Lambert here: The fool in the shower with the solid gold Louis Quinze taps?

Bas Bakker, Division Chief in the European Department, IMF, and Joshua Felman, Assistant Director in the Reseach Department, IMF. Originally published at VoxEU.

Many academic papers about the Great Recession in the US have focused on the boom-bust in housing wealth and how it affected spending of the middle class. But there are reasons to think that a large role was actually played by the rich, as they responded to developments in their overall wealth.

According to the traditional narrative, the rich play a role but as generators of ‘excess saving’ (Kumhof et al. 2013) and not as part of the spending boom-bust. In the 1980s, incomes of the high-saving rich soared, while those of the middle class stagnated. So the rich lent their ‘increased’ savings to the middle class, who used the funds to maintain their consumption growth (Rajan 2010) and speculate in real estate. Initially, all was well, as the real estate boom propelled a construction-based expansion. But by 2007, the music had stopped. The middle class became overextended and ceased buying houses, causing prices to collapse so sharply that many homeowners were plunged ‘underwater’ on their mortgages, owing more than their houses were worth. Some defaulted, while others rapidly increased their saving rates so they could pay down their debts (Mian and Sufi 2014). The result was a deep recession.

In a recent paper (Bakker and Felman 2014) we argue that:

- It was not just the drop in housing wealth that made the Great Recession so deep, but also the decline in financial wealth. The decline in total wealth was key to explaining the depth of the recession, not the decline in housing wealth only.

- The rich were not merely passive spectators, generating excess saving to finance the middle class, but active participants in the consumption boom-bust cycle. The saving rate of the rich actually went through a similar cycle as that of the middle class, as rising wealth first spurred their consumption and then falling wealth restrained it. And as the rich accounted for such a large share of aggregate income, this cycle had a profound impact on overall consumption.

Wealth Losses and the Great Recession

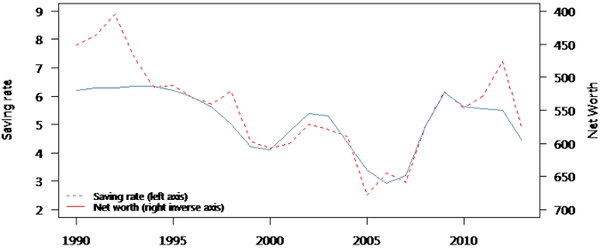

Wealth effects played a key role in the pre-crisis drop and post-crisis surge of the household saving rate (Figure 1). Asset prices surged during the boom years, boosting consumption and fuelling a drop in the saving rate. When asset prices collapsed during the crisis, wealth effects went into reverse, leading to drop in consumption (Case et al. 2011).

Figure 1. Household net worth and saving rate (% of disposable income)

Note: In this figure, net worth in year t is the average of net worth at the end of year t-1 and the end of year t.

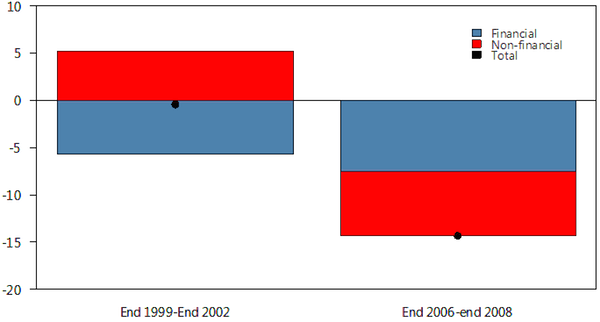

Wealth effects also help explain why the housing market crash was so much more severe than the dotcom bust. Mian and Sufi (2014) have argued that housing assets are special. Acquisition of real estate, unlike purchases of financial assets, is largely funded by borrowing and this explains why the Great Recession was so much more severe than the dotcom bust, even though the housing market losses in the former were about the same as the stock market losses in the latter. A simpler explanation may be that the dotcom bust was mitigated by an increase in nonfinancial assets (mostly housing) while the housing market crash was exacerbated by the drop in financial assets (Figure 2), which actually accounted for $8 trillion of the $13 trillion in peak-to-trough losses in wealth.

