By Michael Olenick, founder and CEO of Legalprise, and creator of FindtheFraud, a crowd sourced foreclosure document review system (still in alpha). You can follow him on Twitter at @michael_olenick

Fallout continues from the ProPublica/NPR story “Freddie Mac Bets Against American Homeowners,” though probably not the sort ProPublica expected.

Many in the blogsphere who work on finance and housing finance issues, including myself and Yves Smith, didn’t find the piece to be convincing. In a rebuttal Yves, who like me is anything but a cheerleader for the GSEs, explained Freddie’s practice is, in reality, only slightly more nefarious than clearing snow from the parking lot. That is, of all the awful decisions Freddie Mac makes, this isn’t one of them.

ProPublica co-author Jesse Eisinger replied to Yves’ critique in the comment section. I e-mailed Yves about Jesse’s remarks and she suggested I flesh my observations out into a post.

To recap: Freddie Mac purchases and bundles mortgages, bundles those mortgages into pools of mortgages, then sells the expected mortgage payments to investors in the form of bond-like securities.

Securitization is a vital component of the modern mortgage market, or most other credit markets for that matter, since the process frees up capital that can then be used to make more mortgages.

In late 2010 Freddie Mac, according to the ProPublica story, started to retain a greater number of “inverse floaters,” an instrument created when mortgage pools are turned into collateralized mortgage obligations. As Yves pointed out, even though this portion is typically hard to sell and is thus often retained by the originator, it often makes more sense to use a CMO to create more conventional-looking bonds that can be sold to investors at better prices and retain inverse floater because it results in lower interest rates than if they sold a simple mortgage pass through. The GSEs have a mandate to provide more affordable loans to homeowners and better results to taxpayers, so lowering the cost of mortgage funding is consistent with those objectives. It is true that inverse floaters benefit when borrowers don’t refi, but as Yves pointed out, the GSEs engage in very complex interest rate hedging strategies. Looking at this position by itself tells you nothing about Freddie’s overall interest rate bets.

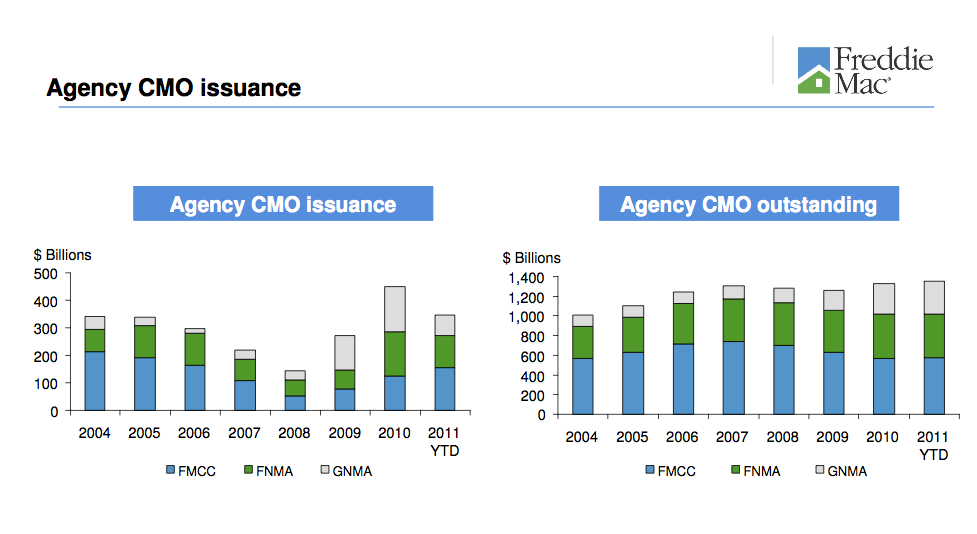

ProPublica tried to argue that an increase starting in 2010-2011 versus 2008-2009 in the number of deals where the inverse floaters were retained was a sign of Freddie positioning itself to bet against homeowners. The authors apparently failed to look at Freddie’s CMO issuance during this period. Its CMO issuance rose, and so it appears that much, perhaps all, of the increase in retention was due to an increase in mortgage funding by Freddie (see the bottom blue bars in the left hand chart):

Moreover, the inverse floater is the portion of the CMO that is most exposed to prepayment risk. Given the uncertainty about government intervention in the mortgage market, investors in both straight passthroughs and in CMOs would be more leery than usual of taking prepayment risk. To put it in trader-speak, as readers have, this is a “long vol” bet, and if investors were unwilling to buy volatility (as in vol was unusually cheap), it would make even more sense to retain it.

Yet ProPublica contended that Freddie Mac’s use of inverse floaters represented a conflict of interest because the GSE would lose money from the hedges if borrowers refinanced to lower interest mortgages. They implied Freddie could abuse its influence in the housing market to prevent lower-interest refinancing programs, which are better for borrowers.

