By Lambert Strether of Corrente.

California is a bellwether state for the such success as ObamaCare[1] has had, as well as for its failures. From the Kaiser Foundation’s recent report (“Coverage Expansions and the Remaining Uninsured: A Look at California During Year One of ACA Implementation”):

California is a bellwether state for understanding the impact of the ACA. The state’s sheer size and its high rate of uninsured prior to ACA implementation means that its experience in implementing the ACA has implications for national coverage goals. In addition, California was an early and enthusiastic adopter of the ACA; the state implemented an early Medicaid expansion through its Low-Income Health Program (LIHP) and was the first to create a state-based Marketplace.

Long-time health care reporter Trudy Lieberman argues for a focus on California from her outpost at the Columbia Journalism Review:

Why we need stronger coverage of Covered California

It’s not easy to figure out how to monitor the progress of Covered California, the country’s largest state-run health insurance exchange.

Lieberman then goes on to look at coverage of enrollment figures, and the tendency of our famously free press to write the easy benchmark story and print Covered California’s rosy press releases, instead of going out and doing actual reporting; we’ll get the numbers below. Lieberman concludes:

[G]oing forward, the exchange warrants closer scrutiny than, for the most part, it got this year. And while reporters should definitely be attentive to outside evaluations both critical and positive—like a recentHealth Affairs study that found exchange plans were of comparable or even better quality than plans bought on the private market—there is a role for journalists to play, too, in getting out there and talking to people about their insurance arrangements.

Amen. And I hope readers who have Covered California policies, or Medical, will chime in with their experiences, good and bad.

Absent in-depth reporting of people’s real experiences with Covered California, I’ll aggregate the press coverage I can find — there has been an uptick, lately — under the headings of Cost, Complexity, Quality, Coverage, and — saving the juiciest for last — Corruption. Of course, problems in all these areas are functions of ObamaCare’s overweening complexity, which is a result of the broken system architecture required by official Washington’s determination to preserve the private health insurance because markets, instead of adopting the simple, rugged, and proven single payer approach (see here at “largest controlled experiment in the history of the world”).

Cost

Cost of the Exchange. In general, the state exchanges are struggling. The Washington Post reports:

Nearly half of the 17 insurance marketplaces set up by the states and the District under President Obama’s health law are struggling financially, presenting state officials with an unexpected and serious challenge five years after the passage of the landmark Affordable Care Act.

Many of the online exchanges are wrestling with surging costs, especially for balky technology and expensive customer call centers [a function of ObamaCare’s complexity] — and tepid enrollment numbers [a function of poor quality]. To ease the fiscal distress, officials are considering raising fees on insurers, sharing costs with other states and pressing state lawmakers for cash infusions. Some are weighing turning over part or all of their troubled marketplaces to the federal exchange, HealthCare.gov, which now works smoothly.

Covered California is no exception. Covered California is running an $80 million deficit, because it’s not making its numbers, of which more below. Meanwhile, Covered California, including the Exchange, is funded — in classic neoliberal fashion — by a fee tacked on to premiums:

Covered California can’t draw on the state general funds, and its primary source of revenue is a $13.95 monthly fee tacked onto every individual policy sold.

So Covered California, in order to hold the line on access fees, is reducing funding on the exchange, reducing funding on outreach, and using up the last of the Federal funds it kept in reserve. Seems rather like a mini-death spiral, doesn’t it? Apparently, they plan to increase enrollment by decreasing marketing and failing to improve the website (also of which more below). Let me know how that works out.

Cost of the Policies. Let’s recall that “affordable” means that people can afford it. But from Kaiser’s “Coverage Expansions and the Remaining Uninsured”:

Many Covered California enrollees report difficulty paying their monthly premium. Nearly half of newly insured adults (47%) say it is somewhat or very difficult to afford their monthly premium, compared to just 27% of adults who were insured before 2014. Further, 44% of Covered California enrollees report difficulty paying their monthly premium, versus a quarter of adults with other types of private coverage.

Complexity

As should come as a shock to absolutely nobody, layering the insanely complex ObamaCare marketplace on top of the already insanely complex private heath insurance system costs a boatload of money. Health Affairs:

The $273.6 billion in added insurance overhead under the ACA averages out to $1,375 per newly insured person per year, or 22.5 percent of the total federal government expenditures for the program.

I don’t know about you, but I’d rather see that $1,375 spent on health care, as opposed to being spent on insurance company administrators whose job, after all, is to create profit by denying care, not providing it.

Traditional Medicare runs for 2 percent overhead, somewhat higher than insurance overhead in universal single payer systems like Taiwan’s or Canada’s. Yet traditional Medicare is a bargain compared to the ACA strategy of filtering most of the new dollars through private insurers and private HMOs that subcontract for much of the new Medicaid coverage. Indeed, dropping the overhead figure from 22.5 percent to traditional Medicare’s 2 percent would save $249.3 billion by 2022.

The ACA isn’t the first time we’ve seen bloated administrative costs from a federal program that subcontracts for coverage through private insurers. Medicare Advantage plans’ overhead averaged 13.7 percent in 2011, about $1,355 per enrollee. But rather than learn from that mistake, both Democrats and Republicans seem intent on tossing more federal dollars to private insurers.

$249.3 billion siphoned off by rental extractors. That’s a lot of money! Of course, to us, that’s a bug. To them, it’s a feature!

Quality

Yelp gives Covered California a one-star review. Here are some of the reasons why.

Service. Oddly, or not, Covered California’s doesn’t seem to be collecting, or at least making public, any data on how well policy holders are being served. Kaiser Health News:

No one has tracked how many people had problems like the Chiajis [we’ll get to them below] in the first year of enrollment, but many customers reported initial computer and communication glitches. For example, consumers and insurance agents in California said that when they tried to tell Covered California about a change in their income, their insurance plans were cancelled and they had to be re-enrolled, according to the Center on Health Reporting.

Sounds like HAMP.

Anthony Wright, executive director of Health Access, an advocacy group in California, said the percentage of people who experienced problems enrolling in Covered California was likely small.

Actually, Covered California’s lousy renewal numbers would argue that the percentage is “likely” large.

“But even if you’re dealing with 10 percent or 1 percent, in Covered California you’re still talking about tens of thousands of people,” Wright said.

With that, the Chiaji’s story:

[Kairis and Arthur Chiaji of Sacramento, Calif] had been thrilled to learn last year about the prospect of subsidized coverage under the nation’s health law, she recalled. Each of them had been uninsured for years when they signed up for coverage through the state exchange, Covered California.