Figure 2. Change in assets, dotcom bust vs housing crash (Trillions of US dollars)

The Saving Rate of the Rich

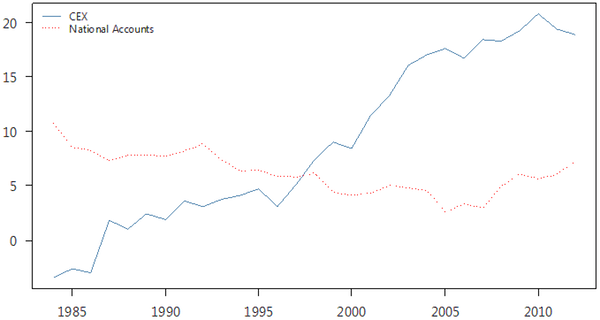

Many papers have assumed that the saving rate of the rich remained very high during the boom years. This is consistent with the Consumer Expenditure Survey (CEX), which shows that the saving rate of the top quintile averaged 33% during the 2000s, compared with 21% during the 1990s.

However, data in the CEX are not consistent with the National Income and Product Accounts (NIPA). According to the CEX, the aggregate household saving rate increased before the Crisis, by a considerable amount. This is at odds with the NIPA data (Figure 3) which show that household saving rates plummeted before the Crisis, from 8.9% in 1992 to 2.5% in 2005. It is well-known in the literature that the CEX data underreport consumption, particularly among the well-off; and this underreporting has increased over time. As a result, the apparent rise in the saving rate may simply represent an increased underreporting of consumption.

Figure 3. Household saving rate: National accounts vs CEX

If we use the NIPA data we don’t have figures on saving by income class. But we can nonetheless figure out what must have happened to saving rates of the rich and the middle class. We have to explain why the aggregate household saving rate declined in the pre-crisis years, even as there was a shift in income distribution towards the (presumably) high-saving rich. The standard explanation is that the reduction in saving by the middle class outweighed the rise in the saving of the rich.

In our view, the more likely explanation was that the reduction in middle class saving was accompanied by a decline in the saving rate of the rich. If the saving rate of the rich had remained constant, it is difficult to explain why the correlation between distribution and (NIPA-measured) saving over the past three decades has been strongly negative––the greater the income share of the rich, the lower aggregate saving (Figure 4). By contrast, if the saving rate of the rich has trended down, this could have offset the impact of the shift in income toward the rich on the aggregate saving rate. The flow of funds shows that before the Crisis the debt of the rich actually increased as rapidly as that of the middle class (Figure 5).

Figure 4. Income share top 10% and household saving rate

Figure 5. US: Average household debt

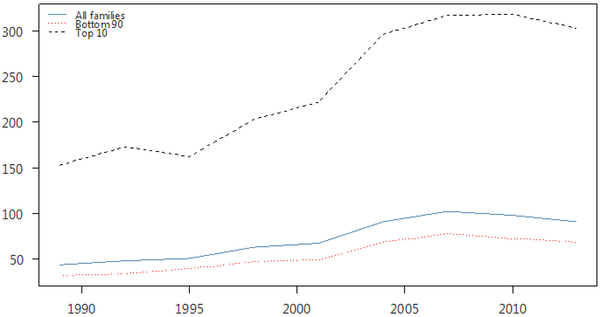

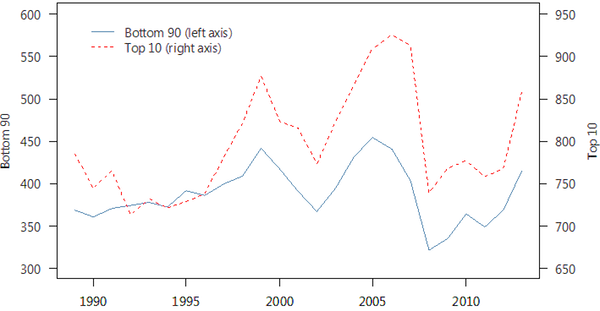

But why would the rich have reduced their saving rate, even at a time when their incomes were rising rapidly? They were responding to the surge in their wealth. The wealth-to-income ratio of the top 10% soared from 721% in 1994 to 912% in 2007. By contrast, the wealth-to-income ratio of the bottom 90% increased from 373 to 404% only (Figure 6).

