Yves here. This post gets a bit geeky at points, but it confirms what is a conclusion many readers may have made already: that nominal wealth and income in the US are misleading due to how many costs Americans bear that counterparts in other countries don’t, or don’t as much.

By Timm Boenke, Assistant Professor of Public Economics, Freie Universität Berlin; Markus M. Grabka, Senior researcher, DIW Berlin; Carsten Schroeder, Head of Applied Panel Data Analyses, DIW Berlin; Professor of Public Economics and Social Policy, Free University Berlin; and Edward Wolff, Professor of Economics, New York University. Originally published at VoxEU

While wealth inequalities have received some attention, most academic, political, and public debates focus on inequalities in income. Concerning private wealth and international comparisons of wealth inequalities, research usually investigates the distributions of real and financial assets, debts and net worth.1 Net worth is the current value of all marketable or fungible assets (total gross wealth) minus debts.2 Differences in levels of, and inequalities in, these aggregates miss an important component of household wealth positions, namely, pension wealth – the discounted expected present value of future entitlements from public, occupational, and private pension schemes. Considering pension wealth is important because households in different countries make private savings decisions conditional on the country-specific characteristics of pension institutions. In particular, many studies show that (public) social security pension wealth serves as a substitute for other forms of private savings.3 Higher net worth in country A than in country B may indicate higher propensities to consume in the former. Yet if pension institutions are more generous in the latter, the opposite may be true.

A comprehensive measure that considers pension wealth in addition to real and financial assets is augmented wealth (Wolff 2015a, Wolff 2015b; Bönke et al. 2016). In a recent paper, we attempt to create a wealth database that allows us to conduct a systematic ‘head-to-head’ comparison of household net worth, pension wealth (including survivor pensions), and augmented wealth for two countries: the US and Germany (Bönke et al. 2017). The pension systems of both countries comprise three components: social security, occupational pension (including a government employee pension scheme), and private pension. Beyond these common features, their systems differ markedly with respect to generosity, coverage, attainment of entitlements, and type of financing. Our database builds on harmonised data from the Survey of Consumer Finances for the US and the Socio-Economic Panel for Germany in 2013 (see Bönke et al. 2016, Bönke et al. 2017).

Including Pension Wealth Narrows the Wealth Gap Between the US and Germany

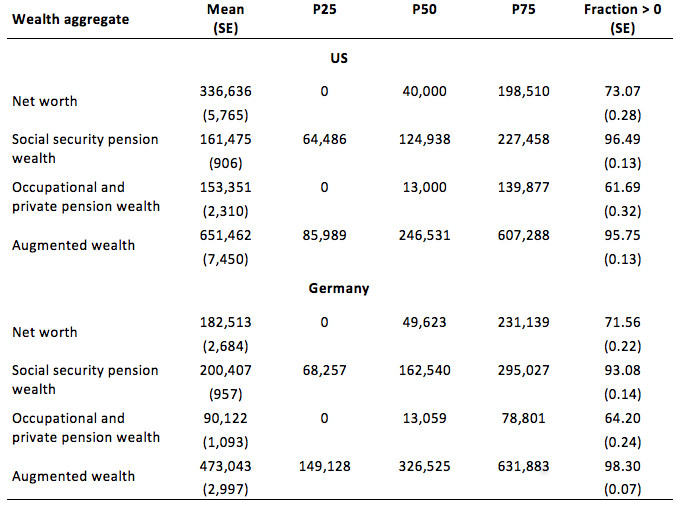

Our data show that net worth holdings differ substantially between the two countries (Table 1). The mean for private households (in 2013 US dollars and purchasing power parity (PPP) adjusted) is about $183,000 in Germany versus about $337,000 in the US. This gives a ratio of about 1.84 in favour of US households. The gap for median net worth is smaller and the median is even slightly higher in Germany – almost $50,000 compared to $40,000 in the US. For the 75th percentile, we also find a small difference in favour of German households. In both countries, net worth for the 25th percentile is zero. These numbers suggest that net worth in the US is more concentrated at the top of the distribution.

Adding pension wealth implies a sizeable reduction of the wealth ratio of the two countries. Augmented wealth holdings of the average US household are about $650,000, or 1.4 times the holdings of an average German household of about $473,000. This difference is mainly driven by the higher net worth of US households that belong to the top of the augmented wealth distribution. Up to the 75th percentile, households in Germany possess larger assets. For example, the 25th percentile value of augmented wealth is about $149,000 versus $86,000 in the US.4

Table 1 Household wealth in the US and Germany

Note: The sample is top-trimmed at the 99.9th percentile. All results are based on multiple imputations, bootstrap standard errors accounting for multiple imputations are shown in parentheses. Nonlinear estimates (P25, P50, P75) are based on first imputation only.

