Yves here. This post by Steven Horn about that shows the typical terms of an oil and gas rights lease for American Energy Partners buries the lead, in that Steve needs to give the context of how the lease came to be public before he turns to explaining how the lease rips off the party who signs it. Among other things, it requires the homeowner to have any mortgage made subordinate to the royalty agreement, something no lender will agree to. If the homeowner can’t get the subordination (a given), no royalties will be paid! As you’ll see, there are other “heads I win, tails you lose” terms in these agreement.

By Steve Horn, a freelance investigative journalist and past reporter and researcher at the Center for Media and Democracy. Originally published at DeSmogBlog

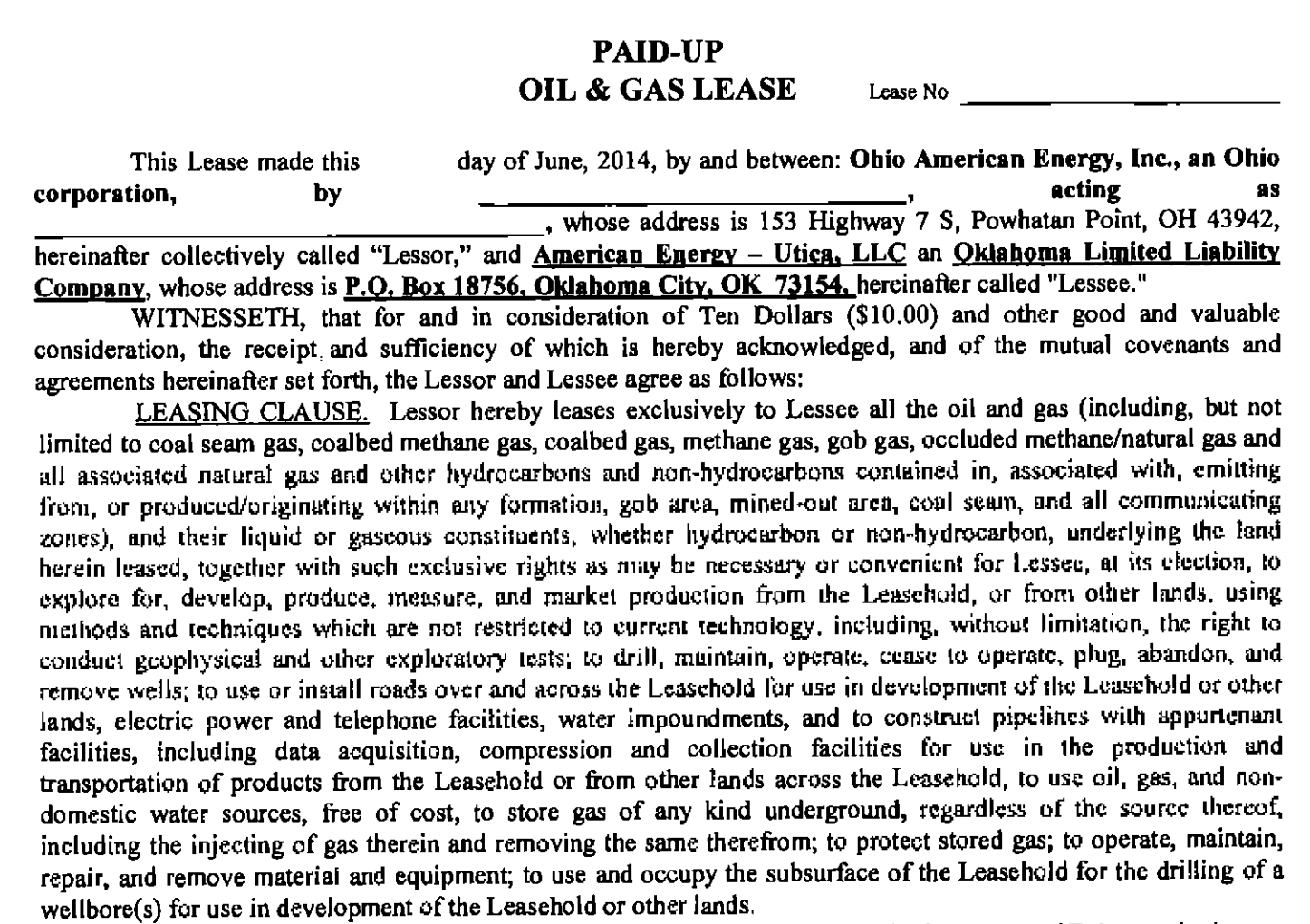

DeSmogBlog has obtained a copy of a sample hydraulic fracturing (“fracking”) lease distributed to Ohio landowners by embattled former CEO and founder of Chesapeake Energy, Aubrey McClendon, now CEO of American Energy Partners.