Figure 6. Wealth-to-income ratios top10 and bottom 90

The Role of the Rich

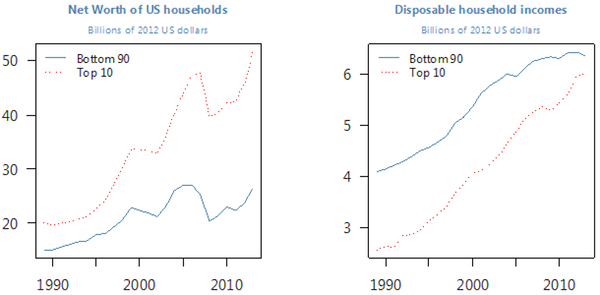

If the saving rate of the rich followed the same cycle as that of the middle class, then the rich must have played a key role in driving the consumption boom-bust because they were the group that received the bulk of the income and wealth gains during this period (Figure 7).

Figure 7. US: Net worth and income of bottom 90 and top 10

To demonstrate this empirically, we use a consumption function that incorporates elements of both the inequality and the wealth narratives. In line with the inequality narrative, we assume that the marginal propensity to consume income for the rich is lower than that of the poor. At the same time, we assume that consumption also depends on wealth.

We specify the consumption function in log terms:

LOG (Ct) = a ßrlOG(Ytr) + ßmlOG(Ytm) + y LOG(Wt)

We estimate the model using annual data for the US for 1990-2013. The estimated model fits the data well, and the estimated parameters are broadly in line with the literature:

- The elasticity of (total) consumption with respect to middle class income is 0.58, which implies a marginal propensity to consume of 95%. The elasticity of consumption to the income of the rich is 0.33, which translates to a marginal propensity to consume of 65%.

- The implied marginal propensity to consume out of wealth is 2.2%, compared to standard estimates ranging from 2 to 6%.

Next, we use the model to calculate the role of the rich in driving consumption. We would expect a significant role, simply because their income and wealth gains have been so much larger than those of the middle class.

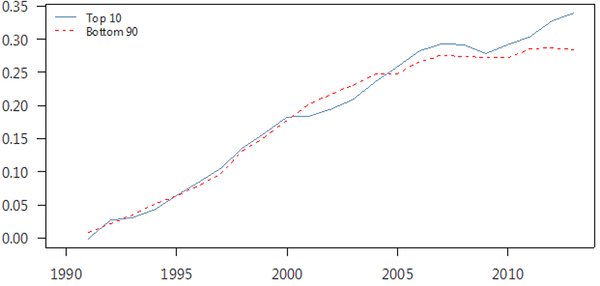

The model suggests something truly striking. The top decile explains the bulk of overall consumption growth (Figure 8). Between 2003 and 2013, about 71% of the increase in consumption came from the rich. Much of the slowdown in consumption between 2006 and 2009 was the result of a drop in consumption of the rich. The rich also played a key role in the subsequent recovery.

Figure 8. The top 10 and bottom 90: Contribution to change in consumption from 1990

Conclusion

Our results suggest that the standard narrative of the Great Recession may need to be adjusted. Housing played a role, but so did financial assets, which actually accounted for the bulk of the loss in wealth. The middle class played a role, but so did the rich. In fact, the rich now account for such a large share of the economy, and their wealth has become so large and volatile, that wealth effects on their consumption have started to have a significant impact on the macroeconomy. Indeed, the rich may have accounted for the bulk of the swings in aggregate consumption during the boom-bust.

Disclaimer: The views expressed in this blog are those of the authors and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

References

B B Bakker and J Felman (2014), “The Rich and the Great Recession”, IMF Working Paper WP/14/225.

Case, K E, J M Quigley, and R Shiller (2011), “Wealth Effects Revisited, 1978–2009”, Cowles Foundation Discussion Paper No 1784.

