The Democrats, flushed with triumph at having taken Medicare for All “off the table” — during a pandemic! — when they “beat the socialist,” have initiated a process that will culminate in Medicare’s complete privatization. (This after having implemented an NHS-style “free at the point of care” vaccination program, too.) In this post, I’ll first look at the current state of Medicare; the neoliberal infestation is bad. Then, I’ll look at the Democrat’s privatization scheme. (I am looking at Medicare through the lens of political economy; sadly, I cannot give advice on Medicare for your individual state, but there is a program of volunteers who can do that. I believe we have at least one reader in this program.) This will be a long post, but I feel it’s important to lay down some markers, here.

The Structure of Medicare and Medicare Advantage

Being of a certain age, I have always pictured my health care journey as being like Eliza’s in Uncle Tom’s Cabin: Hopping from ice floe to ice floe in the rushing river, until I reach the safety of the farther shore: Medicare. Sadly, it turns out that Medicare, though not as horrid and grift-ridden as the rest of our health care system, is nonetheless possessed by an extremely noxious neoliberal infestation[1], as we shall see. Here is one graphic picturing the Medicare system:

This one is all over the Twitter, primarily from health insurance brokers (here, Holliman Financial), and is clearly meant to steer you toward their services. Just look at the chaos. Here is a more structured diagram:

Those of you who followed my coverage of ObamaCare will remember that I often used the trope of two tracks, one leading to HappyVille, and the other to Pain City, and may think that this diagram suggests these two tracks. But — plot twist — in this diagram both tracks lead to Pain City, although in varying amounts and degrees. (The entire system is best thought of as a diabolically designed minefield. The lucky will get through, and bless the system. The unlucky will not.)

The pain of Pain City on the left (or sinister) hand, “Original Medicare,” side is clear enough: For Medicare A, Deductibles, co-pays, and premiums. For Medicare B, deductibles, premiums, and co-insurance. Of course, to make that pain go away, you can purchase Medigap, which “can cover” that pain, but the purchase price is its own pain. (Deductibles, co-pays, premiums, and co-insurance all create a class of fee-collecting gatekeepers whose only purpose in life is to deny you care. The entire system should be dynamited — as it was, when it came time for “jabs in arms.”)

The pain of Pain City on the right (or correct) hand, “Medicare Advantage,” is more diffuse and less clear. (The diagram inexplicably omits one major pain point: Medicare Advantage has networks, and you could end up paying full freight for out-of-network services.) First, I will look at two pain points in choosing between Original Medicare and Medicare Advantage: Clairvoyance and location. Then, I will look at Medicare Advantage as a system, and at the pain you could experience when you discover how Medicare Advantage really works (both as a person conscious of policy, and as an enrollee).

Choosing between Original Medicare and Medicare Advantage requires clairvoyance. You have to know how much care you will need before you get care. (This is true for ObamaCare as well. their term for clairvoyance is “smart shopping.”) From the Kaiser Family Foundation:

In the case of inpatient hospital stays, Medicare Advantage plans generally do not impose the Part A deductible, but often charge a daily copayment, beginning on day 1. Plans vary in the number of days they impose a daily copayment for inpatient hospital care, and the amount they charge per day. In contrast, under traditional Medicare, when beneficiaries require an inpatient hospital stay, there is a deductible of $1,484 in 2021 (for one spell of illness) with no copayments until day 60 of an inpatient stay (assuming no supplemental coverage that covers some or all of the deductible).

In 2021, virtually all Medicare Advantage enrollees (99%) would pay less than the traditional Medicare Part A hospital deductible for an inpatient stay of 3 days, and these enrollees would pay $747 on average (Figure 3). But slightly more than half of all Medicare Advantage enrollees (53%) would pay more than they would under traditional Medicare (with its $1,484 deductible) for stays of 6 or more days, with average cost sharing of $1,763, among those enrollees with costs above traditional Medicare.

For a stay of 10 days, 69% of Medicare Advantage enrollees would pay more than beneficiaries in traditional Medicare, and among those enrollees in plans with cost-sharing requirements that would exceed the Part A deductible, average cost sharing would be $2,059. For a length of stay of a least 20 days, 81% of Medicare Advantage enrollees would pay more in cost sharing than the Part A deductible – $4,866 on average.

This analysis does not take into account the fact that a majority of people in traditional Medicare would not pay the deductible if hospitalized because they have supplemental coverage, although those with Medigap or retiree health would have the additional cost of a monthly premium.

Obviously, the smart shopper would know in advance that they would need hospital stays of ten or twenty days, and pick Medicare A. How how many smart shoppers are there? (It would be very, very interesting to know how Covid has turned out for those who chose Medicare Advantage. I’m guessing not well.)

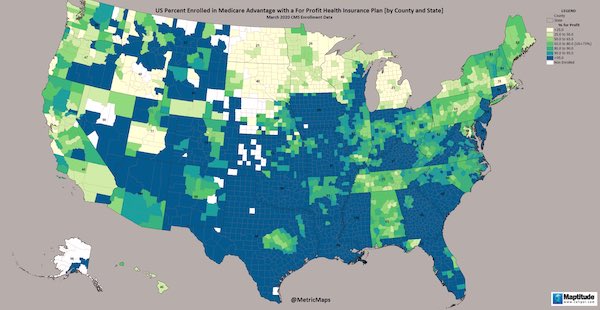

Choosing between Original Medicare and Medicare Advantage also requires that you live in the right state, since coverage — as with ObamaCare — is random with respect to jurisdiction. (Of course, you could always “just move.”) Here is a handy map:

Now let us look at the salient features of Medicare Advantage as a system. They are much as we might expect for a profit-driven system, with a few special twists. Summarizing:

1) Medicare Advantage is a rapidly growing, capitated, for-profit system

2) Medicare Advantage’s data is so bad that it cannot be effectively regulated

3) Medicare Advantage cost $220 billion in 2020 and is characterized by capitation fraud and enormous overhead.

4) Medicare Advantage customers are “traditionally marginalized”

5) Medicare Advantage insurance companies often deny care without justification, especially to “traditionally marginalized” customers

6) Medicare Advantage delivers worse outcomes to “traditionally marginalized” customers

7) Medicare Advantage is heavily and successfully marketed to the “traditionally marginalized”

8) Medicare Advantage penalizes lack of clairvoyance

In detail:

1) Medicare Advantage is a rapidly growing, capitated, for-profit system. From JAMA:

Medicare Advantage (MA) is rapidly growing. Enrollment in the program has increased from 26% of Medicare in 2012 to 42% in 2021, now including more than 24 million beneficiaries. In MA, private plans are paid on a capitated basis by the Centers for Medicare and Medicaid Services (CMS) to cover the health care needs of their enrollees. In addition to capitated payment, MA differs from the traditional Medicare (TM) program in that plans can use selective contracting to set specific networks of providers and can offer supplemental benefits not available in TM, such as dental coverage, vision coverage, gym memberships, transportation, and meals services. Medicare Advantage plans often have lower premiums than TM and include annual out-of-pocket payment caps. These differences in costs and additional benefits have contributed to the rapid growth in MA enrollment. The Congressional Budget Office projects that approximately half of Medicare beneficiaries will elect to enroll in MA by 2030.

As we go through the points that follow, we’ll see that although some Medicare Advantage customers (or “enrollees,” as we say) do make it to Happyville, many others go to Pain City. It’s the luck of the draw, something every right-thinking American loves in a health care system.

