By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

The layoffs in the tech and social media bubble are quickly getting absorbed by other companies, including in other industries, while the number of layoffs and discharges across all industries are near historic lows, and applications for unemployment insurance remain near historic lows. Wages have continued to surge; and for job hoppers, wages have exploded as desperate companies are willing to pay to fill slots, amid a gigantic pile of job openings and massive job hopping as workers are arbitraging the tighter labor market for their benefit.

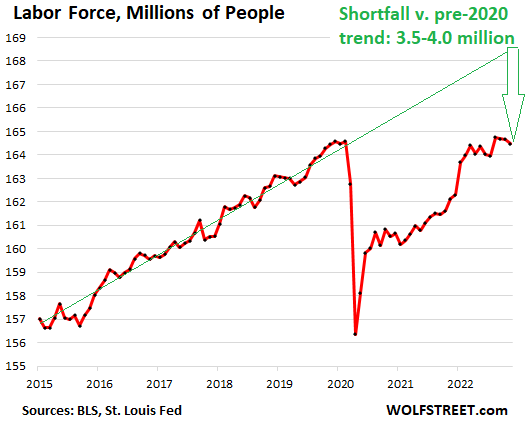

And today, we got more of the same with the jobs report from the Bureau of Labor Statistics. The labor force – people who either have jobs or are actively looking for jobs – is still the key problem: It dipped further and remains far below pre-pandemic trend. This is the supply of labor.

Powell, in his speech two days ago, focused on the labor force. He pointed out that the Fed cannot increase the supply of labor, and the Fed cannot increase the labor force; but the Fed can tamp down on the demand for labor, to bring supply and demand somewhat in line in order to tamp down on the inflationary pressures that occur when companies are passing on their surging labor costs by increasing prices. This is particularly an issue with services where raging inflation has now taken hold. And in many services, labor costs are a huge factor.

And this is now happening everywhere: Companies that provide services are passing on their surging labor costs by jacking up their prices.

The Fed is now trying to tamp down on this demand for labor – in addition to tamping down on the demand for goods, services, and investments – with the fastest rate hikes in four decades and with the fastest QT ever.

But it’s not working yet. Consumer demand is not landing, and the labor market isn’t landing either. And inflationary pressures persist, particularly in “core services” where labor costs are a huge factor.

The labor force is not recovering back to trend.

The labor force – people who either have jobs or are actively looking for jobs – fell by 186,000 people in November, the third month in a row of declines, to 164.5 million, which is roughly back where it had been before the pandemic, but it remains stunningly far below pre-pandemic trend.

In other words, the labor force, after growing for decades, stopped growing once it bounced back from the pandemic lows.

In his speech two days ago, Powell pointed out that there is a “shortfall” of about 3.5 million people in the labor force, compared to pre-pandemic trends, citing data from the Congressional Budget Office and the BLS. And I’m getting about the same thing, based on BLS data and my own calculations: a “shortfall” between 3.5 million and 4 million:

Where does this shortfall come from?

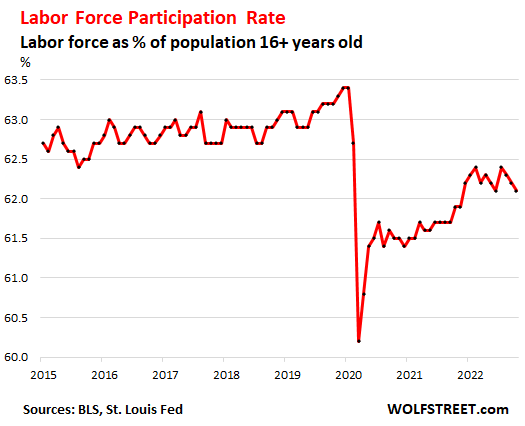

The labor force participation rate – the labor force as a percent of the working-age population 16 years and older – dipped for the third month in a row to 62.1%. It has gone backwards this year:

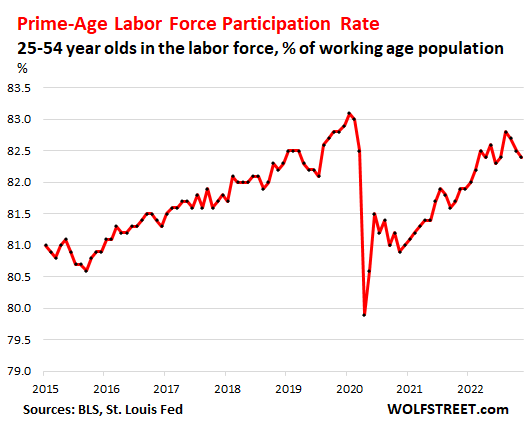

The prime-age labor force participation rate – people between 25 and 54 years old, which eliminates the effects of retiring boomers — also dropped for the third month in a row, to 82.4%, but it is close to where it had been before the pandemic (83.1% in January 2020 and 83.0% in February 2020).