Kumhof, M, R Ranciere, and P Winant (2013), “Inequality, Leverage and Crises: The Case of Endogenous Default”, IMF Working Paper WP/13/249.

Mian, A and A Sufi (2014), House of Debt, The University of Chicago Press.

Rajan, R (2010), Fault Lines: How Hidden Fractures Still Threaten the World Economy, Princeton University Press.

Strengthens argument that incomes are failing to cycle properly and mass consunption is no longer driving ecomomic performance. Insufficient aggregate demand.

With the printing of money, and the continued government spending well in excess of receipts, we have rung out about all we can on the demand side. The rich will always have a low marginal propensity to consume (MPC). After they spend all they can, there is a large portion left over which goes to saving and investing. If you substantially raise taxes, they will still consume roughly the same. But what will tend to go up is saving, and what will go down is investing. Investing (I) is a substantial component of GDP, and any policy which discourages it will ultimately hurt the middle class. Ipso Facto, at this point it is not demand side that needs stimulating. It is supply side.

Nonsense. This recession (as generally in modern economies that have not e.g. been damaged by war) is caused by lack of demand. The “printing of money” you speak of has not put it into the hands of people (poor and middle class) who would actually spend it buying things. What could is more investment when businesses are dying from lack of customers?

What GOOD

” What good is more investment when businesses are dying from lack of customers?”

That’s simply not true. Profits are reasonably high and stable. But businesses in general are sitting on retained earnings and not expanding. Too much uncertainty and a somewhat business hostile environment.

Profits have been strong because deficits have been significant per the Kalecki profits equation, and for no other reason. Profits cannot exist without a corresponding government or foreign sector deficit.

Admittedly I know little about Kalecki, but I know a lot about Keynes, and he certainly did not advocate deficits as a long-term strategy. In fact, he primarily counseled to use it to combat deflation. Other than that he urged policy makers to return to “classic macro-economic theory”.

Economics is a two headed beast…supply AND demand. If you work with just half of the equation, you will get just half the desired results. Those on the right tend to ignore demand. Those on the left ignore the supply side. We need to get politics out of policy-making if we are to move ahead.

There are three ways the business sector can run profits: they can accumulate claims against households via debt, they can accunulate claims via government deficits or accumulate claims against the foreign sector via trade surpluses. Households can’t handle any more leverage and we can’t run trade surpluses. That leaves only the government sector.

It’s just how the accounting works out.

Well, we haven’t had trade surpluses in years, so we can discount that. Federal deficits have had a degree of efficacy by stimulating demand. But then they hit a wall. If you want to ignore the two headed beast, feel free. I lament how hard it is to communicate ideas when one is straining to force some sort of understanding into a vacuum.

Or to put it more simply, government must deficit spend so that businesses have the ability to accumulate cash reserves.

Printing money is irrelevant to aggregate demand. If demand had been pushed to its limits rhen by definition there would not be mass unemployment, all we have done so far is rely on supply-side measures.

“all we have done so far is rely on supply-side measures.”

Really?! Specifically what supply side measures have we relied on?

Ricardian equivalence via the sequester, Ricardian equivalence via increase in top income tax bracket, $400 billion in tax cuts via the ARRA, shifting national income from wages to profits, reductions in SNAP benefits, the U.S. – Korea Free Trade Agreement, the Troubled Asset Relief Progam, the Term Asset-backed Securities Loan Facility, the Zero Interest Rate Policy, quantitative easing, Too Big to Fail/ Too Big to Jail prosecution policy, fraud decriminalization, chained CPI, weakening Dodd-Frank. . .

Supply side policies have nothing to do with SNAP cuts. Ditto with sequester (actually Obama’s idea). But you really confused me with “increase in top income tax bracket”. Yes Obama raised the top bracket from 35 to 39.6%. But that is a good example of anti-supply side policy…exactly something that should not be done. All this really calls into question everything else on your vaunted list. Do you even have a clue as to what I mean by “supply side”?

I posted to a thread a few days ago but Yves was misunderstanding what I was trying to convey. I should have more fully explained the concept I was trying to express because the concept also applies to a nation’s economy itself, even if it didn’t trade with other countries (hypothetically speaking).