2) Medicare Advantage’s data is so bad that it cannot be effectively regulated. From the Journal of the American Geriatrics Society, the epigraph to their article:

The current state of quality reporting in Medicare Advantage (MA) is such that the Commission can no longer provide an accurate description of the quality of care in MA—Medicare Payment Advisory Commission, Report to the Congress, March 2020, and again, March 2021

And from their article:

The one element that is critical to addressing all of these areas of concern and effectively regulating MA programs is robust data. Unfortunately, MA data have many problems and remain somewhat of a “black box.” While administrative data on traditional Medicare enrollees have been available for decades, MA programs were not required to submit data to Medicare until recently. This has changed with MA “encounter” data being made available as of 2015, but concerns persist regarding the completeness and quality of that data compared to claims data for traditional Medicare. This might have been acceptable when MA plans only included a very small percentage of Medicare beneficiaries, but is inadequate when almost half of Medicare beneficiaries are enrolled in MA. The Center for Medicare and Medicaid Services must put resources toward ensuring MA plans are submitting accurate data and making that data easily accessible to researchers. They also need to ensure that data on demonstration projects, such as the hospice carve-in, are promptly available to researchers so they can conduct evaluations in real time.

Shorter: Medicare Advantage insurance companies, because there’s no data and thus no regulation, are free to move the quality of care downward to maximize profit.

3) Medicare Advantage cost $220 billion in 2020 and is characterized by capitation fraud and enormous overhead.. From Dave Lindorff at Tarbell:

The big carrot is a bonus paid annually to insurance companies for enrolling patients who are characterized as sicker, frailer, older or more seriously injured — a bonus that traditional government Medicare does not get.

Companies offering Medicare Advantage plans received an annual fee of over $12,000 for each subscriber from the federal government. But at the same time they have been raking in those fees, the industry also stands accused of sucking up more federal money by misclassifying upward the medical problems of their subscribers, for which they then receive higher reimbursements for coverage of the patient medical bills. Federal investigators claim that over the past three years, Medicare Advantage insurance firms have bilked taxpayers and the Medicare program by over $30 billion by inflating patient health conditions and risk classifications that led to over-compensation by Medicare for their costs of covering subscriber hospitalizations. In 2015 an audit by the Health and Human Services Inspector General’s Office found Humana, another major player in the Medicare Advantage business, bilked Medicare of $200 million just for its plan in Florida by overstating how ill their patients actually were. And those princely sums are not all the fraud that is going on through this scam. The feds were only auditing some of the accounts, not the whole system.

The annual fees alone for signing up 24 million elderly and disabled people into MA plans and keeping them or luring them off the traditional government Medicare rolls came to $288 billion in 2020. Total spending on Medicare that year was $776 billion, meaning that the payment to the MA industry for patient care to their covered patients that year represented more than a third of the total federal outlay on the program, not counting the fraud for subscriber medical condition inflation.

4) Medicare Advantage customers are “traditionally marginalized”. From Health Affairs:

Expansion of the Medicare Advantage program during 2009–18 saw greater enrollment among racial/ethnic minorities and other traditionally marginalized groups. Growth was more rapid among Black, Hispanic, and dually enrolled beneficiaries than among White and non-dual beneficiaries. The implications of greater heterogeneity in the program for enrollee outcomes are uncertain.

5) Medicare Advantage insurance companies often deny care without justification, especially to “traditionally marginalized” customers. From the Kaiser Family Foundation:

Overall, about one in six Medicare beneficiaries (17%) reported a cost-related problem [jargon for denial of care] in 2018, with a somewhat lower rate among traditional Medicare beneficiaries (15%) than Medicare Advantage enrollees (19%), attributable to a lower rate of cost-related problems among the majority of traditional Medicare beneficiaries with supplemental coverage (12%). The rate of cost-related problems is highest (30%) among traditional Medicare beneficiaries without supplemental coverage, who account for about 10 percent of the Medicare population.

A smaller share of Black beneficiaries in traditional Medicare (24%) than in Medicare Advantage (32%) reported cost-related problems. Rates of cost-related problems were lower among Black beneficiaries in traditional Medicare with Medicaid and other forms of supplemental insurance (20%).

One in five Hispanic beneficiaries overall reported a cost related problem (21%) and the share was similar among those in traditional Medicare with supplemental coverage (18%) and Medicare Advantage (22%).

The share of Black Medicare beneficiaries reporting cost-related problems was higher than among White beneficiaries in both traditional Medicare and Medicare Advantage. Additionally, the difference in the share of Black beneficiaries reporting cost-related problems in Medicare Advantage compared to traditional Medicare with supplemental coverage was larger than for White beneficiaries.

Half of Black Medicare Advantage enrollees in fair or poor self-assessed health reported cost-related problems, compared to one-third of Black beneficiaries in traditional Medicare overall and just over one-fourth of Black beneficiaries in traditional Medicare with supplemental coverage.

6) Medicare Advantage delivers worse outcomes to “traditionally marginalized” customers. From JAMA:

Medicare Advantage star ratings, which are designed to reflect overall performance in a plan, are only modestly associated with quality for racial/ethnic minorities and enrollees of low SES in the same plan.

Medicare Advantage plans enroll higher proportions of racial/ethnic minorities and enrollees with lower income and education than the traditional Medicare program, and prior work has found substantial disparities in the quality of care in the MA program. These disparities in care have been found within plans (disparities in quality of care for enrollees in the same plans), and between plans (disparities driven by disproportionate enrollment of minorities in plans with worse quality).

We build on past work detailing disparities in the MA program in several key ways. First, we found that the disparities are evident not just in some selected outcomes, but across aggregate plan quality and in a composite metric (the star rating) that determines the distribution of $6 billion in annual bonus payments to MA plans. Second, to our knowledge, this is the first study to demonstrate that MA plans with higher-measured quality have larger magnitudes of disparity in quality within their enrolled populations. Third, we found a low correlation between a plan’s rating for its enrollees of low SES and Black and Hispanic enrollees, and its enrollees of high SES and White enrollees, although this may be largely due to the low reliability of the simulated scores.

There are many factors that could explain disparities in quality, including access to care, plan cultural competence, access to high-quality or racially concordant health care professionals,28,29 and other facets of structural racism. The CMS star ratings currently reward contracts that have greater disparities in quality for enrollees of low SES and Black or Hispanic enrollees.

7) Medicare Advantage is heavily and successfully marketed to the “traditionally marginalized”. Dave Lindorff at Tarbell:

If Medicare Advantage plans were in truth better or were better deals financially than traditional Medicare Parts A and B, plus Part D, the companies offering them wouldn’t be resorting to the aggressive and costly promotional campaigns they currently employ, with sales reps calling older people’s phones day and night endlessly and making major ad buys on TV networks and the internet. They wouldn’t be resorting to costly come-ons like offers of free gym memberships and dental and drug insurance coverage either (which Congress in its “wisdom” bars government Medicare from doing in its traditional plans). The health care industry is the biggest advertiser on television and ads for Medicare Advantage are a big part of that spending, especially on networks whose viewership skews heavily toward older persons, like CBS.

And the marketing works. From the Journal of the American Geriatric Society:

MA plans are appealing to many patients for their lower co-pays for physician visits, and their coverage of services such as routine dental care, eyeglasses, and hearing aids. With newly expanded benefits such as transportation to physician visits and caregiver supports, MA plans are attractive to those who do not qualify for Medicaid but are in dire need of additional financial benefits to pay for services. Indeed, MA enrollees are more likely to have incomes below $40,000, be from racial and ethnic minority groups, and have lower levels of education. These individuals may be financially induced to enroll in MA without understanding the implications of enrollment. Furthermore, navigating MA may be particularly challenging for populations with cognitive impairment, as they are more likely to make disadvantageous choices for themselves when selecting a MA plan compared to those without cognitive impairment. These populations warrant particular research and monitoring focus.

I should make it clear that I don’t blame the customers at all. Clearly the TV advertising is a scam, but I can see myself making the exact same decision: No cash now, and trust to luck that I don’t have a major illness. Unfortunately–

8) Medicare Advantage penalizes lack of clairvoyance. Daily Kos (sorry) summarizes in plain English:

You may be okay for a time and save money monthly – as long as you don’t get sick. Once you need to use the plan, you will discover the problems that come from being in a for-profit plan that makes more when it denies you care. Your choice of physicians will be restricted to a list. The specialist you need may not be anywhere near where you live. The hospitals and rehabs centers will be limited. The post-hospitalization facility available to you is likely to be the one with the worst reputation. The drugs you need may now cost a fortune.