Arthur, an immigrant from Kenya who worked in food preparation, hadn’t had coverage since he left his home country, which has a national health insurance program. “Everybody can afford insurance,” said Arthur, 39, who married Kairis in 2013. “And so that’s how I thought it was gonna be [in America]. That was not the case.”

Life’s little ironies, eh? They sign up with Anthem Blue Cross at one of those outreach “health fairs”:

Kairis and Arthur went home and waited to receive their insurance cards and first bill. Nothing arrived.

At the end of June, they finally received their cards and a bill for May, June and July, Kairis said.

They sent in one month’s payment, which they assumed would be for July since they hadn’t even known they were eligible for coverage in May and June. But Anthem told them their payment only covered May, Kairis said.

When Kairis called Anthem to ask whether there had been a mistake, “they said you’re not covered [now] because you have to pay the months before now,” she said.

As she tried to resolve the problem, Anthem told her to hold off paying another bill until the insurer was able to process a change in their income, which would lead to a slightly lower premium. So she waited, but didn’t get another bill. …

Kairis tried to clear things up on the phone with Anthem. “You wait on line for an hour, you get disconnected, they say no one can talk to you and hang up on you,” she said. “It was really frustrating.” When she called Covered California, she said, she got a message explaining operators were busy and she was disconnected.

Kairis estimated that she spent about 20 hours in all trying to figure out their insurance situation. Each time she called, she said, she was told something different.

This is a the “tax on time” Yves talks about. If only Kairis could bill for her time, like one of Covered California’s high-paid cronies consultants!

“At some point, [Anthem] said the month that you paid for basically amounted to nothing. There was never a month when we had insurance we could use, and you have to back pay four months worth of coverage in order to get covered right now — $138 times four, they wanted that payment.”

That would have been $552 for insurance the Chiajis said they never actually had.

There’s a lot to like here, but my favorite part is where Kairis and Arthur assume that the United States has a health insurance system that’s as functional as Kenya’s.

The Exchange. The blog “Insure Me, Kevin” seems to have taken on the task of tracking changes in Covered California’s website for both consumers citizens and insurance companies. Kevin’s conclusion, after this spring’s batch of changes:

A year and half after the launch of Covered California the CalHEERS enrollment website is still a work in progress.

Awesome. Emily Bazar of The Center for Health Reporting gives an example of progress that has not been made:

Projecting your income for the coming year has become a confounding but critical exercise in determining your eligibility for tax credits from Covered California, the state’s health insurance exchange. It’s doubly hard for self-employed individuals and freelancers whose incomes fluctuate not only from year to year, but week to week.

Readers will recall that income-based subsidies are a fundamental aspect of ObamaCare’s system architecture.

You’d think you could call Covered California or go to its website, report the income change and have your tax credits and premiums updated and applied to your current plan.

But when someone reports an income change, “the person is terminated from the current health plan they’re in and they’re re-enrolled in the same health plan with the new income information,” says Jen Flory, senior attorney for the Western Center on Law & Poverty.

What could go wrong? Well, exactly what went wrong for the Chiajis, as we saw above.

It took [freelancer Marilyn Hammers more than three months to get insured again and sort the matter out. All of this shortly after she underwent surgery and chemotherapy.

Why does this happen? Because Covered California’s nearly half-a-billion-dollar computer system apparently can’t handle that kind of complexity.

“They didn’t build the system in a way that allowed for such changes,” Flory says.

(Covered California denies this, but Bazar has numerous counter-examples, because she writes an advice column.) What I want to know is, which well-paid crony technical consultant wrote the specifications for Covered California’s website, such that a fundamental requirement of ObamaCare’s system architecture was left out? And who signed off on it? Bazar concludes:

I can’t advise you not to report an income change because state and federal law requires it, even though there are no penalties for failing to do so.

What a mess, where people need to have sane ways to work with an insane system explained to them with nods and winks!

Finding a doctor. Citizens consumers are still being denied care because of Covered California’s narrow networks:

Compared to only 3% of adults with other private coverage, 13% of adults with Covered California and 8% of adults with Medi-Cal say a provider would not take them as a patient because of their coverage. Medi-Cal enrollees also reported higher rates of long waits for appointments (21%) than those with other private coverage. Like the forces underlying choice of usual source of care, these issues may reflect continuing problems with network adequacy, despite the existence of state standards for network adequacy and patient access.

The provider directories from the insurance companies should sort in- from out-of-network doctors, but they aren’t accurate, so at a minimum the patient pays Yves’s “tax on time” by taking a trip to the wrong office, and at worst they get stuck with a huge and unexpected out-of-network bill.

Coverage

Enrollees Covered. Trudy Lieberman looks at how Covered California reports its enrollment numbers in the press, and if I didn’t know better, I’d say they were jiggering the numbers:

It’s not easy to figure out how to monitor the progress of Covered California, the country’s largest state-run health insurance exchange.

Is it the total number of people who have signed up for an insurance plan on the exchange during open enrollment? The rate at which people renew? The number of new sign-ups in a given year? The number of Latino sign-ups? The number of “covered lives”? The number of Californians who have had coverage through the exchange at any point? Or, simply, the overall rate of uninsured adults across the state?

In recent months, Covered California has cited each of these measures to tout its success. And though outside analysts have raised some notes of caution, press coverage has largely followed the lead set by the exchange. The result is coverage that has too often been reactive, short on enterprise, and with missed opportunities to ask some necessary questions. Covered California may ultimately have a success story to tell—but it will need to face some sharper skepticism before we can be sure.

Coverage Growth. Awful. The health insurance consultancy Avalere ran its own numbers and concluded:

California, the state with the highest enrollment in 2014, only retained 65 percent of their 2014 enrollees.

Explains that one-star rating, eh? And awful in relative terms, as well. Los Angeles Times:

The state made little progress this year. California was one of the worst-performing states, with 1% net enrollment growth, according to a recent analysis by consulting firm Avalere Health.

Unequal Coverage. As we showed here, here, here, here, here, and here (“Obama’s Relentless Creation of Second Class Citizens”) consumers’s citizens’ access to life-saving health care under ObamaCare is random with respect to income, age, jurisdiction, and a host of other factors, including education level, language, and race. California was and is no exception. Kaiser:

Mirroring historical patterns and legal barriers to coverage, the remaining uninsured population is more likely than the insured to be Hispanic, to be male and to be undocumented. The high share of remaining uninsured who are Hispanic may reflect barriers in outreach to this population or eligibility limits based on immigration. Though most newly insured and uninsured adults are in a family with a full or part-time worker, the specific work profile differs between groups: newly insured adults are less likely than remaining uninsured adults to be in a family with a full-time worker (versus only a part-time worker). With new coverage provisions in place as of 2014, there were more options for health insurance outside employment, and groups traditionally left out of the employer based system—such as part-time workers or low-wage workers—had new avenues for coverage.

