By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

When tighter regulations were imposed on the banks after the Financial Crisis, the largest among them, the very ones that threatened to bring down the financial system, began squealing. Those voices are now being heard by Congress, which is considering deregulating the banks again. In particular, they claim that current capital requirements force banks to curtail their lending to businesses and consumers, and thus hurt the economy.

Nonsense! That’s in essence what FDIC Vice Chairman Thomas Hoenig told Senate Banking Committee Chairman Mike Crapo and the committee’s senior Democrat, Sherrod Brown, in a letter dated Tuesday, according to Reuters. The senators are trying to find a compromise on bank deregulation.

If banks wanted to increase lending, they could easily do so without lower capital requirements, Hoenig pointed out.

Rather than blowing their income on share-buybacks or paying it out in form of dividends, banks could retain more of their income, thus adding it to regulatory capital. Capital absorbs the losses from bad loans. Higher capital levels make a bank more resilient during the next crisis. If there isn’t enough capital, the bank collapses and gets bailed out. But banks that increase their capital levels through retained earnings are stronger and can lend more.

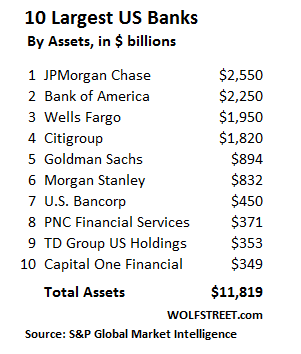

Alas, in the first quarter, the 10 largest bank holding companies in the US plowed over 100% of their earnings into share buybacks and dividends, he wrote. If they had retained more of their income, they could have boosted lending by $1 trillion.

The CEO of the top bank on this list has been very vocal about plowing more of the bank’s income into share buybacks and dividends, while pushing regulators to lower capital requirements.

In his “Dear Fellow Shareholders” letter in April, Jamie Dimon wrote under the heading “Regulatory Reform,” among many other things:

“It is clear that the banks have too much capital.”

“And we think it’s clear that banks can use more of their capital to finance the economy without sacrificing safety and soundness. Had they been less afraid of potential CCAR stress losses, banks probably would have been more aggressive in making some small business loans, lower rated middle market loans and near-prime mortgages.

But the government was preventing them from doing it, he suggested.

This didn’t sit well with Hoenig apparently. He was president of the Kansas City Fed and member of the Fed’s policy-setting Federal Open Market Committee (FOMC) from 1991 to 2011 – through the Financial Crisis. Observers of the Fed remember him wistfully as a one of the rare “hawks” on inflation. And, in his function at the FDIC, he’s not shy about being a thorn in the side of the biggest banks – though he is outclassed by the power of the biggest bank regulator, the Fed, which has a much more accommodating view of bank regulation.

So Hoenig supplied some numbers in his letter.

The largest bank on his list, JPMorgan Chase, earned $26 billion over the four quarters. But it plowed $27.6 billion – or 106% of its income – into share-buybacks and dividends. If it had retained that income, it would have raised its capital by that amount, and it would have been enough to make an additional $250 billion of loans under current capital rules.

In total, the 10 largest banks combined, on an annualized basis, will plow 99% of their earnings into share-buybacks and dividends. Share-buybacks alone amount to $83 billion (not counting dividends). Under existing capital rules, if the banks were to retain this capital instead of buying their own shares with it, they could have increased commercial and consumer loans by $741 billion.

And they could have still paid out their big dividends. If they cut their dividend payments some, they could have boosted their lending by over $1 trillion.

“I can only caution against relaxing current capital requirements and allowing the largest banks to increase their already highly leveraged positions,” Hoenig wrote. “The real economy has little to gain, and much to lose, by doing so.”

“While distributing all of today’s income to shareholders may be received well in the short run, it can undermine their future returns and weaken the growth outlook for the larger economy,” he wrote.

“I recognize that dividends are an important factor for investors and they should be rewarded for the risks they take. But it is also true that funding business growth, assuring future economic success, and promoting capitalism depend upon the retention of earnings,” he wrote.

What is it that makes me think that his reasoning and pleas will once again fall on deaf ears? Is it the fact that banks, including Goldman Sachs, have aggressively schmoozed with Congress and staffed essential parts of the administration? Something tells me that Hoenig will be once again shunted to a sidetrack and forgotten.

And the number three on the list, Wells Fargo, is now in the middle of a new scandal: another 570,000 (or 800,000?) customers become victims. Read… It Just Doesn’t Let Up with Wells Fargo

Dimon at Chase and his fellow-travelers are big generators of derivatives, those instruments of mass financial destruction. Given the orders of magnitude of the notional values involved, the next financial crisis will likely be too great for the TBTF band-aids used recently. Dimon et al are playing with house money and then buying many flammable items.

