By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

How many years would it take first-time homebuyers, earning a median household income, to save enough money for the standard 20% down payment on a median home? Are you sitting down?

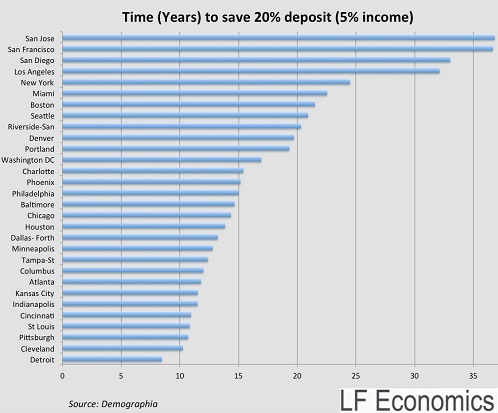

An impossibly long time in many cities, Lindsay David of LF Economics (and a contributor on WOLF STREET) found in his report on mortgage stress. He looked at 30 large US cities, using their local median incomes and median home prices. It assumed that young households could accomplish the tough feat of saving 5% of their income, year after year, through bouts of unemployment, illness, shopping sprees, family expansions, or extended vacations.

The results are stunning – if just a tad discouraging for first-time buyers.

In my beloved and crazy boom-and-bust town of San Francisco, where a median home (for example, a two-bedroom no-view apartment in a so-so neighborhood) costs $1 million, it would take – are you ready? – 37 effing years.

Given its higher median income, San Francisco is only in second place. The winner by a few months is another Bay Area city, San Jose. In San Diego, it would take 33 years. In Los Angeles, 32 years. First-time buyers might be retired before they scrape their theoretical down payment together. Theoretical, because in reality, too many things change, and they’re chasing after a moving target.

So lower your expectations and step down to buy a below-median home? Here is what TwistedPolitix found on the market in that price category:

Yes folks, step right up and get your 700 sq. ft. home in Redwood City, California, heart of the Silicon Valley, for just $649,000! The American Dream! 1 bedroom, 1 bath for just $3,154 per month on a mortgage with super low interest rates if you put down 20%.

If you pay the mortgage back according to the standard 30-year schedule, in April 2045 you will have paid $1,135,721 for a tiny little [bleep] shack. Brilliant!

And that 20% down payment would still amount to $130,000. How long would it take first-time buyers with a median household income to save up this much money? About a quarter century!

In New York City, fifth place, it would take just under 25 years, followed by Miami, Boston, and Seattle. In ninth place, Riverside-San Bernardino, CA, just over 20 years. In tenth place, Denver, just under 20 years. This puts five California cities on the list of the top 10 most impossible cities for first-time buyers to buy a home in.

Of the 30 cities in the chart from LF Economics, there’s only a handful where a household with a median income, and able to save 5%, can come up with a 20% down payment in about a decade.

It gets easier when people refuse to move out of their parents’ home. If they don’t pay one dime in rent or help with cable TV or whatever, they might be able to squirrel away 30% of their median income. To come up with a 20% down payment in San Francisco or San Jose, it would take them a little over 6 years.

But for the hardy folks trying to make it on their own, it’s impossible. They probably can’t even save enough for a 3% down payment, which in San Francisco would set them back by $30,000. Charge it on a credit card? Hardly. So perhaps they can bamboozle mom and dad into helping out.

Driving home prices into the stratosphere has been top priority for the Fed. It’s called the “healing of the housing market.” The higher the home prices, the more they’re “healed.” It was designed to bail out the banks, their stockholders and bondholders, such as Warren Buffett who is the largest investor in the nation’s largest mortgage lender, Well Fargo, and presides over a vast finance and insurance empire. It was part and parcel of the Fed’s successful plan to inflate all asset prices via waves of QE and interest rate repression, come hell or high water.

Inflating the prices of stocks and bonds is one thing. People don’t have to live in them. Not so with homes. People have to live somewhere. By inflating home prices, the Fed has inflated the costs of everyday life for all Americans. No big deal for the wealthy. But woe to those on a median income.

The effects are pernicious. In its report on housing, California Housing Partnership Corporation has this to say about California, “the largest and wealthiest state” of the US, where housing is particularly, to use the Fed’s term, healed:

We lead the nation in the number of people experiencing homelessness. We lead the nation in poverty rates. We lead the nation in overcrowded rental homes and severely rent-burdened households. We lead the nation in the largest shortage of affordable rental homes.

If housing costs are factored into poverty rates (which federal measures do not), then the percentage of people living below the poverty line jumps to 22% in California, up from 16.2% mentioned in federal reports. In that respect, according to the report, the worst is Los Angeles County with a poverty rate of 26.9%. Orange Country, one of California’s wealthiest counties, has the second highest housing-adjusted poverty rate, 24.3%.

These housing costs are confronting people with what the report calls impossible choices: “Rent or groceries? Rent or medication? Rent or a bus fare?”

People who pay a large part of their household income for rent or a mortgage, or who save assiduously for a huge down payment, don’t have much cash left to contribute to the overall economy. Most of their income simply gets confiscated by inflated home prices, or the resulting high rents and associated expenses. It’s channeled to landlords, PE firms, and REITs that own the homes; banks and investment funds that own the mortgages or the mortgage-backed securities; and a million other entities. Most of it becomes part of the grease that keeps Wall Street from squealing. But nothing happens with that money to move the real economy forward.