I continue to see no moral justification for treating the lives and health of presumably equal citizens so unequally, except the ideological requirement to preserve the market in private health insurance. (Note that even the Fiscal Times has moved on from TINA, and actually mentions — dread words — single payer.)

Corruption

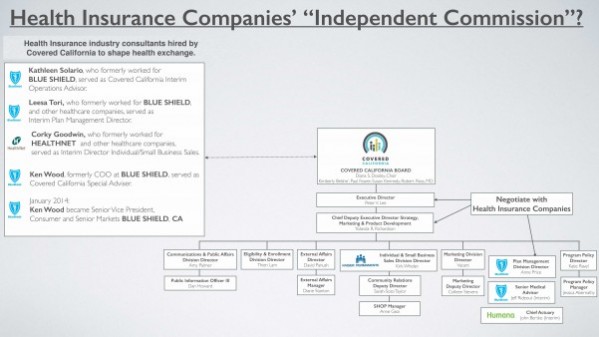

Corruption in Covered California takes two forms: A Flexian infestation, and regulatory capture:

Flexian Infestation. “Flexian” is a term invented by Jane Wedel in her excellent book, Shadow Elite. In short form, Flexians dissolve the boundaries between public and private in all their affairs; it’s not a matter of a “revolving door”; there’s no door, or even wall, whatever. This, as Zephyr Teachout shows us, is the very essence of corruption. Flexians band together to advance their mutual interest in “Flex nets,” and one such is evidently running Covered California. Consumer Watchdog to Kamala Harris in 2014:

The Associated Press reported today that the state’s insurance exchange Covered California “awarded $184 million in contracts without the competitive bidding and oversight that is standard practice across state government, including deals that sent millions of dollars to a firm whose employees have long-standing ties to the agency’s executive director.”

The contracts reflect a troubling practice at Covered California, which has paid very large amounts to current and former employees of health insurance companies to create the exchange and to oversee contracts and contract negotiations with the health insurance companies on the exchange.

An independent investigation by your agency is warranted to determine whether taxpayer dollars have been misused and whether consultants have inappropriately used their position with the government agency to advance the interests of former and current insurance industry employers.

The Associated Press story focused on $4.2 million in no-bid contracts to Leesa Tori, who is closely connected professionally to Covered California’s executive director Peter Lee.

Tori also worked at Blue Shield and her interim role at the agency included negotiating and overseeing contracts with health insurance companies including Blue Shield.

We ask that your investigation include the degree to which consultants who work or or have worked for health insurance companies may have used their official positions at Covered California to advance the interests of those companies at the expense of policyholders and taxpayers.

That is, Lee and Tori are Flexians, part of the same Flex Net. And that $184 million may not seem like much, since we’re used to thinking of squillions, but it’s a lot at the state level. Sacramento Bee:

The no-bid contracts represent nearly $2 of every $10 awarded to outside companies by the agency and were among roughly $1 billion in agreements disclosed to AP that the exchange executed from late 2010 through July, according to the records.

Consumer Watchdog President Jamie Court concludes:

“This isn’t about speed. This is about being opaque,” said Consumer Watchdog president Jamie Court, rejecting Covered California’s claim that it needed uncompetitive contracts to meet the tight deadlines to carry out the state version of the federal Affordable Care Act. “For $4.2 million to flow to a former associate without any oversight is the antithesis of open government and good government.”

And it’s also the essence of corruption, as Teachout shows.

Regulatory Capture. Here’s a handy chart from California’s Consumer Watchdog in a letter to the California Attorney General (link to the full-size version):

Shockingly, or not, the Covered California Board, which negotiates plans and also regulates the Covered California Exchange, is full of insurance industry insiders (note the blue logos on the small version here).

Conclusion

I’m sorry to have written a such a long long-form post, but I’m afraid that’s yet another side effect of ObamaCare’s complexity; there’s just so much to go wrong, and so many people harmed. (Here I must insert an obligatory troll prophylactic: A program as large as ObamaCare is bound to benefit many people. What I would like ObamaCare apologists to explain is why all should not benefit, equally, with the many that do.)

We might also view ObamaCare as a case study of bootstrapping a major social insurance program on neo-liberal principals. At the heart of ObamaCare is the market: Both the private insurance market, and the ObamaCare marketplace, overlaid upon it. My tentative conclusion is that we should never regard a market as neutral, but always structured for the benefit of those who design and create it: In ObamaCare’s case, rent-extracting private insurance companies and Flexians. Perhaps, if we are lucky, we will one day have a health insurance system as inclusive as Kenya’s.

Notes

[1] I’m continuing to use the popular “ObamaCare,” as opposed to the ACA, PPACA, or “Patient Protection and Affordable Care Act,” for search results. “ObamaCare” is, of course, a contested term — although not by Obama — and some outlets have taken to using the anodyne “Health Care Law” to refer to it. That’s a particularly unfortunate locution, because ObamaCare is primarily about health insurance, with actual care a secondary consideration.

Addendum

In researching this post, I ran across this from Kevin Knauss:

Should you sell assets to avoid Medicaid and get ACA tax credits?

An unfortunate flaw of the ACA is that determines eligibility for the tax credits to lower the monthly health insurance premium amount solely on income. Many people who have structured their lives to live on very little income, but may have a nice nest egg of assets, are only eligible for Medicaid. This is because their income falls below the federal poverty line established for Medicaid. For those individuals who would like assistance paying for a private plan they are faced with the prospect of selling assets to generate enough income to push them out of the Medicaid or Medi-Cal range.

That people even have to ask that question… That ObamaCare’s architects put people in such a position… I’m shaking my head.

All those “problems” can be fixed with more loot. Especially the corruption part.

As long as it’s “working” to distribute loot to the politically connected (aka: the adults) it’s “working”.

Not much different than: Big-MIC, Big-Road, Big-Train, Big-Water, or any other Big-Gov scam the adults of society are getting rich off of.

(Disclaimer: I LOVE my Big-Gov scams, all three of them: Big-FIN, Big-Ed, and Big-StateGov)

In software engineering, they call that “broken by design.” Indeed!

