be sustained forever. A government benefit program whose costs consistently rise faster than the rate of expansion of the tax base will absolutely have to be adjusted at some future point, and it is not just ignorant, but deliberately foolhardy to insist that such a thing cannot be known. Likewise, economic trends that are dependent on demographics absolutely will adjust as those demographics change, and it would likewise be foolhardy to ignore that.