I’ll summarize Jesse’s comments, which I verified did come from him:

• Freddie’s retention of inverse floaters increased in 2010 then came to an abrupt half in 2011, making it appear that the FHFA, which oversees Freddie, told them to knock off which is a tacit acknowledgment the government-owned organization should not profit by trapping people in higher-interest mortgages.

• There exists less complicated and less expensive ways to hedge the interest rate risk. Jesse quoted a trader who summarized “.. comparing inverse floaters to hedging tools is not just apples and oranges — it’s more like apples and cars. They just have nothing to do with each other.”

• Retaining the interest-only streams runs contrary to Freddie’s mandate to decrease their portfolio.

I have to point out that Jesse misrepresented Yves’ argument. She never said the inverse floaters were a hedge; she said you can’t tell what bets Freddie is making unless you look at all their positions, since the GSEs do a great deal of interest rate hedging. The wager represented by the inverse floater may well have been partially or fully offset by other positions.

Since the story surfaced, the FHFA released a statement clarifying that the inverse floaters make up about $5 billion of Freddie’s $650 billion portfolio.

My own analysis is that the argument that Freddie didn’t bet against the American homeowner. There’s just too much direct and indirect evidence supporting they simply made a decision that was, in hindsight, politically bone-headed albeit fiscally benign.

Consider the following:

Every quarter the Office of the Comptroller of the Currency (OCC) releases a study detailing loss mitigation options, including modifications, for mortgages. Their latest study was release for Q3, 2011. They break modification options down into several buckets, including capitalization, interest rate reduction, interest rate freeze, term extension, principal reduction, principal deferral, and “not reported” (the servicer cannot contractually explain what modification term they offered).

Freddie regularly freezes and lowers interest rates in modifications. Since Freddie refuses to engage in principal reduction, it makes no sense they’d neuter one of the favorite tools in their modification arsenal by betting against it.

Here are some modification stats. Keep in mind, while reviewing the figures, that most modifications involve more than one category of relief, so results add to over 100%.

Freddie reduced interest rates in 74% of the modifications they offered and froze rates in 7.6% of their mods. In contrast Fannie reduced rates in 70.4% of their mods and froze rates in 3.6%. In contrast government-guaranteed (FHA, VHA, etc..) loans lowered rates in 93.7% of their mods, private investors lowered rate in 71.5% of their mods, and portfolio loans lowered interest in 83.6% of their mods.

Fannie and Freddie are vigilant, almost to the point or paranoia, about strategic defaults: making bets to trap people in high-interest mortgages makes strategic default more likely. The Mortgage Bankers Association commissioned a study about strategic defaults, comparing them to a disease. That is, strategic defaults, they argued, are contagious across borrowers. Their solution, faster foreclosures to stem strategic defaults, appears nonsensical. But the underlying theory, that if one neighbor sees another move down the street into the same model home for half the rent that the second neighbor will do the same, does not appear far-fetched. Getting back to the issue at hand, it just doesn’t make sense that Freddie Mac, for some short-term trading gains, would risk spreading a “disease” that puts the entire portfolio at risk.

Freddie doesn’t have enough influence over borrower interest rates to believe they could rig the entire market. There’s nothing except the fiscal/monetary policy firewall stopping the Federal Reserve from offering to buy bundled refinanced performing GSE mortgages. By offering to pay a premium they could reduce interest rates and justify enough cash-flow for some limited principal reduction.

In normal times that firewall would prove impossible to breach, but these are anything but normal times. Arguing that the Fed is banned from engaging in this type of relief would be akin to a mother of four arguing she needs to preserve her virginity.

If that happened, and it does not seem far-fetched, Freddie or Fannie would have no say about the matter. People would go to a private lender, who would sell their loans on a private secondary mortgage market, and quickly flip the pooled securities to the Fed. This policy would quickly enable the refi’s, reduce the GSE’s portfolio, and might reignite the private secondary mortgage market.

Freddie surely recognized this risk and wouldn’t be foolish enough to bet against it happening in a major way.

Freddie acts stupid, not suicidal. Freddie is already a political pariah. In modern American discourse there are few areas of consensus on any subject between the political right, left, and center, or between various economists and businesspeople, except that Freddie Mac and Fannie Mae are awful.

Debates typically center around how much they suck, but nobody argues they’re welcome additions to the US business climate. Literally nobody except maybe Newt Gingrich likes these organizations.

Freddie surely would not be so stupid as to overtly bet against American homeowners in this environment. Conversely, once they realized their hedging strategies could be perceived as exactly that they quickly stopped using that strategy, which is why the use of inverse floaters came to an abrupt end.

ProPublica has an established reputation. But sometimes even the best bomb.

