American policymakers are giving more and more credence to the role of monopoly concentration in the economic restructuring that started in 1980, in the Reagan/Thatcher era, that shifted power and rewards from labor to capital. Importantly, these experts don’t just see monopoly as a problem; even basic economic courses show in toy models that they increase prices and decrease output. They also acknowledge that stagnant wages, rising profit share of GDP and escalating wealth concentration are bad outcomes economically and societally.

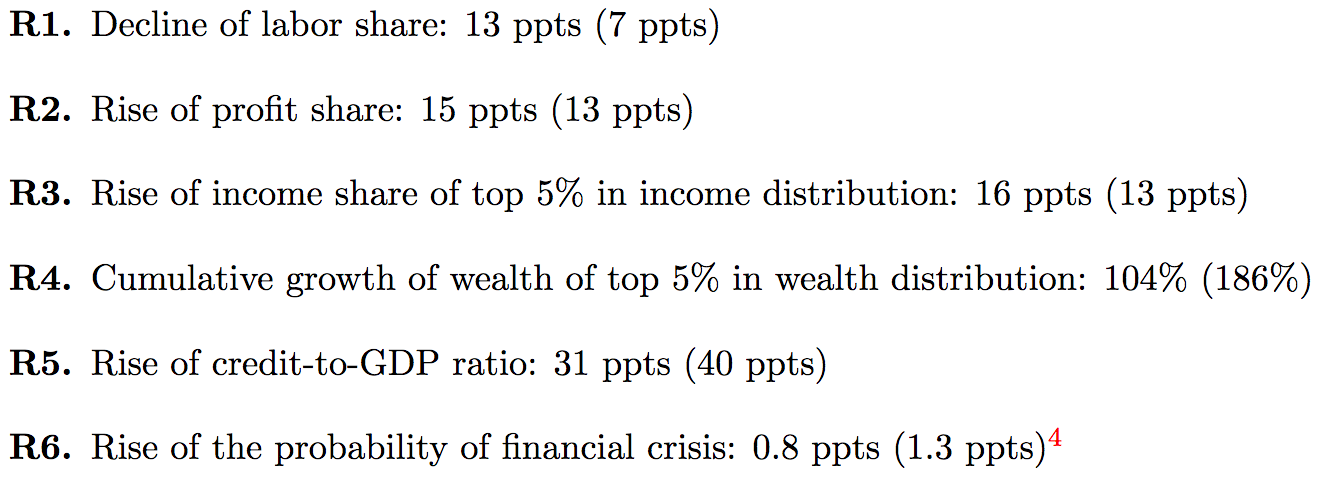

A new paper by Fed economists Isabel Cair ́o and Jae Sim describes how they developed a model to simulate the impact of companies’ rising market power, in conjunction with the assumption that the owners of capital liked to hold financial assets (here, bonds) as a sign of social status. They wanted to see it it would explain six developments over the last forty years:

Real wage growth stagnating and lagging productivity growth

Pre-tax corporate profits rising rapidly relative to GDP

Increasing income inequality

Increasing wealth inequality

Higher household leverage

Increased financial instability

And it did! For a model to have pretty decent fit for so many variables is not trivial. The first are what the model coughed up, the second, in parenthesis, are the real world data:

We’ve embedded this readable paper at the end of the post. The authors did quite a few sensitivity test and also modeled some alternative explanations, as well as showing panels that compared model outputs over time to real economy outcomes. They also recommend wealth distribution as a way to dampen financial crises, or even just taxing dividends at a healthy level.

Bloomberg wrote up the paper, an early indicator that it might get traction in official circles, and quoted Matt Stoller:

Matt Stoller, the author of “Goliath: The 100-Year War Between Monopoly Power and Democracy,” said both parties are culpable for the concentration of market power. Change is afoot because lawmakers realize they’ve ceded too much authority to large companies, he said.

“What you are seeing in the last five years is a shift where lawmakers think democratic institutions should be making more of the decisions,” Stoller said.

The anti-monopolists are on a roll. Matt’s colleague, the founder and head of Open Markets, Barry Lynn, wrote the cover story in the current Harpers Magazine, The Big Tech Extortion Racket: How Google, Amazon, and Facebook control our lives.

