Yves here. We’ve regularly pilloried the idea of competitiveness as a goal for nation-states because it’s a pretty-seeming term that uses an already dubious idea, mercantilism, as an excuse for squeezing worker wages. Widespread adopting results in every country striving to be an net exporter, which would clearly be impossible. In addition, putting the emphasis on costs (which generally is what “competitiveness” has come to be about, as opposed to, say, having governments support high potential young industries and provide inexpensive education) lowers domestic demand by lowering domestic incomes.

Nicholas Shaxson dissects a key chapter of a 2004 book by Martin Wolf that provided the intellectual foundation for the competitiveness fad. Ironically, Wolf decisively debunked his own thesis in it.

By Nicholas Shaxson, the author of Treasure Islands, an award-winning book about tax havens. Originally published at Fools’ Gold

Martin Wolf, the Financial Times’ chief economics commentator and one of the world’s most influential economists, published a book in 2004 called Why Globalization Works: the case for the global market economy. A forceful, heavily researched and uncompromising work, it became for a while a bit of a bible for those pushing for freer trade and further liberalisation of the global economy.

When the global financial crisis hit in 2007, calling into question some of the mainstream economic profession’s most cherished beliefs, Wolf – unlike many economists – seems to have done a serious re-think, and he has found a dramatic and radical new enthusiasm for reining in an out-of-control financial sector, whiile remaining essentially in favour of free trade. As he told us in an email in response to an earlier draft this post:

I have only changed my mind on finance and even then I was already quite sceptical. I think my chapter on the state was rather good.

The chapter in question, the subject of this blog, is entitled “Sad About the State”.

Optimistic About the State: Martin Wolf’s Searing Attack on the Competitiveness Agenda

Few people who cited Why Globalization Works in defence of endless liberalisation and globalisation seem to have realised that this chapter, Sad About the State, contains a damning and clear-thinking critique of what is probably their most politically potent set of arguments for steamrollering opposition to liberalisation – what we at Fools’ Gold like to call the ‘Competitiveness Agenda’.

This agenda is constantly pushed by lobbyists and hyperventilating politicians who shriek that we are in a #globalrace (that is, for the non-twitterati, a ‘global race’) on things like tax and labour and environmental standards, and that our countries have no choice but to ‘compete’ by gratefully showering goodies and privileges on the owners of mobile capital, in terror that if we don’t feed them we become ‘uncompetitive’ and they will all skitter away to Geneva or Singapore.

Wolf asks what the word ‘competitive’ might mean for a country – and we haven’t seen evidence that he has changed his mind significantly about any of what follows here.

Introduction: The Problem with “Competitiveness”

Wolf’s arguments, exploring what it might mean for a country to be ‘competitive’, can be summed up briefly.

In short, he supports our own optimistic view that you needn’t bow down to the competitiveness agenda. “Competitiveness”, he explains, is Fools’ Gold – and in pretty much the same way that we argue it is. The chapter contains a related argument, which Wolf summarises:

The notion of the competitiveness of countries, on the model of the competitiveness of companies, is nonsense.

He points out, as we often have, that what so often lies behind all the woolly thinking out there is the ‘fallacy of composition’ (or, in his geeky formulation, the application of “‘partial equilibrium’ reasoning to a ‘general equilibrium’ question.”) In other words, what’s good for one company or sector isn’t necessarily good for the whole economy.

Wolf covers ground we’ve already explored recently via Paul Krugman and Robert Reich – but he gives it a much more comprehensive treatment than either of them, exploring a greater range of ways that one might talk about competitiveness.

All of the possible tests for ‘competitiveness’ crumble to dust in his hands – as they should.

Part of our raison dêtre here at Fools’ Gold is to expose and debunk exactly these commonly held arguments, and Wolf has done a lot of heavy lifting for us here.

Must Social democratic States Bow Before Omnipotent Markets?

The chapter “Sad about the State” begins by quoting the English philosopher John Gray, who argued that “the chief result of this new competition is to make the social market economies of the post-war period unviable.” Similarly, Thomas Friedman famously said that the world is ‘flat’: every country in the world would have to become like the US or die.

Wolf points out that this is a view held on both the right (beneficient markets force evil governments not to fleece their people) and on the left (beneficient governments can’t shield their people from nasty global forces). He summarises:

Both agree that impotent politicians must now bow before omnipotent markets. This has become one of the clichés of the age. But it is (almost) total nonsense. Policies matter to the extent that they adversely affect performance. The notion of competitiveness is irrelevant.

