By Rumplestatskin, a professional economist with a background in property development, environmental economics research and economic regulation. Follow him on Twitter @rumplestatskin. Cross posted from MacroBusiness

As the Piketty-train rolls on it leaves behind it a trail of confusion in economic circles about the proposition to reduce inequality via a global wealth tax.

Economic thinking, it seems, floats on the political tide. The authors of this paper in 2006 noted that:

…at present there appears to be little interest in the net wealth tax. In recent years this tax has been practically excluded from any discussion or doctrinal debate on tax reforms, and over time has fallen into disfavour.

Eight years and one financial crisis later, the tide has turned dramatically in favour of using the tax system as a tool for creating a desirable wealth and income distribution.

Many sceptics, however, argue that a wealth tax, either national or globally, is technically or politically infeasible. The basic reasoning is as follows:

…it is impossible within the U.S., never mind the world, as the top 0.1% own the political machinery. Why would anyone who owns the political process agree to tax themselves?

It’s a good question. But it merely suggests we look deeper at the heart of the matter. I like to use one of Matt Bruenig’s favourite lines, “imagine people did things they already do”, as a starting point.

The point being that if the top 0.1% control the political system, then it should be impossible at all points in time to tax wealth.

Unless you are Spain, and it’s 1977. Or France and it is 1981.

Both these countries brought in annual taxes on wealth, with progressive scales just like income taxes. In France 1.5% of tax revenue came from their wealth tax in 2007, while in Spain around 0.5% of tax revenues are raised from such taxes.

Indeed most countries already raise about 5% or more of tax revenues from direct taxes on property, which is essentially a wealth tax on a slightly narrower definition of wealth.

Not only are wealth taxes possible, they are already a feature of the tax system in most countries.

Implementing a shift towards greater taxes on wealth merely requires a minor tweaking of tax rates and/or qualifying assets for taxes that already exist. The institutional machinery is already in place.

The question of the political power of the wealthy is certainly valid. But this merely provides guidance on likely political avenues for change. The obvious follow-up question is, what political circumstances led to the implementation of current wealth taxes?

I’m no expert here, and I’d appreciate any detailed accounts of the political climate at the time, especially in France and Spain. But it seems that the wealth tax was part of the French Socialist’s Party’s platform in the 1981 Presidential elections; which the right-wing party abolished in 1986, for it to be reinstated just two years later.

At first glance it appears that breaking the link between political power and the interests of the very wealthy, via democratic processes, is one successful political path for change.

It may even be of some assistance, politically, if the economic profession would stop pretending to debate the possibility of things people already do. Wealth taxes are certainly possible and are effective tools for reducing inequality.

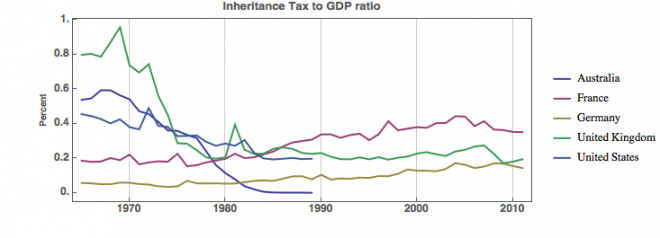

Another wildly successful tax on wealth is the inheritance tax. Inheritance taxes are again real things, that real countries have, but that fell victim to the political tide of the 1970s in the Anglosphere.

At their peak in 1968, taxes on inheritance made up 3.1% of Australian tax revenue, or 0.6% of GDP. In the UK inheritance taxes were 1% of GDP in the same year.

The chart below shows the massive shift away from such taxes at exactly the time inequality began to skyrocket across the Anglosphere:

Australia, the UK and US all went through a political change in the 1970s that saw a dramatic reduction in revenue raised from this source, with Australia and the US abolishing inheritance taxation altogether in 1989.

Germany and France maintained these taxes, which have generated an increasing share of revenue since the 1970s. Australia however, chose to forgo this progressive tax and in doing so has forgone significant public revenues. Last year alone the revenue from an inheritance tax levied as per 1968 would have raised over $9 billion.

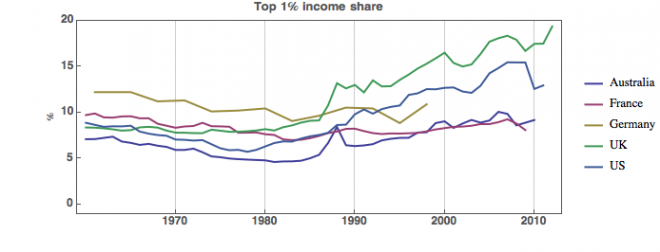

Not surprisingly countries that reduced or removed inheritance taxes saw the most rapid rise in inequality since the 1980s. Below I use the data from Alvaredo, Atkinson, Piketty and Saez’s World Top Incomes Database to show this relationship:

The top 1% share of income shoots up in the 1980s in the UK, US and Australia, while staying steady in France, and also Germany (at least till the late 1990s).

Once again the political tide is in favour of taxing wealth. The economic debate, however, is settled. Wealth taxes reduce inequality. Most countries already implement taxes on wealth to some degree, either through annual or inheritance taxes, and have institutional mechanisms in places to administer the them. The sceptics do raise an important political question, but we should learn from history and see that democratic processes, in which economists play a part, can provide avenues for change.

I’m not sure I can comment on the political climate in either Spain c. 1977 or France in the early 80s, but one thing occurs to me…

Did either country have the political machinery (campaigns, fund-raising, selection process, etc) that allows the wealthy to control our political system in the first place?

I’m not saying it’s impossible to make happen in the United States, just markedly more difficult than it might at first appear.

There is a reason why the wealth tax in France brings so little money : it is so full of loopholes that it makes the US Income tax virtuous in comparison :

A) it doesn’t cover business owners : if one is a controlling shareholder of a company (down to 25% of voting right), one is not liable, (note that it is not shareholding, but voting rights : if google was french, Page and Brin would not be liable ! Bernard Arnault doesn’t pay wealth tax on his LVMH holding either !)

B) it doesn’t cover one own productive assets : for instance a radiologist who owns several millions of equipment doesn’t pay wealth tax,

C) it doesn’t cover the present value of most pensions : most of the wealthy retirees derive their income from their “pay go” pension plan.

D) some life insurance contracts are excluded

E) ultimate insult : it doesn’t cover even cover antiques, which means that art collection is subsidised by the state

The real technical difficulty for a wealth tax is to evaluate the value of assets for which there is no market (such as productive assets, physical and intellectual). The French wealth tax completely sidesteps this difficulty by just exonerating these hard-to-value assets from taxation. Enlarging the tax base is therefore much more difficult than a simple “tweaking”.

Maurice Allais had a good idea concerning the valuation of asset in the framework of a wealth tax : it essentially says that the price at which one declares an asset is a binding offer, that the state can exercise if it thinks that the price is too low. Probably too good an idea to be implemented in reality, just as the Piketty proposition…

ISTM that the problem with taxing wealth is that it’s a rear-guard action: i.e. it’s trying to fix the problem of inequality exogenously and post facto, after allowing the problem to have been created endogenously.