I strongly urge you to read the article in full. Lynn describes how America first grappled with monopoly power with the development of railroads and the telegraph. Their answer was regulation:

For a century and a half, Americans used common carrier policies to ensure the rule of law in activities that depended on privately held monopolies. These rules served as a pillar of American prosperity through much of the twentieth century. By neutralizing the power of all essential transport and communications systems, the regulations freed Americans to take full advantage of every important network technology introduced during these years, including telephones, water and electrical services, energy pipelines, and even large, logistics-powered retailers. Citizens did not have to worry that the men who controlled the technologies involved would exploit their middleman position to steal other people’s business or disrupt balances of power.

Lynn explains how this has all gone pear shaped in the Internet era. The tech giants’ access to personal information enables them to connect individuals to services they are presumed to like with enough success to drive more and more activity, transactions, and ad revenues through their platforms. Recall that tailoring also allows for price discrimination. Users of Apple devices have been shown higher airline ticket prices than PC/Android customers.

Amazon has preyed on third party sellers by copying their goods, as well as demanding more and more of the end sales price. This isn’t a new trick. One of my former lawyers, who represented some beauty, cosmetics and dietary supplements entrepreneurs, warned them never to take orders from Walmart. The Bentonville giant would attempt, usually successfully, to place bigger and bigger orders so as to become the little company’s biggest customer, by a large margin. Walmart would then squeeze the vendor to lower its price, which had the effect over time of wiping out profits and often leading to business failure. Walmart didn’t care. To them, the world is awash in products. But Lynn sees Amazon as more predatory:

Back in the day, Walmart’s goal was simply to force manufacturers to offer it lower prices in order to undersell and bankrupt rival retailers. Now that Amazon has effectively killed off all its online rivals, its model is to pit every seller and trader on its website against one another in a carefully orchestrated scramble to be placed first before the eyeballs of the busy buyer. Amazon gets to sell both access to the market and protection from its own thuggish behavior.

Having said that, it’s disappointing to see Lynn demonstrate such a complete misunderstanding of Uber that he includes it as one of his monopoly villains. The fact that Uber has done damage to local taxi companies has zero to do with monopoly power or network effects. Uber’s app isn’t special and Uber has no cost advantages over traditional cabs; in fact, it is high cost provider. Nor are there meaningful barriers to entry to operating a local transportation business. Uber is a pure and bizarre case of predatory pricing funded by very deep Silicon Valley pockets.

Unfortunately, the discussion of Uber suggests an intellectual blindness to the anti-monopolists, that they have such a strong idee fixe that they wind up in “If the only tool you have is a hammer, then every problem is a nail” mode.

A final development, and I must confess to needing to read the court filings to do it justice, is the brazen effort by Apple and now Google to crush games giant Epic for trying to go around the app store choke points. “Tying,” or requiring the buyer of one product (like Apple products) to buy other products (apps only through them) is a per se violation of anti-trust laws. Epic would seem to have a very strong case, but Apple has just said it is also cutting Fortnite off from developer tools by August 28.

Even big player like Epic can’t afford to wage this legal war unless it gets an emergency injunction. But this sort of thuggery usually happens less visibly and with companies too small to do anything other than capitulate. If Fortnite can get the courts to restrain Apple and Google while they duke it out in court, expect this to be a very important case. Let’s hope Fortnite can afford to proceed.

00 Market Power, Inequality, and Financial Instability - 2020057pap

The maker of Fortnite is Epic Games, under CEO Tim Sweeney.

Perils of AM drafting and not being a gamer. Tidied up the text a bit.

good catch

Reading this and that FED paper while listening to the MSM’s love fest over the Dem convention is deeply disturbing. Am I living in the same world that Dem partisans and Biden/Harris supporters see? As irrational as such thoughts are, there is a part of me that would welcome American failure as both political parties eagerly sell us out.

The interesting bit is that they work with a class structure that is consistent with data on the functional income distribution. The mostly useless mathematics gives them more than enough parameters to calibrate to the data and track the numbers pretty closely. More power to Fed economists (of all people!) for actually bringing in class even though their bargaining power in a Nash equilibrium and changes in the elasticity of substitution say nothing about the underlying political economy.

Pause to raise a mug or glass, depending upon one’s time of day, to the memory of Wright Patman. I recommend reading Stoller’s Goliath for details.

Cheers! Yes, Wright Patman was a hero for all time. Texas used to produce them with regularity.

The Harpers Magazine article made me think about Niemöller’s poem. That inspired the beginnings of a variation.

First Google came for me, and I did not speak out – because I was not a Googler.

Then Facebook came for me … not a Facebooker.

…

It becomes harder for the individual to survive and resist in the face of such toxic actors, but it is not impossible.

