Lambert here: Who doesn’t like new experiences?

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

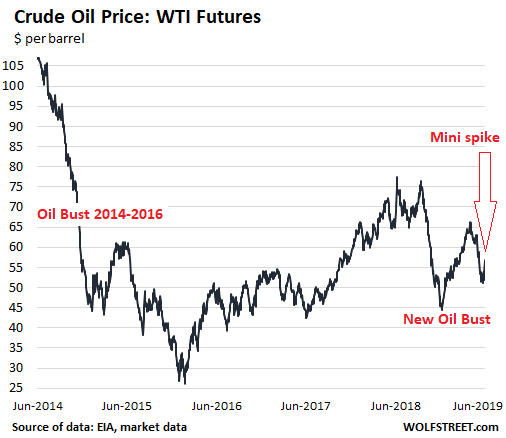

Powered by the iffy situation in the Persian Gulf, the Strait of Hormuz, and the Gulf of Oman, with attacks on tankers and now the downing of a US drone, the price of crude oil got a little nervous in recent days. WTI jumped about 6% today to over $57 a barrel.

But this was just a minor uptick in the overall scheme of things: The US, which has become the largest oil producer in the world, is in the middle of its second oil bust in five years:

These two oil busts are largely a consequence of surging US crude oil production. During the oil bust of 2014-2016, the price of WTI collapsed by over 75%, careening from $107 per barrel to a low of $27 per barrel in 18 months, before starting to rebound. In the process, a slew of oil-and-gas drillers filed for bankruptcy.

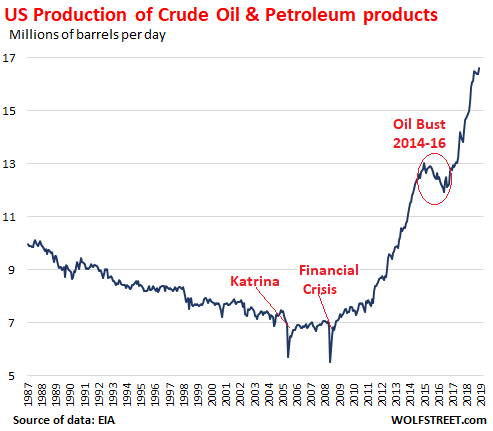

For a while it looked like the shale boom, where all the growth in production had come from, was running out of money, and therefore out of fuel. Production fell sharply from early 2015 through much of 2016, but then new money from Wall Street appeared, and production began to soar again, hitting new records all along the way.

Shale wells produce a variety of liquid hydrocarbons (they also produce gaseous hydrocarbons which are not included here). This production of crude oil and petroleum products soared from just over 7 million barrels per day (bpd) in 2010 to 16.6 million bpd currently, according to EIA data:

This surge in production comes even as shale oil-and-gas drillers have essentially been cash-flow negative in their entire history, drilling more and more of their investors’ funds forever into the ground. But so far so good — as long as it’s not my money.

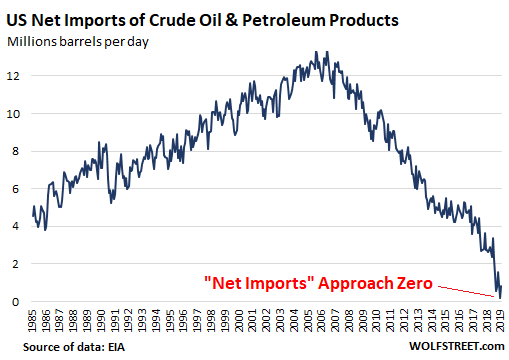

The US used to be the largest net importer of crude oil and petroleum products in the world. Between 2005 and 2008, “net imports” (imports minus exports) of crude oil and petroleum products exceeded 12 million bpd. But surging production in the US has slashed imports. And recently exports have surged, and the trade in crude oil and petroleum products is now nearly balanced between the US and the rest of the world. And the net imports are heading toward zero – the point where the US imports as much as it exports.

In February, net imports were down to just 176,000 barrels a day, the lowest in the EIA data going back to 1971. In March, the most recent data available, net imports were 842,000 barrels a day:

The fact that the US imports a lot of crude oil and petroleum products, even as it exports a lot too, is related to a variety of factors and market conditions.

For example, California is the fourth largest oil producing state in the US, but it’s not enough. It’s not connected via pipelines to producing regions east of the Rocky Mountains. So it gets some oil by oil train. It imports oil from Alaska. And it imports the rest from other countries.