So you might want to switch back to Medicare from Medicare Advantage with a program called Medigap taking up any slack in coverage. Not so fast. The government has imposed enormous switching costs on you. From eHealth, and I’m quoting an enormous slab of this to show how Kafkaesque the process is:

To switch from Medicare Advantage is a multi-step process. First, you need to drop your Medicare Advantage plan and return to Original Medicare, Part A and Part B. Then, you can apply for a Medicare Supplement insurance plan.

In most cases, you can only leave a Medicare Advantage plan during certain times of the year, such as:

The Medicare Advantage Open Enrollment Period (OEP) between January 1 and March 31.

The Annual Election Period (AEP), between October 15 and December 7. This is also called the Open Enrollment Period for Medicare Advantage and Medicare Prescription drug coverage.

Outside these periods, you can only switch between Medicare Advantage and Original Medicare if you meet certain requirements like moving outside your plan’s service area. You may also lose your Medicare Advantage plan if it leaves your area or ends its contract with Medicare. You’ll get returned to Original Medicare….

Once you’ve left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap. You generally have guaranteed-issue rights for six months when you are both 65 or older and enrolled in Medicare Part B. Guaranteed-issue rights ensure that you can buy any plan sold in your state, and that you won’t be charged higher premiums based on your health status.

Without guaranteed-issue rights, your insurance company may require medical underwriting before it sells you a plan. During medical underwriting, the insurer looks at your past medical history and current health status. If the company determines the risk of covering you is too high, it can refuse to sell you the plan you want, or it may charge you much higher premiums for the coverage.

Lol, Medigap has tests for pre-existing conditions. At age 65. For “marginalized populations”! Dave Lindorff once more:

You could, theoretically, do what is recommended at the time you first apply for your Medicare at 65, which is to purchase a Supplemental Medigap insurance policy, but unfortunately, these plans are unregulated by the federal government, but rather by each state. Thanks to the Obama administration and Congress, Medigap plans were exempted by Congress and all but four state legislatures from putting limits on coverage for “pre-existing” conditions, or from increasing premiums exorbitantly for those with such conditions. In other words, if you waited until you got older and sicker or became disabled with chronic conditions, and then try to switch back to traditional government Medicare and and buy a Medigap plan to cover all those extra bills not covered by traditional Medicare, as well as the cost of meds, you may find yourself priced out of the marker or not even allowed to by such coverage.

The Obama administration did a big favor to Medicare Advantage companies when it passed the Affordable Care Act, with its ban on the ability of insurers to exclude from coverage “pre-existing conditions,” probably the most widely appreciated part of the ACA, but exempted so-called Medigap plans intended to cover the holes in traditional Medicare from that same ban.

Thanks, Obama! The bottom line that you should think long and hard about the Medicare Advantage choice. Before it’s too late:

Susan Rogers, president of Physicians for a National Health Plan (PNHP), says, “People who reach Medicare eligibility need to know that when they sign up for the program and are deciding whether to go with the traditional government or a private Medicare Advantage plan, they’re buying health insurance not for today but for the future. If they’re relatively healthy at 65 and select an attractively marketed Medicare Advantage plan that works for them at first, they are going to run into trouble as they get older, trailer, and sicker. Also, the premium they initially are looking at can go up, and there’s nothing they can do about it.”

And now for the fun and easy part: Democrat betrayal and perfidy!

The Democrat Plan to Privatize Medicare

Here is Dave Lindorff’s scoop in Tarbell (the reason an alert reader sent us the link):

“Starting next year,” [PNHP’s Susan Rogers] warns, “the government is talking about testing something called ‘The Deal,’ where whole Medicare-eligible populations in certain geographical markets will be put into Medicare Advantage plans whether they want it or not.” The idea is presented as a test to see how that system works.

“It’s really a back-door way of privatizing Medicare,” she says, “a process that with voluntary sign-up for Medicare Advantage plans is already well underway.”

Now, I have to say that although I yield to nobody in my mistrust of liberal Democrats on health care policy, I was left a little skeptical. For one thing, Rogers is a single source. For another, I can’t find any mention of “the deal” via (the admittedly crapified and grossly compromised) Google. For a third, there’s no additional supporting material. However, I went looking, and old-time health reporter Trudy Lieberman has the goods. Please forgive the length of this quotation, especially after that great load of vile dreck on Medigap:

[The Commonwealth Fund in New York City] explained that the Center for Medicare & Medicaid Services (CMS) had just unveiled the Geographic Contracting model, or “Geo,” a wonky proposal meaning that beneficiaries in traditional Medicare in 10 metro regions across the country[2], “will be required to enroll” in what’s being called a “direct contracting entity.” That entity, which could be a physician group, insurance company, managed care organization, or accountable care organization, would deliver all the care for those in the plan and receive one payment from the government for giving that care. The goal is to boost quality and lower costs. It would work sort of like Medicare managed care does now, but unlike people in Medicare managed care who have chosen to be in that program, beneficiaries who live in one of those selected regions would be required to choose one of these new entities in order to receive any Medicare benefits at all. That would be the first time in the history of the program that beneficiaries would be forced into any kind of new care arrangement.

This proposal, The Commonwealth Fund report said, is “one of the most significant changes to the way Medicare beneficiaries receive health care since managed care was introduced into Medicare in the 1970s,” adding the model was “raising critical questions particularly among beneficiary groups.” Perhaps due to the wonky nature of the discussion, the proposed change has generated almost no media coverage although it would upend the health insurance for millions of Americans. CMS is scheduled to start testing the new program in 2022.

“This is the privatization of traditional Medicare over time, turning it in to another form of Medicare Advantage plans,” said Diane Archer, who founded the Medicare Rights Center and is now president of Just Care USA, an independent digital hub that covers health care. “The purported goal is to see whether these entities which will come between doctors and their patients will be able to reduce costs and improve quality.” Archer noted that “many government and independent analyses of Medicare Advantage plans show that people who need complex care tend to leave them in disproportionately higher rates.” Unlike Medicare Advantage plans, however, which include many HMOs, all the Geo plans are supposed to work like PPOs, which allow members to go out of network for care, said Gretchen Jacobson, one of the authors of the Commonwealth Fund report.

But there are enough similarities between Medicare Advantage plans and this new program to raise real concerns.

And since personnel is policy:

At the beginning of March Elizabeth Fowler, one of the authors of the [Commonwealth Fund] report, started a new job at the CMS office that will be in charge of creating and implementing the new model.

Ah, Liz Fowler. An old friend and an especially scaly Flexian who makes Jon Gruber look like a cute little gecko:

When the legislation that became known as “Obamacare” was first drafted, the key legislator was the Democratic Chairman of the Senate Finance Committee, Max Baucus, whose committee took the lead in drafting the legislation. As Baucus himself repeatedly boasted, the architect of that legislation was Elizabeth Folwer, his chief health policy counsel; indeed, as Marcy Wheeler discovered, it was Fowler who actually drafted it… What was most amazing about all of that [or not] was that, before joining Baucus’ office as the point person for the health care bill, Fowler was the Vice President for Public Policy and External Affairs (i.e. informal lobbying) at WellPoint, the nation’s largest health insurance provider (before going to WellPoint, as well as after, Fowler had worked as Baucus’ top health care aide). … More amazingly still, when the Obama White House needed someone to oversee implementation of Obamacare after the bill passed, it chose . . . Liz Fowler. Now, as Politico’s “Influence” column briefly noted on Tuesday, Fowler is once again passing through the deeply corrupting revolving door as she leaves the Obama administration to return to the loving and lucrative arms of the private health care industry: “Elizabeth Fowler is leaving the White House for a senior-level position leading ‘global health policy’ at Johnson & Johnson’s government affairs and policy group.”