Source: Bönke et al. (2017).

Household Portfolios of US and German Households Are Different

With regard to the composition of household total gross wealth, the most important difference between the two countries pertains to owner-occupied property (Table 2). This wealth component contributes nearly 60% to total gross wealth in Germany, but only about 40% in the US. Important differences also relate to the relative contributions of business assets as well as to financial assets and building society savings agreements. Business assets contribute only about 7% to total gross wealth in Germany, but almost 19% in the US. For financial assets and building society savings agreements, the respective numbers are 28% in the US and 17% in Germany.

Concerning debt, total household debt in the US is, at about $91,000 on average, 2.5 times higher than in Germany ($36,000). Mortgage debt on owner-occupied property makes up the largest relative portion in both countries: 74% in the US and 61% in Germany. Debt ratios in the US are also higher than those in Germany, with respect to both income and net worth. These numbers suggest that the willingness to go into debt is much greater in the US, and access to credit markets appears to be easier there than in Germany.

Table 2 Overall portfolio composition

Note: The sample is top-trimmed at the 99.9th percentile. All results are based on multiple imputations, bootstrap standard errors accounting for multiple imputation are shown in parentheses.

Source: Bönke et al. (2017).

Considering Pension Wealth Mitigates Wealth Inequalities

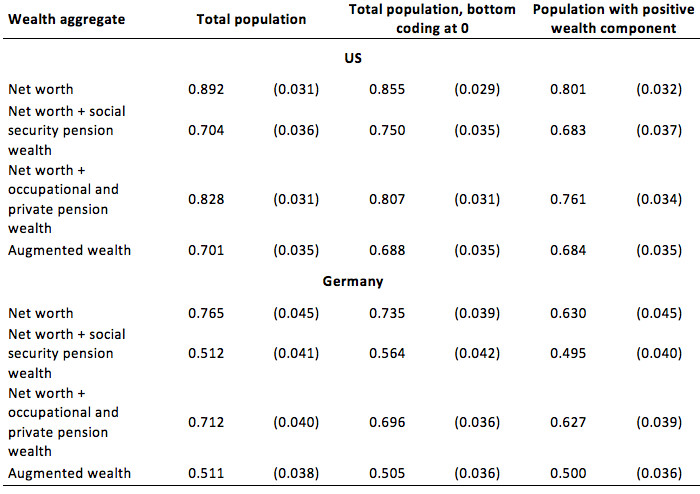

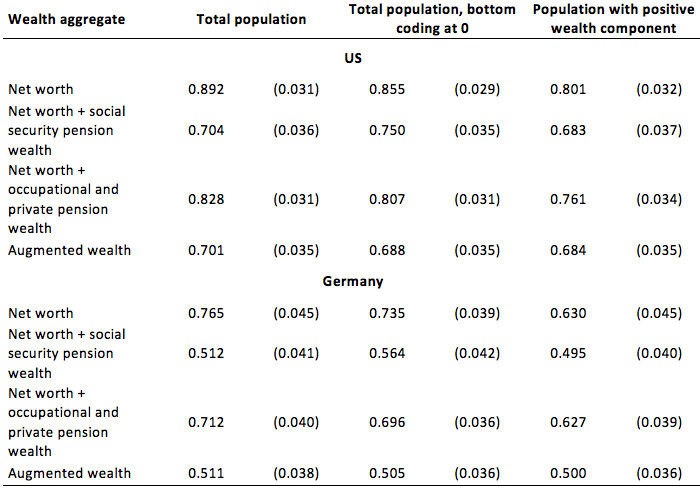

Table 3 presents Gini coefficients for the different wealth aggregates in the two countries. Because indices are difficult to interpret if the distribution entails observations with negative wealth, we re-did the analysis for the total population with a bottom coding of the wealth component at zero. Finally, to shed light on the inequalities among households that actually hold positive wealth, we have also derived all indices excluding all households with zero or negative wealth.

Here we only comment on the results for the overall population without bottom coding. Pertaining to net worth, our results confirm the previous finding of markedly higher inequality in the US. The Gini index is 0.892 as opposed to 0.765 in Germany. These high numbers indicate that wealth is highly concentrated among a small number of households in both countries and that it is much more concentrated than income.

