The 1677 Statute of Frauds: History We Neglect at Our Peril

Have you ever signed a document disposing of something valuable, like a house or your estate? Did you find you needed to get it witnessed, and that the witnesses couldn’t be family members, and had to put their addresses on the document too? Then it may surprise you to learn that you are following legal precepts established by a long dead Welshman; this one, in fact:

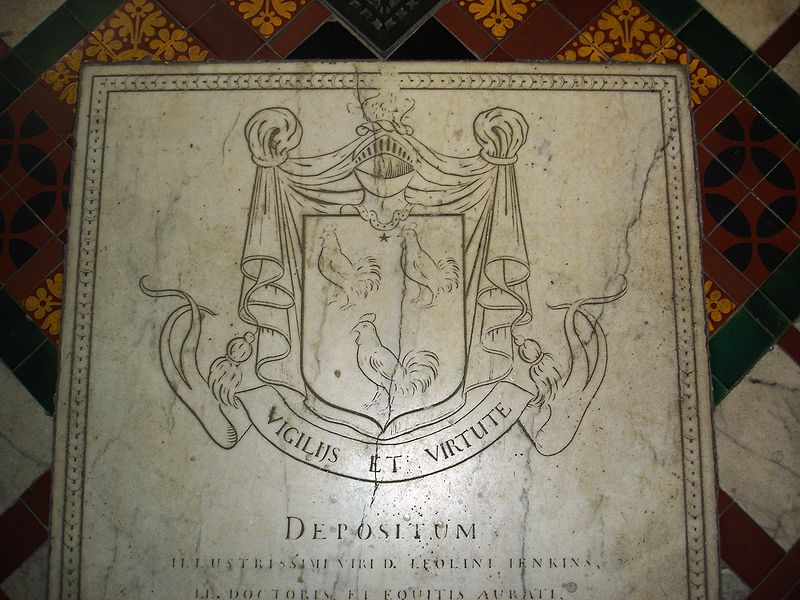

[caption id="attachment_14376" align="alignnone" width="631" caption="Sir Leoline Jenkins (hat tip Wikipedia)"] [/caption]

[/caption]

whose tomb is at Jesus College, Oxford; oddly, no more than ten minutes’ amble from where I am sitting, carving out this post. I like the way his “Llewellyn” has been semi-Englished to “Leoline”. Right now, he is probably spinning, at a fair clip, for he is the originator of the Statute of Frauds.

Read more...