The GAO released a report yesterday that provided some anodyne but nevertheless useful confirmation of many of the things most of us knew or strongly suspected about the Fed: it’s a club of largely white male corporate insiders who do a bit too many favors for each other. But the GAO seemed peculiarly to fail to understand some basic shortcomings of its investigation.

The report has the dry title FEDERAL RESERVE BANK GOVERNANCE: Opportunities Exist to Broaden Director Recruitment Efforts and Increase Transparency and is the result of an amendment to Dodd Frank by Bernie Sanders to audit the governance of the Fed. Sanders’ office published a useful list of highlights, such as:

The GAO identified 18 former and current members of the Federal Reserve’s board affiliated with banks and companies that received emergency loans from the Federal Reserve during the financial crisis including General Electric, JP Morgan Chase, and Lehman Brothers.

There are no restrictions on directors of the Federal Reserve Board from communicating concerns about their respective banks to the staff of the Federal Reserve.

Many of the Federal Reserve’s board of directors own stock or work directly for banks that are supervised and regulated by the Federal Reserve. These board members oversee the Federal Reserve’s operations including salary and personnel decisions.

Under current regulations, Fed directors who are employed by the banking industry or own stock in financial institutions can participate in decisions involving how much interest to charge to financial institutions receiving Fed loans; and the approval or disapproval of Federal Reserve credit to healthy banks and banks in “hazardous” condition.

The Federal Reserve does not publicly disclose its conflict of interest regulations or when it grants waivers to its conflict of interest regulations.

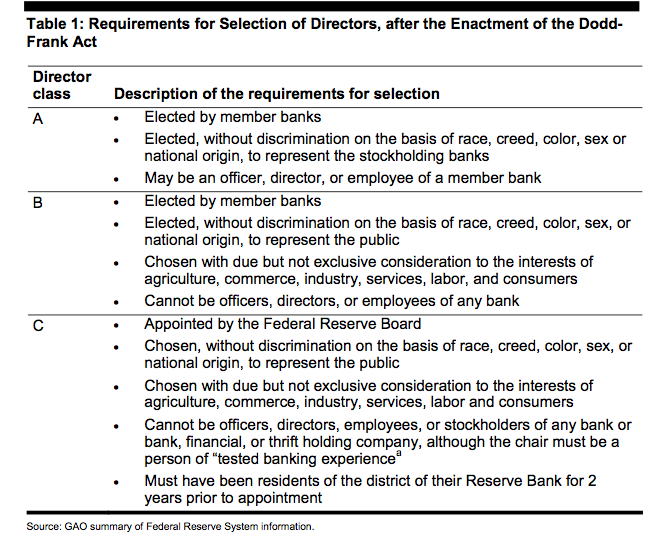

The report is very much worth reading. Roughly the first half discusses, in considerable detail, how the Fed is governed, for instance, the role of the regional Reserve Banks, how their Class A, B and C directors are selected. And a big chunk of the balance of the report, which the Sanders extracts ignored, discussed the lack of diversity in the key decisions makers at the Fed and discussed measures for improving that (the biggie was not taking people from the very top level of banks, since those are heavily white men, but from the next tier, which is more mixed).

This is an important issue, but not for the reason the GAO focused on. The Fed has always have the mandate of preserving the safety and soundness of the banking system, and later had the “dual mandate” added, of promoting price stability and full employment. It isn’t hard to see that the Fed has long been more interested in price stability, and Greenspan added a new mandate, which was that of preserving financial asset prices (note that that is also generally consistent with low interest rates).

Economist Joe Stiglitz has long advocated that labor should be represented on the Fed’s interest rate setting Open Market Committee, and this raises a point given short shrift by the GAO: the most important type of diversity missing from the Fed isn’t ethnic, racial, or gender, it’s class.

Both Class B and C directors are supposed to represent broader public interests, but Kathryn Wylde of the New York City Partnership illustrates how badly that works in practice. Her foundation is an advocate for large financial firm and big business donors. She had the nerve to try to tell Eric Schneiderman, New York state’s top law enforcement official, to back down on investigations that might hurt her meal tickets, in particular Bank of New York, which she has chosen to defend with particular vigor. This is unabashed cronyism.

