By Justin Mikulka, who writes for DeSmogBlog. Originally published at DeSmogBlog.

Last August, ExxonMobil warned that it may need to remove 20 percent of its oil and gas proved reserves from its books. While that was a shocking number from the oil major, reality proved to be even more of a shock to the company. On February 24, Exxon reported that it would actually remove over 30 percent of its proved reserves from its books — essentially wiping out the value of its Canadian tar sands holdings from its books.

According to the Securities and Exchange Commission (SEC), proved reserves are “the estimated quantities of crude oil, natural gas, and natural gas liquids which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions.”

Proved reserves are the concept on which the whole oil business is based. It is a main factor in how oil and gas companies are valued and in determining how much money banks will loan companies. Much of oil and gas lending is known as reserved-based lending.

Exxon’s latest move is even more remarkable, however, because it has a reputation for being resistant to properly valuing reserves, often lagging behind the other oil major companies in making these downward adjustments.

In this case, the market — and the SEC— forced Exxon’s hand on the matter. SEC rules require that oil and gas companies value reserves based on the average price of oil from the previous 12 months.

In its latest SEC filing released this week, Exxon explains that this requirement essentially meant removing all of the value for its Canadian tar sands investments from its reserves.

Along with wiping out the value of its tar sands holdings, Exxon also noted that it wrote off “approximately 1.5 billion oil-equivalent barrels, mainly related to unconventional drilling in the United States.” Unconventional drilling refers to the fracking business, which has been a financial disaster for many of those involved.

“In the past decade, capital employed in Exxon’s upstream business has risen by a third — and…production fell 17% & proved reserves by 39%. This…has trashed Exxon’s return on capital.”https://t.co/KnHnth4t1F#OOTT #oilandgas #oil #WTI #CrudeOil #fintwit #OPEC #Commodities

— Art Berman (@aeberman12) February 26, 2021

Fraud Allegations Related to Exxon Accounting

Exxon’s resistance to properly valuing its reserves and assets has been the focus of multiple recent fraud allegations against the company. Earlier this month, DeSmog reported on claims made by former Exxon employee Franklin Bennett who, in an SEC complaint, accuses Exxon of overvaluing its assets by $56 billion.

Bennett’s accusations focus on Exxon’s purchase of the shale gas company XTO in 2009 — which is considered one of the worst oil and gas investments ever made. Late last year Exxon wrote off $20 billion related to the XTO deal but that likely isn’t the last of the company’s fracking write-offs.

The financial industry has been aware that Exxon has been reluctant to write down the value of its assets. In 2018 an analyst for oil industry consulting firm Raymond James noted that the whole XTO investment was likely a loss. “That was one of the worst acquisitions in the history of the energy business. It was exquisitely poorly timed,” Pavel Molchanov, an energy analyst at Raymond James, told CNN in 2018. “…It was essentially $40 billion down the drain.”

And in a 2015 interview, former CEO Rex Tillerson, who oversaw Exxon’s purchase of XTO, stated the company policy on this matter: “We don’t do write-downs.”

While that is a bold statement from an oil and gas CEO, it is also a recipe for potential fraud. Overestimating reserves values is at the heart of many instances of fraud in the oil and gas industry.

In addition to the accusations related to the XTO acquisition, Exxon is already facing an SEC investigation for potentially overstating the value of its Permian assets in Texas.

Tillerson was wrong about XTO, which was a bet on the future profitability of fracking for natural gas that didn’t pay off. Tillerson was also wrong about Exxon’s policy on write-downs. As with much of the oil industry these days, it is becoming increasingly hard for these companies to hide the grim financial realities of the oil and gas business, and accusations of fraud are starting to emerge.

In September 2020, for example, Bloomberg reported a whistleblower complaint and shareholder lawsuit against the oil and gas company Anadarko. The complaint alleges that Anadarko management overstated reserves and the potential of its Shenandoah oil field in the Gulf of Mexico. Anadarko management was touting this field as its top asset, despite a senior engineer informing management that this simply wasn’t true. According to Bloomberg, Anadarko ended up writing off the full value of Shenandoah and “The project had gone from a multibillion-dollar golden goose to worthless.