This shows that the biggest issue in the labor force is not the “prime working age” segment of the population, but the over-54 segment:

Powell on why the “shortfall” in the labor force.

In his speech, Powell discussed two categories of reasons responsible for most of this “shortfall” of about 3.5 million people in the labor force: excess retirements and slower growth in the working-age population.

“Excess retirements”: 2 million of the 3.5-million shortfall in the labor force. Excess retirements are more retirements than would normally be expected from aging alone. Powell was referring to recent research at his shop.

What might have caused these excess retirements, according to Powell:

- Health issues: “COVID has posed a particularly large threat” to the elderly.

- For older workers who’d lost their jobs during the mass layoffs, “the cost of finding a new job may have seemed particularly large, “given pandemic-related disruptions to the work environment and health concerns.”

- “Gains in the stock market and rising house prices in the first two years of the pandemic contributed to an increase in wealth that likely facilitated early retirement for some people.”

And they’re not coming out of retirement, according to Powell:

“The data so far do not suggest that excess retirements are likely to unwind because of retirees returning to the labor force. Older workers are still retiring at higher rates, and retirees do not appear to be returning to the labor force in sufficient numbers to meaningfully reduce the total number of excess retirees.”

Slower growth of the working-age population: 1.5 million of the 3.5-million shortfall in the labor force. “The combination of a plunge in net immigration and a surge in deaths during the pandemic probably accounts for about 1.5 million missing workers,” he said.

The Fed cannot increase the labor force, but it can reduce demand for labor.

The Fed’s tools “work principally on demand,” Powell said. It’s not up to the Fed to increase the supply of labor, he said. But it can reduce the demand for labor.

And we knew that: Higher interest rates make credit-funded consumption and investments by consumers and businesses more expensive, and they are dialed back, removing some demand for labor. The decline in asset prices increases uncertainty among businesses, and new projects are being dialed back, etc., which further decreases demand for labor.

“For the near term, a moderation of labor demand growth will be required to restore balance to the labor market,” he said. This was very hawkish.

And it became even more hawkish in light of today’s jobs data. So higher interest rates and more QT, because those are the tools the Fed has to tamp down on demand for labor, which would tamp down on surging labor costs that companies are passing on to consumers via higher prices.

But demand for labor didn’t cool: Aggressive hiring pulled people out of self-employment.

The number of people in the labor force that are not working has been near historic lows. In November, it dipped further to 6.0 million unemployed. Over the past five decades there were only three brief periods when the number of unemployed people in the labor force was this low.

What do employers do to fill their open positions? They hire aggressively and offer higher pay to attract workers that already have a job (which creates the current churn) and to attract workers who are self-employed…

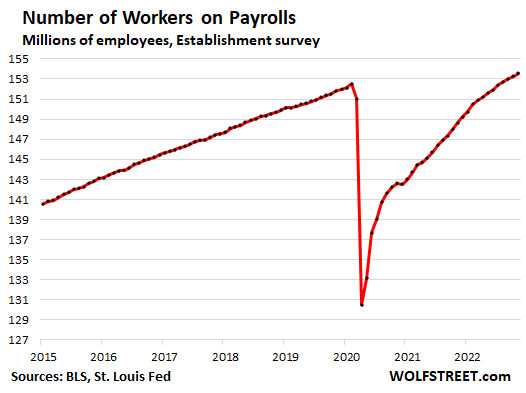

The pull from self-employed to regular payrolls shows up in the gap between the growing number of workers on regular payrolls, as reported by employers, and the stagnating number of all workers, including the self-employed, in line with the stagnating labor force, as reported by households.

The number of employees on regular payrolls rose by 263,000 in November from October, and rose by 816,000 over the past three months, and by 1.9 million over the past 6 months, to 153.5 million employees, which is up by 1.044 million from February 2020, according to the survey of employers.