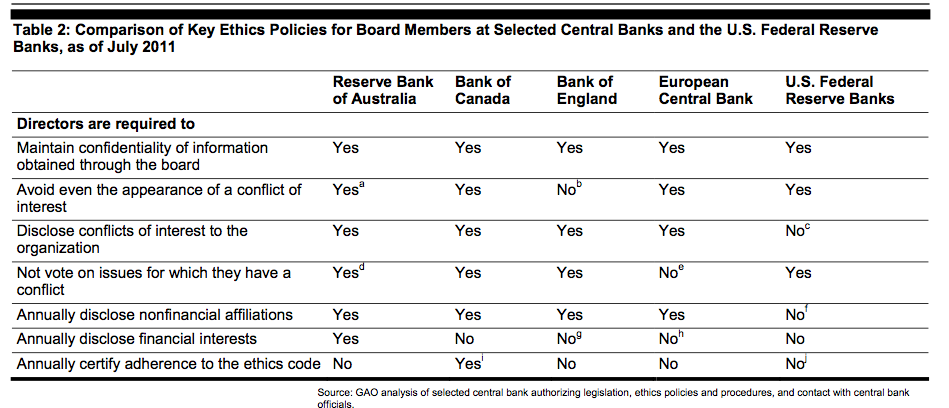

And this points to a major gap in the GAO report. The GAO found evidence of conflicts of interest, such as the notorious incident in which former Goldman co-chairman Steve Friedman continued to be a Class C director even after Goldman became a bank without getting a waiver, and even worse, acquired more Goldman stock while privy to the Fed’s interest rate and rescue-related debates and decisions. But there is no way to know what conflicts the GAO missed, since the obligations to report conflicts are non-existant. The Fed has an official “Don’t ask, don’t tell policy”:

So as much as what the Sanders report unearthed was troubling, we have no idea how many unknown unknowns there are. This is why ongoing audits of the Fed are critical. It is hermetic, hopelessly biased towards large financial firms, and is too far removed from accountability even as its power and political role have grown. It needs to be forced to respond to interests of the broader community, not just favored insiders.

“Stiglitz has long advocated that labor should be represented on the Fed’s interest rate setting Open Market Committee, and this raises a point given short shrift by the GAO: the most important type of diversity missing from the Fed isn’t ethnic, racial, or gender, it’s class.”

But Stiglitz’s remarks can be interpreted as making just this point about class albeit indirectly.

And it is understandable why broad representation fails given the selection process. This report seems pretty anodyne really.

This reads as though most Fed appointees do have some sort of rigorous background in economics and finance. Do unions and various consumer protection organizations employ economists, etc. of equal standing? Who could be seamlessly integrated into existing Fed bodies?

Probably, but the consequence would be the kind of paralysis that is currently allowing the train wreck of Europe to unfold. About the only way these bodies can work is if everyone within them is of one mind even if it’s closed.

The only solution is a return to outdated, laughable concepts such as ‘greater good’ and ‘public service’, or better yet (you’d better sit down for this) ‘honesty’ and ‘integrity’ – ideals which nowadays feature only in fairy-tales and their grown-up equivalent, Hollywood.

I dont’ agree. Roosevelt made a point of having very diverse views among his top staffers. McKinsey recruits people of very diverse backgrounds and is able to have them work together effectively. I’ve personally recruited people who were unusual and had them work together very effectively. You have a pretty narrow idea of what it takes to make an organization work.

agreed, I would think the TVA and WPA are good examples

I know spell checking is not the most productive use of your time, but pls fix “favored insiders” for clarity sake. Thx.

Why? You obviously know what was meant. One wonders what people like you would’ve done before there was dictionary. I mean, all those “misspelled” words! Hell, you probably would’ve written one yourself so you could run around beating people over the head with it. If you’re gonna be anal, go do it in private.

Good God; do you really think the problem with the Fed can be solved by affirmative action? Hasn’t the experience with multicultural boards of directors taught you anything, or are you perhaps angling for an appointment?

Look: the problem with the Fed is that its sole purpose is to enable bank looting and perpetual inflation. It is working just as JP Morgan and Paul Warburg intended.

Jake — I agree with you totally. I thought the whole diversity issue was one big straw man and the typical answer coming out of do nothing washington. Do you not thing you can find enough people of diverse color that would back the current fed policies.

I thought the list of problems by the GAO were laughable. I mean let’s focus on how the Fed controls billions flowing to so called economists in so called academia to rubber stamp what the Fed wants. Why should the Fed decide who gets these funds much less distribute what is basically the money of the people of the US.

