Yves here. Conventional wisdom for some time has been that weakness in oil prices would be short-lived, with prices rallying in the second half (and arguably, the current rally representing the financial markets correctly anticipating a much improved supply/demand picture soon).

Goldman breaks with this consensus, arguing that prices will fall again as drilling will pick up again quickly. Their argument is similar to that of John Dizard, who at the outset of the oil price swoon, said it would not be over until the US shale players ran out of financial rope and money for oil plays became more scarce and costly.

By James Stafford, editor of OilPrice. Originally published at OilPrice

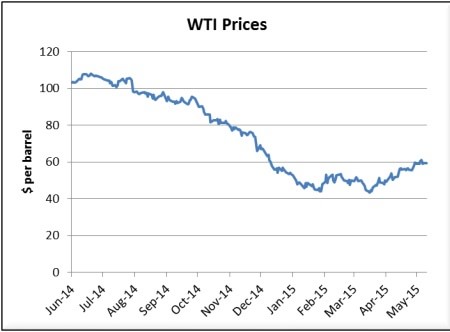

Oil prices have rebounded with surprising speed in recent weeks, with WTI prices bouncing by more than a third from March lows.

There are good reasons for this. Rig counts are down by nearly 1,000 (or nearly 60 percent) since hitting a high in October 2014. Spending on some of the world’s largest projects has been cut by a combined $129 billion, a figure that could balloon to $200 billion by 2016. The spending and drilling contraction is finally leading to some small production declines.

The downturn in activity sparked optimistic sentiment among oil traders that the markets have adjusted, and could be on their way back up.

Not so fast, says Goldman Sachs. The investment bank argues in a new report that not only is the oil rally a bit premature, but that the rally itself will be “self-defeating.” The rally could bring drillers back, but that would merely contribute to a reversal in price gains. More drilling and more production worsen the glut that has not yet been resolved, and prices could be in for a double dip (or triple dip if you count the price declines from February to March 2015).

The Goldman Sachs report says that the problem is not just from a surplus of crude, but also a surplus of capital. Access to cheap finance has allowed production companies to stay in the game and continue to drill new wells. Even companies that have seen their cash flows dry up or have run into liquidity problems have still been able to find investors willing to pony up fresh capital.

For example, in January and February, the world’s largest oil companies issued $31 billion of new debt, the highest quarterly total on record. Part of the reason for new debt is the need to raise capital – in other words, it is evidence of distress. But new debt was only made possible by the ultra-low interest rate environment. The Federal Reserve has kept interest rates low for many years, hoping to stimulate the economy. But that also has investors struggling to find yield, inducing more risk taking. With safer assets not offering the returns that investors are looking for, large levels of investment and lending are being funneled into oil companies, including some that are in precarious financial positions.

With a financial lifeline in hand, many companies that would have otherwise cut back more drastically are instead kept alive. Some may even begin drilling again. But the recent rise in oil prices is predicated on the fact that a real, authentic balancing is underway. In short, the only way prices stay in the $60 per barrel range, or even rise above that level, is if global oil production is materially reduced. That hasn’t yet happened in a significant way, and if output rebounds because of higher prices, the glut will not be resolved.

Goldman Sachs thinks the pieces are in place for another decline in oil prices, perhaps as low as $45 per barrel by October. “We find that the global market imbalances are in fact not solved and believe that the rally will prove self-defeating as it undermines the nascent rebalancing,” Goldman analysts wrote in an investor’s note.

If another round of price declines set in, the oil industry will be forced to make fresh cuts to their drilling fleets, spending programs, and workforces. These swings in prices, and the fortunes of oil companies, will continue until a much more lasting reduction in supplies is realized. In short, as we discussed in a previous article, a much more robust shake out probably needs to take place, with weaker drillers forced out and more production taken offline. That could still be several months away.

I would say that’s a logical assumption. If it’s so cheap to borrow money, what is to stop companies from throwing good after bad in pursuit of cash flows and payments to executives/shareholders? I imagine all producers envision themselves in a long game, waiting out a price spike that will shower riches on their gamble. Who knows if it will come? And honestly, sometimes I wonder if we can trust any information that comes out of Goldman Sachs. When their firm is shovelling shit while selling shinola, it’s hard to know where the truth lies.

Isn’t there a huge meta-problem with these sorts of predictions? Really, the price of oil is merely an artifact of chaotic system. Sure, we can make informed guesses about what may transpire in such a system, but in the end such guesses are equivalent to dice rolling. The fact that passive index funds always outperform active management strategies (especially the longer the time period–as is consistent with random distributions) should bear testament to this fact. So why waste the ink?

The only strategies for getting ahead that consistently work anymore are buying venal central bankers/regulators/legislators and defrauding investors. I would strongly suspect that purveying such philosophically unknowable information of this sort would fall into that latter category.

One of the crudest marketing techniques in the sleazy world of finance is the claim of successful predictions. It’s a staple of newsletter purveyors to claim that ‘I predicted the Crash,’ ‘I predicted the Bubble,’ ‘I predicted Apple would go to $700 a share,’ etc.

As Jack Bogle was told early in his career on Wall Street, “Nobody knows nothin’.”

If GS ‘knows’ crude is going to $45 in October, let them short the futures. Otherwise, I’d rather listen to the birds chattering outside my window. Crude will do what it’s gonna do, end of story.

Too bad that what crude is gonna do is kill the planet, but giving a select few Players a really nice buzz for their individual remaining lifespans, with no consequences to them.

It’s broken, and it can’t be fixed.