It’d be legitimate to question why, say, Fannie and Freddie have a higher 12-month re-default rates than private market modifications over recent years, despite having substantially lower-risk borrowers. An investigative series about their central role in the foreclosure fraud crisis — their reckless policies and practices set the stage for our current fraud-fest — would be welcome and bruising. It’s arguably harder to find something that the GSE’s do right than something they do wrong.

Maybe ProPublica is a victim of its own success. This story about inverse floaters is the inverse of what we’ve come to expect and what the economy requires if we’re ever going to substantively recover: fact-based reporting on serious but solvable real problems.

One would hope that PP would be intellectually honest enough to admit they aired a non-story, but seeing how they pretty much dismiss Yves’s (as well as the WSJ’s) prior research on Magnetar as, and I quote, “Several journalists have alluded to the Magnetar Trade in recent years, but until now none has assembled a full narrative. Yves Smith, a prominent financial blogger who has reported on aspects of the Magnetar Trade” and “there was a bit of reporting on Magnetar before our story. For example, The Wall Street Journal wrote a short but notably early story in January 2008, and the pseudonymous blogger Yves Smith wrote about Magnetar in her new book, Econned [seriously? “a bit”?]”, I am somewhat doubtful that they will.

Anyway, thanks for the post.

My friends told me about—onenightcupid.c/0/m—. She told me it is the best place to seek casual fun and short-term relationship. I have tried. It is fantastic! Tens of thousands pretty girls and cute guys are active there. You wanna get laid tonight? Come in and give it a shot, you will find someone you like there. Have fun! :D

My question is whether or not this is a political hit by Geithner against Demarco.

While Geithner does not give a sh%$ about homeowners or principal mods, his head is clearly exploding at the thought of more put-backs from the GSEs to the TBTF banks.

If only both sides could lose.

Your sentence construction is confusing(“…is that

the argument that…”). Did you mean to say:

[Your] own analysis is:Freddie didn’t bet against the American homeowner. ?

Good point – will ask Yves to update and clarify it. Yes; it’s unlikely that Freddie was “betting against the American homeowner.” They were retaining the IO portion, probably so that they could modify interest later without raising investor liability. One legitimate criticism is that when this issue was raised Freddie could have explained what they were doing, and why they were doing it. The lack of transparency from the GSE’s, especially in an environment of widespread distrust, works against them.

I suspect ProPublica IS a victim of its own success. I hope it reconsiders as uninvited guests come a-calling.

Good read, thanks.

‘Pro Publica is described in a New York Times article as a non-profit group dedicated to “a new kind of investigative journalism.” According to the article, “Paul E. Steiger, who was the top editor of The Wall Street Journal for 16 years, and a pair of wealthy Californians are assembling a group of investigative journalists who will give away their work to media outlets. … Pro Publica is the creation of Herbert M. Sandler and Marion O. Sandler, the former chief executives of the Golden West Financial Corporation’

The Sandlers are huge $$$$ Dem supporters. Not all members of the .01% are politically active behind the scenes, but this power couple is.

It’s the technique of robber barrons: Haul in a destructive boatload of wealth, kill anything that gets in the way and buy off any Gov’mint query. For the coup de grace, build your own “investigative” machine that serves up distraction with a side of scrapple. Some of the most famous and highly regarded ‘Muricans have smashed heads, raped the environment for mineral and pillage and threw people off their land after robbing them blind. Then they made a newspaper.

Hi from Finland, Yves! Our very popular national broadcasting company is putting you on near-primetime with a French document about Goldman Sachs. Cool!

If Eisinger had shown the story to any competant cmo derivative guy they would’ve shot the story down as non-sense. Eisiner jumped the shark on this one. And that he hasn’t backed down and admitted as such, he’s aslo pulled a Dan Rather

Comment over here, folks:

http://www.cjr.org/the_audit/audit_notes_finally_fraud_char.php

Like the Taibbi piece, this PP article aims at the educated, “informed” part of the Democratic base, especially those who back Obama. I find it creepy. I hope you will write an article on how our population is broken into very small segments which are then marketed the political “product”. There is information about this in the book: “Life Inc.” but I think political product marketing has become much more sophisticated since that book was written.

Our newz simply does not involve reporting, let alone investigating what is actually going on. The PP and Taibbi piece could easily have become accurate simply by looking further into the subject. Yet they don’t do any looking. Isn’t actually looking into things the essence of real journalism? Instead we are given misinformation dressed up as the real thing or fairy dusted musings based on membership in a cult of well paid hacks. We really don’t get good information easily in this culture.

I think many (most) reporters mean well — I normally really like both Matt and Jesse’s work — but with a fire-hose of complex and contradictory information it’s easy to fall apart in the grey areas. This is especially clear when there isn’t a clear good or bad character, when a central character switches their normal role, when financial tools are involved that can be used for good or bad purposes without being good or bad on their own (and the definitions of good and bad can be contradictory), when behavior can be doubly construed, and when there’s either data overload or data ambiguity.

