Yearly Archives: 2013

A Very Profitable Part Of Banking Goes Totally To Heck

Refinancing mortgages is a phenomenally profitable and nearly risk-free business for banks, and one of the few growth sectors that were actually spawned by the Fed’s herculean efforts to force down long-term interest rates through waves of quantitative easing. Banks went on a hiring binge to shuffle all this paper around and extract fees along the way before they’d dump most of these mortgages into the lap of government-owned and bailed-out Fannie Mae and Freddie Mac. And then they’d run.

Read more...What is Shadow Banking?

There is much confusion about what shadow banking is and why it might create systemic risks. This column presents shadow banking as ‘all financial activities, except traditional banking, which require a private or public backstop to operate’. The idea that shadow banking is something that needs a backstop changes how we think about regulation. Although it won’t be easy, regulation is possible

Read more...CFPB Examiners Find Mortgage Servicing Business Remains a Sewer

Not that we needed additional evidence, but the Consumer Financial Protection Bureau has found more fraud and theft inside the nation’s mortgage servicing operations. CFPB has examiners in both bank and non-bank servicers; this is the first time non-bank servicers have faced such scrutiny. And their new report on Supervisory Highlights for the summer shows that extremely little has changed, despite a gauntlet of settlements that were supposed to end this conduct (OK, not really).

Read more...NASDAQ Trading Halt Open Thread

By Lambert Strether of Corrente.

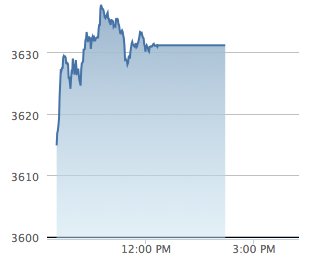

WTF? NASDAQ flatlines. Oopsie:

FT, 1:09PM Trading halted on all Nasdaq-listed stocks:

Read more...Trading in stocks listed on the Nasdaq including Apple, Google and Facebook were halted just after midday in New York as the second-largest US stock exchange by volume experienced technical issues, causing chaos and confusion among traders and market participants.

Equity and options exchanges run by NYSE Euronext, Bats Global Markets and CBOE also halted trading in Nasdaq-listed securities following Nasdaq’s notice that it was experiencing issues with “quote submission to the UTP SIP”, the system that governs the collection, processing and distribution of specific market data.

Greg Gordon Speaks about Singing Every Day at The Wisconsin State Capitol for Solidarity Singalong (and Getting Arrested)

By Jessica Ferrer, Naked Capitalism’s intern. Jessica also interviewed Barbara Parramore on Moral Monday in North Carolina.

While the rest of us are singing in the shower, Greg Gordon and other Wisconsinites are taking their singing to the Capitol Rotunda in Madison. Governor Scott Walker and his administration are the target audience, with the singers meeting every weekday at noon. Gordon says they are singers, not protestors, maintaining a peaceful presence in the Capitol since 2011. However, the Capitol police have started arresting the singers and issuing citations for participating in an “unlawful event” based on controversial permit requirements. The singers don’t have a permit and won’t get a permit. Gordon explains why.

Read more...Links 8/22/13

The Rise of Bullshit Jobs

Yves here. I’m going to reverse my normal convention when I have a cross post but have something to add. Here I first offer you a MacroBusiness post (which in the layered ways of the Web relies heavily on an article by David Graeber) and natter afterwards.

Read more...Ilargi: The Darker Shades Of Shale

By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth, Cross posted from Automatic Earth

No, I wasn’t going to write a third article on shale in 2 weeks, absolutely not. But what I’ve read these past few days doesn’t leave me much choice.

Read more...Patrick Durusau: Groklaw Goes Dark

By Patrick Durusau. Cross posted from Another Word for It

Just in case you missed it, Groklaw has gone dark.

In Forced Exposure, Pamela Jones outlines why Groklaw cannot continue when all email is subject to constant monitoring by the government.

Read more...Links 8/21/13

Why Progressives Are Lame

Yesterday, we ran a post by Bill McKibben on leadership in social change movements. McKibben argued for a “small l” leader model versus a “big L” leader, which readers debated. Some argued that the Leader model was really code for “Great Man” that was a less viable approach than it once was due to assassinations. Others were struck by the emphasis on distributed leadership, which is an obvious analogy to modern computer and communications networks, and how political commentators to frame their ideas of social order in terms of the technology of the day. Some pointed out that the idea of minimal oversight and control of communities was a long-stading Utopian line of thought, often espoused by people who wound up implementing the exact opposite.

However, I was particularly struck by Dan Kervick’s remark, which came late in the thread:

Read more...What Paul Krugman Should Have Learned from James Tobin but Didn’t

Paul Krugman last week wrote yet another response on the issue of “how banks work”. The problem is that Krugman’s critical source for his argument, James Tobin, in fact has taken the position the opposite of Krugman’s on monetary operations, as do central bankers.

Read more...Barbara Garson: How to Become a Part-Time Worker Without Really Trying

Yves here. This post by Barbara Garson, which originally appeared at TomDispatch, describes how big companies squeeze down even more on workers by turning what were once full-time jobs into part-time positions to avoid providing benefits and to push pay even lower (workers who are desperate to get more hours will also accept reduced wages, working off the clock, and abusive work conditions).

Read more...Bill Black: The Banksters Master Irony – Push Summers & Geithner for Fed Due to Their Regulatory Zeal

The big banks are desperate to prevent Janet Yellen from being appointed as Bernanke’s successor to run the Fed. Their sexist attacks have backfired.

Read more...