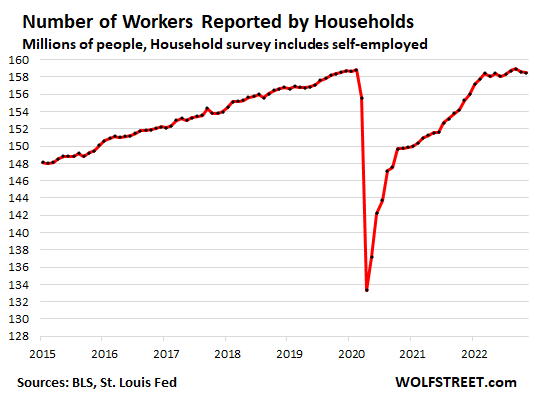

But the total number of workers, including self-employed, fell by 138,000 in November, and fell by 262,000 over the past three months, to 158.5 million, which is still down by 396,000 from February 2020, according to the survey of households.

Both of them — payrolls and total number of workers — are also far below pre-pandemic trends.

The stagnation in the total number of people who are working, as reported by the survey of households, and the growth of regular payrolls, as reported by the survey of establishments, shows that employers’ efforts to fill their open positions by offering higher wages and better benefits is drawing the self-employed into the employment realm, while the overall number of working people hasn’t improved at all this year.

This situation where employers struggle to fill jobs – more demand for labor than supply for labor – is a good thing for workers. It has shifted the power balance, and it continues.

But now there is raging inflation, and this inflation is fueled by a complex combination of factors, including vast amounts of money printing, interest rate repression, and stimulus spending to produce the most wildly over-stimulated economy ever, and this money is still circulating out there, and it’s still creating demand for goods, services, and labor. And the Fed is now trying to tamp down on this demand, including the demand for labor, with, as Powell indicated, even higher interest rates, for even longer.

Interesting that there is no mention of the Wealth Inequality Effect. In effect, if I have done my reading right, a lot of the money “sloshing around” in the economy, (which is considered a major cause of inflation,) is in the hands of a very small segment of the population. Silly me. I thought that tax policy was made to ‘adjust’ this mismatch.

Bring back Eisenhower Era tax rates.

Yes, well:

> The Fed cannot increase the labor force, but it can reduce demand for labor.

The ratchet only turns one way.

Well, ratchets do have a binary switch. Not that Powell would know this ;-)

Agree!

The bubble still exists and has distorting powers that require a determined attempt to eradicate them.

If fake capital conmtinues, it depresses the true rewards for genuine capital and can cause loss of that capital, a feature, not a bug. Most coin deriviatives are pure Ponzi schenes and the financial powers are happy to allow that and will not demand minimum disclosures for them.

When the true price of capital reasserts itself, many industries will cease to exist as they do not have the pricing power to pay interest and some capital. The productive assets, ie industries not in FIRE, may then become cheaply available for ‘small business owners’. All the fake capital has been munching up these entrepreneurs and buying them out.

Why is it taking so long?

How many wars will it take?

Allowing the greedy and weak to borrow their way to riches or bankruptcy is not capitalism.

Look around! We have a lot of productive assets. These will generate genuine wealth once the bankers have sunk back into their rat nests.

There will be generational effects for the winners and losers. Another aspect of the desire to impose eugenic principles without the opprobrium.

Large borrowings always generate significant incomes, declared and otherwise, for those who assist. Coruption has large costs and flourishes in bubbles

No mention of the structural causes of inflation: sanctions, greedflation, underinvestment in supply, and supply chains broken by COVID, which includes protective measures in China.

If there’s too much stimulus, I agree with ambit – fix tax policy: stock buybacks, special dividends, financial speculation, windfall profits, etc.

the 25-54 labor force participation hit its record high of 84.2% in the late 90’s.

Today’s 82% versus 84% doesn’t sound like a big difference, but that equals 2 million workers.

presuming one reason for those missing 2 million are due to child care.

pre-K child care costs have gone through the roof (after-inflation)—so high that presumably for many families, it makes more sense to have one parent stay home.

Might be a corollary to this– covid pandemic epiphany that there is more to life than money.. work/life balance etc…

We have a situation in our immediate family in which the mother lost her high-paying job and was, by default, forced to care for her newborn baby rather than continue to “farm out” motherhood to recent female immigrants from the Third World.