What is needed, imho, is to re-structure our economic system so that massive inequality is not the natural result of the working of the system. If business profits were divided among (and by) all of the employees of a business, for example, rather than flowing first to the owner/manager who then determines how to divide the profits, inequality would be less of a problem for us to deal with.

My major critique of these tax-the-rich proposals (besides the practical, political difficulties) is that they only ever address the problem of inequality after it is already a fact–rather than trying to re-jigger the system so that inequality doesn’t become a problem in the first place. Treating symptoms, in other words, and not underlying causes.

you nailed it. you’re a smart guy. it makes me wonder why you hate white people so much, since they can get tans and they’re not white anymore! haha

seriously, you nailed it. there is an entire theory of economics I’ve developed around that central idea — form and quantity. You can adjust quantity, but there’s no assurance that form will adjust, and you’ll eventually be back in the same place.

But how do you adjust form if not through quantity (i.e. capital flows and investment)? Law is one way. Regulation is one other way. Ideation is another way. There is some additional detail but right now I have to work

Marjorie Kelly’s 2012 book, “Owning Our Future”, addresses this issue.

Who or what is honest / competent enough to administer and disburse the proceeds of this global tax? The corrupt UN? The USSA? I see no organization capable of this … let’s create a new one to manage this? There are no men capable of a) the economic planning necessary for this to lift the masses out of poverty b) To run a clean efficient organization ( so many charities spend most of their money on admin and staffing )

Then again the rich just use the money to buy the political system. Tax the rich and burn the proceeds.

JUST PLAIN UNFAIR

They did indeed. But if we look at Piketty’s own numbers for France at the World Top Incomes database, we will see that for the top 10Percenters, the “take” has been steady at around 32/33% for a long, long time.

Which means the wealth tax that came in since has had an effect, but not that much. (Which is not an excuse for not passing such a tax.)

In America, I would worry about the fact that both LBJ and Reckless Ronnie took hatchets to Top-Income rates, the latter doing the most damage in the 1980s. Just look at the history of US tax rates.

Note that twice in our history we drastically reduced upper-income taxation drastically. First in the 1920s, to be followed by the Stock Market Crash of ’29 and the subsequent Great Depression. Again in the late 1980s, to be followed, this time a bit later, but inevitably by the Great Recession of 2009, from which many Americans have not yet seen the light at the end of the tunnel.

When are we ever going to learn that the greatness of a nation is not numerical – neither in the number of its millionaires/billionaires nor in the horrendous amount of Total Income that they obtain.

The greatness in a nation resides in its sense of Social Justice – that is, it’s committment to the notion that no one is to be left behind. It is just plain unfair, and Uncle Sam’s is one of the most unjust nations on earth.

Great comment.

One way to tap all that wealth is to tax capital gains and dividend distributions as ordinary income, and to restrict stock buy-backs. In the US, the top 1% own 40% of equities, and the top 10% own 80%.

To say “it can’t be done” is to say “the only solution is violent revolution”.

“both LBJ and Reckless Ronnie took hatchets to Top-Income rates”

Wasn’t that JFK, not LBJ, who did that?

The “Kennedy Tax Cut” was proposed by JFK but signed by LBJ.

That was the cause of our Inequality and the rise of the Oligarchy!

The Rich know the Truth. The TAX CODE is their tool to keep the 99.99% in their place! Wage slaves to be stolen from and keep the .01% wealthy and in control of the TAX CODE!

Its imperative that we tax high incomes at rates of 50% or higher, and inherited wealth at the same rates. But the fact that we haven’t even been able to get rid of the “carried interest” charade that income of hedge fund managers is treated as capital gains, and that capital gains are still taxed at a ridiculously low rate, means we’re going to need more ethical leadership before we see anything done to remake our once progressive tax system. Mitt Romney didn’t win the election, but he came close enough despite his putrid defense of his tax rate being roughly half what a schoolteacher pays. If the American people aren’t fully on board with this program how do we think we can get our millionaire politicians to back it?

That thing on Romney’s tax hits the nail Frank. One wonders what ‘we’ do vote for. Policy and law don’t seem high on the list.

There are several issues.

-Voting is tribal.

-We don’t have a one man one vote system.

-Democrats rarely run to the left. There is no alternative. Obama claimed he and Mittens agreed on most issues.

-The media doesn’t help. Being a proponent of education and supporting charter schools are incompatible positions.

-Many people don’t realize the scale of inequality or that they aren’t in the top 2%.

-Taxes at all levels tend to blend in people’s minds, so many voters who go about taxes are worried about the nickel and dining caused by devolution.

-Democrats publicly look down on voters. Telling people they are voting against their interests while offering nothing but Bill Clinton and triangulation wont go over well. Republicans at least lie. I like to call my Senators to complain and went from two GOPs to two Dems, and the GOP offices were polite, helpful, and took my abuse. I called Mark Warner’s office to ask about Ukraine, just ask it first, and the guy answering “uh…uh I can’t speak for the senator.” I had to remind him his job was to read public statements back to constituents. Warner and Kaine’s offices are terrible, and I wouldn’t be surprised if that is how Dems run things. Webbs office was a clown show too.

Since two articles I’ve found on the web do the subject better justice than I could (though a resident of France I don’t pay a Wealth Tax), here are two articles that describe it well enough:

*Solidarity Tax on Wealth

*Wealth Tax in France

This post is a cross post. I’m not the author. Please look at the start of the article again.

Ehh No.

This will further centralize the money power on a now global scale.

A bank operating on a global scale will simply consume resources at a faster rate.

The solution is of course to give purchasing power back at a local and national level.

People will therefore no longer have to work in Donald Trumps new golfcourse to maintain a basic standard of living.

Donald trumps credit card will have less power to control the masses.

Donald is a fool.

But no one ever asks who gives Donald the credit for his escapades.

Attack the ability of this centralized credit to buy up the worlds resources and you will go somewhere to solving real problems at a local level.

Are there dots I’m not connecting?

1) How would raising tax rates on the wealthy necessarily mean further centralizing the money power on a global scale?

2) Where does the post mention a “bank operating on a global scale”?

Who gets the taxes? What will they use them for? Those questions are just 2 dots.

Raising taxes won’t do anything unless the people who collect the taxes are replaced.

“In that, Doug Henwood repeats a bit of silliness I’ve seen from monumentally uninformed critics: MMT claims government doesn’t need taxes. Where do they get this stuff?

How does every MMT explanation of government currency begin? Taxes Drive Money. Put the damned phrase into your favorite search engine. I just did it in quotes to limit the hits. I got 36,000. I did not scroll to the bloody end, but virtually all the links up top went to the MMT literature.

