As we’ve described at length over the years, pension funds like CalPERS are violating their fiduciary duties when they invest in private equity. Remember that a basic requirement is to evaluate the costs and risks of a possible investment against its potential returns.

With private equity, limited partners like CalPERS do not know the full costs of their private equity investments. Many, particularly charges made directly to portfolio companies, are astonishingly kept secret. But even worse, investors don’t really know what they make from private equity either. We’ve pointed out some of the many cons private equity managers make to goose apparent returns, such as exaggerating the value of portfolio companies early in a fund’s life (which will particularly juice the misleading but widely used IRR calculation as well as benefiting fundraising, since new funds are typically raised 4-5 years after the last “flagship fund” launch).

Private equity experts Eileen Appelbaum and Jeffrey Hooke have published a damning new analysis, using CalPERS data, on another private equity trick we’ve written about, that of keeping dogs in the portfolio at their original purchase price rather than writing them off or selling them at a realistic price. Not only does this happen, but it’s a significant practice. Private equity firms like to wind up in eight, at worst ten years, so any companies still held in portfolios after that time frame are dregs.

Moreover, the fact that they are overvalued at this point means they have been overvalued all along. So all the past valuations for the unsold portion of the portfolio were too high, inflating returns. The rotting leftovers are the most visible evidence of fund manager funny business, but there’s plenty more. From Appelbaum’s and Hooke’s new paper:

Even as the stock market is in free fall and interest rates are rising, private equity (PE) funds continue to pursue new investors, peddling the myth that private equity returns defy the laws of financial gravity…How is this amazing sleight of hand accomplished?….

Year-to-year PE fund returns consist of how much the fund received—or cashed out—from these sales of portfolio companies plus the value of the remaining unsold companies still in the fund’s portfolio.

That’s where the mischief comes in.

Unsold companies are illiquid assets whose true value won’t be known until they are sold. In the meantime, in the years before the fund reaches the end of its life span, typically 10 years, the fund manager (that is, the General Partner) provides “guesstimates” of what these companies are worth. These estimates may be optimistically high, thus inflating the fund’s value and exaggerating its performance until the fund reaches the end of its life span and cashes out entirely….

The PE firms that set the prices of these companies have little incentive to reassess their value. The guesstimates of the value of the fund’s unsold inventory form the basis for the myth of PE funds’ strong performance and that they serve as a hedge against a falling stock market….

So, about all those terrific private investments that have supposedly provided souped-up returns for the last dozen years: Guess what? Many of the companies that were acquired are still sitting on the shelf, waiting for the PE fund to sell. And thus….a significant amount of the funds’ returns is unrealized, a figment of the PE managers’ fertile imaginations and failure to adjust the values of companies in their portfolios to changed market conditions (that is, to mark-to-market).