Liz Fowler, the Typhoid Mary of neoliberal health care policy…

Meanwhile, in New York, we see the not only state Democrat leadership nobbling single payer, but the public sector unions doing what looks for all the world like running a test case for Liz Fowler’s efforts at CMS:

New York City public sector unions are pushing a plan to move retirees from Medicare to privatized health insurance, drawing intense protest from thousands of members. The move, which could affect 200,000 municipal retirees — including retired teachers, sanitation and park workers, firefighters, and staff from the City University of New York — and their 50,000 dependents, could be finalized as soon as July 1. But many members are hoping to stop it. In New York City, public sector retirees are insured by Medicare, the federal government’s program for people over 65, and the city reimburses for outpatient care, as well as for a supplemental “Medigap” plan that offers additional services. The proposed switch would move retirees to privatized health insurance through a program known as Medicare Advantage.

Well done, Democrats!

Conclusion

As I have said before:

We are blessed, on this continent, with the closest thing you can get to a controlled experiment in the real world on how to do health care right, and how to do it wrong. We have two countries, of continental scale, both from the English political tradition, each with a Federal system of government, and similar economies. The two countries are similar enough culturally that their citizens can move with ease from one country to another. Canada has a single payer system; the United States has a private health insurance system. And Canada “bent the cost curve” in the mid-70s, when it adopted single payer, and the United States did not.

[O]ur private health insurance system is purely parasitic; it is useless; it exists solely for the purpose of rental extraction from its host, the body politic. Abolish it, and you bend the cost curve to look like Canada’s. If single payer had been adopted in 2009, and given a year to implement (like Medicare) the country would already have saved a trillion dollars, and several thousand people would not be dead.

But we can’t learn from the success of others, I suppose. Perhaps that’s it. Maybe we should go all Shirley Jackson and make lottery tickets for decent health care a free gift at co-pay time. Why not? Medicare Advantage: You may already have won!™

NOTES

[1] The Medicare for All campaign organizers really need to rethink their approach. Although they always have wanted to improve Medicare — to make it more like what the innocent young, perhaps, think that it is — that’s clearly not enough. Nor is it enough simply to add dental to it, although incrementally that is a good thing. Nor, apparently, did Medicare for All appeal to all “marginalized populations.” I don’t recall the Sanders campaign mentioining Medicare Advantage once.

- Atlanta

- Dallas

- Houston

- Los Angeles

- Miami

- Orlando

- Philadelphia

- Phoenix

- San Diego

- Tampa

APPENDIX

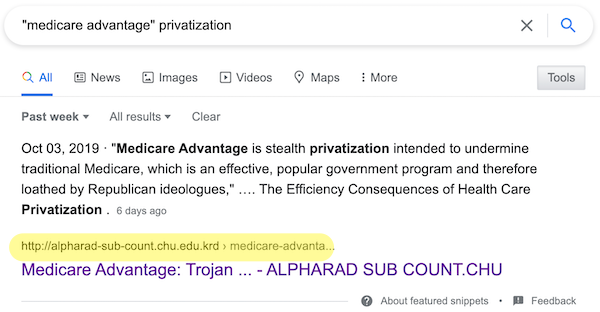

When doing the research for this post, I had a very odd experience with Google. Searching on ‘”medicare advantage” privatization’ I got a search result with the following snippet:

When I clicked on the highlighted link (or, a second time) the bold title (“Medicare Advantage: Trojan….”) Google redirected me to this site (DON’T CLICK THE LINK):

https://iqbroker.com/lp/mobile-partner/en/?aff=194306&afftrack=&clickid=&aff_model=cpa

which is some cheesy finance site, and nothing to do with what the snippet promises, or my search. Although I didn’t fall off the turnip truck yesterday, and didn’t allow the IQ broker entity to infect my machine with their cookies, they went ahead and did so anyhow. Thanks, Google!

Interestingly, after poking around, I found the post I wanted, at Common Dreams, which has been blacklisted by Google. Speculating freely on technical matters, it would be a neat trick for Google to sell blacklisted URLs to scam artists, both for the pure joy of it and to pollute the discourse, though I confess I hadn’t given consideration to the idea that Google would use its precious snippet system to embed their redirects.

If the Democrats think that they can move senior citizens unwillingly and unwittingly to a Medicare Advantage plan then they will soon find out what it’s like to lose 100 seats in the House and 20 in the senate.

It’s almost like they so surprised themselves by winning the whole enchilada in 2020 that they are looking for ways to make sure that they lose big in 2022.

The Democraps will have the temerity to move citizens to shady insurance plan just like they did with Obamacare while people stood by and watched. Then the people forget about their actions and vote them in because the Republickers are even worse. Voters are fooled every 4 years. Bush I screws up, Clinton gets in. Bush the lesser brings on financial collapse, O’liar gets in. Orange Devils mishandles the pandemic response and Buyden gets in. Now Buyden will sell off the commons in the name of improving the infrastructure. On and on it will go with the dismantling of every decent government program. The average taxpayer will have no services left because the rentiers will have controls of everything. The Congress doesn’t care if it doesn’t get re-elected because they would’ve got their loot. We don’t have a Democracy anymore.

The dynamic you describe is often called “the ratchet effect.” However, the teeth of the ratchet wear down, there’s increasing strain on the pawl, the vandals take the handle, etc.

The reality is that a lot of people got on the Biden bus because Trump was so so bad, yet Trump would never have been able to get away with privatizing Medicare, any more than Reagan could gut Glass Steagall. When the GOP is in power, they can’t touch entitlements, when the Democrats are in, the corporate lobbyists have the keys to the kingdom. Would you rather have Medicare or obnoxious tweets?

Yes, this has been true since at least Clinton – the Democrats just $crew their voters when they get it.

In my opinion Clinton wasn’t a true democrat. He actually was a moderate republican. His record shows this to be true. The same could be said about Obama.

Obama in an interview came out and literally said that in an earlier time, that he would be considered a moderate Republican-

https://thehill.com/policy/finance/272957-obama-says-his-economic-policies-so-mainstream-hed-be-seen-as-moderate-republican-in-1980s

With PNTR, repeal of Glass-Steagall and NAFTA, I’d say Clinton was an ideologically addled right-wing nut.

Don’t forget the Telecommunications Act of 1996, without which media consolidation would have been illegal.

Mike Gravel was the last true Democrat

Except Geo Direct Contracting is a CMMI model from the Trump era.

True. And supposedly this got slipped in before the Inauguration. So I will hold my breath while the “true party of the working class” and “seniors” quickly reverses it. Given the MSM silence though, it smells like “bipartisan” chicanery with the timing just right so everyone can blame everyone else when the bubbles come bursting out of the bathwater.

> Except Geo Direct Contracting is a CMMI model from the Trump era

Liz Fowler was hired by CMS to implement it, so what on earth does the “Trump era” have to do with anything?

This is a great article you produced, but it would be helpful to have the concrete measures that have been enacted by hook or by crook (executive, administrative agency or congress), and a timeline. Further, if the reader had a better sense of where this was coming from, it would be easier to know who to call up and pull the “I’m mad as hell” business. Not that our enlightened leaders have any sense of shame, but sometimes they feel like it is necessary to pretend like they do.

As head of CMMI she inherits all of their models not just this one. As far as we know the only thing she has done with this model is delay it’s implementation by a year. I suspect a legal review of all the models is going on to figure out what theyre bound to by the previous administration, given the rulemaking process and CMMI’s strange quasi-authority.

Lambert: didn’t Medicare (dis)Advantage start under Cheney/Bush? I was already on traditional Medicare, and avoided it like the scam/plague it was/is. I’m sure I am not the only one, and if the yuppie corporate RW/Blue Dog Democrats want to cut their throats by pushing it, have at it idiots.

Since the 80’s there have been various attempts at introducing private HMOs into Medicare. That all got consolidated into Medicare+Choice in the late 90’s. Medicare+Choice wasn’t nearly as successful as the neoliberals architects hoped. As you note during the Bush W years it got turned into Medicare Advantage at the same time that they created the Part D drug program. ACA also made some changes to the payments paid to MA plans which I’m sure they thought were “oh so clever” but MA still continues to reap huge profits for the plans.