The Epic v. Apple situation is a bit worse than you described. Epic provides a game engine, called “Unreal,” which is essentially the framework upon which game developers hang their game content, allowing them to create their games (like Fortnite) without having to do most of the hard tasks that allow modern games to function. Hundreds of games not produced by Epic use the Unreal Engine.

Apple’s move to deny Epic access to Apple’s development tools will affect all of those folks who have or want to have games running on iDevices and Macs. Epic describes that effect as existential for the Unreal Engine, although it’s not clear if that’s true, since console and Windows gaming markets would be unaffected, but it ain’t nothing.

I am totally not skeptical that politicians who find monopolist largess filling their campaign coffers are going to do something truly effective to reign in monopolies. I mean, it’s not like depending on politicians to address the obviously destructive aspects of our economy has ever failed before. And we all know that our congresscritters’ chief concern is making sure that big business operates in a way that benefits all Americans. So I’m sure they’ll fix this. Completely convinced.

A very good point. As mentioned in the article, regulation is the solution to the problem. That change in the Guided Age only came about due to class struggle in the streets and through organizing third parties. The height of the last Gilded Age and Great Depression were not pretty. Change will not come about magically without sufficient prodding. The standing system is too corrupt.

Agree with both of you. The only institution powerful enough to control corporations is government so corporations have purchased the politicians running govt to serve them, not the people. Matt Stoller’s book, Goliath, is well worth reading but I find his faith in govt reasserting its role naive/gullible. He appeared on Rising to comment on the tech giants hearing and was full of praise for the “forceful” questioning. It was quite a contrast after cohost Saagar Enjeti had belittled the kabuki of it all during his opening segment. https://www.youtube.com/watch?v=Y8gHDoY9E70

The merge of corporations and government into one single, self-perpetuating unit… What would we call that?

I believe Mussolini had a word for it…

I’d call it the Orwellian “If you want a picture of the future, imagine a boot stomping on the human face, forever.”

There’s a much simpler alternative to “the assumption that the owners of capital liked to hold financial assets (here, bonds) as a sign of social status”: Wealthy people and big corporations have a management bottleneck. Hence they prefer passive investments like bonds and shares in monopolistic corporations or large tracts of land. Because they are highly liquid and future-oriented, they have a low internal discount rate, allowing them to outbid poorer investors and smaller corporations for such assets.

Hmmm. If I were driving an Apple or Google car and pulled into an Epic gas station and wanted to buy $100 worth of Fortnite gas I would also have to pay Apple or Google an additional $42.86 before the dispensing nozzle is allowed to fill my tank?

Is this a correct analogy?

no, you wouldn’t have to pay Apple/Google before you fill the car, you get your $100 of petrol either way. But Epic Gas Station, instead of getting $100 revenue, only gets $70 revenue, with the other $30 going to Apple or Google.

Then (and the analogy becomes tortured here), say Epic Gas Station gets a bit sick of this situation and offers the Apple/Google drivers a special pump where they get the exact same amount of fuel for $80, and they keep all that revenue instead of giving $24 to A/G. A/G then crack the shits snd say ‘sorry, it’s no longer physically possible to fill your car at the Epic Gas Station’

(Someone please correct me if I’m wrong; this is my understanding)

They don’t ask a lot, they just want to wet their beaks.

A quick look at the tens of billions in increased wealth American billionaires have acquired – since the start of the Covid-91 epidemic – would suggest that wealth is as much a threat as monopoly power. But the two are intimately tied together.

Bezos and Musk, for example, topped the charts: each added some $40 billion to their portfolios. You can buy a lot of local, state, and federal government influence with a fraction of that wealth. Breaking up the monopolies that confer much of this wealth on them would be a good start.

Off the top of my head I recall on percentage terms that zuck had the largest boost and it confuses me, also how did musk get so much? Money for SpaceX or something. It will be quite the eye opener to see how much they can rake in over the course of an entire year. Ain’t no stopping it now. (reply to EoH @ 12:08)

Re Musk Wealth increment.

Maybe increment came from Tesla stock going up 351% year to date?

TSLA now has a market cap higher than GM + Ford + Fiat/Chrysler + Toyota combined

It appears Musk has the golden touch in the eyes of some investors.

Batteries and outer space are the new plastics I guess…

Lithium batteries for the golf carts here are starting to show up, lighter, easier to charge,

I’ve likely bought the last set of lead batteries and will be converting over. It’s pretty simple but currently about twice the cost (give or take 1600) of GC1 which is about $700+. The price should come down

One quibble: US wages haven’t stagnated. They’ve plunged.

