Yves here. While readers may take issue with an economist who comes originally from the Troika, I’ve seen other credible analyses come to similar conclusions: that the structure of the Greek economy and its output mix means that it would not benefit anywhere near as much as one would expect from a large fall in the value of its currency.

Keep in mind that this post does not consider the other reasons for a Grexit. But as various readers have pointed out, Greece gets the same bargaining leverage from threatening to default (or actually defaulting) with much less collateral damage than it does via exiting the Eurozone (even if the rules allowed it, there is a fair bit of debate as to how, and even whether, that can happen from a legal standpoint).

By Guntram Wolff, Director of Bruegel and a member of the Solvay Brussels School’s international advisory board. Wolff was recently with the European Commission, where he worked on the macroeconomics of the euro area and the reform of euro area governance. Prior to joining the Commission, he was coordinating the research team on fiscal policy at Deutsche Bundesbank. He also worked as an adviser to the International Monetary Fund

The genie is out of the bottle: Europe is again discussing the possibility of Greece leaving the euro. With it, the debate has re-emerged whether this would be helpful or not for Greece and whether there would be contagion to other euro area countries. A big question is, of course, how the Greek financial system would survive an exit with a debt restructuring; how long it will take until Greece would regain access to financial markets; and how big the benefit of a debt restructuring is given the relatively low interest load. The absence of external help would be a further factor weighing on Greece. All these factors speak clearly against an exit from the point of view of Greece but they are not discussed in this blog.

In this blog, I want to focus on the claim that Greece needs to exit in order to devalue and in order to regain competitiveness so that it can grow again. This point has again been made prominently by Professor Hans-Werner Sinn of Ifo institute in Munich.

Greece stands out as an outlier in external adjustment. Its adjustment was almost exclusively driven by a contraction in imports

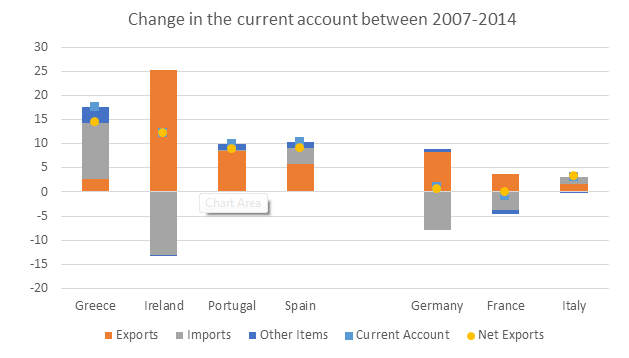

So what do the data tell us? Greece, Ireland, Portugal and Spain all had very significant adjustments of the current account since 2007 from high deficits to close to balance or surplus. However, the composition of the adjustment has been very different (see chart). In Ireland, Spain and Portugal, the largest part of the adjustment has come from an increase in exports. All three countries have therefore managed to change their production structures and substantially increase exports. This is a desirable and healthy way of adjusting, which also shows that it was not primarily a demand compression that drove the external adjustment in these three countries. Also in Italy, the increase in exports was larger than the decrease in imports.

Greece stands out as an outlier in external adjustment. Its adjustment was almost exclusively driven by a contraction in imports while exports have only very recently been positive.

Note: Nominal change in euros measures as percent of 2014 GDP. The sign of the change in imports is inversed so that an increase in imports is shown as negatively affecting the current account.

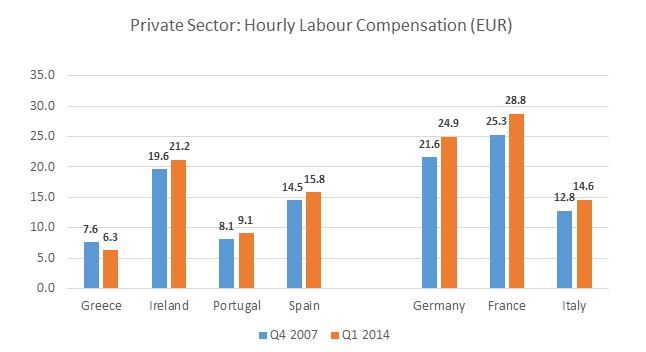

Are high wages the main problem in Greece hampering exports? Is the absence of a real depreciation the main driver of the different adjustment experience of Greece compared to the other euro area countries? The following two graphs show the simple wages measured in euros in the private sector. As we can see, hourly wages have come down substantially in Greece and are in fact the lowest in the euro area with the exception of Latvia and Lithuania. This contrasts with the experience in the other three countries adjusting, where hourly wages in the private sector have increased.

