Dean of quantitative investing and critic of public pension fund and endowment performance Richard Ennis sent along a delicious article, Should CalPERS Fire Everyone and Just Buy Some ETFs, by Chief Investment Officer and analyst Meb Faber. Faber, who manages an over $1 billion fund, has little respect for CalPERS and Betteridge’s Law.

I hope Mr. Faber will not take umbrage at my quoting liberally from his piece, since I imagine he’s more interested in having his ideas get wider exposure than driving traffic to his site. And as a matter of good order, CalPERS can’t fire everyone. It is a large health insurer and also has a very large operation keeping tabs on employer payments to the fund and paying member benefits. But gutting the investment office is indeed a sound idea.

It’s noteworthy that one or Faber’s findings amounts to saying that CalPERS is overdiversified. In a recent article on endowment performance, Ennis surmised that a major reason they underperformed public pension funds, despite being supposedly more sophisticated, is overdiversification. From our 2021 discussion of that paper:

Ennis’s analysis paints an extremely unflattering picture. One way to summarize it is that endowments’ staff and their outside managers have added negative value, or in finance-speak, negative alpha. Note that Ennis’ estimate is charitable since he does not add in the cost of the endowments’ investment offices, which run to 0.50% to 0.75% of assets. And on top of that, all of their machinations, um, exercises in diversification, have achieved absolutely nothing. Their results are functionally the same as being fully invested in US equities. From his overview:

Endowments have underperformed by 2.5% per year over the 13 years ended June 30, 2021. I estimate that endowments’ annual cost of investing is approximately 2.6% of asset value. Given the extreme diversification of the composite, which comprises more than 100 large endowment funds with an average of more than 100 investment managers each, there is every reason to believe that cost is the principal cause of endowments’ poor performance. During the most recent 5–7 years, which I refer to as the Modern Era, endowments have exhibited an effective US equity exposure of 97% of asset value, with frictional cash accounting for 3%. The overwhelming exposure to the US equity market raises important strategic questions related to risk tolerance and diversification for trustees and fund managers.

Ennis’ findings that overdiversification was the likely culprit for investment bad outcomes is consistent with his 2020 public pension fund study that found that their investment programs generated negative alpha, as in destroyed value, and CalPERS was one of the worst sinners. In this and other analyses, Ennis focused on the other big performance drag, alternative investments (real estate, hedge funds, and private equity). From New Study Slams Public Pension Funds’ Alternative Investments as Drag on Performance, Identifies CalPERS as One of the Worst “Negative Alphas”; Shows Folly of CalPERS’ Desperate Plan to Increase Private Equity and Debt and Go Bigger Using Leverage:

Ennis’ conclusions are damning. Both the pension funds and the endowments generated negative alpha, meaning their investment programs destroyed value compared to purely passive investing..

Educational endowments did even worse than public pension funds due to their higher commitment level to “alternative” investments like private equity and real estate. Ennis explains that these types of investments merely resulted in “overdiversification.” Since 2009, they have become so highly correlated with stock and bond markets that they have not added value to investment portfolios. From the article:

Alternative investments ceased to be diversifiers in the 2000s and have become a significant drag on institutional fund performance. Public pension funds underperformed passive investment by 1.0% a year over a recent decade…

For a decade [starting in 2009], stock and bond indexes have captured the return-variability characteristics of alternative investments in composites of institutional funds, for all intents and purposes. Alternative investments did not have a meaningful effect. The finding that the correlation between funds with significant alts exposure and marketable securities benchmarks is near perfect runs counter to the popular notion that the return properties of alts differ materially from those of stocks and bonds. That, after all, is an oft-cited reason for incorporating alternative investments in institutional portfolios. As we see here, however, alt returns simply blend into broad market returns in the context of standard portfolio analysis in the latter decade.

….Ennis found the median cost of the mismanagement by the 46 public pension funds as roughly 1% per year. CalPERS is a standout in the “negative value added” category, ranking 43 out of 46, with a “negative alpha” of 2.36%. This is a particularly appalling scoring, since CalPERS has far and away the largest and best paid investment office of any US public pension fund.

Back to the present post. The reason for the stage-setting with quant/fund performance maven Ennis’s work is that Faber, even though he calls for getting rid of CalPERS’ investment office, he is less negative about CalPERS’ than Ennis, merely finding them to be lackluster as opposed to negative value added. How can that be?

Faber is far too charitable to CalPERS. He looks at their results since 1984. As incredible as it may seem, CalPERS had a vigilant board and highly respected Chief Investment Officers though the early 2000, when Fred Buenrostro became Chief Executive Officer and was then later convicted and sent to prison for taking bribes. CalPERS has never recovered. Its later CIOs were light on investing experience.

