The Chinese central bank is playing very high stakes poker. China’s interbank markets have been highly stressed for the last two days. An effort by the central bank to tighten in order to put a crimp on shadow banking activities looks to be spiraling out of control as one-week repo rates hit nearly 8.3% up 144 basis points in a day, and one-week Shibor has risen from its June 5 level of 4.8% to just shy of 8.1% today. Per Reuters:

The People’s Bank of China (PBOC) told the market that it would not conduct repo business in its regular open market operations on Thursday, frustrating widespread expectations that it would use reverse repos to inject cash to ease an acute market squeeze over the last two weeks.

By not easing liquidity conditions, it could exacerbate an economic slowdown that already appears well under way. China’s factory activity weakened to a nine-month low in June as demand faltered, a preliminary survey showed on Thursday.

The benchmark weighted-average seven-day bond repurchase rate jumped a whopping 380 basis points to a

record high of 12.06 percent, while the overnight repo rate surged 598 bps to 13.85 percent…But a full-blown crisis is unlikely as liquidity is expected to improve significantly from mid-July, after the seasonal effects of the quarter-end fade and a large volume of maturing PBOC bills and government bonds injects cash into the market, traders said.

As an indication that the market expects improved cash supply in coming weeks, the 14-day repo rate fell

52 bps to 7.41 percent in early trade on Thursday, while the 21-day rate rose a moderate 8 bps to 7.59 percent.

More detail from the Financial Times:

The main reason for the lack of liquidity has been the central bank’s reluctance to pump liquidity into the money market, wrongfooting banks that had expected Beijing would continue to support them with large cash injections.

Signalling that the cash crunch could persist for a while, the China Securities Journal, a big state-run newspaper, ran a front-page commentary saying China was at a turning point in monetary policy. “We cannot use as fast money supply growth as in the past, or even faster, to promote economic growth,” the newspaper said. “This means that authorities must control the pace of money supply growth.”

Interbank rates began to rise earlier this month ahead of a public holiday – a normal pattern as demand for cash typically increases before festivals in China. Bankers and analysts had expected rates to fall when the country got back to work.

Instead, the central bank has remained on the sidelines of the market over the past five working days, refusing to provide the short-term cash injections that banks had expected. On Thursday, the PBoC said it would not conduct repo business at a scheduled auction, disappointing market players who thought it might relieve pressure on them by making a cash injection.

“The only explanation is that the central bank wants to send a warning signal to commercial banks and other credit issuers that unchecked credit expansion, particularly through the shadow banking system, will not be accommodated,” said Na Liu at CNC Asset Management.

Now the notion that liquidity will be better soon may sound reassuring, but recall the progression of our financial crisis. It moved through four acute phases. First was August-September 2007, when the US asset-backed commercial paper market froze over subprime worries. The next was November-December 2007. That, by the way, had a “seasonal” element not unlike the one mentioned in the Reuters story, in that liquidity normally is low at year end because a lot of investors try to close their books (at least as much as they can) as of mid-December. But things got sufficiently dire-looking that the Fed launched its first emergency lending facility, the TAF, in early December. The next was due to the Bear meltdown, March 2013, and the last was the big one, September 2008, in which the conservatorship of Fannie and Freddie were openers to the Lehman collapse and the panicked AIG salvage operation.

Given that accommodating central bank in economies with pretty good reporting was unable to forestall a meltdown, the Chinese central bank’s tough guy stance isn’t looking like the best reflex. The underlying concern isn’t just that there’s been a short term crunch, but that it comes against a backdrop of massive and increasingly low-productivity debt financed investment. And in another worrisome parallel to the crisis just past, it’s pretty doubtful that the authorities have any better handle of the size and interdependence in their shadow banking system than ours did in 2007. A sampling of alarmed commentary. MacroBusiness:

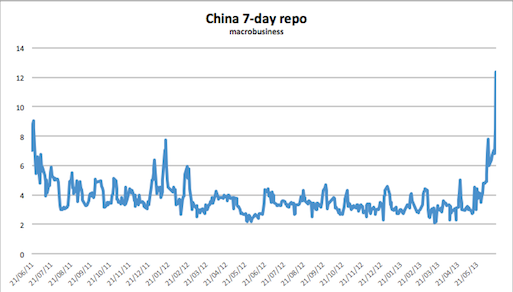

There’s no mystery about why stocks and the dollar are getting pounded today but there is another bogey that is not helping. As I noted this morning, China is going through something of a credit crunch with the PBOC apparently engineering high short term debt costs to squeeze down credit growth. However, today it’s looking a little more chaotic with all short term rates shooting for the stars. 7 day repo for instance:

It is remarkable that China’s central bank has been unable or unwilling to contain the spike in short-term rates, as the interbank liquidity squeeze continues. This is roughly the equivalent of the Fed not being able to control the fed funds rate. You can certainly have fluctuations, but within a couple of days a major central bank should be able to inject enough liquidity into the system to bring down rates – unless of course the central bank wants the rates higher…

It’s not clear if people fully appreciate the potential impact of this liquidity squeeze – including folks at the PBoC. This is not a game. These tight conditions and high rates over a longer period can easily derail lending activities across the country while potentially putting a number of financial institutions at risk and sending the economy into a tailspin. With the Eurozone still struggling in the aftermath of the crisis, let’s see what a recession in China (12% of world’s GDP) can do for global growth. Mr. Bernanke and company may need to go back to the drawing board very soon.

Wang Tao of UBS, via the Financial Times:

A liquidity crunch could happen unexpectedly somewhere. There could be a disorderly deleveraging in the interbank market.

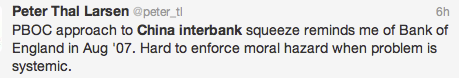

And some tweets:

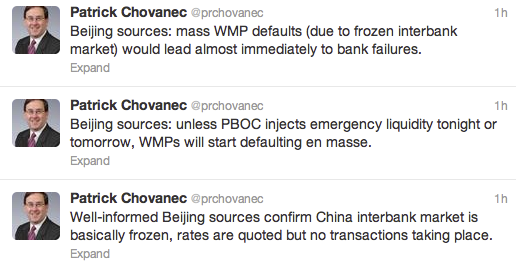

And this gives a clearer picture of the risks:

And as Chovanec also points out, “all the liquidity injections in the world won’t save bad investments from being bad.” But disorderly failures can have knock-on effects to otherwise good but not terribly liquid holdings. That’s the logic of the Bagehot rule: in a crisis, lend freely against good collateral at penalty rates. The PBoC is playing Russian roulette by ignoring this principle. It may come out of this staredown fine, but this is a fraught exercise.

Personaly methinks China is calling the Feds bluff… whom has the real bubble… when it comes to future liabilities… ablity to make good…

skippy…. what a show!

or perhaps from a cynical angle, the Chinese gov’t is pulling a Putin, washing out the over-leveraged private players, and reasserting its control over China’s oligarchs and provincial party bosses who got a bit too wealthy for Beijing’s liking.

Meow lives – still – and the past not long forgotten.

skippy… determination thingy.

So lakewoebegoner, exactly. This is the Party breaking the nascent oligarchs and Taiwan onshorers. Money in motion outside direct FinSys and Party control has gotten big enough lately, and big enough in its britches, that if the Party is going to keep control of the economy they have to whack the tyros. This has been coming for awhile. China does _not_ function like a Western liberal market economy, and actions there cannot be framed in that perspective. Now, that doesn’t repeal economic systemic relationships such as knock-on failures of bystander concerns from a liquidity crunch. . . . But then again, the Center in China has seriously _wanted_ to reign in just such over-leveraged weak shops, who—hasn’t this been the recent meme?—have been frothing bubbliciously. Just what Uncle Ben is doing in Transatlantica, no? China can simply print money to bail out concerns it wants to save while letting the lesser oligarchs lie crushed in the rubble. “Everyone needs us. Really.” That’s the message, to me. And no better time to spark an unwind when the Fed is doing that also and a lot of Japanese money is going to get caught on the wrong side of this . . . .

I hate to say it, but this post reads like WSJ gobbledegook. What exactly is the big deal about a crash of Chinese banks, or shadow banks either? China still has coolie labor and that labor has to eat, and if a few million Chinese speculators lose a few trillion reminbi, who cares?

Anybody know what a reminbi is in real money?

When one is running a command economy, one is perhaps not so scared of bankers squeaking about “Disorderly Deleveraging” to do more than the usual, time-proven, stabilising measures?