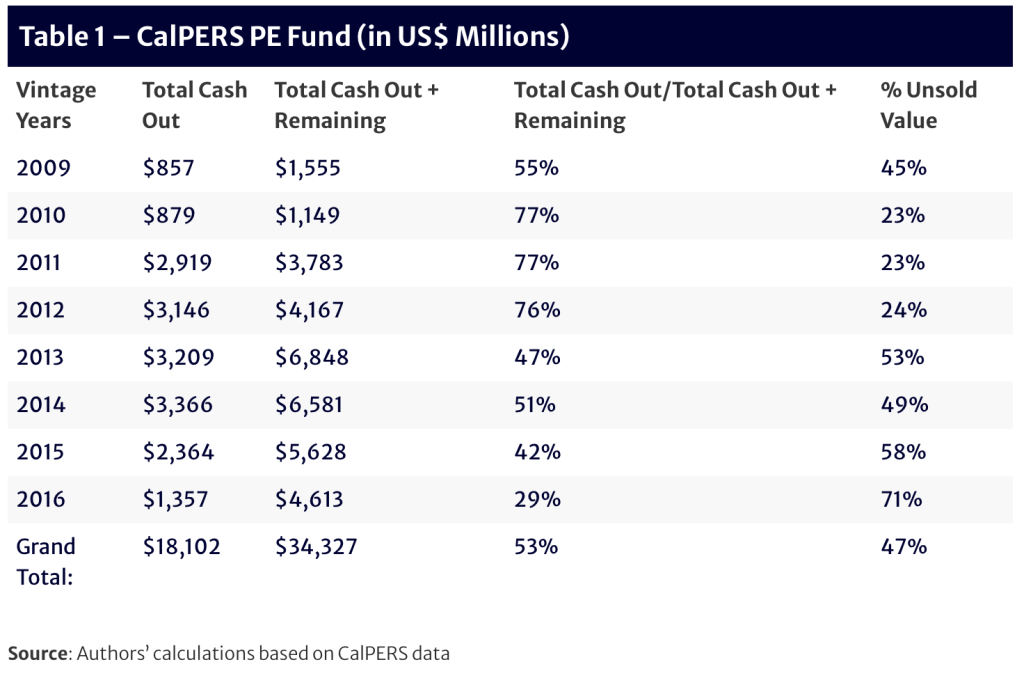

Notes: (1) Vintage Year refers to the year in which the fund was launched. (2) Total Cash Out refers to the cash paid out by a fund to its investors (to CalPERS in this case). (3) Total Cash Out + Remaining is the value of the fund and refers to cash paid out plus the value of unsold investments. (4) The ratio of Total Cash Out to Total Cash Out + Remaining is the share of the fund’s value that has been realized. (5) % Unsold Value is the share of the fund’s value that has not yet been realized. Columns (4) and (5) add up to 100 percent. The second row of the Table indicates that of all the funds launched in 2010 in which CalPERS invested, 77 percent of portfolio assets have been sold and 23 percent remain on the books of some of the funds from that vintage.As Table 1 points out, the unsold portion of the total value averages 47 percent for vintage years that are between 6 and 13-years-old. The 2009 vintage still has 45 percent of its value tied up in companies sitting on its shelf, whose value is largely a guesstimate by PE fund managers. Managers’ guesstimates account for almost a quarter of the value of the other mature funds with vintages dating back 10 years or more. More recent vintages have much higher proportions of unsold inventory, with the 2013 vintage, now working on its tenth year, stuck with 53 percent unsold, and the 2016 vintage with 71 percent unsold.

CalPERS did not respond to our request for its comment on this analysis of CalPERS’ data.

In another fresh blow to CalPERS’ private equity fetishism, one of the deans of investment management and financial analysis, Richard Ennis, published a new paper that we’ve embedded at the end of this post. We strongly urge you to read it in full. Some of its damning findings:

Public pension funds in the United States have underperformed properly constructed benchmarks—ones indicating a fair economic return—by a wide margin and with consistency…

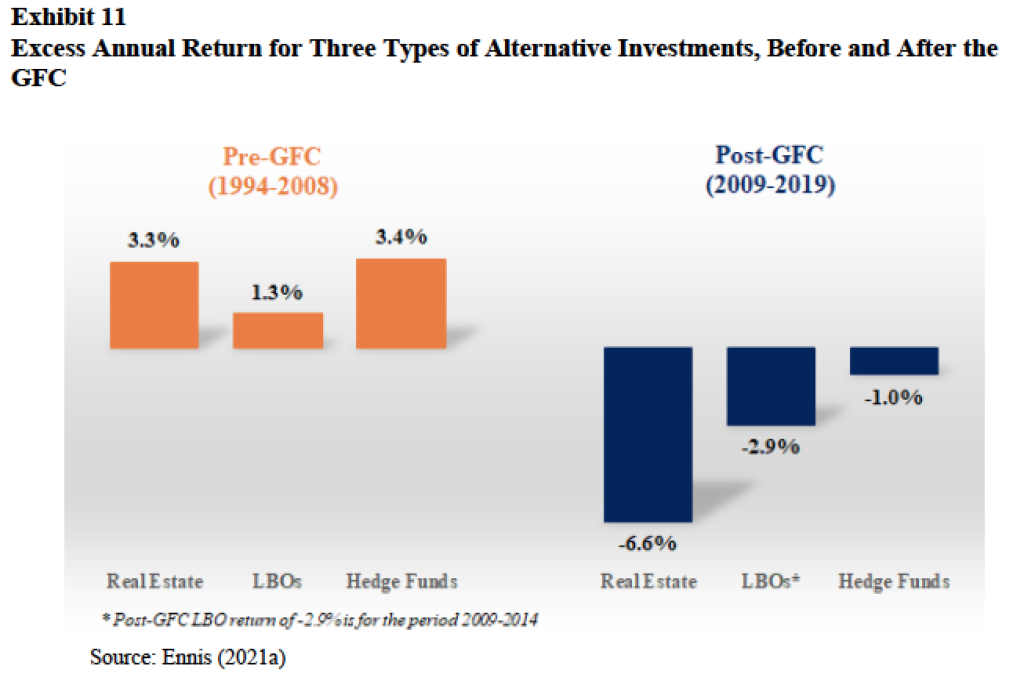

Large public pension funds have piled into largely illiquid alternative investments, such as private equity, private real estate and hedge funds, in recent decades. The average allocation to “alts,” as they are often referred to, increased from less than 10% in 2001 to more than 30% at June 30, 2021.The motivation for this major asset allocation shift was that alts were thought to provide a diversification benefit plus an alpha owing to market inefficiency and the accessibility of skillful managers. I have shown (Exhibit 3, from Ennis, 2021a) that alts generally haven’t contributed to public fund diversification, at least not since the Global Financial Crisis of 2008 (GFC). Exhibit 11 indicates that, at the same time, alternative investments, in general, ceased to be a source of positive alpha.

Exhibit 12 indicates that alternative investing has hurt the performance of public pension funds. It illustrates the relationship between the alpha earned by the 59 funds described above and their exposure to alternative investments for the 13 years ending June 30, 2021. The slope coefficient is -0.039, with a significant t-statistic of -3.1. The negative slope indicates that a reduction in alpha of nearly 80 basis points per year relative to marketable securities alone is associated with a 20% allocation to alts, and 120 bps for a 30% allocation. An interpretation of the latter result is that the underperformance of alts alone has been sufficient to account for the overall underperformance (at -1.21% per year) of public funds.