In Stephanie Kelton’s new book on MMT, there’s one brief passage where she says wages have crept up 3% or so since 1970. Later she writes that back in the day (presumably including 1970) “a single breadwinner could support a family, buy a home, put two cars in the garage, send the kids to college, take the family on vacation once a year and retire with a decent pension.”

Well, if wages had basically held steady, an average single income would STILL be able to provide all those good things. Of course, that’s hilarious nonsense. So let’s finally ditch this idea that wages have stagnated. They haven’t. Working wages have been plundered, murdered and gutted, and the officially calculated CPI is a load of garbage.

One should also factor in the value that everyone (perhaps working class in particular) benefited from good US infrastructure in the past.

The average citizen’s ability to enjoy well maintained and less crowded roads, safe bridges and water systems are not counted in these wage comparisons.

In essence, today’s US citizens must compensate for various infrastructure issues with a portion of their time and wages.

Yes, working wages are not stagnant, they have been plundered.

This further decreases the value of current wages.

I’ve been checking the gaming industry press for reaction. There’s a sense that it’s big but I’m not sure they realise how potentially big beyond their own industry

this take is a bit undergrad but might still be of interest:

https://www.gamesindustry.biz/articles/2020-08-14-epics-nineteen-eighty-fortnite-video-is-an-irresponsible-piece-of-corporate-propaganda-opinion

More straight news here:

https://www.gamasutra.com/view/news/368367/Epic_asks_court_to_block_Apples_retaliation_as_Fortnite_Unreal_Engine_face_consequences.php

https://www.gamasutra.com/view/news/368364/Apple_to_revoke_Epics_dev_tools_including_those_used_for_Unreal_Engine.php

The sentence about not ever expecting the tech giants to middleman the economy was stunning. Nobody expected it; I, for one, like to order stuff and pick it up at the post office and I don’t mind a few obnoxious ads on my screen. So now I’m thinking about how much middle manning is going on all the time. It could be synonymous with monopoly. If we can no longer make the internet obey common carrier laws because the internet is simply too connected and complex to not be a middleman then the next best step is to nationalize them all, that or open up the access for those services and hope it’s not too much of a free-for-all. We’re digitizing money as fast as we can – that might help. The money markets themselves middleman us the same way. We’ve got sovereign money and we make sovereign spending decisions – why on earth do we need to go through the money markets to find a loan? Because it’s a monopoly. This is a whole new way to think.

We are a monetary sovereign, like so many other countries, but we are still busy selling bonds for these Covid-19 emergency spending purposes. Why bond? It doesn’t seem to be a question of choice.

It seems to me that Uber/Lyft could potentially monopolize public transportation in all but the largest metro areas. They are certainly trying. Successful efforts to supplement then replace public transportation appears to be the source of promised investor profits.

Unfortunately, a number of previously public services have been privatized into monopolies/duopolies in that way. For example, Aramark/Sysco have duopolized local university/government/military food services for decades despite offering a product that would appear to be highly competitive. I’ve read Hubert Horan’s articles but still don’t understand why he thinks public transportation in mid-sized cities can’t be monopolized profitably.

Wash your mouth out and please read Hubert Horan’s series. Uber and Lyft cannot monopolize local rides. They have no cost advantage. There is nothing special about their app. Passengers regularly have apps to more than one ride share co. Drivers are regularly using more than one rideshare co. Taxi companies have developed apps.

There are also no/low barriers to entry to providing a local car service.

Uber and Lyft have no cost advantage, in fact they are higher cost providers that traditional cab companies. The only reason their rides are cheaper is they are massively subsidized by investors, to the tune of >40%.

So what happens when Uber and Lyft have killed many taxi companies? They have to jack up their prices to cover their costs and all the past losses, oh, and provide for a profit.

Ridership drops like a stone and non-Uber/Lyft provides come into the market.

As operating losses accumulate, the point where Uber would have to finally pay a buck of income tax on any profit at all is pushed out to eternity.

There used to be a limit to this “carry forward losses” games in that after so many years you would lose it. In Canada it used to be seven years and somewhere arounf 2006 or 2007 that was changed to twenty years. In the US there is no time limit anymore.

If there were a limit of lets say seven years, the billions of dollars of losses accumulated by Uber would not be allowed to be used as an offset to reduce taxable income to zero from here to eternity.