In addition, by going back to 1984, Faber picks up the period when CalPERS started investing in “alts,” particularly private equity (starting in 1992). The so-called “vintage years” of 1995 to 1999 produced stellar performance since there had been a leveraged buyout bust in the late 1980 through 1992 and funds that were buying companies in the early 1990s got great bargains. That situation had gone into reverse by 2006. Oxford professor Ludovic Phalippou has determined that private equity stopped outperforming public stocks starting then. Too much money chasing too few deals! And remember, private equity, due to illiquidity and higher risk (leverage) is supposed to beat public stocks, not merely match its returns, to justify investing in it.

Remember also, as we have pointed out regularly, that various analysts accept private equity results as reported. Yet private equity is the only major investment strategy that is not subject to independent third-party valuation of its assets.

So even with giving CalPERS credit it does not deserve, he still deems CalPERS’ performance to be too poor to justify all the wheel-spinning by its investment staff. Key points from his post:

“He was a U.S.-class smooth politician, which is the only way you’re going to survive in that job. It has nothing to do with investing.”

That’s how Institutional Investor recently described a former CIO of the California Public Employees’ Retirement System, also known as CalPERS.

The description is especially interesting when considering that the “I” in “CIO” stands for “investment,” which raises an eyebrow at how the role could have “nothing to do with investing”….

The staggering waste of CalPERS market approach

CalPERS’ stated mission is to “Deliver retirement and health care benefits to members and their beneficiaries.”

Nowhere in this mission does it state the goal is to invest in loads of private funds and pay the inflated salaries of countless private equity and hedge fund managers. But that is exactly what CalPERS’ does.

The pension’s Investment Policy document – and we’re not making this up – is 118 pages long.

Their list of investments and funds runs 286 pages long. (Maybe they need to read the book “The Index Card”.)

Their list of investments and funds runs 286 pages long. (Maybe they need to read the book “The Index Card”.)

Their structure is so complicated that for a long time, CalPERS couldn’t even calculate the fees it pays on its private investments. On that note, by far the biggest contributor to high fees is CalPERS’ private equity allocation, which they plan on increasing the allocation to. Is that a well thought out idea or is it a Hail Mary pass after years of underperformance…

Let’s examine CalPERS’ historical returns against some basic asset allocation strategies.

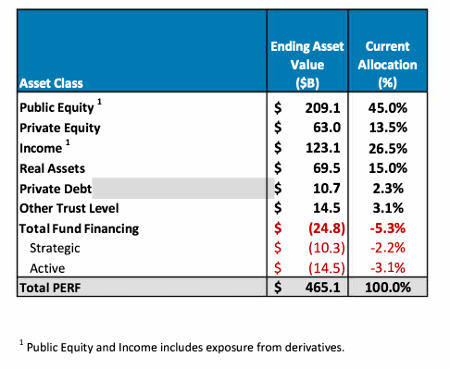

We’ll begin with CalPERS’ current portfolio allocation:

Source: CalPERS

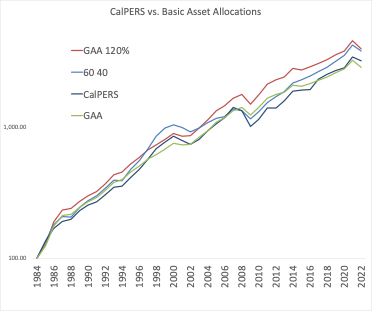

Now, that we know what CalPERS is working with, let’s compare its returns against three basic portfolios beginning in 1985.

- The classic 60/40 US stocks and bonds benchmark.

- A global asset allocation (GAA) portfolio from our book Global Asset Allocation (available as a free eBook here). The allocation approximates the allocation of the global market portfolio of all the public assets in the world.

- A GAA portfolio with slight leverage, since many of the funds and strategies that CalPERS utilizes have embedded leverage.

Source: CalPERS, Global Financial Data, Cambria

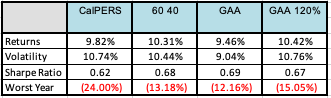

As you can see from the table, from 1985-2022 CalPERS fails to differentiate itself from our simple “do nothing” benchmarks.

To be clearer the returns are not bad. They’re just not good.

Consider the implications:

All the time and money spent by investment committees debating the allocation…

All the time and money spent on sourcing and allocating to private funds…

All the time and money spent on consultants…

All the time and money spent on hiring new employees and CIOs…

All the time and money spent on putting together endless reports to track the thousands of investments…

All of it – absolutely wasted.

CalPERS would have been better off just firing their whole staff and buying some ETFs. Should they call Steve Edmundson? It would certainly make the record keeping a lot easier!