Then much more needs to be explored about insider trading. The leaks that come out of the Fed is like a sieve. Ever hear of one person from the Fed being prosecuted over insider trading.

Bringing up EEOC issues is laughable. It would be kind of like going into the Mafia family and saying they are violating the EEOC because everyone is Italian while they are committing all sorts of crimes from murder on down.

Having spent a number of years in the audit function, I also fail to understand the call for an audit. What kind of audit are we asking for. To me the clear call should be either total elimination of the fed or at the bare minimum clear guide lines of what the Fed is allowed to do with American citizens money and if you violate those severe penalities including time in a max security prison.

well…Al Capone did go to jail for tax evasion

A large minority of the population CANNOT handle any confrontation of any type (http://www.amazon.com/Influence-Practice-Robert-B-Cialdini/dp/0321011473) and will rationalize a behavior away (“oh….they aren’t looters, they just made some itty bitty mistakes and they are truly sorry!”) to avoid any conflict or consequential action. They are

truly sweet and forgiving people…..however….

Sociopaths depend upon this to divide and conquer the population, such that no meaningful response can occur

to a looting (made legal by the same sociopath’s contributions to Congress/Lobbyists) of the citizenry.

The percentage of the population that has no problem

with conflict and confrontation has now realized it must

act while carrying the dead weight of the learned helplessness crew. Enough lives have been seriously

disrupted to produce a critical mass….it’s a fickle

threshold, but one nudge too many can be lethal…

jake chase: “do you really think the problem with the Fed can be solved by affirmative action?”

Yves Smith: “the most important type of diversity missing from the Fed isn’t ethnic, racial, or gender, it’s class”

The point of having labor represented isn’t to have diversity for diversity’s sake, but to try and have someone on the board who actually cares more about working people than about inflation or bond market confidence.

1996 Board of Directors

Herman Cain, Chairman

(January – August 19, 1996)

Chairman and CEO

Godfather’s Pizza, Inc.

Omaha, Nebraska

http://www.kc.frb.org/aboutus/leadership/kansascity-alumni-directors.cfm

They have plenty of diversity at the Fed, just look and see.

Maybe Obama will get a Fed job, after 2012?

He’s earned it, right?

Yves,

Your insights ‘within’ the ‘system’ are always amazing. But, I’m always surprised how you miss the point when the analysis steps back further ‘outside’ the ‘system’.

I recently read Chris Hedges’ Death of the Liberal Class. Hedges arguments are VERY convincing: there are essentially no liberal forces (i.e. institutions fighting for the working class’) remaining in the ‘system’. I would be surprised if, after reading his book, you didn’t agree with Hedges.

From this ‘outside’ perspective, FlyingKiwi is simply saying that the system needs to bring back liberal principles (e.g. ‘greater good’, ‘public service’, ‘honesty’, ‘integrity’).

Your response referring to people with “diverse views”, “diverse backgrounds”, and “people who were unusual” seems to indicate that you believe ‘liberal’ people are all around, still integrated and an influential part of the ‘system’.

I disagree. I agree with Hedges and FyingKiwi, liberalism is completely missing from the table… and that is an extremely serious, if not the biggest, problem we face.

Having more people who are not part of the elite business/political community in the Fed apparatus say the economy sucks and ordinary people are hurting would be more progress than you imagine. There is a monster disconnect between how the economy looks to the top 1% and the people at the Fed who talk only to them or whose fortunes are closely tied to those of the 1%. No joke, the affluent (which extends into the top 10%) have no idea how bad things are and a lot of them buy the propaganda that the problem is “structural unemployment” or worse, too much regulation of business.

Diverse views and thought processes are necessary for organizations that seek to productively grow and benefit their employees, customers, and shareholders.

Diverse views are NOT needed for organizations that are actively looting their servile populations. Such diversity might include opinions like “maybe we should not do (insert looting activity).” These opinions must be excluded for the party to continue. Opinions on the degree and timing of looting are allowed.

Ascribing a potential “good” motive in any form to the Fed or the United States Government, now, today, is anathema to me. I have no hope for positive change.

The only hope I have is for the devolution of government due to lack of revenue, power center infighting, and the opting-out of the 53% (or whatever percentage that pays taxes but is not the top .5%) who devolve themselves into voluntary simplicity and non-compliance.