Note: For Germany, Ireland, Italy and Portugal Q1 2014 data is used instead of Q2 2014 since the latter is not available

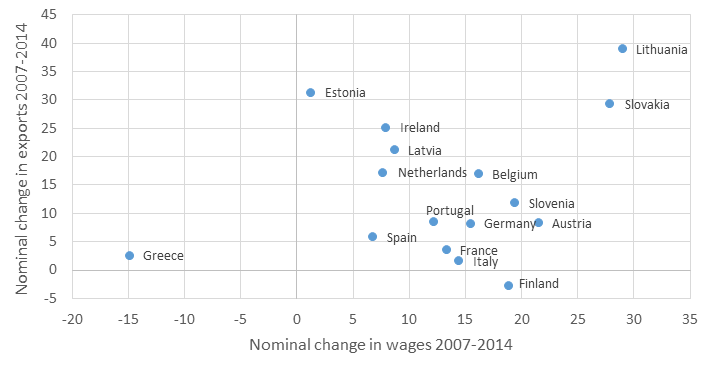

Correlating the change in exports with the change in wages in the private sector shows that Greece is an outlier as previously evidence by my colleague Zsolt Darvas. Despite a significant wage adjustment, exports have not picked up as they did in other countries. The following scatter plot illustrates further that Greece is a clear outlier as are Lithuania and Slovakia.

Note: Nominal change in exports is given as % of 2014 GDP. Nominal change in wages calculated as nominal % change between Q4 2007 and Q1 2014

Overall, I conclude that the Greek economy would not benefit as much as hoped for from a rapid depreciation. The reasons for the weak Greek export performance might primarily lie in other factors such as rigid product markets, a political system preventing real change and guaranteeing the benefits of the few, the lack of meritocracy among other factors, as nicely outlined by Brookings scholar Pelagidis. To the extent that the Troika can help reform the country, an exit of Greece from the euro would even be counterproductive.

An Grexit is unlikely to easily help the economy much as exports do not react much to changes in wage costs due to the sclerotic economy

This does not mean that the current debt trajectory and debt level is sustainable. It may be necessary to further alleviate the debt burden on Greece, especially if inflation remains low and growth is weaker than the Troika believes. This has been done a number of times before by the official creditors and already now the average maturity on the European debt is 30 years. This maturity could be increased if necessary, effectively reducing the debt burden further and I could even see a nominal debt cut at some stage. An exit of Greece from the euro would not only create significant market turbulences, increase borrowing costs for Greek business and society and create geopolitical instability. But this blog demonstrates that it is unlikely to easily help the economy much as exports do not react much to changes in wage costs due to the sclerotic economy.

I can’t agree with his conclusions. For one, Greece was worse off than all the comparative countries in terms of debt. Take Portugal for instance. While Portugal and Spain have a huge private debt to GDP comparatively, Greece’s problems were in the public sector. For various reasons, it is easier for the Euro elite to require more stringent measures in the public sector than in the private. Thus, Greece cut output precipitously. That’s the key difference. But there are others.

Other reasons for the lack of rebound in exports is that the cratering GDP is taking along many casualties with it. Even in an environment of high costs prior to 2009, you had many Greek companies exporting competitively. These companies are shuttering for a variety of reasons, tens of thousands of them. For one, they can’t find lending for operations. Two, those with cash on hand are finding absolutely no one willing to insure exports for bills of ladling, for fear that any guarantee will be lost in the event of a Greek exit. Insuring goods exported from Greece is akin to buying Greek gov’t bonds it seems.

The fact that Greece is an outlier when you’ve had huge wage cuts (compared to Slovakia) should have been a cause for seeking explanation. And the explanation is that the Greek banking system is terminally broke, while the gov’t is dysfunctional as it sags under the weight of a monumental debt. In Slovakia, these factors did not exist.

“Two, those with cash on hand are finding absolutely no one willing to insure exports for bills of ladling, for fear that any guarantee will be lost in the event of a Greek exit.”

I’m certain that you know what you are talking about, but I’m curious about the kinds of “guarantees” that are involved here. Who is guaranteeing what to who, and in what way are the Greek banks or government necessarily involved?