> didn’t Medicare (dis)Advantage start under Cheney/Bush

It did. This campaign/tendency/funding opportunity has been going on for quite some time (rather like the Tory assault on NHS).

Question about the test areas:

Are these cities, counties or metro areas? The CMS document say metro and micropolitan(?) Areas, yet you mention cities at the end!

That’s a lot of people to potentially annoy.

I have the feeling that at the beginning-after the initial shock- the program will be very popular, so it can be declared a success and then go national.

Any problems, say like Medicare Advantage, will creep in slowly over time. That’s my guess.

Thank you for the great article and research.

I couldn’t read it, too painful after only a few paragraphs.

The casual brutality is emblematic of the USA these days.

What those implementing this “casual brutality,” eerily reminiscent of Dick Nixon’s “benign neglect,” do not realize is that the Laws of Political Physics have not been repealed. For every action, there is a reaction. perhaps not as equitably distributed as in the physical sciences versions of the law, but still applicable.

I shouldn’t be surprised by this latest betrayal… but I am surprised they are so blatant so quickly when millions of the working class are in desperate straights and see original Medicare as the light at the end of the tunnel of their working years if they can just hang on and reach retirement age and sign up for original Medicare. Now the Dems want to remove even that safety net for the elderly who’ve worked a lifetime, often at low wage and physically demanding jobs??? The estab Dems are a cracking party. ( the inference will be clear to US readers of US history and the Old South’s Dem party machinery from 1866 onward.)

Thanks for this post.

Being of a certain age, I have always pictured my health care journey as being like Eliza’s in Uncle Tom’s Cabin: Hopping from ice floe to ice floe in the rushing river, until I reach the safety of the farther shore: Medicare.

An excellent comparison on several levels.

Figure they reckon “Where else are they going to go?”

I live in a California county, one of 19, that does not have a Advantage plan available. When I signed up about 5 years ago, I was told there were few takers anyway. I suspect there are lots of holes in Advantage plans that I doubt the Dems really understand or know the costs to fill them.

the despicables strike again…

wasn’t the campaign promise medicare at 60?

> wasn’t the campaign promise medicare at 60?

Well, nobody said which Medicare.

Medicare For All that corporate scumbags ca all get behind.

“Rents for the restricted right to minimal healthcare!” Biden/Harris/Buttgieg 2024

Interesting . . .

I would say there is some growing consensus that the payments/capitations to Medicare Advantage plans should be reduced. MedPac consistently recommends changes to the payments and its shown up in certain proposals. Though the amount of movement back to FFS is a real guess, for the last 5-10 years many thought the MA market had hit it’s ceiling as a % of beneficiaries but it kept going up, getting closer and closer to half of beneficiaries.

Also the Geographic Direct Contracting Model being put on ice is a way to kill it I think. Its one of a handful of rushed CMS proposals from Trump’s final year, many of which are getting challenged in court or laxly enforced.

Thanks. That is a useful link that one might speculate fills in some gaps. (I’ve gotta say that I’m a little annoyed that I had to discover this from Lindorff and then run it down with Rubenstein. PNHP and the left should have been screaming at the top of their lungs about this. Sanders plan for expanding dental should be put in this context. But silence. It’s just one more example of anesthesia in the Biden administration).

Reading the article, I am not sanguine about killing Geo, for several reasons:

1) That’s not what the article says. “The agency did not immediately respond to a request for comment on the reason the model was put under review nor for how long it would happen.”

2) Liz Fowler is still in place at CMMI. It’s a reasonable assumption that she was hired to do what she said she would do in her Commonwealth Report as reported by Rubenstein.

3) “The Geographic Direct Contracting model generated major pushback from several provider groups…. Some providers were in favor of the model, including America’s Physician Groups.” Meaning this is seen by the players as an apolitical fight, a technical matter. When the providers work out their differences, the program can go ahead.

4) I’d speculate that the gap between Rubenstein’s article in March, which was in the pushback period, and Lindorff’s reporting on “the deal” this month is in fact about those differences being worked out. That implies to me that Geo, or something very like it, perhaps rebranded, is very much alive.

Right you are. Again. From the horse’s mouth, as it were:

That didn’t take long, did it?

Also, this:

Mandatory here means mandatory for providers. Medicare already holds providers to a mandatory payment system, the fee schedules and hospital services reimbursement systems it’s been using for decades. All providers are held to those payment or they opt out of treating Medicare patients. I didnt see anyone complaining when MIPS came about, another mandatory change to what Medicare pays providers intended to align payments with quality not volume.

If the issue here is that Medicare leaves privatized providers that’s been true since it’s inception. I’d be all for American NHS, remove all the MBAs running hospitals nowadays, figure out where all that revenue is going in hospital budgets, cut out the ridiculous middlemen and fraudsters. Maybe even reduce the huge income premium American doctors especially surgeons receive compared to their international colleagues.

I don’t see MA staying in the model tbh, but we’ll see when it’s unfurled.

As Groucho Marx says at the Miami lots sales pitch (from the film “Coconuts,”) linked to yesterday; “Oh, how you can get stucco!”

Important to emphasize the fact you included that much of the architecture of the Medicare programs is set at the State level. The disaster that is the “roll out” or more properly the “non roll out” of Medicaid expansion in certain states, as part of the implementation of the ACA, is the telling point.

America does not have a national system. It has fifty plus State systems. That is the perfect environment for corruption to flourish.

It used to be that Social Security and Medicare were characterized as the “third rail” of the government. I for one never imagined that clever hucksters would turn that ‘third rail’ into the power source for a massive rent extraction enterprise.

As I age, I am constantly re-discovering the basic fact that I can never be too cynical.

+1000 points for a Marx Bros reference

+500 points for a Coconuts reference.

America does not have a national system. It has fifty plus State systems. That is the perfect environment for corruption to flourish.

Yes, on one level. On another level, the US federal system does have its merits. For example, without the federal system of individual states who knows how long it would have taken to end slavery in the US, given that the slave holding states were generating the bulk of US wealth at the time (and given that money is the mother’s milk of US politics, as has been said.) / ;)

What’s the phrase…”It’s complicated.”? Yes, it is.

The US DOES have a national health care system, with free-at-point-of-service care, covering employees and their dependents, with free transport to specialized care centers if the local hospital can’t provide the care. The feds DO know how to deliver community healthcare to millions of people.

It’s there on every US military base in every state and around the globe.

But there is never a discussion that this could be implemented at scale for civilian US. Not even at a small, experimental level as a test.

Do not spread misinformation. Medicare, including Medicare Advantage plans, is regulated by the Feds. You are confusing Medicare with Medicaid. California, for instance, explicitly disavows having anything to do with Medicare Advantage:

http://www.insurance.ca.gov/01-consumers/110-health/10-basics/overview.cfm

And….

https://medicareadvocacy.org/medicare-info/medicare-advantage/

Now having said that, Medigap plans are state regulated.

Fair enough. Maximum confusion is never to the “customer’s” advantage.

I can see where the separation of responsibility and oversight for the Medicare and Medicaid programs is to the benefit of non-state actors.

The carve out of Medicare Advantage plans from the traditionally State regulated insurance “marketplace” is a big red flag all on it’s own. If the Medicare Advantage “market” can be Federally supervised, why not all the rest of it? Politics.

Just to add more crazy to the Medicaid/Medicare confusion … I’m a Veteran and get most of my care through the VA. I’m also on SSDI (a.k.a. Disability) and have Medicare, which automatically kicked in after 18 months. You get Part A at no cost, but if you want Part B, they deduct the monthly premiums from your already meager disability payments. The VA covers dental only for a top tier of Veterans, of which I’m not one, and Medicare has no dental at all, so when I broke a tooth last year, I came close to a nervous breakdown worrying about how to pay for a crown.