Plus, they would save hundreds of millions a year on operating costs and external fund fees. Cumulatively over the years, the costs run well into the billions.

Personally, I take the “I” part of the acronym very seriously and have offered to manage the CalPERS pension for free.

“Hey pension funds struggling with underperformance and major costs and headcount. I’ll manage your portfolio for free. Buy some ETFs. Rebal every year or so. Have an annual shareholder meeting over some pale ales. Maybe write a year in review.”

I’ve applied for the CIO role three times, but each time CalPERS has declined an interview.

Faber is also being kind in his characterization of the results, even using a time frame that is extremely flattering to current CalPERS management. If you look at the second table, it shows CalPERS has the second worst returns, with volatility barely distinguishable from the strategy that scored 60 basis points higher. A difference like that adds up over time. So I would not deem the results to be just “not good”. They are mildly bad.

The rest of the post is similarly readable and has fun analyses. Faber then looks at the storied hedge fund Bridgewater:

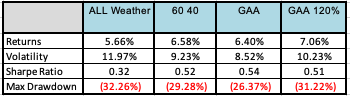

In 2014, we set out to clone Bridgewater’s All Weather” portfolio – an allocation that Bridgewater says has been stress-tested through two recessions, a real estate bubble, and a global financial crisis.

The clone, based on a simple global market portfolio comprised of indexes, did a good job of replicating Bridgewater’s offering when back tested. More importantly, running the clone would have required zero hedge fund management costs and lockups, and wouldn’t have been weighed down by any tax inefficiency. To be fair, this backrest has the benefit of hindsight and pays no fees or transaction costs.

The All Weather portfolio, with its focus on risk parity, shows that if you’re building a portfolio you don’t necessarily have to accept pre-packaged asset classes….

So clearly the world’s largest hedge fund should be able to stomp an allocation one could write on an index card?

Once again, from 1998-2022 we find that a basic 60/40 or global market portfolio does a better job than the largest hedge fund complex in the world.

Source: Morningstar, Global Financial Data, Cambria

One may respond, “OK Meb, All Weather is supposed to be a buy and hold portfolio. They charge low fees. You want the good stuff, the actively managed Pure Alpha!”…

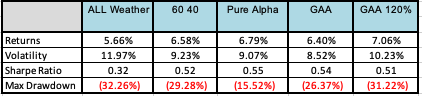

Let’s now bring the Pure Alpha strategy into the mix. Below, we’ll compare it with All Weather, the traditional 60/40 portfolio, and the Global Asset Allocation (GAA) portfolio from our book and above. Finally, the risk parity strategy uses some leverage, so we also did a test with GAA and leverage of 20%.

The replication strategy back tested the portfolios’ respective performances between 1998 and 2022.

Once again the returns of Pure Alpha were nearly identical to the GAA and 60/40 portfolios, with performance differing by less than 0.5%. And don’t miss that Pure Alpha actually trailed the leveraged version of the GAA portfolio.

Again, this isn’t bad, it’s just not good…..

Here’s the problem. Many of these hedge fund and private equity strategies cost the end investor 2 and 20, or 2% management fees and 20% of performance. So that 10% annual gross performance gets knocked down to 6% after all of those fees.

So yes, perhaps Bridgewater and other funds do generate some alpha, the problem is that they keep it all for themselves.

Here I am going to quibble further with Faber. He assumes that public pension funds (and presumably other institutional investors, like endowments) are in the business of getting the best return possible given their risk tolerance.

But that is not what that sort of investing is about. First, it’s about liability avoidance via following Big Consultant sanctified investment allocations, whether they add any value or not, and going through a process of looking like you’ve vetted investments in accordance with again some sort of seen-as-orthodox approach.

Second, the wasted fees are a feature, not a bug. For universities, those big hedge, private equity, and real estate funds have firm heads and other partners who are highly sought after donors. I’ve been told by private equity fund salesmen that endowments in particular do virtually no due diligence. It’s as if it’s against club rules to do so.

Similarly, prominent CalPERS beneficiaries contend that the reason the giant fund is so doggedly loyal to high-fee strategies like private equity is that it is understood that the fund principals will grease the wheels of political incumbents. There’s no ready way to prove that, but it’s not crazy. Another motivation is staff corruption. Private equity staffers get permitted bribes in the form of going to fund annual meetings (which are really the fund staffers selling, not disclosing) at fund expense at lavish venues with top tier entertainment and food. Many are allegedly afraid of having a PE firm insist on their firing if they recommend against a fund manager their employer has invested in before (from what we can tell, it is a complete urban legend as to whether this has ever happened, but that does not mean the fear is not real). Another bad staff motivation for currying favor with private equity firms is the naive belief the the private equity manager could help them get a job when they chose to leave.