In other words, public pension funds would do better if they abandoned private equity and other “alts” entirely. Ennis lays out a preferable investment strategy.

And in case you might try contending that these sorry findings might apply less to CalPERS, by virtue of its size and correspondingly large and well-paid investment staff, don’t. A earlier study by Ennis found that CalPERS was near the bottom of all public pension funds in its performance, and generated one of the highest levels of “negative alpha,” as in destroying value through poor investment management.

Recall that CalPERS had to rejigger its benchmark to hide private equity underperformance, not only changing the stock indexes used as a reference, but even more important, cutting the risk premium from 300 basis points to 150 when there’s been no change in the riskiness of private equity compared to public stocks.

Despite that, CalPERS has increased its private equity allocation from 8% to 13% of its portfolio. Last December, Institutional Investor published an article voicing doubts about this change. For instance:

One former member of CalPERS’s senior investment team, Ron Lagnado, is raising concerns about the plan. “That’s an enormous amount of money to be shoveling into private equity,” Lagnado said. “Everybody is trying to crowd into the space. If this is all the largest pension fund in the United States is going to come up with, I don’t think they’re thinking carefully about what they’re doing.”…..

“I have no axe to grind,” Lagnado said in response to a question about his criticism of the CalPERS plan. “I voluntarily left.” But Lagnado is passionate about how public pensions will make good on their promises to investors and the limitations of traditional approaches to diversification, including the diminishing protection that comes from bonds during a drawdown. He previously argued in an II opinion piece that state pension funds are underfunded and that will only get worse when markets inevitably turn down “A considerable body of evidence shows these funding problems are connected with how most pension portfolios have been constructed for more than a decade. Without changing the approach, it seems unlikely that funded status can be improved in the coming decade through investment performance alone.”

CalPERS’ unwarranted loyalty to private equity, in combination of the giant pension fund having been used in the past to launder political money via “pay to play” and bribes that landed former CEO Fred Buenrostro in Federal prison, have led insiders to come more and more to the view that something isn’t on the up and up. Mere stupidity isn’t adequate to justify this level of value destruction.

00 Richard Ennis on Public Pension Fund Herding and Alts

And if you think a 300 basis point risk premium is reasonable you are very optimistic indeed.

I’m sure that Attorney General Bonta will be all over this in no time!

He’s not as energetic as Becerra was,but as soon as he’s done fighting the Supreme Court about the recent overturn of Roe Vs Wade and the Bruen decision I’m sure he’ll get around to it.

Unless something comes up.

I have to admit that when all this comes to trial one day, as it inevitably will, I will feel sorry for the prosecuting attorney trying to get an answer out of Marcie Frost. I can see it now-

Attorney: ‘Now you are the CEO of CalPERS, correct?

Marcie Frost: ‘Fifth!

Attorney: ‘Never mind that now. Did CalPERS know the full costs of their private equity investments?’

Marcie Frost: ‘Ummm.’

Attorney: ‘Did CalPERS now how much they were actually making from those private equity investments?’

Marcie Frost: ‘Ummm.’

Attorney: ‘Is it not true that you had to bodgy up your own benchmarks to hide the hits that your were taking on those private equity investments?’

Marcie Frost: ‘Ummm.’

Attorney: ‘Is it not true that CalPERS would have better if they had abandoned private equity altogether?’

Marcie Frost: ‘Ummm.’

Attorney: ‘After throwing all those massive bets into private equity and ignoring the consequences which led to CalPERS going broke, should you not be going to prison?’

Marcie Frost: ‘Of course not!

Attorney: ‘And, pray tell, why would that be?’

Marcie Frost: ‘Because I am the only person that knows what went on and can unscramble all those accounts.’

Overstating PE and RE returns and valuations falls under the rubric, “It’s a feature, not a bug.”

Let’s take a look at the investment and administrative overhead of the other big California pension fund, CalSTRS, the school teachers. Using 2021 numbers, CalPERS managed an asset pool about 54 percent greater than CalSTRS: $500B vs $325B.

CalSTRS reported administrative and investment overhead of $600M. Applying simple arithmetic to the back of the napkin (and not accounting for economies of scale), one would expect CalPERS to have administrative and investment overhead of about $900M. They don’t. Instead CalPERS reports administrative and investment overhead of $1.9B, an excess in expected overhead of a billion dollars.

Where is most of this difference found, one might ask? CalSTRS reported $307.4M in external costs; CalPERS reported a staggering $1.2 Billion Dollars in external costs , the lion’s share going to fees, profits, and carried interest effectively gifted to outside PE and RE managers. Can it be mere coincidence that hose same PE and RE managers appear repeatedly as the largest donor group to the national-level political class?

As always, Follow the Money.

Thanks for your bulldog determination to keep reporting the CalPERS failure of fiduciary duty to its members. (I’d call the ongoing failures evidence of hidden corruption, but that’s just my opinion.)

Thanks for your continued reporting on CalPERS, PE, and pension.