Seems like anyone who could provide disintermediation could make a buck in this situation. (??)

It was a bad metaphor. I was comparing the risk of insuring Greek goods to the risk of buying Greek bonds. There is no connection.

As for the lack of insurance, outfits like Euler Hermes and Coface refuse to insure Greek exports on worries of a default. This insurance is there simply to pay an exporter in case of a client default. It hurts Greece both ways as exporters have difficulty shipping to Greece, while Greek exporters can’t insure their goods because of a lack of cash on hand. The market for this insurance has been driven sky high since the biggest players stopped insuring Greece.

In other words, lack of cash flow for companies in Greece then leads to further restrictions elsewhere in the distribution chain, especially when costs rise. But those costs are costs that typically aren’t accounted for when someone is looking at average prices.

You are missing that Greece can default without exiting the Eurozone. Or threaten to default, which is what Syriza has signaled it plans to do, if it wins or has a strong position in a like-minded coalition.

It isn’t clear if Greece can exit or it can be thrown out, at least under the rules. The legal issues are apparently murky. However, if the Troika really wants them out, I am sure a way will be found to tidy that up.

The big problem is that the Greek bonds are now sitting mainly with the ECB. The ECB has no freedom, unlike the Fed, to print to monetize losses. So the losses will be paid by member states. That is why the Trokia has refused to write down principal. They did not want to do it when the banks were on the hook, because taking the losses would have created a banking crisis. And now by having Greece borrow more while wrecking its economy via austerity, the eventual writedowns will be even bigger than if they problem had been addressed years ago.

Yes, it can. But at the same time ECB can turn off the EUR liquidity tap, effectively forcing Greece out of EUR. Now, I’m not saying this is the rational step for ECB to do (and, to be honest, left to Draghi I doubt he would do it), but I can see a deal done in Frankfurt which goes along the lines – we’ll let you to do limited QE (say buying bond in proportion to ECB capitalization, with credit guaranteed by the the individual central banks), but if Greece threatens to default, you’ll cut them off, to make an example of them (and getting rid of those who shouldn’t be in in the first place).

Game of chicken way too often ends with no-one blinking. Damn the rationality and full speed ahead!

Greece should not be in the eurozone because the eurozone is a bad fit for weaker countries without industry. However, if you’re referring to the state of Greek finances at the time, some very bad journalism and reporting has repeated the canard about the Greek gov’t budget at the time.

Read this article from 2003: http://www.risk.net/risk-magazine/feature/1498135/revealed-goldman-sachs-mega-deal-greece

Greece was actually below eurozone thresholds with or without the Goldman deal, a deal, by the way, that was known by all or many, a deal concluded by many others, and which was not counted as debt per the whims of the euro FMs, against the wishes of Eurostat.

I think the media paints with such a broad brush and repeats such canards so that the people with the most to lose can say, “I didn’t know Greek finances were so bad, they lied to enter the eurozone.” The Greek elites certainly took advantage of the eurozone, and took huge bribes in vendor financing scams that destroyed the country, but for anyone to say that this was done mysteriously is a total falsehood, which simply reinforces the moral failings of the banks in this mess.

I’m actually not advocating it either way, since I think the current and probable future inside the euro will be much more of the same. Outside the euro is a complete guess by everyone.

As for staying in the euro and defaulting, yes it is possible. The ECB does not have to completely obliterate the Greek banking system, if it doesn’t want to.

But most commenters seem to have missed the fact that as part of the second memorandum, in 2012, the troika promised Greece that its debt would be written down if it achieved a primary surplus. Greece managed that in 2013 and by early 2014, the IMF was already highly critical of the missed opportunity to offer Greece the writedown. In other words, Syriza is simply saying something that the troika has already promised–but has not fulfilled. The current gov’t is pointing out the troika’s failure behind closed doors (which is why the recent negotiations are not proceeding).

Greece, by the way, today announced a cash surplus of over 3 billion euro for the first 3 quarters of the year. This money could go toward financing the debt, or it could lighten the tax load and support increases in minimum wage. This is the crux of the issue.

Can’t leave the Euro can’t stay in the euro. Why not a shorter analysis, “Greece is f****d. “

Greece has specific problems that make export-driven recovery more difficult. It’s road/rail communications are through the non-EU coutries (Macedonia, Serbia), which increases freight cost and complexity to reach the bulk of the EU market. Rail freight through the Balkans is a nightmare, it probably takes 24 hours or more for the freight train to go from Athens to Budapest (1100 km).