That would also stop the business model of generating huge losses deliberately to put any competitor that doesn’t have the same pile of money backing them, out of business.

There is no “market” for providing the highly-subsidized city bus & transit services that Uber plans to monopolize. Local private taxi/bus companies won’t be successfully bidding on contracts to replace these services any more than local caterers bid on university food service contracts. Uber’s inability to compete profitably with private taxi services doesn’t mean that it can’t monopolize a subsidized city bus service.

Uber is already providing city-subsidized rides in a some communities – Innisfil, Ontario is one example. Means-testing the subsidies available to riders will likely be the key to making the service profitable while limiting tax expenditures.

City bus ridership has been declining in many mid-sized cities. Proposals to supplement their services for a cut of the subsidies will eventually become offers to replace city buses altogether. Once the infrastructure supporting bus service is gone, a national duopoly will be free to divvy up the privatized spoils. Uber’s leadership has been crystal clear about these intentions. Horan’s analysis explains why Uber can’t compete with private taxis. It doesn’t explain why Uber can’t privatize a city bus service into a profitable monopoly.

This comment is incoherent. If we agree that Uber is incapable of earning sustainable profits from the operation of urban car services, profits from urban bus services is even more implausible. Cities have no rational reason to pay Uber to operate buses given its higher costs (and investor profits) when it could operate them themselves or pay smaller operating specialists with much lower overhead.

interesting post. I don’t get the whole tangent on uber. predatory pricing is a type of anticompetitive conduct that is enforced under monopolization law. Investors value uber highly because of its network effects. sidecar is suing uber for predatory pricing, which is an antitrust case. anyway, good post except for the weird part about uber.

Please read Hubert Horan’s series on Uber. You have been had. There is no network effect with Uber’s app.

I was a seed investor in Lyft, so i’m pretty sure i understand these businesses and their intentions and how they have evolved.

seemingly endless investment capital has poured into uber with the hope that one day it will extinguish cabs and engage in a monopoly or duopoly with lyft. The economic destruction that that promise of monopoly holds has led to real economic damage. The interest in monopoly is precisely why they’ve gotten so much VC money, so it is odd to try to distinguish those things.

I guess you can call that a different type of problem than monopoly, but i’m not sure why such a semantic point really matters.

on your points about network effects and barriers to entry. I mean, open up an uber app. see how long it takes to get a car. open up a lyft app and see how long it takes to get a car. If it takes less time to get a car on uber, it is benefiting from a network effect. i don’t need to read a paper to understand that. I can go outside and do that. In DC, cabs have tried to develop an app to compete with uber, and, for whatever reason, they can’t make one that’s as easy to use. I’m not sure why, but that is a barrier to entry. you may think it is small, but it is enough that the DC cab market still hasn’t figure it out. That is somewhat mitigated because Uber is required to carry cabs as an option on the app, but still, very bizarre to make a claim that barriers to entry are low when you can just look at your local experience (or read the sidecar complaint against uber) to understand how the people who run these businesses run into barriers to entry.

like i said, I enjoyed the post except for the weird tangent on uber not presenting a monopoly issue.

No, it is not a network effect. You have not read Horan or do not understand transportation economics, or both. Which is quite the stunning de facto admission from an investor.

The number of cabs available is due to investor subsidies. It has absolutely nothing to do with network effects.

ok. it is enabled by investor subsidy, and it is a harm. you don’t want to call it a “network effect.” that’s totally fine. just a waste of time to get so wrapped up in the semantics of a genuine “network effect” or one sustained by seemingly limitless investor capital. the result is the same. it is predatory and does not allow for other competitors, even ones that would otherwise be sustainable businesses, to survive. your obsession with some sort of natural economic definition of “network effect” is bizarre. nobody is saying that uber earned its market position.

saying i don’t understand transportation economics is irrelevant. you are classifying this as not a monopoly issue, despite evidence that opponents of uber are succeeding against it with antitrust law. and you are saying antimonopoly people are being narrow minded about classifying everything as being about monopoly, but you are being weirdly narrow minded about defining something as a natural “network effect” or an artificially investor-subsidized dominant/predatory company.

nobody is disagreeing that it is investor-subsidized power being used in a bad and unlawful way.

to be solution oriented: what law would you prefer to use to police this type of abuse? how would you prefer companies and workers crushed by uber to avail themselves from a legal and policy perspective?

It appears Odysseus did not see my reply to him further down, since this comment ignores important substantive issues I have addressed, both in this thread, in NC posts, and in my academic articles.