So this is yet another reminder that CalPERS is not helping beneficiaries or California taxpayers. But you had probably worked that out.

Delicious article.

How much does political pressure on Board, and lobbying money by PE and others, drive the inane operations? The unstated CalPERS motto must be Fiduciary, shmiduciary!

Yes.

The only drawback will be an increase in the mentally ill homeless population.

Which is much less harmful than leaving the mentally ill in charge of CalPers.

The penultimate paragraph sums-up the situation quite well. Follow the money…

By the way, it is quite easy to “prove” that Private Equity and Real Estate Investment owners/managers are generous political donors. However, state-level officials and labor bosses are merely concerned about getting “credit” for “behesting” campaign money to the national party organizations. This relieves them from the obligation to fundraise for the national parties, while theses kick-backs are untraceable to them personally.

Of course, the Private Equity and Real Estate moguls are merely kicking-back a paltry 5-percent or so as actual contributions and most of the fees “stick” — setting aside for the moment how Private Equity and Real Estate Investment also fund the Military-Industrial Complex that is the only American economy left (see yesterday’s Water Cooler Nation link about Jake Sullivan’s “Military Keynesianism”) . This still amounts to tens of millions of dollars to grease the wheels of the Inverted Totalitarian political machine.

Sadly, Faber and Ennis have proven exactly what the shills on the CalPERS Board would tell you: That CalPERS performs no worse than most other indices while merrily laundering billions to the political parties and keeping the financiers happy. All in exchange for “wetting their beaks” on a junket to a nice hotel every now and again. This system is profoundly corrupt and contains internal contradictions which may eventually cause the entire house of cards to collapse, but the attitude is IBG/YBG.

Forget it Jake. It’s Chinatown.

Since the iron rule of investing is to avoid unnecessary fees, I bought the S&P 500 Index Fund without professional help and have been pleased with its performance.

Good on you for sharing this, Yves, I agree the author will be more interested in widespread view of his thoughts than in driving traffic. Have you shared a link to this for if you’re mistaken so you may drop the NC article? Just in case. Anyway, it’s my opinion ETFs and bonds, typical 60/40 split, likely beats almost any human on this earth except maybe the 2 & 20 crowd, and I bet it beats a LOT of those types, too.

Private Equity is very, very profitable – FOR the GPs. They have hired some of the world’s best salesman. We all like getting our egos stroked and the private asset salesman are very good at it.

In the long run PE is still equity, company ownership. It must track the overall equity market. PE companies tend to be smaller, leveraged and illiquid all of which has to shown to lead to higher returns. The industry and the pension funds tend to either ignore or overlook that the higher returns are a function of higher risk. The industry does not claim high risk-adjusted returns; just high returns.

The reported diversification all comes from the timing and method of measuring valuation. People paid for assets under management are unlikely to lowball values.

Long live high rent extraction!

I don’t see how the looters can be dislodged, just as I can’t see how those in dc and thruout the country can be. Corruption is simply too extensive to stop, and getting worse by the day. Ukraine is dead, long live the new Ukraine.

I’m so old not so as not to worry, Calpers will last long enough for me… apres-moi le deluge.

Perhaps, in relation to articles titled “Should CALPERS [do things differently]?”, one could formulate a principle that the answer is always “yes.”

Call it “Worsepoor’s law.”

The Board is more interested in diversity (politics by another name) than returns. It is rampant throughout the organization but particularly in the Investment Office. The cost is a few percent a year (adds up in a $400B+ fund) to enrich largely unqualified staff. GPs don’t mind and stay silent/subservient as they skim the majority of those few hundred basis points.

Thanks for continuing to keep tabs on CalPERS. What’s the saying? “Past performance is no guarantee of future results.” Interesting to think my small flyover state’s public pension is in relatively better shape and better managed than CalPERS.

Thanks for your continued reporting on CalPERS, pensions, and PE.

About 10 years ago I pitched a quant solution to them

To address the above said problem that plagued all multi manager platform like theirs :1) law of large number (no risk or no active bet) 2) agency issue where allocator has no consistent way to access sub advisor actions. They had roughly 50% in public equity at the time (now 45%) spread over 60 managers. The total holdings spread over 7,000 stocks and tracking error against either their own custom benchmark or broad market was merely 17 basis points. They at the tight hugged the index tighter than the ETFs. Yet they average fees paid to managers were north of 50 bps. This means these managers collectively have to achieve IR over 3 to make this break even. Privately we considered this is more a rentiers situation. Yet the public display of probity is just as comical : they declined the bottled water we offered for the meetings. They brought their own. All the while retirees money that trickled away.