We emphasize over and over and over that without the obligation, acceptance of the government’s currency would come down to a Dumb and Dumber greater fool theory: I accept the currency because I think BiffyBob and BillySue will accept it.

Now, to be sure, taxes are not the only obligation that will drive the currency. As we’ve pointed out countless times, the farther you go back in history the more you will find that other kinds of obligations drove the currency—tithes, tribute, fees, and fines. History is on our side. There are very few examples of currencies that do not have such obligations behind them.

OK, there are Bitcoins. More later.

Jesse Myerson has this right—this is just Post Keynesian theory explained simply. Does anyone doubt that modern sovereign governments impose taxes? Does everyone notice that in almost all cases governments choose a money of account, impose taxes in that unit, and issue currency in that unit.

Is the following logic oh-so-difficult to understand?

From inception why would anyone except BiffyBob and BillySue accept a “fiat” currency if there were no better reason to accept it other than the dupe-a-dope expectation that someone else is dumb enough to take it? OMG if that works, I’ve got a stack of my business cards I’m willing to exchange for your Beemer.

No, we are not that stupid.

As Warren Mosler long ago realized, if he could impose a business card tax on his kids, he could get them to wash the car to earn the means of tax settlement. When he paid the business cards to them, his kids did not wonder if they could find dopes to take them. But they understood that if they didn’t pay their taxes they’d face punishment. Probably not prison, but perhaps straight to bed after dinner with no TV.

Taxes drive business cards. And currencies.

Now, did Warren need to receive his own business cards in tax revenue in order to pay the kids to wash the car? Of course not. He spent first, then got the tax revenue.”

http://neweconomicperspectives.org/2014/05/need-taxes-mmt-perspective.html

“Who gets the taxes? What will they use them for?”

It goes into the “Public-Private Partnership Fund.”

That way, when they charge you to drive on the road outside your house on your way to work every morning or send you a bill for your appendectomy that their insurance company declined, we just give them their own money back.

OUR MEGABUCK FRENZY

Most Megabuck Millionaires make their over-night killings by “going public”. The revenue from such manipulations, since they are like any stock-market frenzy, should be taxed in a punishing manner.

So, why not have an extraordinary Speculation Tax at that level of income? As I noted in a comment above, every time we lower taxes, speculation on financial markets runs overtime as everybody rushes to make a killing. The Greed Factor is a powerful motivating force amongst all humans – and it kicks in when there is far too much ease of manipulation.

Is this the way we want wealth to be created in America? Let’s think about it. Because, regardless of any lingering Marxist notions we may have, it is doubtful that creating wealth can be done away with entirely. It is not capitalism per se that is at fault, but the way we allow the mechanism to function.

Moreover, equities are also employed to reward executive management in ordinary circumstances as well. Why not legislate that these rewards be generalized to all workers in the company by means of a preferred stock (held uniquely by those who work for the company). As well, why not give workers the right to two-seats on the BoD – as is the case presently in Germany? (Known as codetermination.)

Dividends from employee preferred-stock could be the venue for disbursing achievement-related pay-for-performance and exactly in the same manner for determining normal pay rises – that is, by the company’s Personnel Wage Plan. The dividend could be set in proportion to the worker’s responsibility and level of management in the company as well as performance. It would function as an equitable but not equal distribution of net-revenues throughout the hierarchy.

At present, we are fixated upon Return on Investment (RoI), whereas the other input to any industrial/commercial endeavor, that is, Return on Labor Input (RoLI), is neglected. We assume wrongly that wages are more than sufficient as a return to labor.

Such dividend-awards would be taxed at “normal” income tax rates, which should be raised to levels that existed before 1960 – and even progressively higher according to total income. Many think rightly that unfettered income is a threat to our national governance, and given present circumstances that fear seems well-founded.

Before 1960, when LBJ mistakenly started the trend down in upper-income tax rates from the 80/85%-level, America was quite capable of rewarding achievement in business. Since Reckless Ronnie, however, it’s gone on a frenetic binge resulting in unconscionable Income Disparity.

The link above does not seem to work, so here here it is again.

Yes, maybe these issues could be addressed by corporate charters along the lines you suggest. See also http://www.marjoriekelly.com/books/owning-our-future/

She uses the term “Generative Economy”

Dividends are dumb since they are paid out of assets while the purpose of a common stock company is to consolidate assets for economies of scale, not dissipate them.

Instead, the workers should be paid as much as possible with shares in equity, common stock, since those do not dissipate the assets and those shares could be redeemable for the goods and services of the company produced BY the assets.

All Swiss Cantons have a wealth tax. The Federation taxes only revenue, and that tax is lowish as most tasks like education, police, etc. fall to the Cantons.

It is very broadly defined, includes jewelry, art, cars over a certain value, horses, cows, boats, etc., at ‘market‘ value, usufruct (having the use of something) and all financial wealth, bonds, funds, savings, etc. Plus property of course.

Concurrently, there is usually no or very little inheritance tax in CH, which makes sense. The wealth tax accounts for maybe something like 5 – 10% of Canton revenues, depending on tax schemes / place (one very rich person in a small canton..) It is steeply progressive – the low-level saver / bond holder pays nothing. But all property owners will pay something, as even the value of a tiny flat is quite high. (I’m not a tax expert, just general knowledge..)

Huge row going on right now between France and Switz. 1

France wanted to apply inheritance tax on property at their rates (up to 46% but very progressive) to people residing in France (French, Swiss, Swedish..) who inherit property in CH. (I’m simplifying and leaving a few things out.)

Thus breaking the rule that inheritance tax on property is levied at the place of residence.

And pitting two different taxation systems against each other: pay as you go, year by year, CH, vs. pay ‘nothing’ on property (unless you own apartment blocs and a chateau or whatever) but give up, or back, what the State helped you with during your life time. – France encourages property ownership with tax deals, rebates, deductions, loans, mortgages, special savings and insurance accounts, and so on.

France does have a property tax (taxe foncière) but it is melded with what the the Brits call ‘rates’ (taxe d’habitation – garbage disposal, etc.) and is so low that it is invisible. Poor home-owners are exempt in any case.

So, it is not that simple. One shoe does not fit all.

These laws of course also impact many dimensions other than wealth – for ex. territorial management, construction, energy use, etc.

In any case the top 1% are not or little affected, imho.

1. The lower house (CH) has refused the accord and it will probably be junked. France has said it will then denounce the previous accord (1953) and it will apply its legislation unilaterally. Whooooo! This is a big deal around here…

Thanks for those details. Important to keep in mind these things, as loopholes presented by issues such as residency and domicile (2 different things) can make all the difference in whether legislation accomplishes its goal of raising funds from the most well-to-do, or just provides the appearance of doing something to keep the masses quiet.