The tourism sector is much larger than in other EU countries, about 15% of GDP and employment, compared, for example, to 6% in Spain. Greek economy is tourism-heavy so it’s hard for other sectors of the economy to make a big dent in the current account.

nevermind the balkans, rail through northern greece is bad enough.

regarding tourism, yeah, it’s huge and it’s also the reason why greeks work longer hours than anyone else in europe. a tourist shop in the plaka will open around 9 in the morning and will be staffed by the same person until late, though most of that time is spent unproductively (e.g. waiting for customers).

“ Beijing hopes to turn the Greek port of Piraeus — where the Chinese shipping giant Cosco has a 35-year concession to hugely expand its two container terminals — into a new hub for trade with Europe.

Despite being hit hard by the economic crisis, Greece still has the world’s largest merchant marine fleet, with China one of its key customers.

…

“We will propose construction of a rapid land and maritime route based on the Budapest-Belgrade railroad and the Greek port of Piraeus to improve regional connectivity,” Li told Serbian media ahead of the summit in Belgrade.”

What has Greece lost to the troika’s policy? They lost their jobs, independence from external control, their ability to export and import, their quality of life, and the ability to plan for a future without consulting the parties that “relieved” them of their choice.

What have they traded all of these things for? A debt they can never repay with no relief from being a vassal reliving serfdom under the current conditions.

“When you’ve got nothing, you’ve got nothing to lose”, may be the issue for the majority of voters. Thus democracy may again prevail.

i look at the data and arrive at a different conclusion: a massive contraction in imports and stagnating exports signify that Greece would benefit greatly from a devalued currency. low imports would lower the pain of leaving the euro while a cheaper currency would increase foreign demand for Greek exports. this, in turn, would boost domestic demand for labour.

i have no doubt that the author is more intelligent/literate in economics than i am, so what am i missing?

I don’t think you are missing anything per se, but the author sees actual lowered prices (Greece has experienced a big deflation, a big wage contraction of 25-30%) with no upward bump in exports. This makes Greece an outlier in terms of what should happen in such events.

I think what the author misses is the lack of banking, lending, cash flow, which leads to successful companies shuttering doors (companies formerly successful even in a difficult business environment), and thereby leads to fewer exports. Austerity and deflation are bad for business. Who woulda thunk it?

Greece themselves are bad for buisness.

NY Times had an article on how

http://www.nytimes.com/2011/01/30/business/30greek.html

You have to compare then the business climate from before 2011 to the current business climate. If the austerity measures adopted are better for business, then why is the business climate worse? I note that your link is from a 2011 article. Yet after the bailout and austerity measures, the business climate is worse than it used to be, even given all the red tape.

The Neoliberal Project cannot be seen to fail at any point, because that might add leverage to the arguments of other Euro-skeptic parties elsewhere in the Zone. Faced with a imminent failure in Greece (and even a small win for Syriza could qualify), the Project may be left to its “Ukraine option”; Align with the Nazis, and buy the Greek military’s support with guarantees of new toys should it assist. Of course some Greeks would die in the process, but that’s happening anyways and is of little matter to their masters. It’s the price a country pays for being on the edge of the first world, but not quite in it.

What does Greece export that would benefit significantly from a large devaluation in anything other than the very long term? I have googled briefly and am far from persuaded I know. Petrol refining, tourism and shipping seem to be the main export activities, everything else is pretty small beer. I cannot see a devaluation having much effect in those three sectors. Happy to be persuaded otherwise.

It would be nice if a German car company set up a large new factory in Greece but I cannot see it happening, if only because of transport issues. Greece seems to me to have many of the same problems as Sicily – wrong end of Europe, too far away from the golden corridor, or whatever one calls it, ever to be really prosperous – and that is before the political problems, corruption are taken in to account.

Sicily has not really been sorted in 70 years, it seems to me.

The real question is how would it help Greece return to its former productivity.

You have to compare everything to how Greece already was. For instance, Greece’s GDP rose by 10% after adoption of the euro. But it has gone down by over 30% in the last few years. The question for Greece is, can it return to 2003. In other words, Greece has given up everything it gained from the euro and so much more.