And renters that stretch to the maximum to pay rent won’t ever be able to save for a down payment to buy an overpriced home.

In this ingenious manner, the Fed has created today’s struggling consumer class that doesn’t have enough money to spend and then gets blamed for not borrowing enough to fire up the languishing consumer-dependent economy.

In Canada it’s even worse. Even “second-time buyers” can’t afford to buy a home without help from mom and dad. Read… Canada’s Magnificent Housing Bubble Goes Nuts, Cracks</u>

Was just talking with the Pops the other day about who in the hell is buying all these $300,000-$400,000 that he sees being built all over. There’s no way median income earners can afford the mortgage payments, so whose buying these things? And we’re talking whole developments full of these monstrosities…is it just cheap money allowing developers to endlessly roll-over their loans for these projects, skimming off their salaries until the whole thing collapses?

That’s my question, too. I sort of get it how/why prices in CA coastal cities are so high, but I don’t understand who can afford to pay the rising costs of housing in Sacramento. Despite the drought, there are several big developments going forward in the area – some inner city, some outlying suburbs – with either big condos (downtown) or big houses (mostly outlying). These giant condos/homes are selling at very high prices, esp given the more working class nature/paycheck of Sacramento.

Who is buying these homes? And for what purposes? I did have friend tell me recently that the 1930s era small apt bldg. where she lives was recently bought by an “older” couple from San Francisco. Apparently, they are totally demolishing the currently empty apts and doing high end upgrades. My friend is depressed bc the upgrades have ultra-modernized what were once nice units reflecting the charms of the era in which they were built. Now being turned into square box rooms but with granite countertops, etc. She is concerned about her rent being jacked up, which she can’t afford.

I get it that a lot of probably older speculators are buying in Sacramento, but it’s unclear who’s supposed to rent their properties at high rental rates. Again I feel a bubble is growing. A lot of Gen X/Y and millenials in this town simply cannot afford high rents or the high cost of purchase prices. Nutty.

It’s bubble/ponzi nuttiness. Homebuilders are building for “investors”, who expect to sell to other “investors” in the future. Everybody thinks somebody else will be the greater fool. They build large, luxurious homes because that’s what’s supposed to go up the most. At the peak of the bubble last time there was a lot of construction of these large deluxe homes in extremely remote sections of LA or even out in the middle of nowhere in the Central Valley. There are huge tracts that are mostly empty to this day. Sounds like that’s starting up again.

It’s amazing how quickly greed overrides common sense and how easily everyone assumes it’s going to be someone else left holding the bag when things go south.

Another thing I saw in the last bubble was absurdly large houses, up to 9 bedrooms, which I assume were being built on the basis that the largest houses went up the most. Is that happening this time? In the last bubble we sometimes went out to the Inland Empire to see some of the craziness going up. I haven’t felt the urge this time, and the OC where I live isn’t seeing much of the obviously crazy stuff, although there does seem to be a slant to the big 4 and 5 bedroom houses.

Latinos want them because of large families. My housekeeper banked 500K in cash when she sold her six bedroom tract home in Perris at the height of the boom. The area was all Latino. Four people working can handle a pretty big mortgage although I suspect Bank of America or Chase ate the loss when the short sale happened. She is retired and back in El Salvador living the good life. Don’t tell me illegals are stupid. Of course, she did legalize herself with the Regan amnesty.

Sacramento, I should add, appears to me to be in a “if you build it, they will come” mentality. I read articles in the Sac Bee that frankly make no sense but basically boil down to: If we want Sacramento to be a “world class city” (lots of cultural cringe going on here), the we HAVE TO build a lot of expensive properties!!! And THAT’s the solution!!! woot.

I. Don’t. Get. It.

Some parents help with a downpayment, but even that can’t explain it because although it’s somewhat common, it can’t bet that common can it? If your parents didn’t help you, well it’s not our fault if you chose the wrong parents. ;)

I think we can’t undercount the mass immigration angle. For instance, very few (maybe California in the 1950s) immigrants in upstate NY, because of deindustrialization. Our housing prices have been flat for decades, missing the last two bubbles.

Immigrants are either wealthy, wanting to live like kings in the cities, or very poor and shack up 20 to a NYC flat. I dated a Chinese girl. When i visited her in Brooklyn, the whole area had been bought by mainland Chinese, the one family flats were separated by several sheets of plywood, housing 13 illegal immigrants/refugees. I was only allowed in there for a few days. I doubt taxes were being paid. The roaches were like waterfalls when the lights were put on. One clue to this kind of tenement business, is looking at how much trash builds up. if there is a need for several private pickups in addition to the public pickup, you know there are many more people than code living there.

Up where I live, eastside of Seattle, a lot of folks touring the new $900,000 homes are Chinese and Indian. In my neighborhood are a few new home owners from China. On my late evening or early morning dog walks, I frequently encounter older Chinese couples out for a stroll. Limited English, but very friendly.

The Chinese are usually corrupt party or coporate Mandarins buying a lifeline if there’s urest in China, as well as finding a way to launder money.

From living in Patel hotels (88% of budget hotels are now owned by the Patel Clan), buying a small business is a circumspect way to buy a green card. One of the Patel owners confided in me that he is amillionare but bought the rundown hotel so his kids would eventually get a greencard, no need for sponsorship. When he bought the motel in the 1980s, it was a declining industry; however, with all of the computerized credit reports, a large lupenproletariate can no longer get proper leases, so thees Patel hotels live on month-to-month rentals, along with the usual prostitution.