A very timely article. There has been an initial surge of dismissive attitudes toward Piketty’s proposal for a global wealth tax, even among people who are otherwise very enthusiastic about the book. The attitude has been, “Why waste time on such utopian proposals? That will never happen.” But I have been re-reading Piketty’s chapter on the global capital tax, and it is full of interesting ideas to which people need to pay attention. Just a few random bits from the discussion:

1. Even if a global wealth tax cannot be put into practice in the near future, it can serve as a worthwhile reference point, and a standard against which alternative proposals can be measured.

2. It is possible to move toward the ideal incrementally, beginning with cooperation on a regional level to impose regional wealth taxes.

3. “Many people will reject the global wealth tax as a dangerous illusion, just as the income tax was rejected in its time, a little more than a century ago. When looked at closely, however, this solution turns out to be far less dangerous than its alternatives”

4. Various forms of capital taxation already exist.

5. The point of the global capital tax is not to generate revenue, but to regulate capitalism by (i) decreasing inequality and (ii) imposing effective regulation on financial and banking system.

6. To achieve these two goals, the global wealth tax must promote democratic and financial transparency: clarity about who owns what assets in the world.

7. Even a small global wealth tax would generate a large body of reliable information about the distribution of wealth. “The benefit to democracy would be considerable: it is very difficult to have a rational debate about the great challenges facing the world today – the future of the social state, the cost of the transition to new sources of energy, state-building in the developed world, and so on – because the global distribution of wealth remains so opaque.”

8. The international organizations responsible for regulating the global financial system currently have only a rough idea of the global distribution of financial assets, and the amounts hidden in tax havens. Implementing a global wealth tax would require full disclosure of such information, under penalty of law.

9. A global capital tax would force governments to clarify and broaden information on the automatic sharing of banking data.

10. Progressive income taxes cannot play the same regulatory role and provide the same level of democratic control over capitalism, because for the wealthy income is often not a well-defined concept.

Dan, I’m curious, why do you think capital/wealth can be defined better than income/compensation?

I heartily agree with your first point, but my personal preference is to focus on income taxes rather than wealth taxes precisely because I think income is the easier, lower hanging fruit. I also prefer to directly regulate undesired behavior rather than to try to create incentives through the tax code.

Because the wealthy have assets that appreciate continually in value, but that might not be delivering any kind of income stream that needs to be declared. It would be good to have something like Zucman’s idea of a global capital registry. We need to know in any given year where all the assets are, who owns them, and what their current market value is.

I agree that if we had a good understanding of capital/wealth, a sort of universal property tax would be an interesting idea. But my question is why you think such a definition of capital is easier to create than such a definition of income?

The reason that “wealthy income is often not a well-defined concept” is because the wealthy don’t want income well-defined. If we are talking possibilities here, removing the particular constraints of our present system, I would say such difficulty disappears.

A better question is whether or not the really wealthy have income. Wealth and income are not necessarily the same thing, and IMO income inequality is not as large and important a problem as wealth inequality.

I agree, we need good definitions of wealth and income. But the reason that wealth inequality exists is because of income inequality, both in a direct sense that wealth is the past tense of income, and in a broader economic sense that income inequality creates the two-tiered justice system and other problems, allowing the crimes upon which extreme wealth depends to proliferate unopposed. The reason that American judges and prosecutors and police chiefs and tenured professors and doctors and so forth enable the system is because they are significantly better off than most workers. With less income inequality, there is less incentive for them to entrench the various oppressions of our system.

Or to say it differently, if you don’t tax income, then you entrench a high standard of living for some at the expense of the rest. Because by definition, what is spent on consumption is beyond the reach of the wealth tax. Wealth is income minus expenses.

Families with large wealth holdings learned a long time ago that their wealth can go up by $10 million in a year with zero tax owed, whereas families whose income goes up by $10,000 a year might pay taxes as high as 50% on the marginal increase. Wealth and income are to sides of the same coin, which is one reason we ask businesses to prepare both income statements (cash flows for the period) and balance sheets (the wealth – or asset cost – balances at a point in time). An interrelated tax system, including both income and wealth taxes, prevents the wealthiest families from playing games between “reported” incomes and non-reported increases to wealth.

Adopting a wealth tax as a true alternative minimum tax (that could be partially offset by any income taxes paid) would be a key selling point. Another key selling point would be to offset regressive taxes on working people by the amount of revenue collected from a wealth tax. Shifting current taxes from labor and onto passive income and wealth sources would do more for lower and middle income working families than merely increasing more government revenue with a wealth tax.

#2: Are these regions different countries? Do I, as a voter, have authority to dictate policy to them?

#4: But not on a “Global” scale. Implies a “Global” entity that “owns” all persons/property, and has the right to enforce such.

#5: And when “Regulation” is the source of inequality? When elites have captured regulators and government to serve their interest in raising barriers to competition, or establishing oligarchy by government fiat?

#6: And must therefore “know” and identify everyone, and have the control and enforcement power to do so.

#7: No rational debate, power will flow to those with the most money and ability to exert power.

#8: That’s right. Penalty of law. Of Global law. That supersedes any “national” law, including those little things like constitutional rights…(ohhh, conspiracy theory! Lets invalidate everything said!)

#9: To the advantage of those in power…

#10. Correct! As written in law, income is not defined well. That’s intended…by the wealthy. Hence why ordinary income taxes are not a good way to hinder the inequality in wealth. Now, It would be far better to have capital, transaction, and local wealth taxes, including a big inheritance tax on estates over $50 million than “progressive” income taxes. Work that brings income should be taxed lightly for anything under a million bucks, but passive investment income should be heavily taxed.

Overall, Dan, a very poor analysis that does not consider, at all, the follow on consequences of this idea. To subject ideas of the rights of property, though they are being abused by the global elite at the moment, to casual confiscation by a body that is not elected by the ruled? Gee, I think we played that scenario out a couple of hundred years ago…

Dan,

Capitalism doesn’t need to be regulated, it needs to be dismantled and replaced with a system based on cooperation and democracy.

The biggest problem I have with Piketty is that I dont see democratic control coming about merely from the adoption of a global wealth tax. To make that connection it’s going to take a new idea of the market and a new concept of democratic participation in social life, and then radically different institutions than the ones we have today. I agree that the global wealth tax could be one of the institutions in the new post-capitalist world order, but the global wealth tax also could be happily incorporated into neo-liberalism by its acolytes.

So, rule by the largest or most vocal/violent pressure group? That’s democracy, no?

And co-operation. MMM, yes. Co-operate by giving your wealth to the powerful, and they’ll co-operate by not killing you. Much.

Why is it that people yearn for a idyllic system of human goodwill, but then use words like “dismantle” and “new concept of democratic participation” and “radically different institutions”? It’s like they disregard history completely, no recognizing for a second that those words are soaked in blood and stand on the ash and bones of countless human beings. For every truly positive result, such as the US, there are dozens of failures that have etched human history with marks so black that they can never be removed (Pol Pot, Stalin, Great Leap Forward, Pox on Blankets, etc.).

Regardless of the eventual tax strategy adopted, steps towards increasing transparency should be taken asap.