Perhaps this blog post should the link to the pertinent article below?

http://www.alternet.org/economy/142603/priceless%3A_how_the_federal_reserve_bought_the_economics_profession/

“Probably, but the consequence would be the kind of paralysis that is currently allowing the train wreck of Europe to unfold.”

What’s paralyzing Europe is having 27 countries to satisfy, not the diversity of class.

Yves is right: you have a very narrow concept of how groups work.

You say seamlessly but don’t you actually mean toothlessly? Isn’t seamless integration the problem?

I meant to imply members who could argue on an equal intellectual footing, not be part of existing groupthink.

This is the governance level (the boards) not the managerial level or staff.

And tell me exactly why Kevin Warsh was qualified to be on the Board of Governors?

I don’t think much of economists. The Fed is full of monetary economists who are arrogant and don’t know what they don’t know. Shaking them up and making them be less insular would be a big plus.

I know nada. Last paragraph and your observations about Roosevelt answer my question nicely. Thanx!

Well Yves we do agree on that point. Having a degree in econ among others I think very little of economists. In the 70’s I got a C in psych because I thought Freud was just a hack and I think the same about most econ thinking.

Most econ schoold should be torn down to the ground and totally rethought.

There would have been zero chance for the constitution to have been ratified by the colonies had an institution like the Fed been even hinted at in the proposed text. It was bad enough that the constitutional convention was held in absolute secret, yet the proffered text intentionally vague enough for the status quo ante of the pre-revolutionary legal system to continue and flourish: Thus the smooth transition from the British to American aristocracy. Much of the opposition to ratification held views that the document had no clearly articulated principles that would discourage the formation of secret schemes and collusion between powerful persons.

A thoughtful read of history, thanks.

One can only hope that the resolution to our current situation does not evolve in any back room without public scrutiny.

We will see if the world is ready for structural change or just a rearranging of the deck chairs on our good ship Titanic.

I think that’s true. In broader business or political settings the policy alternatives are often numerous and unconstrained by rigid institutional limitations. And the goals are so simple and self-referential — profits and victory — that they enable a machiavellian logic as the primary energy of argument.

With the Fed, the nature of the beast (no pun intended) limits policy options to a few narrow variables — open market operations and asset purchases (if I remember my textbood reading). And the choices here are so heavily influenced by the academic school one subscribes to as to be virtually pre-determined.

And since this is theology and not gnosis, there’s little that differences in business background, gender, skin color, or broad life experience can influence.

Either you go for tight money or easy money, or you just say F&ck It and go for the MMT approach, which would be such a jump from the prevailing orthodoxy that it would be a theocratic change, likely to come from middle age white guys in Kansas, not some rainbow coalition who made their money working the levers of the current regime or in some other field entirely.

Not to say that more diversity isn’t socially beneficial at an abstract level, but I don’t see how it would change anything — as it didn’t during the housing boom and bust. The institutions did what they did because of the cult-group-think and timidity in the face of the prevailing priesthood, which is human.

If they appointed horses, tropical plants, dolphins, and talking parrots to the boards and started channeling their energies for insights, then we might get somewhere new. But that’s admittedly unlikely.

Exactly. Diversity of opinion is what counts.

I don’t see cronyism as being any more genetically linked to skin colour or race than intelligence. Plus, in my admittedly limited experience, I’ve found women to be quite capable of groupthink as their male counterparts. Ditto for members of this or that race. So selecting for certain genders and races to ‘diversify’ the group’s THINKING, as opposed to mere visual characteristics, won’t necessarily eliminate cronyism, much less stimulate new ideas. Cronyism is probably a good trait (social desire to cooperate with the group) run amok.

I would rather look to improved procedure than improved social engineering to address the problem of cronyism. Maybe shorter terms for each member of the Fed would help to counteract this tendency?

Fritz. Evolution is hillarious. The Fed actions induced the ripping open the curtain behind the Wizard of Oz to tens of millions of people. Now the model will evolve. Alan Greenspan in claiming debate aren’t for the little people back in 2004 shows he was never the genius wonder kid many believed. Bright yes, genius no.

Give the man his high priest robes back so he can at least look normal to his shrinking flock faith-based and deluded followers. Go worship the sun on another planet. I thought we were all getting over that?!?!