Speaking of REIT’s, some of which that have the best monthly payouts, also have a lot of leverage. I was also reading they are dipping into repo markets, but with yields high, a seemingly high appetite for RISK, and the assumption that rates stay low, I don’t think we’ll see a change here. Multi-family buildings appear to still be the go to place, even though it’s declining from its peak. The chase for yield appears to be insatiable in REIT’s, especially hovering around 10%.

People will/are simply be too mathematically poor to buy/own a home, while the investor class will continue to squeeze every penny out of the renter class. Renters will simply will never be able to keep up. Or, I’m reading this completely wrong, but if there’s money involved, especially at 10%, I’m not sure anyone cares.

http://research.stlouisfed.org/fred2/graph/?g=1b7c

We have friends who have returned to the area looking for apartments. Rents have absolutley skyrocketted in the last year to crazy numbers that require two incomes to pay. Which is a real problem if you are single. There are no rentals for median income.

I have a friend who’s a real estate agent in SoCal. She just said that she sold a $1.7m house — and it was a fluke. She’s been in real estate for, oh, three years, and AFAIK, she hasn’t been doing too well.

So, moral to this story is: The buy side is tough, as Wolf Richter notes above. The sell side isn’t much easier.

It just seems to me that the banks never lose no matter what the house prices are. Today, the mortgage rates are super low (along with interest rates) but houses cost a fortune. When we were buying our home (1983), the mortgage rates were super high (more than 12%) but houses were affordable (just over $100,000 where we live). Now our home is, supposedly, worth twice that but when you consider that we probably paid for our home three times over when including the interest, the only real winner is–the friggin’ banks!

Mostly what intrigues me is the way our government fast-tracks people with money into our economy. There are stories concerning Vancouver homes where wealthy investors buy up small homes, level them and then build super nova homes without yard space. Our housing policy has not been a good one no matter what time frame you select after 1980.

Further afield but in the same ballpark, here’s a useful opinion piece from down under:

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11446055

The stark realities of living (or trying to) in Auckland, New Zealand when there’s no Katy to bar the door.

Sydney too. Median house price here has sailed past a million.

http://www.smh.com.au/business/property/median-asking-price-for-sydney-houses-tops-1-million-20141112-11l0pm.html

Lots of, ahem, foreign buyers goosing it but the Reserve and Big 4 banks along with the govt are doing most of the goosing themselves. Which may end up being a problem for the banks given how much of their loan portfolios are property and how deeply dependent they are on foreign money market cash to operate each day.

Your link had another on that page, which also applies to Sydney. ‘Ordinary’ people, i.e. the non-wealthy, can no longer afford to live in the cities they work in.

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11448155

You might consider that sub prime has been substituted by wealthy foreign buyers, money laundering and ludicrous LVR loans [incoherent asset valuations dialed to tulip setting].

“This is where subprime and Alt-A originations found their home. There simply weren’t enough qualified buyers out there to feed the hungry maw of the mortgage securitization and derivative mill, so underwriting standards had to be lowered, and homeowners had to be encouraged to refinance early and often – refinancing not only provided grist for the mill (while only affecting the junk tranches of existing issues of CDOs) – it allowed bad underwriting to be covered through the new issue of loans before an existing loan had to be written off for nonperformance. This worked as long as demand for housing remained high enough to keep home prices rising (it was the increase in a homeowner’s equity that allowed them to refinance out of one nonperforming loan into another that was just as unlikely to perform). In order to make this happen, they had to ignore the fed funds rate and make mortgage loans at rates that would keep housing demand high. This, again, explains the proliferation of nontraditional loans, which kept interest rates low for a time but recaptured money from the borrower later.”

http://www.nakedcapitalism.com/2015/05/200pm-water-cooler-51115.html#comment-2442514

Skippy… as such one has to seriously consider the disconnect between government and CB rates wrt RE in the traditional sense, tho I would acknowledge that governments are highly invested in C/RE themselves and as such acutely aware of its ramifications.

There was a time, not long ago, about 14 years, when Australia was the new cool, cheap place to live. Multiculturalism killed that. Now it’s expensive, over crowded, right-wing, not safe…

“Multiculturalism killed that”

Show your work out, it does not seem the influx is running the Parliament.

‘Multiculturalism killed that’

No, neoliberalism did, and still does.

I’m curious for other readers’ observations about who is buying these homes. In my observation from SF and the East Bay, the buyers aren’t just from tech, but many are Chinese buyers looking to stash away their newfound wealth in foreign assets. There are plenty of anecdotes that they’ve been bidding up the market here, but I haven’t seen any hard numbers. The market is already beyond ridiculous regardless. In Berkeley, the average home is selling for 15% above asking now, and I’ve seen some recent closes go for $400k-$600k above asking price (!). Many of the houses I see coming on the market are ~$550/sq ft, and just 10 min down the road in Piedmont they’re often starting at an inconceivable $800/sq ft. The bubble must burst at some point, so we’re just waiting it out for now.

Hmmm. Foreign Trade/Current Account imbalance coming home to roost. U.S. dollars came back into treasury bonds for a while, but yields are low, and after all, the buyer just ends up with more U.S. dollars. Gold is in demand, and, as we see, tangible assets.