And this is, if you think about it, a very optimistic view.

We like to put it this way: politicians think they are in a global race (and thus feel obliged to slash taxes on capital, weaken labour rights and so on) – but they are labouring under false consciousness. A country can tax mobile corporations and protect workers – and suffer no overall economic penalty for doing so. International co-ordination on these things is useful, for sure, but another way is possible: countries can unilaterally opt out of the race.

To engage can be to indulge in self-harm.

It is all about trade-offs. For example, a more ‘competitive’ (devalued) exchange rate may benefit exporters, but it will hurt consumers buying dearer imported goods. Is this an overall benefit? Perhaps, perhaps not. Corporate tax cuts benefit corporations, but the lost revenues hurt taxpayers elsewhere and consumers of public services. To call these moves a priori ‘competitive’ is silly. But people do it all the time. For example, the pre-eminent Oxford-based think tank advising the UK government on corporate tax policy, was apparently set up to give the UK a more “competitive” tax system. Wolf looks briefly at corporation tax, noting in passing that countries show a huge range of corporation tax as a share of GDP (then between 1.8 percent in Germany to 6.5 percent in Australia in 2000; today the range is 1.2 percent in Slovenia to 8.5 percent in Norway), without any obvious effect on growth despite this enormous sevenfold range.

As a first general source of reassurance about unstoppable global forces, Wolf notes that there are large swathes of the economy sheltered from global forces: immovable domestic services, healthcare and education, for instance. (This seems to correspond to what the Manchester Capitalism project formerly known as CRESC calls the ‘Foundational Economy’.) And the sheltered parts of the economy are huge: in most high-income countries, Wolf says, relatively non-tradable services like this amount to two thirds of GDP or more. No need to get ‘competitive’ here.

But not all of the economy is thus sheltered, so at least in theory, there might still be something to talk about. In which case, how might one measure ‘competitiveness’?

Possible Measures of ‘Competitiveness’

Wolf looks at a number of possibilities. His basic test candidates in Why Globalization Works are highly taxed and regulated European countries, versus lower-tax and more laissez-peers like the U.S. and the U.K.

Are there any signs that the higher-tax countries are, in some sense, uncompetitive?

And what could ‘uncompetitive’ actually mean?

This reminds us of Paul Krugman’s comment in 1994 that when you analyse what “competitiveness” might mean, then the c-word “would turn out to be a funny way of saying ‘productivity.’”

Wolf’s first test looks at the work of Belgian economist Paul de Grauwe, who studies “competitiveness rankings” from the World Competitiveness Report from the IMD in Lausanne, and relates these to ratios of social security spending in GDP. Wolf summarises:

He finds a modest positive correlation: the higher the social security spending, the more competitive the country. It is not difficult to understand why this positive correlation might exist: a generous social security system increases people’s sense of security and so may make them more willing to embrace change.

This clearly isn’t in line with the urgings of the Competitiveness Agenda. But still, the objection to these rankings, Wolf says, is that they are arbitrary. “Can we obtain more direct indicators of competitiveness? Yes.”

So, second, he cites possible weak trade performance (or trade deficits) as another possible meaning of ‘uncompetitive.’ But the ‘competitive’ UK and US economies, he noted, were running trade deficits, while the highly taxed countries ran surpluses (and this overall picture hasn’t changed decisively for the Eurozone, the UK or the US since then.)

So trade performance isn’t where ‘competitiveness’ is at, either.

Third, could it be all about export growth, relative to the local markets?

Well, exports from all the highly taxed economies grew faster than their markets from 1993-2002, while low-tax Japan and the US performed badly. (Latest data suggests that the UK and low-tax Japan have performed relatively poorly here; France and Germany have done rather better, and the US has done quite well – which isn’t so surprising for a faster-growing population.) This is a mixed bag: still no obvious overall pattern.

Fourth, could it be ‘the share of exports in the world economy’ that we’re after? He looks at the numbers (we haven’t yet found an updated data set for this,) and finds that all the main OECD countries saw a modestly declining share, presumably because other exporters like China are growing fast. He concludes “there is no sign of an exceptional deterioration in the trade performance of the highly taxed and regulated continental European countries.”

So it’s not that either.