Some fretted over the mother’s feminist failure. I disagreed: there was one “winner” on this and that was the baby … as should be the case. The baby is now being raised by his MOTHER rather than a potpourri of women from alien countries and alien cultures.

I track age-specific participation, which corrects for the changing age structure of the population. Consistent data are available from 1994.

Relative to the 2000-2006 average, prime-age participation was about 2% higher ca 1997-2000, but was lower before and lower since, though late 2019 was back above average. From late spring 2022 rates for all age brackets are slightly above the 2000-2006 average. In contrast, teen age participation (age 16-19) began a sharp decline from 2000, from 46% to 33%. In 1994, participation at age 55-59 was 65% but today is 71.5%, and age 60-64 went from 42% in 1994 to 56% today. The rise in older age brackets is even greater, from 21% for age 65-69 in 1994 to 33%-34% today. Patterns for men and women differ, eg with women in general working more, and men working less. The Atlantic Fed has a team publishing regularly on various aspects of participation.

So the story is much more nuanced. But to the extent inflation is directly tied to covid (as in used and new auto prices), higher interest rates are an indirect and extremely blunt tool. High rates won’t increase the supply of used cars – low sales the past 2 years can’t be changed retroactively, and rental car companies and other fleets are below target, so continue to feed fewer vehicles into the used pipeline. Nor will high interest rates produce more chips.

I looked at the Atlanta Fed site, my data are yes/no participation, which understates labor market tightness because desired hours have fallen. You may be able to hire someone, but you may not be able to do so if you want a long work week, eg my son’s has been 4 days x 12 hours with occasional extra days.

I can’t help but think that the pandemic is having a bigger effect on the labour market than recognized. Well over a million people will not be rejoining the workforce due to them being, well, dead and that is recognized in this article. Now it mentions a major factor being excess retirements so how to explain that. Well, over 100 million Americans have been infected by this virus and it is recognized that it hits older people worse. So a lot of older people may be too sick with long-Covid to go back in the work force. And think too this. I am willing to bet that a lot of older people are not willing to go back into the workforce due to the risks involved. If you knew that your job was insisting that you be cramped into crowded workplaces and attend maskless socials while trying to pretend that the Pandemic is over, would you risk you life working for such a bunch of lunatics if you could avoid it? And that slower growth of the working-age population might be a result of people constantly falling sick or being removed from the work force by long-Covid and this is happening 24-7. Has anybody done the maths for those people to see how they add up annually?

I agree with this take and have had discussion with economists. They mostly aren’t convinced because disability claims haven’t risen..

That may be how our disability system is supposed to work, but its “means testing” and bureaucratic process is almost certainly keeping people from claiming disability who otherwise should be eligible.. especially for a new disease that manifests itself in so many – often subjective – ways

disability is low because no claims are being approved. people on unemployment getting kicked off after 3 months, people filing for unemployment not receiving any and the case gets mysteriously closed.

Disability and unemployed aren’t the same thing. Disability requires a doctor signing off that you are unable to work. Unemployment by definition means you are able to work – the unemployment are in the labor market still and are counted in the partication rate

I tend to agree with your analysis that the pandemic had a more significant impact on the work force than is visible in the numbers at this time. Plus, given the state of American health insurance, I’m not sure we will see reliable data any time soon. Many people in America avoid health care; it’s too expensive, and many people that are getting sick have no health care, and are not being counted. I expect we will see more reliable data from countries that have more usable health care such as the NHS or Canadian Medicare where people seek out health care less burdened by excessive costs.

But as other comments above and below point out, there does not seem to be any compelling evidence that even the slight uptick in American wages is causing this inflation. It is happening world wide. Instead we have supply chain problems, shortages, and a lot of excessive price gouging/profiteering paired up with decades of free money injected into the economy to prop up stocks, housing, etc. It’s almost as if many of our elites have put the greed dial at 11 to squeeze the last bit of blood out of the economy before The Jackpot takes hold.

Can we just see, with this very particular framing, that this dude is high off his rocker.

This is the guy that’s normally banging away about how low interest rates are bad, and public debt is bad, and “money printing” is bad, and now he’s actually highlighting that job security, and economic growth, are at risk if they turn the spigot off?

Who does he propose stimulate the economy, if the feds don’t do it?

Yeah, it’s great, that he’s showing the data for what it is, but he’s not telling it like it is.