Shake the tree a bit, see what falls out. Allocate ressources in the re-education camps – or the organ donation centers – as the occasion merits and make it known. That should keep a lid on things.

Totally. Not to say that the Chinese will not have a heart attack sooner or later, but this one can be fixed in one go in the short term anyways.

For the past few years, every time US bond yields further up the curve threatened to spike to unsustainable levels, we’ve had crises in other parts of the world, prompting safe haven flows that bring long yields down again.

Once again, this time is no different. Makes you wonder.

I don’t wonder at all, I draw an inference. Speculators correlate; originator authorities hit the cut-out switch—or a fuse blows. Credit Mobilier all over again; same as it ever was.

Europe & America needs China to fall down so that it can eat its fossil fuel ration.

However the banks who control these western countries may not be as happy as they make money out of global labour arbitrage.

Energy dynamics is beginning to override these arbitrage machines known as credit banks.

What is a “WMP?” For those of us who are not career finance types.

Wealth Management Products.

That’s Chinese for shadow(y) banking. Or more accurately, retail investment accounts with high yields and some (supposed) deposit protection.

Not a finance professional either, but I’m going to guess “Wealth Management Products.” See FT alphaville article here:

http://ftalphaville.ft.com/2013/06/19/1539712/the-wmp-whack-revisited/

Weapon of Mass Poverty?

Just saying. That is what a lot of them will turn out to be in the end if China has learned well enough from the West.

Sebastian Amithere wrote:

“For the past few years, every time US bond yields further up the curve threatened to spike to unsustainable levels, we’ve had crises in other parts of the world, prompting safe haven flows that bring long yields down again”

Not this time. The dollar will be no safehaven. China is now in a position to withstand their U.S. sovereign debt being severely marked down because they have something in their possession that will more than compensate. And the U.S. does too. We are getting closer to the break the glass and press the red button moment.

Seems to me that a crash in China is not a bad thing for China – it maybe a long term goal for the nation to show it’s people how bad it is to play the international shadow bankers speculation and arbitrage games – that China needs to stay it’s course in the 500? year plan and punish people who play outside the communist box – who exhibit folly. They may be sending a message to their population – don’t let the outside world influence your commitment to our own people.

Just my own thoughts on a highly symbolic driven sector of the human population – not saying that anything is wrong with a different perspective, in fact, differences are great. Now, if we could only avoid bashing each other over our differences in our usual manner (war, conflict, dominance etc) and go about it more peaceably – then all this economic gyration would not seem half as bad. Particularly if we all decided that life and love is more important than money.

Interesting perspective!

China isn’t in any way defined as simply Communist, that’s meaningless. China has been helping the resource grab attempts in Afghanistan by helping to fund the war of terror for years now, but things are changing in Afghanistan.

The party’s only ideal is power, its only goal maintaining its hold on power; it doesn’t care what particular song society dances to, only that they’re controlling the stereo. Or in Deng’s famous formulation, “It doesn’t matter whether the cat is black or white, as long as it catches mice.”

This is a credit bubble starting to pop, not a political play. As it unravels it will become more and more apparent that the party is like the Wizard of Oz – all show, no power. The only reason the party has maintained the confidence of the people is constant growth and perceived progress. High inflation and growing wealth inequality has already lessened the people’s confidence over the past few years. If a crisis disrupts growth and increases inequality further, confidence will disappear and we’ll see some interesting moves as levers are frantically pulled. My worst fear is that in the event of a crisis the party will jump at any opportunity to escalate tensions with Japan as a distraction. I hope I’m being too pessimistic.

mookie said:

“its only goal maintaining its hold on power;”

But all elites know that in order to hold on to power there should be sufficient social stability in society to avert chaos, war and rampant criminality.

more at:

http://aquinums-razor.blogspot.com/2011/02/give-500-per-month-to-each-us-citizen.html

Mansoor H. Khan

putting the squeeze on banks? sounds good to me…

Banks have gone belly up since teh down of times and the sun has risen every since. What is the big deal with a gold old wipe off of bad credit. If written down quickly, equity, bonds of Banks but stopping at the deposit level, it would be healthy. You would have a plunge of GDP of 5% and if enough bad credit is written off a sharp recovery. Europe used to have that old the time in teh XIX century, and yet Europe had a fantastic period of progress during that period.

Some reckless bankers would be kicked, and so what?