A great question to ask is where, in physical terms, the loot is being extracted from. The American Empire is draining the world of energy and resources to enable such hyper complex scams that only “benefit” (as defined in a very narrow and short sighted manner) a few corrupt elites (while everyone else suffers).

I’ve been listening to the history of Rome podcast and it’s amazing how strikingly similar the precise same dynamic (complete with bread and circuses no less) was playing out as the Roman Empire was nearing its end.

The only thing that delayed the collapse of Rome, was that magic spreadsheets hadn’t been invented yet. Ultimately the lack of understanding of the exponential function destroys all civilizations.

Thanks for the post which has pulled together various issues. I live in CA, part-time in Sacramento and part-time in San Diego. I am employed by a small state agency and have health insurance coverage via my employer, which is close to as good as it gets. I don’t have any direct or indirect experience with Covered CA – it’s only what I read in the nooz or maybe hear via third hand gossip, the latter is pretty meaningless.

All I can contribute is that everything, absolutely everything, in my PPO plan has gotten more expensive. Well the premiums were already rising at atmospheric rates anyway, but of course, the premiums continue to rise. But my deductibles have risen, and the things that are now “outside” of the coverage provided have expanded and the costs for a variety of services are very high.

It’s the usual stuff. Why are doctor visits so expensive? Doctors now charge per “thing” that they do, so if you go in for a annual physical, but the Dr checks out something that is not strictly within the narrow confines of the “services” provided in the annual physical, then I’m charged a separate fee for whatever that might happen to be. And such “things” tend to be charged at an insanely high rate, imo. I mean, I’m already there for the physical. Then the dr does some slight other “thing,” but that’s charged at maybe $300 or $400 more on top of whatever the going rate is for the annual physical. That didn’t used to happen. It would just all be included in the one price for the physical. And typically, whatever that extra “thing” is – I’m charged a high deductible for it. So it’s personally expensive.

I’m lucky because I’m extremely healthy and fit for my age, but I am *heading* towards what used to be called the “golden” years (yeah, right). I take NO medications other than standard vitamins (which my Dr does review and advise me on). I have no known health conditions at this time; have never had surgery; my joints so far are in great shape. So I’m very lucky.

And yet, I’m paying through the nose almost any time I go to the dr. Plus my Dr does order, sometimes, some additional blood work just to double check various possible issues. Again, I pay through the nose for any blood work which isn’t the plain vanilla stuff.

I don’t know how some of my co-workers, who have a variety of health issues, can afford to pay for their health care.

That’s my report. Everything is very pricey out here in Cali. You’d better be prepared to pay a lot of money even when you allegedly have “good” health insurance. I shudder and tremble in real fear to think about what my costs might be should I be unfortunate enough to get really ill or be in a bad accident. I do have additional insurance coverage – paid by me via my work – and that *might* cover some other expenses in cases of catastrophic medical issues.

It’s pretty frightening, frankly. I feel like most citizens are in total denial about what’s happening right in front of their eyes.

My experience with being billed per “Thing” has led me to the belief one should never, ever answer the question “Do you have any other concerns?”, particularly if your provider likes to pile on prescriptions. Your 30-second response and the provider’s attempt to force another med on you will be billed as a separate visit.

That’s horrible.

Trudy Rubin is referred back to before her article and name are mentioned.

Oh, yikes, good catch. I used to read the Philadelphia Inquirer’s Trudy Rubin all the time, and I confused my Trudies consistently [lambert edits furiously].

Excellent presentation of this morass of complexity!

I am glad to learn the term ‘flexian’, which immediately applies to the sleight of hand underway as the Patriot Act morphs into the Freedom Act.

I’m very disappointed in representatives with a capital R, plus senators with a capital S (including S Sanders) for glomming onto the latter ‘act'( which deserves a diminutive a).

flexians all! (And flabby ones, at that.)

Thanks! Be sure to check out the link, though; Wedel’s presentation is at once more subtle and powerful than my quick summary here. Or buy the book!

Sometime this week, the hospital in my small west coast town is supposed to go live with the integrated medical records (oops, health care information management ) system provided by CERNER so the hospital can finally integrate electronically all those private practices it has swallowed up over the past few years.

http://tinyurl.com/fat-tick

Yes, that CERNER, the one that just gave early retirement to the majority of it’s management. When it doesn’t work, who you gonna call? The trainwreck promises to be EPIC, which just so happens to be the name of the system they are trying to integrate.

Coming on the heels of this clusterf*** will be the ICD-10 coding conversion. If there are live patients under the rubble of this monstrosity when it collapses, it will be a miracle.

Sounds like you’re a medical coding geek. Do feel free to send me interesting links on that topic.

Recent article on best website …

http://www.govhealthit.com/news/could-congress-delay-icd-10-again-next-week

Not everyone has moved to ICD-10 yet, some are experimenting now, by coding with both the new and old systems at the same time, to work out the bugs in how the new codes will be used.

January this year was when my company made the switch over to an Obama-care policy through Anthem/Blue Cross. And the nightmare has been ongoing ever sense.

Not a week passed when the press broke the news that Anthem’s network was hacked. Suddenly, every one in the company is at risk for identity theft. Anthem dose the responsible thing and provides “free” identity monitoring – for three months, and even then only basic monitoring. If you want more sophisticated long term protection – you guessed it, Anthem has a monthly subscription fee-service.

And it turns out this was no small risk. Several of my co-workers got their identities hit. Most disturbing however is the scope and scale of the information the hackers got into. The government is restricted from knowing detailed personal information, but apparently Anthem is not. And by extension the hackers.

So identity theft turns into a profit center for Anthem. That’s sick.

Not a bug, its a feature.

I also ran into another problem. There is something strange going on with the pricing of drugs. Here is a copy of a conversation I had with my employer.

Keep in mind my deductible is about $1800. But sense then the pharmacist has offered me some kind of “discount card” that nether me or the pharmacists fully understands. (Apparently the payment system is as much a mystery to him as it is to me.) The discount card brings down the cost, but still above the going market rate. This just ends up extending the time before I meet my delectable.

The bottom line is that I can no longer afford to take out this prescription. My existing income is laughably inadequate. I am now forced back to my condition before the prescription, which forces me to sleep randomly and is quite painful. It’s also a condition of further employment (safety reasons) so I am once again having to hide this from my supervisor, who thankfully has taken up the attitude of don’t ask – don’t tell. Otherwise I would have to be let go – and essentially rendered unemployable.

To add further insult to injury – narcolepsy is one of the few conditions that doesn’t qualify for disability, because (wait for it) a treatment is available.