But California’s refineries also export gasoline to Mexico and other countries – try to explain this to Californians who groan under high gasoline prices! This mismatch of supply and demand, lacking infrastructure, and global factors plays out across the US and leads to a mix of imports and exports.

The US has become a huge oil producer despite the cash-burning characteristics of the shale oil business. But the very fact that the shale oil business burns so much cash makes it a large contributor to the US economy as every dollar that gets “burned” is actually spent in the US and gets recycled in the US economy.

The jobs are well paid. The business has a large high-tech component, involving highly paid technology employees and contractors, along with expensive specialized tech equipment and software. In addition, it involves sophisticated heavy equipment in the field that is fabricated in factories around the US. It involves transportation to get this equipment and supplies to the oil field. It involves the construction of infrastructure, such as pipelines and oil storage facilities, processing facilities, and the like.

Oil-and-gas related industries and their suppliers weigh heavily in US industrial production and manufacturing, but also in services such as engineering.

Back when the US was the largest net-importer of crude oil in the world, any increase in the price of oil siphoned most of this money out of the US economy to oil-producing countries. As consumers and businesses had to shift spending dollars from US products to products based on imported oil, a big surge in oil prices – the “oil shock” – could trigger a recession.

This picture has now completely changed. And Fed Chair Jerome Powell made note of it during the post-meeting press conference on Wednesday.

While there are some strengths in the US economy, such as services and consumer spending, he said, there are also some weak spots, particularly business investment and manufacturing production. He listed a number of factors, including “lower oil prices.” They not only contribute to “lower investment,” but also to lower manufacturing production as purchases of new equipment are put on hold.

This is already showing up. The plunge in oil prices since August has caused the oil-and-gas sector to get skittish with capital expenditures this year, and Powell picked up on that. Investment in the US shale sector has a big impact on the real economy.

This became apparent during the 2014-16 oil bust when the sector drastically cut back on investing. The overall economy started to slow in 2015, and in 2016, GDP growth was just 1.6%, the worst since the Great Recession. When the shale patch recovered, economic growth accelerated.

A higher oil price, say over $75 a barrel, would unleash investment in the US oil patch, and it would unleash orders for new equipment and services. When companies invest in US shale oil, it triggers a whole chain of activities in the real economy.

Then Powell touched upon the other side of the coin of lower oil prices: Consumers pay less for gasoline. Conversely, they would pay more for gasoline when oil prices are higher. Consumers hate paying more for gasoline. But here is the thing:

Whatever amount consumers spend on gasoline is part of “Consumer Spending” which accounts for about 70% of GDP. So, when gasoline prices rise, consumers with limited budgets shift some of their spending from Walmart’s imported doodads to gasoline. In this scenario, gasoline sales would rise a lot and Walmart doodad sales would fall some, and it would all flow into “consumer spending.”

But gasoline in the US is now mostly a made-in-the-USA product (see the trade data above, third chart), and most of the money spent on gasoline goes into the US economy, and stays in the US economy, and is not siphoned out by OPEC or other producing countries.

Imported doodads siphon money out of the US economy (imports are a negative value in the GDP formula). So every dollar a consumer shifts away from imported doodads to gasoline ends up boosting the overall US economy – though it might slow China’s economy a tad.

Obviously, there are dark consequences of higher gasoline prices: For example, they may also shift dollars from things like food and healthcare to gasoline. Higher gasoline prices make consumers surly, and squeeze spending on discretionary things, such as movies or restaurant meals. But they’re all shifts within “consumer spending.”

If the price of WTI goes back to $75 or $80, there will be a flood of new investment in the oil patch in the US. This spending would flow into manufacturing and services. It would flow into wages. It would flow into trucking and tech. It would ricochet around the US through the multiplier effect. Now that the US is the largest oil and natural gas producer in the world, higher prices for these products are actually beneficial to the overall US economy, just like they are beneficial to OPEC. This is a new experience for the US.

For six months now, folks said the Fed had made a “U-turn” and would cut rates at the “next” meeting, etc. But none of it happened — and might not happen. Here’s why, in Powell’s words. Read… What Powell Really Said about the Economy and What Would Trigger a Rate Cut

Wolf, this is kin to saying that more death sentences by firing squad would be good because it would spur more demand for guns and ammo plus create good paying jobs for sharpshooters. I understand that we need oil, but in addition to moving the world economy away from consumption of fossil fuel, fracking is the worst of the oil economy with the associated massive impacts to clean water and fresh air. I don’t care if the fracking economy would thrive with expensive oil, earth needs to move beyond that. Let the marginal investment, all of it, be directed toward a brighter future.