Adding social security pensions to net worth reduces inequality: the Gini index falls to 0.704 in the US and to 0.512 in Germany. When adding occupational and private pension wealth to net worth, we also find an inequality-reducing effect, albeit smaller. The Gini indices for augmented wealth reveal the overall effect of the inclusion of pension wealth – the respective index for US households is 0.701 and 0.511 for German households.

Table 3 Gini-coefficient by wealth aggregate

Note: The sample is top-trimmed at the 99.9th percentile. All results are based on multiple imputations; bootstrap standard errors accounting for multiple imputation are shown in parentheses.

Source: Bönke et al. (2017).

Putting the Results in a Broader Perspective

We would expect that the wider social safety net in Germany, relative to the US, implies that middle-class and poor Germans need to save less for job loss, sickness, and old age than corresponding US citizens. We would expect this primarily because of the higher social security pensions and their greater relevance in Germany than in the US. In addition, university education is free in Germany, which means that, unlike US citizens, Germans do not need to save for university tuition. In general, one would think that a wider social safety net would mean less need for precautionary savings. However, net worth is actually higher in Germany than in US up to the eighth decile. Our research also shows that cross-country comparisons of wealth are sensitive to the choice of the wealth aggregate. Augmented wealth may provide a more accurate picture of the welfare positions of households in different countries than net worth. Nevertheless, interpretations should be made with caution because of the restricted convertibility of social security pension wealth.

See original post for references

From Wikipedia:

Comparing the same years, the average US Soc Sec benefit in 2012 was $1,229. The German average benefit was about 12% more generous. But Germany’s onerous 19.6% payroll tax is 28% higher than the US rate of 15.3%, indicating that hapless Germans receive an even crappier return on their government-mandated “investment” than USians do.

That ain’t no way to get rich, or even passably comfortable. :-(

Don’t forget the 19% German VAT…

Also don’t forget the deduction from SS to pay for your Medicare Part B premiums ( and maybe Part C and Part D premiums ).

And I guess that means, from the standpoint of those that are comfortable, and have the knack for successfully negotiating what past “investment advisers” refer to as “exposure to risk” (in lieu of what I grew up thinking of as “investing”), exactly what? “Kill all social benefits, you live and die in Galt Gulch!”?

Of course the comparison chosen in the comment kind of cherry-picks the information, maybe to add weight to the notion that all that money that otherwise might be characterized as wages (FICA, both employer and employee amounts) ought to be turned over to individuals, who can then “choose” how they want to “expose themselves to risk,” I guess. Via one of the many fee-generating “vehicles” our benefactors on the Street will be so happy to offer — “Buy a 2018 ETF! Go off the cliff in real style! (and pay no attention to the reams of tiny text at the bottom of this

advertisementprospectus! “Binding arbitration” is just words! Trust us! Would we steer you wrong?” http://www.coastal-one.com/uploads/text/Past-Performance-Disclosure.pdfSS, as you know, is not an “investment,” it’s a government-mandated savings program. It’s not even “like an investment.” The only “growth” potential is via Crapified Price Indexing, or some total reversal of legislative trends on the looting side, like removing the cap on wages, WAGES now, subject to FICA withholding, or realistic indexing to real costs of surviving (since SS does not provide a “living” for most of us when we become “useless eaters” past the ability to be looted by employers..

Too bad the SS mandatory savings program is not enhanced by the availability of other things the “government” (an almost wholly-owned subsidiary of looting corporate sh!ts) might offer, like a postal savings bank, universal Medicare (amended to remove the looters’ tentacles) for All, an end to the Imperial “full spectrum destruction for profit,” stuff like that… But for those who are agile, have sharp little teeth, and can swim a little faster than the other preyfish, hey, I guess this might be close to the least worst of all possible worlds, no?

And what do the Germans, Osten und Westen, get for their taxes? Like the VAT, which looters here are promoting?

If you don’t believe in “public goods”, then money and loot are interchangeable concepts and any money that isn’t financing looting somewhere is a wasting asset.

Tell it, brother

70% of the US looks like a non-industrial dump – no place in Germany is as bad as Camden, Baltimore or E. St. Louis. And MOST of the US looks like Detroit or the Mississippi delta counties now. San Francisco and Fairfax, Virginia are the exceptions – tiny islands of prosperity in a sea of deindustrialized poverty and hopelessness.

Germany actually has functioning railroads and factories that produce things. The US has basically nothing in comparison. Per person levels of industrial production in Germany rival E. Asia (almost S. Korea level highs). The US is now somewhere between Brazil and Iran. When the dollar collapses our living standards will come into line with our levels of per person industrial production. Yes, that means US living standards will collapse to the levels of a Tunisia or Iran.