Yes, Obamacare has put me one hairs breath away from absolute destitution, nether qualifying for employment or disability. Where before the treatment made my life a whole lot better.

Pain city, population me.

(Thanks, I needed to get that out.)

What does that even mean that a company switches over to an Obama-care policy? Aren’t ACA policies a separate thing than employer provided health insurance? Unless the employer eliminates coverage and forces you onto an exchange I guess. You may have a worse policy than before but is it really Obamacare?

Insurance getting more expensive and companies switching to cheaper policies was happening anyway, true the ACA didn’t solve anything …

Anecdote … I work for a large company. my insurance changed Jan 1 2014 to a system with half the benefits, twice the deductible, but the same cost as before. I was “encouraged” to put money into a company run health care slush fund, to help cover my increased deductible. Before, participating in a health savings plan was sold for entirely different reasons, to ameliorate health expense flow for chronic conditions. So basically it is now a clone of the Obamacare Bronze plan. So when the mandate comes, if it ever comes, there is no need for them to dump us on the Obamacare plan, because we are already in a company version of that. Aetna was the bandit, before and after the change … and Aetna famously was quoted as saying that health insurance business was bankrupt, if they didn’t get the Federal subsidy.

One of the central features of Obamacare was to do away with something called “full coverage plans” that was popular with most employers and unions. Full coverage meant zero deductable. You paid for it with high premiums and high deductibles, but expensive stuff was totally covered.

But neo-liberal thinking argued that this caused the run-away price hikes. You see people weren’t paying any thing for their care, thus were not making good decisions needed to force the markets to reduce cost and improve quality. So the ACA moved to encourage high deductibles for force consumers to have “skin in the game”. This would force people to shop around and in turn bring down costs.

When I say we switched to an Obamacare policy, what I mean is the ending of the full coverage policy, and replacing it with basically a basterdized version of the bronze plan. There are some who tell me they looked on the exchange hoping to find a better deal. To my knowledge, none of my employers found a better deal. (All though to my knowledge, they don’t even have a right to apply for a market plan so long as their employer is providing coverage. And employer plans are also exempt from subsidies.)

Keep in mind Obamacare (to my knowledge any way) did not pass any law prohibiting full coverage policies from being offered. But for some reason, the policy providers simply pulled all full coverage plans from the market.

“Skin in the game.” I think it’s a safe bet that any policy maker/opinion crafter that uses that deadly turn of phrase has never had their skin in the game.

Why should they? They are the one’s receiving the skins.

Stupid question: when health reform is analysed, are the increased deductibles considered? When cost of living numbers are crunched, are just premiums considered, or are the deductibles considered?

I know in my case, seeing a dermatologist was a 3 week long wait, because there is ONE in the network.

We actually do not know. The only real analyses done to date was done by the CBO (Congressional Budget Office). And their work is never published directly so all we really get are the conclusions with no way of scrutinizing the work that went into the conclusion.

Today, only government agencies have access to this information, (Or privacy and propitiatory reasons, many of which are legit IMMHO) Amusing agencies are even collecting this sort of data.

I think the best that is out there come from a hand full of states and municipalities which track and publish this data. Not enough to draw any national conclusions.

Its as if Obama has decided that the best way to insure Obamacare will work – is to simply not look.

I’m a practicing internist in CO. Most doctors are not happy with the environment the government has created. For every patient-doctor encounter that occurs, there are probably 200-300 administrative encounters that are occurring in offices, insurance companies, state/federal agencies. The Exchanges just increased the administrative encounter ratio — it didn’t do anything to help take care of people. As time goes on, I think the only way out of this morass is to get all the millions of middle-men out of the equation and let it be a transaction/barter between patient and doctor.

Well, that’s what Canada does, AFAIK. Single payer handles the back office.

For every patient-doctor encounter that occurs, there are probably 200-300 administrative encounters that are occurring in offices, insurance companies, state/federal agencies.

Those are high paying bullshit jobs. Same as an economist’s job. Adds to GDP so it’s all good.

One of the political problems is the HEALTH Complex Keynesianism. The paper pushing, bill collecting, can all be wiped out, but instead of these people out work, really good health care would involve this same army of paper pushers following each patient like an account manager. Following up on filled prescriptions, or not, following up with reminders about appointments, transportation issues. Sick people, not just ones going in for a physical are not top performing go getters once fallen ill. And you don’t need a heart attack or car crash to get knocked off your feet. Infections and other less famous problems land people in the hospital.

The following up for rehab, meds, etc all by yourself is no easy task. Even if married, a spouse has to handle the household with one man down, all of the kids, their own job and career, etc etc. Anyone who has been really sick and I don’t mean even a really bad flu, and loses a week or more to the hospital and home care knows how all by yourself you really are. Following the blizzard of redundant or mistaken paper work that starts to show up in the mail for billing and other purposes piles up unopened until you feel better.

All of the paper pushers could be working to make you feel better, have a handle on all of your paper work and real health care instead of the market generated paper chase. There will still be jobs and real health care making people really get better sooner, instead of harassment and anxiety over bills, being on time for appointments, you know, or you’ll still get billed you bad, bad sick person, snap it up!!

No paper pusher, ever, has made me feel better. Paper pushers by my definition are well paid people that subtract value from a transaction. Useless eaters, so to speak. Gargantuan overhead is what gets paid when those blizzard of bills show up in the mailbox, with their $500.00 charges for an Aspirin, and $1000.00 for a tongue depressor.

. . . I think the only way out of this morass is to get all the millions of middle-men out of the equation and let it be a transaction/barter between patient and doctor.

I agree with Dr Disenchanted, but have you ever tried to get rid of a middleman? They are like the worst barnacles on a ship. All the insurance people, the hospital administrators, they will tell you that what they do is vital, yes vital to your health.

But that is a lie.

Surgery Center of Oklahoma – pricing

Try getting an estimate from any other hospital for the same surgeries. Perhaps all those useless eaters can make themselves useful, and post a friggin price list at the hospital entrance, just like the oil change shop.

That number is absolutely believable in motor vehicle accident cases, from my (remote and indirect) end of the industry.

What about putting doctors on (a fairly generous, mind you) government salary and having their educational debts extinguished by the state? It’s an anti-market solution, sure, but that’s probably better for the patient who doesn’t have to worry about being upsold so someone can make this month’s mortgage payment or downsold so someone can make this month’s bonus.

re: “rent-extracting private insurance companies”

About 35,000 New Mexicans could see their health insurance rates skyrocket if Blue Cross Blue Shield gets its way. We’re talking about a 51 percent increase here.