It would apply to any arrangement (loan, equity, etc.) where a currently produced “surplus” of human-created wealth is trying to be “saved for the future” by allowing someone else to consume it here and now.

Let me give an example which is relevant to this thread about the “rich”. They are generally net savers. Many of them don’t consume all their income/wealth/riches/etc. as time goes along. So, they either have to reinvest it or allow others to consume it or it goes to waste.

If you think it through, there are only so many ways you can “store” human created wealth. That is, the wealth that is being generated by the economy as we go along in time. I’m talking on a macro or aggregate level. On an individual level you can “store” your income by buying land, but what you really did was trade whatever you (or your capital) produced for the land, which is not human created wealth.

So with this drive to store current surplus production, we wind up with things like malinvestment, overproduction of capital, etc. Or…..debt. Because another way to “store” wealth/income is to lend it out (so to speak). In other words, you allow someone else to consume it with some expectation of being paid back in the future.

If you think this through, it could explain why we now have so much debt in the system that can’t be paid back.

excellent point, Ralf, nice way to view the forest from the birds’ perspective.

this intersection between land (the natural world) & capital (the virtual world) is quite ripe for further investigation, methinks. thinking about how the virtual world can meaningfully interface with the natural world (beyond the extraction of rents & resources to satiate the endless appetite of the virtual) might be a worthwhile investigation that could provide an alternative to the constant preoccupation with debt as the preferred method to “preserve” capital.

elated to read that Henry George’s ideas are starting to get an audience beyond us lunatics on the fringe of the fringe.

The notion that lack of demand on the part of the “wealthy” was a significant cause of the last recession is bizarre, but completely in sync with a Keynesian perspective of the world. “Deficient demand” as represented by most Keynesians is actually a desire to save, and to defer current consumption relative to one’s production, so that one has a future claim on production to provide for one’s retirement, one’s children or other heirs, or to give to one’s preferred charities or other causes. Consuming less than producing is the only way real capital is built up (much of it represented by financial claims on real capital), and is the source of all improvement in the overall standard of living.

From a national perspective, national savings is accurately described in a similar way … it is the excess of a nation’s production over consumption, enabling the accumulation of capital and or financial claims on the future production of others, which if deployed wisely produces a real return to the nation. This accumulation can be used at a future date when the nation “needs” to consume resources in excess of what the nation produces.

Such desire to produce more than is consumed on the part of an individual or a nation has almost no correlation with our modern financial systems’ capacity to create debt completely independent of anyone’s desire to save and invest for the future. Central banks and commercial banks today facilitate the creation of new debt to allow governments to spend in excess of their willingness to tax, allow speculators to gamble on assets they cannot afford through their own excess production over consumption, and allow bankers to skim off large swaths of the total production pie before the bad loans have their “emperor has no clothes” moment. The current attempts to transfer the burden of all that bad debt onto the backs of middle class citizens, many of whom had nothing to do with the creation of the bad debt, is the reason for the current political earthquakes around Europe.

The Keynesian focus on demand is the fundamental error. Humans have limitless demand, as is evidenced by the white-hot demand for $20 million apartments in New York City and elsewhere. It is the ability to produce them that is the difficult part (otherwise many of us would live in them). Gather ten of your Keynesian friends around a dinner table and ask them to raise their hand if they are willing to spend more than they currently do if you give one million dollars or euros of newly printed money to each participant . All 10 hands would be raised, as most humans have a propensity to consume far in excess of that which their effort in life permits. Then ask all ten how many are willing to produce more … you know, work longer hours, learn how to work more productively, perhaps by gaining access to better capital goods. Likely no hands will be raised, as most people believe they already work too hard and have too little leisure time.

There is no such thing as deficient demand … though there is such a thing as deficient demand at the current price structure. Our refusal to allow prices to correct to equilibrium levels … a price level determined by the pool of real savings in the world, not “financial savings” … and not a price level determined by continuous exponential accumulation of un-payable debt … is the reason for the current financial chaos we see everywhere. It will not end well for anyone.

This is a mispresentation on multiple levels.