Lawyers for Anadarko attempted to have the shareholder lawsuit dismissed, arguing that the shareholders could’t prove management statements were made “with an intent to deceive, manipulate or defraud.” That effort was denied.

The Wall Street Journal reported in June that Exxon’s unwillingness to take similar write-downs earlier could amount to fraud under SEC rules.https://t.co/TfWd5210l8

— Antonia Juhasz (@AntoniaJuhasz) November 1, 2020

Exxon Doubles Down on Natural Gas

Exxon notes in its SEC filing that the company was forced to write down its reserves values due to SEC rules and 2020’s low oil prices. In that same filing, the oil giant lays out its plans for the future, which are all about natural gas, which is primarily methane. Despite the huge losses on XTO, Exxon is once again betting its financial future on natural gas.

In the SEC filing, the company writes that “power generation is expected to remain the largest and fastest growing major segment of global primary energy demand” and that “Global electricity demand is expected to increase approximately 50 percent from 2018 to 2040.”

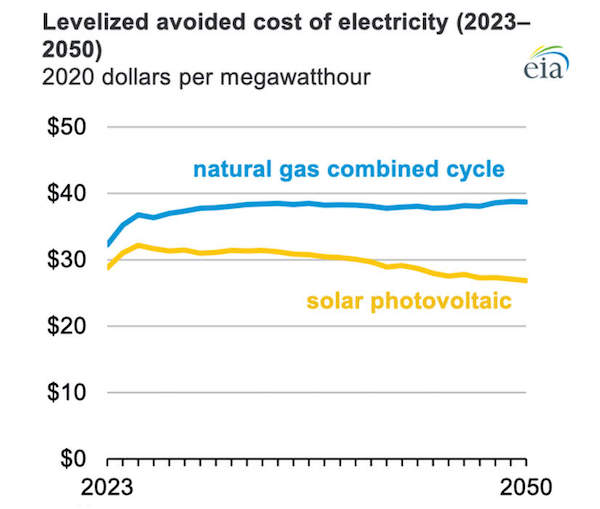

While these expectations mirror the consensus among industry analysts, what remains to be seen is how that electricity will be generated. Exxon is betting on natural gas, but renewable sources like wind and solar can already provide that electricity for a lower cost in most places — without producing the methane and carbon emissions which Exxon’s products create.

Exxon also mentioned other factors that may impact its future financial results, including “technological advances in energy storage that make wind and solar more competitive for power generation.”

Based on current trends, many further developments are likely to make wind and solar even more competitive for power generation, but in many places, these combinations are already more than competitive with natural gas.

Solar is now ‘cheapest electricity in history’, confirms IEA | @DrSimEvans @Josh_Gabbatiss https://t.co/xEdIB5Z13M #archive pic.twitter.com/tm96k601ql

— Carbon Brief (@CarbonBrief) February 26, 2021

A big part of Exxon’s plans for future profits is a bet on natural gas beating out wind and solar for power generation. But recent data from the Energy Information Administration shows that gas is losing this race in 2021, and the economic prospects for natural gas get worse in the future.

Costs of solar vs. gas for power production. Credit: Energy Information Administration

Exxon’s Very Bad Year

Writing off over 30 percent of the value of its reserves would normally be the worst news Exxon was facing. But these are not normal times for the oil and gas industry.

Exxon also is being investigated by the SEC and is battling multiple accusations of fraud made by former employees. In 2020, the company was forced to finally acknowledge the huge losses associated with the purchase of XTO. Exxon lost a total $22 billion dollars in 2020.

“The past year presented the most challenging market conditions ExxonMobil has ever experienced,” Exxon CEO Darren Woods told The New York Times in early February, adding that Exxon ended the year as “a stronger company.”