Ditto. This was a perverse article in every way. On the other hand, if we’re trying to exhaust the remaining accessible oil supplies so that we can get on with things, by all means, lets have more conflicts in order to drive up oil prices so that we can extract and burn the stuff all the sooner. Not that the MICC or Wall Street need any such excuses, of course.

Ditto, yes very perverse.

It’s a very shallow article. The negative impact on the economy due to higher oil prices will be be much larger than the meager employment created by fracking. Since the price impact of higher oil prices will affect all countries, imports will get more expensive too! To me it looks like only the oil companies will benefit.

There won’t be higher prices in the medium and long term if it would help u.s geo-political adversaries such as the russian federation and venezuela.i could be proved wrong at some point but i simply don’t see it happening.

As clathrates percolate out from where the permafrost used to be, just think how expenditures will plummet?

Boo-RAH! Go… Cracken!

https://siberiantimes.com/other/others/news/alarming-wildfires-rage-near-giant-mouth-of-hell-gash-in-the-tundra-a-wonder-of-siberia/

http://blogs.discovermagazine.com/imageo/2019/06/18/wildfires-rage-near-siberias-mouth-of-hell-a-giant-depression-thats-getting-bigger-due-to-global-warming/

Ah, but here’s the rub. Production increases but consumption decreases (gets more expensive ) so alternative sources get more cost effective.

No simple answers…

I don’t think he’s saying that at all. NAFTA and other trade deals sent much healthier production industries, from shoes and clothing to medical equipment and ceramics, overseas. The dynamics that Wolf describes, especially the synergies with local employment and capital investment, would occur in any industry that meets a strong demand, regardless of its collateral environmental impacts.

It’s perverse that it’s oil that produces this employment and “burn” distribution, but the perversity is in the oil’s characteristics, not in the normal economic activity it produces.What if it was shoes, or cookware?

NAFTA?????? B….what????? They were long gone before that. Try harder when you post.

Durably expensive oil, stemming for instance from a conflict in the gulf, is not only good news for the oil patch. Expensive hydrocarbons this time could be the spark to generate big investments in relatively expensive carbon free energy, especially in hydrocarbon deprived regions like Europe or North Asia. Once economies of scale exist and technical know-how become widely spread, the world may get out of its hydrocarbons addiction through price parity. It is fair to say that the US will not be a leader on this though…

Is Wolf really arguing that a government action (war) will prop up the price of a product by restricting it’s availability (oil) and be good for the economy of the country that produces it? Does this sound like the reaction of a planned economy to anyone else?

“Does this sound like the reaction of a planned economy to anyone else?’

I have to wonder “what kind of planning.”

The USA is in this position because it protected its oil industry. Plenty of oil manufacturers and refineries still produce in the USA.

Somehow it never crossed their minds that outsourcing manufacturing for all kinds of other tech wasn’t a problem. Now there is this “dust up” with China among other things.

What kind of planning?

It “would flow” into earth’s air and water, into the bank accounts of the obscenely wealthy, and into the voting booth, giving us 4 more years of the comb-over presidency…

Obama’s only lasting legacy.

One question, if the industry is bleeding money, why does it exist? I thought capitalism would put this dog down, right? Something is missing here.

The same argument can be made regarding Uber, Lyft, etc.

Be patient. These companies are currencies users, not issuers, and eventually the external funding will dry up.

It’s a very different kind of scam than the attempt by Uber and Lyft to conceal the extend and nature of their losses from investors, the public and regulators, while building a bubble on the corpses of US antitrust and state/local livery industry regulation.

Nominal “losses” by fracking Master Limited Partnerships are a feature, not a bug for tax-exempt limited partners (especially university and hospital endowments). They allow the non-profit LPs to offset other Unrelated Business Income Tax liability generated by certain trendy “alternative asset class” investments in other sectors, the revenue or gains from which can’t be fudged as related to the charitable mission of the tax-exempt organization.

So the investors are accruing benefits even as the industry is supposedly tanking. Would be curious to see someone who knows what they’re doing take a deep dive on some of the bankruptcies. Are the MLPs themselves going under, or just some of the C-corporations in different slots along the production stream? It’s a cyclical real estate-based industry. Without understanding how the assets are disposed, and following investor money through each portion of the stream as company managers take different pieces of the supply chain public and private, it’s really hard to tell who the winners and losers are.