He then summarises that “a slightly less economically illiterate way of assessing ‘competitiveness’ is in terms of flows of capital and labour. “A high-tax economy might bleed capital, for example, particularly corporate capital…Tax revenue does not go up in smoke. It is spent on things”

This could possibly be measured, fifth, through examining the current account, he says. A country bleeding capital will have a capital account deficit, (which by definition is the same as a current account surplus.) He finds a motley assortment of performances in the highly taxed and regulated European area and an overall tiny current account surplus there (which doesn’t seem to have changed much since, except in the last couple of woeful Euro-years, overshadowed by Grexit fears). No obvious smoking gun here either.

Sixth, a related point, what about a more pointed measure: net capital outflows as a proportion of savings? In other words, what proportion of national savings was exported abroad in a given year? Euro countries tend to save more than the US or UK, he notes, so are more likely to be able supply the capital cravings of their Anglo-Saxon peers by investing some of their savings over there. But even after some exports of capital there, he found that the European countries invested domestically as much, if not more than, the US, as a share of GDP:

“There is, in other words, no sign of de-capitalization or capital flight from highly taxed continental European countries.

Seventh: capital flows are a blunt instrument anyway: what about a more pointed measure, namely large net outflows of foreign direct investment (FDI), pointing to an ‘uncompetitive’ economy? Again, he finds a mixed bag in the Eurozone, with one outlier as the worst performer on this measure: the United Kingdom, with a very large net stock of FDI abroad of nearly 33 percent. Wolf’s comment:

What is striking is the variety of national positions. There is no sign that highly taxed countries, in general, suffer from a huge, unrequited outflow of corporate capital.

Latest UNCTAD data, p209 shows this:

$trn, 2013

Inward FDI stock

Outward FDI stock

Net

% of GDP

USA

4.9

6.4

1.5

9.0

UK

1.6

1.9

0.3

11.5

EU

8.6

10.6

2.0

10.8

Still no obvious pattern that could suggest a loss of ‘competitiveness’ for highly-taxed European nations.

Having been through these seven possibilities, all of which fell to pieces under cross-examination, he concludes:

Lack of competitiveness is nowhere to be found in these highly taxed countries. Particularly important is the finding that they are not suffering a haemorrhage of capital or skilled people. Being rich and stable, with superb social services, they are net importers of people.

And, despite all the shrieking and anecdotes about high taxes and regulations driving clever people away, the more recent evidence seems to bear Wolf out, as numerous studies have found. Sure, the Eurozone’s had problems of late, but these things go in cycles, and the US and UK haven’t recently been looking so clever.

Some Better Measures?

The story doesn’t end there, though. Wolf offers what he sees as more defensible models for ‘competitiveness’.

How is this possible? How can some countries have much higher tax and regulatory burdens than others and yet show none of the signs of a lack of international competitiveness?…The question, then, is whether the notion of competitiveness of countries, under globalization, has any relevance. The answer is that it does, but in very different ways from those popularly supposed. Two legitimate meanings can be identified: changes in the terms of trade – the relation between the prices of exports and imports; and overall economic performance. Neither is what those worried about competitiveness mean.

So he examines these two meanings.

First, terms of trade.

An improvement in the terms of trade means that a country’s exports are becoming more valuable: in short, the country can buy more imports with the same level of exports. But if an improvement in the terms of trade means imports are becoming relatively cheaper, then people will cry: “we are being flooded with cheap imports! We are becoming uncompetitive!” Wolf summarises:

The paradox of the popular debate is that improvements in competitiveness, thus defined, are generally seen as a deterioration instead. The availability of cheaper imports, which improves the terms of trade, is seen as a reduction in competitiveness.

This is a tricky argument to make, of course: French workers thrown on the dole by cheap Chinese imports won’t be mollified by cheap trinkets for them to put in their kids’ Christmas stockings. But Wolf’s overall point here is not invalidated by that, and it returns us to the fallacy of composition: the performance of the export sector isn’t the same as the performance of the whole economy.

Second, overall economic performance. Here, his point is quite simple.

Many of those who think of competitiveness mean overall economic performance: productivity, employment and growth. These are perfectly legitimate objectives of policy. There is no question that the level of taxation and regulations, as well as the quality of public services, have an impact on economic performance. But this impact does not come via anything that might be called “competitiveness.”

(Remember Krugman’s point about ‘competitiveness’ simply being ‘a funny way of talking about productivity.’) And here the laissez-faire UK currently looks particularly problematic: Britain’s “Open for Business” government, obsessed with winning the “global race” with “competitive” policies, has presided over the weakest productivity record of any government since the Second World War. (The U.S. has a less disappointing, but still lacklustre, record.)