We all have our blind spots. Unfortunately, Wolf repeatedly gets caught staring at the blinding sun of misguided monetary policy.

To be fair, he is right that the interest rate repression for decades is one of the causes. And Wolf does bang on the drums that the Fed needs to sell it’s assets.

And maybe Wolf realizes that our economy is really a mirage, and without the spigot it will show it’s true colors.

Agreed – there’s a middle ground between giving money to banks at 0 percent and jacking up rates 300 percent in a span of 9 months

We’ve had decades of inflation in healthcare, housing, education, national security, end the price for a mediocre CEO. High stock prices with low interest rates mean that its been getting more expensive to fund a retirement too. None of this was a problem for the Fed or the press. But now, OH MY GOD, the little people think their wages should keep up with the cost of everything else. We can’t have that.

Rail strike break…. true colors of the powers that be.

We need a new General: General Strike. Perfect time of the year for a General Strike.

They don’t need to strike, they just need to work to rule and slow things down.

Weren’t we all supposed to be replaced by robots and self driving cars? These days I’m bombarded with bezzos ads pimping warehouse slavery as “tech training!”…SMH… are they having that much trouble getting employees? Are’nt we supposed to be begging for the lash? oh and since I don’t have much time today I must add…Globalist Bankster! Globalist Bankster! Globalist Bankster! A bunch of religiously identified atheists and assorted true believers in the true god, The Almighty Market! All hail the Almighty Market!

Yeesh,

Show me your Smile! because the Economy anyone?

Don’t forget that ‘Globalist Bankster’ once was “House of Rothschild,” code speak for ‘Greedy Rich J–s.’ The old style was anti-semitic. However, as I learned as a teen on Miami Beach, there are a H— of a lot of poor j–s. So, it really is a class issue in disguise.

“Both of them — payrolls and total number of workers — are also far below pre-pandemic trends.”

it’s still creating demand for goods, services, and labor.

So yea uummm. fewer workers and less payroll producing more is causing inflation because workers are getting paid a little more but overall less and their little nudge up in wages is a bunch slower than inflation. so yea ummm it all works out if you look at it in a particular way so as to meet the narrative.

Has nothing to do with saddling debt on corps for stock buy backs and dividend payouts so if you fall a little in your margins you start to get into knee cap territory with your criminals err con men aah erm lenders. Or nothing to do with housing costs and rental costs going up or food prices going up cray cray cause of the gambling going on with it in leveraged volatile distillates of cash….. but yea all them workers demanding to get a bit of cabbage to make it through with a bit a dignity… how dare em cause this inflation problem.

Am still digesting these data, and it’s early morning here as well. Good points in the comments above (as usual!). If I understand correctly, older, close-to-retirement workers who left the workforce after the onset of COVID have not returned — and show no signs of wanting to do so (but see below). And because of this ‘problem’, Powell’s daft strategy is to force everyone to suffer (exempting very wealthy people like himself of course, whose boats will continue to float very well, thank you) a recession, and toss a lot of them out on the street as they lose their jobs, their homes, are unable to make rent, buy food, meds, etc. In another words, another neoliberal disaster.

Methinks Mr. Powell has little experience with trying to get (re)hired for a job, any job, with any significant skillset when over the age of, say, 45 (exempting of course, investment banker, I suppose). You are viewed as over the hill and a candidate for the wastebasket. To people I know in their forties, my advice is, “if you have a job now, like it, and need it, then don’t lose it”. The bias against hiring older workers, despite valuable experience and expertise that requires decades to develop, is something I stupidly never anticipated.

No mention of massive and surging corporate profits.

No mention of supply side shocks.

No mention the “wage price spiral” isn’t even keeping up with inflation.

With reporting this myopic, who needs Social Media?

So workers are extorting hand over fist from all the poor employers faced with cashiers, nurses and fry cooks that went home because of COVID. Not to mention all the largesse from stimuluses and ZIRP and just printing like it’s going out of style — dollars are flying around like bats in a barn.

It’s no wonder Blackstone had to raise the rent 75%, my kid’s health insurance is through the roof with an $8000 deductible, and a packet of ramen costs $2.25. I will rest easy knowing we got economic geniuses at the top, tirelessly working to keep too much money from slipping through the cracks and landing in anyone’s greedy pocket.

https://fred.stlouisfed.org/series/CIVPART/

This chart goed back to 1950 and the earlier days of post WWII economics.