“The Chinese are Coming!” is real this time in parts of the SF bay (unlike in 2008). My mother-in-law saw several properties she was looking at in the East Bay get snapped up by foreign Chinese buyers last year. I don’t have numbers either though. It’s not happening down here in SoCal.

Thanks for the feedback. Worse than I felt from from where I live.

Rebuilding a decently wealthy middle class implies positive interest rates and a saver-friendly attitude by public authorities. In the US as much as elsewhere.

No need to be an Hayek follower to get this. Just a fair and decent understanding of the asymmetries created by manipulated markets. Manipulating the interest rate via central banking will in the end benefit the rich not the poor.

Trying to make for it via mortgage market tricks will not make it. Quite the opposite indeed… That has started and will continue until the middle class is left wealth-and-home-less.

Out here in Denver, Colorado it’s been getting ridiculous for the last couple of years. The number of houses going for $400,000+ exceeds the number of people who can realistically afford them—at least those who want a place to live—but it’s not cheap to rent here either.

I’ve been wondering, like other posters, who is buying all these houses. I’ve also been wondering how this ends: will there be an eventual correction than brings prices back down to reasonable levels, or is Denver going to go the way of San Francisco with a permanent housing affordability problem?

If the choice is between a bubble economy (Larry Summers) and no economy at all, the Fed chooses a bubble economy. There is no way to get out of this rat race. It’s bubbles or nuthin’. Because, as we all know, the rest of the economy got off-shored. I keep asking myself, Will the Fed be so stupid this time as to crash the housing market again? Will they learn from Hank Paulson’s mistakes? Or will they repeat those mistakes after pumping tens of trillions back into it to save it from the Hankster. Jack Lew is noticeably silent on all this stuff. The obvious problem is that there is no way to manage a bubble economy. Gotta wonder what they are thinking. How do they stop this?

The “War on Terror(tm)” was a ham-fisted attempt at building an economy based on a new boogieman since the old tried-and-true Soviet Union disappeared. The Cold War provided lots of fuel for an economy (based largely on overblown military spending). The War on Terror started out big but rapidly shot its wad and cannot be counted upon for that…so TPTB are busy trying to CREATE a new Soviet Union-like enemy in Russia. Turn that country and its “evil emperor” into a big boogieman the same way that the USSR was, then base the economy on military spending to fend off the boogieman.

I’m hopeful that the clumsy and ridiculous attempts to do this will fail as badly as the WoT, leaving TPTB empty-handed.

The problem with that is the paltry number of jobs modern military contracts create. Everything is capital/robot intensive and so the multiplier effect (remember that old term?) is very low. When computer-controlled robots do all the welding on warships, how does building more warships aid the overall economy? Not much. The problem is that the positive feedback loop of new technology creating more jobs than it destroys has lurched into reverse. Everything we’ve done as a political economy for 200 years was based on the maxim that new technology will mean more jobs. This is no longer so but no one seems to want to study, no less confront, that reality. They just want to rattle along with the old maxim and hope for the best–the trend has GOT to reverse itself, screams the cargo cult of economists. But I don’t think it will.

It’s not really the jobs that matter anymore, it’s the money for corporations/execs/investors. Jobs are an afterthought or side effect. The defense/intelligence industries are always under threat of downsizing and cuts when there’s no obvious reason for their huge size. Rather than suck up that reality, TPTB prefer to create a new threat out of whole cloth to justify not just continued big spending on defense/intelligence but large increases. TPTB make their money and obtain their power from the amount of money tossed their way, not by the number of jobs they can create.

I WISH my home value was inflated. It is virtually worth as much now as when I first signed the mortgage paper (I cannot say “…as when I first bought the house”. NO ONE buys a house unless they’re rich. You buy a LOAN but don’t own the house, technically, until you have the title in your hands). I will be paying off the mortgage next year after 15 years on a 30-year mortgage (suck it bankster). If I sold it the amount I might bring in is about 10k over what I paid for it originally. If the value were inflated I would be tempted to sell it to a sucker and just acquire some acreage and pay for a micro-home to put on the land. Or build an “earthship” myself on the land.

It would be great if it’s a negative interest rate mortgage loan.

You borrow $250,000 to buy a house, and the central bank (or Freddie Mac/Fannie Mae/FHA) pays you interest money for parking its dollars at your house (Hey, they can’t make land anymore).

Hurry up, Ms. chairwoman. Bring your fiat money to my corner of the finite planet.

I guarantee you that this negative-rate scheme will really inflate the housing market.

So instead you’re the sucker who has all his capital tied up in this fixed asset but could have had stupidly low fixed interest rates on the property for 30 years?

No, my money is parked in small acreage that sports horses and chickens and a nice veggie garden. This isn’t some city house. I own/control my water (well) and sewage (septic). I will OWN it in just a few months (except for taxes). No more interest, no more money for the bankster. It’s just if I had it to do over I’d take (more) land with no house and build a ultra-efficient tiny home on it to spec, STILL pay it off sooner rather than later. Other than that I don’t have any intention of leaving it for a good long while so I’m not “stuck” with anything really.

I see this mistake made all the time — people think that they’re screwing the bank by paying off their mortgage. Instead, you have capital tied up in a fixed asset and that capital is earning a suboptimal return. What’s the opportunity cost of owning that property outright? It’s very high, especially when one can lock in historically low interest rates for 30 years and then let that money compound in a high-return investment instead of fully owned real estate (and if the mortgage is big enough, stick the government for the interest expense). So looking at the interest costs only is myopic. It’s all about opportunity cost.