I don’t believe there are any conspiracies. Rather ther’s lots of ambiguity and those with political agendas can easily twist that ambiguity, especially if they’re already trusted sources. That’s always true but in this field, where the level of “us vs them” distrust is almost as sky-high as the amount of money and power involved, the effect becomes magnified.

Michael,

I’m having some difficulty in responding to this particular comment because I’m not quite certain who you are referring to at points. For example I don’t know who you mean when you say, “when a central character switches their normal role” concerning the PP and Taibbi stories. So I’m going to respond in general terms and please do let me know if I get something wrong, because I will change it.

Glenn Greenwald is one of the best media deconstructers out there. He has been able to show again and again that the press reports what they are told by the administration even when it is contradicted by information which is known by the press.

If you look at the coverage leading up to the war against Iraq and compare it to the coverage now about Iran you will see many similarities. The war against Iraq really was a conspiracy–meaning the people who planned it knew it was based on a lie and they sent forth their minions to make certain our population was told those lies, over and over again. That lie is still costing lives, health and has left a society in ruins.

I don’t know if you heard this story. I found this at Jonathan Turley’s site. The Washington Post confirmed it was true but said they stopped doing it (after they were outed). “The Washington Post is accused of arranging for meetings between power brokers, lobbyists, and politicians, including Post reporters and editors for $25,000 to $250,000. These meetings are billed as off the record, non-confrontational access to “those powerful few” in the Beltway. Called “Salons,” the entire program is raising eyebrows in both the media and business areas.

This offer includes unique access to the “health care reporting and editorial staff” of the Washington Post.

The flier advertises:

Underwriting Opportunity: An evening with the right people can alter the debate,” says the one-page flier. “Underwrite and participate in this intimate and exclusive Washington Post Salon, an off-the-record dinner and discussion at the home of CEO and Publisher Katharine Weymouth … Bring your organization’s CEO or executive director literally to the table. Interact with key Obama Administration and Congressional leaders …

Spirited? Yes. Confrontational? No. The relaxed setting in the home of Katharine Weymouth assures it. What is guaranteed is a collegial evening, with Obama Administration officials, Congress members, business leaders, advocacy leaders and other select minds typically on the guest list of 20 or less. …

Offered at $25,000 per sponsor, per Salon. Maximum of two sponsors per Salon. Underwriters’ CEO or Executive Director participates in the discussion. Underwriters appreciatively acknowledged in printed invitations and at the dinner. Annual series sponsorship of 11 Salons offered at $250,000 … Hosts and Discussion Leaders … Health-care reporting and editorial staff members of The Washington Post … An exclusive opportunity to participate in the health-care reform debate among the select few who will actually get it done. … A Washington Post Salon … July 21, 2009 6:30 p.m. . . .

Washington Post Salons are extensions of The Washington Post brand of journalistic inquiry into the issues, a unique opportunity for stakeholders to hear and be heard,” the flier says. “At the core is a critical topic of our day. Dinner and a volley of ideas unfold in an evening of intelligent, news-driven and off-the-record conversation. … By bringing together those powerful few in business and policy-making who are forwarding, legislating and reporting on the issues, Washington Post Salons give life to the debate. Be at this nexus of business and policy with your underwriting of Washington Post Salons.”

This shows a complete interlocking directory at the highest levels of govt. with the purpose of getting out the administrations’ message to our public.

I don’t want to take up a bunch more of this comment section but you may really like the book, “Life Inc.” It’s a real eye opener on what goes into political branding.

I wasn’t referring to the journalists; I meant those that they’re reporting on. Fannie and Freddie are oftentimes impossible, irresponsible, and have serious and well-documented ethics issues. So when a reporter stumbles onto something that looks questionable they’re bound to suspect there’s some “there” there, to view whatever they’re seeing with deep cynicism. But sometimes, not always (maybe not even often), but sometimes the “villain” isn’t doing anything especially dastardly.

I’ll check out the book.

Thank you for clarifying what you meant for me. I also appreciate your willingness to check into the book.

you have to learn how to channel your information.

why wade through all the BS?

Freddie’s biggest problem is the fact that they were run by people sympathetic to the bankers. The accepted no paper. They have no deeds of trust (mortgages) or promissory notes in their posession. As a result, they have no beneficial interest in their loans. None.

This created a big problem when people began defaulting. Freddie as a non-owner could not assign the notes to the servicers. The servicers began “creating” assignments out of thin air (MERS) and filing these with the county clerks to establish a beneficial interest. MERS had no beneficial interest to convey.

The State Attorney Generals that sign off on the “blanket amnesty” should be held accountable. Those that “sign off” should be charged with neglect of duty and removed from office.

Times, they are a-changin and the sh** is about to hit the fan.