The people affected would be Blue Cross Blue Shield customers on individual health plans under the Affordable Care Act.

The ACA is working just fine, thank you:

https://www.google.com/finance?chdnp=1&chdd=1&chds=1&chdv=1&chvs=maximized&chdeh=0&chfdeh=0&chdet=1433188800000&chddm=984538&chls=IntervalBasedLine&q=NYSE:UNH&ntsp=0&ei=kqZsVdCILJS1mAHoh4BY

Got an address where we mopes can send a big Thank Yew So Very Much note to all the Fellow Consumer Progressive Enablers who lined up like good little Obots and still try to convince us that the ACA was/is a Great Victory for the Common Man.

As a back office nurse I do get to see the bloody mess as it ” matures.”

thanks for this excellent update, Lambert. Extremely information rich. It went straight to Health Care For All Oregon, the OR single-payer campaign. I’m guessing you don’t mind if they quote it liberally (so to speak.)

We’re counting on you to keep up with this issue. It’s a tough job, but you seem to be up to it,.

I eagerly await a column by Ezra Klein maintaining that all of this is proof that ObamaCare is really working as intended.

The ACA is working exactly as intended:

https://www.google.com/finance?chdnp=1&chdd=1&chds=1&chdv=1&chvs=maximized&chdeh=0&chfdeh=0&chdet=1433188800000&chddm=984538&chls=IntervalBasedLine&q=NYSE:UNH&ntsp=0&ei=kqZsVdCILJS1mAHoh4BY

Does anyone have any idea what a typical deduction would be before the insurance company pays the first dollar?

Varies by plan and “metal of choice” coverage. My deductible as a single working person went from $3000 to $6000. A better plan would have kept that at $3000, but at increased monthly cost. In my case it is worse, since I was “encouraged” to contribute more anyway, to help allay the increased deductible … they are afraid I will default if I get sick.

Some patients in our practice are saying $8-10,000 for individual plans in FL, a pit of corporate cruelty and greed. Lots of easily findable reporting, here is one source that says for 2015, those Bronze plans have median 5000 indiv and 10000 family deductibles. I’m a veteran that gets VA care for zero, though the neolibs want to ” fix”that too, fees and privatize. And I also signed up for Medicare with that AARP supplement, some exclusion like vision and of course we are all screwed by Part D on drug costs and generally by Big Pharm, my monthly is $ 182, or $2184 a year.

In case nobody noticed, we are being screwed, and killed too, by “health care.” Record keeping, quality of care, every aspect. Work hard for your Overlords, and when you can’t, die quickly and quietly and be sure you have pre- paid for your incineration.

http://www.thefistimes.com/2014/11/21/Obamacare-Deductibles-Already-High-Climb-2015

It appears to be a dead link

http://www.thefiscaltimes.com/2014/11/21/Obamacare-Deductibles-Already-High-Climb-2015

The link is fixed, but this is still a year old. Sorry, but you will need something more current.

$8-10K/yr would be a bonus. First year on COBRA, was paying $26K/yr because wife couldn’t get coverage because of an existing condition she has had since a kid, but never required any treatment (nor will in the foreseeable future). ACA did get us in Covered CA at $14K/yr the first year. Got treated like Medicaid patients, lost our primary care providers for kids, ourselves, countless hours on the phone, higher co-pays (good thing probably), less coverage. After all that, was able to get on a regular plan outside of Covered CA. Same cost, at least better service – but still no where like it used to be under an employer plan.

This whole medical system is beyond belief. And all we get is the same re-hashed politicians that advocate more of the same – selected by the moneyed class who are comfortable with more of the same.

I was surprised to read in Kaiser Family Foundation study that most of individuals and families were satisfied or even happy at their coverage. What the report did not detail was how many people who reported satisfaction had actually had to use their coverage. It is easy to be satisfied at the façade of great coverage with a substantially subsidized premium.

But many consumers of the ACA plans are finding out that the coverage promised is not always what is delivered. “No cost preventive office” visits that turn into a large medical invoice, shock over out-of-network charges, and the sting of not locating either a doctor or dentist that will accept the new individual plans have dampened the enthusiasm of many people with the new health plans.

I agree with your conclusion that Obamacare must be viewed as a case study and we need to note what works properly and fix those provisions that hurt unsuspecting consumers.

It’s just Rampant Statism, and people thinking there might be software or ballot box fixes are clinging to the slenderest of straws.

Whether it’s the Wizard of Janet at the Fed micro-managing the price of money, the Wizard of Hilary at State believing she can finesse and micro-manage WW III, or the Obot Wizards believing they can completely “state-ify” rampant trough-slurping by Big Insurance, Big Medicine, and Big Pharma…it’s the same delusion.

There’s no way to finesse our way out, it’s time for the tumbrils and heads need to roll. I’m more convinced than ever that the real solution is the Madame Defarge type, and the sooner the better for “all”. It’s heroic to think otherwise, and I do applaud people for it, but that’s my sad conclusion.

Finding a doctor. Citizens consumers are still being denied care because of Covered California’s narrow networks:

Compared to only 3% of adults with other private coverage, 13% of adults with Covered California and 8% of adults with Medi-Cal say a provider would not take them as a patient because of their coverage. Medi-Cal enrollees also reported higher rates of long waits for appointments (21%) than those with other private coverage. Like the forces underlying choice of usual source of care, these issues may reflect continuing problems with network adequacy, despite the existence of state standards for network adequacy and patient access.

The provider directories from the insurance companies should sort in- from out-of-network doctors, but they aren’t accurate, so at a minimum the patient pays Yves’s “tax on time” by taking a trip to the wrong office, and at worst they get stuck with a huge and unexpected out-of-network bill.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

DOES ANYONE KNOW HOW MUCH THESE INSURANCE COMPANIES GET PER MONTH FOR EACH PERSON ON MEDI-CAL FOR THEIR “MANAGED CARE” SERVICES (for which they get away with not providing services, I think I read on another blog that in Arizona they get $3,500 per month, in other words, you have to wait for services while the insurance company collects from the government their monthly fee)?

The Covered California chaos is the biggest unreported story in the state. As I wound my way through the system, I kept wondering what mechanism was used to maintain press silence.