Let us know how that works out for you….

The last 6 years have been fabulous. Instead of parking money (prepaying) in a house earning 5% — the cost of debt financing — the S&P is up some 200% over that time frame. Obviously that type of return can’t and won’t continue. However, over time stocks (a diversified basket) vastly outperform real estate. It’s not even close.

So if I put ten grand into one end of this S&P thingy 6 years later twenty grand pops out the other end? Fantastic!

Jim, I’d like to know which diversified basket you live in? Does it have a sunny spot for growing a few subsistence crops?

Woohoo! You got a dollar every time your fellow Americans got screwed by the oligarchy and got their jobs shipped overseas.

No thanks, I’ll tie our income to a piece of land. At least I won’t feel like I need a shower after we’ve bought it.

Isn’t this whole piece on young people being unable to afford property? And then I suppose those who can afford property will morally condemn them for putting what money they are able to save, if any, in bank accounts or the stock market or treasuries or something, even though they are priced out of property markets anyway.

How does that owning property thing work when you have to move to stay employed anyway? Who has a job so stable they don’t’ have to these days.

If my ability to buy a home hinges on screwing over other people or encouraging my kids to screw over other people via the rich people gambling casino I’ll pass. Feel free to do what YOUR conscience tells you to.

My conscience has stopped taking responsibility for everything. Like how responsible I am for the entire of capitalism by having some stock mutual funds in my 401k if that’s what is being argued (I don’t think middle class people and their 401ks *even collectively* own most equities anyway, I think it truly is the rich that do)

Because I can’t do it anymore anyway. Housing as an investment, mostly priced beyond the means of Gen X and after around here. But the boomers got their precious asset appreciation on housing. Post office bank? Oh post office bank where are you? But bank accounts paying nothing because of round after round of QE.

Then I suppose I could feel guilty whenever I bought something from somewhere other than a co-op like a big box (not even *that* big box). Everytime I lost all patience with the day, and bought some awful GMO containing something from the vending machine. For driving too far in a tiny car to a job to keep a rented roof over head, for my computer being made in China.

But I can’t even keep up with it, I’ve been able to draw the line at which companies I will WORK for mostly.

Effing MBAs and their financial casinos. I could maybe see your point if the markets had not been rigged. But they are, so for conservative people like me it makes eminent sense to secure my shelter and partial food supply before I enter into any casino to gamble away my hard earned money. Could be my peasant background triumphing over my fancy and useless education, but I never saw a peasant starving and homeless unless he had hawked his property to the damned banks.

The markets are absolutely rigged. They’re rigged for capitalists to win. So one has to be a capitalist. They’re the only people who get bailouts.

So which great capitalist family do you hail from, Jim? The way I see it, hardly any so called investments go into anything productive, rather it’s a bunch of pyramid schemes. Yesterday’s great capitalists who did build things are gone, today’s so called capitalists are glorified card sharps who produce nothing but like any parasite they suck the host dry. There isn’t much left to strip, so I am not about to be caught holding a losing hand. My money goes into agricultural land in the old country, while the getting is cheap and the foreigners are prohibited from owning it. That’s a productive investment.

So, where to put new money today?

One hopes that when the Shirriff comes next time to foreclose for the bank and evict the people and conduct the sale, the response would be at least as strong as for that asshole out West that fed his cattle on our Commons and refused to pay up. Too bad that the Pot-bellied Militia is not very well Regulated. And prone to demagogic capture, and in our own US history, syndication and brigandry… Or maybe like happened in the hinterlands in the 1930s…

With universal debt jubilee mentioned periodically here, I believe it offers salvation for all – flippers, deceived borrowers and too big too fail banks.

I would agree with you (except for natural disasters like locusts, floods and droughts), though I also worry about armed, roaming brigands coming from the city to borrow from the down-to-earth peasants.

I will OWN it in just a few months (except for taxes).

As in, you won’t own it — your financing will simply convert to an end-stage perpetual ARM.

One word not mentioned: “Immigration”.

Where there is less demand, prices drop.

And I’d like to add that even if you do get to buy a house, holding onto it it problematical. My school and property taxes keep shooting up. Nobody seems to control the school boards from spending millions and then coming to us with their hands out. And if the area is deemed “up and coming,” property taxes reflect that. We also get hit with some form of occupancy tax as well. I end up shelling out so much money in taxes that I can’t afford to make repairs….

Also, I have a friend who was about to lose her home. She was able to work out something with the bank but then her mortgage went up an additional $400. So she constantly struggles to come up with that every month. As a result, she can’t afford to buy a new used car; hers is 20 years old. I can’t afford another car either; mine is 11 years old. In fact, none of my friends have money left for anything. There is no economic recovery for most of us; it’s all smoke and mirrors.

Every jurisdiction is different; however, property taxes are usually assessed on the value: i.e. if the value of your home goes up, so will taxes.

Thus the UPSIDE to my home’s static “value” over the past 15 yrs. It angers me no end how that works. You may live for a generation or two in a home only for the neighborhood to suddenly become trendy or “up and coming” so a bunch of snot-nosed hipsters can move in, drive up prices, and ultimately force you out of your home because they drove the taxes into the stratosphere. There REALLY needs to be grandfather clauses in property taxes, paying what you paid at purchase. If/when you sell for a killing, THEN you pay taxes on the capital gain and the new tenant can pay the higher property taxes, etc.