1. “Trickle down economics” has NEVER been a Keynesian position or even that of most mainstream economists. Keynesians regularly write that rich people can’t possible consume enough, relative to their income level, as lower and middle income people do. Keynesians advocate programs like “automatic stabilizers” such as unemployment insurance and other social safety nets, to get more income in the hands of those at the bottom of the economic food chain, when the economy is weak, because they have the highest propensity to consume and thus give you the biggest bang for the buck, stimulus-wise. No Keynesian would advocate focusing on boosting incomes of the rich in response to an economic downturn.

2. We do have insufficient demand. The proof is in our sustained high un and underemployment rate and stagnant wages.

3. This post is a straight-up defense of the Greenspan/Bernanke view of the world, that the dot-com bust was a very dangerous event and demanded aggressive responses (negative real interest rates for a full nine quarters) and the Bernanke view before the crisis that everything was hunky-dory because household balance sheets were fine (based on inflated housing prices!) and his emphasis on the wealth effect (aka goosing asset prices) in his post-crisis response. Greenspan was never much of an economist, and no one would ever call him a Keynesian. Similarly, and Bernanke is a monetarist, as in a Friedmanite, NOT a Keynesian.

There is a lot not to like about American Keynesianism, which is a distortion of Keynes, but your criticism isn’t even within hailing distance of Keynesianism.

I agree automatic stabilizers are good. However, programs which create long-term dependency, or programs which create make-work are not helpful. The normal incentives to find a job, save for the future, and for businessmen to hire and invest in capital (not pumping up the price of financial claims) have been completely distorted up by our Frankenstein financial system which currently benefits only the 0.1%. That is why the middle classes in most nations are falling behind.

Positive real interest rates, debt issuance restricted to that which has a high probability of repayment, sound money, and market-determined price levels are all necessary to move forward in a positive direction. That will require the write-off of prodigious amounts of current debt which never should have been issued in the first place. Whose ox will be gored by that reality is the key issue the world faces today.

Let’s throw a little more math in there to legitimize this. Please. Wealth consumption, no matter how unshackled, remains finite. One wealthy person will buy only so many mansions, yachts and jets.

However, wealth income seems to be infinite, so much so that the rising levels of income for the wealthy have grown so enormous that it is now pulling up the averages. That makes for great headlines, in that “average wages” can be reported as increasing when, in fact, it is the wealth income that is greatly exaggerating the averages.

And those income reports cover only the, well, reported income.

Basically the middle classes have only one major asset, the family home. They borrowed more to buy bigger homes. The rich already own their family home, they borrowed more to invest in high yielding assets like corporate bonds, stocks, hedge funds etc.

When the shit hit the fan, the rich ran for the exit door and deleveraged, the quickest movers being the biggest winners and the slow coaches getting trampled. The middle class had nothing to sell and were stuck in homes with negative equity. The rich were breathless and excited but mostly still sitting pretty in their mansions.

After their good friends in Government bailed out the banks, shafted the middle class and lowered interest rates to zero, they were back to races levering up to buy more financial assets. That’s where we are today, the rich are looking richer with super high stock prices, but it’s all built on expanding margin trading, they are waiting on the bigger fools to lever up and buy at the top before the switch is flicked and the roller coaster starts off downhill again.

I should add that investment is based on the actors having excess income to save, there’s always leakage from the investment community to buy consumer goods as various actors win big and spend up. The losers just keep quiet or double down on the debt.

Tax Corporate Revenues, Not Profits; http://goo.gl/Z3ofHb

I know it’s a broken record, but I would like to see a large amount of space in this article dedicated to all the frauds and greed that accompanied the rich saving all that money and the banks pushing all those derivatives.

I strongly agree with you JEHR — where is mention of the “frauds and greed”?

The first question that came to mind as I read this post, “Why does it matter how the rich savings rate and consumption varied leading up to, during or following the financial crash?” After that, I wondered who fit into the category of rich and what meaningful items — goods whose consumption would have impact on the economy of the country — did they consume at varying rates? I keep recalling the candybars example from Econ 101. What is the “take-away” from this post?