Greece’s goals after an exit should be employment, domestic food production and maintaining sufficient forrign reserves to buy whatever it might not be able to produce itself. Wolff, however, seems to believe the only method of restoring the Greek economy is by becoming an export machine, another Germany. And since Greece can’t do that, won’t benefit from an exit.

For me the above post illustrates how deeply inflation-phobia has embedded itself in European elite thought. Domestic consumer demand isn’t even a possibility for them, and so the endless crisis goes on.

‘Already now the average maturity on the European debt is 30 years. This maturity could be increased if necessary, effectively reducing the debt burden further.’

This is just playing mathematical games with net present value. And when you’re already 30 years out, even making the loans perpetual (with no repayment date ever) only helps slightly.

What potential foreign investors see is debt at 175% of GDP. Extending maturities only postpones the next crisis. Principal cuts are the only effective medicine. But the euro boffins can’t do that, since others would line up, banging their soup bowls with their spoons, crying ‘me too.’ And the Germans would go berserko …

Are you sure they aren’t already?

but having one’s own currency was supposed to solve all problems….

The argument is turning on exports. Even if Greece leaves the EZ, the world economy is so sick there will be no stimulus from exports, (Spain’s export blip notwithstanding – that’s prolly because Japanese companies relocated there.) and implied in the export argument is the subtle reminder to Greece that their credit will be toast with Goldman Sachs and Deutschebank for decades to come so don’t count on anything from us you hoser. So returning to the drachma would be good just to run domestic necessities, but Greece would not manage to climb out of its hole for such a long time, they might as well stay with the euro. If they take the long view with the euro there is always the promise of Silk Road trade in the next few years. Altho’ I think that is just hype at this point.

Greece needs to exit, period. Austerity is econspeak for brutalizing the masses, forcing them into servitude, total control. They are voting to give themselves a chance to be free from the dictates of an EU that is dysfunctional and corrupt.

I can see the mind tricks at play by the Austerian Jedis… Now Greece is an outlier, so austerity is safe even if Greece fails :)

Rephrased in more serious terms, the guy is starting the retreat line for the austerians after Greece gets a more or less reasonable solution: it is just for Greece, you Spaniards and Portuguese should keep with the medicine…

The data on which this whole edifice is based upon is appalling. To suggest that between 2007 and 2014 (strange, to say the least, to get nominal wage data for 2014 so soon, even if it is mid-year data) France and Italy with horrific unemployment and very little to zero inflation have had close to 15% increase in nominal wages……, that Austria, very tightly run economy has had ~22% increase in nominal wages and Finland whose main export is wood products has had ~18% growth in wages. I don’t even want to mention Portugal, and Spain. Greece has serious economic and efficiency problems that are not shared with other Med countries, esp. Spain and Portugal. It has a huge per capita intellectual base and very smart entrepreneurs who know international trade and shipping but they also know how to avoid paying taxes, just like in this country.

The people advancing such hypothesis are Euro-bureaucrats who are best suited for shuffling papers and drinking lattes in Brussels.

It is unfortunate

‘Unfortunate’ comes across as harsh, though the lack of agency is commendable.

Can we just settle on ‘mistakes were made’ for the communique?

For Spain the main cause of higher wages is the huge increase in unemployment, specially of temporary workers earning less for the same job and easier to fire. So the unitary wage and apparent productivity is increasing; what is really happening is that the quotient is diminishing. Not too different to the increase of Greece GDP due GNP falling less than prices.

I am not impressed by this analysis. I think you need to know the composition of imports and exports, trade partners and what was happening in their economy to draw any conclusion from the information provided. From my snap googling, it appears that a very good proportion of Greece’s exports are products that are probably rather insensitive to wage changes (refined petroleum products, metals, etc.). Also, what was happening in the economies of the country’s major export destinations? if they were having their own struggles (because they were pressed into austerity, for example) this might explain the meager change exports. I think the bigger point though is that the main reason why an exit makes sense is so that Greece regains control its fiscal authority. It will then regain the ability for the government to spend in its currency to mitigate shocks in private spending independent of the dictates of EB/EC/IMF. It seems to me the main question is weather Greece would have the capacity/foriegn currency to purchase the imports it needs after exit, but that is not addressed in this article.