Elisabeth Radow, a New York-based attorney who examined a copy of the lease, told DeSmogBlog she believes the lease “has the effect of granting American Energy Partners the right to use the surface and subsurface to such a great extent that it takes away substantially all of the rights attributable to homeownership.”

The American Energy Partners fracking lease was shaken loose as part of the discovery dispute process in an ongoing court case pitting coal industry executive Robert E. Murray — controversial CEO of Murray Energy Corporation and American Energy Corporation — against McClendon in the U.S. District Court for the Southern District of Ohio Eastern Division.

Murray brought the suit against McClendon back in August 2013, alleging McClendon committed trademark and copyright infringement by using the “American Energy” moniker. Murray’s attorneys used the lease as an exhibit in a Motion to Compel Discovery, filed on September 8, over a year after Murray brought his initial lawsuit.

The case has ground to a slow halt as the two sides duke it out over discovery issues and related protective order issues, making a large swath of the court records available only to both sides’ attorneys and causing many other records to be heavily redacted.

Out of that dispute has come the American Energy Partners lease, published here for the first time.

McClendon’s Company Sent Murray a Lease

As part of ongoing discovery-related legal battles, the McClendon legal team argued against handing over an unredacted copy of a sample lease requested by Murray Energy because — as it stated in a June 24 letter that is now part of the court record — Murray has yet to demonstrate the “leases are reasonably calculated to lead to the discovery of admissible evidence.”

In other words, they’re arguing that Murray’s team hasn’t shown how getting its hands on a sample lease has anything to do with the legal case it is making: that McClendon’s company had infringed upon its trademark and copyright.

Murray’s team subsequently threw a mighty counterpunch.

In its September 8 Motion to Compel Discovery, the Murray team submitted that McClendon’s company — while arguing in court against providing a lease — had actually sent a lease packet to Murray Energy Corporation on June 5 via lease-buying company Purple Land Management. They attached the lease as an exhibit to the motion.

That lease doled out to Murray Energy Corporation set off legal alarm bells for the Murray legal team. Murray’s attorneys argue that the lease completely undermines the McClendon team’s discovery-related legal case, while also cutting straight to the heart of what their legal complaint centers around: McClendon’s use of the name “American Energy.”

Murray’s legal team argued that the content of the American Energy Partners lease itself could cause “potential and actual confusion” about the “American Energy” name and which company is which. They pointed to numerous examples of such confusion both in the September 9 Motion to Compel Discovery, as well as in a more recent October 13 Motion in Opposition to the Protective Order and an accompanying exhibit.

Lease Allows Fracking and Waste Injection

The American Energy Partners’ lease itself is 11 pages long and Radow — author of the article, “Homeowners and Gas Drilling Leases: Boon or Bust?,” published by the New York State Bar Association Journal — says it is more harmful to land-owners than an earlier lease doled out by Chesapeake Energy. Radow supplied DeSmogBlog with a copy of a Chesapeake Energy lease from December 2009 for sake of comparison.

Radow pointed out two big differences between the December 2009 Chesapeake lease and the June 2014 American Energy Partners lease.

“One significant addition to this lease involves the right to suspend payment of royalties to a property owner with a prior mortgage until a subordination of mortgage is delivered in a form acceptable to American Energy obtained at the cost of the property owner,” Radow told DeSmogBlog via email.

“Educated mortgage lenders are well aware of the risks to their mortgage collateral associated with hydraulic fracturing and will be unlikely to subordinate their interests to the gas company. If they do refuse to deliver a subordination agreement, this clause gives the gas company a free pass on drilling a mortgaged property without paying royalties.”

The other main addition to the June 2014 version: it permits injection of “hydrocarbon related substances from any source” on a homeowner’s property for payment of just $1,000.00 per year,* proportionately reduced to the homeowner’s interest in the estate (“estate” is likely intended to mean the homeowner’s proportionate interest in the spacing unit).

“Once the lease term expires, if no drilling operations are in effect, American Energy has the unilateral right to extend the lease indefinitely to use the subsurface to inject waste,” explained Radow.

“One possible effect of this clause is to entitle American Energy to sign leases on properties with existing wells and only use that property for deep well injection of waste. Without fully understanding the ramifications to a drinking water supply of injecting toxic and radioactive waste below a person’s family residence, this unregulated practice could potentially transform a residence into a property unsuitable for habitation.”

Radow also cited the risk of earthquakes caused by fracking waste injection in Ohio — and beyond — and the loss of value that could impose upon a home.