Transparency will help make all other steps easier politically and more effective. Without having true transparency first, any steps taken are doomed to be ineffective.

We should start legislating for greater transparency even if others don’t. We have to start somewhere and not wait.

All of this discussion assumes that the welfare/warfare state deserves yet more revenue. It doesn’t.

Starve the Beast.

It’s not about revenue. The wealth tax would actually bring in only minimal amounts of revenue. It’s about the public getting its arms around capitalism and directly attacking the source of plutocratic power.

Who is the public, Dan?

Replacing Plutocratic power with Autocratic power does not work so well…

I’ll take my chances with the Many to defeat the Few.

And lead them to become the new Few?

You seem to be against the concentration of power in general, yet in favor of acquiescing to the concentration of power that is now going on. Is your point that we are getting screwed anyway, so relax and think of England?

I agree that the bloated beasts should be starved. Some of the beasts in the U.S. who deserve to be starved (metaphorically) are the Koch brothers, the Walton siblings, Bill Gates, Warren Buffet, Larry Ellison, Sheldon Adelson, Michael Bloomberg, the Mars family. Starving those beasts doesn’t have to benefit the warfare state, since taxes could be lowered on the 99% once we’re getting enough from the 0.01%.

As for the welfare part of the “welfare/warfare state”, the biggest beneficiaries of government welfare are the giant banks, other big corporations, and their plutocratic owners. In other words, welfare for the ultra-rich, and yes, such welfare should be cut off.

Just because it’s possible doesn’t make it a good idea.

Do we really want to hold up France and Spain as economic models to emulate?

I would rather tax economic rents, particularly intellectual property and infrastructure (search engine monopolies, telecom, media giants, high frequency trading/preferential access to “public” markets).

Taxation is less about fund raising than establishing incentives (the “rules”) both carrot and stick.

It isn’t just about wealth per se, it’s wealth bolstered by gatekeeping, which creates insidious incentives that inhibit creative wealth generation.

But it’s also just about wealth. The reason some people have way more influence over government than others is because they are richer. That’s it. Money always talks. If you want to cut plutocrats down to size politically, you need to take a lot of their money and stuff away.

So, you’d use government regulation to take the ability of the rich and powerful, who influence and control government, to influence and control government?

It’s not a government based solution that is required.

What do you suggest?

Opt-out.

Organized movements have succeeded in the past in using the strength of sheer numbers to defeat the power of concentrated wealth. The wealth of the wealthy gives them much more power than the average person. But it doesn’t make them omnipotent. And there are a lot more of us than there are of them.

I actually agree with you, Dan. They have overreached. There must be a reset.

It’s what comes afterward where we disagree.

The trouble is that anarchy leads to dictatorship, royalty, feudalism, or some such.

Truthfully I’d rather tax bads. Tax carbon. If we can talk about a global wealth tax why not a global carbon tax? Tax pollution. Tax non-renewable resource depletion. But wealth is pretty deeply tied up in all these problems. Why can’t any of them be addressed afterall? Because big money …

You would rather tax economic rents. But isn’t that what a wealth tax gets at?

I wonder if anyone who has written about platinum coins and sector financial balances over the past few years will dispute taxation as a solution? After all, increased taxation is austerity, taking savings away from the private sector and shrinking the public deficit as a share of GDP.

Yes. People act like taxing the rich helps the poor as if government were the poor! It isn’t. So taxation on the rich should be combined with at least equal grants to the non-rich. That’s right, GRANTS, not dubious services or programs that implicitly blame the victims.

A tax on wealth encourages its economic use, to pay the taxes if for no other reason. Under current circumstances, would that not be stimulative?

When Mitterrand was first elected in 1981, he started doing some pretty wild leftist things including nationalization of banks. His first prime minister was Pierre Mauroy.

Of course he was soon punished by the “markets”, with the devaluation of the Franc, resulting in high inflation. That’s when Mitterrand made his U-turn with austerity (“rigueur”) replacing the previous profligacy. Mauroy was duly replaced by Laurent Fabius (today France’s secretary of States).

That was the last time the French left dared defy the markets. They learned their lesson well.

I forgot to say. It was an euphoric moment when Mitterrand was elected in 1981. It was the first time in the history of the 5th Republic (est. 1958) that the left had won the presidency. Everything seemed possible. The streets were alive with the sound of music. There were even some communist ministres in Mitterrand’s first cabinet.

Then France was crushed and learned about the obscure and awesome powers of the Markets.

What the foreign armies could not do at Valmy in 1792, the International Markets worked out quietly in 1981/82/83. France was never independent again.

Of course he was soon punished by the “markets”, with the devaluation of the Franc, resulting in high inflation. That’s when Mitterrand made his U-turn with austerity (“rigueur”) replacing the previous profligacy. Mauroy was duly replaced by Laurent Fabius (today France’s secretary of States).

That was the last time the French left dared defy the markets. They learned their lesson well

That’s the usual story, but what happened was that Mitterrand, a very faux socialist, snatched defeat out of the jaws of victory with his turn to austerity. It was a crucial moment, of worldwide, historical importance. A crucial moment to discredit Keynesian policies, the “profligacy” which had worked everywhere superlatively well for decades, and could have continued to work in all countries, or even a single one like France which simply decided not to join the other lemmings.

So a Keynesian expansion – like any other expansion – can depress the foreign exchange value of a currency through trade. And this can cause some inflation. The proper response to this empty, expectable and limited “market” response is – so what? As Abba Lerner had noted decades earlier, arguing against Keynesian stimulus / functional finance prosperity for these reasons is not arguing against “Keynesian”, but against “prosperity”. If Mitterrand had just “stayed the course” on common sense policies as Reagan did on his depraved and criminal ones, France would have been a brilliant example of prosperity, too glaring for elite comfort. Instead Mitterrand used something real but entirely natural as an excuse to implement prior plans, exactly as the real Oil crises & their inflation had been earlier used. And succeeded well in teaching a false lesson of the imaginary power of “the market” to a generation.

For a different story, see Mitterrand’s Turn to Conservative Economics: A Revisionist History Parguez’s mother happened to have been Mitterrand’s mistress for a while.

Was going to bring all this up myself. Another point is – big deal about the wealth tax. Sure, it is a good thing, and it is good to take note of really existing wealth taxes. But what is important is spending and full employment. A tax alone is no solution at all to current problems – it is primarily a solution to a different, already solved, problem – that of a state to give value to its currency. Why should not Piketty’s wealth tax be but a cover for far-right policies underneath? That’s what Mitterrand’s was.

I am not a lawyer, but I suspect that implementing such a tax on the Federal level in the US would require a constitutional amendment. This, of course, would require persuading a supermajority (2/3) of both Houses of Congress to even propose the amendment, and an even greater supermajority (3/4) of the state legislatures to ratify. I think that’s incredibly unlikely. After all, we couldn’t even pass the ERA in the 70’s when it had been a plank in the platforms of both legacy political parties for decades.