This is the sort of shit that happened to people who were living in places like Vale or Aspen Colorado LONG before it became a destination for rich carpetbaggers. They lived there easily and happily for a long, long time then Hollywood types fall in and they are no longer able to live in THEIR neighborhoods, THEIR homes. The outsiders came in and ruined everything and forced their taxes beyond the stratosphere so they HAVE to leave and all that’s left are rich snots with the real populace forced to move into overpriced local apartments or far away where the hipsters haven’t yet decided is a “cool” place to live.

That hasn’t worked out so well in California under prop 13. Sounds all well and good but it starves local communities of much needed funding, especially if turnover in home ownership is low.

And of course all other taxes have to be high and don’t make up the difference. If you want to be California first better raise the sales and income taxes to 9-10% each (marginal on the middle class), then be prepared to be courting bankruptcy every recession.. And still schools are underfunded and housing is constantly bubbly.

Texas freezes the majority of property taxes at age 65.

People don’t buy a house based on its price. They buy according to the estimated monthly payment. If suddenly California started thinking sensibly and Prop. 13 were repealed, home prices would drop as property taxes rose. Better if property taxes were two tier: higher if the owner did not occupy.

In that sense, you never want to buy when mortgage rates are low. You want to buy when mortgage rates will be low sometime in the near future so you can refinance. Or buy when rates are high and pay cash.

Nobody said living in a third world country was going to be easy.

Only in a 3rd world country things like housing are often affordable, if low quality. It’s not a 3rd world country it’s some horrible Frankenstein monster.

But we saved the banks, so … s’all good.

Forward.

My question is why the housing market continues to be so hot? What market mechanism(s) is failing such that prices don’t normalize? I think there must be some “behavioral finance” element here in addition to good ol’ fashioned market manipulation. I.e., people are making suboptimal choices, perhaps for cultural/axiological reasons. So perhaps people feel compelled to buy regardless of price. Is it because houses price off comps so prices at the high end trickle down to mid-range houses, thus pushing their prices up regardless of ability to pay?

Why do people feel compelled to buy a house and not simply rent? In my area — DC — the rents I’m willing to pay are perhaps 50% of the cost of owning the cheapest decent house in the area. Plus, we have a metro very close by the rental. But people want to pay $700-800k for a 3/2. That prices in a very low cap rate on any owned property such that it makes little sense to buy.

So anyway, which market mechanism is failing such that prices don’t normalize?

Not every place is like Washington D.C. Where my wife and I live (near Honolulu) the 20 year old mortgage + maintenance fee on our town home is less than the going rental for the same type of unit (the rent probably includes some profit for the landlord). And God willing the the mortgage will be payed off in a few more years when we hope to retire. I’m glad we’re not young people starting out today though. It’s a lot tougher for my son and others his age.

My God, after 20 years of owning the property, I sure hope your P+I is less than comparable rentals. As noted in the chart above, DC is one of the WORST markets in terms of affordability. I’m sure Honolulu is just as bad, if not worse, due to geographical limitations, though it’s probably erroneously omitted from the chart. My point is that I think there’s a failure of market actors somewhere, and I suspect house buyers are a key component of that failure.

At some NYC apartments I’ve seen, cap rates are also stupidly low. In other words, people are willing to accept low current return in exchange for the prospect of growth later. But of course asset prices in the long term are always tied to income growth. It’s just that some people are making suboptimal decisions to buy now, in part because they have the debt capacity.

I also suspect we are not seeing the traditional house buyers.

We have never see this many cash-rich buyers with Wall Street money before.

I’d say the mechanism preventing prices from falling actually is pretty simple. The government has spent the past couple decades socializing the risks of housing, especially through mortgage guarantees but also more generally the protection of fraudsters and mortgage interest tax deductions and various real estate development tax credits and the homebuyer tax credit and so forth.

There is no “market”. The government backs essentially the entire system at this point.

Here in Somerville, MA, there is a 2+ year buying frenzy. Houses sold by open house with multiple bids. Retired, and now a renter, I go to some out of amusement, trying to keep a pulse on the market. Using the realtor.com payment schedule the bottom line is much higher than even the sky high rents. Add a PMI and it gets worse. Factor in realistic maintenance on these 80-120 year old homes and it really gets bad. Renovated interiors masking what is behind the walls, in the basement, and under the roof (ice dams anyone?). But so long as there is tight inventory and demand bidding up prices, the psychology is ripe for the market to continue.

But once the first hint of not being able to get out with a gain, much less breaking even, after 5 years hits, reality will set in. I have no basis for saying this, but it seems to mean bidding wars, paying tens of thousands more than asking, and a widespread feeling of, “I got to get in now or I will never be able to get in,” adds up to a housing bubble. Maybe add to that, “But this time is different.”

A final thought–most of the condos (meaning a twin or triple decker) are not places a young family would want to live in for more than 3-5 years. Once the kiddos get older, its out to the good school districts. I think these folks believe they are leveraging their future by buying now. What they will learn is when the housing market rises, it is virtually impossible to move up.

Ok, so one of the reasons for the housing frenzy is school districting? That would certainly be a behavioral bias. Doesn’t Elizabeth Warren point this out in a book of hers?