Exxon, however, has been borrowing money to pay its dividend to shareholders and in the process has been rapidly increasing its overall debt. In November 2020, financial publication Barron’s reported that Exxon might need to borrow $8 billion in 2021 to keep paying its dividend.

Borrowing to pay dividends is a classic sign of a company in trouble. #Exxon appears to be firmly on the losing end of an industry on the verge of major #transformation https://t.co/7mvmRSmPjo #EnergyTransition

— Rebecca Henderson (@RebeccaReCap) August 6, 2019

In 2018, Exxon had $20.5 billion in long-term debt. In 2020, that number had more than doubled to $47 billion. This is not the sign of a company that is becoming “stronger.”

The oil major’s increased debt was the reason it was featured in a Bloomberg article published in November 2020 on “zombie companies.” According to Bloomberg, zombie companies don’t have the ability to pay off overwhelming debts.

Exxon has a well-established history of misleading the public and investors about the risks of climate change, and is involved in a number of lawsuits from cities and counties over it. The company now faces multiple accusations from former employees, alleging it also has misled the public and investors about its financial prospects.

With the pile of debt facing Exxon — debt that increased by over $20 billion in 2020 and is expected to increase by as much as another $8 billion this year — the truth about whether the oil company really is “stronger” should become obvious soon enough.

Exxon did not respond to DeSmog’s request for comment by time of publication.

Interesting how none of this Surfaced during Rex Tillerson’s sojourn as CEO of Exxon Mobil.

For the record Exxon (ESSO, or Standard oil New Jersey) and Mobil , previously SECONY or Standard Oil of New York, were separated when the USG took the Standard Oil empire apart with the Anti-Trust laws.

It will be interesting to see how far this deleveraging goes. I imagine that the future value of oil assets is not just reflected in the share price of oil companies, but in a series of institutional funds, side bets, associated industries, &c. Not to mention the curious economic dimensions of stock shorting that will emerge. It couldn’t happen to a nicer group of companies, but knock-on effects will probably be chaotic and far-reaching. Laissez les bin temps rouler…

No comment on the Exxon portion of the article but the author doesn’t understand the solar vs gas chart that’s included.

That specific graph from EIA is showing the Levelized Avoided Cost of Electricity (LACE). LACE is a marginal estimate of value (the “avoided cost” of replacement). This is in contrast to the more commonly understood Levelized Cost of Electricity (LCOE), which measures… cost. LCOE has been around forever; LACE was introduced as an output of EIA modeling some time in the last… 5ish(?) years to communicate additional information.

The LACE chart is showing that combined cycle units are more valuable than solar. A higher lace is better. The solar LACE declines through time at high rates of deployment as its marginal capacity value (that is, how much it is able to contribute to system peaks) decreases as more solar is added to the system. The value of CCs stays constant as they are dispatchable (except in Texas, apparently).

So basically, the chart makes the point opposite the one made in the article. But solar is still definitely cheaper than gas. Just less valuable to the power system.

From Wikipedia

In 2012, Tillerson’s compensation package was $40.5 million.[55] It was $28.1 million in 2013, $33.1 million in 2014, and $27.2 million in 2015.[56] In late 2016, Tillerson held $54 million of Exxon stock, and had a right to deferred stock worth approximately $180 million over the next 10 years.[57] Tillerson is estimated to be worth at least $300 million.[18] When he left Exxon, Tillerson was four months away from retirement, at which time he would have been entitled to a $180 million retirement package.[18] He owns two ranches in Texas, where his wife, Renda, raises cutting horses.[18]

Well those bets on fossil fuel looked really bad when oil was 30 bbl and nat gas was cheap.

Now oil is 60/bbl and Texas got a reality check……. do they need to revalue again?

XOM cash flow is now somewhat improved and will improve more as economy recovers after pandemic is declared over…. the need to borrow for dividends will be reduced maybe eliminated…

Not saying they don’t have issues… but oil will be around for a long time so will XOM… and those 10% dividends were too tempting when XOM was int he thirties……

“Borrow to pay dividends:” What the heck? Is that a thing?