“Homeowner’s insurance does not cover hydraulic fracturing operations and the lease has no provision for insurance,” commented Radow. “Even if the homeowner, at its expense, or American Energy, at its expense, were to purchase earthquake insurance endorsements to their existing coverage, it is not at all clear that the added insurance will cover manmade earthquakes.”

Junk Debt Fuels Second Land Grab

While the U.S. shale boom currently faces free fall mode with the global price of oil plummeting, McClendon’s company appears to be repeating the ways of its precursor, Chesapeake Energy, by going full-throttle into “land grab” mode.

Most recently, Bloomberg reported that sources say American Energy Partners may soon buy up Freeport McMoran’s acreage in California’s Monterey Shale, a basin whose oil-producing potential was downgraded by 96-percent by the U.S. Energy Information Agency in May 2014.

Bloomberg also reported that American Energy Partners has relied on low-rated rated junk debt bonds as capital to finance its land buying spree, graded Caa1 by Moody’s, which Bloomberg described as “a level that’s seven steps below investment-grade and indicative of ‘very high credit risk.’”

“Prices on $1.6 billion of speculative-grade bonds sold by the upstart exploration firm of former Chesapeake Energy Corp. chief Aubrey McClendon have plunged as much as 19 percent since being issued in July,” wrote Bloomberg.

In the history portion of its website, Chesapeake calls the period between 2003 and 2007 its “Executing the Land Rush Plan” phase.

“During this time, we rapidly increased our acreage positions in these unconventional plays as we won what we have called the ‘gas shale land grab,’” says the website. “We believed that by winning this land grab, we could establish Chesapeake as the premier U.S. natural gas producer for decades to come.”

McClendon has also publicly stated that flipping land is more profitable than selling gas.

“I can assure you that buying leases for x and selling them for 5x or 10x is a lot more profitable than trying to produce gas at $5 or $6 per million cubic feet,” he once said on an investor call.

An Exhibit found within court records from the Murray v. McClendon case shows American Energy Partners has posted newspaper advertisements reading “We are drillers, not land flippers!,” likely an attempt to differentiate the new start-up company from the past deeds of Chesapeake Energy.

Yet, the content of the American Energy Partners lease served to Murray Energy, the company’s current on-the-ground activity nationwide and McClendon’s Cheasapeake Energy “land grab” track-record tells another story: that of another land grab well in the making.

Murray Energy Corporation CEO Robert E. Murray; Photo Credit: YouTube Screenshot

Now that would be something, an insurance lawsuit against a landowner premised on the earthquake coverage only covers natural and not man made earthquakes. Have an insurance company bring in the experts to prove in court that fracking causes earthquakes. I wonder who would want to weigh in on that court case.

Unbelievably lousy leasing terms for the homeowner.

There should be legally required consumer protection language in plain English as part of this lease–“Truth in Fracking” stuff.

Having lived in Louisiana for many years, the question of the conveyance of the oil and gas lease from owner to owner comes up. There are many properties in Louisiana where you buy the land and don’t get the mineral rights. Since fracking is showing a massive propensity towards degradation of habitability of the surface lands, who gets relief? Can a landowner and tenant sue for compensation when the land in question becomes uninhabitable? Does the mineral rights leaseholder take precedence? If damages are awarded, who gets them?

Finally, I’m wondering if some sort of sub surface eminent domain clause is in the works. Splitting the surface layer off from the deep sub surface layer would seem to be an optimal strategy for the looting class.

I’m not sure what you mean, ambrit. There is already forced pooling, which is a form of eminent domain.

It would be interesting to see whether one could claim that forced pooling was an unlawful taking by introducing evidence that the other landowners had entered into the leases at far less than market value, or that the result would result in the surface becoming unusable. Cases such as structure damage due to subsidence from mining operations come to mind.

Thank you Winston, I was wondering about that. I did know that parcels of a certain size within a defined radius from the drilling site get shares of the royalties automatically. Where there are shared returns, shared responsibilities are the logical outcome.

Now I’m thinking about “pooled liability” for the drillers of a shale play.

It should be noted that if a subdivision is developed the mineral owner typically has to execute a waiver of surface rights. Of course with horizontal drilling its easier to get access without the surface rights, since you can typically put one drill pad per square mile. If the waiver is not executed then mortgages may not be available.

As to the habitablity question, I have not heard about much of an issue in the Barnet which lies under a good part of Fort Worth.

Thanks for posting this, Yves. One would think it might be important information for Ohio voters to have before the Nov. 4 election. I have forwarded the link to several reporters at the Cleveland Plain Dealer and NPR station WKSU, but doubt anything will come of it.