Notable: The accelerating lower labor participation rate since 2000.

Also, that the labor participation rate used to rise again after recessions and that stopped happening in the 21st Century.

This looks like a continuation of the downtrend – longterm – in the labor participation rate and not any recovery.

And birth rstes can’t be the only factor.

Post-2000 are the heightened years of the opiod crisis (other drugs in some areas), increased mass shootings (including the not as heavily reported domestic violence), and chronic health issues like diabetes have seen an increase. And for those that say violent crime is down, it has to be considered whether the number of victims in an individual crime has increased.

With housing prices in the stratosphere, and real wages not keeping up, the only motivation that is given is “work or die”.

Why can’t birth rates be the only factor?.. I’m not saying it is, but it does a pretty good job explaining the trend. The baby boomer generation is now entirely above 55. It’s remarkable how much the partication rate peaked right as that generation was in its prime working years (also helped by women’s rates steadily increasing)

It’s actually surprising the overall participation rate held up as high as it did for so long. It required individuals to work longer and longer. The oldest segment of our population’s participation rates have been increasing for decades. Even with this post covid lull, rates are much higher then they were 20 years ago

The acceleration of the trend also has to be taken into account.

There has also been inflows of immigration to offset, slow the effects of the birth rate. So I’m thinking of other factors contibuting to the accleration of the trend – and the dates it picked up steam.

I would note the decrease in fertility rates also accelerates between 1960 and 1970. I agree though that immigration is also a factor

https://fred.stlouisfed.org/graph/?id=LNU01000000,LNU01000060,LNU01024230

We spend too much time on labor force participation rates.

The chart above looks at actual labor force levels by age groups [55+, 25-54 and total]. The residual is the age group below age 25. Since June 2007, the fastest growing age group through June 2022 was the 55+, at 11.6 million. Growth in the total labor force was 10.7 million over the same period. The youngest sector [<25 yrs] actually declined by 1.3 million.

The fastest growing group [seniors] will begin its inevitable decline as it ages and either retires or dies. The groups that follow lack the numbers to change the inevitable trajectory of the labor pool. It will barely stay even and may likely decline. That is the problem.

We're looking at a stagnent labor pool for the next decade or more unless our immigration policies are changed. Further, the financial markets will face increasing sell pressure to accommodate the needs of the senior group. Again, a more liberal immigration policy may help. Good luck with that.

inflation cannot be kept under control, nor will labor markets come back to what they were because, deregulation, privatization, free trade, tax cuts for wealthy parasites, jim crow laws, and slashing the social safetynets are inflationary to prices, and deflationary to wages.

in plain english, capitalism cannot self regulate, self correct, self police, capitalism is full of roped dopes.

the coin thing is a direct results of said economic policies that are pure nonsense. in a economy that can no longer produce real wealth except way over inflated paper assets instead of real production with skilled labor which is the real wealth of a nation.

the coin thing is simply to try to generate value, wealth, and a income stream off of nothing. its perfectly logical to the powers that be. its why it was never put out of business the minute it appeared on the horizon.

we are watching real wealth being produced at a astonishing rate out of russia and china, the direct results of communism, socialism, and central planning, and lenins prediction that free market capitalists, are prime fodder full of dopes to be roped.

https://www.dissentmagazine.org/article/the-legacy-of-the-clinton-bubble

The youngest possible entrants to the workforce are the results of decisions made 16 years ago. Far preceding the pandemic, but in the heart of our current round of wealth misdistribution. This seems to be ignored but is probably most important. Whether better wealth distribution would bring up birth rates in developed countries is crystal ball territory, given that declining birth rates have so far been a characteristic of developed countries.

A recent link explored how this is going to cause somewhat of an implosion in higher education as well, with fewer applicants for colleges. A justly deserved implosion, to be sure.

Real inflation is 20-25% based on everything I purchase, and unless there is a mechanism on the other end to keep inflation honest, such as 15% interest rates, there’s nothing to stop it from skyrocketing, and a thing to keep in mind that the entire developed world is on the same inflation footing, which has never happened before.

I mentioned the other day Panda Express was offering $17 an hour for new hires here in Godzone-which is the 6th poorest county in Cali, what happens when it buys the employees practically nothing and the highlight of their job really, is the free meals?