You’re right, fritz, just like the guys pictured below:

http://www.globalresearch.ca/articlePictures/ clintonsignsglasssteagallrepeal.gif

(What a grand bunch they were…../end_sarcasm)

http://www.globalresearch.ca/articlePictures/ clintonsignsglasssteagallrepeal.gif

Did you leave out “male” in your title?

And it would be interesting to learn more about the gender composition of our top 1 percent, in general.

What I’d like to know is how much of the 1% is made up of inherited wealth. We certainly know what fine contributions to society have been made by the likes of the Kochs, the Waltons and Richard Mellon Scaife.

A recent article by Konczl I saw over on global research ca gave a chart of the top 1 percent by *income from IRS data. Entertainment was 3 percent, trust fund babies about 6. Data doesn’t give mean figures in each category. So trust fund babies may average 1b but Athletes and entertainers 10m.

I believe that the report is a cover for the global inherited rich….they don’t have income that will ever be seen by us little people just like you can’t disentangle their overlapping matrix of ownership.

I believe that there are parts of the 1% that are on the side of the 99% but they have no power in relation to the global inherited rich that have generations to build their power structures and control mechanisms.

Laugh the global inherited rich out of control of our society and into rooms at the Hague. Perhaps during the prosecution of these folks perversion of our world we can determine how best to insure that it never is allowed to happen again.

There’s a subtle point here. Most of the people listed as making their money from finance, as corporate executives, etc. didn’t inherit their vast fortunes.

But they did inherit small fortunes, which allowed them to get started on their career.

If you start out without a small fortune and embark on a career as a criminal, you end up in prison. If you start out with a small fortune and embark on a career as a criminal, you end up with a large fortune.

Well, the Seven Sisters (elite US all-womens’ colleges) have very fat endowments, often better than those of comparable elite mixed-sex universities, in spite of the fact that many Seven Sisters graduates never worked a day on their lives outside their home. (Spare me the PC talk, that’s just how it was until not long ago.)

I have to say, what bothered me most about this report was the blatant disregard for central problem of the Fed system: that conflicts of interest are built into it, by design. Meaning that incidents like Stephen Friedman will continue to happen, regardless of policies put in place: http://bit.ly/qi8dNW

‘Steve Friedman continued to be a Class C director even after Goldman became a bank without getting a waiver, and even worse, acquired more Goldman stock while privy to the Fed’s interest rate and rescue-related debates and decisions.’

Goldman Sachs and Morgan Stanley are prominent examples of investment banks which, prior to Bill Clinton’s sell-out signing of the Gramm-Leach-Bliley Act, were PROHIBITED BY LAW from masquerading as banks. Since they didn’t and don’t serve as deposit takers to the public, saving their white-shoe asses is not our freaking problem.

As is so often the case, the foot in the door of eroding legal standards was provided by none other than the squalid old bank cartel, the Federal Reserve. Wikipedia recalls the sordid history:

What conflicts of interest? The interests of the FRBNY, Goldman Sachs and Stephen Friedman’s pocket are perfectly aligned.

http://dailybail.com/home/is-stephen-friedman-guilty-of-insider-trading.html

Appease the gods, haha you get it. If you have a cement foundation with air pockets in it, the house collapses and then you remove the rubble and fix the air pockets.

Leave the old priests to console the saddened worshipers out in the desert. Maybe this shouldn’t just happen metaphorically. The irony would certainly be delicious.

The GAO just recently learned that photography was invented? All one has had to do for the past century is look at the photographs of the members to come up with the obvious.

One way to get better diversity would be to mandate one or two members of each Fed district come from small local or regional banks headquartered in cities with less than, say, 1 million people. These people understand traditional banking but also have to relate to the 99% or their business fails.

They already do. The regional and local fed boards are much more diverse — in all respects — than the national board and FOMC as a result, and given Yves short synopsis here, the national level seems to be where the GAO is focusing its attention with this report.

The GAO’s mandate allows it very narrow discretion in responding to requests for reports. It also maintains a very high bar in terms of the accuracy of it’s claims. The relevance of their conclusions therefore depend heavily on the quality and relevance of the questions asked of it. If you want the GAO to produce more systemically relevant reports, then encourage your representatives to write them a request for an answer on a systemically relevant question. Of course, the GAO’s budget faces deep cuts, so they will prioritize mandated reports above others.

RD, how about 7 billion bankers and no middle man?

and, Yves, to your point about diversity–Stephen Friedman, former Chairman of Goldman Sachs, was one of those Class C directors “appointed to represent the public”.