But there are real winners, and the “OMFG peak oil! Fracking is bust! Alternatives will win as soon as stupid investors realize this!” arguments that one finds at NC on a regular basis are, let’s just say, based on less than a full understanding of the financing of this industry.

Yep, MLP’s and special tax treatment ubiquitous in the oil/gas industry are suspect.

Also a chunk of their losses are the producers being at the mercy of pipelines. Shortage of take-away capacity gives the midstream owners a bigger cut. Another chunk is the oil services providers taking home the money.

Lastly, indebted and unprofitable companies have less ability to restrain production, not more. Even bankruptcy of a producer doesn’t create a reason to abandon half finished production (drilled-but-uncompleted wells).

Indeed. It’s not like most shale plays are prime hotel, residential or shopping mall real estate — the carbon is what makes the land worth buying in bankruptcy court. And it’s not like the equipment gets melted down to make trucks during a down price cycle, even if the owner or lessee goes technically belly up.

A little smoke in the Straits of Hormuz and the US economy starts purring like a kitten.

Who knew it was that easy?

Higher gas prices and aquifers polluted with super-secret frack liquids are a small price to pay to make oil companies happy.

What’s not to like?

What’s not to like? Italics, that’s what.

Hmmm… trade disputes, seeking to prop up US commodity prices and promote exports, international fleets dancing about Feudal Muslim states. Contentious, loudmouth, know-nothing 1% politicians, European solidarity, Asian trade partners, monopoly media…

what could go wrong?

Unclosed formatting tags that run on until the end of the document make a great metaphor for economic activity with unlimited negative externalities.

LOL. Commenters here are way too smart. :)

+1

I agree with Arizona. Italics are for special occasions.

Yeah, this article makes one wonder if foreign policy is being decided on what is best for the oil economy. The attempted coup and sanctions in Venezuela would help domestic oil consumption. Add in sanctions on Iran and Russia and it seems reasonable that the powers that be are trying to aid the domestic oil industry via belligerent foreign policy.

What a terrible allocation of resources! So much for the free market.

Makes you wonder? Big oil has been driving foreign policy in the middle east for decades.

It’s privately funded “fossil carbon Keynesianism”. It could go “full on” MMT if the Fed were to start purchasing the shale producers’ bond issues.

I think that he makes an interesting point that the income losses experienced by the industry could, in an aggregate sense, be more than offset (limiting one’s attention to income and expenditure — not taking into account environmental issues) by the benefits elsewhere — a multiplier effect (or maybe just a differential propensity to consume; the investors aren’t buying stuff but the workers are). It’s a Keynesian intuition, and valid as far as it goes.

(Not sure that ALL the expenditure stays within US. I have the impression that “frac” sand is getting hard to find and is being imported. But that’s surely a small part of the total cost of extraction)

But the neglect to notice the externalities of tight oil extraction is disappointing.

So much for any positive externalities. Now, let’s illuminate the negative externalities having to do with oil extraction beginning with the production of additional greenhousse gasses all along the industrial chain.

Wolf Richter’s argument suggests a re-interpretation of the “pressure on Trump” argument that Moon of Alabama has been making. Perhaps Trump likes the chaos as it drives up oil prices (MoA writes from the assumption that DJT fears high oil prices because of their effect on the cost of consumption goods) and will not back down under any low-intensity asymmetrical action scenario. In that case, the Iranian “pressure campaign” might actually be targeting Europe, which Iran wants to fulfill its obligations under the JCPOA, and which is more vulnerable than US to negative economic consequences of high oil prices.

I think you have something there – Europe WILL feel the pressure. But so will the US. Just take a look at what Pepe Escobar says in Iran goes for “maximum counter-pressure” and the concept of “notional” commodity prices. Prices that are ridiculously out of the money. Let’s say I buy a call for $500 a barrel of oil. Today I may pay a penny per futures contract or option for that. Maybe I spend $100,000 for a number of those futures. In 3 or 5 days, say there’s a LOT of smoke in the Straits of Hormuz. Whoops, my penny per contract is now worth $500,000. $500,000 – $100,000 is now worth $400,000 if I sell.

Not bad for me…

But it gets bad for my neighbors: gas prices; food prices; another mall will close; 3 more Dollar Tree or whatever they’re called will open with associative food quality.

And there goes the local revenue.

So even if I live next to an oil patch (like I do here in New Mexico), it ain’t gonna be fun.