There are plenty of reasons why the current income distribution is very very wrong without trying to make an argument about savings rates and aggregate demand. To offer one of those reasons — the aggregation of wealth and control of income in so few hands concentrates political and economic power in those few hands, undermining even a semblance of democracy. and through this capture of the government undermining even a semblance of a market for goods and services.

In many instances, the rich didn’t “save” any money. They borrowed enormous sums from a complicit financial industry despite limited capacity to repay the sums unless asset prices soared higher. This, in a nutshell, is why we have QE globally today. They must keep the bubble inflating.

*Sigh*. Even with the rich borrowing more than they did historically, the rich are not big borrowers. The leverage was created by OTC derivatives and the player were banks, hedge funds, insurers, and to a lesser degree, other institutional investors.

When I state that the rich borrow, I didn’t necessarily mean on a individual direct loan basis. However, when an affluent person owns a position in a leveraged hedge fund he is effectively borrowing to leverage gains. When corporations leverage up to repurchase stock the primary beneficiaries of the leverage are the affluent. The corporate officers of financial firms who constantly lobby for reduced capital requirements do so not only to leverage returns to bank shareholders (largely the affluent), but also to benefit themselves, as the leveraged returns “justify” their bonuses and option packages.

And in the past 7 years, a lot of the incremental government debt in the world has been issued to keep banks at least superficially solvent, and thus asset prices owned by the affluent elevated.

I’m not saying the conclusion is wrong but the dot com was contained in stocks, which are mainly holdings of the wealthy, housing is much more spread out so the drop effected lower income groups as well. that would tend to support the traditional narrative. It’s not the amount lost, it’s thee people affected that made the difference

You’re partly correct. However, stocks are indirectly owned by middle income people (and some lower income people) via pensions and pension replacements such as 401(k) plans, so it wasn’t just the rich who were affected by the Dot Com Bust.

There sure are a lot of instances of would, could, should, must, if and may in this article. Sounds like a good way to rationalize yourself straight to h*ll. Plus a proxy is being used to derive a substitute data set without any explanation how well this works in the real world.

“If we use the NIPA data we don’t have figures on saving by income class.”

“If the saving rate of the rich had remained constant,…”

“…if the saving rate of the rich has trended down, …”

“If the saving rate of the rich followed the same cycle as that of the middle class,…”

“…must have happened to saving rates of the rich and the middle class.”

“…data in the CEX are not consistent with the National Income and Product Accounts (NIPA).”

“But why would the rich have reduced their saving rate,…”

“We would expect a significant role,…”

“…may be that the dotcom bust was mitigated…”

“…the apparent rise in the saving rate may simply represent…”

“…may need to be adjusted.”

“…the rich may have accounted for…”

Plus no mention is made of rentier financing of speculation in the real estate market as just one example of overlooked possibilities for the explanation of bubble expansion and implosion. Frankly, the article appears to be tiptoeing around such issues.

The Use and Abuse of Mathematical Economics by Michael Hudson.

Yes , one thing you can say about the authors’ qualifications : they’re qualified in the use of qualifiers.

The thing that immediately struck me was their use of the common trick of defining the “rich” as the top 10%. Any studies about inequality in the US that only segregate by decile or quintile are avoiding confronting the major issue : the upward transfer of significant income share from the bottom 90% to the top 1% , and particularly to the top of the top 1%. I don’t think this avoidance is accidental in most cases.

100% consistent with the Citigroup Plutonomy memos, which said that the rich spent most of their income and were dominating the economy.

Most of us save for a rainy day — retirement, sickness, layoffs — but if you have buttloads of wealth, there’s no such thing as a rainy day, so why save?

Dan,

The Rich, by definition, do little else but save. It is their raison d’etre. It’s called accumulation. The one with the biggest savings wins. You get Sauron’s Ring if you out-accumulate (save) everyone else. The fact that they spend more than the rest of us on things that generally do NOT help the overall economy is a side-show, consuming a tiny fraction of current-year’s income.

The policy implication is that the so-called “balanced budget multiplier” is very small. While it still may be desirable and necessary to tax the rich in order to reduce inequality, “tax and spend” policies will do little to stimulate the economy. Instead, we need more deficit spending.