As I indicated, I’ve seen other analyses of precisely the sort you suggest and they show Greece would not be a beneficiary save for tourism and agriculture. Given how the country has fallen apart, tourism has fallen and is unlikely to recover with a cheaper currency (normally that would be a big plus, but, for instance, cruise lines have cut way way back on cruises with stops in Greek ports) and they can’t make much if any more in the way of agricultural goods. Basically, it has an uncompetitive export mix, as do most of the other periphery countries.

Commodities are in the tank right now, so any price advantage they gain is not going to do them all that much good selling into a a saturated market. They will get more net but from a much lower level than the dated stats are likely to show.

2012 A Greek exit would not cause havoc

Posted on Monday, October 22, 2012 by bill

http://bilbo.economicoutlook.net/blog/?p=21418

Argentina does provide some guidance to what happens in these situations and the message, while complex and structured, is overall that Greece would be better off defaulting and reintroducing a floating currency.

The crisis in Argentina was very damaging and the poverty rates rose alarmingly. But the predictions of the mainstream economists (especially from the IMF) at the time did not come to fruition and an understanding of Modern Monetary Theory (MMT) can help us understand why.

2013 Christmas is in decline in Greece

Posted on Wednesday, July 3, 2013 by bill

http://bilbo.economicoutlook.net/blog/?p=24528

The situation would have been worse had not the population also declined over the last few years (see next graph). The estimated population in 2012 is now 15.5 per cent below the estimates for 2010. Austerity always looks better than it is (which translates to slightly less devastating than it is) because it leads to declines in population.

It would seem Van Rompuy failed to do his job. But he won’t be forced into penury as a result. It seems that Osborne and Cameron and all the rest of those who claimed that there could be fiscal contraction expansion got it wrong – badly.

Why haven’t the business sector taken them to task for wrecking countless firms?

That’s the genius of the neo-liberal project: once you’re ruined, you’er in no position to hound the psychopaths that did it to you, you’re too busy trying not to starve or walking long distance to find work! It works even better in nations with suburbs: see Ferguson…

Isn’t tourism their largest industry – and most important “export”? It should be pretty flexible in responding to a currency change, given a couple of months. Tours can be rescheduled, and so can people’s vacations. “Hey, Maude, the Greek islands are a bargain – let’s go!”

No it isn’t, given the absolute train wreck Greece has become. Who wants to visit a country that is falling apart, where garbage isn’t being collected, where stores are shuttered, where hotels don’t have the cash to order supplies regularly and tour boat operator have gone out of business and the few who are operating can’t get fuel on a regular basis?

You didn’t see people rushing to Iceland after its central bank went bankrupt and its currency tanked, and Iceland had a sudden crisis and still has the outside trappings of being prosperous.

My mother goes on cruises regularly, and as soon as austerity started, cruise lines were giving away Eastern Mediterranean tours. It was clear customers were canceling like crazy and no one was taking up the empty berths.

All those problems will get worse, not better, with a Grexit.

Perhaps I am missing something, but it seems to me reconstruction of tourism and other infrastructure would be one of the important efforts to which resources available in the country’s currency would need to be directed. From what I can gather (see chapter 3 of http://www.oecd.org/daf/competition/Greece-Competition-Assessment-2013.pdf, for example) Greece has a well developed construction materials industry, so why would they not be able to spend in local currency to rebuild? There is no hope for that under the Euro and austerity. No one is suggesting that there would not be substantial hardship following exit, but it should not be as prolonged or much worse than the nightmare they have been going through the last few years.

It’s not a physical rebuilding issue, it’s that Greece has become deeply impoverished and disorderly. Even in most third world destinations, India being a classic example, but see also Vietnam and Indonesia, you can still have first world accommodations, often provided by recognized international hotel chains. If you can’t get foreign goods reliably and foreign managers aren’t willing to work there (due if nothing else to the disaster the hospitals have become, they can’t get many medications and can’t even afford to change the sheets when they get a new patient), you’ve lost a big sector of the market in revenue terms.

i was just in greece in october and the situation there wasn’t anywhere near as dire, and not just in the islands. in the mainland and athens, people are poor but there is no disorder. you see plenty of destitute people in athens, but no more than in paris, and garbage is certainly being collected. a lot of people have resorted to doing business under the table, not just in the hospitality business where this was a longstanding tactic.

as poor as greece has become, the media sensationalize the situation on the ground. it’s still a fantastic country for tourists.