Besides, depending on where you live various forms of wealth taxation (in the forms of real and personal property taxes) may already be quite high due to the dependence of some state and nearly all local governments on property taxes for a big chunk of their revenue. Any Federal wealth tax is going to be strongly opposed by those entities (there goes ratification), as well as by residents of states and localities that already have a heavy property tax burden.

Curiously enough, in the US property taxes seem to be quite regressive (which, one assumes, is the exact opposite of the intention of a so-called “wealth tax”), as this handy Wikipedia graphic shows:

http://en.wikipedia.org/wiki/File:Average_Effective_Property_tax_of_the_50_States_%282007%29.jpg

In other words, it (like the capped FICA tax) seems to be just another scam to disproportionately burden the 99% for the benefit of their masters. Some may argue that this is just a matter of poor (or corrupt) implementation – which sounds to me rather like the plaintive wail of ideologically pure-minded Marxists and Libertarians that their respective Utopian schemes haven’t been given a fair shot in practice.

To elaborate a bit on what I think the real effects of such a tax would be in the US:

I think it will, paradoxically, tend to concentrate asset ownership even further in the highest income brackets of the population. I think the poor and middle class who manage, through thrift or just dumb luck, to accumulate any “wealth” will eventually be stripped of it because at some point they will lack the liquidity (due to ill health, job loss, or just bad luck) to carry the tax burden. High-income individuals (and corporations, let’s not forget them) will then be able to accumulate this “wealth” at fire sale prices. In the case of real property, they will of course merely raise rents to compensate for the burden of this “wealth tax”, thereby further impoverishing the poor and middle class.

In the US a wealth tax is a direct tax, which could only be levied by the Federal gov’t if it then returned it to the states from whose citizens it collected it. Given the record of tax avoidance by the rich, that might not be a bad idea.

Huh? Did you miss the discussion of inheritance tax as a wealth tax? And we now tax capital gains too. Wealth isn’t very useful if you can’t monetize it, and we already tax monetization. And real estate taxes are wealth taxes and are ancient.

A wealth tax is annual, while estate tax is only levied at death, making it a poor substitute. The commenter is right: a wealth tax at the federal level would likely be found unconstitutional.

tried

let’s try this:

Reaching 4 Nothing Magicians

A home is where parents teach their children to be productive. A house is a revolving piece of paper, a debt parading as an asset corporation, masquerading as a home. Of course the critters want abortion and civil marriage; they don’t want the weight of the empire they are so busy building on their shoulders. Don’t waste your time on a plan to build economic prisons and expect not to find yourself inside with no exit. If you project a conscience upon the unconscionable, who is to blame?

The vast majority in a late stage empire, what you are looking at, will gleefully engage the machine, technology, to hide the truth from themselves, that they are homeless. Empires are consumers herding up to occupy space, with the intent to control all commerce, extortion of producers. That’s what all those licenses, certifications, degrees and titles are all about, entitlement to the extortion pie. It’s always Edison vs. Tesla.

The critters haven’t backed themselves into the REIT hedge to make money; the Fed does that for them, with consumer margin control. Contrary to popular assumption in the press, America is not eternally young. Its elderly majority is married to debt inflation. What has Asia, the majority’s purported future, gained for all that printing, other than a global real estate glut hidden off-sheet, some pretty boys playing polo, a brand new 50-yr-old Navy, and Henry Kissinger?

There are no more kids coming from small towns to feed the global cities, with technology to exploit the countryside. The empire owns everything and nothing, and its consumers are turning on each other for lack of producers that will accept debt slavery as wealth. Most of the human DNA on this planet will not be here 25 years from now (what you replace it with is up to you).

The upper middle class equal rights crowd wants theirs, and each wants an equal part of yours, to leave you in poverty, and the legacy landed class wants the same, their property and your rent. Together they produce nothing but paper, with increasingly shoddy merchandise to show for it. All contracts, including civil marriages and empire constitutions, are made to be broken accordingly. The rate of divorce and poverty, lost purchasing power and increasing debt, are not random accidents.

Human behavior cannot be changed in real time. The empire solution before, during and after this latest artificial crisis is the same, a train to Democracy – stealing land, controlling commerce and feeding an empire of bankrupt consumers. The slave and the slavekeeper are one and the same, with recognition delayed by the miraculous ‘invisible hand’ of peer pressure. The consumers are pricing themselves out of business, from the bottom up.

The price of the vacant house held off-sheet, extortion, goes up as the value of the home goes down. Empires exterminate fathers because fathers nip extortion in the bud, kicking their own children over the cliff, which is a mole hill selected by the children for the purpose of extortion. Without fathers, that mole hill becomes a real cliff, and if you think dad will not kick this empire over the cliff, you are sadly mistaken.

Dad doesn’t have to do anything. Nero burns down his own empire every time, increasing prices on falling demand in a demographic bust, backfilling with the illusion of monetary expansion and fiscal control. Everyone everywhere is not stupid just because the manufactured majority votes the assumption in. You can be producer, consumer or any ration you want, any time you want, male or female, in any class, but if the circuit is not completed, there is no circuit.

Childbirth is painful for a reason. You don’t prepare by getting fat, dumb or lazy in a controlled environment for the purpose. A lactation nurse is a highly paid oxymoron. All proteins are not created alike, and dad only appears to have been exterminated, within the empire, by the feminist and her warmongering eunuch, products of government as demand and supply, always trying to hide their tracks with ever more laws.

The empire is in the dead zone and the headwind coming isn’t just any wind. The consumers are once again waiting for their mythological savior, which isn’t coming, surrounded by a fusion/fission reactor they cannot see, because they are waiting for someone else to do the work, for them to efficiently organize. Regardless of system, you have priorities, a budget and a feedback loop. All empire mechanisms are a feedback loop bait and swap designed to hide the reality of supply-side economics, until they can’t, by which time the organizers hope to be dead and gone.

last try to finish:

oh well…

Another aspect of the inheritance tax is that it is an anti-dynasty tax, or anti-de-facto-aristocracy tax. How ironic that the US, which abolished aristocracy at its inception, should have embraced the formation of de facto aristocracy through inheritance.

Piketty is good for the widespread discussion and fuss about his rock star status among the upset profs who think they have done better work. All well and good for economists and as for his contribution to not only raising the subject matter into the day to day discussion of people who normally don’t want to hear about economic reports, he also makes a contribution towards some remedy to the inequality he fully documents. His economic analysis has set the stage for an economic solution. And as Yves seconds the motion, I would vote in favor of pursuing this as a tactic and not a strategy to deal with the problems of the political economy. As for the larger problem, a larger analysis would be needed.