The caseworker in my congressman’s office (the “mangy blue dog” who lost by 109 votes after a three-month recount) put me in touch with a contact who works for a Medicare Advantage plan. It took a while to get it through my head that I wasn’t going to pay premiums, but this is how it worked: First I had to apply to the county for Medicaid to see if I qualified. The income cut-off is ridiculously low, but I just made it. Medicaid wouldn’t have made sense for me due to spend-down requirements, but the county/state doesn’t think it makes sense for them, either, for residents who have Medicare. What they do instead is pay the premium for Part B, but you have to have a “sponsor” — meaning a Medicare Advantage plan. The agent helped me fill out the paperwork, co-signed her name at the bottom, and handed me the envelope to mail to county social services. About a week later, I got a call from a surprisingly knowledgeable caseworker double-checking to make sure that I in fact didn’t want Medicaid. The application was approved within a week.

A few weeks ago, I received a letter from the county saying that if I want to stay with the program, I need to submit a form with updated income info. It’s pretty simple, and I still need a crown, so I’ll do it. BTW, the plan did also pick up a couple of prescriptions during a screw-up at the VA pharmacy, and they’ve got a few other backups that might be useful.

After reading this very enlightening article, I can see why the marketing for these plans is so aggressive. In return for the monthly Part B premiums from the state and whatever else they might be getting, they paid out maybe $20. Nice work if you can get it.

Very brave of you to dive into the deep end of a pool of muck, Lambert. (If you happen to read this account, I hope you’re still breathing normally afterward.)

After all that, I still haven’t got a crown on the growing hole in my mouth. I managed to find one of the few dentists in my rural area who accept Medicare, and while they weren’t familiar with the MA plan, they did whatever they had to do to sign up. The initial exam was covered, and about two weeks later I got a letter from the insurance company approving the crown — the day after dental offices were put on pandemic lockdown! When dental clinics were allowed to reopen for business, I called repeatedly over several weeks to schedule an appointment, and no one called back. Evidently, the entire staff changed as a result of the pandemic, and most were English-challenged. By the time I finally got through to them, the approval date for the crown was two days from expiration. They wanted me to come back for another exam and resubmit the work request, but when it took ten minutes on the phone just to spell my name, one letter at time, repeatedly, until they could find me in their computer system (after rudely insisting I wasn’t there), I decided to keep chewing on one side of my mouth and look for another dentist. If and when I find one, my copay for a crown will be $125 (limit one per customer).

I feel quite sure that neoliberalism could’ve found another way to have them end up dead. Yes, cynic.

As far as saving a trillion dollars… well, we did do that, didn’t we? Taxes didn’t destroy that trillion, it was redistributed to the various players in the medical industrial complex and of course to countries which supply drugs, medical equipment, etc. They “saved” it from being destroyed by taxes and put it into other areas for productive and targeted use. Would be interesting to know where those trillions went and I don’t just mean to individuals with large wealth. Their “savings” don’t just sit in the hole in a backyard somewhere.

> They “saved” it from being destroyed by taxes and put it into other areas for productive and targeted use

Administrative costs for administration that shouldn’t exist, marketing, and executive salaries? Really?

Brilliant reporting, brilliant analysis. Naked Capitalism has the best coverage of the politics of health care.

you know, rather than (1) reading all the fine print & (2) comparing this incalculable against that unknowable & then (3) consulting a soothdayer to determine the odds of my developing a serious illness sometime in the next 20 years, i think i will just rely on the answer to 1 question:

did nancy pelosi choose medicare? or medicare advantage?

i will go with whatever shes got.

“did nancy pelosi choose medicare? or medicare advantage?

i will go with whatever shes got.”

Nancy has access to the Office of the Attending Physician.

https://abcnews.go.com/GMA/OnCall/congress-health-care-clinic/story?id=8706655

Nancy is also very, very wealthy. I’m sure health care costs are not a concern for her.

Sorry – she has a plan only available to lawmakers, better than anything available to you, though paid for by you.

Here is a CMS link with more information:

https://www.cms.gov/newsroom/fact-sheets/geographic-direct-contracting-model-geo

It looks like only new enrollees in Medicare will be forced into this “experiment”.

This was written right after the election (12/3/2020) and before Biden’s inauguration. Is there a chance it can be cancelled?

From my reading this experiment will include anyone with Medicare as primary insurance. I didn’t see anything about new enrollees:

I must say that the very idea of this so-called experiment makes me sick. My heart is still racing from the fear of it.

Just like the experiment (Phase III trial) we are being put through with vaccine testing for COVID.

I think this is the key paragraph:

In other words, the experiment won’t work if people aren’t forced into it.

And they will probably get away with this one, because this time it is just a done deal, no tax penalty for refusing as in the ACA mandate, etc.

As bad as Medicare is compared to a first world system (even ones that have been infected by neoliberalism) it is light years ahead of what the majority of people can get who haven’t been lucky in our current system.

They have set up a continued crapification of most employer plans, as the power players in the Insurance/medicine for profit corporations have codified ripping as much profit for providing no health care into the plans. The ACA plans have always been garbage for the most part. The only area truly ripe for the rentier class are those fools on traditional medicare and some of the VA/Tricare system.

I knew we were well and truly screwed when not even a pandemic could slow the parasites down.

Could you point out where only new enrollees are aligned (CMS lingo)? I read that all current Medicare meeting the criteria will be put in a group.

A much denser version than the partial summary Lambert included.

Thank you Lambert for getting this discussion rolling.

Lambert:

Are you on Medicare? A, B, and D?

Such a personal question. Why? The old 60’s saying “the personal is political” intended to expand politics to include personal experiences of women and minorities and gays for example… a good thing, imo. On the other hand… national safety nets are national without regard to personal situation or experience. In national safety nets the personal is beside the point, imo.

Flora:

It is a fair question for Lambert and he knows me.

I also write on healthcare and been asked to write on particular topics also.

I am in Medicare A,B, and D.

I also carry dental and vision.

Do you know the costs?

This is NOT a “fair” or even germane question. I again call bullshit. Your line of questioning looks like a plan to set up a straw man.

This only add to the impression of bad faith argumentation. Why do I have to say a second time that this post is about Medicare Advantage, which about 40% of Medicare-eligible citizens now buy, and not about original Medicare? IMHO, the popularity of Medicare Advantage despite its inferiority is due to aggressive marketing (I now have old people TV on due to my 93 year old mother, and the barrage is relentless), the false economy (“no pay” plans v. Medicare B premiums, at a minimum) and the complexity of original Medicare versus the one-stop shopping of Medicare Advantage.

At a bare minimum, it’s thread-jacking, which is also a violation of our written site Policies.

Relentless barrage? Tell me about it!

Two years ago, when I was back east tending to my mother in her final weeks, I noticed something about her phone. Danged thing rang like nobody’s business.

Many of the calls were of the aggressive marketing variety, and they were about insurance.

Yeesh. It just didn’t stop.

After Mom died, the calls kept coming. I finally unplugged that phone, which was a landline, so I could get some peace.

Indeed, I do, for my state’s options, as presented with the Medicare.gov online portal, having made a careful study of same since I will soon need to decide which path to choose.

And again, I stress that one buys insurance to stabilize one’s financial world as much as possible if real disaster strikes, not to get away as lightly as possible during the good times only to be drowned in the bad times. etc.

adding: imo, traditional Medicare is insurance that’s there when you need it if disaster strikes. Not perfect, but there’s a floor and costs regulations that’s pretty good, all things considered. Medicare Advantage plans are low cost, getting away lightly plans during the good times, but if real disaster strikes…. heaven help you. No floor, and no meaningful costs regulations, ( the fine print is a wonderful thing for the private insurers.) I can’t see how the Medicare Advantage plans in any way stabilize one’s financial world if disaster strikes.

adding: The “no pay” advertising is bogus, since the Medicare premium usually deducted from the Social Security retirement benefit continues to be deducted and goes to the Advantage Plan directly. The advertising that “you may get” this or that isn’t a guarantee of any kind. A Silver Sneaker membership doesn’t count for much if all your very expensive chemo drug prescriptions in your Advantage Plan are denied as being “off formulary” for example. (Not making this up.) This is disaster striking. Too emotive an example? What about traveling within the US, but outside the Advantage Plan’s network of hospitals and doctors, and having a car accident requiring expensive treatment at a hospital. Too bad for you. Out of network. Not covered. (Traditional Medicare is nation wide, treatments covered if hospital accepts Medicare.) I’ll stop now.