Yet tourism is up higher than ever before. And, someone has to account for the fact that thousands of formerly profitable companies have shuttered. This reminds me of the Treuhand argument in Eastern Germany. You must burn the village to save it. Yet in the final analysis, we see destruction of formerly profitable companies (they may be inefficient, or behind modernization) and a complete wipeout in terms of unemployment.

I would ask people to look at where Greece used to be BEFORE austerity when it comes to exports. Far from improving, far from becoming MORE competitive, they’ve become less competitive,

What if most of the imports are expensive stuff from Germany for the affluent?

And what about the mantra of exports when you have to provide first of all for your own population?

With respect to Mr. Wolff, a Greek exit and reversion to domestic currency will enable the country to fully employ its resources and end a crushing depression. It won’t be roses at first but it’s a lot better than what they’ve got now.

The global neoliberal model which has infected and contaminated ALL things human and humane should be thrown out lock, stock and barrel. If I had a say in Greek policy I would leave the Euro and default on my debts. Local peoples should set up their own public banks and figure out how to be community. It would be hard but would unleash creativity and imagination; human aspects that are dead in a neoliberal world.

what Ben Johannson says.

The analysis in the article is written by an economist trying to justify his past bad decisions.

Greece was a very desirable place to visit and live before it entered the EU it even had one or two billionaires. What it mainly had was a fantastic quality of life. That has been traded for iPhones, BMW’s, smog, a huge unpayable debt and mass unemployment. A Grexit and drachma-isation means no debt, rebuilding by mobilizing local resources and n more Beemers or iPhones. Greece can generate enough forex with tourism to maintain a good medical system and buy some oil/gas – what else do they need?

They can’t drachma-ize the debt. It’s English law debt. So they can’t redenominate it and have any fights in Greek courts.

They can default and see what happens. Argentina shows foreign courts are not very nice to small countries, and remember Argentina cut a deal with almost all its creditors. Much better fact set than a default.

And your comment is basically ad hominem. Breugel is pretty liberal for an orthodox economics blog, and you have no idea whether Wolff was on board with the view of his prior employers or was an internal dissident. The fact that he left for what most people would see as a minor position suggests he was not happy about something.

This guy blows the whistle on himself: They would lose the “help” of the Troika – and he claims that’s a disadvantage?

That’s the whole point of a Grexit.

And an exit “might not be possible” – are you saying Greece isn’t a sovereign country? In which case, neither are the rest of the Euro bloc. That would be big news – and would lead very shortly to a new war in Europe.

The Trokia, specifically the ECB, can cut off the Greek banks from clearing and settlement. The Greek banks use clearing and settlement networks under ECB and US control, and if the ECB cut them off, the US would almost certainly follow. That would send Greece back to the Dark Ages pretty quickly. They’d been unable to import or export. So yes, Greece is effectively not sovereign. Under the Maastrict Treaty, it can’t just quit the Eurozone. I believe the basis for debate is that no exit mechanism is specified.

Now that does not mean that they will go that far, but do not underestimate the Troika’s leverage.

If the ECB cuts off the Greek banks then euro deposits cannot leave Greece – and the country is effectively expelled from the eurozone.

But that is not allowed by the European Treaties. The European Comission has recently re-stated that a member country cannot leave the eurozone.

So, yes, maybe the ECB could do it. Or maybe it’s just a bluff. If they really did they would be openly violating their mandate – it would be a true rogue move, as in a constitutional coup d’état.

My guess is they would likely think twice before going that far.

The unmentionable: they’ll become largely agrarian and learn to take care of their own needs locally. Foreigners who try to interlope with local “government” collaboration won’t be able to accomplish anything reasonable at all as the locals will just ignore whatever edicts are handed down. That’s the direction everyone’s headed anyway, so no reason for the Greeks not to get a head start and spare themselves a lot of unnecessary misery.

My comment may not fit in this blog space. But Yves indicated something to put into considrations rathan than purely econ realm.

My impression on Euro zone problem is not economical questions, rather political questions. And my hope for the Greeks is that they are asking the polical question, rather than techinical economical questions.

From what histories tell us about formations of uniting different organizational forms, what makes to unite them is someting external to them which doesn’t share their value system or belief.

The US as non democratic socity as it is has economical weapons in their choices, however so dismissive state of political notations are. Should we consider polical solutions in terms of massive qualitiy of ours to seak of less distains and minium caualities?