The MA market is currently a catch 22. Pay ridiculous rents for the few decent rentals remaining, or blind bid for a 100 yr old 1000sf apartment ridden with asbestos and lead paint, at far above the asking price. Not even talking about ritzy Boston areas. The formerly working class areas of Waltham, Watertown and even Medford, are attracting first time condo buyers to the tune of over 400K. The local press assures “this time is different” stressing the biotech researchers, and google/facebook engineers are currently priced out of Cambridge (small 2 bedroom condo’s 700sf start at 500K), forced to branch out to adjacent towns. A bubble ignored yet again.

Low inventory ensures that blind bidding wars continue. Just heard the Chinese are now buying entry level condos for cash in Arlington, a suburb of Boston. It’s beyond over for the average buyer when foreign cash, and onshore Banks for that matter, begin “preying” on a given area.

Halle-flippin’-loo-yah. Somebody FINALLY did the math.

This article gives great detail on the Seattle market. An 1,120 square foot home in Seattle’s Ballard neighborhood going for $158,000 above the asking price for a total sale of $717,000. Ballard used to be a working class neighborhood, but with its proximity to the Puget Sound and the conversion of old industrial areas into a vibrant restaurant and boutique scene, it is white-hot.

Finance & [C]apital manipulated land asset prices is the way capitalism deals with the Malthusian issue…basically by feeding the pigs.

So I take issue with :

[“Most of it becomes part of the grease that keeps Wall Street from squealing.”]

Wall Street will always squeal. They’re pigs and that’s what pigs do…

Here in SoCal, housing has been unaffordable for so long that I think a cultural change has occurred. It’s now normal for people in their 30s and even 40s, even those with good jobs, to have roommates. Having a roommate and sharing a nice house is no longer socially unacceptable, so even people who could afford to have their own places decide to share. After all, even if you can afford $3k in rent, why not split it with a buddy anyway?

I think what that means is that the social impetus that drives new household formation has been broken. Gone are the days when you’re expected to have your own place after college. Now, there’s no social stigma to sharing a place until one gets married. So who will be filling all these new houses that investors are hoping to rent out?

There must be something wrong with that chart. There is no inflation in the US.

***

But seriously, that’s a great article.

For me, the extremes at the bottom of the list are just as interesting as the top. In places like the Bay Area, SoCal, NY, DC, and south FL you have great weather and natural restrictions on land and major industry/government centers and so forth. But that quartet of Detroit, Cleveland, Pittsburgh, and St Louis has no such context. Yet it still takes a decade(!).

5% of income a tough feat ? shopping sprees, family extensions and extended vacations unavoidable expenses ? Is this a joke ? East and South East Asians save 20 to 40% of their incomes and they still have a life. There was a time where US had similar saving rate. This time can come back. Actually, it has to.

My point is not to argue if the property market is to high or not (I agree with the author, it is). Property bonds and stocks are also very high. But if you expect to work 40 years and retire 30 years with 60% of your income with non volatile real interest rate at 1% (not a specially conservative assumption), the corresponding saving rate is around 32%.

3% non volatile real interest rate (not conservative at all) ? still a bit above 15%.

What is the real interest rate to make this fly at 5% of saving ? A crazy level between 6 and 7% every year ! the outcome is hugely instable (at 5% you are missing 5 years, at 6%, you are 600% of your annual income to you heirs!).

Bottom line : Pinning your retirement hopes on the exponential function is a bad idea.

A 40% savings rate? Taxes at the very least are 8% of income. Housing 30% , health care 9%, food at least 10% and that doesn’t cover transportation or utilities and the person in question is already bust. And heck, I’m being modest since they’ve said the bottom end of the food chain spends closer to 50% just on housing.

Raise social security.

If whatever social arrangement exist don’t work for most people in it, maybe it’s time to dump them. People in European social welfare states often spend less, very few countries match U.S. consumerism, but they’re not all frantic about providing for their own retirements either.

In California it’s not only hell to try and buy, it’s hell to own. Every year the county reassesses the value of our properties based on recent neighborhood sales. This year they sent me a revaluation that raised the tax base of my 2 bedroom, 2 bath, 1200 sq. ft. house nearly $100,000. I filed an appeal and beat them back — but they’ll be coming after me again next year, and I can already see, based on recent sales, that I’ll have no data to fight them off this time.

In California, reassessment is limited by Proposition 13 to a very small percentage a year – approximately the cost of inflation. In real terms real estate taxes barely rise – if the do at all – year to year. There is a real value reassessment only when the property is sold – and not even then in some cases. The inequity in Prop 13 is that commercial real estate turns very slowly, and so is taxed at very low levels if held for long periods.

That is state property taxes, but I think they might be talking about local property taxes (the *county*). There are state and local property taxes.

Prop 13 provides for a 2% increase in the tax base every year. When properties are valued at well over half a million dollars on average, that translates into a substantial increase every year. In my case, and that of most of the county of Los Angeles and elsewhere, the county was forced to lower the tax base as the comp sales in neighborhoods dropped after 2008. Great, I thought. The base for taxing my property dropped. The county is only allowed to assess a 2% increase per year. I can breathe a little easier. No, not the case. Prop 13 allows the county to continue keeping track of what the tax base WOULD BE if prices had not dropped. My annual “Assessment of Value” notice includes a “Prop 13 Value” which goes up 2% every year over my purchase price in perpetuity and is the base on which the county will assess my annual tax bill as soon as the market value of homes in my neighborhood rebounds to the previous (unaffordable for the middle class) levels. Which they now have. That’s why my tax base will go up $100,000 next year.