I live in an area with a bunch of genuine conservatives (as opposed to fascists) and religious Christian Fundie nuts. However, they all agree with me on two things: climate crisis/catastrophe, and craporate price gouging. Interesting, huh? Population decline is also happening cos climate crisis is affecting human fertility rates. They’re declining. Very interesting fact.

Lots of great comments here. All I have to add is the observation that this focus on monetary policy is the work of the illusionists distracting us from where the real action is — fiscal policy.

I believe the much altered structure of the u.s. economy is not captured in the current neoclassical macro economic models. Labor once represented a key factor of manufacturing — the production of goods. Much/most of u.s. manufacturing was off-shored, along with ‘Labor’. Labor used to mean full-time employment with benefits and to a certain extent represented an aggregate component of the economy with the political power to offer some counter-balance to the political power of Capital and of Wealth. That ‘Labor’ is no more. And what of Capital? Most Capital in the neoclassical model departed from the u.s. the same time ‘Labor’ was extinguished. The new Capital is pricing and buying power represented in the growing monopolies grabbing larger and larger shares of the economy. Wealth has spread into new forms or at least certain of its components have grown out of proportion to the others. The saying garbage-in-garbage-out presupposes the model the garbage feeds, but what if the model is false and deceptive? Neoclassical Macroeconomic models aggregate the functional units of the economy into components that no longer exist in the real u.s. economy. Where is Banking and Finance? Where is Insurance and Real Estate? Where are the other growing players in the Great Game of economics and political power — players like the Medical Industrial Complex, the MIC, Big Oil, Big Agriculture, the Education Industrial Complex along with numerous smaller players fighting tooth and claw for their piece of the u.s. economy and their piece of the u.s. Populace? And what of the World outside in a Global Economy? Where are the model components aggregating the players manipulating the wide wide world?

I believe the current laser-focus on ‘Labor’ as a factor through which the Fed might control inflation is a smelly red herring. I do not pretend to grasp the full picture of the current Great Game — but I do smell a stunning reek of something more than mere Elite incompetence or stupidity. Fossil Fuels are a key input to the economy. The aggregate Fossil Fuels tends to hide their underlying complexity. Fossil Fuels are a very large aggregate of many products which serve as the basic input in the production of many child products. Fossil Fuels in the form of diesel are crucial to transportation and agricultural production. If Fossil Fuels, especially those best suited to producing diesel are cut-off or constrained in amount through embargo or the actions of a cartel, anyone who lived through the 1970s knows that inflation will result. However, any such person should also be aware that even in the 1970s ‘Labor’ was a vanishing and waning economic player, though it still had the ability to push up wages — at least for the lucky few who were members of one of the Big Unions. Are we really expected to be so gullible as to believe the same old story the Fed told in the 1970s? I am afraid the Elites believe they have sufficient coercive force backing them that they do not really care what the Populace believes as long as the Fed has a pretty story to tell to stifle and befuddle the credulous.

Recalling the ample generosity to Big Banks and Finance wrapped under the CARES Act’s trickle to the Populace, I wonder whatever became of that largess. I suspect it retired a lot of bad bets and also filled Banking and Corporate war chests with heaps of low interest money. If so, how much of the money in those war chests remains ready to play havoc in an assets market momentarily crushed by rapid and substantial increases in interest rates. The Fed is not independent of the Banks. How many Banks and Finance Firms were surprised by the interest rate hikes?

> . . . mere Elite incompetence or stupidity.

This is not what we have. We have elite intelligence and competence. They use that to crush peasants for profit, present corrupt politicians that have their lips glued to elite asses and do their bidding no matter how horrible life is for the peasant.

Democracy and capitalism is a figment of our imagination. We have neither.

The misery index – line goes up.

Thanks very much for this post.

Important, imo.

How does the US economic model works? Using soft and hard power to import goods without delivering US made goods and services in exchange? In other words running 30 years negative Current a/c balance. These negative balances are invested back in the US and result is oversupply of capital in the US. The country is getting richer and richer, interest rates keep declining and funding speculation and unproductive investments (US social system, defense, security, social science CVs at universities, etc.) becomes easy. The result? Lots of jobs created in these unproductive areas. Are higher interest rates the solution? Probably not because higher rates will hit mainly productive sphere and not the areas where all these unproductive jobs were created. These areas are funded by government money which can print them if there is consensus in the system. So the real solution is to cut government funding. Good luck with that.