This is an interesting article in doublespeak. It essentially attempts – as all voodoo practitioners of the bullshit science of economics attempt – to find an alternate explanation for the financial bubble when the proximate cause of said bubble is already abundantly clear.

The article attempts to show that TINA to the notion that the rich “caused” part of the financial crisis by lending out their financial windfalls when the actual circumstances are abundantly documented: too low interest rates for too long by the Fed coupled with Presidents on downward pushing home ownership, in turn accelerated by fraudulent conversion of liar loans into MBS’s which were then both sold to institutional suckers around the world and bet against using CDOs and CDS’s.

Where does the above fact fit with the doublespeak in this IMF exercise in counting angels dancing on a pin?

Supposedly it was the rich who lent the money for the poor to borrow on liar’s loans. This might even be true to some extent, but the real reason for the bubble wasn’t that the rich lent their capital directly or indirectly via their brokers – the real reason was the control fraud perpetuated at the highest levels in government and financial intermediary institutions.

Can someone answer a few naive questions:

1. Where does all the money corporations are sitting on show up in this data? This is savings but not personal savings.

2. What do corporations like Apple do with the money they are sitting on? Presumably, it doesn’t all sit as cash in money-market funds. But if they invest in in other financial instruments, then isn’t it investment, not savings?

Much as possible goes into Treasurys, the rest into high quality corporate bonds.

Left In Wisconsin, my take on your two questions.

1. The Cash Balances on Corporate Books are priced in to the share-prices on the market (according to Capitalist mythology) and are reflected here in that way.

2. Economists seem to call “investment” a form of “saving”. When you go to Macau and put $100,000 on Red at the roulette wheel, it is still savings. It is asset value destruction when your bet (your bond or CDS or whatever) comes up Black (worthless). You didn’t spend it. This is one of the cute euphemisms that make financial speculation sound virtuous. Putting Capital into risk assets (stocks, bonds, ETFs, etc.) is “saving.” Clever, no?

I wish AAPL’s cash hoard was properly priced in to its stock. I would feel a lot wealthier.

I don’t like this. Confusing financial assets with wealth is a rather foolish thing to do. Financial assets are a claim on wealth, not wealth itself. An important distinction when the said claims on wealth are rapidly multiplying while actual wealth (as measured in access to physical resources in the real world) is dwindling.

Participating in a (housing or financial) bubble and seeing the nominal value of your alleged assets appreciate does not make you any more or less wealthy–until you actually cash out of the musical chairs game and have an accounting of what you have in your possession at that time. Until then it’s all just a delusion.

How convenient for the 1% that Paulson pulled their chestnuts out of the fire, made them whole and reinflated or bought at 100 cents on the dollar their worthless paper. And that Timmy continued to reinflate the wealthy, while the rest of the citizenry lost everything they had worked for: jobs, homes, health insurance, pensions, and their children’s and grandchildren’s futures.

There isn’t any way to put a smiley face on this decade, or rather, the last 40 years. Don’t even bother to try.

No way to make it sound better, but certainly there are ways (not yet mentioned) to make it sound much, much worse!

I.e., how could a financial analysis of the past 10-15 years take no account of hemorrhage of perpetual war?

Where is the P/L on MIC stocks?

Who (aside from Chenobama) got the payouts from MIC stock inflation? I am not a finance pro but I smell macro “stock buy-back” via the us taxpayer/treasury!

The rich could use a tax repatriation holiday about now.

I’m not convinced by this article. They data they quote doesn’t support their fundamental premise (that the rich spent more than was believed). They merely show that the data their opponents use isn’t accurate (e.g. CEX). The data they do use, by their own admission, isn’t broken down by income groups, so their premise remains unproven.

Furthermore, if they’re right, that the rich spend a higher portion of their wealth than commonly believed, then we should not be in a recession right now. The stock market is at all-time highs and real estate is increasing. Even most of the income gains have gone to the top earners. So why is demand so low? My best guess is because the authors are wrong: the rich aren’t big consumers…

Problem: Offshore wealth is not considered, thus you miss the whole picture