Thanks for the contribution. I read what James Stafford writes with some interest. Appreciate the great information and am certainly not alone. But getting GS into the loop is spoiling the source a bit IMHO. Why the hell do people listen to what a banking institution such as GS say? Still wondering. I can take the sellers’ argument. I can take the buyers’ ones as well. The bankers’ ones? Give me a break as you say:)

Stafford is the one who is citing Goldman. Goldman’s analysts get paid largely based on whether they are ranked as a top analyst by Institutional Investor. So while they may wind up being intellectually corrupted by having access to intelligence from the trading desks, their incentives are to get this right. An analyst that makes good calls has clout, and one that makes bad calls by being a tout for the traders is quickly recognized as such. In general, however, analysts have strong incentives to have a bullish bias, so a bear call and one that is contrary to conventional wisdom is worth considering.

It seems logical that when you have a lot of mothballed wells, with owners desperate for cash-flow, then you have a situation when every significant price rise will be choked off by a surge in supply. And of course we also know the Saudi’s are keen not just to give tight oil plays a kick, but to kill them off altogether.

I do remember from the days of the great Oil Drum blog that some of the more astute commentators were predicting that a peak in oil would be characterised not by a permanent rise, but a situation of constant irregular spikes, surges and peaks in prices, as dropping demand tried to match irregular drops in supply. This always made more sense to me than predictions of $200 plus barrels of oil. I do wonder if the very unstable situation created by all these cowboy tight oil plays may have put us in exactly this situation – maybe in years to come fluctuations from $40 to $100 plus will be a regular annual occurrence. Great for speculators and market manipulators, terrible for drillers and direct investors I would imagine.

predictions of “permanently” high oil will be true when oil becomes scarce, and people regularly conflate peak oil, which is just decreasing production of it, with scarcity. Those who predicted booms and busts were spot on because they understood what they were talking about.

Last time I counted there are approximately 1,000 wells drilled but not completed waiting on higher prices. How long they can wait to start production who knows. In addition, significant investments have been made in gathering and mid-stream systems which are just now being tied into production. I know for a fact of one gathering system platform in the gulf which cost over a $1 billion just came on line and phase two (several hundred million in investment) is to come on line in January 2016. Significant production will be gathered by this platform.

This is the way oil priced in the 1980’s. A big drop following by major investments hoping to catch a falling knife followed by another large drop. John Connally attempted a similar knife catching and then filed for bankruptcy in 1986.

$45 oil? That might just be enough to pop the property bubble in Canada. Good news for anyone who wants a house.

My hunch is that Greece is going down the rat-hole, temporarily at least, and that will cause havoc for the oil markets despite rising car registrations in Europe which is in a deep funk. I would bet that the oil markets are propped up by derivatives and loaded up tankers. The Saudis are fighting and financing wars and pumping oil away because they need the money and are near bankrupt. Goldman and JPMorgan are morally corrupt companies and they have sold their trading desks. The U.S. guberment is cutting its budget and the jobs are being off-shored. I think the $35 oil (perhaps overshoot) may not be an outlandish bet within 2 years. Time lags are difficult for my generally accurate forecasts.

One thing not discussed in this article is whether demand is also dropping. The sell-off which started in mid-June last year was not mainly driven by too much supply but by a decrease in demand and the biggest driver was China. This is the reason that other commodities such as copper and iron ore also took a dive around the same time.

So the question is whether China has recovered and is demand increasing there, is Europe picking up the slack and is the US economy roaring ahead? I believe the answer to all of these questions is not only NO but that there is a continual decline in demand.

In addition, supply from outside of the US seems to be continuing to increase. Accordingly, I see nothing but downward pressure on oil prices. This little bounce was knife catchers running in thinking we are going to get a bounce like 2009. Well, the fed and govt went all out to flood the market with liquidity and that drove up prices (much longer than I expected to be honest). No similar action has taken place at the current moment and I wonder if the fed or government even have the ability to do this.

Here is Ish’s take on Sun Tzu “The US government will be fighting to save everything until in the end it will be fighting to save itself.”

$45.00 or less, great if it happens, considering the price of a gallon of regular in the S.F.bay area is $4.00+ today.

I was paying in the mid-range $2 in Oklahoma. Arrived in LA and gas was like $4.25. Difference is (1) cost of additives in California, (2) refining limitations and (3) state taxes.

The gas price differential in California vs the rest of the US is 1) additives $.15-.20/gal and 2) state taxes are ~.25/gal higher than US average. This is ~.40-.50 / gallon. So the difference in price – which can be as high as $1.70/ gal , is inexplicable in terms of just additives and higher sales tax.

California – ever since the deregulation of energy in the late 1990’s – has become the land of high energy costs. We have an extremely industry friendly Public Utilities Commission , chaired until recently by Michael Peavy , who was the ex-CEO of AES . Peavy is/was a neoliberal, chummy with the Clintons. Peavy was instrumental in the catastrophic deregulation of energy in the late 1990’s. Since this cost California hundreds of millions , he was rewarded with the chairmanship of the PUC.

His wife held a seat for him in the Ca Assembly and later the State Senate. There are deep ties between Peavy and the California Democratic Party.

In a word, this is why gas is so expensive in California.

If only we knew how priceless oil is. If we respected its energy content I like to think we would (1 boe ~ 1620 kWh). Though our species does tend to take good things for granted. Energy commodities (particularly oil) are far too politically loaded to say they are accurately priced. They are as accurately priced as politics allow. Unfortunately under this paradigm, to a certain extent, politics are able to drive the resource to near non-existence with no viable alternative or escape. If we included scarcity, environmental impact, uniqueness, and political leveraging of commodity I imagine oil would cost more than most of us could afford.

Finally, someone gets to the heart of the matter. Thank you.

In December 2007, the USA entered a recession. WTI was around $90. Seven months later, it was trading at around $140. Oil traders know nothing about the present, let alone the future.