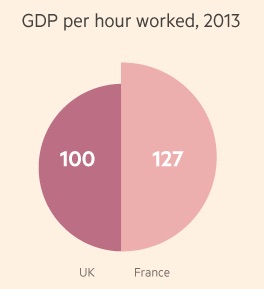

Would it be cheeky of us to point out that, as the FT noted in March, French productivity, in terms of GDP per hour worked, was a whopping 27 percent higher than in the UK? See this chart from that FT story:

We’ll restrain ourselves, of course, from saying that the French economy is much more competitive than Britain’s – France’s unemployment rate is currently quite a bit higher – but still.David Ricardo: It’s the Tradeoffs, Stupid

Wolf’s discussion of ‘competitiveness’ ranges still further.

He makes an extended foray into David Ricardo’s theory of comparative advantage, a concept that is also clearly relevant for connoisseurs of national ‘competitiveness’.

In short, Ricardo said that gains from trade outweigh losses, regardless of whether the trading partner is more or less economically advanced, as each nation shifts its production to where it has a comparative advantage. There are plenty of problems with Ricardo’s battered old theory, of course, but it’s not irrelevant. Let’s bear with Wolf here:

The notion that countries compete directly with one another, as companies do, is nonsense. It is nonsense because the most important source of both wealth and comparative advantage, namely people, is highly immobile. A country cannot lose its comparative advantage. Its comparative advantage can change. It is even possible that this change is, in some sense, undesirable. But a country has to have a comparative advantage in something.

All that is needed, he argues, is that the relative prices of different goods and services differ from their relative prices in world trade. These differences, he adds, are greater than they ever were in world history. What is more, the logic of comparative advantage

would apply even if a given factor of production (such as capital) were perfectly mobile, provided the distribution of some other factors of production (natural resources, social and human capital or knowledge) varied across countries and so generated sources of comparative advantage.

The big difference between countries, in this respect, comes in the form of social and human capital: well-educated workers, for instance. And people generally don’t move:

Not only is the human population anchored; so, notwithstanding all the hyperbole about globalization, is the vast bulk of its capital. People who live in stable, propserous countries believe their investments are safest at home.

. . . .

[financial] capital, the most mobile of all factors of production, will flee from a jurisdiction so under-taxed that it fails to provide decent and reliable justice.

. . . .

Capital will also be attracted by a jurisdiction with a highly educated labour force or any other complementary asset.

. . .

Because resources, particularly people, are immobile, patterns of comparative advantage are also deeply rooted.He could have noted more explicitly, as the Tax Justice Network has done, that genuine productive capital that is embedded in the local economy creating jobs and supply chains – the useful stuff, in other words – isn’t generally tax-sensitive: investors are generally most interested in other factors like education and infrastructure and the rule of law. And if it is tax-sensitive (which a fair amount of capital admittedly is) then by definition it’s flighty, and therefore not embedded, so it’s almost certainly the least useful stuff: profit-shifting and other nonsense. Tax may affect the real stuff, but only at the margin.

To illustrate this better, take the case where industries are most locally rooted: mineral-rich countries, where the resources are physically anchored underground. As OPEC learned in the 1970s, host countries can apply exceedingly high tax rates and strong regulations, and the investors will still come. They have to, because that’s where the oil is. Tax cuts for Big Oil won’t increase ‘competitiveness’ in any meaningful way.

Yet natural resources aren’t a special case either, as Wolf explains.

It is also true of activities that take advantage of human skill, or cultural assets: German or Swiss engineering is an obvious example.

Even in finance, one of the most weightless of all sectors, clustering effects can be particularly strong, anchoring activity to big financial centres. And Wolf notes:

It is perfectly possible for countries to have high taxes and regulatory standards, but no loss of international competitiveness because these foundations are location-specific, they can, within reason, be taxed.

Even Ireland, supposedly a poster child for ‘competitive’ policies on corporate tax, supports Wolf’s,rather than the ‘competitive’ tax-cutters’ case, as we have shown.

Overall, then much of the analysis here seems to make perfect sense. Countries don’t behave like companies. And showering goodies on one sector of the economy, paid for by other sectors, doesn’t seem like an obvious route towards anything one might sensibly call ‘competitiveness.’

Some Quibbles

There is, of course, plenty in this otherwise fascinating chapter that one might disagree with.