If this is the Fed’s idea of Joe and Jane Q. Public, well, let’s just say it explains a lot.

So it sounds like the Plunge-Protection-Team-conspiracy theorists might have been on to something after all—-except that the PPT is merely front-running/insider trading by Fed insiders.

The Plunge Protection Team or PPT is not a theory of any kind let alone a ‘conspiracy’ theory. It is short hand for the following: from http://www.rense.com/general52/secretsoftheplunge.htm

Executive Order 12631 – Working Group on Financial Markets – Mar. 18, 1988; 53 FR 9421, 3 CFR, 1988 Comp., p. 559.

“By virtue of the authority vested in me [Ronald Reagan] as President by the Constitution and laws of the United States of America, and in order to establish a Working Group on Financial Markets, it is hereby ordered as follows:

Section 1. Establishment. (a) There is hereby established a Working Group on Financial Markets (Working Group). The Working Group shall be composed of:

(1) the Secretary of the Treasury, or his designee; (2) the Chairman of the Board of Governors of the Federal Reserve System, or his designee; (3) the Chairman of the Securities and Exchange Commission, or his designee; and (4) the Chairman of the Commodity Futures Trading Commission, or her designee.

Economist Joe Stiglitz has long advocated that labor should be represented on the Fed’s interest rate setting Open Market Committee, and this raises a point given short shrift by the GAO: the most important type of diversity missing from the Fed isn’t ethnic, racial, or gender, it’s class.

A big part of the problem is how the FOMC is constituted — it’s peopled by regional FEDs’ presidents, their managers, not their chairpersons or other board members, who tend to have far more diverse and broad backgrounds. Changing that would go a long way to shaking up the FOMC’s focus.

Also, your continued minimization of ethnicity and focus on income above all is unnecessarily simplistic. It may have an attractive kind of logic given your own ethnic, regional, and income(?) background, but it’s simply not the case that controlling only or mostly for income will substitute effectively for, and provide the kind of broad advocacy, perspective, and interests that often accompany, other identities. This is another example of you bashing, ‘identity politics,’ in center-left and left politics by and as a way of pushing an identity politics of your own — specifically, lower- and middle-income Euro American identities. You’re not the only one, of course: both Susie Madrak and Firedog Lake often rail on this kick, stridently, hysterically, and myopically (none of which you’re doing with this post), and I’ve stopped reading them as a result. The compartmentalization that’s become a pattern with this kind of Euro ethnic identity politics is unnecessary, since multiple identities and advocacies can effectively coexist in left politics, and when it shows up here at NC, it often distracts from your otherwise almost uniformly high-quality blog.

Of two minds about that. The corrupt banking cadres infesting the Fed staff could be curbed by almost any kind of diversity. Class diversity would be great. But if you want intellectual variety, as opposed to just plurality of interests, you do need cultural diversity. For example, nobody in this country thinks in terms of economic rights – nobody except indigenous peoples. For everybody else, it’s banker’s dogma, progress=Ke**rt. The inclusion of some native peoples and recent migrants would bring the Fed more in line with current development thinking that subordinates finance to human well-being instead of the reverse. Academics are no substitute: the Stiglitz Commission sank without a ripple in this country.

“The corrupt banking cadres infesting the Fed staff”

Really? Nuance and detail lost on you? The overwhelming majority of STAFF in the Federal Reserve System are just ordinary people working from paycheck to paycheck. Hard to see how corruption would build amongst that particular crowd. The lack of diversity exists at the director level, think multi-tiered corporate boards, which coincidentally could be said about the boards of directors of most organizations.

Don’t blindly vilify everyone within an organization because you’re too slow to distinguish between the relative roles of the individuals in that organization.

“the Fed staff could be curbed by almost any kind of diversity”

Like the diversity provided by Herman Cain (Deputy Chairman of the Federal Reserve Bank of Kansas City)?

Diversity of sex/race/ethnicity/religion, while desirable for a variety of reasons, is often used to mask a lack of diversity in financial interests. Or do you think that Barack Obama or Michelle Bachman are friends of the 99%?

I have blood of three indian tribes in me and do not believe in economic rights! Economic rights is just a code word for communism! Get over it!

“Economic rights is just a code word for communism!”

Unless you’re talking about the economic rights of bankers.

Anon, alternate media has a new role in attempting to defend the concepts of equality. Publishing articles that it wasn’t “All those cursed Jews” that did it actually leads to fixing the foundational model.