Investopedia: A dividend is the distribution of some of a company’s earnings to a class of its shareholders, as determined by the company’s board of directors. Common shareholders of dividend-paying companies are typically eligible as long as they own the stock before the ex-dividend date.1 Dividends may be paid out as cash or in the form of additional stock.

From “Little Big Man:” “There is a thing here I do not understand. There is a pain between my ears…”

XOM is experiencing a short term cash flow issue due to the low price of oil. The stock took a hit because many believed they would cut the dividend. Management believe the pricing issue would resolve and committed to continue the payout.

Price of oil was $30 then now $ 60…… so far managements decision in this regard seems to have been correct for the shareholders… We’ll see how cash flow relative to dividend coverage when the #’s come out for this Qtr…

When I was a portfolio manager at one of the World’s largest asset managers in the 90s and early 00s we had many non-roadshow meetings with Exxon’s CEO in our offices. They distinguished themselves from every other company we met with in that we were not permitted to ask questions. Full stop. Period. Questions were submitted to the Head of IR in writing in advance of the meeting and they decided whether to respond.

An imperial corporation that was impervious, or so they thought.

At the time, did you-all get the feeling that Exxon was too Proud and High Handed to take questions , just on general principles? Or did you get the feeling that Exxon knew it had things to cover up and decided to cover them up under a screen of High Handed Imperious Pride? Or some of both?

And looking back in hindsight, is it possible to retro-read today what Exxon’s mood and motives for rejecting the whole concept of live questions really was at the time?

Exxon, however, has been borrowing money to pay its dividend to shareholders and in the process has been rapidly increasing its overall debt.

imo, maybe it is legal but This is wrong on so many levels. Thwarting shareholder reality and costs with grifting tricks is despicably and desperately short sighted.

Isn’t forced complicity against the Law?

Not defending Exxon, but if you’ve been known as a blue-chip reliable dividend payer and therefore are in millions of capital-preservation portfolios, it’s a big decision to skip a dividend. You get kicked off a lot of lists and out of a lot of accounts. It’s understandable to consider going out on a limb to keep paying a dividend, especially if you think the cash shortage is a short-term problem. And it’s not despicable to the widow/orphan/foundation keeping their income stream up during iffy times. Management probably with hubris thought their cash flow would suddenly shoot back up and stay up and cover their series of bad calls.

How many widows and orphans hold XON and rely on dividends and appreciation for their meager sustenance? That is a BS argument. Not even suitable for a libertarian to make. This seems to me just another evidence of how deep the fraud that is the “market” runs.

I bet a lot of Foundations for the Relief of Widows and Orphans have XON and similar shares in their portfolios. And the practice of fraud-based accounting is a threat to all these portfolios.

And if fraud-based accounting and dividending is widespread, then what choice do the porfolio-runners have?

Thats why all the clever and oh-so-exquisitely shyster-legal business value-simulating frauds and etc. should be made illegal in fact as well as in theory. And all the perpetrators should be sentenced to life without parole in the carceral state’s prison spaces which could be freed up for them by releasing all the ” non-violent drug offenders” for example.

I don’t object to a carceral state if it carceralises all the right people and only the right people. I suspect endless thousands of business leaders and followers and lawyers and money-laundry operators and creative accountants and etc. belong in carceral state facilities.

Quite a few, because by ‘widows and orphans’ we mean ‘income investors who need reliability’. I am one of those and I am legion, though I don’t hold XOM. If XOM did not have the flexibility to take on debt during a crisis, it could cause dumping of the stock, falling price of stock, lower worth of the company, and higher debt costs, thereby making things worse in the long run for investors.

It’s fine for you to not like the market, but that doesn’t make it fraudulent or evil on its face.

But Exxon is fraudulent on its face…

Hence JT and Rod’s points about the whole thing sticking like a pile of manure.

Those “investors” you talk about should be upset about that.