It also appears Odysseus never understood Yves’ criticism on the Uber point in Lynn’s paper. Among other things, Yves was objecting to Lynn’s effort to closely equate Uber’s artificial market power (strictly a function of huge predatory subsidies) with those aspects of Amazon/Google type market power derived from data-driven manipulation of consumers and suppliers once their core businesses had been established. The exchange here is confused further by Odysseus’ incoherent reference to non-existent network power.

I think Odysseus’ original point, translated into clearer language, was “Hey I don’t understand why you think Uber isn’t pursuing monopoly just like Amazon and Google when obviously they were”. This totally point that even raw financial power cannot create a monopoly. Even if you can destroy competitors now, local transportation does not have barrier to entry, and an app that is readily emulated don’t confer that either. New competitors will come in if Uber raises its prices even to cover its costs, since it not a low cost producer.

Yves was not denying that Uber is pursuing artificial market power,. Yves was pointing out that Lynn got the dynamics wrong and that Uber’s strategy was very different from Amazon’s. Odysseus appeared to totally miss all that.

When both of us first read Odysseus’ initial network power comment it sounded like the “Uber’s growth based on strong legitimate economics” claim many Uber supporters have made. Odysseus’ follow up suggests this was just sloppy thinking/writing and he was just using “network power” instead of simple predatory pricing, unrelated to any realistic expectation of permanently driving out competitors.

Odysseus’s comments suggests profound ignorance of the basic economics of companies like Uber and Lyft. Odysseus seems somewhat aware that these companies were working to eliminate competition but apparently hasn’t given any thought to how they were doing it.

The fact that customers find more cars available at lower prices on their apps is entirely due to the tens of billions in predatory subsidies. It has absolutely nothing to do with the app. Traditional taxis who have introduced apps have failed—not because they couldn’t match Uber/Lyft’s wonderful user interface, but because they were limited to only offering cabs where fares covered the cost of service. Hundreds of other consumer industries have introduced smartphone apps, but absolutely none of them led to major changes in industry competition.

Urban car services have operated for a hundred years and there has never been any evidence of network effects or even significant scale effects. Network effects can take different forms but are well understood. Taxis don’t have “hub-and-spoke” type network effects. Taxis don’t have “Metcalfe’s Law” type network effects, where the utility of a service (like Ebay or Facebook) to individual customers increases significantly as the total customer base increases. None of the people claiming that Uber/Lyft have powerful network effects can explain where they come from, why no one in the history of taxi service had ever noticed them before, or demonstrate the huge utilization/productivity/cost efficiency impacts you would see if they existed. All of the rapid traffic and market share growth is explained by predatory pricing. All of the increased used of the apps is explained by the artificial destruction of competitive options which forces drivers and passengers to rely on these companies.

That Odysseus is both a fervent believer in strong network effects and a Lyft investor is especially curious. If these network effects existed, Uber would have destroyed Lyft years ago, because (as companies like Ebay and Facebook demonstrate) larger companies with more powerful network effects rapidly capture share from smaller companies, and the customer utility gap grows at near-exponential rates.

Odysseus’s assertion that predatory pricing could not be relevant because it would be stopped by antitrust enforcement suggests similar ignorance of competition law practices. While laws against predatory pricing nominally exist, they have been gutted by decades of non-enforcement justified by specious economic arguments. Original claims that predatory pricing actions had to consider the consumer welfare impact of lower prices were eventually corrupted to the point where “lower prices” was a prima facie defense, without any need to demonstrate that the lower competitive prices were justified by superior competitive efficiency or any need to demonstrate that the predatory company had no incentive to reverse course once it had established market power. Odysseus cannot cite any examples of predatory pricing actions against large consumer companies pursuing industry dominance because these cases do not exist.

How can we break monopolies? One way, perhaps, could be to charge a sales tax that is dependent on the sales volume of the seller (higher percentage if the company has higher sales). This way, new entrants can compete with Amazon. Customer will have more choice and Amazon will have to fight harder to get shops to list their products on Amazon Marketplace (i.e. lower fees) because they now have a choice.

Perhaps we can also ban companies from taking over rivals. For example, some years ago when Instagram turned up as a potential rival to Facebook, the latter simply bought them. Had they not been bought, they may have become a viable rival, which would have been a much better outcome (less power concentration).

Wild ideas that of course won’t happen because of vested interests, but monopolistic corporations are becoming the new government and we should fight that tooth and nail.