Wolf makes a number of statements that he may well have changed his mind about since the crisis, such as “minimum wages normally reduce employment” which doesn’t seem borne out by recent evidence. He also makes an ill-advised brief foray into the hilarious world of Charles Tiebout, and opines that open capital flows may provide useful ‘discipline’ for corrupt governments: something that seems strange in light of the record of élites in poor countries using ever freer global finance to loot their nations and stash their wealth offshore and out of sight.

Wolf also understates the difficulties of taxing companies in the digital economy. This is important, because he conveys a sense that the battle is, if not won, not so hard to win. Yet even then he avoids the ‘tax competitiveness’ nonsense that has gripped so many nations like the UK. His response to the thorny problem of tax avoidance isn’t to recommend corporate tax cuts but instead to try and tax corporations more effectively — he even advocates something at the cutting edge of tax advocacy these days, called formula apportionment (a component of unitary taxation. (The Tax Justice Network prefers the term ‘tax wars‘ instead of ‘tax competition” and in an email exchange last year with today’s blogger, Wolf said “I don’t object to your rephrasing.”) He also takes a deft and hefty swing (not in this book, but more recently in the FT) at Britain’s ridiculous tax ‘domicile’ rules: it’s an attack that is firmly in line with his ‘competitiveness’ views from 2004. This one is particularly timely as Britain goes to the polls where the domicile rule has been a point of contention.

A Last Word

In short, this was (and still is) a devastating attack on those who argue in terms of a need for countries to be ‘competitive’. So it is an attack on one of the most politically resonants arguments used in defence of the whole liberalising, tax-cutting project.

But at the end of the day, Wolf didn’t quite say it like this. Instead, he puts it like this:

Politicians insist they have no choice: globalization makes slashing taxes, cutting spending, reducing regulations and so on inescapable. But this is a dishonest excuse for pursuing the right policies. Worse, it is a dangerous one.

If has since changed his mind on some of the reasons why he thought the policies were right, then his searing critique of politicians doing these things for the wrong reasons is all the more powerful now.

But we would frame this all a slightly different way.

1.The Competitiveness Agenda is a nonsense: and thus potentially a house of cards.

2. Even so, this nonsense has politicians the world over in its thrall. (Once you know where to look for it, you’ll find the Agenda everywhere, larded into all sorts of rankings and phrases such as “Open for Business” or “a Competitive Tax System,” or “healthy business climate” and other weasel terms.)

3. The solution to false consciousness is to expose it. If it is a house of cards, then it should be possible in the long run to defenestrate it and turn its fevered advocates into laughing stock.

And that is, in short, why we have set up this site.

The basic arguments needed to demolish this cracking edifice are already out there and have been for years, in the works of people like Wolf, Krugman and others. But they are not getting through where it matters.

What we think is needed now to combine expertise with activism: pushing these woolly-minded arguments directly back in the faces of those who wield them, and challenging them in public to stand up and defend the indefensible.

We haven’t yet really got around to the activist phase yet: we’re building up our materials for now. But watch this space.

From Martin Wolf, “Why Globalization Works,”Yale Nota Bene 2005; particularly its chapter “Sad about the State.”

Thanks for the ammo, boss.

What is not clearly stated is what exactly is the game, and perhaps more importantly the end game, in which we are competing?

In my opinion the wealthy/corporate elite and the political elite had been playing two different games. Currently the political elite are getting onboard with the game and that game has many names, race to the bottom, musical chairs to the death, grow or die. It all falls under the rules of capitalism, in particular the final stages of capitalism which I call the cannibalistic stage.

Academia talks as if we are still playing the other game, the one where everything is fair and equitable.

Bravo! Finally someone who understands. Life is not a spelling bee, it is for keeps. It means that if Genghis Khan is at your door, you will have to destroy his army or you aren’t competitive. Economic warfare is simply a more civilized form of military warfare (whether directed externally or internally). If people accept the rules of the game, and don’t overturn the chess board when they lose … then everything is good, at least for the winners. But frequently nations are poor losers.

Be that as it may, allowing them to set the terms of debate nearly guarantees that their aims will be seen as legitimate. Exposing all their rhetoric for what it is forces them to fight in the open.

“export sector isn’t the same as the performance of the whole economy.”

That depends on the size of the economy. In general, small economies will not be able to produce sufficient goods and services internally (Swiss are not going to be self-sufficient in food and oil anytime soon…), and thus requires substantial export sector to pay for the imports. I would argue that a small country can significantly improve lifestyle only with a large export sector and is likely to be a net exporter.