1880’s propaganda still circulates that all bankers are Jews and all Jews are asset-strippers, therefore all Jews must die. Another reason why indpendent media is so critical these days. When 1880’s propaganda can still be so widely circulated and believed, Houston we have a problem!

My solution would be to populate the board entirely with Native Americans who didn’t believe in 1% concepts like private property.

Wouldn’t that be fun.

Any light shone on the Federal Reserve, what it actually is, how it is constituted, and how it functions always shows the same thing, that it is a completely corrupt institution run by the banksters for the banksters, and screw the 99%.

So in that sense the GAO report does some good, while still missing the larger point. It is rather like finding that there are problems in governance aboard a particularly murderous and destructive pirate ship and making a few suggestions, not as to how the piracy might be stopped, but what cosmetic changes might be made to make the piracy more acceptable to the pirated.

Democratize the Fed.

How should fed directors be chosen?

Random selection from geographically diverse high school graduates w/o felony convictions.

I think its important that directors be able to read staff reports and bring knowledge from different parts of the country.

But I don’t think there is any evidence that businessmen or economists are better at setting monetary policy than citizens.

Since electoral systems are easily gamed by money and media

why not try randomness?

The Fed exists at the pleasure of the Congress. Whereas we once had a collection of money center banks we now have a few national banks that have combined commercial banking with investment banking while we have concurrently adopted the canard that there are institutions that have become too big to be allowed to fail. We have socialized the cost and penalty of profligacy and failure.

Critically, our government, most especially the Justice Department has gone missing and there have been no prosecutions of what appear to have been flagrant common accounting frauds. The SEC is now doing some catch-up but the civil actions result in chump change fines. It is worrisome that the statute of limitations is ticking and there is a high probability that some of the most flagrant frauds will not be prosecuted.

In light of all of the foregoing it is no surprise that we have OWS, a tower of babel convention that could well be the seed bed of an off-with-theirheads flight to anarchy.

So ‘quelle-surprise’ indeed. What is clear to the thoughtful is that this mess will not be resolved any time soon and that the trip to resolution will be very painful. What we have is a cancer that has been festering for the better part of 50 years. The tentacles of our malady reach across social classes; but the core of the disease lies in the monied classes who while comfortably rich are not necessarily competent nor sufficently thoughtful to lead us to a better place. In fact, for them, their best interest appears to lie in the further coniving and cheating that will make safe their ill gotten gains.

President Obama offers change you can believe in. One has to wonder just what kind of change he has in mind. This is a Presidency that inherited a sorry mess, it is a Presidency that has yet to offer genuine leadership.

The solution to the economic problem of excess credit money is not the creation of more credit money. Daily, the Fed forces interest rates to ludicrously low rates and savers and fixed income souls are made substantially poorer. In fact, the entire population is being made notably poorer.

History will ultimately be very unkind to those who ascribe to the false philosphy of the easy credit that saved zombie banks at the expense of the production economy.

Sorry, but what exactly does the voice of organized labor add to the making of interest rate policy? An inflation bias? What’s the point? Why not recruit giraffes to make sure the interests of giraffes are well-represented? Maybe some academic clown can develop a theory of giraffe targeting, or diagram steps for the giraffe twist. More mandates only allow the Fed to compound its failures. The Fed should do only what it needs to to, has demonstrated it can do, by decisions made free of conflict of interest. In other words, the Fed should be abolished.

Abolish the FED.

The government does not need it and bankers should NOT have it.

You Progressives make me laugh. Central bankers are thieves. What good does diversity among thieves do? An honest person could never be a central banker, at least not for long.

Hey but theft is OK as long as the “right people” are in charge?

You get it F. Beard. I’ll put it in biblical terms for you: You cannot pour new wine into old wineskins.

The “Right People” are in charge, all the way to THE RIGHT.

Quelle surprise, crocodiles can’t be tamed.

Labor? Like the unions that voted for thise that passed NAFTA?

The only purpose of a central bank is to serve the 1% at the expense of the 99 by inflating or expanding credit.

Jefferson would cry angrily and with pity at the fact that some 100 years ago this many tentacled FED beast slithered into its insidious existence, quite literally in the dark of nights in 1910 and made legal in 1913.

All central banks rule by using a clever Ponzi money scheme! Private semi-humans have created a “banking” system designed specifically for their own greed and power.