If US were half as industrialized as Germany and had the breadth of its industrial production we would be infinitely better off. You have to factor into the equation that the US trade deficit will eventually reverse itself – quite brutally one supposes – since no one has either the wisdom or the guts to do anything in D.C. to avert catastrophe.

But…but…the US does have industries…..Designing massively over budget airplanes that can’t fly in the rain. Inventing airy-fairy castles of investment “products” that collapse into gluons and Higgs Bosons. Besides, does Germany have anything as fine as McLean, Virginia, Newton, Mass, or Los Altos Hills for The Only People Who Matter?

and in Germany you don’t have to save 200k to buy a college experience for one of your kids (of course the return on that investment will make it worth it and until tvat comes in baristas at starbucks get health insurance-just medical with high defuctibles but hey if they come down with cancer you don’t have to take a third mortgage)

Because of the extra land, North America development is like a hit and run…. build it to last maybe a couple of decades and then move onto the next pristine area with lower taxes.

Now we’re stuck with thousands of eyesores and too many roads to maintain

The book “dirt”(can’t remember author right now) discussing a wide swath of the history of agriculture and mentions that southern cotton plantations had a real ponzi-like quality to them. Slavery HAD to expand westward because export oriented agriculture and the high cost of slaves and low cost pf land meant you had to go for fast cash crops for as long as you could before the soil was exhausted and eroded. Then, you had to quickly clear cut the next bit of pristine land and wreck the soil there to keep the cycle going and get a decent return on investment.

In short, there’s plenty of history of abusing land as much as abusing people.

It’s still happening today. Alberta can essentially mine the majority of its province for crude… and the more people we are the faster the treadmill goes… if we want to keep on importing machinery and BMWs we need to export a lot of joules.

I receive the max on SS and it was $1530.00 per month then I pay fine for the rest of my life Medi-Care D and it went up this year so I now earn $1522.00 per month. The $4 raise was canceled out. Thanks Congress;)

The best SS in the world was Chile but then dead uncle Milton came to the rescue and now it the worst.

You are not receiving the max possible for any beneficiary. Possible monthly benefits, based on prior earnings and age at which benefits are drawn on a retirement account can be in the $3000 range.

I bet jo was talking about his personal situation. Hardly enough detail to judge the max benefits point from his comment. And yes, people who get paid more and can keep working longer — on average, those two things seem to go together — get a bigger payout. System favors the fortunate, and prudent of course also.

Side note: the “workers comp” for damaged GIs tops out at around $3,500 a month. Of course veterans do get access to actual health care and don’t pay for “insurance. ” But the Monoparty that runs things is working diligently to fix that…

“

FokkThank you for your service. You got enough free stuff while you were on active duty. “Maybe precautionary saving isn’t as motivational as enrichment saving. After all, what’s one more disaster? It’s just another instance of spending all the ready cash and then putting the rest on a high-interest credit card, and never ever being able to get ahead. A savings program that leads to some desired goal could enhance the sense of agency of a depressed member of the precariat.

The precariat, those with W-2 jobs, have a savings plan called FICA. A whole lot, W-2 or not, live hand to mouth and have zero chance of your agency-providing goal directed savings. Always the neoliberal pull on your bootstraps thing, right? Only the deserving poor, and all that?

I was trying to say that a social safety net is a good thing precisely because it is a safety net!! It helps keep people out of disaster mode. It allows for something other than fear-based actions. It helps a family do something future-oriented once in a while, instead of constantly putting out brushfires.

“W-2 job”? Good grief.

You think German citizens are going to hold on to that for much longer, while the other Eurozone countries have their pensions squeezed? Once they’ve squeezed them they come for the German pensioners. What you are praising the usual suspects of the current economic ideology see as a crisis.

http://www.independent.ie/business/world/german-pensions-crisis-is-warning-to-rest-of-the-world-35535691.html/

Greece was just the test run for what the rest of Europe will be facing.

It’s just going to take them a bit longer to work their way around to Germany.

France is up next.

The fact remains that the median net worth of the lower 50% of Americans is Zero after paying for a relatively minor illness or injury that results in hospitalization. After paying co-pays on a bill that is set arbitrarily and without advance notification, it matters little whether you have insurance or not— the medical extortion scheme will extract all your remaining funds.

Bringing up statistics like average wealth serves only to uncover the extreme inequality In the US. Median wealth is the more meaningful statistic. The US is near the bottom for advanced industrialized countries. And this doesn’t factor in the contributions of social support systems that are more substantial in many/most other countries.