Which is his point: there are lots of things to consider on a case by case basis which means that simplistic sentiments like “more exports=good” are downright harmful. Try telling the IMF (leadership) that, though…

I entirely agree – but the article is written as if it didn’t matter at all and all economies could be almost autarchies..

All coins have two sides, and in economy just about everything requires two parties (to have any sense). But there are those who argue that only sellers matter (supply side), only buyers matter(demand side), only imports matter, only XYZ matters – but nothing of it can exist without obverse. As I wrote somewhere else, it’s great to have lots of supply, but if ultimately no-one can afford to buy it, it’s the same as if the supply was 0 (arguably worse)

Every modern country is dependent on import.

Europe as a whole should not have any problem being self-sufficient on food, rather the opposite.

To be a net exporter require that there is someone willing to be a deficit country. Are the net exporters creating US big trade deficit or is it US that create net exporters? A way to make US omnipresence globally possible? the world is sending goods and services to US in exchange for “small pieces of paper” created out of thin air (on the margin).

Net exporters have a tendency to suppress its own populations consumption so they won’t buy to much import.

There is not really any public available measures how much countries actually export or import for general consumption. In industrialized countries export sector is also the largest importer, one have to extract the export industry’s import to get the net numbers on export and import.

Countries import and export.

To maintain cash flow, just to give one of many reasons, it’s necessary to take out foreign-currency loans. Unless you are the global reserve currency issuer.

Countries depend on export to accumulate the global reserve currency, except, again, the global reserve currency issuer. And it’s possible for everyone, except the global reserve currency issuer, to be a net exporter.

Maybe countries are not interested so much in ‘economic performance,’ as to be able to defend themselves from financial attacks like those that were launched on the emerging market nations in the 90’s.

The native elites, afterwards, thought to themselves, ‘We have to mobilize to defend our unequal wealth. This calls for workers to sacrifice themselves. Time for imposing martial law as we are at financial war.”

I wonder if it would do any good to send this to Hillary. It was so well explained. I’m sure she will opt to remain uninformed. And I can just hear the idiotic debate already between Hillary and Jeb on the wonderful benefits of competitiveness. In a totally messed up world.

Export numbers, % of GDP or fixed dollar have grown significantly since around 1990 and so have import in tandem. Due to globalization. Companies have became bigger and bigger by neoliberal transfer from wages to the few and financialization have given the leverage tool. Big part of export/import is merely transaction inside big companions and their vassal subcontractors.

In this environment in modern industrial countries the export industry is also the largest importer. To know if the export sector have grown one have to extract their import from export. Like e.g. a Swedish made Volvo is up to 75-80% imported, one $40k car is debited on the export but only 8k is produced in Sweden.

Even more extreme, some years ago an iPod cost $180 to produce. A sum debited on Chinas export whom exported the final product but only $3-$5 was added in China.

.

One can not lump EU together in these comparison, EU is all from Netherlands, Germany to Bulgaria and Romania. The former highly developed industrial nation high up in the value-chain and the later more like developing countries. Romania have €200/month official minimum wage and average wages on €500, a MD makes from €380 to €850.

An modern industrialized country high in the value chain isn’t comparable with a raw material exporting banana republic. In the later a devaluation can create wonder, in the former where the export industry is the biggest importer it isn’t so clear.

“Globalized Competitivenesß” internalized: http://www.bloomberg.com/news/features/2015-06-02/who-s-murdering-thousands-of-chickens-in-south-carolina- check where the incentives come from…

I read Michael Porter’s The Competitive Advantage of Nations, all of it, I ought to get a medal for perseverance, and two of the few things I remember are 1) a healthy economy is largely, about 67 percent, if memory serves, supported by its own population: its people have to be able to buy what it produces, which also means afford what it produces; 2) america was moving towards a wealth driven economy. Porter’s book was published in 1998 and the research, then, was done earlier.

The same Michael Porter whose consulting company was instrumental in russia’s economic disaster. But the two points cited are valid, and the only things I got for my time and trouble. Well enough worth it.

Should have written first published in 1990. It’s been republished since, but my edition was an early one.

I found this book to be very good re globalization: “Bad Samaritans” by Ha-Joon Chang.