While I agree with James and Phil’s points, I think it’s ok to give Wolf a break on the content and the admittedly limited set of assumptions he is looking at.

Our unenlightened species is only going to realize the problem that it has created for itself when the endgame gets closer. It kind of reminds me of working for a housing developer in California in the housing boom 2004-2008. From 2005, we all knew what was coming and our personal culpability in it, but everyone was determined to suck the last dollar out of the then-dying regime. It will be the same with this.

extracting every last dollar could cause civilization to collapse. the risk of continuing the denial strategy are far greater.

Banker/ Terrorist… Thank heavens we don’t have to choose!

https://truthout.org/articles/history-proves-we-cant-count-on-democratic-party-for-a-green-new-deal/

Wolf can be oblivious sometimes, but this time he sounds just plain stupid. This is an awful suggestion. Gee, let’s raise the price of oil surreptitiously by instigating international paranoia so our frackers can make a subsistence living rolling over huge amounts of debt while devastating the planet. Great idea, Wolfie.

And just to illustrate how confused the economy is: in Links above, CEPR. Dean Baker – one of my faves, is telling us not to let the fracking industry operate inexpensively but instead raise the cost of mining frac sand so that their expenses will go up, putting them out of business faster. Which will, of course, cause them to raise the price of oil in a desperate tempt to stay alive. Actually, I think the reality is that frackers are trapped. If they let their wells go idle it is doubly expensive and sometimes impossible to get them back on line. The whole thing is just insane.

Most insane article I’ve seen in a while. Thinking like this is why capitalism will be the end of humanity.

I thought it sounded like someone had hacked Wolfstreet…

“I’m a capitalist to my bones”. Yea well at least the bones comment is close to inadvertently recognizing it’s a death system I guess.

“The jobs are well paid. The business has a large high-tech component, involving highly paid technology employees and contractors, along with expensive specialized tech equipment and software. In addition, it involves sophisticated heavy equipment in the field that is fabricated in factories around the US. It involves transportation to get this equipment and supplies to the oil field. It involves the construction of infrastructure, such as pipelines and oil storage facilities, processing facilities, and the like.”

Now imagine that this is not for fracking but for infrastructure such as repairing bridges, schools, hospitals & clinics, roads, etc; building light rail, building light cabins for the homeless, repairing environmental damage. Teach these crews more skills and pay them well with the benefit that the money will be spent in the local economy. Sort of like FDR’s Civilian Conservation Corps but one dedicated to rebuilding America which would both improve and benefit the whole economy. Wouldn’t that be something?

“Now imagine that this is not for fracking but for infrastructure such as repairing bridges, schools, hospitals & clinics, roads, etc; building light rail, building light cabins for the homeless, repairing environmental damage”

EVERY last bit of that is powered by OIL!

Higher prices for gas at the pump is a death blow for Trump or any pres seeking re-elect.

simple-he does not want it.

Stop subsidizing the oil business. Make oil companies pay the costs levied on the rest of us in environmental damage and destruction.

We need water to live, not oil. Invest in renewable energy seriously and protect clean water.

An oil based economy does not benefit the public equally. Oil tycoons have notoriously used their fortunes for personal gain. That kind of lopsided economic growth from oil is parasitic. It is killing us.

Spending on infrastructure is an investment in our country. If it takes oil to do it, then spending money on oil is worth the public investment. The oil would not be sold for commercial gain like it is now.

Climate change driven by humans on the earth is the saddest thing I have ever witnessed.

The US is essentially neutral in oil import/export. Higher or lower prices make no difference for balance of trade.

Higher prices do “create economic activity”, and I get that this is the point of the article, but that is a limited way to think about what is “good for the economy”.

If oil is a little harder to come by, and more energy production activity is needed to fuel every other economic activity, that just means you give a bigger slice of the pie to oil industry. You may have made the pie bigger in dollar terms, but in terms of all other products and services, you haven’t changed the pie at all. You’re just working harder to get the same thing.

And that doesn’t even get into the environmental costs.

May I assume that Wolf is not old, disabled, and barely living in poverty on SSI? Is there someway I can do without Walmart doodads from China such as plumbing parts so my toilet doesn’t spray water all over and leak through the house? More for gas? Just don’t buy chicken or milk.

Maybe I should just kill myself and boost the economy for funeral directors? But no — that wouldn’t help the oil industry, would it. Oh, wait — I could buy a gun from the weapons manufacturers, and I suppose that be as good.