The Chiaji’s problems are familiar, and must be to half the population of the state. Enrolling in March 2014 with Covered California telling me I would have a premium of about $20, Anthem Blue Cross informed me it would cost me $232! I sent in the $20, and never received any acknowledgement. Called up Blue Cross and they told me I owed them $60 more for my coverage that began in January! Finally got them to start insuring me by sending them the $60 — and then I went straight to the California Department of Managed Care, who got me some action. I didn’t have to pay for a while, since I’d paid so much up front — then the Department wrote me that my premiums had been reduced to either $1 or $2. It was a happy ending for me…for now.

Covered California sends out reams of letters that seem to be generated entirely independent of human agency, that are either self-contradictory or just plain senseless. Now I just throw them straight in the trash or save them for quiet evenings when I need a laugh — reading them out loud to friends can be highly entertaining. Just after filing my taxes this year they sent me an email telling me that they’d sent me incorrect information for my taxes, and then never sent the amended information they promised. I can’t even remember how many times I have received letters telling me I have been disenrolled and then reenrolled.

My guess is that total administrative chaos reigns within Covered California, and that a lot of the work is done by software alone, including decision making.

When I have actually been able to speak to Covered California (and Anthem Blue Cross) staff, they have been sincerely helpful to me, and even gone out of their way to do so — they seem to have been given some latitude to make things right for people. The bias seems to be to get people enrolled and keep them enrolled first, and clean up everything else later — once I even got a promise from an Anthem staffer that I would have coverage for a month, even though they were for some obscure reason (that they understood and had seen before, but would not tell me) unable to take my payment for it! That was a first from an insurance company! I wonder if it was actually true?

Somebody up high prioritized rapid enrollment above all, and also took pains that all the chaos remain out of public view, and had the pull to keep it out of the media — thanks for opening the door on this story! May we bring the day of single-payer closer!

Those are features, not bugs.

And complaining to Kamala Harris about corruption? I haven’t laughed that hard in months. Kammie is willie Brown’s Protege’, probably smarter certainly as ruthless and equally corrupt as Willie the Bagman.

Lambert, not sure which metaphor fits best: nest of vipers, roach motel, hornets nest, swarm of vampires, conspiracy of lawyers,there are so many. Basic problem is like so much else covered in NC: it’s too big, too complex, too many threads and nettles, too much money whatever that is, too much power, too much stupid but fundamentally too much of that fruit of the tree of the knowledge of life… Plain old evil, written in our genes and wetware. You could disappear all other political economic discourse here, drown it under the weight of just the trillions of words on just this one obviously complex “issue…”

The beginning of the complexity is with 50 states that have to set up their own exchanges, expand 50 Medicaid programs, basically multiply anyone problem times 50. Medicare doesn’t have this problem. And this battle was lost back in the New Deal/Great Society when to get something, the poor, the disabled, basically, all that don’t work full time for living and contribute to making profits are relegated to 2nd class status.

If Obama wanted us to shop like we do on Amazon, you will notice, Amazon does not have 50 websites for each and every state of the union. That would be so stupid, that even writing it out seems surreal. Who is forced to operate like that? DUh, Medicaid, unemployment, SNAP/EBT!!! Out of work, poor, single mom household.

It would seem that Medicare and Social Security which are professionally designed by actuarial guidelines for low cost/high volume operations would be also be the model for Obamacare, with only one national website, instead of 50. It seems that Medicaid is unequal before the law because it varies in benefits from North to South and in the case of Obamacare, does not expand at all most states where the republicans rule. Someone should sue for a uniform Medicaid because of the wide spread benefits from state to state. Of course the easy answer is replace it with Medicare and shut down the 50 state programs. That would save the states a lot of money. Without even going to Universal Single Payer, the vast improvement by having a nationally administered system, like Medicare would begin the reduction in complexity immensely. It is catering to the mean spirited cheap skate mentality to give bargain basement 2nd class treatment to people who have fallen through the cracks of health care insurance benefits due to unemployment or self employment or just incapable employers.

Oh, but not to worry, Nancy Metcalf of Consumer Reports will be all over this. LOL.

One of the recent issues of Consumer Reports had a very long article about how to find the Very Bestest hospital for your cardiac surgery. Of course, the article was only relevant to people who have Medicare or the rare-and-vanishing non-restricted policies, that let you go anywhere. Not relevant to a huge number of people now. For the people with miserably restricted Obamacare policies it was truly a “let them eat cake” piece. I guess that since only old people who have Medicare subscribe to CR, what does CR care about poor and struggling middle class younger people anyway? They don’t need subscribers, they have a “foundation.” Please donate generously to it right away, LOL.

Yes, Consumer Reports will devote ten pages to how to get the best cell phone plan, and thereby save $50/month. But for your biggest/scariest expense (housing may or may not be bigger, but it is far more under your control), NOTHING. Truly they do not give a crap about poor people subject to Medicaid clawbacks (oh you thought it was insurance? no, it’s a LIEN). Or the screwed people who get “Covered California.”

Not one tiny bit of guidance for them, none at all; I check each issue expectantly (/s). I have a friend who worked recently in a carpet store; one of the workers came in and the owner asked him if he’d gotten his injured shoulder looked at. No, the guy said, he had an Obamacare policy (it had to have been Covered California), and he could not find a single doctor who would take it as coverage. If a private sector insurer were selling worthless or near-worthless policies, Consumer Reports would be all over it. But because it is being done by the government, they are happy to throw the poor under the bus for the sake of their ideology. They are not even willing to print a few measly articles to give these poor shmucks some hints or tips; no, they leave them to feel as if they are utterly alone in their misery.

Things are equally dysfunctional in Vermont. I spent time working both at the state and local government levels in IT management and finally quit a couple of years ago after putting up with years of bureaucratic stupidity. Why did this happen? I’ve decided that bureaucrats and politicians believe the hype salespeople pitch and completely ignore the council of technology managers who understand the gap between promise and delivery. The unfortunate reality is that when you try to automate bad business processes things simply get worse at a faster pace.

Thanks for furnishing the Covered California Organizational Chart. Years ago, Board Member Kimberly Belshe was appointed Secretary of the California Health & Human Services Agency by Governor Schwartzenegger. Board Member Susan Kennedy was Schwartzenegger’s Chief of Staff.

Kimberly Belshe has a burnished resume in health care with one little tiny omission. She omits her job with “public affairs” firm Ogilvy & Mather when she was the high profile spokesperson for the tobacco industry hired to defeat the California 25 cent tobacco tax ballot initiative Prop. 99 in 1988. With that on her resume Schwartenegger picked her to head his state health department.