The very same Martin Wolf says of it: “Every orthodoxy needs effective critics. Ha-Joon Chang is probably the world’s most effective critic of globalization. He does not deny the benefits to developing countries of integration into the world economy. But he draws on the lessons of history to argue that they must be allowed to integrate on their own terms.”

I agree RGC. Bad Samaritans is a great book, with many current and historical examples.

The link on Ireland (“Even Ireland, supposedly a poster child for ‘competitive’ policies on corporate tax, supports Wolf’s,rather than the ‘competitive’ tax-cutters’ case…”) doesn’t work.

In Spain the competitivity meme has come to such a level of stupidity that it will be very difficult to overcome. Policymakers and mass media continuously use the terms “Spain brand” as if Spain was a corporation instead of a nation or a country. You can read here and there that “this incident harms the brand Spain” or “our main concern is to promote the brand Spain”.

I like this. The US has a huge internal market, which should make foreign competition less important. However, American companies do a lot of exporting/importing in order to take advantage of cheap foreign labor, which means that American workers lose their jobs due to American companies, rather than foreign competition, and this — of course — reduces the size of the internal market. (The companies could decide to stay in the US and improve production, which was the traditional American way to deal with high labor costs.)

One is reminded that up until around 1970 (ish) the United States was a functional autarchy. With abundant resources, and an economy large enough to support competition and division of labor within itself, we didn’t need to worry about competing with the sub-poverty third world. If you can’t win, and you don’t need to play the game, why bother?

Of course, massive post-1970 immigration (before then the United States had a very tight immigration policy – anyone else notice any inflections in the economic data around 1970?) has already added about 100 million people to the population of the United States – and at the current accelerating pace is going to significantly exceed a billion by 2100.

When countries have their populations forced upwards, they end up with no choice but to compete in global markets for ever scarcer resources – and that’s a zero-sum game that heads only down. OK go ahead and say that this is ‘scapegoating immigrants’, but when a nation gives up the option of being self-sufficient in food and other vital resources by forcing population growth, it gives up it’s freedom to stay out of the race-to-the-bottom.

As some have noted, guns are important to the competitiveness ratio between nations. The colonies and their compradors are inherent in the european conquest of the planet. (Empires: Athens, Rome, Venice, Spain, Portugal, Dutch, England, France, German). Catching up via pin making is a fools game.

What is often overlooked is the idea of national competitiveness in built on the analogy between countries and corporations. The assumption that countries and firms are alike is to commit the Fallacy of the Insidious Analogy. The Fallacy of the Insidious Analogy may not even be intended by the author. The insidious analogical inference is embedded in the author’s language which is then transferred to the reader’s mind by subliminal process. Other examples of insidious analogies are common terms like the “Cold War,” “Dark Ages,” “economic depression,” the “Age of Enlightenment,” the “Industrial Revolution,” “Homeland,” the “Sick Man of Europe,” and the “consumer is captain.” These analogies are powerful because they convey a negative impression, or positive acceptance almost unconsciously.

Also, I am glad to see the use of the Fallacy of Composition. This is a very common error in reasoning made in many discussion of “The Market,” and between the micro and the macro. Arguments about free self-regulating markets commits the logical Fallacy of Composition. You cannot infer something is true of the whole from the fact that it is true of some part of the whole: “If someone stands up out of his seat at a baseball game, he can see better. Therefore, if everyone stands up they can all see better.” The Fallacy of Composition is essentially fallaciously reasoning that claim attributes of the parts of the whole are also attributes of the whole itself. The fallacy can have various forms such as “the machine is made of many light weight parts; therefore, the machine as a whole is light weight.” Or one might say, “The lead actor in the play was excellent so the play as a whole was excellent.” Another example the composition fallacy is, “Each aircraft in the squadron is ready for combat; therefore, the whole squadron is ready for battle.”

In each case the fallacy confuses the “distributive” and “collective” use of a general predicate term. One can say that college students are only allowed to vote once in a general election; however, it is also true that college students cast millions of votes in a general election. Of course in the first proposition the predicate term “vote” is used distributively, but in the second proposition the term is used collectively. There is a difference between a collection of elements, and a whole constructed out of those elements. A pile of bricks is not a house.

Likewise, a collection of individual buyers and sellers making directed voluntary choices do not make a market possessing those same human attributes. Market forces are assumed to have the same characteristics as persons: rational, acting freely, and knowledgeable. In other words, market fundamentalists anthropomorphize mass-market movement. The Pathetic Fallacy attributes human attributes of volition, and rationality to non-human entities such as the mass market.