What in hell does one think FIAT MONEY and FRACTIONAL RESERVE are, for god’s sake??!! Aids to the working and middle class??

The ONLY way to deal with the FED is to abolish it completely! Forget fixng or auditing it! It is like giving vitamins to a flesh eating zombie to make it a more sensitve being. Destroy the damn thing!! GEEZ!!!!!

There is another way:

1) Make the FED part of and subservient to the government.

2) Allow the government to issue currency in all forms (coins, paper bills and bank deposits).

3) Outlaw Fractional Reserve Banking. Make all bank deposits 100% reserve government issued money.

4) Abolishing the FED will lead to very unstable pre-FED like banking. Banks runs and bouts of extreme deflation.

5) The government can fight deflation via increased government spending or just by “increasing” citizens’ bank account balance.

6) The government can fight inflation by decreasing government spending and/or taxing and destroying currency.

Mansoor

The Fed has NOT supported price stability since its inception!!!

Inflation is itself the byproduct of excess liquidity….money that essentially goes to bankers and corporate leaders. So the fed essentially has the same bias towards an inflation mandate that gvmt would have therefore the fed has to be STRICTLY reformed and enforced.

From the Federal Reserve Act itself…”shall maintain credit aggregates commensurate with the economy’s ability to grow” meaning you allow for there to be sufficient credit to grow the economy but keep prices stable….ie THE SAME. Growth in a zero percent inflation policy is the best growth because you get a stable dollar, reward savings and enjoy reall prosperity backed by real lending practices (backed by solid collateral) with normal interest rates (ie depositors have a say now since their MONEY forms the basis of new capital not Fed credit and monetization).

Jane D’Arista, of the PERI Institute says: –I mean, we’re already appointing the board. Why aren’t we appointing the presidents of the reserve banks or whatever regional situation we decide makes more sense in the current context? So, yes, I mean, the democratization of the Fed is a very important issue. But it’s not the only issue, and too many people really focus too much on that and not actually on the operations of the Fed. The Fed gave up reserve requirements as a tool. It allowed the banks to sweep the accounts out, not have required reserves. It allowed–and then Gramm-Leach-Bliley in 1999, the so-called “Modernization Act”, came in and said, you, the banks, asked for this, and got–we can borrow for traditional as well as special things. So they no longer–the large banks were no longer dependent on deposits. They could go in and borrow money from the other financial institutions. So that’s when we got this terrible situation going, where the financial sector borrowing from one another, investment banks borrowing as well, in the market for the repurchase agreements, took us to the brink of disaster, because, [as] I was explaining to you on another occasion, they were borrowing money, pledging assets against it, taking the money that they received to buy more assets to borrow more, and that was the pyramidal Ponzi scheme, which collapsed. And part of the problem there was they were liquefying the markets irrespective of the Federal Reserve. They were creating liquidity in this fashion themselves, but they were also becoming so interconnected with one another that if one of them went, the others were going to follow.

JAY: And this liquidity was, to a large extent, used in gambling against each other in derivatives schemes, Ponzi schemes, etc., etc., rather than into the productive sector of the economy. So is there a role for your new Fed (I don’t know what you would call it; maybe you could still call it the Federal Reserve; then you don’t have to change the name of your book) to say to the banking system, you can’t have this money if it isn’t going into the productive sector?

D’ARISTA: That is correct. In other words, the Fed has to go back to using tools which will control the supply of credit as well as the interest rate, which only influences the demand for credit and which has proved to be very weak. People will borrow even when the interest rate is high if there’s a lot of money around.

JAY: And is there also a role for the Fed to strengthen small community banks and regional banks and actually diminish how much support for the big six?

D’ARISTA: Absolutely. That too.

http://therealnews.com/t2/index.php?option=com_content&task=view&id=31&Itemid=74&jumival=5883

The Fed needs to be subsumed into the Dept of Treasury and money be SPENT into existence rather than lent into existence. Banking, ALL banking, needs to be handled, regulated, and execs paid, as public utilities and NO bank gets any loans from the Fed unless they actually LEND – no more sitting on OUR money, no more hoarding OUR money. Lend to feed economic activity or be shut down.

Best to end the Fed and have currency directly minted and issued by authority of Congress. That along with cleaning/purging of the House and Senate to leave the likes or Sanders, Paul, Kuchinich, and Grayson would be a major start.