Every economist should spend at least a few years in poverty, and in a wage slave job, so they have a clue what the words mean.

Rather than invest more in pumping oil, all subsidies should be removed. The gas-using public would wise up in a hurry about the priority for renewables.

I cannot imagine a serious person suggesting pumping more oil.

“California is the fourth largest oil producing state in the US”

Why doesn’t California have a statewide oil severance tax?

in spite of their commitment to fight global warming caused by fossil fuels?

The Brown’ Family, father, Pat, California governor, 2x, son Jerry, California Governor, 3x, Mayor of Oakland, Sister Kathleen, state treasurer and Hal, Marin supervisor, all live(d) off a blind trust stuffed with Occidental Petroleum stock.

Funny how that works.

if only it were as simple as this?

Wolf Richter reminds me of the nursery rhyme about the little girl with a curl in the middle of her forehead. When he is good he is good but when he is bad he is awful. I read the subject post on his website which I view regularly and placed it at the top of the awful.

One of his weaknesses is in his belief in GDP as a good measure of the health of the economy. Coming from someone who took both undergraduate and graduate courses in environmental economics from Herman Daly, I learned some 40 years ago about about how both wealth and illth are given equal measure in GDP. It’s all additive.

In addition to his over-reliance on statistics which are gamed to please the confidence fairies, Wolf seems to have little if any knowledge of MMT.

I had to look up “illth” — thank you for that. Always great to learn something new, that’s useful. And now to peruse some Ruskin…

Bayer sells the carcinogens through its Monsanto biocide company, AND it produces the chemotherapy drugs to “fix” the cancer they caused. Vertical integration…

Not exactly, a new concept to Bayer Monsanto ? Or Interessengemeinschaft Farbenindustrie AG

https://www.businessinsider.com/yes-bayer-promoted-heroin-for-children-here-are-the-ads-that-prove-it-2011-11

Some have said it, but any analysis of extraction industries that don’t take into account climate chaos or pollution should be considered null.

This post is absurd. A disorganized increase in energy prices is dangerous to the economy and society.

The Yellow Vest riots in France were the direct result of increased gas and diesel taxes. I have not heard a peep from David or any posts here since May Day. I assume that is because the police numbers have overwhelmed the protestors. Jupiter still reigns. I guess that Donald Trump knows instinctively that gasoline lines and increased prices would have the same effect in the USA. He did not bomb Iran. Significant energy price increases would assure that a Democrat is elected President next year.

Tulsi Gabbard in her speech to South Carolina Democrats is specific. She would end federal subsidies to the fossil fuel industry in conjunction with the conversion to clean energy. The only way this will happen is if the government is once again run by and for the people.

I have seen this point-source italicization happen before from time to time. Somebody hits the right button wrong or the wrong button right and italicizes their comment. For some reason, a single point source of italic pollution pollutes the whole downstream thread. And everything stays italicised until someone who knows how to do it reverse-hits just the right button and shuts down the source of italic pollution.

the “net imports approaches zero” graph shows an anomaly resulting from the Venezuelan sanctions – the result was to drive our refining and supply of gasoline down, and we still have not recovered..

Fracking wells will be the useless monuments to our oil-based capitalist lunacy – marking the decline and rapid collapse of our society — sort of like the Easter Island Heads only grotesquely ugly in comparison – a monument to the destruction of aquifers and a stable climate instead of just the trees – a monument to the insanity that destroyed our not-so-civil-i-zation. Wolf Richter’s blind spots were never more apparent. This nonsensical article reminds me why I stopped bothering with his web site.

Wolf responds to the comments on his web site. Here is what he said about this article, explaining the point he is trying to make:

Wolf Richter

Jun 23, 2019 at 3:08 pm

Yeah, lots of people who have never lived in the oil patch and have no idea of the economics of oil and gas drilling get emotional about this. They hate fracking. I hate fracking too. But that doesn’t matter.

What matters economically is that now the oil patch is huge and has spread across the US and is a big part of the real economy — manufacturing, industrial production, services, including technology and finance all of it with lots of high-paid jobs — as the US has become the largest oil producer in the world, after having already become the largest natural gas producer in the world.

This is very new for the US, and people just don’t get the economic importance of it yet, and they don’t want to get it because the hate fracking (and I hate it too). That’s why I wrote the article to let people know that there are new dynamics at work now that the US has not experienced in my lifetime, and people who want to understand the real economy in the US need to open their eyes and look at the data