Ironic that after years of Troika induced austerity, Greeks are still slightly more wealthy than Americans.

Exceptionalism at work —.

From Wickipedia:

Country/Territory Median wealth 2014

Australia $225,337

Belgium $172,947

Iceland $164,193

Luxembourg $156,267

Italy $142,296

France $140,638

United Kingdom $130,590

Japan $112,998

Singapore $109,250

Switzerland $106,887

Canada $98,756

Netherlands $93,116

Finland $88,130

Norway $86,953

New Zealand $82,610

Ireland $79,346

Spain $66,752

Taiwan $65,375

Austria $63,741

Sweden $63,376

Malta $63,271

Qatar $56,969

Germany $54,090

Greece $53,375

United States $53,352

Slovenia $50,329

The Germans get bang for their buck. They pay higher taxes, but have infrastructure that’s first rate, and an education system that is both free and useful. Their higher education is free even to foreigners.

Meanwhile, the arts don’t take a back seat, either. I’ve read that the arts budget for just the City of Berlin exceeds the National Endowment for the Arts for the entire U.S. of A.

But…how many aircraft carriers does Germany float? We know what is REALLY important!

I hope you know what aircraft carriers are being used for. Not for defense, purely for offensive wars. That’s why Russia didn’t had aircraft carriers until very late to the end of the cold war. That’s why almost nobody invests into aircraft carriers. They only feared an US invasion, and for defensive purposes rockets are much better.

https://en.wikipedia.org/wiki/List_of_aircraft_carriers_by_country

USA, Italy, Spain are the leading offensive nations. France and UK decommissioned theirs, Germany tried to build 7 but never completed them.

Aircraft carrier are almost solely for the projection of power around the world. The projection of power is one of the key components for pushing the use of the dollar world wide.

Carriers are enormous targets; recall the British/Argentine war over those island rocks, Argentina was limited in Exocet missiles, I believe they only had less than half a dozen and they wreaked havoc on the invading British fleet…..Just imagine a country that has a “adequate” number and the wreckage they could bring on.

Depending on the “Mailed Fist” to back up our global predatory monied system is not a long term strategy.

Somewhere along the line either we all get along or we all perish…….munching on Fukushima and Hanford sandwiches.

When you’re healthy you’re rich.

“infrastructure that’s first rate” is a relative thing. Of course, compared to the the U.S, with it’s crumbling highways and byways, Germany is Nirvana. However, (lack of infrastructure) spending is a hot topic in current Federal State elections. Under Merkel-led austerity, infrastructure in Germany has not seen the necessary upkeep that it needs.

Well, the German retirement system isn´t exactly the bee’s knees

http://www.dw.com/en/german-retirement-system-leads-to-pensioner-poverty/a-18889839

And millions of Germans working poor depend on social welfare to pay the rent. How are they going to save for a pension.

German politicians like Merkel and Schäuble diligently export such conditions, what Thatcher did in UK, to the rest of the Eurozone.

(2012) “Wage restraint and labor market reforms have pushed the jobless rate down to a 20-year low, and the German model is often cited as an example for European nations seeking to cut unemployment and become more competitive.”

http://www.reuters.com/article/us-germany-jobs-idUSTRE8170P120120208

Of course this can´t go on in the future. New technology is about to radically change the job market . A newly made rapport from McKincey goes “Some 40 percent of working hours in Denmark are automatable based on demonstrated technologies. All occupations will be affected by automation, but few occupations can be fully automated ” and “Danish automation potential is lower than the global average of 49 percent.

McKinsey Global Institute research, focusing on 47 countries representing 95 percent of global GDP, finds the average level of automation potential corresponds to 49 percent of the working hours

currently supplied by the global workforce. Denmark’s 40 percent is mainly due to sector composition, e.g., a large public sector”

On avarage 49% of jobs.

If this is of any interest the rapport is here

https://innovationsfonden.dk/sites/default/files/a-future-that-works-the-impact-of-automation-in-denmark.pdf

The big question is if the automation has reached a point where there can´t be created new jobs at a pace to keep up employment as the current generation of technology is the first to automate non-routine tasks.

Meet Erica https://www.youtube.com/watch?v=87heidlFqG4

What I find most notable is that the median, as distinct from mean, net worth is higher in Germany than in the US. There is somewhat less inequality there, and a higher proportion of Germans than Americans might be getting by, especially given their health care and educational systems.

I wish medians had been provided for more of the data. They are often more instructive than means, and taken together can be quite enlightening.