Well this is a bit of a bait and switch…Why would we even think that “first time home buyers” would be able to afford a “median” home? In a NORMAL market first time home buyers would be buying “Starter” homes at less than median prices. But the market is SO out of whack even starter homes are is difficult to imagine affording with a sane mortgage Add to that the fact that young people of middle class upbringings and expectations are often paying off ~100k of college debt these days.

Why would a normal market be one where we are constantly churning the housing stock? The concept of a starter home itself is part of the problem I’d say. Why shouldn’t first time home buyers be buying homes they can live in for decades?

Fulcrum Economics

If you multi-part a line to pick a heavier load, reducing the load the motor sees, what happens to the rest of the load? What happens to speed? What is the tension on each part? Which knows more about economics, an experienced crane operator or an economist? What does the bureaucrat writing the test for crane certification know? What happens to the crane operator population when it is filtered by certification?

If a crane operator goes to work as a laborer, secretary, or programmer, what is the affect on assumptions normalized in the surrounding populations? What is the economic effect of pigeon-holing people into efficient specialization? What does an HR specialist know? If you part the load to decrease the size of the motor, what are the trade-offs? Who gets laid off when an economy stalls?

Why does an economy stall? What is the effect of printing money and measuring its multiplier effect on velocity as productivity? If a herd moves into gold, how much do you want? If you could choose one, which would you choose: a farmer, an admiral, a programmer or a doctor? What is the difference between earth gravity and feeding a herd of consumers?

Why do economists tip the load and say they never saw it coming, every time? Do G and I belong on the same side of the equation? What is integral I and derivative I, the ladder? What was the effect of giving Fed control over both money and the labor market, in terms of an electrical circuit, and why do you suppose Congress was so willing to cede control?

Money, specialization, automation and artificial intelligence – treatment, solving the problem of technology with technology, doesn’t solve the problem of being incapable of consideration, which is why all empire contracts, including the US Constitution, are worth no more than the paper they are printed on. The word of a feudalist, regardless of bipolar, divide and conquer, angenda-ism, is worth exactly nothing, no matter how many feudalists agree in public, to split the return on economic slavery.

GDP is a positive feedback signal for consumption, trade balances are an accounting ploy to swap migrants, and HR enforces feudalism, waiting for someone else to do the work and capitalize it. Empire infrastructure is artificial mobilty for artificial emotion accordingly. Voting on who administers Family Law is a waste of time, because Nature is far more effective.

The economy is like a crane, but you hold tension on one of the lines, to adjust fulcrum, load, torque and speed. If you let go, the load and crane go over. It is in the manufactured majority’s interest to interfere in your marriage, to grow the RE ponzi with your children. Raising children to accept physical poverty or control those so-bred with artificial intelligence is an efficient, but not effective approach, ignoring Nature until it is far too late.

Supply-side economics is a prison. The more prisons you build, the more prisoners you get, and they are always over-crowded, because the behavior is the product, which the Great Society is trying to hide with all the misdirection. White collar criminals paid in arbitrary credit, breeding blue collar criminals with arbitrary debt, don’t get a slap on the wrist by accident.

Depressions occur when labor moves forward, and is felt by the middle class from the bottom up, because the upper middle class landlords will believe the lie of RE inflation until it can’t, and capital will pump and dump until it can’t. Silicon Valley, the last second derivative, is still the current empire prototype, and the empire cannot see the next integral. Look at rent/wage versus population in California. Life is not a competition to become a commodity, replaced by technology.

You can only know a tiny fraction of what there is to know, which is relevant to spacetime, which is always more than the empire knows, so labor increases wages by decreasing hours, for those who can accurately set slip/traction in their private lives, to appropriately gear the economy, and the empire increases surveillance along with associated overhead, destroying its own transmission mechanism, replacing it with efficiency consultants, a few of whom are labor, to keep the machine running as long as necessary.

Procrastination is empire SOP, and most kids are simply following the lead, but not participating in the make-work, waiting for their parents to die, experiencing declining living standards, and playing with virtual toys. Archimedes is still the master, relative to the latest empire ponzi, which in over 2000 years has merely managed to travel backwards, as expected, new world order always the same as the old, old feudalists preaching stupid.

Empire is a counterweight, which the moneychangers short, to their own demise, Wyle E Coyote style.

We’re heading for a generational down-adaptation to artificial scarcity. Little-by-little, law-by-law, capital rich institutions and individuals have been rigging the game for the last 3 decades, worldwide.

Aside form the near impossibility of saving enough to buy even a modest home, how are things going to work out as AI and robotics continue to displace workers? We now just see the tip of the iceberg re: this work-automation phenomenon, but it’s going to float aggressively to the surface, fast, as soon as the various sweatshop labor pools dry up (or smarten up); then what?

Bottom line: it should be against the law to leverage shelter for profit. I mean that. There is something wrong when necessities are permitted to be bargained and traded in imperfect markets, with massive profits going to those with more perfect information (in this case, shelter/housing), while those with smaller capital reserves (including zero capital reserves) are left to fend for themselves.

On the other hand, this could be a harbinger of new adaptations that see young people move away from the most popular cities to places that are more affordable. That’s still possible in America, but not so much in many other developed nations.

In any case, the recent development in the almost universal non-affordability of shelter is sickening, and amount to nothing less than a social crime.