You are totally out of line in asking. This smacks of an intention to discredit him with some sort of “gotcha” which is irrelevant to this post. It’s about Medicare Advantage.

I have said repeatedly I loathe the day I have to go on Medicare. My current plan is vastly better.

I could only have written about prairie dogs because I am a prairie dog. Sadly, we prairie dogs, even though we are sentient beings, do not meet Medicare’s eligibility criteria. Please see this change.org petition that Medicare age requirements for prairie dogs be calculated in prairie dog years, not human years. Thank you.

I stan with prairie dogs.

Excellent, thorough, sickening analysis Lambert. I’ve mentioned it before but the main reason my wife and I decided not to move back to the USA was health insurance, decision clinched by an article in The New York Times from ten years ago or so on how to choose the right Medicare plan. We both have chronic conditions – Cue up Warren Zevon’s – My Shit’s F*ucked Up.

Here is a newspaper commentary on the situation in Norway ( Google translated). We’re not the USA but we see the pattern. It’s more top down control, more administrators, more mid level mangers taking advanced degrees like Masters in Leadership, more privatization under the Conservative government’s banner of choice – “everyone wants to a boss in their own life”

Dagbladet : A Journey Into the Absurd

https://www.dagbladet.no/meninger/en-reise-inn-i-det-absurde/73957905

I don’t actually have a dog in this fight, although I used. Starting in the late seventies, for fourteen years I worked as a psychologist for an HMO in the USA. Actually a private company contracting with HMO’s to administer and run the mental health services for them at a negotiated rate per enrollee. This meant we paid should patients need hospitalization for mental health or substance abuse treatment. At one point we had four hundred thousand subscribers for whom we were the only approved provider, this in a metropolitan area with a population of two and a half million.

It was interesting to see the company start off idealistically, sort of, and seeing it turning into a profit maximizer.

Lot more can be said.

Instead of replacing Obamacare with Medicare for All they want to replace Medicare with Obamacare for Old People.

Lambert, thank you for researching and reporting this horrible situation.

> Lambert, thank you for researching and reporting this horrible situation.

Medicare Advantage is horrid enough as it is.

This is depressing. Another failure of politics.

My friend in Spokane WA just wrote and using the geological record, they have had the hottest temperatures in 1200 years.

There is less and less slack in the system and the waste and corruption is criminal

The most evil part of Medicare Advantage, which doesn’t get nearly enough attention: the Medicare Advantage insurers are the same profiteering sleazeballs who routinely denied you coverage before you were 65.

Medicare Advantage companies act as gatekeepers between you and Medicare. They use their own eligibility criteria, with their own dysfunctional bureaucracy and legendary customer service pigpiled on top. Their profit model is simple: Take your money. Insert themselves between you and Medicare. Decide whether you get coverage or not. Bill Medicare whenever possible and profitable. Make you fight for everything else, just like before.

They can and do deny coverage for things that you are eligible for under Medicare A and B and D. If you travel, you often aren’t covered at all.

We spent years fighting for critical periodic treatment for my father. Medicare covered it. Not only did Blue Cross Medicare Advantage refuse to cover it, they refused to allow us to pay out of pocket for it. There was no appeal. We watched helplessly as he steadily deteriorated, knowing that he would have been far better off if Medicare Advantage had never existed. His physician was left with a horrible choice: allow his patient to die prematurely knowing that treatment was available and effective, or lie and provide a different diagnosis which happened to fit Blue Cross eligibility criteria.

Burn Medicare Advantage to the ground. Salt the soil. Till the ashes.

I agree, and I’ll bring the salt. / ;)

I think the real tell is that they make the switching costs between Traditional Medicare and Medicare Advantage so high. Medicare Advantage is a roach motel.

The marketers are really doing splendidly on this: “Advantage” v. “Traditional” or “Original.” Who doesn’t want the new and improved version?

Perhaps it would be better to call “Original Medicare” Authentic Medicare….

An apocryphal story that I just made up. So Silicon valley turned their attention to healthcare in America in order to jam their high-tech blood funnels into all that money and health care was smelling mighty ripe by now. So they figured to create an AI that people could interact with. The AI would be loaded up with all the public and private healthcare plans going in America so that people could, by answering a series of simple questions, have the AI inform them which would be the best plan for their circumstances, how much it would cost both annually & long-term, and the justifications for that advice. Silicon valley knew that they would be on a winner and that America would beat a path to their doors to use this service and would be prepared to pay any fee asked to use it. They put together an AI based on all the latest tech that they were capable of building and then uploaded all those health care plans so that the AI could learn from them before going to work. But no matter how many times they tried to get the AI to incorporate all those plans to use, the output was always the same on their screens-

‘Are you f****** kidding me?’

How can the Democrats still think it’s possible to win in 2024? Scratch that–keep their majorities in 2022??

That’s it, that’s the comment, I have nothing else to say. Please, tell me what they could possibly even run on. I don’t really want the Republicans to sweep everything but it’s coming, isn’t it? It’s coming in like a tidal wave…

While I agree the end goal is indeed the privatization of Medicare (which is obviously problematic for so many reasons). At first blush it doesn’t look like the test program will take away any Medicare options, just add to them.

From https://www.cms.gov/newsroom/fact-sheets/geographic-direct-contracting-model-geo

Will beneficiaries lose any of their Original Medicare benefits?

No. Beneficiaries will maintain all of their Original Medicare benefits.

Can beneficiaries still see any Medicare provider or supplier they want to see?

Yes. Beneficiaries can continue to see any enrolled Medicare provider or supplier of their choosing.

So it seems the DCEs are left with having to use carrots to entice members to use the DCE. I am a little wary about how the DCEs might lean on doctors to stop taking traditional Medicare patients though, which would be a backdoor way of restricting access, even if a person has a good Medigap policy.

Sorry, this is inconsistent with other blurbs:

As readers indicated above, and my mother has experienced personally, to the tune of $30,000 and counting, Medicare Advantage plans have narrower networks than original Medicare and it’s the insurers who determine what services and providers are eligible. The rehab facility she is at (the only one in this area that does actual rehab, as opposed to being a warehouse for old people) isn’t in her plan’s network. At least they’ll accept cash pay patients, which frankly in my experience is unusual for practitioners and facilities that accept Medicare. Medicare bars cash payment from Medicare patients for Medicare services, and even when I’ve tried arranging cash pay for non-Medicare services, they’ve pretty much always won’t take any form of direct pay if you are over 65.

At a minimum, the insurers all would have to create separate coding and completely different claims processing for this “test” to live up to the text you cited.

Well the text is what it is. I assume they are not outright lying. So I expect they will put in place a parallel system that all those who meet the criteria will automatically be enrolled in. But I agree that the level of effort would be high for an insurer. So it will be interesting to see how much interest they get from insurers to participate.

In the short term this will mean that it will be mostly Medicare part A/B individuals who don’t have great Medigap policies who will be enticed to use the new system.

I suspect the real pain will come from either the insurance company figuring out how to strong arm providers into pushing patients into the new system, or after the trial period when this gets rolled out, the option to retain the old system goes away (or new comers no longer get to choose).

With all that said, as you’ve documented in our current system, unless you know (and can afford) to enroll in a community rated (vs age rated) Medigap Plan G (F no longer available to new comers) at age 65, the likelihood of ending up in pain city is high no matter what you do afterwards.

I assume they are not outright lying

“You can keep your doctor…” B. Obama in the sales phase of ocare.

No reason to “assume” they’re not lying.