Remember all those fire prevention reminders from long ago about the dangers of oily rags and spontaneous combustion. Those messages and the messengers were budget casualties. The phrase I’m alright, Jack has become I’ve got mine, Jack. What is left?

Oh so Dimon et al are Bookies!!

Dimon is a CEO, not an owner.

The Top Ten banks have what in common?

Their majority shareholders are the Big Four investment firms: Vanguard, BlackRock, State Street and Fidelity (sometimes this changes, but drilling down in the alternative firms one finds the Big Four to be the major shareholder in those firms, etc.).

And who are those entities investing through the Big Four?

Nobody knows, they don’t have to list their major investors since 1993. Thus, we have no idea who the actual owners are?

Now isn’t life grand?

I happened to be looking at mutual funds the last couple of days.

So, Vanguard, Blackrock (iShares ETFs), and Fidelity make complete sense since virtually every large cap mutual fund (index or actively managed) that includes the banking sector owns the largest banks. Those are 3 of the largest mutual fund companies.

I don’t know how State Street fits there.

State Street’s one of the biggest custodian banks in the world. They do accounting/custody for lots of mutual funds and ETFs (SPDRs) and have their own investment mgt company under the State Street Global Advisors (SSGA) brand which manages SPDRs.

Basically, they’re in the same business.

“The problem with a super-smart banker like Jamie Dimon, CEO of JPMorgan Chase, is not just that his bank makes risky bets with its own money. The real scandal is that Dimon’s hot-shot traders are gambling with our money. If their complex derivatives deals should go horribly wrong and lead to the megabank’s failure, the taxpayers are on the hook to clean up the mess.

That is because JPMorgan Chase shrewdly parks virtually all of its vast derivatives holdings in its commercial bank subsidiary. In the event of a collapse, the bank can use its deposit base to pay off the derivatives, while leaving the Federal Deposit Insurance Corporation to reimburse depositors if their money runs out. This is not a trivial technicality. JPM is the world’s largest purveyor of derivatives. Its total contracts have a notional value of $72 trillion—and 99 percent of them are booked at its FDIC-insured bank. In the event of failure, sorting out the claims and counterclaims will be a costly nightmare for the FDIC. The bulk of the contracts are “plain vanilla” derivatives used as standard hedges against price or currency changes. The exotic derivatives, however, are dangerous—the kind that suddenly blew up in Dimon’s face some weeks ago, when his bank swiftly lost at least $3 billion on one complicated market gambit, with maybe more losses to come.

We are “insuring” other big boys of banking in the same way. Citigroup has nearly all of its $53 trillion in derivatives in its FDIC-insured bank; Goldman Sachs has $44 trillion parked at an FDIC-backed institution. After Bank of America purchased Merrill Lynch, BofA began transferring the securities firm’s derivatives to the FDIC-insured bank, which now holds $47 trillion in contracts. When Senators Sherrod Brown and Carl Levin, among others, complained that regulators’ acquiescence in these transfers contradicted Congressional instructions in the 2010 Dodd-Frank reform law, the Federal Reserve, the FDIC and the Treasury Department’s Office of the Comptroller of the Currency refused to answer their objections. This matter involves “confidential supervisory” and “proprietary business information,” the three agencies responded in unison.”

https://www.thenation.com/article/why-fdic-insuring-jamie-dimons-mistakes/

As Hoenig points out, this latest claim by the CEOs of the megabanks is just more BS. Their Fed has again enabled them to privatize enormous profits and socialize their losses. In fact, that seems to be Fed’s sole real mandate.

Huge derivatives exposures?… Market manipulations and speculations?… Enormous stock buybacks and dividend payouts that deplete their capital?… all good. But they just don’t have sufficient capital to lend money to small and medium-sized business? (Never mind that they themselves have killed healthy borrower demand.)

How can we rid ourselves of the clowns that run these organizations? It’s far past time to reinstate the Glass-Steagall Act.

“[Hoenig’s] not shy about being a thorn in the side of the biggest banks – though he is outclassed by the power of the biggest bank regulator, the Fed, which has a much more accommodating view of bank regulation.”

Putting a bank cartel in charge of regulating themselves, while maintaining an anodyne facade as a gov-affiliated entity — nope, no conflict of interest there! /sarc

Not until the cancer of the Federal Reserve is excised will the putrid tide of self-serving hogswallop from the likes of Jamie Dimon [whose bank is a stockholder in the Fed] stop polluting our public discourse.

Smash the Fed.

Thanks for this post.

There are and have been some very good regional Fed governors, men like Kansas City’s Thomas Hoenig and Dallas’ Stanley Fisher. NY Fed never seems to listen to points of view that disagree with the NY Fed and NY’s Wall St banks.