We have taxed the wealthy before, we have Glass Steagalled the wealthy before, we have legalized unions and let them organize, before, only to watch the counter moves of the most reactionary conservatism destroy all of that. So, while the technocratic fix of a tax on the wealth of 1% is in order, how does the politics of this hope to come about? TINA does not mean that there is no possibility of thought of alternatives. We are not lacking in good theory. We are not lacking in enough people of good will. Despite all of the wailing and gnashing of teeth here on NC, I have witnessed and participated in resisting bad outcomes and building alternative institutions to the all profits all the time juggernaut and spoke with and learned from others who have done likewise for their generation. The hopes for radical change have lost a lot of battles. Some gains have withered away. Some are firmly consolidated and strengthened, like Social Security, but are under continual assault as seen in the Ryan Budget.

Piketty can be added to the list of important works, not because he is the only one to seriously address income inequality, but because of the disruption that is being initiatived by his academic rigor and historical approach. Here is a video that covers the same matter but adds to the inequality not only income, but political inequality that goes hand in hand. The market and the state, money for power, power to protect the money, in pursuit of never ending profit taking, that is capitalism, the rule by money which has been transformed into political power.

————————————————————————————————————————

http://www2.ucsc.edu/whorulesamerica/video.html

William Domhoff lecture from this past January about his new book covering the recent triumph of the corporate wealthy.

See 15:30 for his tax chart on the 1%. The income inequality research is finding many hard hitting outlets among the social scientist who study power structures. At the same time economics, politics and social analysis work together to get the whole picture. Economics and a tax fix is not enough. It is important, not at all small potatoes, but by itself, it can be reversed at the legislative level. A Council of Democratic Advisers is as important as a council for economics or national security, but that important social relationship does not have a seat at the table of power.

At first, I was happy to see that there’s a new edition of Domhoff’s Who Rules America?. Then I saw the price: more than $60 for 288 pages!

fabulous video link!

That’s the clearest explanation I’ve ever heard for how our political / economic structures developed the way they did.

I’m very glad he mentioned our so-called “democracy” as in how we vote and the limitations of our 2-party system (compared to other places with different voting systems).

It was very clear how he described people voting their “identity” (e.g., race, religion) rather than their class, which led to the conservative coalitions we have today, explaining why many people don’t vote in their own economic self-interest.

This talk was good in so many ways. . . Amazingly fast-moving, too.

And I loved how he compared “outsourcing” to the Southern “right to work” states being like how we outsource to China now.

As someone else said we should eliminate unjust wealth disparity at the source. Otherwise, you risk punishing the good with the bad with taxation.

So why, pray tell, should the rich be able to borrow more than the poor when it’s the PUBLIC’S CREDIT that is being lent via extensive government privileges for the banks? But the public’s credit should only be used for the general welfare which could easily include welfare for the poor but never welfare for the rich.

tax their assets off.. they’re too heavy and they just lay around in their excess reserves wallowing in folds of fat groaning with greed. what good is that, even for them? wouldn’t it be nice to sit up, wipe the money grease off the mouth and even stand up and walk around? there’s a whole world out there to see. you can’t just lay around in folds of fatty excess reserves gorging yourself on money night and day and think that’s the whole universe.

once you get up and walk around, you’ll see things you’ve never seen. imagine the fascination you’ll feel at the sight of reality. it’s astonishing, what you”ll see. but laying their doing nothing under fetid folds of fatty capital with money grease dripping from your hands and face, what can you see? the ceiling. LOL, assuming you don’t have dollar signs in yer eyes.

You’ll thank them for taxing you — once your buff and limber walking down a street with your mind flaming like a sun. it’s an intervention

To those who say money given to the poor will mostly end up with the rich since they own most of the assets, yes, I agree but:

1) The money the poor use to pay off debt to the banks will extinguish itself leaving “only” the interest to accrue to the rich.

2) Then let’s get busy promoting the equal redistribution of the common stock of all large corporations since those were likely built using the public’s credit anyway.

Btw, JG proponents, shame on you for promoting jobs instead of justice.

YankeeFrank : “” Its imperative that we tax high incomes at rates of 50% or higher, and inherited wealth at the same rates.””

There is only one fair tax – a flat rate income tax , the same rate for everyone – where any money received that can be used to pay for living is ” income “. A progressively higher tax on your wealthier neighbors leaves them with a progressively lower return on their investment ( paid taxes ) in government than your ROI ; that cannot possibly be justified .

Russia is the only country that does taxes correctly – a flat rate income tax and a corprorate tax only . The corprorate tax is justified only to the extent that income from money moving thru offshore tax havens can be easily lost and become untaxable . Taxes are to ” pay ” for government irregardless of contemporary progressive propaganda to the contrary . Without government spending there would be no need to ” pay ” for government . An equal rate income tax is the only fair way to ” pay” for government . All other tax schemes and types of taxes are “unfair” ( ie. unjustifiable ) . The ancient Egyptians of Babylon knew what a fair tax was – 10% of your income , rich or poor . Since then people worldwide have been smothered by unjustified tax schemes . Government schools ( ie. public schools ) are virtually incapable of teaching the truth about taxation – so the public remains forever ignorant and will accept any scheme you can sell .

The US has never had an inheritance tax (except for a few years during the civil war). We have always had, and continue to have, an estate tax.

Excellent point. A year ago I didn’t understand the difference, but now I do. I briefly discussed this last month here at NC:

http://www.nakedcapitalism.com/2014/04/effective-remedies-inequality.html#comment-2027233

IANAL, but I don’t think so. An inheritance tax, IIUC, is legal because it falls under the Income Tax Amendment. We call it an estate tax, but if it were literally a tax on property, it would not fall under that amendment.

IAAL and an estate planner to boot.

Washunate : “” my personal preference is to focus on income taxes rather than wealth taxes precisely because I think income is the easier, lower hanging fruit. I also prefer to directly regulate undesired behavior rather than to try to create incentives through the tax code.””

Amen . The flatrate income tax – same rate for everyone – can be fully justified in a way that no other tax can be so justified except maybe a corporate tax for the pragmatic reason previously mentioned . Only an equal rate income tax for everyone can be said to be a “fair” way to pay for government . Why pay / charge any other kind of tax ?

Why pay / charge any other kind of tax ? masterslave

Government privileges for the banks overwhelmingly favor the rich at the expense of the non-rich. Therefor the rich should be the overwhelmingly biggest payers of taxes.

If they don’t like that then they should use their influence to lobby for a just money system and asset redistribution to re-level society.

Until then, a flat-tax is flat wrong.

I would be curious what you mean by flat tax. If you mean setting ablaze the thousands upon thousands of tax loopholes so that the same simple rules apply to everyone, I completely agree.

But if you mean 1 tax bracket, I would disagree. Eliminating progressive income taxation would get rid of one of the very few remaining semi-functional checks in our system.

“The flatrate income tax – same rate for everyone – can be fully justified in a way that no other tax can be so justified”

Only if income were proportional to wealth, which it is not. $1,000 is worth more to a pauper than to an average householder, it is worth more to an average householder than to a millionaire, and it is worth more to a millionaire than to a billionaire. A flat tax on income does not capture that difference. A flat tax on wealth is closer to the mark, since the tax bite is closer to being equal for each.

redleg : “” IMO income inequality is not as large and important a problem as wealth inequality “”

Wrong wrong wrong . The problem is not ” having wealth ” ; the problem is ” how much should YOU pay for government whoever you are ?” Whenever you have money that is taxable , then what you have remaining after any taxes have been paid is your return on investment in your government which includes local , state and federal tax jurisdictions . .