Energy Partners needs a Class II UIC permit from either the state or EPA before injecting drilling waste. Although I suppose there is no particular reason for that requirement to be included in a lease agreement, the fact that it’s not mentioned interests me. I wonder if they are planning to apply for those permits.

subordinations are quite standard – ask any bank in an active play.

injection wells: quite uncommon, never in a standard lease. Require special permitting/review form OG commission. And , can’t be forced onto a mineral owner. Unless they don’t read the lease, and even then probably not….

Here’s the thing: the lease has the potential to be in effect for as long as production/activity holds it – could be 20 years. So obviously it behooves the MO to get an attorney and negotiate the lease. Common sense.

Ex. I had an acquaintance who signed a lease, after i told him it was an extremely poor offer. He got spooked after the leasing co. shot down his negotiations for better terms, and caved. Now he has 6 wells on a 1 acre pad on his back 10 acres. And among other things he didn’t even get a vertical pugh clause. He’s married to that lease.

What is a “vertical pugh clause”?

Vertical pugh clause: the o/g co is going after a specified formation, at a spec’d depth so the lease should specify that only that formation can be held by production. That enables the MO to have the potential to lease other strata that may be viable, in the future. A depth clause is another way to accomplish that.

w/o that , everything, all depths and strata are leased and hbp. in older larger fields , oil co’s are able to lease new undeveloped zones that have been held by the production from the original lease to another co bc they control it.

That makes total sense. Why “Pugh”?

Pugh Clause – Understanding the Horizontal & Vertical Pugh Clause

(via google)

No way will a bank accept subordination on a residential mortgage. They get no extra income and they impair their rights, and they have to spend staff time to agree. And if it has been securitized, which the overwhelming majority are, it simply can’t be done.

well perhaps subs have a different purpose for an oil and gas lease. here is the body of a Sub i just sent out. As I read it, it is essentially trying to preserve the validity of the lease – doing so i think simply reinforces the original title and lease, and therefore the legal integrity of the entire Pooled Unit. In other words, if a lease were to become invalid somehow, it would create a cloud on title, which i suppose would create problems for the insurance/financing end of things.

NOW, THEREFORE, in consideration of the premises and to encourage exploration and development of the above described lands for oil, gas and other minerals, the lien of the above described mortgage, deed of trust or other security instrument is hereby subordinated to the interest of the said lease owner under and by virtue of said lease and the undersigned hereby consents and agrees that said oil and gas lease shall have the same validity, priority and effect as if executed, delivered and recorded prior to the date of the execution of said mortgage, deed of trust or other security instrument; provided, however, that nothing herein contained shall operate in any way to alter, change or modify the terms and conditions of said mortgage, deed of trust or other security instrument, or in any way to release or affect the validity of its lien upon the real estate covered thereby, or upon their landowner’s royalty reserved in said oil and gas lease, or to affect the priority of said line, except as herein provided.

Regardless of any provision which may be contained in said mortgage, deed of trust or other security instrument whereby the undersigned or his successor in interest may have a right to rentals, royalties or other lease payments which may be payable under said lease, the undersigned hereby expressly authorizes and directs that such rentals, royalties or other lease payments may be paid to the Lessor of the above described oil and gas lease or his successor in interest in accordance with the terms of said lease or any amendment or revision thereof; provided, however, that this authorization and direction may be revoked by the undersigned or their successors in interest by giving written notice of such revocation to the said lease owner or its assigns by registered mail.

I re read the article. I think the company is seeking leases for injection wells, and may have been devious in that regard, ie hinting that they may drill a well. Hence the court battle.

Getting royalties from a well is one thing, getting 1k ( or less ) a year to have toxic sludge pumped/stored underground is another. From the perspective of an “injection well lease” – i would guess that a bank would be predisposed to turning it down. I haven’t had any experience with injection wells, just my opinion.

And then to see that the lease puts the onus of getting the sub on the lessor….ouch. Very shady.

a search on NDRIN ( north dakota recorders info network) shows 257 subs from banks in one county ( 1990-current) . “sub of mortgage to oil and gas lease”

a good amount of counties are online these days……particularly those in o/g plays.

Well I just got back the Sub i sent out last week and have sent it in to be recorded. The Bank ASBT, Williston ND, had no problem with it. The sub was for a residential mtg in which the lands have been pooled into a 1280 acre Unit, with several producing wells. I wanted to clarify this for posterity, since i have seen a lot of misinformation lately. As i ment’d above the purpose of a Sub of mtg to an oil and gas lease is similar to a ratification in that it simply seeks to be able to continue paying the royalties owed to the potential successor in interest ( the bank, etc) , and thus continue to perpetuate the lease in accordance with O/G title law.

Now that I think about it, we lived near an IBM Dry Copier production facility that injected its waste about a thousand feet below our feet. For various reasons we moved away from there. Not everyone has that luxury.