When you read the link provided by David Jacobs, this is an important paragraph in reference in GEOs:

DCEs will take responsibility for total cost of care for Medicare Fee for Service (FFS) beneficiaries in a specific region. DCEs will implement region wide care delivery and value-based payment systems with the goal of improving care for beneficiaries through higher quality and lower costs. To achieve these goals, the model will enable DCEs – which may include sophisticated Accountable Care Organizations (ACOs), health systems, health care provider groups, and health plans – the flexibility to utilize a variety of tools described in more detail below.

According to my husband who has been a licensed agent focused on Medicare for 10 years, FFSs are an extremely unique Advantage plan. He discourages people from Medicare Advantage plans and lately has refused to provide them. But, he points out that these FFSs are extremely rare.

After reviewing the CMS site, he feels that these new rules will target a very limited number of Medicare enrollees. The CMS material is very confusing. But maybe we should delve into this language a second time to confirm that this only applies to Fee for Service members which is a subset of Medicare Advantage enrollees. Here is the data for Fee For Service enrollees in https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/FFS-Data

Bait and switch is a time tested ploy.

One needs to follow this story for several years to see the way tradtional Medicare medigap part C and F (two of the more comprehensive medigap plans) have been eliminated as required private insurance medigap plan options for new enrollees in real Medicare after 2018 and 2020, though people already enrolled on those plans are grandfathered in going forward.

Grandfathering in is a neat ploy allowing tptb to say nothing is being lost… except to new enrollees who won’t have those options. Starving the system slowly, too slowly for most people to see who aren’t paying attention for several years. imo. This year is not year zero, though the privatizers want you to think this is year zero and nothing came before. / ;)

> So it seems the DCEs are left with having to use carrots to entice members to use the DCE.

No, that’s not true. Quoting as above the CMS fact sheet on the program:

In other words, the experiment won’t work if people aren’t forced into it. That, to me, is the key point that over-rides all others, far more than the bait of improved coverage, with the switch to come.

Also, I don’t think it makes sense to be sanguine about actual coverage as opposed to marketed coverage. See point #8 on denial of care without justification. I didn’t get a chance to cover this, but the appeal process is through the Medicare Ombudsman, and it’s (as one might expect) complex and an enormous tax on time. So I wonder how many people suffer abuse in silence.

How does capitalism actually work?

The classical economists identified the constructive “earned” income and the parasitic “unearned” income.

Most of the people at the top lived off the parasitic “unearned” income and they now had a big problem.

This problem was solved with neoclassical economics.

Hiding rentier activity in the economy does have some surprising consequences.

Ricardo was part of the new capitalist class, and the old landowning class were a huge problem with their rents that had to be paid both directly and through wages.

“The interest of the landlords is always opposed to the interest of every other class in the community” Ricardo 1815 / Classical Economist

What does our man on free trade, Ricardo, mean?

Disposable income = wages – (taxes + the cost of living)

Employees get their money from wages and the employers pay the cost of living through wages, reducing profit.

Employees get less disposable income after the landlords rent has gone.

Employers have to cover the landlord’s rents in wages reducing profit.

Ricardo is just talking about housing costs, employees all rented in those days.

Low housing costs work best for employers and employees.

Who pays?

It’s the right question, but we keep getting the wrong answer with neoclassical economics.

Employees get their money from wages and it is employers that are paying, via wages, reducing profit.

Everyone pays their own way.

Employees get their money from wages.

The employer pays the way for all their employees, via wages, reducing profit.

No wonder all our firms are off-shoring.

Capitalism actually works best with a low cost of living, but no one can see that with neoclassical economics.

You should keep medical costs down.

so, the democrats AREN’T on the side of the people?… Who could have seen that coming? time to vote green.again.

But otherwise, in a larger sense, maybe it would be good to privitize medicare. Just think if we got a system of “medicare for all” when bernie was pushing it… all the plans,copays,coinsurance,etc… would be set in stone yet again.

This way the whole damned thing can be objected to. Time to throw the baby out with the bathwater, and opt for SINGLE PAYER….

Time to plan to start from scratch. the only plan is to wipe everything from the ground on up, build new foundations , and an actual system based on what works best for the people, and for the most reasonable low cost…(the cheapest usually isn’t the way to get anything of value,of good quality)

It isn’t like we need to re-invent the wheel. There are too many working models to choose from. the united states of america doesn’t have to be the stupidest gorilla in the room for ever.Even though we are truly exceptional in that sense.

As another note/tie in…

bill moyers did a great episode on the state of maine vs ?insurance co/pharma industry? in their medicaid dispute and ability to negotiate prices… the state kept winning in Maine’s supreme court… so the pharma industry went into high gear pushing medicare part d, provision that the feds couldn’t negotiate prices , despite have @ 52% of the aggregate volume/purchases..

It’s been @20 years since that show was on… and here we are slip slidin away…and paying all the way.

Thank you for writing this. I had no idea what was lurking behind the term “Medicare,” with which I had only positive associations, not least because of “Medicare4All.” OK I was dimly aware there were shenanigans going on, but I didn’t know how bad.

This was always the problem with using “Medicare4All” as an organizing slogan. In theory, what Bernie/Jayapal etc were advocating was IMPROVED Medicare, which would have expanded benefits, eliminated premiums & deductables, basically a from the ground up reworking of current Medicare, not just an expansion to a larger population. In practice though, tying reform efforts to an existing and already limited and corrupted system meant that political negotiations would take THAT as a ground floor starting point and public education about the issues involved would be more easily confused (see Medicare-for-all-who-want-it, etc).

Opponents of nationalized health care have already managed to successfully fight a delaying action in the US for almost 100 years now. When forced to it, they implement crippled or limited programs like Medicare/Medicaid and Obamacare as firebreaks to forestall more comprehensive and effective reform, selling them politically as lesser-evil / half-a-loaf advances while leaving themselves enough maneuvering room to erode and degrade even these programs. Meanwhile, Neoliberal forces are busily working to replace more functional healthcare systems currently existing in other countries with more privatized US-style schemes. TINA is their end goal.

Good reporting, but I kept thinking so what do we do with it?

Medical care is becoming or has become money laundering in a sense. Appealing to the morality of the top 10% is rather a crap shot. We have West Virginians are too fat and deserve not to have clean drinking water over here. Methane leaking fracking wells over there. Going after a lawyer for daring to win an ecocide case over here. A publisher / journalist for embarrassment or perhaps for holding certain secrets in reserve.

A global 10% who talk climate change but by their own actions make it likely that the coming eye of the Jackpot will hit harder and faster than expected. But hey, we’re impoverishing those lazy, fat Americans whose standard of living and planetary consumption is too too high. If we can lessen their planetary consumption, have more of them live precariously (again lessening their consumption) and perhaps even go die (dead people don’t consume), that will be enough to let us keeping doing what we want to do. Even I think I’m too cynical.

I digress… But if laying out the numbers, making a logical case, appealing to morality isn’t enough to get the policy makers or their handlers to reverse their long-term goals / plans — to see actual people not of their class as worthy humans and not just the one offs who they decide to save now and again — then what is?

It looks like the program is currently on pause:

Biden Administration Pauses Key Value-Based Reimbursement Models

https://revcycleintelligence.com/news/biden-administration-pauses-key-value-based-reimbursement-models

But the “value based” risk sharing models look to be embedded in a lot of the payment coordination systems.

https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/sharedsavingsprogram

Spun up under the most recent administration and on aggressive time lines across the whole landscape of managed care. Here’s a bit on home care providers that might be of interest:

https://homehealthcarenews.com/2021/04/pause-to-alternative-payment-models-gives-some-providers-a-golden-ticket-leaves-others-behind/

> It looks like the program is currently on pause:

See my response to TBellT here.

Shorter: They didn’t hire Liz Fowler to leave her pet program on pause for long.

Apologies if this was addressed already, I had a hard time finding this:

What five states have laws that ban insurance companies from rejecting medi-gap insurance coverage for applicants on the basis of preexisting conditions?

https://www.ncsl.org/research/health/individual-health-insurance-in-the-states.aspx

State Action Pertaining to Guaranteed Issue: Pre-Existing Condition Coverage