Prop. 99 was a highly important milestone in tobacco history, the first ballot measure in the country to test the power of the industry against the will of the voters. Though hugely overspent by the tobacco industry, healthcare nonprofits (Cancer, Lung, Heart), with only 2 campaign staff members who organized volunteers throughout the state, the Prop. 99 tobacco tax initiative passed. Millions in annual revenues were earmarked for tobacco education by this measure, which was in the form of a state constitutional amendment. This marked the beginning of the very public backlash against the industry throughout the country that continues to this day.

Under Schwarzenegger, Ms. Belshe went on to take the California Healthy Kids campaign on the road, supposedly to increase enrollees. The plan would expand health care for kids whose families were slightly above the poverty level. Belshe toured a few out of the way towns in California to “publicize” (not) this program. Potential enrollees were never assured that their immigration status wouldn’t be used to deport them.

The CA Obamacare faults detailed in this welcome piece about Covered California aren’t there by accident. There’s more than one way to (skin a cat) thwart a program that should be humane. Are the right people in place to do that?

Correction: Kimberly Belshe and Susan Kennedy were appointed by Schwarzenegger to the CA Health Benefit Exchange.

The federal exchange behaves the same way as Covered California when reporting a change in income. I increased my estimated income by $3,000 and found that my family’s existing coverage was then automatically canceled effective at the end of the current month. I was then prompted to choose a new plan plan from a list of available plans and re-enroll. This resulted in a new insurance cards with a new starting date, and a lot of unnecessary worry about possible lapses in coverage. Lesson learned: once you obtain a policy, never, EVER log in to the exchange unless it’s absolutely necessary.

If you want to lose yourselves at NC in more idiotic complexity and take on an attempt to bring decency and rationality to “health care in the US,” I wish you the best of luck. My little testimony, just a start of an infinitude of links that show the evil and corruption and business as usual in that one piece of the US “markets:”

The Pricing Of U.S. Hospital Services: Chaos Behind A Veil Of Secrecy

http://content.healthaffairs.org/content/25/1/57.short with lots of related inks, calls bullshit on “market” effects, dated from 2006 obviously with no appreciable impact on the corruption and scamming.

“As Hospital Prices Soar, a Stitch Tops $500”

“Sutter is a leader — a pioneer — in figuring out how to amass market power to raise prices and decrease competition,” said Glenn Melnick, a professor of health economics at the University of Southern California. “How do hospitals set prices? They set prices to maximize revenue, and they raise prices as much as they can — all the research supports that.”

In other countries, the price of a day in the hospital often includes many basic services. Not here. The “chargemaster,” the price list created by each hospital, typically has more than ten thousand entries, and almost nothing — even an aspirin, a bag of IV fluid, or a visit from a physical therapist to help a patient get out of bed — is free. Those lists are usually secret, but California requires them to be filed with health regulators and disclosed.

http://www.nytimes.com/2013/12/03/health/as-hospital-costs-soar-single-stitch-tops-500.html?pagewanted=all&_r=0 Also old news…

Look, there’s a whole lot of links and stories out there about the cancer that is the US billable-medical- event and medication dispensing monstrosity. Complexity and confusion are built in, intentionally in many cases, to build, as with the financializationalists, a structure so complex as to defy the kind of simple slogan-based ground resistance that might work, with power players and stakeholders aligned (e.g., who wants to kill more “good paying middle level jobs,” after all, that one might also network or luck into?) and a magical ordinary-working-person-based wealth generator that somehow creates the money fictions and illusions that let it all grow unchecked, unseen by what would be the analog of your immune system that keeps neoplasms in check in healthy bodies. All the while, just like tumors in metastatic malignancies, tricking the remaining healthy tissue into creating large new blood vessels (angiogenesis) just to feed the remaining strength of the body direct to the tumors.

As a nurse I spend a large part of my day “managing care” by doing stuff like get “prior authorizations” for medications that people have been stable on for years because some ‘crat is under orders to cut costs by changing the “formulary” of “approved medications,” randomly or for some annual “review” process. Telephone tree thickets, often with hang-ups, leading in many cases to finally speaking with some mope trying to keep her (usually, women get paid less) job by presenting that “Department of Denial, how may I not help you” corporate visage. Often, via a kind of institutional jiu jutsu, it can be worked out so after the doctor fills out a bunch of uncompensated additional paperwork and/or spends time in an uncompensated “peer-to-peer” conversation with a usually cynical and skeptical doctor employed by the insurer or one of the many intermediary gatekeepers and service rationers the insurers employ, the patient patient gets what’s needed. (Doctors and other “providers” have “wants,” too, and they and their structures that increasingly include corporations that own the docs that used to do private practice, are in on the scam.) Not always successfully able to “flip” the decision-making process, more and more patients are being told they have to “fail” serial 30 day trials with two or more less expensive, patently less effective other medications before even getting “approval” for the pharmacy to dispense, usually with a much higher “tier” co-pay that may effectively deny treatment that has kept a person going, because of (as lawyers in the Cook County courts say when explaining the need for yet another continuance to judges in on the game) the “unfortunate absence of Mr. Green.”

I am very near the end of my working life, with little besides VA benefits and Social Security and Medicare to look forward to for food, shelter and all that. Many NC people are dumb or cruel enough to say that end-of-life poverty is all personal weakness and incompetence. Is it wrong for me to hope that it becomes their turn to become impoverished, old and weak thanks to a system that they personally were able to negotiate “successfully” pending a smarter scam by people even less decent than themselves? Goes against the version of Christian charity I was taught growing up, but then that version was crafted by scammers for the oligarchs of yesteryear, Calvin and Knox, building momentum for the long-game notion that the 144,000 Elect who owned heaven and earth Rightfully were easily known by their wealth “that God gave them.”

The medical-pharm-financial-regulatory-legislative-executive-judicial complex holds all the cards, has all the marbles in its bag. It’s too complex and entrenched, and analysis and suggested improvements and do-overs are both not gonna happen, thanks to the “vectors” of the interests and behaviors and incentives that, added together, resolve to what we are facing, and are aimed at a moving target that is always way ahead of any possible lead…

Thanks a lot for posting this, especially the chargemaster data link for California. I had not seen that data before. I can only find 2013 data for the one hospital I checked. I suspect they do not file 2014 until very late in 2015.

What will be the death toll due to taking the wrong path on health care in 2009? Here was the estimated toll some time ago.

My wife and I had a baby last year under Cover California. The birth and pregnancy were completely uncomplicated.

Along with our other child, our total out of pocket for insurance and everything was just shy of $22,000. A higher marginal tax rate for single payer is looking very attractive to me right now.