Non-monetary wealth , such as land , has hypothetical income value which becomes real income when the land is sold . The government should never tax hypothetical wealth because it puts the gov on boggy grounds as well as the wealth owner .

washunate: “” But the reason that wealth inequality exists is because of income inequality “”

Amen .

The reason wealth inequality persists is because of inheritance.

Not the only reason, OC. ;)

Inheritance is income.

There is nothing INHERENTLY wrong with inheritance.

So how about we fix KNOWN injustices FIRST such as eliminating all privileges for credit creation since those privileges are the means whereby the rich can steal from the poor by bypassing the need for the savings of the poor. And after a re-leveling of asset ownership then EVERYONE will have something to pass down to their descendants.

Calgacus: “” A tax alone is no solution at all to current problems – it is primarily a solution to a different, already solved, problem – that of a state to give value to its currency.””

The first major problem – the primary issue – is the all important issue of taxation : how does the gov maintain the value of its indespensible currency ( whether the currency is cash , coin or electronic bits ) ; and that problem remains insufficiently resolved .

No, this problem has been solved for practical purposes for a long time. Hyperinflation is a rare phenomenon. And if one wants to have low inflation, probably zero inflation or even deflation it is very easy – follow MMT/Keynesian prescriptions like ZIRP, and above all have full employment, a JG, tying the currency’s value to an appreciating asset, labor time. An MMT-guided society would have the hardest currency the world has ever seen.

It’s really simple – spend money tightfistedly on the non-rich to do something. Something good. The traditional mode of spending is to spend profligately on the rich to do nothing (at best) with bonds) or more usually, to do destructive things, often enormously, criminally destructive things. And the best joke the 1%ers have played is the claim, the amazing, the comical, the fantastic claim that the common-sense way, the MMT, Keynesian, JG, moral, just, way is inflationary, and that welfare for rich layabouts and thugs preserves currency value! But it is time for them to find a new joke. This one had a good run, but like all things, is becoming unfashionable.

Taxation on land, on its unearned rents and other kinds of rents is abstractly-economically the best kind of tax. Seals of approval from classical economists and Michael Hudson. A land tax is essentially a rent charged by the state, which is the ultimate, underlying owner of all land practically everywhere (in all legal systems I know of, and in international law). So it is very easy to justify.

Pretty much the way I think about it Cal – though I want something more detailed. My own feeling is leaving the banks doing investment is doomed to failure. We need most of the expertise needed embodied in machine, not their corruption. And if we shift to a much fairer and egalitarian way, we might be able to remove the rich and inheritance because there would be no need for either.

Cal:

Land is certainly easy for government to tax, because you can’t hide it. However, landowners are often ‘land rich, cash poor.’ A shift to this sort of real property based wealth tax would lead to lots of property being put on the market at once, with a huge decline in property values. I know people with $10 million in property whose primary income comes from herding cattle. You’d have to begin such a wealth tax project by making exceptions for people like them, and exceptions are a poor way to start anything.

Jim in SC:My main point was that land taxation, or most taxation of economic rent is easy to justify. However, the focus should not now be put on taxation, as Piketty does, but on spending. Since the purpose of this kind of taxation is solely to create a demand for, to give value to the currency, the usual proposal is at a flat rate based on area or cubic feet of dwelling space (Mosler). So it wouldn’t be a very variable revenue stream. And if levied by a national government, it would be unrelated to spending; national governments do not and can not spend tax revenue. These land rich, cash poor people would be a lot less cash poor in a healthy, MMT-guided society. I think most people, the academic MMTers included underestimate how much damage bad economics is causing societies, and probably, the planet; and therefore how much is to be gained by not playing straight man to the .01% jokesters any more.

It’s really simple – spend money tightfistedly on the non-rich to do something. Something good. calgacus (Calvin the II?)

Like the Pyramids? Sure, let’s have generous infrastructure spending and generous welfare but paying the unemployed to waste their time is obscene, more so if done “tightfistedly”.

Besides, if you wish to raise the price of labor, a Guaranteed Living Income does that much more elegantly and is much more just besides since theft requires restitution and one does not have to work for restitution else it is not restitution.

As for currency hardness, coexisting government and truly private money supplies is the solution with fiat being legal tender only for government debts and private monies only acceptable for private debts.

Two points. One, contrary to the point made by the charts, I thought the UK had a very substantial inheritance tax that kicks in at very low asset levels. For example, if UK house prices double again, the average house will be subject to an estate tax levy.

http://www.telegraph.co.uk/finance/personalfinance/consumertips/tax/10745009/The-desperate-tactics-being-used-to-avoid-inheritance-tax.html

http://blogs.telegraph.co.uk/finance/ianmcowie/100024643/house-prices-quadrupled-during-the-typical-mortgage-term/

Second, property taxes lead to unreliable revenue streams because asset prices vary greatly from year to year. That’s why municipalities have an out: they can charge more than the property is worth if they choose to, and they often do. There seems to be a conceit on the left that runs ‘once rich, always rich.’ The real world is not so tidy.

UK does have a decent size inheritance tax. IIRC it’s a 45 rate and 250k nil band or something.

the chart is a mess.

Yes, the charts do show that the UK still has an inheritance tax. It just raises 1/5th of what it did in the 1960s relative to GDP each year.

Yes, some people do avoid inheritance taxes, and they usually coincide with gift taxes and other arrangements to make avoidance difficult. It the system could be administered in the 1960s to generate 5x the revenue, even after avoidance efforts, surely it can be done again.

The US must either lead on this, or at minimum not oppose it, in any of the varied scenarios put out. Can it still work for others if the US balks at change?

Anyone who believes that something other than the TAX CODE is the GRAND DECIDER of who is Rich and who is Poor is a FOOL!

Something the RICH have known since the beginning of TIME!

There is only one way to redistribute wealth to the many, to have an evenly distributed shortage of labor. It give everybody a fair economic value, not because someone want to be fair, just and magnanimous but because of economic necessity.

That was what redistributed productivity wealth in the golden decades after WWII, it rectified inequality at the source, it wasn’t high marginal taxes, inheritance and wealth taxes.

Piketty believe one can polish a bit on the surface on a system that is in its core wrong.

At this point I’m not fussy. Tax income, tax wealth, tax property, tax inheritance, tax the whole bloody works.

Don’t worry about the utility. Under our current market conditions, Levelling is a good worth paying a high price for. The recent conduct of our 1% has inflated the market value of social equality.

If we find ourselves mourning some lost efficiency, then we can always get around to it later.

Why don’t you just steal what you want from the rich. There are more of you.