Agree with you, flora, but perhaps you meant Richard Fisher, who retired a couple of years ago as President and CEO of the Federal Reserve Bank of Dallas.

Yes, you are correct. I meant to write Richard Fisher. Thanks for the correction.

I met Richard Fisher a few years ago. He was giving a speech at the University of Arizona’s b-school. A very sharp cookie. I was impressed.

Dimon’s offer seems to be, “Allow us a smaller safety net and we’ll take bigger risks.”

Yes, but it’s really, “allow us a smaller safety net and you (taxpayer) take bigger risks. We just keep the profits.”

If you’re a TBTF bank, you don’t need no steenking reserves. If there’s a problem, good ol’ Uncle Fed will bail you out.

It just makes Jamie Dimon’s incessant whiiiining about how “unfair” it is that the rubes hate him all the more deplorable and despicable.

No doubt another doomsday is looming on the horizon. Dimon & his venal, greedy, out of control ilk will be speedily at the front of the line with their hands out demanding recompense for the financial disaster that they created.

And our supposedly “elected representatives” will undoubtedly be only too willing to Re-Fi them yet again – after all, they’ll benefit from the payola.

All while the rubes in the 99% get screwed once again… while the M$M will commence blaming it on the victims, as usual.

Lather, rinse, repeat… is there ever an end to this cycle? Will the USA finally reach some rock bottom level that can no longer support this kind of villainous theivery?

Rather than blowing their income on share-buybacks or paying it out in form of dividends, banks could retain more of their income, thus adding it to regulatory capital. Capital absorbs the losses from bad loans. Higher capital levels make a bank more resilient during the next crisis. If there isn’t enough capital, the bank collapses and gets bailed out. But banks that increase their capital levels through retained earnings are stronger and can lend more.

Nice. They really like that heads I win (Profits!) tails you lose (taxpayer bailout!) arrangement don’t they.

this always seems self serving they want a break so they scam us more, since there hasnt been all that big of increase in demand for loans, which the low interest rates should be helping, but doesnt seem to be and once rates go up, demand will go down even more.

They live on our backs and produce nothing.

La solution est la guillotine.

Just imagine if our bankers/rulers had to show, as they would under Chinese Capitalism with Chinese Characteristics, CWCC, that their use of capital for commercial loans had to show a direct benefit to the Chinese State and/or people? Chinese bankers laugh at our government’s takeover by our TBTF banks. Without globalized finance allowing them to hide their reckless ambling the TBTF banks would be TPMTS, too poorly managed to survive. Thank goodness for corrupt, ignorant, “law makers.” Otherwise banking would really have to be a business.

What this article fails to even mention is that the Banks aren’t making more commercial and consumer loans because the economy is stagnant. There are not enough customers demanding goods and services to make it wise for corporations to expand capacity. Corporations already have more capacity than they need in order to supply existing demand. As long as we keep concentrating wealth in fewer and fewer hands, the economy needs less and less capacity to satisfy demand.

If there were good opportunities for banks to lend to (and make money) they would certainly find a way to do it within existing regulations (as this article makes clear). The Fed put out $29 trillion in liquidity to bail out the banks. Where is that money sitting? It is not being circulated in the real economy.

Talk about being “stabbed from the front”. Where do we go when the government abandons all pretense of lawfulness? I am devastated.

https://www.housingwire.com/articles/40918-doj-will-be-allowed-to-join-ocwens-challenge-to-constitutionality-of-cfpb

(After finally being finished, I noticed the length of my rant. My apologies)

I know math is not my best subject. However. Eleven Trillion Eight Hundred and Nineteen Billion Dollars?!?! Just among the top ten banks? Am I reading this right?

Now, I know that the Venn diagram’s circles of the wealthy, and of these institutions and the Congress are not completely congruent but as someone desperately trying to get some grants and scholarship money for next year so I don’t wind up in the car with my cat. Partly because of the tech boom that has further Disneyfied the Bay into a Monied Wonderland full of young wellpaid techies.

We are about due for another economic downturn despite not completely getting out of the last one. Perhaps, just maybe if some of those 11+ trillion dollars were actually invested, loaned, or taxed we might mitigate or avoid altogether the next recession. But no, that’s socialism or something? So more tax cuts and more quantitative easing.

I’m supposed to be sympathetic to the fat cats? Or worry about (take your pick now) the Democrats/Republicans/Terrorism/Guns/Blacks/Hillbillies/Transgendered/Christians/Easter Bunny is gonna get me?

Perhaps I will actually care once I stop stepping over mentally ill people marinating in their filth or seeing people working full time living in their cars and campers. Until then, no.