All numbers aside (please), “Europe” is doing a fine enough job drowning itself. I don’t imagine Greece’s extra weight will make much difference helping or hurting. This is a big nasty political problem (with all the history riding piggy back). What else could happen when you have an entire continent (excluding England) whose industrial power was/is centered on Germany? As expected, Germany is calling the shots because they have a solid, modern productive base, while Greece is crawling along with pre-industrial economic drivers like agriculture/harvesting (olive oil, grapes, fishing) and desperate economic fill-ins like tourism (there is a reason why this is the primary source of GDP in “3rd world countries”). I’m just not seeing how its being part of a group of counterparties in a single monetary paradigm is going to help them at this point. This is the same EU that can’t stand by their own interests during a conflict between the USA and Russia. What Greece needs right now is what Greece needs via democratic process and trial-and-error, however unsavory this may be. They are done with the Euro and they should be. I will advocate for a monetary unity once we have political leaders that are competent.

Assuming Syriza won (I hope, but it’s hardly in the bag). They are then going to have to deal with the globacrats in the EU, ECB, or these guys at the European Commissio:

http://ec.europa.eu/economy_finance/publications/economic_paper/2014/pdf/ecp518_en.pdf

Greece is a victim not so much of the EU or Germany as it is the explosion of global corporate growth/trade in China/Asia/Oil Kingdoms powered by ever-lower interest rates delivered by the financialization of about 10 years’ worth of global GDP. Ireland attached itself directly to the US/UK/EU corporate supply chain which doubtless factored in the deals cut for Ireland by BoE and IMF not on offer to Greece.

I think the ECB, Fed, TBTF banks et al have had 3 years to consider what to do in a worst case with Greece and am not convinced Syriza has the leverage here to get a deal that is not only marginally better materially. It would still be a worth-while trade-off for Greeks to exit the Eurozone, as noted by others, because it still means control of their own incredible historical identity and destiny. From this perspective it would not only the the EU, but the US as well that would be hostile to an outbreak of democratic actions based on principles.

Greece is the metaphor for the global race to the bottom. From countries large and small, down to regions, sub-regions, cities, counties, towns in their untold thousands scattered all over the developed world, areas corporate globalization or financial flows will ever flow through. It’s hard even to leverage brains. But in fact, and I mean no disrespect whatever to Greece, what it might consider is to study Cuba’s development of a sustainable, independent, fair, lawful economy even under decades of debilitating US sanctions. If Greece after an exit sought assistance outside the EU, I see no reason someone would not then provide it, or that Greece wouldn’t finally dump its political, business and banker kleptocrats out on their asses.

Let this be hope well placed.

First and foremost Greece needs to exit the euro to gain sovereignity. Once they have it, clever management of GCB would allow an even cleverer government to get away from the misery that Greece has turned. Access to foreign financial markets is not required from the very beginning. Once the government stabilizes the situation, then they can try to gain credibility in international financial markets if they wish to.

Clever government would be cool.

But, even before that, why do Merkel and Hollande tug their forelocks,

every time Uncle Sam or Mister Market grunts?

Kyrie Tsipras is not the first opposition leader to promise instant relief.

Will we be surprised?

Yves, Thank you! After ingesting todays filet of sole (A filet of sole refers to the piece of meat that is cut from the bones in order to be consumed.), I feel nothing but despair for the attempt by the troika to unify thru econ means, Though a thought has entered my head , ? As the euro loses exchange value, is this good and bad at the same time! Good as it brings individual balances closer to par and reduces debt load? aaannnd Bad because it refects the freeze up of liquidity in the zone overall? As I’v seen stated somewhere , Greece is just the tip or exposed part of the iceberg with the larger mass below the water line invisible but 10 times as big of a problem? If trade is the most important aspect of a normalization of imbalances within the eu community then this process could take a very long time and the trading partners such as China and Russia are well , lets say , looking less and less likely to carry the world thru growth! And at the same time these currencies are falling as well ! So its not because of exchange rates or currency wars ect…that trade is stymied but that demand is flattening out! The US is sort of like the only game in town as far a currency value is concerned, YES? Financialization was in the kool aid in the bowl that the world was so freely drinking before this whole crisis started and now they think more kool aid is the cure ! WoW! thus my Despair! So yeah why not a grexit, everything else has been tried! If they go under at lease they went as a freemen!

Good as it brings individual balances closer to par and reduces debt load? Not !!!!!! I am dyslexic deflation is bad and bad !